Professional Documents

Culture Documents

Nevada Bar No. 005 148: Kolesar & Leatham, CHTD

Nevada Bar No. 005 148: Kolesar & Leatham, CHTD

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nevada Bar No. 005 148: Kolesar & Leatham, CHTD

Nevada Bar No. 005 148: Kolesar & Leatham, CHTD

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 1 of 12

NILE LEATHAM, ESQ.

Nevada Bar No. 002838

2

3

TIMOTHY P. THOMAS, ESQ.

Electronically Filed July 9, 2009

Nevada Bar No. 005 148

KOLESAR & LEATHAM, CHTD.

4

5

3320 West Sahara Avenue, Suite 380 Las Vegas, Nevada 89102-3202 Telephone No. (702) 362-7800 Facsimile No. (702) 362-9472

E-Mail: nleatham(aklnevada.com

tthomasqklnevada.com

IRA S. DIZENGOFF (NY Bar No. 2565687)

7

8

PHILIP C. DUBLIN (NY Bar No, 2959344)

ABID QURESHI (NY Bar No. 2684637)

9

10

AKIN GUMP STRAUSS HAUER & FELD LLP One Bryant Park New York, NY 10036

Telephone: 212.872.1000

ci .

Facsimile: 212.872.1002

11

" :: '" '" u: "

.-:N ~ =0 f'

R =fJ I~~&1~~"C .. ~" E- =

i: ciZ"' " .0

i- el ~ '" " '" 0

E-Mail: idizengoff(gakingump.com

12

13

pdublin(gakingump.com aqureshiqakingump.com

"'~ '"

Counsel for First Lien Steering Committee

.. ~ = ~.... '" 14

UNITED STATES BANKRUPTCY COURT

DISTRICT OF NEVADA

In re:

) CASE NO. BK-09-14814-LBR ) (Jointly Administered) )

) Chapter i i

d( ~ 11'' 15 ~;;G

'" il ~~ ~ ~ R 16 o -' '"

CI ~ i: '" '"

.. ~

0

~

17 18

THE RHODES COMPANIES, LLC, aka "Rhodes Homes," et al.,l

Debtors.

)

) Hearing Date: July 17,2009 ) Hearing Time: 1:30 p.m.

19

20

21

i The Debtors in these cases, along with their case numbers are: Heritage Land Company, LLC (Case No. 0914778); The Rhodes Companies, LLC (Case No. 09-14814); Tribes Holdings, LLC (Case No. 09-14817); Apache Framing, LLC (Case No. 09-14818); Geronimo Plumbing LLC (Case No. 09-14820); Gung-Ho Concrete LLC (Case No. 09-14822); Bravo, Inc. (Case No. 09-14825); Elkhorn Parters, A Nevada Limited Partership (Case No. 0914828); Six Feathers Holdings, LLC (Case No. 09-14833); Elkhorn Investments, Inc. (Case No. 09-14837); Jarupa, LLC (Case No. 09-14839); Rhodes Realty, Inc. (Case No. 09-14841); C & J Holdings, Inc. (Case No. 09-14843);

Rhodes Ranch General Partership (Case No. 09-14844); Rhodes Design and Development Corporation (Case No.

22

23

24

25 26

09-14846); Parcel 20, LLC (Case No. 09-14848); Tuscany Acquisitions IV, LLC (Case No. 09-14849); Tuscany

Acquisitions 11, LLC (Case No. 09-14850): Tuscany Acquisitions 11, LLC (Case No. 09-14852); Tuscany

Acquisitions, LLC (Case No. 09-14853); Rhodes Ranch Golf

Countr Club, LLC (Case No. 09-14854); Overfow,

LP (Case No. 09-14856); Wallboard, LP (Case No. 09-14858); Jackkife, LP (Case No. 09-14860): Batcave, LP

27 28

(Case No. 09-14861); Chalkline, LP (Case No. 09-14862); Glynda, LP (Case No. 09-14865); Tick, LP (Case No. 09-14866); Rhodes Arizona Properties, LLC (Case No. 09-14868); Rhodes Homes Arizona, L.L.C. (Case No. 0914882); Tuscany Golf

Country Club. LLC (Case No. 09-14884); and Pinacle Grading, LLC (Case No. 09-14887).

553708 (7540-1)

- i -

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 2 of 12

Affects:

) OBJECTION OF THE FIRST LIEN

2

3

All Debtors The Following Debtor(s):

) STEERING COMMITTEE TO MOTION

) OF DEBTORS FOR ENTRY OF AN

) ORDER EXTENDING THEIR

) EXCLUSIVITY PERIODS TO FILE A ) CHAPTER 11 PLAN AND SOLICIT

4

5

) ACCEPTANCES THEREOF PURSUANl

) TO SECTION 1121(d) OF THE

) BANKRUPTCY CODE AND (II) ) EMERGENCY MOTION TO EXTEND

) THE 90-DAY TIME PERIOD TO FILE A

6 7

8

) PLAN UNDER SECTION 362(d)(3) OF ) THE BANKRUPTCY CODE

9 10

The First Lien Steering Committee (the "First Lien Steering Committee"), consisting of

certain unaffiliated lenders under the Credit Agreement dated as of November 21, 2005 among

~ ~ :: '" U: "

II

Heritage Land Company, LLC, The Rhodes Companies, LLC, and Rhodes Ranch General

Parnership, as the Borrowers, the Lenders Listed Therein as the Lenders (collectively, the "First

Lien Lenders"), and Credit Suisse, Cayman Islands Branch, as Administrative Agent, Collateral

=0 _ ~ OO_N _"'0 = ,. 13 tt C"'~Q,oor~ ~~"

:: .;: '" '"

.,~ ~ 12

.. ~ = ~:;.. '" 14 i: el Z-. " _0

Agent, Syndication Agent, Sole Bookrnner and Sole Lead Arranger, by and through its

undersigned counsel, hereby fies this objection (the "Objection") to (i) the Motion of Debtors for

i- CI If '" " ~ 0'

d? el 2PrJ ~;, r-

~ ~ gff

15

-: il -' '

cz '" -

o"

16

Entry of an Order Extending their Exclusivity Periods to File a Chapter i 1 Plan and Solicit

i: i:

.. 0

~

f-

17 18 19

Acceptances Thereof Pursuant to Section 1121(d) of the Banuptcy Code (the "Exclusivity

Motion") and (ii) Emergency Motion to Extend the 90-Day Time Period to File a Plan Under

Section 362( d)(3) of the Banptcy Code (the "SAR Extension Motion and, together with the

20

21

Exclusivity Motion, the "Motions"). In support of this Objection, the First Lien Steering

Committee respectfully represents as follows:

22

23

PRELIMINARY ST A TEMENT2

I. By the Motions, the Debtors seek to extend their exclusive plan fiing and

24

25

solicitation periods in an attempt to control a plan process that, thus far, has been largely driven by

the First Lien Steering Committee. As the First Lien Steering Committee advised the Court in its

26 27 28

recent statement regarding the Debtors' use of cash collateral (Docket No. 285), the First Lien

2 Terms not otherwise defined herein shall have the meanings ascribed to such terms in the Motions, as applicable.

553708 (7540.1)

- 2-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 3 of 12

Steering Committee determined in late June that negotiating a fully consensual transaction with the

2

3

Debtors and James Rhodes, in his individual capacity, could not be achieved. Accordingly, the

First Lien Steering Committee focused its efforts on negotiating a consensual restructuing with

the Committee and has made substantial progress in this regard over the past few weeks.

4

5

2. The First Lien Steering Committee fully expects to be in a position to fie a plan of

6 7

8

reorganization that wil have the support of the Committee in the coming weeks. The First Lien

Steering Committee wil not be permitted to file such plan if the Debtors' exclusivity periods are

extended. Thus, while the First Lien Steering Committee remains committed to obtaining the

Debtors' support for a plan, the First Lien Steering Committee believes that continuing the

9

LO

Debtors' exclusive control over the plan process is not conducive to achieving a near-term

:: : u

ci .

'"

~ "

1 1

resolution of these chapter I I cases. Based on the foregoing and for the reasons set forth below,

i: ciZ"" " .0 d( ~ II~

4S~~ l3 = ~~ C"C" ~~" .. '" -c....~ Cl 14

I~ fJ

~

=0 ~ "'~ '"

.":N M

l2

the First Lien Steering Committee does not believe that cause exists to grant the relief requested in

the Motions.

BACKGROUND

3. On either March 31, 2009 or April, 1,2009 (collectively, the "Petition Date"), each

i- ci ~ '" " '" Q

0

~

-: il -' 0 l6 o '" C/M C i: i: f- l7 .. l

18 19

~;;~ l5 ;a ~M

of the Debtors commenced with this Court a voluntar case under chapter 1 I of the Bankuptcy

Code. Certain of the Debtors certified on their voluntary petitions that they are single asset real

estate debtors (the "SARE Debtors").

4. Pursuant to Banuptcy Code sections I 107(a) and 1108, the Debtors are currently

authorized to operate their businesses and manage their properties as debtors in possession. The

Debtors' chapter I I cases are being jointly administered for procedural purposes only. No trustee

or examiner has been appointed in these chapter I I cases.

20

2l

22

23

5. On May 26, 2009, pursuant to Bankruptcy Code section 1102, the United States

Trustee for the District of

24

25

Nevada appointed the Committee. The Committee curently consists of

four members: G.C. Wallace, Inc.; Interstate Plumbing & Air Conditioning; M & M Electric, Inc.;

and Southwest Iron Works, LLC.

26

27 28

553708 (7540.1)

-3-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 4 of 12

i

2

3

6. On June 16, the Debtors fied the SARE Extension Motion seeking to extend the

90-day period within which the SARE Debtors must fie a plan of reorganization under Banruptcy

Code 362(d)(3) through October 2,2009.

4

5

7. Pursuant to Banptcy Code sections 1121(b) and (c), the Debtors' exclusive

period to file a plan currently expires on July 29, 2009 or July 30, 2009, as applicable, and their

exclusive period to solicit acceptances of a plan currently expires on September 29, 2009 or

September 30,2009, as applicable.

7

8

8. On June 19,2009, the Debtors filed the Exclusivity Motion seeking to extend their

9

10

Exclusivity Periods through October 28,2009 and December 27, 2009, respectively.

OBJECTION

I. The Debtors Have Not Satisfied Their Burden for an Extension of their

ci .

" :: .. " u : 0; . '" .. ;::Ml"

:: 'l 00 t-

11

Exclusivity Periods

12

13

9. Banuptcy Code section i 121 limits the amount of

-c (1- N

~ Cl "'Co " ~ '"

-c ~ t~ p. el;z-. 14 " .0

d( ~ 11'' 15 ~;;tJ

= ~ C'C~~ ~ .. "

=0 _ :: ~ '" ."'0

time a debtor may have to fie a

plan of reorganization and solicit acceptances thereof. Specifically, section i 12l provides that,

subject to certain exceptions, the debtor has the exclusive right to fie a plan for only the first 120

days of

~ ~;M -: il -' '" 16 o C r/M 0

the banptcy proceeding. 11 U.S.C. 1121(b). If

the debtor fies a

plan within that 120-

a ~

i: i:

..

f-

17

18

day period, the debtor's exclusivity periods are extended to 180 days in order to provide the debtor

with an opportunity to solicit acceptances of its proposed plan. i i U.S.C. 1121(c). After these

initial periods expire, however, a debtor may only extend its exclusive periods upon a showing of

"cause" up to a maximum of i 8 months after the petition date with respect to filing a plan, and up

19

20

21

to 20 months afer the petition date with respect to soliciting and obtaining acceptance of any such

plan. i i U.S.C. i 121(d). For the reasons set forth below, the First Lien Steering Committee

22

23

respectfully submits that the Debtors have not made the requisite showing of cause for an

extension of

24

25

their Exclusivity Periods.

A. The Debtors Have Failed to Establish that "Cause" Exists to Support an

Extension of Their Exclusivity Periods

10. As noted, after a debtor's initial exclusive periods expire, they can only be extended

upon a showing of "cause." 11 U.S.C. 1121(d). A debtor seeking.

26 27 28

to extend its exclusive periods

553708 (7540-1)

- 4-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 5 of 12

bears the burden of

proving that there is "cause" for such extension. See In re Wash.-St. Tamany

2

3

Elec. CooP.. Inc., 97 B.R. 852, 854 (E.D. La. 1989); In re Cent. Jersey Airnort Servs.. LLC, 282

B.R. 176, 184 (Ban. D.N.J. 2002); In re Servo Merch. Co., Inc., 256 B.R. 744, 751 (Bankr. M.D.

4

5

Tenn. 2000); In re McLean Indus., Inc., 87 B.R 830,834 (Ban. S.D.N.Y. 1987).

i I. While the Bankuptcy Code does not define what constitutes "cause" for purposes

of section 1121, cours in this jurisdiction and elsewhere generally consider the following factors

when determining whether cause exists:

a. the size and complexity of

7

8

the case;

9 10

b. the necessity of sufficient time to negotiate and prepare adequate

information;

ci

N " :: " '" U:

c. the existence of good faith progress toward reorganization;

i I

d. whether the debtor is paying its debts as they come due;

"'~ '" ."'0 ~~"'~ = ~:: ~ 00 t"

=0 _

12

e. whether the debtor has demonstrated reasonable prospects for filing a viable

13

plan;

f. whether the debtor has made progress in negotiating with creditors;

g. the length of

~ ci "'0 ciZ~ " .0

.. ~ '"

~~" E- = "C .. ~ ....eo

" ~ '"

14

15

d( ~;; G ~ II~

p:~"'M

time the case has been pending;

-: o R il:i",

i: i:

cz '" -

16 17 18 19

h. whether the debtor is seeking the extension to pressure creditors; and

.. 0

~

f-

1. whether unresolved contingencies exist.

See In re Henry Mayo Newhall Mem'l Hosp., 282 B.R. 444, 452 (9th Cir. BAP 2002); In re Cent.

Jersey Airnort Servs.. LLC, 282 B.R. at 184; In re Servo Merch. Co., Inc., 256 B.R. at 751; In re

20

21

Express One Intl. Inc., 194 B.R. 98, 100 (Bank. E.D. Tex. 1996). When considering whether to

extend a debtor's exclusive periods, cours do not merely tally the above factors, but instead

recognize that certain factors are more relevant or important than others. See In re Dow Coming

22

23

Corn., 208 B.R. 661, 669 (Ban. E.D. Mich. 1997). In addition, "(eJxtensions are not to be

granted neither routinely nor cavalierly." In reMcLean Indus.. Inc., 87 B.R. at 834 (citing In re

Swatara Coal Co., 49 B.R. 898, 899-900) (Bank. E.D. Pa. 1985)).

12. Application of

24

25

26 27 28

the foregoing factors to the Debtors' chapter i i cases evidences that

the Debtors' Exclusivity Periods.

cause does not exist to justifY an extension of

553708 (7540-1)

-5-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 6 of 12

B. The Debtors Have Failed to Progress the Reorganization

13. In support of the requested extension of

2

3

their Exclusivity Periods, the Debtors assert

that they have made "significant progress towards a plan of reorganization. . . and have spent time

4

5

reviewing, analyzing, and negotiating the plan term sheet that wil hopefully serve as the basis for

the Debtors' plan." Motion at il9. The Debtors' representations regarding the status of plan

negotiations are misleading. The plan term sheet referenced by the Debtors is no longer being

considered by the paries. Indeed, on July 8, the First Lien Steering Committee sent the Debtors a

6 7

8

draf term sheet that it believes wil form the basis of a consensual plan of reorganization with the

Committee. To date, the Debtors have not been actively involved in negotiating the current

iteration of the plan term sheet.

9

10

~ :: u

GS~R 13 = ~~ ="C.. ~ ~ "

I~"'~

~ ~ =0 ~ "'~ '"

11

14. While the First Lien Steering Committee believes that the Debtors acted in good

faith in connection with prior plan negotiations, the First Lien Steering Committee disputes the

Debtors' assertion that they have made "significant progress towards a plan of reorganization."

12

.. ~ = ~.... '" 14

.. co "'0 " ~ '"

i: coZ-' " .0

Indeed, the First Lien Steering Committee, not the Debtors, has taken the lead in efforts to

formulate a confirmable plan of reorganization in these cases. Given these facts, an extension of

Cd co iPi-

.0 il ~ f" tl -' ' -:

cz '" -

~;;~

15

.. 0

~

i: i:

o"

16

17 18 19

the Debtors' Exclusivity Periods is not justified and, if granted, would be an impediment to the

First Lien Steering Committee's efforts to effectuate a swift restructuring of the Debtors'

businesses.

f-

C. The Debtors Cannot Demonstrate Reasonable Prospects for Filng a Viable

Plan

20

21

15. The Debtors canot propose a plan that complies with Banuptcy Code Section

22

23

1129 without the support of the First Lien Lenders. It is undisputed that the Debtors do not have

the ability to repay the First Lien Lenders in full, in cash. Thus, absent the affrmative vote of the

24

25

First Lien Lender class, the Debtors would have to propose a "cram-down" plan. A plan of

reorganization may not be confirmed, or "crammed-down," over the objection of a secured creditor unless the plan provides for the secured creditor to (i) retain its liens on its collateral (or on the sale

26

27 28

proceeds of its collateral) and receive deferred cash payments equaling the present value of the

creditor's allowed secured claim, or (ii) realize the "indubitable equivalent" of its allowed secured

553708 (7540-1)

- 6-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 7 of 12

i

2

3

claim. 11 U.S.C. 1129(b)(2)(A). Based on the value of the Debtors' estates and the Debtors'

projected operating performance, the Debtors wil be unable to propose a plan that provides for the

First Lien Lenders to (i) retain their liens and (ii) receive deferred cash payments equaling the

present value of their secured claims. Accordingly, the only viable plan that can be proposed in

these cases must provide for the First Lien Lenders to receive equity in the reorganized Debtors in

at least parial satisfaction of their claims. The Debtors canot, however, confirm a plan that

4

5

6 7

8

provides for such an equity distribution over the objection of the First Lien Lenders. Indeed,

cours that have considered whether a secured creditor can be crammed down with equity have

9 10

generally held that equity securities in a reorganized debtor do not constitute the "indubitable

equivalent" of the secured creditor's claim. See,~, In re TM Monroe Manor, 140 B.R. 298

(M.D. Fla. 1992) (holding that a debtor's proposed plan of

ci

. ~11 ::

~"'~M~ =0 _ "'~ '" -~ 0

:: ~~!:

13

reorganization that provided a secured

u : ; 12

creditor with limited partnership interests in the reorganized debtor did not provide the secured

creditor with the indubitable equivalent of such creditor's claim). Accordingly, the Debtors cannot

demonstrate reasonable prospects for filing a plan without the support of the First Lien Lenders.

D. The Debtors Have Not Made Progress Negotiating With Their Creditors

16. "One of

~ 5'g .

-: ~ ~.: 14

IE~;;

~.::~ 15 _" ~ II~

"'~;; ~

~ tl ~l" -: ~-' ~ 16

cz '" -

the most important reasons for extending the debtor's period of exclusivity

:: ~ 17

,,' i:

o

~

is to give the Chapter i i process of negotiation and compromise an opportunity to be fulfilled, so

18

that a consensual plan can be proposed and confirmed without opposition." In re All Seasons

Indus.. Inc., 121 B.R. 1002, 1006 (Ban. N.D. Ind. 1990); see also In re Mid-State Raceway. Inc.,

323 B.R. 63, 67-68 (Bankr. N.D.N.Y. 2005) ("Exclusivity is intended to promote an environment

19

20

21

in which the debtor's business may be rehabilitated and a consensual plan may be negotiated.

However, undue extension can result in excessively prolonged and costly delay, to the detriment of

the creditors.") (quoting H.R.Rep. No. 103-835, at 36 (1994), reprinted in 1994 U.S.C.C.A.N.

3340, 3344).

22 23 24

25

17.

When plan negotiations fail to render a consensus, it is therefore appropriate to

26 terminate exclusivity to rebalance the negotiating process. See,~, In re Mid-State Raceway.

27 Inc., 323 B.R. at 70 ("(Terminating exclusivity) simply returns the parties to a level playing field

28 after the period of debtor control intended by Congress has expired." (quoting In re Pub. Servo Co.

553708 (7540-1)

- 7-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 8 of 12

of

New Hampshire, 88 B.R. 521, 540 (Ban. D.N.H. 1988)); In re All Seasons Indus.. Inc., 121

2

3

B.R at 1002 (recognizing the same principle). Terminating a debtor's exclusive periods permits

parties with a more objective view of the debtor's circumstances to fie a plan. See,~, In re

4

5

Lehigh Valley Professional Sports Club. Inc., No. 00-1 1296DWS, 2000 WL 290187, at *4 (Bank.

E.D. Pa. Mar. 14,2000) ("Shortening the debtor's exclusive period for filing a plan wil permit any

pary in interest, including paries with perhaps a more objective view of the debtor's

6

7

8

circumstances, to file a plan." (quoting In re Crescent Beach Inn. Inc., 22 B.R. 155, 160-61 (Ban.

Me. 1982)).

9

10

18. As noted above, to date, the Debtors have been unable to achieve consensus with

their various creditor constituencies and Mr. Rhodes over the terms of a plan of reorganization. At

ci .

::

u :

~~ ( .':MI"

" " "I

'"

11

this juncture, the First Lien Steering Committee is skeptical of the Debtors' ability to achieve

13 "~ tc c: I ~ C"'"i:

~ ~ "

.. ~ '" -i ~ .. (I 14

=0 "'~'"_ ."'0

12

consensus and, thus, should be given an opportunty to pursue its current course of action

including, if necessary, fiing a plan of reorganization. Accordingly, the Debtors' request for an

extension of their Exclusivity Periods should be denied and the playing field leveled to rebalance

the negotiating process.

E. The Size and Complexity of the Debtors' Cases Do Not Justify Extending the

i: =2:" _0 ~ co"'o " ~ '"

d( ~ 11'' 15 ~~ ~

~ ~: f'

-: il -' R o '"

cz '" -

16

.. 0

~

i: i:

f- 17

Exclusivity Periods

18 19

19. The Debtors argue that the size and complexity of their chapter I I cases warrant an

extension of the Exclusivity Periods. See Motion at iii 0- I I. Courts, however, have recognized

20

21

that large and complex cases do not necessarily require extended periods of exclusivity. See In re

Henr Mayo Newhall Mem'l Hosp., 282 B.R. at 452-53 (recognizing that the view that complex

cases require extended exclusivity had been debunked). Moreover, "(s)ize and complexity alone

canot suffice as cause" to extend exclusivity. In re Pub. Servo Co. of

22

23

New Hampshire, 88 B.R. at

24

25

537. If size and complexity alone were enough, a debtor in a large and complex case would

automatically have a right to plan exclusivity throughout the proceedings, contrary to the rationale

of Banruptcy Code section 1121. See id. Size and complexity must be accompanied by other

26 27 28

factors pertinent to the particular debtor to justify extension of plan exclusivity. See id.

553708 (7540-1)

-8-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 9 of 12

20. The First Lien Steering Committee concedes that the Debtors' cases are large given

2

3

the aggregate amount of secured debt outstanding. Notwthstanding the Debtors' assertions,

however, these cases are not complex. Although the Debtors cite to multiple classes of potential

4

5

creditors, a plan of reorganization that complies with the Banptcy Code's priority scheme can

easily be crafted that wil provide an appropriate distribution, if any, to each class. In addition, the

Debtors' businesses themselves are not overly complex and, thus, cause does not exist to grant the

Debtors' requested extension on this basis.

F. Extending the Exclusive Periods May Pressure Creditors

6 7

8

9

10

21.

13.

The law is well settled that debtors are not permitted to use exclusivity as a

tactical device to pressure paries to consent to a plan they consider unsatisfactory. See,~, In re

ci .

u :

::

"I ~o~ ( .-:M M QO _ "'~ '" ~ ~ ."'0 00 i:

-c ~ ~ ~

ii ~ 'Z.. " .0 ~ eu~"'= " '"

.. .. "

i I

Kun, 15 B.R. 852, 853 (Banr. D. Ariz. 1981) (recognizing that Banruptcy Code section 1121

was designed to prevent debtors from exercising excessive leverage in negotiations); Century

12

13

Q ~~ C'l" ~~"

Glove. Inc. v. First American Ban, 860 F.2d 94,102 (3rd Cir. 1988); In re Hoffnger Indus.. Inc.,

14

15

292 B.R. 639, 643 (8th Cir. BAP 2003) (citations omitted); In re General Bearing Corn., 136 B.R.

~;;~ il ~~ ~ ~R o -''''"

0( = ~r-

361,367 (Ban. S.D.N.Y. 1992); In re Texaco Inc., 81 B.R. 806, 812 (Ban. SD.N.Y. 1988).

iz~ i: '" '"

16 17 18 19

Accordingly, courts have denied the requests of debtors to extend exclusivity in order to prevent

the debtor from employing such tactics. See,~, In re Media Ctr.. Inc., 89 B.R. 685, 687 (Ban.

.. ~ 0 ~

E.D. Tenn. 1988) ("The Court announced it would not fuher extend the exclusivity period for

purposes of allowing (the debtor and its affliates) to cram down major creditors who had not

accepted the debtors' plans.").

22. While, to date, the First Lien Steering Committee believes that the Debtors have

20

21

22

23

worked in good faith towards achieving a consensual plan of reorganization, those discussions

occurred in connection with plan proposals that would have resulted in consideration going to Mr.

24

25

Rhodes and his non-Debtor affiiates in exchange for, among other things, continued cooperation

in matters where the Debtors' operations and Mr. Rhodes' non-Debtor affliates overlap. As a

26

27 28

result of the breakdown in these negotiations, the current construct of the First Lien Steering

Committee's plan term sheet is neutral as to Mr. Rhodes' personal interests. The First Lien

Steering Committee is concerned, therefore, that extending the Debtors' Exclusivity Periods may

553708 (7540-1)

- 9-

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 10 of 12

allow Mr. Rhodes to exert excessive leverage over the plan process. Although the First Lien

Steering Committee is hopeful that this wil not occur in light of

2

3

Mr. Rhodes' fiduciary obligations

to maximize the value of the Debtors' estates for its creditor constituencies, exclusivity should not

be extended to ensure that progress continues to be made towards a consensual plan.

4

5

G. Allowing the Exclusivity Periods to Lapse Wil Not Prejudice the Debtors

6 7

8

23. The Debtors wil not be hared if exclusivity lapses. Courts have consistently

rejected the notion that exclusivity should be extended solely to give debtors more time to fie a

plan. See, sh, In re Yellowstone Mountain Club. LLC, Case No. 08-61570-1 1,2009 WL 982233,

9 10

at *6 (Banr. D. Mont. Feb. 18, 2009) (finding that termination of the exclusivity would do

nothing more than allow other paries to propose plans and give creditors choice about the

treatment and payment of

ci .

:: u:

'"

,. "

'"

11

their claims); In re RG. Pharacy. Inc., 374 B.R 484, 488 (Bank. D.

=0 '" _ "'~ 0 .'" ~~"'* 13 :i ~= ~00 t"

~ ="C.. ~~"

.. ~ '"

12

Conn. 2007) ("The fact that the debtor no longer has the exclusive right to fie a plan does not

affect its concurent right to fie a plan. Denying the motion only affords creditors their right to

fie a plan; there is no negative affect (sic J upon the debtor's coexisting right to file its plan.")

~.... = ~ =z.. " .0

~ = ~ '" "'0 "

d( ~;, ~ ~ II~

14

15

~ ~ ~ f"

(citations omitted) (emphasis in original); In re Grossinger's Assoc., 116 B.R. 34, 36 (Bank.

o M .c~"' R 16 cz '" -

S.D.N.Y. 1990); In re Mother Hubbard. Inc., 152 B.R 189, 195 (Bank. W.D. Mich. 1993)

(holding that termination of exclusivity is not prejudicial to the debtor); In re Southwest Oil Co. of

.. 0

~

i: i:

f-

17 18

Jourdanton. Inc., 84 B.R. 448, 454 (Ban. W.D. Tex. 1987). The risk that another pary may fie a

plan while the debtors are developing their plan is a risk that Congress intended. See, sh, In re

19

20

21

All Seasons Indus., 121 B.R at 1005 ("The risk is, of course, that while it is developing its plan,

another pary in interest wil file a plan. However, that is as Congress intended.") (citations

22

23

omitted); In re Southwest Oil Co. of Jourdanton. Inc., 84 B.R. at 454. 24. Denying the relief requested in the Motion wil not have a negative impact on the

24

25

Debtors' abilty to continue good faith negotiations with the First Lien Steering Committee and the

Committee. Allowing exclusivity to expire wil merely serve as a check on the Debtors' control

26

27 28

over the plan process by allowing the First Lien Steering Committee to propose a plan of

reorganization in the event that negotiations with the Debtors ultimately prove unsuccessfuL. The

First Lien Steering Committee remains hopeful that a consensual transaction wil ultimately be

553708 (7540.1)

- 10 -

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 11 of 12

consummated in these cases but, for the reasons discussed herein, opposes an extension of the

Debtors' Exclusivity Periods.

II. The Debtors Have Failed to Establish that Cause Exists to Extend the 90-Day Time

2

3

Period to File a Plan Under Bankruptcy Code Section 362(d)(3).

4

5

25. Banptcy Code section 362(d)(3) provides that relief from the automatic stay

shall be granted against a single-asset real estate debtor to a creditor whose claim is secured by an

7

8

interest in such real estate, unless, within 90 days after the entry of the order for relief, the debtor

has fied a plan of reorganization that has a reasonable possibilty of being confirmed within a

9

10

reasonable time. I I U.S.C. 362(d)(3). The 90-day period within which the debtor must fie a

plan of reorganization may be extended "for cause." Id.

ci .

:: u:

'"

~ "

i I

26. While the Banptcy Code does not define "cause," the First Lien Steering

Committee agrees with the Debtors that the Cour should consider the purpose of the requirements

=0 "'~'"~ ii~~= ~ I~"'~ 13

~ ="C" ~~"

i: = "'0 coz.. ~ "" ~ .0 '"

12

imposed by Banptcy Code section 365(d)(3) in determining whether cause exists to extend the

time within which the Debtors must file a plan of

.. ~ = .o .. .. '" 14

reorganization. See Motion at ir7; see. also In re

d( ~ 11'' 15 ~;; S il -' g ~~ ~ ~ '" 16

cz '" -

Heather Aparments LP, 366 B.R. 45, 47 (Ban. D. Minn. 2007). Banuptcy Code 362(d)(3)

reflects Congressional concern about the delay in the banptcy process and unfairness to secured

o ,.

f-

i: i:

.. 0 ~

17

creditors that often accompanies single asset real estate cases. See Nationsban. N.A. v. LDN

Corn. (In re LDN Corn.), 191 B.R. 320, 326 (Ban. E.D. Va. 1996). Bankptcy Code section

18

19

362(d)(3) was specifically designed to compel debtors in single asset real estate cases to act

quickly to move their cases forward. In re Oceanside Mission Assocs., 192 B.R. 232, 235 (Ban.

S.D. Cal. 1996). Moreover, "one of (Banptcy Code section 362( d)(3)'s J goals aims to expedite

20

21

22

23

the proposal of meritorious plans of reorganization." In re Heather Apartments, 366 B.R. at 49;

see also In re Kkemko. Inc., 181 B.R. 47, 49 (Bank. S.D. Ohio 1995). The consequence of

failing

24

25 26 27

to act quickly to propose a plan of reorganization is the possibilty that the automatic stay wil be

lifted. In re Oceanside Mission Assocs., 192 B.R. at 235.

27. For the same reasons set forth above regarding the lack of cause to extend the

Debtors' Exclusivity Periods under Banruptcy Code section 11 2 I, the Debtors have failed to

28

553706 (7540-1)

- 11 -

Case 09-14814-lbr

Doc 306

Entered 07/09/09 11:20:44

Page 12 of 12

establish that cause exists to grant the Debtors the requested extension under Bankuptcy Code

section 362( d)(3).

2

3

CONCLUSION

4

5

WHEREFORE, for the reasons set forth above, the First Lien Steering Committee

respectfully requests the Court (i) deny the Motions and (ii) grant the First Lien Steering

Committee such other and fuher relief as is just and proper under the circumstances.

Dated this 9th day of July, 2009.

6 7

8

9

10

BY'~

'Ni E 1; ATHAM, ESQ.

ci .

Nevada Bar No. 002838

'"

:: u:

.. 11 .. "

TIMOTHY P. THOMAS, ESQ.

Nevada Bar No. 005148

KOLESAR & LEATHAM, CHTD. 3320 West Sahara Avenue, Suite 380

=.gj = ~I~"'~~ ~~"

f- i: 'C .. ~..;i '" ~ .. ~

00 _ "'~ ..

12

13

" .0 .w : '" 0 l z.. ..

" ~ '"

14

Las Vegas, Nevada 89102-3202 Telephone No. (702) 362-7800 Facsimile No. (702) 362-9472

E-Mail: nleatham(aklnevada.com

d(

~ ~ ~f" -: il -' R 16 o '"

cz '" -

~ II~ 15 ~;; ~

tthomasqklnevada.com and

IRA S. DIZENGOFF (NY Bar No. 2565687)

i: .. i: 0

f-

17 18 19

PHILIP C. DUBLIN (NY Bar No, 2959344) ABm QURESHI (NY Bar No. 2684637) AKIN GUMP STRAUSS HAUER & FELD LLP

One Bryant Park New York, NY 10036

Telephone: 212.872.1000

Facsimile: 212.872.1002

20

21

E-Mail: idizengoff(gakingump.com

pdublin(aakingump.com aqureshiqakingump.com

22

23

Counselfor First Lien Steering Committee

24

25

26

27 28

553708 (7540.1)

- 12 -

You might also like

- PVT Limited Companies Mobile Database DelhiDocument924 pagesPVT Limited Companies Mobile Database DelhiNishant Kumar92% (12)

- Conflict On A Trading Floor SummaryDocument1 pageConflict On A Trading Floor Summarykfrench91100% (1)

- Por7 Omnibus Response 0812229120213000000000027Document80 pagesPor7 Omnibus Response 0812229120213000000000027joeMcoolNo ratings yet

- Moodys Mood For Love LEAD SHEETDocument2 pagesMoodys Mood For Love LEAD SHEETGabriel Vizcaíno0% (1)

- Electronically Filed: June 25, 2009: Nile Leatham (N Bar No. 002838)Document4 pagesElectronically Filed: June 25, 2009: Nile Leatham (N Bar No. 002838)Chapter 11 DocketsNo ratings yet

- In Re: : Debtors.!Document22 pagesIn Re: : Debtors.!Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument5 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- 10000020904Document30 pages10000020904Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Nevada: E-File: June 19, 2009Document11 pagesUnited States Bankruptcy Court District of Nevada: E-File: June 19, 2009Chapter 11 DocketsNo ratings yet

- Entered On Docket September 22, 2009Document7 pagesEntered On Docket September 22, 2009Chapter 11 DocketsNo ratings yet

- Entered On Docket April 17, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeDocument29 pagesEntered On Docket April 17, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument6 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- November 12, 2009 Nevada Bar No. 005148 3320 West Sahara Avenue, Suite 380 4 Las Vegas, Nevada 89102-3202Document46 pagesNovember 12, 2009 Nevada Bar No. 005148 3320 West Sahara Avenue, Suite 380 4 Las Vegas, Nevada 89102-3202Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument10 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- 10000020943Document579 pages10000020943Chapter 11 Dockets100% (1)

- United States Bankruptcy Court District of NevadaDocument14 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument13 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- T R C, Aka: "Rhodes Homes, Et Al.,"Document6 pagesT R C, Aka: "Rhodes Homes, Et Al.,"Chapter 11 DocketsNo ratings yet

- T R C, Aka: "Rhodes Homes, Et Al.,"Document6 pagesT R C, Aka: "Rhodes Homes, Et Al.,"Chapter 11 DocketsNo ratings yet

- James McAluney Investor Group Awarded Priority Substantial Contribution ClaimDocument26 pagesJames McAluney Investor Group Awarded Priority Substantial Contribution ClaimJim McaluneyNo ratings yet

- United States Bankruptcy Court For The District of NevadaDocument7 pagesUnited States Bankruptcy Court For The District of NevadaChapter 11 DocketsNo ratings yet

- A F LLP: Rent OXDocument15 pagesA F LLP: Rent OXChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument13 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- Midlandholdingsllcanddebtorsresolving LLC Now, TheDocument6 pagesMidlandholdingsllcanddebtorsresolving LLC Now, TheChapter 11 DocketsNo ratings yet

- Inre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredDocument11 pagesInre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument114 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court For The District of NevadaDocument5 pagesUnited States Bankruptcy Court For The District of NevadaChapter 11 DocketsNo ratings yet

- 16 Santa Ana Division: 15 United States Bankruptcy CourtDocument44 pages16 Santa Ana Division: 15 United States Bankruptcy CourtChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Nevada: E-File: June 22, 2009Document9 pagesUnited States Bankruptcy Court District of Nevada: E-File: June 22, 2009Chapter 11 DocketsNo ratings yet

- LION OIL COMPANY v. NATIONAL UNION FIRE INSURANCE COMPANY OF PITTSBURGH, PA Et Al ComplaintDocument22 pagesLION OIL COMPANY v. NATIONAL UNION FIRE INSURANCE COMPANY OF PITTSBURGH, PA Et Al ComplaintACELitigationWatchNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument10 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Counsel To Liquidator of Creative Finance Ltd. and Cosmorex LTDDocument45 pagesCounsel To Liquidator of Creative Finance Ltd. and Cosmorex LTDKhushi SharmaNo ratings yet

- Radio Shack CH 11 Part 2Document20 pagesRadio Shack CH 11 Part 2Robert WilonskyNo ratings yet

- .11'f'J'HE UNITED: The Plan Been AsDocument2 pages.11'f'J'HE UNITED: The Plan Been AsChapter 11 DocketsNo ratings yet

- 10000020383Document77 pages10000020383Chapter 11 DocketsNo ratings yet

- In Re:) : Debtors.)Document114 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Honorable A. Bruce Campbell: of The Court Specifies Who Must Be Served With Notice of Actions To Be Taken, E.GDocument1 pageHonorable A. Bruce Campbell: of The Court Specifies Who Must Be Served With Notice of Actions To Be Taken, E.GChapter 11 DocketsNo ratings yet

- Entered On Docket December 28, 2009Document7 pagesEntered On Docket December 28, 2009Chapter 11 DocketsNo ratings yet

- Nunc Pro TuncDocument24 pagesNunc Pro TuncChapter 11 DocketsNo ratings yet

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefDocument34 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument18 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- Transport RoomDocument21 pagesTransport RoomThe Daily HazeNo ratings yet

- Entered On Docket April 30, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeDocument10 pagesEntered On Docket April 30, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Nevada Southern DivisionDocument9 pagesUnited States Bankruptcy Court District of Nevada Southern DivisionChapter 11 DocketsNo ratings yet

- US Trustee Objection To Las Vegas Monorail BankruptcyDocument17 pagesUS Trustee Objection To Las Vegas Monorail BankruptcyToohoolNo ratings yet

- In The Matter of American Express Warehousing, LTD., Debtor, 525 F.2d 1012, 2d Cir. (1975)Document7 pagesIn The Matter of American Express Warehousing, LTD., Debtor, 525 F.2d 1012, 2d Cir. (1975)Scribd Government DocsNo ratings yet

- United States Bankruptcy Court For The District of NevadaDocument4 pagesUnited States Bankruptcy Court For The District of NevadaChapter 11 DocketsNo ratings yet

- BK 19 (Sde 120) Notice of Removal To U.S. District Court S.D.F.L. 17-80723Document7 pagesBK 19 (Sde 120) Notice of Removal To U.S. District Court S.D.F.L. 17-80723larry-612445No ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Document12 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are (8739) - The Debtor's Address Is: 3251 East Imperial Highway, Brea, CA 92821Chapter 11 DocketsNo ratings yet

- FMFC CompaintDocument200 pagesFMFC Compaintsc178No ratings yet

- TWC Motion To ContinueDocument13 pagesTWC Motion To ContinueTHROnlineNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument4 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- November 12, 2009Document9 pagesNovember 12, 2009Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument44 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- Jsp Agency, Inc. v. American Sugar Refining Co. Of New York, Amstar Corp., Northern Lines, Inc., Athenian Shipping Corp., Caribbean Charterers & Operators, Ltd., Ambrit Sugars, Inc., C. Czarnikow, Inc., Czarnikow-Rionda Company, Inc., B.W. Dyer & Company, Farr Mann & Co., Inc., M. Golodetz & Co., Inc., Lonray, Inc., Amerop, Division of Westway Trading Corporation, Woodhouse, Drake & Carey, Inc., Florida Sugar Marketing and Terminal Association, Inc., Hogan & Company, Inc., Philippine Sugar Trading Corp., Subsidiary of National Sugar Trading Association, Marc Rich & Co., Sugar Ltd. And Allied Towing Corporation, Subsidiary of Allied Marine Industries, 752 F.2d 56, 2d Cir. (1985)Document12 pagesJsp Agency, Inc. v. American Sugar Refining Co. Of New York, Amstar Corp., Northern Lines, Inc., Athenian Shipping Corp., Caribbean Charterers & Operators, Ltd., Ambrit Sugars, Inc., C. Czarnikow, Inc., Czarnikow-Rionda Company, Inc., B.W. Dyer & Company, Farr Mann & Co., Inc., M. Golodetz & Co., Inc., Lonray, Inc., Amerop, Division of Westway Trading Corporation, Woodhouse, Drake & Carey, Inc., Florida Sugar Marketing and Terminal Association, Inc., Hogan & Company, Inc., Philippine Sugar Trading Corp., Subsidiary of National Sugar Trading Association, Marc Rich & Co., Sugar Ltd. And Allied Towing Corporation, Subsidiary of Allied Marine Industries, 752 F.2d 56, 2d Cir. (1985)Scribd Government DocsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument13 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- 45-14 Ex. M Preliminary Pretrial StatementDocument31 pages45-14 Ex. M Preliminary Pretrial Statementlarry-612445No ratings yet

- Document Scanning Lead Sheet: Superior Court of California County of San FranciscoDocument7 pagesDocument Scanning Lead Sheet: Superior Court of California County of San FranciscoL. A. PatersonNo ratings yet

- 4.racl: CtaimsDocument6 pages4.racl: CtaimsChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of NevadaDocument4 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- Letter Re. Pre Trial Conference Letter MRS V JPMC Doc 29Document31 pagesLetter Re. Pre Trial Conference Letter MRS V JPMC Doc 29larry-612445No ratings yet

- United States Bankruptcy Court For The District of NevadaDocument6 pagesUnited States Bankruptcy Court For The District of NevadaChapter 11 DocketsNo ratings yet

- Judgments of the Court of Appeal of New Zealand on Proceedings to Review Aspects of the Report of the Royal Commission of Inquiry into the Mount Erebus Aircraft Disaster C.A. 95/81From EverandJudgments of the Court of Appeal of New Zealand on Proceedings to Review Aspects of the Report of the Royal Commission of Inquiry into the Mount Erebus Aircraft Disaster C.A. 95/81No ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Local Corp Chapter 11 Bankruptcy PetitionDocument18 pagesLocal Corp Chapter 11 Bankruptcy PetitionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- My Views On Whether Customers Are Treated Fairly in Retailer BankruptciesDocument3 pagesMy Views On Whether Customers Are Treated Fairly in Retailer BankruptciesChapter 11 DocketsNo ratings yet

- Writing Logs in Terms of OthersDocument4 pagesWriting Logs in Terms of OthersJake VillaNo ratings yet

- Final AML QuestionDocument2 pagesFinal AML Questionk_didar36No ratings yet

- EY Attractiveness Survey 2014Document52 pagesEY Attractiveness Survey 2014Cátia Martins Dos SantosNo ratings yet

- Geography Map Work Chapter 4 AgricultureDocument25 pagesGeography Map Work Chapter 4 AgricultureSouvik MondalNo ratings yet

- International Trade and AgreementDocument119 pagesInternational Trade and AgreementAirah Golingay100% (1)

- Taylor's ACCADocument1 pageTaylor's ACCASaleel MohammedNo ratings yet

- India'S Foreign Trade: Value Composition and DirectionDocument13 pagesIndia'S Foreign Trade: Value Composition and Directionfuck but TrueNo ratings yet

- LCS FactsheetDocument4 pagesLCS FactsheetPratik BhagatNo ratings yet

- Sample Economics AssignmentDocument9 pagesSample Economics Assignmentsampleassignment.com100% (3)

- International Trade Midterm ExamDocument3 pagesInternational Trade Midterm ExamRucha NimjeNo ratings yet

- mc180202711 Assignment Sol. MGT402Document3 pagesmc180202711 Assignment Sol. MGT402Fari BaniNo ratings yet

- Employee Mileage Log Excel TemplateDocument3 pagesEmployee Mileage Log Excel TemplateRoosy RoosyNo ratings yet

- Ketan Parekh ScamDocument31 pagesKetan Parekh Scamolkp151019920% (1)

- Math 9Document2 pagesMath 9Zeni MalikNo ratings yet

- Gas ShalesDocument49 pagesGas ShalesCharly D WhiteNo ratings yet

- Assignment of B.EDocument33 pagesAssignment of B.EpatelkkNo ratings yet

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument48 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareShrajati TandonNo ratings yet

- FijiTimes - Mar 02 2012 For Web PDFDocument48 pagesFijiTimes - Mar 02 2012 For Web PDFfijitimescanadaNo ratings yet

- GE-3 Activity 3 MIDTERMDocument2 pagesGE-3 Activity 3 MIDTERMArn Dela CruzNo ratings yet

- Rabin - Incorporating Limited Rationality Into EconomicsDocument17 pagesRabin - Incorporating Limited Rationality Into EconomicsNicole ThomasNo ratings yet

- Od327418991622128100 PDFDocument3 pagesOd327418991622128100 PDFSunny SundareNo ratings yet

- Bloomberg Businessweek Europe - April 23 2018Document76 pagesBloomberg Businessweek Europe - April 23 2018Anh ThànhNo ratings yet

- Act 504 Countervailing and Anti Dumping Duties Act 1993Document54 pagesAct 504 Countervailing and Anti Dumping Duties Act 1993Adam Haida & CoNo ratings yet

- Cost and Benefit Analysis of Outsourcing From The Perspective of Datapath LTDDocument59 pagesCost and Benefit Analysis of Outsourcing From The Perspective of Datapath LTDranzlorenzoo100% (1)

- Likaj Et Al (2022) Growth, Degrowth or Post-GrowthDocument42 pagesLikaj Et Al (2022) Growth, Degrowth or Post-Growthdavid2151997No ratings yet

- Account Statement2Document31 pagesAccount Statement2Parminder SinghNo ratings yet

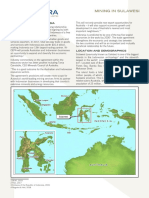

- Mining in Sulawesi: Australia and IndonesiaDocument4 pagesMining in Sulawesi: Australia and IndonesiaAhmad Ome KhomeinyNo ratings yet