Professional Documents

Culture Documents

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

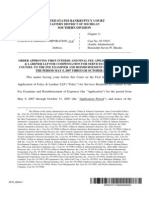

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: COLLINS & AIKMAN CORPORATION,

et al.1 Debtors. ) ) ) ) ) ) ) ) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

ORDER APPROVING STIPULATION RESOLVING MOTION FOR ADMINISTRATIVE CLAIM FILED BY THE CITY OF PORT HURON, MICHIGAN Upon the stipulation [Docket No. 8329] (the Stipulation)1 by and between the above-captioned debtors (collectively, the Debtors) and the City of Port Huron, Michigan (Port Huron) resolving the Motion For Administrative Claim filed by the City of Port Huron, Michigan [Docket No. 8010] (the Motion); it is hereby ORDERED 1. Port Huron is hereby granted an Allowed Priority Tax Claim (as defined in the

Plan) in the amount of $348,000.00(the Priority Claim).

1 The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Stipulation.

K&E 12138930.2

0W[;'*,

0555927071012000000000007

':

2.

The Debtors shall pay the Priority Claim in full to Port Huron by the earlier of

(a) thirty (30) days after the Effective Date (as defined in the Plan)or (b) ninety (90) days after the date this Order is entered. Upon payment of the amount set forth in paragraph 1 of this Order, the Motion shall be deemed withdrawn with prejudice. 3. Payment of the Priority Claim in accordance with paragraphs 1 and 2 of this

Order shall fully, finally and completely satisfy the Taxes, including all the real and personal property taxes incurred in the 2004 and 2005 tax years for the following parcels and any penalties related thereto: 74-06-999-0481-850 74-06-999-0902-350 74-06-901-0130-000 74-06-900-0073-000 4. The amount of the Priority Claim includes 100% of all penalties owed to Port

Huron for the real and personal property taxes referenced in Paragraph 3 above. The difference between the amount of the Priority Claim and the actual amount the Port Huron shows as due and owing on the taxes referenced in paragraph 3 above is a result of negotiations and a reduction in the total interest amount owed on the taxes. 5. Each party to the Stipulation shall be responsible for its own fees and costs

incurred in connection with the Motion. 6. The Debtors are authorized and directed to take all actions necessary to effectuate

the relief granted pursuant to this Order and the Stipulation. 7. The terms and conditions of this Order shall be immediately effective and

enforceable upon its entry.

}

K&E 12138930.2

G.

The Court retains jurisdiction with respect to all matters arising from or related to the implementation of this Order.

.

Signed on October 12, 2007 _ __ _/s/ Steven Rhodes _ _ Steven Rhodes Chief Bankruptcy Judge

}

K&E 12138930.2

You might also like

- Trade Finance Database - Feb'19Document12 pagesTrade Finance Database - Feb'19sheelNo ratings yet

- Pillar 4 - The B-I TriangleDocument15 pagesPillar 4 - The B-I TriangleMostafa MirshekariNo ratings yet

- 10000026731Document3 pages10000026731Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000025709Document138 pages10000025709Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000025824Document554 pages10000025824Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000025263Document449 pages10000025263Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy CourtDocument5 pagesIn The United States Bankruptcy CourtChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000026382Document489 pages10000026382Chapter 11 DocketsNo ratings yet

- 10000027622Document513 pages10000027622Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument34 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In Re Case No. 05-55927-SWR Debtor. Hon. Steven W. RhodesDocument2 pagesIn Re Case No. 05-55927-SWR Debtor. Hon. Steven W. RhodesChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000028261Document1,698 pages10000028261Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy CourtDocument4 pagesIn The United States Bankruptcy CourtChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern DivisionDocument3 pagesUnited States Bankruptcy Court Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy CourtDocument2 pagesIn The United States Bankruptcy CourtChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000027320Document1,562 pages10000027320Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument11 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument6 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- United States District Court District Of: Eastern Michigan Southern DivisionDocument2 pagesUnited States District Court District Of: Eastern Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- First and Final Application of Togut, Segal & Segal LLP For Reimbursement of Expenses For Filing Fees For Adversary Proceedings Filed in May, 2007Document125 pagesFirst and Final Application of Togut, Segal & Segal LLP For Reimbursement of Expenses For Filing Fees For Adversary Proceedings Filed in May, 2007Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- My Views On Whether Customers Are Treated Fairly in Retailer BankruptciesDocument3 pagesMy Views On Whether Customers Are Treated Fairly in Retailer BankruptciesChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Local Corp Chapter 11 Bankruptcy PetitionDocument18 pagesLocal Corp Chapter 11 Bankruptcy PetitionChapter 11 DocketsNo ratings yet

- Principles of Marketing Chapter1 NoteDocument5 pagesPrinciples of Marketing Chapter1 NoteQuazi Mahbub Hassan100% (3)

- Requirements For Authentication and NotarizationDocument2 pagesRequirements For Authentication and NotarizationcourtesybreaksNo ratings yet

- FirmsDocument5 pagesFirmsl.mufaddalNo ratings yet

- LiabilitiesDocument39 pagesLiabilitiesRio Vina Ado SubongNo ratings yet

- State Bank of India Internship ProjectDocument61 pagesState Bank of India Internship ProjectPrince BhardwajNo ratings yet

- Consumer Rights in Bangladesh With Special References To CRPA-2009Document11 pagesConsumer Rights in Bangladesh With Special References To CRPA-2009md.jewel ranaNo ratings yet

- Rajesh Kumar Sethi - 5+years - Project Control Engineer - Foster Wheeler - SenabiDocument4 pagesRajesh Kumar Sethi - 5+years - Project Control Engineer - Foster Wheeler - SenabiSubrata DuttaNo ratings yet

- Leave and License Agreement - Gulraj HeightsDocument5 pagesLeave and License Agreement - Gulraj HeightssaamrockstarNo ratings yet

- Business Administration PapersDocument36 pagesBusiness Administration Papersinfiniti786No ratings yet

- Shy Chapter 7Document18 pagesShy Chapter 7Prinny ThomasNo ratings yet

- Product Quality Plan Flow Chart: 1.0 Plan & Define The ProjectDocument1 pageProduct Quality Plan Flow Chart: 1.0 Plan & Define The ProjectmjapmgNo ratings yet

- Soal Kelas 9Document3 pagesSoal Kelas 9daniNo ratings yet

- Hotel Industry 7Document29 pagesHotel Industry 7ıм IreneNo ratings yet

- Finova - PD Format Oct 2019Document8 pagesFinova - PD Format Oct 2019Madhusudan ParwalNo ratings yet

- Fiche Emploi MSC Sport 2019 PDFDocument2 pagesFiche Emploi MSC Sport 2019 PDFYash DesaaiNo ratings yet

- E Business AssociatesDocument14 pagesE Business Associatesmohammedakbar88No ratings yet

- AReviewof Modelling Approachesfor Supply Chain Planning Under UncertaintyDocument8 pagesAReviewof Modelling Approachesfor Supply Chain Planning Under UncertaintyHadi P.No ratings yet

- Managing Financial Principles & TechniquesDocument29 pagesManaging Financial Principles & TechniquesShaji Viswanathan. Mcom, MBA (U.K)No ratings yet

- Acca BrochureDocument20 pagesAcca BrochureSonuChaudhary0% (1)

- Franchising Pros and ConsDocument8 pagesFranchising Pros and ConsKristie Rose LiswidNo ratings yet

- Upload A Document For Free Download Access.: Select Files From Your Computer or Choose Other Ways To Upload BelowDocument5 pagesUpload A Document For Free Download Access.: Select Files From Your Computer or Choose Other Ways To Upload BelowApril WoodsNo ratings yet

- Standard Patent License Agreement: ConfidentialDocument9 pagesStandard Patent License Agreement: ConfidentialAnonymous LUf2MY7dNo ratings yet

- Corporation Definition The Most Common Form ofDocument20 pagesCorporation Definition The Most Common Form ofmtayyab_786100% (2)

- A Study of The Strategy of A Company When The Company Has Gained or Lost Competitive AdvantageDocument8 pagesA Study of The Strategy of A Company When The Company Has Gained or Lost Competitive AdvantageSanchari GhoshNo ratings yet

- Fiji CaseDocument3 pagesFiji CaseJason Hwang100% (1)

- Corporate Communication Management: 1 Lesson Key Concept of Corporate CommunicationsDocument18 pagesCorporate Communication Management: 1 Lesson Key Concept of Corporate CommunicationsAnna MariaNo ratings yet

- 172-Nissan Motors Philippines v. Angelo G.R. No. 164181 September 14, 2011Document7 pages172-Nissan Motors Philippines v. Angelo G.R. No. 164181 September 14, 2011Jopan SJNo ratings yet

- The Impact of Working Capital ManagementDocument10 pagesThe Impact of Working Capital ManagementAnil BambuleNo ratings yet