Professional Documents

Culture Documents

Platinum Palladium Current Views

Platinum Palladium Current Views

Uploaded by

sobel0722Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Platinum Palladium Current Views

Platinum Palladium Current Views

Uploaded by

sobel0722Copyright:

Available Formats

GFMS

Jewellery Cars

Platinum & Palladium Current views

Peter Ryan

New York, 20 September 2005

Supply Stocks

PGM jewellery China

Proxy: Hong Kong PGM imports

2.5 $900

Jewellery

Platinum demand likely to fall again in 2005

Further decline in China, ongoing erosion in Japan 2m ozs in 2004; could become 1.75m ozs in 2005

Platinum price

2.0 million ozs $600 1.5 1.0 $300 0.5

Why?

Expensive for consumers Only marginally profitable for manufacturers Competing alternatives (gold, white gold & palladium)

Palladium again the beneficiary

0.0 2005 F 1997 1998 1999 2000 2001 2002 2003 2004 $0

Palladium jewellery; gaining ground in China 0.7m ozs in 2004; should exceed 1m ozs in 2005

Platinum

Palladium

Platinum US$

Autocatalyst consumption

(excluding purchases for inventory)

9.0 8.0 7.0 million ozs 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1996 1997 1998 1999 2000 2001 2002 2003 2004 Platinum Palladium

Autocatalyst

Key drivers of PGM demand

Emissions legislation Production of catalyst equipped vehicles Penetration of diesel engined vehicles (platinum) Outlook for gasoline engined vehicles (mainly palladium)

GFMS

Global light vehicle production

(autocatalyst equipped million units)

80 70 60 50 40 30 20 10 0

1996 1998 2000 2002 2004 2006 2008 2010

China/India Europe Japan/Korea South America USA/Canada Others

Global light vehicle production

Market share: gasoline v. diesel

100% 80% 60% 40% 20% 0%

1996 1998 2000 2002 2004 2006 2008 2010

Source: Global Insights

Diesel Gasoline

Source: Global Insights

Global light vehicle production

Gasoline & diesel (million units)

60 50 40 30 20 10 0

1996 1998 2000 2002 2004 2006 2008 2010

Source: Global Insights

Vehicle production outlook supportive of both platinum (diesel) and palladium (gasoline)

Platinums opportunity

Gasoline Diesel

Diesel particulate filters Diesel penetration in North America

Palladiums opportunity:

Platinum 32% share of the gasoline market Emerging technology for diesel autocatalysts

Mine production

Platinum & palladium (million ozs) ozs)

8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1999 2002

Platinum

Autocatalyst scrap recycling

Platinum & palladium (million ozs) ozs)

1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0

2005 F

Palladium

2008 F

1999

2002

Platinum

2005 F

Palladium

2008 F

GFMS

Mine production + autocat recycling

Platinum & palladium (million ozs) ozs)

9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1999 2002

Platinum

Outlook

Platinum: modest surplus in 2005; close to balance

Surpluses expected to appear from 2006 Increased supply 2004 v 2008 ~ 1.4m ozs Represents 19% of total demand in 2004 Represents almost 40% of 2004 autocatalyst demand

Palladium: further surplus expected in 2005 (~500k ozs) ozs)

Surplus should contract in 2006 (post Stillwater sales) Increased supply 2004 v 2008 ~ 1.6m ozs Represents 21% of total demand in 2004 Represents almost 36% of 2004 autocatalyst demand

2005 F

Palladium

2008 F

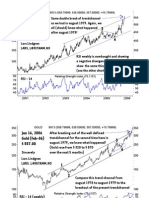

Switzerland: net imports

cumulative change 1987 to 2004

Platinum

0 -0.1 -0.2 -0.3 -0.4 -0.5 -0.6 -0.7 -0.8 -0.9 -1 1988 1990 1992 1994 1996 1998 2000 2002 2004 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 1988 1990 1992 1994 1996 1998 2000 2002 2004

Palladium

Ounces - millions

You might also like

- Peugeot 407 Owners Manual 2005 PDFDocument137 pagesPeugeot 407 Owners Manual 2005 PDFMichael JorgeNo ratings yet

- Copper Market PrimerDocument206 pagesCopper Market Primeruser1218210% (1)

- Auto Catalytic ConverterDocument4 pagesAuto Catalytic ConverterAFLAC ............0% (1)

- Small Boat Design PDFDocument91 pagesSmall Boat Design PDFMRGEMEGP191% (11)

- Watertight IntegrityDocument16 pagesWatertight IntegrityAnonymous S9ObmiLKV75% (8)

- Method Statement FOR Concreting Work: ProjectDocument6 pagesMethod Statement FOR Concreting Work: ProjectKelvin LauNo ratings yet

- Mil STD 209 Lifting, Tiedown ProvisionsDocument69 pagesMil STD 209 Lifting, Tiedown Provisionsdwcook1No ratings yet

- 2010Document14 pages2010David ChengNo ratings yet

- An Overview of Southern African PGM Smelting: Mintek Private Bag X3015, Randburg, 2125, South AfricaDocument32 pagesAn Overview of Southern African PGM Smelting: Mintek Private Bag X3015, Randburg, 2125, South AfricaKyle AprilNo ratings yet

- Rare Earths'Document2 pagesRare Earths'SGAL62SCRIBDNo ratings yet

- Site Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010Document39 pagesSite Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010pldevNo ratings yet

- Sulfur Acid 2010 PDFDocument2 pagesSulfur Acid 2010 PDFNicolás Garcia ZabalaNo ratings yet

- Timin Mcs 06Document2 pagesTimin Mcs 06böhmitNo ratings yet

- 2011Document14 pages2011David ChengNo ratings yet

- Presentation 2Q15Document46 pagesPresentation 2Q15Usiminas_RINo ratings yet

- Carbon Products - A Major ConcernDocument3 pagesCarbon Products - A Major ConcernjaydiiphajraNo ratings yet

- QMAG Presentation 2008Document19 pagesQMAG Presentation 2008tamtran_cnuNo ratings yet

- Indiumcs 05Document2 pagesIndiumcs 05skywayzNo ratings yet

- 0909 PDFDocument3 pages0909 PDFCris CristyNo ratings yet

- Metals AluminiumDocument28 pagesMetals AluminiumSatyabrata BeheraNo ratings yet

- Global Urea Trade To 2013Document11 pagesGlobal Urea Trade To 2013mohammed19877No ratings yet

- Beneficial Reuse Foundry SandDocument28 pagesBeneficial Reuse Foundry Sandmecaunidos7771No ratings yet

- AntimonyDocument4 pagesAntimonyabhay_pratap_2No ratings yet

- CMR Jan 13Document7 pagesCMR Jan 13James WarrenNo ratings yet

- 2012Document10 pages2012David ChengNo ratings yet

- Von ZengenDocument22 pagesVon ZengenMoisi DragosNo ratings yet

- Kimjut SteelDocument14 pagesKimjut SteelLasita KhaeraniNo ratings yet

- Global and Regional Developments in Primary and Secondary Lead SupplyDocument4 pagesGlobal and Regional Developments in Primary and Secondary Lead SupplyetayojcNo ratings yet

- PCI EO MEG Pemex 2013 PDFDocument38 pagesPCI EO MEG Pemex 2013 PDFepesanoNo ratings yet

- Canada Automobile IndustryDocument11 pagesCanada Automobile IndustryRajanikantJadhavNo ratings yet

- Presentation Caustic Soda 13-14 DownloadDocument30 pagesPresentation Caustic Soda 13-14 Downloadajit1949No ratings yet

- Shanghai Apr 14Document7 pagesShanghai Apr 14Baldomero El MontañeroNo ratings yet

- OTN - Private Sector Trade Note - Vol 7 2011Document4 pagesOTN - Private Sector Trade Note - Vol 7 2011Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Tata International NewDocument24 pagesTata International NewTanusmita GhoshalNo ratings yet

- Steel Industry CaseDocument23 pagesSteel Industry CaseNoemie FontaineNo ratings yet

- Coal Part 2 MaterialsDocument17 pagesCoal Part 2 MaterialsNs1503No ratings yet

- Phthalic Anhydride Part 2 PDFDocument3 pagesPhthalic Anhydride Part 2 PDFAjay YadavNo ratings yet

- Mining Obscure MetalsDocument3 pagesMining Obscure MetalsRXillusionistNo ratings yet

- Walid Al AttarDocument24 pagesWalid Al AttarSiddharth PatroNo ratings yet

- Aluminium Products, FabricationDocument12 pagesAluminium Products, FabricationNassim El AzizNo ratings yet

- N P & K Fertilizer Market Outlook: Steve Markey, CRU Strategies GPCA Fertilizer Convention September 2011, DohaDocument26 pagesN P & K Fertilizer Market Outlook: Steve Markey, CRU Strategies GPCA Fertilizer Convention September 2011, DohaPandu Rahmat PinasthikoNo ratings yet

- Agglomeration of Iron OresDocument41 pagesAgglomeration of Iron OresAnonymous NxpnI6jC100% (1)

- PlatinumDocument4 pagesPlatinumapi-281308806No ratings yet

- Bauxite and AluminaDocument2 pagesBauxite and Aluminahobbiton04No ratings yet

- GFMS Pres 2011Document49 pagesGFMS Pres 2011Serhiy123No ratings yet

- 2Q16 PresentationDocument48 pages2Q16 PresentationUsiminas_RINo ratings yet

- Mcs2023-Platinum-Group (Quantities of Metals)Document2 pagesMcs2023-Platinum-Group (Quantities of Metals)Miguel Angel Murillo ZapataNo ratings yet

- Part II: Platinum Group Metals: JOM World Nonferrous Smelter SurveyDocument5 pagesPart II: Platinum Group Metals: JOM World Nonferrous Smelter SurveyChris BothaNo ratings yet

- Ravi INTRODUCTION OF MINERALS (1) 22222Document68 pagesRavi INTRODUCTION OF MINERALS (1) 22222Pankaj TiwariNo ratings yet

- Leading Producer of Base and Precious Metals: Leonid Rozhetskin Member of The Management BoardDocument22 pagesLeading Producer of Base and Precious Metals: Leonid Rozhetskin Member of The Management Board1No ratings yet

- European Aniline ProductionDocument2 pagesEuropean Aniline ProductionheliselyayNo ratings yet

- Vanadium Market Out LookDocument28 pagesVanadium Market Out LookAlphatypemanNo ratings yet

- Zinc StatisticsDocument2 pagesZinc StatisticsROOPDIP MUKHOPADHYAYNo ratings yet

- Investor Presentation1 Aug 2012Document38 pagesInvestor Presentation1 Aug 2012ajujkNo ratings yet

- Project Report On: Oligopoly Market Structure of Aluminium Industry in IndiaDocument5 pagesProject Report On: Oligopoly Market Structure of Aluminium Industry in IndiaShruti SharmaNo ratings yet

- Iron Ore: Demand EstimationDocument12 pagesIron Ore: Demand Estimationmaverick1911No ratings yet

- LNG ShippingDocument46 pagesLNG ShippingmekulaNo ratings yet

- The Iron Ore Market 2008-2010Document99 pagesThe Iron Ore Market 2008-2010ppmusNo ratings yet

- Jean-Raymond Boulle, Titanium Resources GroupDocument30 pagesJean-Raymond Boulle, Titanium Resources Groupinvestorseurope offshore stockbrokersNo ratings yet

- Preços Cloro - Soda CáusticaDocument27 pagesPreços Cloro - Soda CáusticaLuiz Guilherme Carvalho PaivaNo ratings yet

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- 352 ApresentaDocument28 pages352 ApresentaUsiminas_RINo ratings yet

- Money, Finance, Business and Investing: Beginners Basic Guide to Investments - Boxed SetFrom EverandMoney, Finance, Business and Investing: Beginners Basic Guide to Investments - Boxed SetNo ratings yet

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- Precious Metals Investing For Beginners: The Quick Guide to Platinum and PalladiumFrom EverandPrecious Metals Investing For Beginners: The Quick Guide to Platinum and PalladiumRating: 4.5 out of 5 stars4.5/5 (2)

- Collins Easy Learning Audio Polish BookletDocument48 pagesCollins Easy Learning Audio Polish Bookletsobel0722100% (1)

- Enes F1 Ebk - OcrDocument396 pagesEnes F1 Ebk - Ocrsobel0722100% (4)

- TY 2010 CatalogueDocument76 pagesTY 2010 Cataloguesobel0722100% (1)

- Hodder Languages 2010Document32 pagesHodder Languages 2010sobel0722No ratings yet

- Transcending Amaranta Gómez Regalado To My Angels and DemonsDocument17 pagesTranscending Amaranta Gómez Regalado To My Angels and Demonssobel0722No ratings yet

- HE Languages 2010Document22 pagesHE Languages 2010sobel0722No ratings yet

- The Case For Silver: Jensenstrategic - Research ReportDocument4 pagesThe Case For Silver: Jensenstrategic - Research Reportsobel0722No ratings yet

- 2392 Gold 2002 2006 01 16 06Document3 pages2392 Gold 2002 2006 01 16 06sobel0722No ratings yet

- Casualty Investigation Code, 2008 Edition-GADDocument32 pagesCasualty Investigation Code, 2008 Edition-GADGonzalo DuarteNo ratings yet

- E Ducato Broschuere EnglischDocument11 pagesE Ducato Broschuere Englischnawaz khanNo ratings yet

- 2022 TBT Latest Catalog For Pavement TestingDocument19 pages2022 TBT Latest Catalog For Pavement TestingMarc GoNo ratings yet

- Case Study2Document16 pagesCase Study2Darshan ParmarNo ratings yet

- Sarai Gonzalez Moreno, 15apr 1235 BogotaDocument2 pagesSarai Gonzalez Moreno, 15apr 1235 BogotaHax EdxitsNo ratings yet

- Rav4 - TCM 3060 1522222Document44 pagesRav4 - TCM 3060 1522222P SzNo ratings yet

- OIIE Airport ChartDocument14 pagesOIIE Airport Chartmehran mahjoubNo ratings yet

- Mumbai Pune ExpresswayDocument7 pagesMumbai Pune ExpresswayRachit KhandelwalNo ratings yet

- Desktop Case StudyDocument6 pagesDesktop Case StudyAishwaryaNo ratings yet

- An Ambitious Project Taken Up by Kerala PWD (National Highways) - Cold in Place Recycling of Bituminous PavementDocument4 pagesAn Ambitious Project Taken Up by Kerala PWD (National Highways) - Cold in Place Recycling of Bituminous Pavementdivyadeenu9390No ratings yet

- Peng Dong Optimized Shift Control in Automatic Transmissions With Respect To Spontaneity, Comfort, and Shift Loads PDFDocument309 pagesPeng Dong Optimized Shift Control in Automatic Transmissions With Respect To Spontaneity, Comfort, and Shift Loads PDFMehdi AlizadehNo ratings yet

- Alger PerformanceDocument252 pagesAlger PerformanceAbdallah CHETTAHNo ratings yet

- 15 - (169-174) Karachi Shipyard and Engineering Works Limited 25.9.2012Document6 pages15 - (169-174) Karachi Shipyard and Engineering Works Limited 25.9.2012Sana Elli KhanNo ratings yet

- FORM NO 1142 2011-07-29 Rescue Boat DrillDocument1 pageFORM NO 1142 2011-07-29 Rescue Boat Drillgarrytopor648No ratings yet

- Allison at 1927Document51 pagesAllison at 1927alper zihnioluNo ratings yet

- A Study Report On Flexible Pavement Construction in VidishaDocument4 pagesA Study Report On Flexible Pavement Construction in VidishaIJRASETPublicationsNo ratings yet

- BurgmannDocument16 pagesBurgmannRonaldo CostaNo ratings yet

- Accurate, Reliable Inspection of Any Coating, Onshore or OffshoreDocument5 pagesAccurate, Reliable Inspection of Any Coating, Onshore or Offshoreyury1102No ratings yet

- PeugeotDocument357 pagesPeugeotNiray Augusto Orjuela FuentesNo ratings yet

- 18104/ASR TATA EXP Third Ac (3A)Document2 pages18104/ASR TATA EXP Third Ac (3A)shivam.kr.5226No ratings yet

- 02 Flight Line SafetyDocument15 pages02 Flight Line SafetyNino AngobNo ratings yet

- The Importance of On-Board Training: A Seafarer's PerspectiveDocument10 pagesThe Importance of On-Board Training: A Seafarer's PerspectiveNaomi LouhenapessyNo ratings yet

- PGSuperDocument71 pagesPGSuperVietanh PhungNo ratings yet

- STCW - Basic Safety TrainingDocument1 pageSTCW - Basic Safety TrainingRahul DhaliyanNo ratings yet

- CoC POLANDDocument10 pagesCoC POLANDАндрей СевастьяновNo ratings yet