Professional Documents

Culture Documents

Hewlett-Packard, Autonomy and 'Rules of The Garage': The FBI $8.8 Billion Charge

Hewlett-Packard, Autonomy and 'Rules of The Garage': The FBI $8.8 Billion Charge

Uploaded by

Ron IjazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hewlett-Packard, Autonomy and 'Rules of The Garage': The FBI $8.8 Billion Charge

Hewlett-Packard, Autonomy and 'Rules of The Garage': The FBI $8.8 Billion Charge

Uploaded by

Ron IjazCopyright:

Available Formats

Hewlett-Packard, Autonomy and 'Rules of the Garage'

It remains to be seen if Hewlett-Packard's investors (or the SEC and the FBI) will accept a "shift the blame" defense for an $8.8 billion charge it is taking for the $10 billion purchase of Autonomy, a Big Data firm with a big accounting problem that was the landmine in an otherwise unimpressive Q4 earnings report. For those who missed the news from Palo Alto, heres a brief rundown: According to CEO Meg Whitman, Autonomy had been billing low margin hardware sales as high-margin software sales and booked some deals with partners as revenue even though no money changed hands. Making matters worse, the Autonomy charge was the second acquisition-related, $8 billion+ write down in two consecutive quarters. Shareholders quickly drove H-P down 12% to a nearly 52-week low. Now starts the fingerpointing. For his part, former CEO (for 10 months) Leo Apotheker is shocked, shocked that the deal he put together may have been massively flawed: "The due diligence process was meticulous and thorough," he says. Former Autonomy CEO Mike Lynch "flatly" rejects the allegations. An accounting firm that vetted the deal, Deloitte, "categorically denies that it had any knowledge of any accounting misrepresentations in Autonomys financial statements." And Meg Whitman, who as a board member voted in favor of the deal, says H-P was duped. Maybe looking for individual bad actors is the wrong way to think about whats going on. I think the bigger problem is a more simple one. H-P, which invented industries and a start-up culture based on simple concepts, simply forgot to take its own advice. Lets go back to H-Ps central role in the creating the culture of Silicon Valley. David Packard and his newlywed bride moved into 367 Addison Ave. in Palo Alto in 1938. William Hewlett slept in the garage yes, THAT garage. Soon Hewletts bedroom became a workshop; with $538 in capital Hewlett and Packard began creating audio testing equipment. And the idea of staying true to your roots innovating from the garage became the Valley mantra. In 1999, harkening back to the founders, H-P crafted 12 "Rules of the Garage" as an homage to founders Hewlett and Packard (see illustration above). They are great concepts and cultural touchstones, and outline a "no excuses" culture to innovation and problem solving. And, as it happens, a lot of them apply to the Autonomy debacle in particular, and H-P's direction in general. Know when to work alone and when to work together

and Share tools, ideas. Trust your colleagues Whitman owns the problem now and since she had been in favor of it, can only partially disown the acquisition. But at least one executive seemed to see what was coming: Business Insider dug up a Fortune story from this May which reported that CFO Cassie Lesjak vigorously opposed the deal. Working with that (evidently) lone voice, who spoke to power at the risk of her career would have at least decelerated Apotheker's single-minded pursuit of Autonomy. Boards needs to know when to listen past a CEO when to work with and trust any senior executive. "The buck is going to have to stop somewhere," said Lucy P. Marcus, an expert in corporate governance and host of In the Boardroom with Lucy Marcus." "Only careful analysis will determine who may have been willfully misleading and who was perhaps willfully blind, and if anyone was actually in control of the process." If it doesn't contribute, it doesn't leave the garage and The customer decides a job well done The Autonomy process was being driven by H-P's need to evolve the business. But other strategic decisions seemed as hasty and curious as the Autonomy deal. To buy its way into the mobile club, for example, HP paid $1.2 billion for Palm itself a punchline in tech circles primarily to acquire the WebOS mobile operating system. It killed WebOS two years laterbecause it could not compete with Apple's iOS and Google's Android. The customer had decided Palm wasnt a job well done; but that didnt matter to H-P, which needed to play catch-up. The same is true in Autonomys case, a software company that had long been rumored as a takeover candidate, but always passed by. Only H-P decided to take it out of the garage. Invent Companies often need to make strategic acquisitions, but doing so to enter new markets can be tricky. IBM, which pre-dates H-P by a quarter-century, has reinvented itself countless times in its 100-year history. But is better known for shedding businesses (ThinkPad laptops to Lenovo) than buying them (though licensing "DOS" turned out to be a pretty good idea). IBM still invents, things like Watson, which Big Blue is applying to the Big Data space. With Autonomy, H-P was buying, not inventing.

Believe we can do anything When you are battered and down your confidence and daring suffer. You become gun shy. Believing that it can still do anything must be H-P's mantra going forward. It can't be afraid to invent or to risk strategic acquisitions. As Winston Churchill might have told H-P: If you are going through Hell keep going. Look: It's easy to post-mortem from a safe distance. But H-P invented an industry on very simple principles, crystallized by "The Rules," so in a very real way it is the poster child for this kind of introspection. The moral is, adhering to simple rules and remembering to apply them can always save a lot of grief. And sometimes maybe even $8.8 billion.

You might also like

- HP Compaq-A Failed MergerDocument20 pagesHP Compaq-A Failed MergerAmrita Singh100% (2)

- Lernout Hauspie CaseDocument11 pagesLernout Hauspie Caseilyaninasir91No ratings yet

- Compaq Case StudyDocument11 pagesCompaq Case StudyHarneet Singh100% (2)

- Writing A Credible Investment Thesis - HBS Working KnowledgeDocument6 pagesWriting A Credible Investment Thesis - HBS Working KnowledgejgravisNo ratings yet

- SQC Chapter 6-11Document39 pagesSQC Chapter 6-11Vita Shany83% (6)

- Codigo TunstallDocument5 pagesCodigo TunstallLidia LópezNo ratings yet

- Tutorial2 Case HPDocument3 pagesTutorial2 Case HPQiu yiiNo ratings yet

- RevistaFortune - How HP Lost Its WayDocument9 pagesRevistaFortune - How HP Lost Its WayRodrigo Ferreira0% (2)

- Posted 1 Jan 1998 in Volume 1 Issue222Document5 pagesPosted 1 Jan 1998 in Volume 1 Issue222Munyxa AishathNo ratings yet

- HEWLLETDocument36 pagesHEWLLETsana ali huabishiNo ratings yet

- Management: Submitted To: Dr. Aafia Saleem Submitted By: Faizan Sajid & Shahid FarmanDocument9 pagesManagement: Submitted To: Dr. Aafia Saleem Submitted By: Faizan Sajid & Shahid Farmanaqib amjid khanNo ratings yet

- HP Brand IdentityDocument25 pagesHP Brand IdentitySharath Ghosh100% (1)

- HP Culture OrigDocument20 pagesHP Culture Origpeacock yadavNo ratings yet

- HP Brand IdentityDocument26 pagesHP Brand IdentityAnosh DoodhmalNo ratings yet

- HPDocument24 pagesHPManish Jain BafnaNo ratings yet

- HP Individual ReportDocument16 pagesHP Individual ReportHimanshu ShekharNo ratings yet

- The HP Way - How Bill Hewlett and I Built Our CompanyDocument1 pageThe HP Way - How Bill Hewlett and I Built Our Companyvamsi_1n1No ratings yet

- HP's Breakup Is Oracle's FutureDocument2 pagesHP's Breakup Is Oracle's FutureUriel VasquezNo ratings yet

- H.P. Weighs Spinning Off Its PC Unit: Hewlett-Packard Leo ApothekerDocument3 pagesH.P. Weighs Spinning Off Its PC Unit: Hewlett-Packard Leo ApothekerHoney NiennattrakulNo ratings yet

- HP Case SolnDocument4 pagesHP Case Solnindukana PaulNo ratings yet

- Lovely Professional University: Department of ManagementDocument11 pagesLovely Professional University: Department of ManagementMani KanthNo ratings yet

- HPDocument21 pagesHPAnabil MunmunNo ratings yet

- HewlettDocument18 pagesHewlettshrutidogra43No ratings yet

- Pretty Profitable ParrotsDocument2 pagesPretty Profitable Parrotstegris4697No ratings yet

- All Business Strategies Fall Into 4 CategoriesDocument7 pagesAll Business Strategies Fall Into 4 CategoriesrsdhingraNo ratings yet

- Hewlett-Packard Now ServicesDocument4 pagesHewlett-Packard Now ServicesstanleywongNo ratings yet

- Cover StoryDocument7 pagesCover StoryAsad RasheedNo ratings yet

- HP Spin Off CaseDocument4 pagesHP Spin Off CaseHardik NaikNo ratings yet

- First Mover DisadvantageDocument4 pagesFirst Mover DisadvantageShibani Shankar RayNo ratings yet

- Design Thinking 216 SyllabusDocument3 pagesDesign Thinking 216 SyllabusDarlene NaldozaNo ratings yet

- Hewlett-Packard Co. (HPQ) Leo ApothekerDocument4 pagesHewlett-Packard Co. (HPQ) Leo Apothekerrajkumarvpost6508No ratings yet

- Case StudyDocument2 pagesCase StudyJugal Kishore GuptaNo ratings yet

- Kitty Hawk Casedoc - California Institute of TechnologyDocument6 pagesKitty Hawk Casedoc - California Institute of Technologytng8No ratings yet

- Hewlett PackardDocument31 pagesHewlett PackardAamir Awan0% (2)

- History of Meg WhitmanDocument8 pagesHistory of Meg Whitman1990sukhbirNo ratings yet

- 3 Big Mistake in M&ADocument50 pages3 Big Mistake in M&AThế giới Việc làmNo ratings yet

- Project of HP LaptopDocument32 pagesProject of HP LaptopsridharsudharsanNo ratings yet

- Is Ray Dalio The Steve Jobs of Investing (Dec '11)Document8 pagesIs Ray Dalio The Steve Jobs of Investing (Dec '11)Henry Hancock100% (3)

- The Greatest Business Decisions of TimeDocument16 pagesThe Greatest Business Decisions of Timefetox36526No ratings yet

- Clifford Chance Letter in Response To HP's Claim 050515sigDocument42 pagesClifford Chance Letter in Response To HP's Claim 050515sigArik HesseldahlNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummarySahil GulatiNo ratings yet

- Hpcompaq DocumntDocument28 pagesHpcompaq DocumntPreeti MalikNo ratings yet

- Case Study Report-HPDocument21 pagesCase Study Report-HPashankgptNo ratings yet

- Theory of BusinessDocument1 pageTheory of BusinessSomdeep DebNo ratings yet

- 22 Immutable Laws of MarketingDocument24 pages22 Immutable Laws of MarketingAmit KumarNo ratings yet

- Andreessen Horowitz Bad InvestmentDocument5 pagesAndreessen Horowitz Bad InvestmentnayeemNo ratings yet

- Thought ProcessDocument2 pagesThought ProcessPiyush ChoudharyNo ratings yet

- PC Wars: Hewlett-Packard vs. Dell Computer: Group Members: 1.nyleve Henry 2.joe 3.crystal 4.jiafen LiDocument22 pagesPC Wars: Hewlett-Packard vs. Dell Computer: Group Members: 1.nyleve Henry 2.joe 3.crystal 4.jiafen LiCrystal CaoNo ratings yet

- Vaswani Santosh Nathani Gopal Nagra Gulshan Godia Kumar Tolani RoshanDocument8 pagesVaswani Santosh Nathani Gopal Nagra Gulshan Godia Kumar Tolani RoshanAkkhi_D_Chaser_6797No ratings yet

- Hammer Big Idea FastCo2007Document8 pagesHammer Big Idea FastCo2007TOHA FARID MOHD ZAINNo ratings yet

- Hewlett-Packard Investigation HRM-362 Zach Raab 12-3-2020Document7 pagesHewlett-Packard Investigation HRM-362 Zach Raab 12-3-2020api-534799667No ratings yet

- The Smartest Places On EarthDocument4 pagesThe Smartest Places On Earthwamu885No ratings yet

- The Motley Fool Investment Guide: How The Fool Beats Wall Street's Wise Men And How You Can TooFrom EverandThe Motley Fool Investment Guide: How The Fool Beats Wall Street's Wise Men And How You Can TooRating: 3.5 out of 5 stars3.5/5 (3)

- The Merger of Hewlett Packard and Compaq (A)Document25 pagesThe Merger of Hewlett Packard and Compaq (A)roseNo ratings yet

- Entrepreneurship and InnovationDocument5 pagesEntrepreneurship and Innovationsakshimehta07No ratings yet

- Entrepreneurship and InnovationDocument5 pagesEntrepreneurship and Innovationsakshimehta07No ratings yet

- International Physical Distribution Technology: Carlos Adrian Zuñiga Quintero File 2348258 Professor William ArizaDocument4 pagesInternational Physical Distribution Technology: Carlos Adrian Zuñiga Quintero File 2348258 Professor William ArizaCARLOS ADRIAN ZUÑIGA QUINTERONo ratings yet

- HPDocument3 pagesHPSin ThorNo ratings yet

- Event Horizon: Or How My Business Career Got Sucked into the Black Hole of the Radical Change in the Computer IndustryFrom EverandEvent Horizon: Or How My Business Career Got Sucked into the Black Hole of the Radical Change in the Computer IndustryNo ratings yet

- SAP GUI Inst GuideDocument16 pagesSAP GUI Inst Guidevinodk33506100% (1)

- Warthog: All-Terrain Robotic Development Platform For Rapid PrototypingDocument2 pagesWarthog: All-Terrain Robotic Development Platform For Rapid PrototypingNelsonNo ratings yet

- Siemon Wall Mount Cabinet - Spec Sheet PDFDocument2 pagesSiemon Wall Mount Cabinet - Spec Sheet PDFrahmandzukicNo ratings yet

- Engineer Data VRV IV Cooling Part 3Document332 pagesEngineer Data VRV IV Cooling Part 3Tấn BìnhNo ratings yet

- Simplex-4006-9101 Installation Programming Operation Manual Rev BDocument78 pagesSimplex-4006-9101 Installation Programming Operation Manual Rev Bm_sa_djayaNo ratings yet

- Ziva RWW ManuscriptDocument3 pagesZiva RWW ManuscriptroderunnersdNo ratings yet

- SMDM Extended ProjectDocument1 pageSMDM Extended Projectsrashti tripathiNo ratings yet

- Francoise Kempfbvc@Document1 pageFrancoise Kempfbvc@Anonymous n6EISgJRJSNo ratings yet

- Development of A Crashworthy Composite Fuselage Structure For A Commuter AircraftDocument23 pagesDevelopment of A Crashworthy Composite Fuselage Structure For A Commuter AircraftJony M. TemnikarNo ratings yet

- Introduction To The Internet - EssayDocument1 pageIntroduction To The Internet - EssayIra PiguerraNo ratings yet

- PST PlotDocument100 pagesPST PlotClaudiaNo ratings yet

- Explore Your Design With These Useful Single-Line Dbget Scripts in Innovus 2 3Document7 pagesExplore Your Design With These Useful Single-Line Dbget Scripts in Innovus 2 3subha mounikaNo ratings yet

- Solid in FlutterDocument9 pagesSolid in Flutterشہزاد رحیمNo ratings yet

- Delmia Puma Lecture1Document69 pagesDelmia Puma Lecture1Eder GarciaNo ratings yet

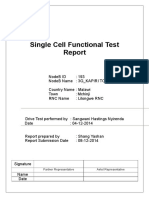

- Single Cell Functional Report - 3G - KAPIRI TOWNDocument25 pagesSingle Cell Functional Report - 3G - KAPIRI TOWNStephen Amachi ChisatiNo ratings yet

- 271 2147 Datasheetz PDFDocument2 pages271 2147 Datasheetz PDFNou NounouNo ratings yet

- 1654860201021effective Resume CompositionDocument10 pages1654860201021effective Resume CompositionMoises E. LegaspiNo ratings yet

- Lecture 9Document8 pagesLecture 9Gordian HerbertNo ratings yet

- Scientific and Technological Thinking - Michael E. Gorman PDFDocument379 pagesScientific and Technological Thinking - Michael E. Gorman PDFpolocanadaNo ratings yet

- Causes of Loosening in Prestressed BoltsDocument6 pagesCauses of Loosening in Prestressed BoltsgauravmeucerNo ratings yet

- Probit ModelDocument5 pagesProbit ModelNidhi KaushikNo ratings yet

- Testing Team and Development TeamDocument33 pagesTesting Team and Development TeamAryaman Singh100% (1)

- The Impact of Social Media: AbstractDocument7 pagesThe Impact of Social Media: AbstractIJSREDNo ratings yet

- Name of Applicant: Personal DetailsDocument4 pagesName of Applicant: Personal DetailsBALACHANDAR SNo ratings yet

- Vmware Validated Design 43 SDDC MonitoringDocument52 pagesVmware Validated Design 43 SDDC MonitoringSri VasNo ratings yet

- Cbse - Department of Skill Education: Artificial Intelligence (Subject Code 417)Document9 pagesCbse - Department of Skill Education: Artificial Intelligence (Subject Code 417)Spoorthi KumbhaNo ratings yet

- Vol 44 Issue 4Document7 pagesVol 44 Issue 4Vinayak KarthikNo ratings yet

- Voluson p8 Brochure Doc1266358Document6 pagesVoluson p8 Brochure Doc1266358Nanang YlNo ratings yet