Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

rohit_pathak_8Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Untitled

Uploaded by

rohit_pathak_8Copyright:

Available Formats

SUMMER TRAINING REPORT ON ANALYSIS OF TRADITIONAL POLICIES OF HDFC STANDARD LIFE SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR

THE AWARD FOR THE DEGREE OF BACHELOR OF BUSINESS ADMINISTRATION (BANKING AND INSURANCE) SUBMITTED BY: -

BATCH-(2010-2013) KASTURI RAM COLLEGE OF HIGHER EDUCATION NARELA DELHI-110040 (Affiliated to Guru Gobind Singh Indraprastha University Delhi)

ACKNOWLEDGEMENT Through words are not enough to express our in debtness and gratitude to all tho se who help me directly or indirectly in conducting this project I hereby ac now ledge all those who, encouraged and inspired through the project. It is privilege to express my sincere and profound sense of gratitude to Ms Sona li Sharma (project guide) her ind help, guidance and corporation despite the ti me and wor constraints with their able guidance, encouragement and valuable sug gestion, this project would have been able to see the light of the day. In the last but not the least I would li e to express my sincere than s to all f aculty members who are not only the source of inspiration, but a constant motiva tion.

Enrollment no.: 00219301810 BBA (B&I)

Name: Rohit Patha

CHAPTER 1 INTRODUCTION

1.1 INSURANCE 1.1.1 Meaning

One and the only certain thing in this world in uncertainty The above statement correctly depicts the uncertainty prevailing in the environm ent. In order to reduce ris due to uncertainty many methods are developed and o ne such method is insurance. Insurance is a contract of indemnity where the inde mnifier (insurer) promises indemnified (insured) to protect him. Insurance may be described as a social device to reduce or eliminate the ris of loss of life and property. Under the plan of insurance a large number of people associate themselves by sharing ris attached to individuals. The ris s, which can be insured against, include fire, perils of sea, death, accidents and burgla ry. Any ris contingent upon these may be insured against at a premium commensur ate with the ris involved. Thus we can say collective bearing of ris is insuran ce. Insurance is a plan by themselves which large number of people associate and tra nsfer to the shoulders of all, ris that attach to individuals. ..John Mage e Insurance is a contract in which a sum of money is paid to the assured as consid eration of insurers incurring the ris of paying a large sum upon a given conting ency. .....Just ice Tindall 1.1.2 History of Insurance The beginning of insurance business is traced to the city of London. It started with the marine business. Marine traders, who used to gather at Lloyds coffee hou se in London, agreed to share losses to goods during transportation by ship. Mar ine related losses included: Loss of ship by sin ing due to bad weather in high seas. Goods in transit by ship robbed by sea pirates. Loss of or damage to the goods in transit by ship due to bad weather in high sea s. The first insurance policy was issued in England in 1583.

1.1.3 FUNCTIONS OF INSURANCE Primary functions

3 Assessment of ris : insurance determines the probable volume of ris by evaluating various factors which give rise to ris . 4 Provide certainty: insurance is a device which helps to change from unce rtainty to certainty. Secondary functions 1 Prevention of losses: insurance cautions businessman and individuals to adopt suitable device to prevent unfortunate consequences of ris by observing s afety instructions. 2 Small capital to cover large ris : insurance relieves the businessman fr om security investment, by paying small amount of insurance against large ris a nd uncertainty. Contribute towards development of large industries 1.1.4 Life Insurance in India In India, insurance started with life Insurance. It was in the early 19th Centur y when the Britishers on their postings in India felt the need of life insurance cover. It started with English Companies li e... The European and the Albert. The First Indian insurance company was the Bombay Mutual Assurance Society Ltd., fo rmed in 1870.

In the wa e of the Swadeshi Movement in India in the early 1900s, quite a good n umber of Indian companies were formed in various parts of the country to transac t insurance business. To name a few:: Hindustan Co-operative and National Insurance in Kol ata; United India in Chennai; Bombay Life, New India and Jupiter in Mumbai and shmi Insurance in New Delhi. In 1956, life insurance business was nationalized and LIC of India came into bei ng on 1.9.1956. The government too over the business of 245 companies (includin g 75 provident fund societies) who were transacting life insurance business at t hat time. Thereafter, LIC got the exclusive privilege to transact life insurance business in India 1.1.5 Types of Insurance

Collective bearing of ris : insurance is a device to share the financial losses of few among many others.

1 Provides protection: insurance cannot chec the happening of ris n provide for losses of ris .

but ca

1.2 Life Insurance 1.2.1 Meaning Life insurance covers the ris that exists in ones life. These ris s may arise du e to accident, illness or natural causes li e fire, flood and earthqua e. Life i nsurance aims to protect the family of the life insured so that they may not suf fer from financial consequences on the death or disability of the insured person . Life insurance needs to be a mandatory part of every persons life. Life insuran ce is a contract that pledges payment of an amount to the person assured (or his nominee) on the happening of the event insured against. Life insurance is a very popular form of insurance. It ensures the life of an in dividual and gives financial protection to the members of the family of the poli cyholder. It is different from other types of insurance in various ways. It not only gives protection but it is a method of compulsory saving. This insurance provides pro tection to the family at the premature death or gives adequate amount at the old age when the earning capacities are reduced. The contract is valid for payment of the insured amount during: The date of maturity, or Specified dates at periodic intervals, or Unfortunate death, if it occurs earlier.

1.2.2 Definition Life Insurance may be defined as a type of Insurance Contract whereby the insure r, in consideration of the premium paid in periodical installments underta es to pay an annuity or a certain sum of money either on the death of the insured or on the expiry of a certain number of years. Life insurance or life assurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a designated beneficiary a sum of money upon the occurrence of the insured individual s or individuals death or other event, such as terminal illness or critical illness. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in l ump sums.

1.2.3 Features of Life Insurance Contract (1) Nature of General Contract- Since life insurance contract is a sort of contr act it is governed by the Indian Contract Act. According to Section 10 of Indian Contract Act, 1872 a valid contract must have the following essentialities:

(2) Insurable Interest- The insured must have an insurable interest in the life to be insured for a valid contract. Insurable Interest in life insurance may be divided into two categories: Insurable interest in own life, and Insurable Interest in others life. (3) Utmost Good Faith- The life insurance requires that the principle of utmost good faith should be preserved by both the parties. The principle of utmost good faith says that both the parties, proposer (insured) and insurer must be of the same mind at the time of contract because only then the ris may be correctly a scertained. They must ma e full and true disclosure of the facts material to ris . (4) Warranties- Warranties are integral part of contract. i.e. they form the bas es of the contract between the proposer and the insurer and if any statement whe ther material or non material, is untrue the contract shall be null and void and the premium paid by him may be forfeited by the insurer. (5) Proximate Cause- The efficient or effective cause that causes loss is called PROXIMATE CAUSE. It is the real and actual cause of loss. If the cause of loss is insured, the insurer will pay. In LIFE INSURANCE the doctrine of CAUSA PROXIMA is not applied because the insurer is bound to pay the amount of insurance whatever may be the reason of death. It may be natural or unnatural. Hence this principle is not of much practical impo rtance with life insurance. (6) Assignment and Nomination- Life insurance policy can be assigned freely for a legal consideration or love and affection. Notice of assignment must be given to the insurer who will ac nowledge the assignment. The holder of life insurance policy on his own may either at the time of affecti ng the policy or at any subsequent time before the policy matures, nominate pers on or persons to whom the money secured by the policy shall be paid in event of his death. Nomination can be cancelled before the maturity, but a notice should be served t o this effect. 1.2.4 Benefits of Life Insurance

Temporary needs / threats The original purpose of life insurance remains an important element, namely prov iding for replacement of on death etc. Regular savings Providing for ones family and one self, as a medium to long term exercise (throug h a series of regular payment of premiums) this has become more relevant in rece

Life insurance has conceived as a ris y ris situations, d, it was realized ng

come a long way from the earlier days when it was originally covering medium for short periods of time, covering temporar such as sea voyages. As life insurance became more establishe what a useful tool it was for a number of situations, includi

Offer and acceptance. Legal considerations. Competent to ma e contract. Free consent. Legal object.

nt times as people see financial independence for their family. Investment Put simply, the building up of savings while safeguarding it from ravages of inf lation. Unli e regular saving products, investment products are traditionally re gular investments, where the individual ma es a one off payment. Retirement Provision for later years becomes increasingly necessary, especially in a changi ng cultural and social environment. One can buy a suitable insurance policy, whi ch will provide periodical payments in ones old age.

1.3 INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY (IRDA) Reforms in the Insurance sector were initiated with the passes of the IRDA Bill in Parliament in December 1999. The IRDA since its incorporation as a statutory body in April 2000 has fastidiously such to its schedule of framing regulations and registering the private sector insurance companies. The other decision ta en simultaneously to provide the supporting systems to the insurance sector and in particular the life insurance companies was the launch of the IRDA online service for issue and renewal of licenses to agents. Section 14 of IRDA Act, 1999 lays down the duties, powers and functions of IRDA. . 1. Subject to the provisions of this Act and any other law for the time being in force, the Authority shall have the duty to regulate, promote and ensure orderl y growth of the insurance business and re-insurance business. 2. Without prejudice to the generality of the provisions contained in sub-sectio n (1), the powers and functions of the Authority shall include, (a) Issue to the applicant a certificate of registration, renew, modify, withdra w, suspend or cancel such registration; (b) Protection of the interests of the policy holders in matters concerning assi gning of policy, nomination by policy holders, insurable interest, settlement of insurance claim, surrender value of policy and other terms and conditions of co ntracts of insurance; (c) Specifying requisite qualifications, code of conduct and practical training for intermediary or insurance intermediaries and agents; (d) Specifying the code of conduct for surveyors and loss assessors; (e) Promoting efficiency in the conduct of insurance business; (f) Promoting and regulating professional organizations connected with the insur ance and re-insurance business; (g) Levying fees and other charges for carrying out the purposes of this Act;

(h) Calling for information from, underta ing inspection of, conducting enquirie s and investigations including audit of the insurers, intermediaries, insurance intermediaries and other organizations connected with the insurance business; (i) Control and regulation of the rates, advantages, terms and conditions that m ay be offered by insurers in respect of general insurance business not so contro lled and regulated by the Tariff Advisory Committee under section 64U of the Ins urance Act, 1938 (4 of 1938); (j) Specifying the form and manner in which boo s of account shall be maintained and statement of accounts shall be rendered by insurers and other insurance int ermediaries; ( ) Regulating investment of funds by insurance companies; (l) Regulating maintenance of margin of solvency; (m) Adjudication of disputes between insurers and intermediaries or insurance in termediaries; (n) Supervising the functioning of the Tariff Advisory Committee; (o) Specifying the percentage of premium income of the insurer to finance scheme s for promoting and regulating professional organisations referred to in clause (p) Specifying the percentage of life insurance business and general insurance b usiness to be underta en by the insurer in the rural or social sector; and (q) Exercising such other powers as may be prescribed

OBJECTIVES

To analyze different types of product and services offered by HDFC Life To compare the products of HDFC life with other competitors in the mar et.

To find the satisfaction level of existing customers of HDFC life and needs of n ew customers. To find out consumer loyalty about HDFC Life.

To study the mar eting strategies of HDFC Life.

To now about the HDFC Life

RESEARCH METHODOLOGY Research methodology is a way to systematically solve the problems. I may be und erstood as a science of how research is done scientifically. We studied the various steps that are generally adopted by a researcher in study his research problem along with the logic behind them. It is necessary for the researcher to now not only the research method or techn iques but also research methodology.

Types of research: Descriptive Explanatory Exploratory Data collection: Primary data Secondary data Primary data: It involves collecting data from its origin. Secondary data: Using information that have already put together.

RESEARCH DESIGN

Research methodology is referring to a search for nowledge. Research is thus an original contribution to the existing stoc of nowledge ma ing for its advancement. It is the persuade of truth with the help of study.

It is used in rigid, which involves specific guidelines to reach the financial r esult data is collected on specific parameters. ANALYSIS OF DATA Data collected from various sources is edited, tabulated & analyzed using variou s tools li e ratios & financial analysis. My study is based on secondary data collected from internet, newspaper, article etc & discredited in nature.

CHAPTER 2 INTRODUCTION TO HDFC STANDARD LIFE

2.1 History of HDFC standard life HDFC Standard life is the joint venture of HDFC Company and Standard Life. HDFC as everyone nows that it is in the mar et since 1977. It is a strong and r enowned company. It has set a benchmar in housing and finance sector. It has ar ound 271 offices which are spread all around and also it has more than 2 million satisfied customers. Standard life is a United Kingdom based company which is a giant company there, catering the insurance needs of its people. It is there in the mar et since 180

years. It was established in 1825. Its asset value is around 180 billion dollars and is trusted by everyone. It has around 1.5 billion individual shareholders i n 50 countries till date. HDFC Standard Life was established on 14th August 2000 and fortunately was the f irst private player in insurance sector after LIC. The day was 23rd October 2000 . It has done a great job in just 10 years and is giving a tough fight to all th e top insurance companies till date. The values and culture of this company is a lso quite good as compared to other insurance companies. The main purpose of thi s company is customer s satisfaction. 2.2 HDFCs KEY STRENGTHS

Core Values: SECURITY: Providing long term financial security to our policyholders will be ou r constant endeavor. They will be doing this by offering life insurance and pens ion products. TRUST: They appreciate the trust placed by their policyholders in them. Hence, t hey will aim to manage their investments very carefully and live up to this trus t. INNOVATION: Recognizing the different needs of their customers, be offering a ra nge of innovative products to meet these needs. HDFC Standard Lifes mission is to be the best new life insurance company in India and the values that will guide HDFC Standard life in this.

Mission: HDFC aims to be the top new life insurance company in the mar et. This doesnt jus t mean being the largest or the most productive company in the mar et, rather it is a combination of several things li e Customer service of the highest order Value for money for customers

Professionalism in carrying out business Innovative products to cater to differe nt needs of different customer Use of technology to improve service standards Increasing mar et share.

Products: HDFC Standard life Insurance offers a range of innovative, customer-centric prod ucts that meet the needs of customers at every life stage. Its 16 products can b e enhanced with up to 4 riders, to create a customized solution for each policyh older. 2.3 Why Life Insurance from HDFC Standard Life

2.4 HDFC Standard Life Vision and Values 2.4.1 Vision of HDFCSL The most successful and admired life insurance company, which mean that we are t he most trusted company, the easiest to deal with, offer the best value for mone y, and set the standards in the industry. In short, The most obvious choice for a ll For retention in the mar et and highest mar et share, we need trust of our custo mer. The customer should trust on our policies, services, employs and they shoul d be friendly with us. It wants to live in the eye and heart of the customer. It wants to give them the easiest deal so that they can be understood the terms an d policies. As we now that profit is the main aim of any business but it thin not only about his profit but also profit of the customer. It wants to be the ch

Strong parentage & long term commitment to this business. Ability to inject additional equity capital Can support long gestation business Renowned for transparency and high corporate governance standards Trac record in personal financial sector. Realistic promises and need based selling Customized solutions Commitment to customer Superior service levels Quality of advice

oice of all people on the basis of trust of customer, delivering high value to t he customer, and delivery of best value of the money. 2.4.3 Value of HDFCSL 1. Integrity HDFCSL believes in honest and trustfulness in every action. Transparency in deal ing with customers. It is stic to principles irrespective of outcome. When we w or in HDFCSL then we observed that its rules and activity of every person in th e organization is just and fair to everyone. Integrity is the bedroc on which the company and the expectations of the custom ers and employees are built. Integrity gives inner feeling to both customer and the employees to wor with it. It establishes the credibility of the person defi nes the character and empowers one to do justice to the job. It enables confiden ce and trust, achieving transparency and laying a strong foundation for a bindin g relationship. It guides principle for all wal s of life. 2. Innovation It is the process of building a store house of treasures through experiences. Lots of product is going to be launched by the competitors. So it is very import ant to loo every product and process through fresh eyes every day. It is the si gnificant part of the business that attracts customer. Innovation is essential to exceed customer expectation and maximize customer ret ention because it is the sector of investment so you need to fulfill the custome r expectation which help you to retain customer. Innovation helps to achieve com petitive advantage. It promotes growth and upgrade standards in the industry. It fosters creativity amongst employees and partners. It opens a world of new poss ibilities because it brings new concept which helps to entice the customer. 3. Customer centric Customer becomes the main properties of any organization. Whatever wor done by the organization runs around the expectations of the customer. Customer becomes centre point of the organization and the main focus of the organization becomes to understand his expectations by eeping him as the centre point. It gives more focus on customer activity and saying. It tries to understand customer needs an d deliver solutions. As we now that the mar et is changed. Lots of competitors is here who search chance to increase their mar et share and entice your custome r so customer interest become always supreme. 4. People Care Genuinely try to understand those people who are wor ing with HDFCSL. It guides their development through training and support. It helps them to develop their r equisite their s ills so that they can reach their true potential. It tries to now them on a personal front because it wor s as a performance appraisal. It try to create an environment of trust and openness so that all people who are wor i ng here behave friendly and helps to each other because team wor is most import ant for getting success and give respect for the time of others. People are the most valuable assets of the company so it tries to motivate indiv idual to give his/her best. It wants to establish a valuable relationship with t hem to create a joyful wor ing environment. The most important thing is that it tries to provide job satisfaction for their people. 5. Team wor One for all and all for one Here whole team ta es the ownership of the deliverables. It consults all involve d in the wor and tries to understand their opinion and then arrive at a common objective. There is a cooperation and support across departmental boundaries. It identifies strengths and wea nesses accordingly allocate responsibility to achi

eve common objectives. Team wor helps everyone to achieve more. It adds joy at wor place which adds i nterest in the wor and new stamina in the wor . It generates synergy and provid es a focused approach. When an idea or activity performed in a group, it has gre ater acceptability. Team wor proves one for all and all for one. 6. Joy and simplicity It believes in joy and simplicity so that people in the organization will be mor e dedicated towards wor and they will give more business to the organization. W or with joy and simplicity brings creativity and new imagination which also bri ngs new innovative ideas that promote competitive advantage to the organization. 2.5 ORGANISATION STRUCTURE The organizational pattern of insurance companies are broadly similar. Each comp any has a board of director president by a full time chairman cum managing direc tor. Each company operates to out the country through regional/area offices, div isional office and branches. Similar structure is followed by HDFC SLIC. These w ould be clear by diagramOrganizational Pattern Diagram

CHAPTER 3 PRODUCT ANALYSIS

TYPES OF LIFE INSURANCE PLAN 3.1 PROTECTION PLANS WHY DO WE NEED PROTECTION PLANS? Protection Plans help you shield your family from uncertainties in life due to f inancial losses in terms of loss of income that may dawn upon them in case of yo ur untimely demise or critical illness. Securing the future of ones family is one of the most important goals of life. Protection Plans go a long way in ensuring your familys financial independence in the event of your unfortunate demise or c ritical illness. They are all the more important if you are the chief wage earne r in your family. No matter how much you have saved or invested over the years, sudden eventualities, such as death or critical illness, always tend to affect y our family financially apart from the huge emotional loss. For instance, consider the example of Amit who is a healthy 25 year old guy with a income of Rs. 1,00,000/- per annum. Let s assume his income increases at a ra te of 10% per annum, while the inflation rate is around 4%; this is how his inco me chart will loo li e, until he retires at the age of 60 years. At 50 years of age, Amits real income would have been around Rs. 10, 00,000/- per annum. Howeve r, in case of Amits unfortunate demise at an early age of 42 years, the loss of i ncome to his family would be nearly Rs. 5,00,000/- per annum.

However, with a Protection Plan, a mere sum of Rs. 2,280/- annually (exclusive o f service tax & educational cess) can help Amit provide a financial cushion of u p to Rs. 10, 00,000/- for his family over a period of 25 years. 3.1.1 HDFC Term Assurance Plan This plan is designed to help secure your familys financial needs in case of unce rtainties. The plan does this by providing a lump sum to the family of the life assured in case of death or critical illness (if option is chosen) of the life a ssured during the term of the contract. One can choose the lump sum that would r eplace the income lost to ones family in the unfortunate event of ones death. This helps your family to maintain their financial independence, even when you are n ot around. Benefits In case of your unfortunate demise or Critical Illness* during the policy term, your nominee will receive the Sum Assured + any optional benefits due. Since this non-participating (without profits) plan is a pure insurance plan, no benefits are payable on survival of the insured life to the end of the term of the policy. Features

3.1.2. HDFC Loan Cover Term Assurance Plan This plan aims to protect your family from your loan liabilities in case of your unfortunate demise within the policy term. It provides the beneficiary with a l ump sum amount, which is a decreasing percentage of the initial Sum Assured. Thi s means that as the outstanding loan decreases as per the loan schedule, the cov er under the policy also decreases as per the policy schedule.

Benefits In case of your unfortunate demise or Critical Illness* during the policy term, your nominee will receive the Sum Assured + any optional benefits due. This Sum Assured will be a decreasing percentage of the initial Sum Assured as the outsta nding loan amount decreases as per the loan schedule, the cover under the policy also decreases as per the policy schedule. Since this non-participating (without profits) plan is a pure ris cover plan, n o benefits are payable on survival of the insured life to the end of the term of the policy. Features 3.1.3 HDFC Home Loan Protection Plan This plan aims to protect your family from your loan liabilities in case of your unfortunate demise within the policy term. It ensures that your family does not lose the dream house that you have purchased for them, in case you are not arou nd to repay the outstanding monthly installments on your housing loan. This prov ides you with the comfort of nowing that in your absence, a sum of money will b e available towards repaying your housing loan, ma ing sure that your family wil l be secure in your family home. Benefits A decreasing Sum Assured payable if you die during the term of the contract. Thi s sum assured is intended to help pay-off your outstanding home loan Policy can be availed by paying a single premium in advance The premium amount can be included in the housing loan and repaid as part of the loan repayment installments Decreasing Sum Assured ma es sure that you do not pay for protection you don t n eed Features

3.1.4 HDFC Life Clic 2 Protect Loo ing for an easier way to insure yourself and secure your loved ones happines s? You now that the solution is a term insurance plan and you see a plan that is convenient to buy and is affordable. Your search ends here. HDFC Life is happ y to present the perfect plan for your protection needs HDFC Life Clic 2 Protec t! HDFC Life Clic 2 Protect is a term insurance plan. This plan provides for a payment of a lump sum in the event of your unfortunate death during the policy t erm Benefits Buy this plan at clic of button , anytime & anywhere High cover at a very nominal cost. Flexibility to choose the Sum Assured and policy term Attractive premium rates for Non tobacco user and those with healthier lifestyle . Tax benefits under sections 80Cand 10(10D) of Income Tax Act, 1961. Features

3.1.5 HDFC Premium Guarantee Plan HDFC Premium Guarantee Plan is an insurance plan that comes with twin advantage of protection and return of premiums on maturity. So, you can enjoy life nowing that your family financial independence is secure even in your absence. And you r premiums are yours on your survival at maturity. Benefits High cover at a very nominal cost. Flexibility to choose the Sum Assured. Return of all your premiums paid on maturity Tax benefits under sections 80C and 10(10D) of Income Tax Act, 1961 Features

3.2 CHILDREN PLANS WHY DO WE NEED CHILDREN PLAN? Children s Plans helps you save so that you can fulfill your child s dreams and aspirations. These plans go a long way in securing your child s future by financ ing the ey milestones in their lives even if you are no longer around to overse e them. As a parent, you wish to provide your child with the very best that life offers, the best possible education, marriage and life style. Most of these goals have a price tag attached and unless you plan your finances carefully, you may not be able to provide the required economic support to your child when you need it the most. For example, with the high and rising costs of education, if you are not financially prepared, your child may miss an opportuni ty of a lifetime. Today, a 2-year MBA course at a premiere management institute would cost you nea rly Rs. 3,00,000/- At a assumed 6% rate of inflation per annum, 20 years later, you would need almost Rs. 9,07,680/- to finance your child s MBA degree. An illustration of how education expenses could rise with passing time due to in flation Source: HDFC Standard Life Survey 2008. Inflation assumed as 6% p.a.

As a parent, your priority is your childs future and being able to meet your chil ds dreams and aspirations. With our HDFC Childrens Plan, you can start building yo ur savings today and ensure a bright future for your child. This With Profits plan is designed to secure your childs future by giving your child (Beneficiary) a gu aranteed lump sum on maturity or in case of your unfortunate demise, early into the policy term. Benefits Lets you customize an ideal plan for your child and provide invaluable financial support The Double Benefit Plan Option helps you secure your child s immediate and futur e needs. In case of your unfortunate demise, we will pay the Sum Assured to your child (Beneficiary). Your family need not pay any further premiums and the poli cy continues. And on maturity of the plan, we will pay you the Sum Assured plus

Bonuses Declared You can choose to pay your premium as either Annually, Half-Yearly or Quarterly depending on your convenience. You also have a range of convenient auto premium payment options Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61 Features 3.2.1 HDFC SL YoungStar Super II There is no bigger joy than being able to fulfill your child s dream on your own . With HDFC SL YoungStar Super II you can fulfill your child s immediate and fut ure needs. So tomorrow when your child needs your support you don t have to depe nd on anyone else.This is a ULIP which aims to help you achieve long term saving s. Benefits In case of your unfortunate demise or critical illness, we will pay the greater of Sum Assured (less partial withdrawals) or Fund Value to your child (Beneficia ry). The policy will terminate. We will pay 100% of all the future regular premi ums to the Beneficiary as and when due, on an annual basis. Please refer to the sales brochure for details. You can customize the ideal plan for your child by choosing the premium you wish to invest along with the Sum Assured, depending on the level of protection requ ired. This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals. Kindly refer to the product brochure for details. You can change your investment fund choices in two ways: o Switching: You can move your accumulated funds from one fund to another anytime o Premium Redirection: You can pay your future premiums into a different s election of funds, as per your need Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61 Features 3.2.2 HDFC SL YoungStar Super Premium With HDFC SL YoungStar Super Premium you can fulfill your child s immediate and future needs- all on your own. Start saving now with this unit lin ed insurance plan and be assured that savings for your child will continue, even in your abse nce. This ULIP plan offers you choice of cover options and benefit payment prefe rences- all designed to suit your needs. Benefits The Triple Insurance Benefit helps you secure your child s immediate and future needs. In case of your unfortunate demise or critical illness, we will pay the S um Assured to your child (Beneficiary). Your family need not pay any further pre miums. With Save -n- Gain benefit ,we will pay 50% of all the original regular p remiums towards your policy and 50% of the premiums will be paid to the Benefici ary as and when due, on an annual basis. Any Death Benefit or Critical Illness c over terminates immediately. You can customize the ideal plan for your child by choosing the premium you wish to invest along with the Sum Assured, depending on the level of protection requ ired and Benefit payment preference. This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals. Kindly refer to the product brochure for details. You can change your investment fund choices in two ways: o Switching: You can move your accumulated funds from one fund to another anytime o Premium Redirection: You can pay your future premiums into a different s election of funds, as per your need Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61 Features

3.3 SAVINGS AND INVESTMENT PLANS WHY DO WE NEED SAVINGS AND INVESTMENT PLANS? You have always given your family the very best. And there is no reason why they shouldn t get the very best in the future too. As a judicious family man, your priority is to secure the well-being of those who depend on you. Not just for to day, but also in the long term. More importantly, you have to ensure that your f amily s future expenses are ta en care, even if something unfortunate were to ha ppen to you. A big factor that you need to consider while building your wealth is inflation. It has a dual impact on your hard-earned savings. Inflation not only erodes your current purchasing power but also magnifies your monetary requirements for the future. Sample this: An 35 Year individual needs to invest Rs. 36,000/- per year with 8% returns to build a corpus of Rs. 10,00,000/- by the age of 50 Years.

However, Rs. 10,00,000/- after 15 years would be worth roughly around half of wh at it is today once adjusted for inflation at the rate of 4%. Therefore, an indi vidual will need to save nearer to Rs 50,000/- annually to reach your targeted s avings at the age of 50 Years, if you consider inflation. Our Savings & Investment Plans provide you the assurance of lump sum funds for y our and your family s future expenses. While providing an excellent savings tool for your short term and long term financial goals, these plans also assure your family a certain sum by way of an insurance cover. With HDFC Standard Life s ra nge of Saving & Investment Plans, you can therefore ensure that your family alwa ys remains financially independent, even if you are not around. 3.3.1 HDFC Life Sampoorn Samridhi Insurance Plan Su h aur Samridhi. Joy, happiness and prosperity are your ultimate desire, not o nly for yourself but also for your loved ones. Life insurance plans not only let you secure financial future of your loved ones, they also assist you in attaini ng prosperity. With HDFC Life Sampoorn Samridhi Insurance Plan, you can be financially prepared for the future and can fulfill your dreams & aspirations. This plan offers fina ncial protection to your loved ones when they need it the most, enabling you and your family live life with peace of mind and sar utha e ! Benefits Financial protection to your loved ones by way of a lump sum payment in case of your unfortunate demise during the policy term. Sum assured plus attached bonuse s will be paid to the nominee. In case of death due to accident, an additional S um Assured will be paid. The policy will terminate and no further benefits will be payable. Choice of Maturity Benefit Option- on survival till maturity , you can choose ma turity benefit option Enhanced Cash Option Sum Assured + Reversionary Bonus +any interim bonus + any te minal bonus + Enhanced Terminal Bonus. Policy terminates and no further benefits are payable. Enhanced Cover Option - Sum Assured + Reversionary Bonus + any Interim bonus + a ny Terminal Bonus payable on maturity + Additional Sum Assured on unfortunate de ath of life assured up to age of 99 years. Tax benefits under sections 80C and 10(10D) of the Income Tax Act, 1961 subject to the provisions contained therein Features 3.3.2 HDFC Endowment Assurance Plan As a judicious family man, your priority is to secure the well-being of those wh o depend on you. Not just for today, but also for the long term. With our HDFC E ndowment Assurance Plan, you can start building your savings today and ensure th

at your family remains financially independent, even when you are not around. Th is With Profits plan is designed to secure your family s future by giving your family a guaranteed lump sum on maturity or in case of your unfortunate demise, early into the policy term. Benefits Ideal way to secure your long-term financial goals and your family s financial i ndependence by giving a lump sum payment (basic Sum Assured plus any Bonus Addit ions) on survival up to Maturity date Provides invaluable protection to your family by way of lump sum payment in case of unfortunate demise within policy term Gives you the flexibility to customize your policy according to your needs by ad ding any one of the 3benefit options available You can choose to pay your premium as either Annually, Half-Yearly or Quarterly depending on your convenience. You also have a range of convenient auto premium payment options Tax benefits under sections 80C, 80D and 10(10D) of Income Tax Act, 1961 Features

3.3.3 HDFC SL Crest Any uncertainty should not affect your plans. Be it of life, or of mar ets. You want to secure happiness for yourself and your loved ones. We present HDFC SL Cr est - insurance cum investment plan that provides valuable financial protection to your family when needed the most along with an investment option for certaint y of highest NAV along with a guarantee on returns*. So that when you reap the r eturns of life, they are on crests not on lows. In this plan you can choose to i nvest in either of two investments options- Highest NAV Guarantee Fund or Free A sset Allocation Option. This plan is a unit lin ed plan with insurance coverage that helps you achieve long term savings. Benefits Choice of two Investment Options - Highest NAV Guarantee Fund or Free Asset Allo cation Option. Benefit of minimum guaranteed NAV of Rs. 15 at maturity *. On maturity you will receive the Fund value as per the investment option selecte d. This plan provides valuable protection to your family in case you are not around . In case of your unfortunate demise during the policy term, we will pay the amo unt higher of your Sum Assured (less partial withdrawals) or your total fund val ue to your family. Please refer to product brochure for details. This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals. Kindly refer to the product brochure for details. Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61 Features 3.3.4 HDFC SL ProGrowth Super II You will settle for nothing but the best. Be it for self or for your loved ones. With HDFC SL ProGrowth Super II, you have a smart savings-cum-insurance unit li n ed plan that will help you effortlessly provide the finest for your family, be it today or tomorrow. This ULIP aims to help you achieve long term savings. Benefits You can choose any of the following 8 plan options as per your requirement. o Life Option = Death Benefit o Extra Life Option = Death Benefit + Accidental Death Benefit o Life & Health Option = Death Benefit + Critical Illness Benefit o Extra Life & Health Option = Death Benefit + Critical Illness Benefit + Accidental Death Benefit o Life & Disability Option = Death Benefit + Accidental Total & Permanent Disability Benefit

o Extra Life & Disability Option = Death Benefit + Accidental Death Benefi t + Accidental Total & Permanent Disability Benefit o Life & Health & Disability Option = Death Benefit + Critical Illness + A ccidental Total & Permanent Disability Benefit o Extra Life & Health & Disability Option = Death Benefit + Accidental Dea th Benefit+ Critical Illness + Accidental Total & Permanent Disability Benefit This plan provides valuable protection to your family in case you are not around . In case of your unfortunate demise during the policy term, we will pay the Sum Assured and your total fund value to your family. This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals. Kindly refer to the product brochure for details. You can change your investment fund choices in two ways: o Switching: You can move your accumulated funds from one fund to another anytime o Premium Redirection: You can pay your future premiums into a different s election of funds, as per your need Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61

Features

3.3.5 HDFC SL ProGrowth Flexi Nothing should hold you bac in life. Uncertainties of life can throw best laid plans and aspiration off gear. It s prudent to be prepared and life insurance so lutions enable you to build your savings and enjoy life cover. With HDFC SL ProGrowth Flexi, you have a smart savings-cum-insurance unit lin ed plan that will enable you to simply provide the finest for your loved ones. In this plan you also enjoy life insurance coverage so that you re loved ones finan cial future is secured even in your absence. This unit lin ed plan aims to help policy holder build his/her savings in long term. There are no bonuses attached in this plan. Benefits This plan provides valuable protection to your family in case you are not around . In case of your unfortunate demise during the policy term, we will pay the gre ater of the Sum Assured or your total fund value to your nominee. You can choose any of the following 2 plan options as per your requirement. o Life Option = Death Benefit o Extra Life Option = Death Benefit + Accidental Death Benefit On maturity, you can ta e the Fund Value at the prevailing unit prices as lump s um or you can opt for settlement option. You have flexibility of o Switching: You can move your accumulated funds from one fund to another

anytime o Premium Redirection: You can pay your future premiums into a different s election of funds, as per your need Features 3.3.6 HDFC Life ProGrowth Plus You wor hard to attain your dreams. Your money should wor harder so that you c an attain your dreams and aspirations. Investing in a unit lin ed insurance plan is a nice way to build wealth and also enjoy life insurance cover. We understan d that you would li e to actively manage your own investment, and prefer to crea te your own investment strategy. We present HDFC Life ProGrowth Plus, a simple savings-cum-insurance plan that wi ll enable you to enjoy life cover and benefit from comfort of creating your own investment strategies. This ULIP plan aims to help you achieve long term savings while providing insurance coverage as per option selected by you. i.e. Life and Extra Life. Benefits This plan provides valuable protection to your family in case you are not around . In case of your unfortunate demise during the policy term, we will pay the gre ater of the Sum Assured or your total fund value to your nominee You can choose any of the following 2 plan options as per your requirement. o Life Option = Death Benefit o Extra Life Option = Death Benefit + Accidental Death Benefit On maturity, you can ta e the Fund Value at the prevailing unit prices as lump s um or you can opt for settlement option. You have flexibility of creating your own investment strategies, as per your ris and return appetite You have flexibility to ma e partial withdrawals to meet any unplanned expenses Tax benefits are offered under section 80C and 10(10D) of the Income Tax Act, 19 61, as per provisions contained therein Features

3.3.7 HDFC SL ProGrowth Maximiser You now that there are no guarantees in life, but when it comes to your loved o nes you dont want to ta e any chances. You need an assurance that if something ha ppens to you, your loved ones happiness and dreams are not hampered. With our HDFC SL ProGrowth Maximiser, you get the valuable life insurance cover along with the choice of investing in any one of 3 different Investment Options. This plan strives to maximize your returns so that ensuring the best for your l oved ones is easy. This plan is a single premium unit lin ed plan with insurance coverage that helps you achieve long term savings with insurance cover. Advantages Choose Investment options as per your need: You can invest into any of the 3 inv estment option designed to meet different investment and return needs. o Highest NAV Guarantee Fund - offers the Guaranteed NAV applicable at mat urity of your policy will be the higher of Rs. 15 or the highest NAV recorded da ily during the first 7 years from the launch of the Highest NAV Guarantee Fund. o Capital Guarantee Fund - This fund guarantees that the Unit Price on mat urity of the policy will be at least equal to the Unit Price that was used to al locate units to the single premium invested by you at inception of the policy. o Free Asset Allocation - This option enables you to invest in any of the 5 non guaranteed fund(s) available under this option. You can ma e your own inve stment strategy by switching between the funds as desired. Invest additional single premium top- ups as per your convenience anytime. Pleas e refer to the product brochure for details. On unfortunate death of the life assured, greater of the Fund value or Sum Assur ed (less withdrawals as mentioned in sales aid) will be payable to the nominee. On maturity, you will receive the fund value as per investment option selected.

This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals Features

3.3.8 HDFC Life Invest Wise Plan You have always lived an enriching life. After providing the best for your ids and loved ones, you do feel the need to do something for yourself. Ta e your pas sion for painting or pottery and ma e it your fulltime occupation. Open up that business you always wanted to but couldn t. Go explore the world or simply own t hat farm you always wanted. You would li e to do all this but not by dipping int o your savings and investments, which you have already earmar ed for other miles tones. This unit lin ed plan aims to help policyholder build corpus for meeting their financial goal. We present a solution for you that will enable you to buil d a financial cushion to let you re indle your dreams. After all, agar aaj jeene i tamana hai toh jiyo sar utha e. Benefits This product enables you to invest in any of the 5 non guaranteed fund(s) availa ble. You can ma e your own investment strategy by switching between the funds as desired. On maturity, you will receive the fund value. You can use the same to fund any o f your goals li e home, retirement, travel etc. On unfortunate death of the life assured, greater of the Fund value or Sum Assur ed (less withdrawals as mentioned in brochure) will be payable to the nominee. This plan can be ta en by filling Short Medical Questionnaire, which may not req uire you to go for medicals. Kindly refer to the product brochure for details. Features 3.3.9 HDFC SL New Money Bac Plan Being self reliant is a nice feeling. Its comforting to be assured that you have necessary funds to live a fulfilling life. With HDFC SL New Money Bac Plan, you will get regular cash bac at periodic intervals, so that you can fulfill your dreams & aspirations. This plan also offers the financial protection to your lov ed ones when they need it the most, enabling you to live life with peace of mind . Benefits Money Bac on completion of every 4 years, you would get a percentage of your su m assured as cash payout. The payout will be as defined below. Policy- Terms (Yrs.) Survival Benefit as a % of Sum Assured (Money Bac Payout) 4th yr 8th yr 12th yr 16th yr 20th yr 24th yr 12 25% 25% 50% + attaching bonus 16 25% 25% 25% 25% + attaching bonus

20 24

20% 15%

20% 15%

20% 15%

20% 15%

20% + attaching bonus 15% 25% + attaching bonus

Provides valuable protection to your family by way of lump sum payment i.e. Sum Assured plus attaching bonuses, in case of unfortunate demise within policy term , over and above any earlier payouts. You can choose to pay your premium as either Annually, Half-Yearly, Monthly or Q uarterly depending on your convenience. You also have a range of convenient auto premium payment options Tax benefits under sections 80C and 10(10D) of Income Tax Act, 1961 Features

3.3.10 HDFC Single Premium Whole of Life Insurance Plan Ideally, just how spending comes to you, so must saving and investing. You are a ble to finance your expenses and ta e care of your family s needs in present tim es. However, to ensure that family is able to maintain the same standard of livi ng in the future, you need to ma e the right ind of investment today. HDFC Sing le Premium Whole of Life Plan is a tailor made plan well suited to meet your lon g-term investment needs and help you maintain your family s financial independen ce. This single premium investment plan is a Whole of Life plan aimed at providi ng long-term real growth of your money. Benefits This participating plan is a Whole of Life plan aimed at providing long-term rea l growth for your money By nature, this is a whole life policy where the term extends for the life Howev er, you can decide on the policy term by using a feature built into it. For a pe riod of 4 wee s, after any one of the 10th, 15th, 20th and subsequent five-year anniversaries, you can choose to receive the Sum Assured plus any attaching bonu ses, in full. Once money has been received, your policy will cease or you may al so continue the policy for your whole life You can terminate the policy any time, after it has been in force for at least 6

month and receive a surrender value. We will pay discretionary surrender value based on our experience. However, after completion of 3 years there will be a gu aranteed surrender value of 50% of premium paid. In addition to the guaranteed s urrender value, we may pay additional discretionary surrender value based on our experience. Contract ends on the payment of the same Features 3.3.11 HDFC Assurance Plan To fulfill your dreams for your family and yourself, you need to start saving to day. And you not only need to save enough but also need the assurance that your family s future is secure. Get the convenience of HDFC Assurance Plan. HDFC Assu rance Plan helps you conveniently build your long-term savings while eeping you r family s future protected. This With Profits savings plan helps you build yo ur long-term savings while securing your family s future. Benefits This plan is a With Profits savings plan, which offers the following features o The plan receives simple Reversionary Bonuses, which are usually added a nnually o At maturity, the plan pays out the basic Sum Assured plus Reversionary B onuses declared during the policy term. Interim or Terminal Bonus may also be pa yable, if declared The plan can be surrendered for cash value before maturity Provides financial support to your family by way of a lump sum payment in case o f your unfortunate death within the policy term. The lump sum is the basic Sum A ssured plus any bonus additions Tax benefit under Section 80C and 10(10D) of Income Tax Act 1961, subject to pro visions contained therein Features 3.3.12 HDFC Savings Assurance Plan Despite your best efforts, you do not end up saving regularly for your family s and your future. Unexpected expenses, unplanned purchases and often, sheer lac of time defeat your efforts. Don t you wish that someone would ta e on the respo nsibility of regularly saving your money for you? HDFC Savings Assurance Plan is a With Profits savings plan which helps you conveniently build your long-term savings and ensure that your family is protected even if you are not around. Benefits The chosen amount is automatically invested from your ban account into the plan This plan is a With Profits savings policy, which offers the following feature s o The policy receives simple reversionary bonuses, which are usually added annually o At maturity, the policy pays out the basic Sum Assured plus Reversionary Bonuses declared during the policy term. Interim or Terminal Bonus may also be payable, if declared On death during the first year, a sum equal to 80% of premiums received is payab le. On death after the first year and during the policy term, all premiums paid to date will be returned with compound interest calculated at 6% per annum, subj ect to a maximum of the Sum Assured plus Reversionary Bonuses declared till date Tax benefit under Section 80C and 10(10D) of Income Tax Act 1961, subject to pro visions contained therein Features 3.3.13 HDFC SL Endowment Gain Insurance Plan With HDFC SL Endowment Gain Insurance Plan, you can be financially prepared for the future and can fulfill your dreams & aspirations. This plan also offers fina ncial protection to your loved ones when they need it the most, enabling you to live life with peace of mind. Benefits

Ideal way to secure your long-term financial goals and your family s financial i ndependence by giving a lump sum payment (basic Sum Assured plus any Bonus Addit ions) on survival up to Maturity date. Provides invaluable protection to your family by way of lump sum payment in case of unfortunate demise within policy term. Gives you the flexibility to customize your policy according to your needs by ad ding any one of the 2 benefit options available. You can choose to pay your premium as either Annually, Half-Yearly, Quarterly or Monthly depending on your convenience. You also have a range of convenient auto premium payment options. Tax benefits under sections 80C, 80D and 10(10D) of Income Tax Act, 1961. Features

3.3.14 HDFC SL ClassicAssure Insurance Plan With HDFC SL ClassicAssure Insurance Plan, you can be financially prepared for t he future and can fulfill your dreams & aspirations. This plan also offers finan cial protection to your loved ones when they need it the most, enabling you to l ive life with peace of mind. Benefits Ideal way to secure your long-term financial goals and your family s financial i ndependence by giving a lump sum payment (basic Sum Assured plus any Bonus Addit ions) on survival up to Maturity date Provides invaluable protection to your family by way of lump sum payment in case of unfortunate demise within policy term. You can choose to pay your premium as either Annually, Half-Yearly, Quarterly or Monthly depending on your convenience. You also have a range of convenient auto premium payment options. Enjoy High Sum Assured Discount of 5% on basic premium for Sum Assured of Rs.5 L a hs and above. See product brochure for details. Tax benefits under sections 80C and 10(10D) of Income Tax Act, 1961. Features 3.3.15 HDFC Immediate Annuity The HDFC Immediate Annuity is a contract that uses your capital to provide you w ith a guaranteed gross income throughout your lifetime or over a period of your choice. This is the perfect way to plan for your expenses after your retirement. This means you can plan your life the way you want it to be, safe in the nowle dge that your gross income will not fall during the period you have selected. Th is is the perfect way to plan for your expenses after your retirement. The HDFC Immediate Annuity, a offers a number of options to meet all your income needs. Benefits Income for Temporary Period Option: You can choose to limit the payment period o f annuity if you only require an income for a specified time. The annuity is pay able for your selected term provided you are still alive. No annuity is payable after the chosen term has expired. You can choose to limit the payment term to b etween 5 and 25 years. The term selected must be at least for one year greater t han any guarantee period Death Benefits: In addition to a regular income, you can choose an annuity that will pay out a benefit on your death or, if you have chosen to provide an annuit y for a named individual, on the later of your and the named individual s death. You can choose the level of death benefit: o Full purchase price, or a proportion of the purchase price o Capital protection option- the amount paid on death is equal to the purc hase price less the gross annuity installments already paid under the annuity

o No death benefit is allowable where a guarantee period has been selected . No death benefit is allowable where a Joint Life annuity reducing on death of the first life has been selected If you need to provide an income for someone after you die: The HDFC Immediate A nnuity can also provide an annuity for a named individual specified in your appl ication form. This annuity will be paid if you die before the named individual. The amount of their annuity can be the same as your annuity or a proportion of y our annuity Features

3.4 HEALTH PLANS WHY DO WE NEED HEALTH PLANS? Health plans give you the financial security to meet health related contingencie s. Due to changing lifestyles, health issues have acquired completely new dimens ion overtime, becoming more complex in nature. It becomes imperative then to hav e a health plan in place, which will ensure that no matter how critical your ill ness is, it does not impact your financial independence. In the race to excel in our professional lives and provide the best for our love d ones, we sometimes neglect the most important asset that we have - our health. With increasing levels of stress, negligible physical activity and a deteriorat ing environment due to rapid urbanization, our vulnerability to diseases has inc reased at an alarming rate. Source: National Commission on Macroeconomics and Health Report 2005. Note: Current figures are for the year 2000(Cardiovascular diseases)), 2001 (COP D and Asthma), 2004 (Cancer) and 2005(Diabetes and Mental Health). All figures a bove are on a per la h basis. As can be seen in the above chart, lifestyle diseases are set to spread at distu rbing rates. The result - increased expenditure. In many cases, people need to b orrow money or sell assets to cover their medical expenses. All it ta es is a su itable plan to help you overcome the financial woes related to your health by pa ying marginal amounts as premiums. For example, if you are 30 years old, then a mere sum of approximately Rs 3500* annually (exclusive of taxes) can provide you a health insurance plan of Rs 5 la h over a period of 20 years, and a worry-fre e future for you and your family. 3.4.1 HDFC Critical Care Plan

Critical Illness can stri e anyone. Today with advancement in medical science it is possible to survive a critical illness. Expenses on survival with a critical illness can be very high. HDFC Critical care plan provides for a lump sum payme nt on survival post diagnosis of a critical illness, so that in the event a crit ical illness stri es, you don t have to dig into those precious savings of yours . Benefits Provides valuable protection on survival post diagnosis of a critical illnesses Covers as many as 30 critical illnesses Lump sum benefit payment paid irrespective of medical expenses The policy continues even after the benefit payment paid on selected illness Choice of the level of health cover and premium payment Convenient and hassle free claims Tax benefits are available under section 80D under Income Tax Act, 196 Features 3.4.2 HDFC SurgiCare Plan In the fast paced lives that we lead, medical contingencies may arrive at our do orstep uninvited. Surgery costs form a substantial portion of health care expend iture and needs to be provided for. Health issues can get compounded if left una ttended and may require a surgery. Plus, the ever increasing costs of surgical p rocedures are sure to burn a hole in our poc ets. HDFC SurgiCare Plan provides you with timely support in case you have to undergo a major surgery and hospitalization, as the case maybe, ensuring your financial independence at all times. Benefits 82 major surgical procedures are covered. Option to include hospital cash benefit Automatic increase in the level of health cover (subject to terms and conditions ) ensures that the increasing medical costs are ta en care of. Lump sum benefits are paid regardless of the actual medical expenses. The policy continues even after the after the payment of first or subsequent sur gical procedures, subject to terms and conditions as stated in the policy brochu re. Flexibility to tailor-ma e the policy by choosing level of health cover, benefit options level and premium payment as per your needs. Convenient and hassle free claims with cashless benefits on surgeries and hospit alization in any of the networ hospitals. Tax benefits can be availed under section 80D of the Income Tax Act, 1961 Features 3.5 INSURANCE RIDERS Riders are to insurance policies what toppings are to pizzas. They let you furth er customize your insurance cover to suit your changing needs. Using riders, you can get benefits over and above those offered by your basic pl an. The amount you pay for these is small when you consider that you would other wise have had to buy a completely new cover and pay a lot more. The following are the types of riders that HDFC SL offers to its clients Critical illness rider Covers illnesses such as heart attac , stro e, cancer, surgery to coronary arter ies. The policyholder is paid the sum assured if he contracts any of the specifi ed illnesses under the rider. Note that the insured would need to survive the sp ecified illness at least 30 days from the date of diagnosis to avail of this ben efit. The policy along with all the riders (to the extent of the Rider Sum Assur ed) is then terminated. But your base policy would continue and you would have t

o continue to pay premiums on it. Accidental death and dismemberment rider Most insurers pay 100% of the coverage face amount in case of death due to accid ent. Also, in case of loss of more than one limb, or sight in both eyes, or loss of one limb and sight in one eye, 100% of the coverage amount is paid. In case of loss of one limb or sight in one eye 50%, of the coverage face amount is paid . Rider cover terminates once all or part of the coverage is paid. Term Rider Provides for payment of the coverage face amount in event of death of the life i nsured Critical Illness Plus Rider Not all insurance companies offer this rider. It covers an additional number of illnesses over and above those covered by the Critical Illness Rider. Will pay t he coverage face amount if the insured is diagnosed with one of the conditions s pecified and survives for at least 30 days from the date of diagnosis. Critical Illness Woman Rider This rider covers 29 illnesses in total. Out of these three are pregnancy-relate d complications. Waiver of premium rider/ life guardian benefit Premium is waived if you are unable to pay premiums in the event of unforeseen c alamities and the policy continues to be alive. Income Benefit Rider In case of death of the life assured during the term of the policy, 10% of the r ider sum assured is paid annually to the beneficiary, on each policy anniversary till maturity of the rider.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Question Answer Bank MBA 201Document51 pagesQuestion Answer Bank MBA 201Shanu RockNo ratings yet

- Real Estate Seller GuideDocument17 pagesReal Estate Seller GuideNicholas Bobenko100% (3)

- Economicoutlook 201314 HighlightsDocument5 pagesEconomicoutlook 201314 Highlightsrohit_pathak_8No ratings yet

- Nism SQDocument3 pagesNism SQrohit_pathak_8No ratings yet

- UntitledDocument33 pagesUntitledrohit_pathak_8No ratings yet

- The Alchemist (Jonson) Summary: Lovewit Face Subtle DolDocument2 pagesThe Alchemist (Jonson) Summary: Lovewit Face Subtle Dolrohit_pathak_8No ratings yet

- 7 Formal Systems and Programming Languages: An IntroductionDocument40 pages7 Formal Systems and Programming Languages: An Introductionrohit_pathak_8No ratings yet

- AKS ProTalentDocument12 pagesAKS ProTalentsampath buntyNo ratings yet

- Chapter 1 2 PosDocument7 pagesChapter 1 2 PosSophia Nichole Contreras100% (2)

- Introducing New Market OfferingsDocument5 pagesIntroducing New Market OfferingsgovardhansgNo ratings yet

- Declaration of LC Firmware Validation: Product Name Product Number Revision NumberDocument2 pagesDeclaration of LC Firmware Validation: Product Name Product Number Revision NumberJonathanCubillosSerratoNo ratings yet

- Unit 3Document57 pagesUnit 3sudo apt install RanaNo ratings yet

- Physical FacilitiesDocument15 pagesPhysical FacilitiesMalou Ruiz DenolanNo ratings yet

- Monetizing InnovationDocument155 pagesMonetizing InnovationRafael MunguíaNo ratings yet

- Painting ContractDocument22 pagesPainting Contractagrvinit123No ratings yet

- (Research in Labor Economics) S. W. Polachek-Accounting For Worker Well-Being, Volume 23 - Volume 23, 2004-Emerald Group Publishing Limited (2004) PDFDocument444 pages(Research in Labor Economics) S. W. Polachek-Accounting For Worker Well-Being, Volume 23 - Volume 23, 2004-Emerald Group Publishing Limited (2004) PDFInna MuthmainnahNo ratings yet

- Contemporary Issues in MarketingDocument19 pagesContemporary Issues in MarketingMilind SinghNo ratings yet

- Toi Interim Report at IbsDocument17 pagesToi Interim Report at IbspurvaNo ratings yet

- CBSE XII - Entrepreneurship - 066 - (2023) QP & MSDocument51 pagesCBSE XII - Entrepreneurship - 066 - (2023) QP & MSdextermorroneeNo ratings yet

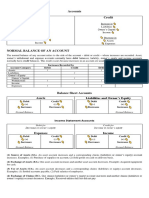

- Assets: Liabilities Are Recorded On The Right Side of The Balance Sheet, While Assets Are Listed OnDocument6 pagesAssets: Liabilities Are Recorded On The Right Side of The Balance Sheet, While Assets Are Listed OnGERMANo ratings yet

- Accounts Debit Credit: Normal Balance Normal BalanceDocument4 pagesAccounts Debit Credit: Normal Balance Normal BalanceVG R1NG3RNo ratings yet

- Mba Thesis Proposal PDFDocument10 pagesMba Thesis Proposal PDFBellaNo ratings yet

- Distribution Strategy in Rural MarketingDocument82 pagesDistribution Strategy in Rural Marketingm_dattaias100% (10)

- Op Transaction History 29!03!2018Document2 pagesOp Transaction History 29!03!2018Avinash GuptaNo ratings yet

- Trio CHPT 3 Brand Resonance, ValuechainDocument48 pagesTrio CHPT 3 Brand Resonance, ValuechainNISHITA MALPANINo ratings yet

- Basilan Estates, Inc. vs. Commissioner of Internal Revenue, 21 SCRA 17, September 05, 1967Document14 pagesBasilan Estates, Inc. vs. Commissioner of Internal Revenue, 21 SCRA 17, September 05, 1967Jane BandojaNo ratings yet

- China Wu Yi QuestionnaireDocument2 pagesChina Wu Yi Questionnairesofian haddadNo ratings yet

- Tle PackagingDocument15 pagesTle PackagingMaybe Not.No ratings yet

- From PLI's Course Handbook: Conducting Due DiligenceDocument16 pagesFrom PLI's Course Handbook: Conducting Due DiligencedaucNo ratings yet

- Best Memorial (Respondent) - GIMC 2019Document36 pagesBest Memorial (Respondent) - GIMC 2019raj bhoirNo ratings yet

- Melc Grade 9 and 10Document3 pagesMelc Grade 9 and 10Angely A. FlorentinoNo ratings yet

- 2024 03 4 10 38 26 Statement - 1712120906544Document28 pages2024 03 4 10 38 26 Statement - 1712120906544successmantraulweNo ratings yet

- NSDL E-Sign: Part A - VERSION 21.2Document31 pagesNSDL E-Sign: Part A - VERSION 21.2Dj Spark IndiaNo ratings yet

- Btec Level 3 (Vocational A'level) in BusinessDocument6 pagesBtec Level 3 (Vocational A'level) in BusinessAsfa GillaniNo ratings yet

- Budgeting For Housekeeping Expenses.: Executive HousekeeperDocument24 pagesBudgeting For Housekeeping Expenses.: Executive HousekeeperHawacom Resources100% (1)