Professional Documents

Culture Documents

Nov30 2012

Nov30 2012

Uploaded by

pribhor2Copyright:

Available Formats

You might also like

- SAYCON v. CA & DEGANO CASE DIGEST SUPREME COURTDocument4 pagesSAYCON v. CA & DEGANO CASE DIGEST SUPREME COURTJyrus Cimatu100% (1)

- Hoag v. ProvidenceDocument10 pagesHoag v. ProvidenceAlex KacikNo ratings yet

- Senate Ratifies New Central Bank ActDocument2 pagesSenate Ratifies New Central Bank ActIza Marie P. Castillo-EspirituNo ratings yet

- Nov07.2012 BDocument1 pageNov07.2012 Bpribhor2No ratings yet

- Aug03.2016 Bsolon Wants Unclaimed Lotto Prizes Utilized For Social Welfare ProgramsDocument1 pageAug03.2016 Bsolon Wants Unclaimed Lotto Prizes Utilized For Social Welfare Programspribhor2No ratings yet

- The Unorganised Workers' Social Security Act, 2008Document11 pagesThe Unorganised Workers' Social Security Act, 2008Akash LakraNo ratings yet

- SSS ProfileDocument9 pagesSSS Profilevictoria tuazonNo ratings yet

- The Standard 18.05.2014 PDFDocument81 pagesThe Standard 18.05.2014 PDFZachary MonroeNo ratings yet

- (Secured Transactions) Act, 2016.Document2 pages(Secured Transactions) Act, 2016.mohammad faraz aliNo ratings yet

- R.A. No. 8282Document8 pagesR.A. No. 8282Nenita OcarizaNo ratings yet

- BSP Sees Steady Remittance Growth: Indom, Eleonor G. Bsma-3CDocument10 pagesBSP Sees Steady Remittance Growth: Indom, Eleonor G. Bsma-3CYhonie IndomNo ratings yet

- Gsis and SSSDocument18 pagesGsis and SSSRoselle OngNo ratings yet

- Legal Pointer: For October (Issue 15)Document8 pagesLegal Pointer: For October (Issue 15)Saurav MishraNo ratings yet

- Background or Conditions Existing Before The Enactment of The LawDocument4 pagesBackground or Conditions Existing Before The Enactment of The LawFlorie-May GarciaNo ratings yet

- Key Points of PakistanDocument3 pagesKey Points of Pakistanmail2ehtashamNo ratings yet

- SSSDocument91 pagesSSSLou Thez Geniza100% (1)

- 54thintrasupplement 110831080225 Phpapp02 PDFDocument11 pages54thintrasupplement 110831080225 Phpapp02 PDFKhaela MercaderNo ratings yet

- Nov11.2015 Btax Incentives For Institutions Engaged in Socialized Housing Projects PushedDocument1 pageNov11.2015 Btax Incentives For Institutions Engaged in Socialized Housing Projects Pushedpribhor2No ratings yet

- Dec15 2012Document2 pagesDec15 2012pribhor2No ratings yet

- Name: Haleema Roll Number: 97-FMS/BBA-2Y/F21 Subject: Human Resource Management Topic: Summary of Pakistani Laws Related To Employee RightDocument5 pagesName: Haleema Roll Number: 97-FMS/BBA-2Y/F21 Subject: Human Resource Management Topic: Summary of Pakistani Laws Related To Employee RightUsman GhaniNo ratings yet

- China's Social Security System - China Labour BulletinDocument13 pagesChina's Social Security System - China Labour BulletinAvinash KhilnaniNo ratings yet

- Presentation Ap Apr 11Document8 pagesPresentation Ap Apr 11Ace ShanNo ratings yet

- National Id SystemDocument21 pagesNational Id SystemAirene CastañosNo ratings yet

- Agra Post TestDocument2 pagesAgra Post Testlaw.school20240000No ratings yet

- News Draft - Gawin Mo To Abby - Also Hanap Ka About Sa CovidDocument6 pagesNews Draft - Gawin Mo To Abby - Also Hanap Ka About Sa CovidAbby Gail TiongsonNo ratings yet

- Analyses of The Labor Policies of The PhilippinesDocument4 pagesAnalyses of The Labor Policies of The PhilippinesOsfer GonzalesNo ratings yet

- Duterte Signs Law Creating National Commission of Senior CitizensDocument3 pagesDuterte Signs Law Creating National Commission of Senior CitizensDoc AlexNo ratings yet

- Social Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byDocument4 pagesSocial Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byAliveNo ratings yet

- Final Requirement - Permalino & ColladaDocument24 pagesFinal Requirement - Permalino & ColladaAra Joyce PermalinoNo ratings yet

- CPH PrimerDocument2 pagesCPH PrimerFrancia ReanieNo ratings yet

- An Act Establishing The Congregation of Private Sectors For Senior CitizensDocument2 pagesAn Act Establishing The Congregation of Private Sectors For Senior CitizensRed HaleNo ratings yet

- BM Be ReviewerDocument3 pagesBM Be ReviewerAngela Ricaplaza Reveral100% (1)

- Bongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Document3 pagesBongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Yan's Senora BescoroNo ratings yet

- Feb28.2013solon Seeks Creation of Legislative-Executive Body To Reconcile GSIS AccountsDocument2 pagesFeb28.2013solon Seeks Creation of Legislative-Executive Body To Reconcile GSIS Accountspribhor2No ratings yet

- Social Security Act of 1997 - Accessibility LawDocument5 pagesSocial Security Act of 1997 - Accessibility LawYordi PastulioNo ratings yet

- Ra 8282 - SSSDocument112 pagesRa 8282 - SSSNelia Mae S. Villena100% (1)

- Social Security System of The Philippines (SSS) : Angeles University FoundationDocument13 pagesSocial Security System of The Philippines (SSS) : Angeles University FoundationLois DanielleNo ratings yet

- Republic Act SMEDDocument22 pagesRepublic Act SMEDTherese ElleNo ratings yet

- CORRUPTIONDocument9 pagesCORRUPTIONKyle Valerie RectoNo ratings yet

- Social Security in India PDFDocument8 pagesSocial Security in India PDFrahul81s100% (1)

- Code of Wages AssignmentDocument4 pagesCode of Wages AssignmentDNo ratings yet

- Ap 11-10-2022Document6 pagesAp 11-10-2022festivista.cessNo ratings yet

- GSIS AccomplishmentDocument16 pagesGSIS AccomplishmentGerrysaudi Dzme-epNo ratings yet

- Program Studi Ilmu Hukum (S2) Program Pascasarjana Universitas PamulangDocument17 pagesProgram Studi Ilmu Hukum (S2) Program Pascasarjana Universitas PamulangBagas KpNo ratings yet

- Cases of Elvin 1Document122 pagesCases of Elvin 1Elvin Nobleza PalaoNo ratings yet

- Project Outline: Labor Laws in PakistanDocument16 pagesProject Outline: Labor Laws in PakistanAbdulNo ratings yet

- Code On Social Security: An Exercise of Deception and FraudDocument22 pagesCode On Social Security: An Exercise of Deception and FraudyehudimehtaNo ratings yet

- Pamantasan NG Cabuyao: College of Computing and EngineeringDocument5 pagesPamantasan NG Cabuyao: College of Computing and EngineeringKnico PerezNo ratings yet

- Press Information Bureau (PIB) IAS UPSC - 4th Aug To 18th August - 2019Document21 pagesPress Information Bureau (PIB) IAS UPSC - 4th Aug To 18th August - 2019Sai Charan.VNo ratings yet

- Unorganized Workers Social Security Act 2008Document10 pagesUnorganized Workers Social Security Act 2008Akhil NautiyalNo ratings yet

- Anti ATM Sangla ExplanatoryDocument2 pagesAnti ATM Sangla ExplanatoryCy ValenzuelaNo ratings yet

- A Model For The Pension System in Mexico: Diagnosis and RecommendationsDocument55 pagesA Model For The Pension System in Mexico: Diagnosis and RecommendationschoyomNo ratings yet

- The GSIS Administers The Social Security Scheme For Workers in The Public Sector While TheDocument1 pageThe GSIS Administers The Social Security Scheme For Workers in The Public Sector While TheDianna MaeNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument55 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleenilesrevillaNo ratings yet

- G1C2 - SSSDocument44 pagesG1C2 - SSSMa. Etienne Therese MarimonNo ratings yet

- Maharlika Investment FundDocument5 pagesMaharlika Investment FundRio GalloNo ratings yet

- Bonded LabourDocument48 pagesBonded LabourBashir AhmedNo ratings yet

- HB00667Document12 pagesHB00667jabezgaming02No ratings yet

- March02.2016 Bbill Condones Unpaid SSS Contribution of "Kasambahays"Document1 pageMarch02.2016 Bbill Condones Unpaid SSS Contribution of "Kasambahays"pribhor2No ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Pensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemFrom EverandPensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemNo ratings yet

- People vs. AbarcaDocument2 pagesPeople vs. AbarcaVeen Galicinao FernandezNo ratings yet

- Republic VS Santos (G.r. No. 160453 November 12, 2012)Document37 pagesRepublic VS Santos (G.r. No. 160453 November 12, 2012)DaveKarlRamada-MaraonNo ratings yet

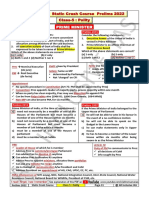

- Aiias Static p22 Class 5 PolityDocument5 pagesAiias Static p22 Class 5 Polityshubham dubeyNo ratings yet

- Eu Exam 2013 (Resit) ABDocument4 pagesEu Exam 2013 (Resit) ABJUNAID FAIZANNo ratings yet

- Panhandling BylawDocument11 pagesPanhandling BylawBillMetcalfeNo ratings yet

- Repeated Questions of International LawDocument13 pagesRepeated Questions of International LawHassan Akbar SharifzadaNo ratings yet

- Evid Finals Cases 2Document98 pagesEvid Finals Cases 2Mary Ann LeuterioNo ratings yet

- SECTION 4. Scope of Application. - This CodeDocument3 pagesSECTION 4. Scope of Application. - This Codethornapple25No ratings yet

- Case No. 1000B (AMB: in The International Criminal Court in and For The Hague NetherlandsDocument10 pagesCase No. 1000B (AMB: in The International Criminal Court in and For The Hague NetherlandsGOVERNMENT OF USICNo ratings yet

- Parayno V Jovellanos (Odsey)Document2 pagesParayno V Jovellanos (Odsey)Charvan CharengNo ratings yet

- Rafael Enrique Gonzales-Corrales v. I.C.E., 11th Cir. (2013)Document8 pagesRafael Enrique Gonzales-Corrales v. I.C.E., 11th Cir. (2013)Scribd Government DocsNo ratings yet

- Sevilla Trading Company V SemanaDocument3 pagesSevilla Trading Company V SemanaAllen Windel BernabeNo ratings yet

- Daniel Lev - Becoming An Orang Indonesia SejatiDocument16 pagesDaniel Lev - Becoming An Orang Indonesia Sejatinanin labadjoNo ratings yet

- Midterms Case Study Week 8Document3 pagesMidterms Case Study Week 8Dimple Mae CarilloNo ratings yet

- Disputing A Fine Sper Fact SheetDocument2 pagesDisputing A Fine Sper Fact SheetCara ElliottNo ratings yet

- Truth Seeking Elements of Creating An Eff Ective Truth CommissionDocument78 pagesTruth Seeking Elements of Creating An Eff Ective Truth CommissionGlobal Justice Academy100% (1)

- Cls - Renewal Procs - Addl Guidelines - 2012-13Document1 pageCls - Renewal Procs - Addl Guidelines - 2012-13mahamayaNo ratings yet

- A Taxonomy of Environmental JusticeDocument25 pagesA Taxonomy of Environmental JusticeIgor MirandaNo ratings yet

- Analysis of If We Must DieDocument2 pagesAnalysis of If We Must DieRendy YoenansyahNo ratings yet

- LegislatureDocument8 pagesLegislaturetanmoy25% (4)

- Later Social, Political and Economic Developments and Scientific InventionsDocument29 pagesLater Social, Political and Economic Developments and Scientific InventionsPrasun TiwariNo ratings yet

- University of Southeastern Philippines: College of Governance and BusinessDocument2 pagesUniversity of Southeastern Philippines: College of Governance and BusinessJoshua JimenoNo ratings yet

- Melita Norwood - HTMDocument7 pagesMelita Norwood - HTMCiscofanatic TorresNo ratings yet

- Benhabib KohnDocument2 pagesBenhabib KohnVincius BalestraNo ratings yet

- Victorias Milling Vs PpaDocument2 pagesVictorias Milling Vs PpaMike LlamasNo ratings yet

- Ricardo S. INDING vs. SANDIGANBAYANDocument3 pagesRicardo S. INDING vs. SANDIGANBAYANMarinelle Aycee Moleta PerralNo ratings yet

- City of Iriga v. Camarines Sur III Electric CooperativeDocument3 pagesCity of Iriga v. Camarines Sur III Electric CooperativeJoseph GabutinaNo ratings yet

- The History of May DayDocument33 pagesThe History of May DayArulsaravananNo ratings yet

Nov30 2012

Nov30 2012

Uploaded by

pribhor2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nov30 2012

Nov30 2012

Uploaded by

pribhor2Copyright:

Available Formats

NOV.

30, 2012

NR # 2939

Legislator wants to ensure that SSS and GSIS pension funds are properly administered

A Metro Manila lawmaker has taken the initiative to consciously monitor how pension funds under the care of the Social Security System (SSS) and the Government Service Insurance System (GSIS) are being managed by filing a measure that would ensure that state pension funds are carefully invested at no risk against losses or siphoned off to benefit private sector entities. Rep. Winston Castelo (2nd District, Quezon City) proposed under House Bill 6665 that the Bangko Sentral ng Pilipinas (BSP) or the Monetary Board issue rules, regulations, guidelines and other sanctions as it may see fit that will introduce the culture of transparency in the business or corporate affairs of both the SSS and the GSIS. In the light that no government agency undertakes a conscious monitoring on how pension funds are being administered, it behooves upon a cognizant entity to adopt a proactive approach as would ensure how substantial chunk of funds may be utilized for all the bonafide SSS and GSIS members and stakeholders, Castelo said. Castelo stressed that there should be an internal system of disclosure initiated by the state pension fund itself for the full dissemination and information as to how such funds are being run. Not surprisingly, SSS or GSIS is awash with cash but this shall not lend freedom for them to invest in any way they see, Castelo said. Castelo said it is of paramount consideration that pension funds are contributed by private and public workers in the SSS and GSIS, respectively and it is only fitting and proper that serious custodial job is reposed upon those that manage these pension funds. The Quezon City lawmaker added that in no permissible instance must management provide any part of the pension funds to buoy up or resuscitate an otherwise ailing private or public entity. Under the proposed Pension Funds Disclosure Act of 2012, a culture of transparency and internal system of disclosure shall be adopted in all the business and corporate affairs of the SSS and the GSIS as a matter of right and privilege on the part of their private and public workers. All returns of investment under this system of disclosure shall be fully disseminated for the information of the private workers in the case of SSS and public workers in the case of GSIS. The SSS is mandated to issue appropriate rules, regulations and guidelines against violations of this Act and similarly, the GSIS is directed to do the same. Pension funds must accrue only to their legitimate contributors and no one else. These should not be siphoned off for purposes other than the higher interest of its contributors, Castelo said. (30) lvc

You might also like

- SAYCON v. CA & DEGANO CASE DIGEST SUPREME COURTDocument4 pagesSAYCON v. CA & DEGANO CASE DIGEST SUPREME COURTJyrus Cimatu100% (1)

- Hoag v. ProvidenceDocument10 pagesHoag v. ProvidenceAlex KacikNo ratings yet

- Senate Ratifies New Central Bank ActDocument2 pagesSenate Ratifies New Central Bank ActIza Marie P. Castillo-EspirituNo ratings yet

- Nov07.2012 BDocument1 pageNov07.2012 Bpribhor2No ratings yet

- Aug03.2016 Bsolon Wants Unclaimed Lotto Prizes Utilized For Social Welfare ProgramsDocument1 pageAug03.2016 Bsolon Wants Unclaimed Lotto Prizes Utilized For Social Welfare Programspribhor2No ratings yet

- The Unorganised Workers' Social Security Act, 2008Document11 pagesThe Unorganised Workers' Social Security Act, 2008Akash LakraNo ratings yet

- SSS ProfileDocument9 pagesSSS Profilevictoria tuazonNo ratings yet

- The Standard 18.05.2014 PDFDocument81 pagesThe Standard 18.05.2014 PDFZachary MonroeNo ratings yet

- (Secured Transactions) Act, 2016.Document2 pages(Secured Transactions) Act, 2016.mohammad faraz aliNo ratings yet

- R.A. No. 8282Document8 pagesR.A. No. 8282Nenita OcarizaNo ratings yet

- BSP Sees Steady Remittance Growth: Indom, Eleonor G. Bsma-3CDocument10 pagesBSP Sees Steady Remittance Growth: Indom, Eleonor G. Bsma-3CYhonie IndomNo ratings yet

- Gsis and SSSDocument18 pagesGsis and SSSRoselle OngNo ratings yet

- Legal Pointer: For October (Issue 15)Document8 pagesLegal Pointer: For October (Issue 15)Saurav MishraNo ratings yet

- Background or Conditions Existing Before The Enactment of The LawDocument4 pagesBackground or Conditions Existing Before The Enactment of The LawFlorie-May GarciaNo ratings yet

- Key Points of PakistanDocument3 pagesKey Points of Pakistanmail2ehtashamNo ratings yet

- SSSDocument91 pagesSSSLou Thez Geniza100% (1)

- 54thintrasupplement 110831080225 Phpapp02 PDFDocument11 pages54thintrasupplement 110831080225 Phpapp02 PDFKhaela MercaderNo ratings yet

- Nov11.2015 Btax Incentives For Institutions Engaged in Socialized Housing Projects PushedDocument1 pageNov11.2015 Btax Incentives For Institutions Engaged in Socialized Housing Projects Pushedpribhor2No ratings yet

- Dec15 2012Document2 pagesDec15 2012pribhor2No ratings yet

- Name: Haleema Roll Number: 97-FMS/BBA-2Y/F21 Subject: Human Resource Management Topic: Summary of Pakistani Laws Related To Employee RightDocument5 pagesName: Haleema Roll Number: 97-FMS/BBA-2Y/F21 Subject: Human Resource Management Topic: Summary of Pakistani Laws Related To Employee RightUsman GhaniNo ratings yet

- China's Social Security System - China Labour BulletinDocument13 pagesChina's Social Security System - China Labour BulletinAvinash KhilnaniNo ratings yet

- Presentation Ap Apr 11Document8 pagesPresentation Ap Apr 11Ace ShanNo ratings yet

- National Id SystemDocument21 pagesNational Id SystemAirene CastañosNo ratings yet

- Agra Post TestDocument2 pagesAgra Post Testlaw.school20240000No ratings yet

- News Draft - Gawin Mo To Abby - Also Hanap Ka About Sa CovidDocument6 pagesNews Draft - Gawin Mo To Abby - Also Hanap Ka About Sa CovidAbby Gail TiongsonNo ratings yet

- Analyses of The Labor Policies of The PhilippinesDocument4 pagesAnalyses of The Labor Policies of The PhilippinesOsfer GonzalesNo ratings yet

- Duterte Signs Law Creating National Commission of Senior CitizensDocument3 pagesDuterte Signs Law Creating National Commission of Senior CitizensDoc AlexNo ratings yet

- Social Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byDocument4 pagesSocial Security Source: Monthly Labor Review, DECEMBER 1943, Vol. 57, No. 6 (DECEMBER 1943), Pp. 1174-1176 Published byAliveNo ratings yet

- Final Requirement - Permalino & ColladaDocument24 pagesFinal Requirement - Permalino & ColladaAra Joyce PermalinoNo ratings yet

- CPH PrimerDocument2 pagesCPH PrimerFrancia ReanieNo ratings yet

- An Act Establishing The Congregation of Private Sectors For Senior CitizensDocument2 pagesAn Act Establishing The Congregation of Private Sectors For Senior CitizensRed HaleNo ratings yet

- BM Be ReviewerDocument3 pagesBM Be ReviewerAngela Ricaplaza Reveral100% (1)

- Bongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Document3 pagesBongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Yan's Senora BescoroNo ratings yet

- Feb28.2013solon Seeks Creation of Legislative-Executive Body To Reconcile GSIS AccountsDocument2 pagesFeb28.2013solon Seeks Creation of Legislative-Executive Body To Reconcile GSIS Accountspribhor2No ratings yet

- Social Security Act of 1997 - Accessibility LawDocument5 pagesSocial Security Act of 1997 - Accessibility LawYordi PastulioNo ratings yet

- Ra 8282 - SSSDocument112 pagesRa 8282 - SSSNelia Mae S. Villena100% (1)

- Social Security System of The Philippines (SSS) : Angeles University FoundationDocument13 pagesSocial Security System of The Philippines (SSS) : Angeles University FoundationLois DanielleNo ratings yet

- Republic Act SMEDDocument22 pagesRepublic Act SMEDTherese ElleNo ratings yet

- CORRUPTIONDocument9 pagesCORRUPTIONKyle Valerie RectoNo ratings yet

- Social Security in India PDFDocument8 pagesSocial Security in India PDFrahul81s100% (1)

- Code of Wages AssignmentDocument4 pagesCode of Wages AssignmentDNo ratings yet

- Ap 11-10-2022Document6 pagesAp 11-10-2022festivista.cessNo ratings yet

- GSIS AccomplishmentDocument16 pagesGSIS AccomplishmentGerrysaudi Dzme-epNo ratings yet

- Program Studi Ilmu Hukum (S2) Program Pascasarjana Universitas PamulangDocument17 pagesProgram Studi Ilmu Hukum (S2) Program Pascasarjana Universitas PamulangBagas KpNo ratings yet

- Cases of Elvin 1Document122 pagesCases of Elvin 1Elvin Nobleza PalaoNo ratings yet

- Project Outline: Labor Laws in PakistanDocument16 pagesProject Outline: Labor Laws in PakistanAbdulNo ratings yet

- Code On Social Security: An Exercise of Deception and FraudDocument22 pagesCode On Social Security: An Exercise of Deception and FraudyehudimehtaNo ratings yet

- Pamantasan NG Cabuyao: College of Computing and EngineeringDocument5 pagesPamantasan NG Cabuyao: College of Computing and EngineeringKnico PerezNo ratings yet

- Press Information Bureau (PIB) IAS UPSC - 4th Aug To 18th August - 2019Document21 pagesPress Information Bureau (PIB) IAS UPSC - 4th Aug To 18th August - 2019Sai Charan.VNo ratings yet

- Unorganized Workers Social Security Act 2008Document10 pagesUnorganized Workers Social Security Act 2008Akhil NautiyalNo ratings yet

- Anti ATM Sangla ExplanatoryDocument2 pagesAnti ATM Sangla ExplanatoryCy ValenzuelaNo ratings yet

- A Model For The Pension System in Mexico: Diagnosis and RecommendationsDocument55 pagesA Model For The Pension System in Mexico: Diagnosis and RecommendationschoyomNo ratings yet

- The GSIS Administers The Social Security Scheme For Workers in The Public Sector While TheDocument1 pageThe GSIS Administers The Social Security Scheme For Workers in The Public Sector While TheDianna MaeNo ratings yet

- Feria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleeDocument55 pagesFeria, Manglapus and Associates For Petitioner-Appellant. Legal Staff, Social Security System and Solicitor General For Respondent-AppelleenilesrevillaNo ratings yet

- G1C2 - SSSDocument44 pagesG1C2 - SSSMa. Etienne Therese MarimonNo ratings yet

- Maharlika Investment FundDocument5 pagesMaharlika Investment FundRio GalloNo ratings yet

- Bonded LabourDocument48 pagesBonded LabourBashir AhmedNo ratings yet

- HB00667Document12 pagesHB00667jabezgaming02No ratings yet

- March02.2016 Bbill Condones Unpaid SSS Contribution of "Kasambahays"Document1 pageMarch02.2016 Bbill Condones Unpaid SSS Contribution of "Kasambahays"pribhor2No ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Pensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemFrom EverandPensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemNo ratings yet

- People vs. AbarcaDocument2 pagesPeople vs. AbarcaVeen Galicinao FernandezNo ratings yet

- Republic VS Santos (G.r. No. 160453 November 12, 2012)Document37 pagesRepublic VS Santos (G.r. No. 160453 November 12, 2012)DaveKarlRamada-MaraonNo ratings yet

- Aiias Static p22 Class 5 PolityDocument5 pagesAiias Static p22 Class 5 Polityshubham dubeyNo ratings yet

- Eu Exam 2013 (Resit) ABDocument4 pagesEu Exam 2013 (Resit) ABJUNAID FAIZANNo ratings yet

- Panhandling BylawDocument11 pagesPanhandling BylawBillMetcalfeNo ratings yet

- Repeated Questions of International LawDocument13 pagesRepeated Questions of International LawHassan Akbar SharifzadaNo ratings yet

- Evid Finals Cases 2Document98 pagesEvid Finals Cases 2Mary Ann LeuterioNo ratings yet

- SECTION 4. Scope of Application. - This CodeDocument3 pagesSECTION 4. Scope of Application. - This Codethornapple25No ratings yet

- Case No. 1000B (AMB: in The International Criminal Court in and For The Hague NetherlandsDocument10 pagesCase No. 1000B (AMB: in The International Criminal Court in and For The Hague NetherlandsGOVERNMENT OF USICNo ratings yet

- Parayno V Jovellanos (Odsey)Document2 pagesParayno V Jovellanos (Odsey)Charvan CharengNo ratings yet

- Rafael Enrique Gonzales-Corrales v. I.C.E., 11th Cir. (2013)Document8 pagesRafael Enrique Gonzales-Corrales v. I.C.E., 11th Cir. (2013)Scribd Government DocsNo ratings yet

- Sevilla Trading Company V SemanaDocument3 pagesSevilla Trading Company V SemanaAllen Windel BernabeNo ratings yet

- Daniel Lev - Becoming An Orang Indonesia SejatiDocument16 pagesDaniel Lev - Becoming An Orang Indonesia Sejatinanin labadjoNo ratings yet

- Midterms Case Study Week 8Document3 pagesMidterms Case Study Week 8Dimple Mae CarilloNo ratings yet

- Disputing A Fine Sper Fact SheetDocument2 pagesDisputing A Fine Sper Fact SheetCara ElliottNo ratings yet

- Truth Seeking Elements of Creating An Eff Ective Truth CommissionDocument78 pagesTruth Seeking Elements of Creating An Eff Ective Truth CommissionGlobal Justice Academy100% (1)

- Cls - Renewal Procs - Addl Guidelines - 2012-13Document1 pageCls - Renewal Procs - Addl Guidelines - 2012-13mahamayaNo ratings yet

- A Taxonomy of Environmental JusticeDocument25 pagesA Taxonomy of Environmental JusticeIgor MirandaNo ratings yet

- Analysis of If We Must DieDocument2 pagesAnalysis of If We Must DieRendy YoenansyahNo ratings yet

- LegislatureDocument8 pagesLegislaturetanmoy25% (4)

- Later Social, Political and Economic Developments and Scientific InventionsDocument29 pagesLater Social, Political and Economic Developments and Scientific InventionsPrasun TiwariNo ratings yet

- University of Southeastern Philippines: College of Governance and BusinessDocument2 pagesUniversity of Southeastern Philippines: College of Governance and BusinessJoshua JimenoNo ratings yet

- Melita Norwood - HTMDocument7 pagesMelita Norwood - HTMCiscofanatic TorresNo ratings yet

- Benhabib KohnDocument2 pagesBenhabib KohnVincius BalestraNo ratings yet

- Victorias Milling Vs PpaDocument2 pagesVictorias Milling Vs PpaMike LlamasNo ratings yet

- Ricardo S. INDING vs. SANDIGANBAYANDocument3 pagesRicardo S. INDING vs. SANDIGANBAYANMarinelle Aycee Moleta PerralNo ratings yet

- City of Iriga v. Camarines Sur III Electric CooperativeDocument3 pagesCity of Iriga v. Camarines Sur III Electric CooperativeJoseph GabutinaNo ratings yet

- The History of May DayDocument33 pagesThe History of May DayArulsaravananNo ratings yet