Professional Documents

Culture Documents

Technical Format With Stock 10.12.2012

Technical Format With Stock 10.12.2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Format With Stock 10.12.2012

Technical Format With Stock 10.12.2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Daily Technical Report

December 10, 2012

Sensex (19424) / NIFTY (5907)

On Friday, our benchmark indices opened flat and tested the mentioned resistance level of 19523 / 5943. A minor correction in the second half led the indices to pair gains but close marginally above the 5900 mark. The Realty, IT and Teck sectors corrected sharply in Fridays session; whereas the Consumer Durables and Auto counters ended with minor gains. The advance to decline ratio was in favor of declining counters (A=1436 D=1486) (Source www.bseindia.com).

Exhibit 1: Nifty Daily Chart

Formation

The 20-day EMA and the 20-week EMA are placed at 18980 / 5770 and 18390 / 5586 levels, respectively. On the weekly chart, we are witnessing a breakout from Downward Sloping Trend Line joining two significant swing high of 19811 / 5944 (April 2011) and 19137 / 5815 (Oct 2012) at 19050 / 5800 level . The 78.60% Fibonacci retracement level of the fall from November 5, 2010 (the high was 21109 / 6339) to December 23, 2011 (the low was 15135 / 4531) is at 19812 / 5945. On the daily chart, we are observing a Hanging Man candlestick pattern, occurred on December 6, 2012.

Source: Falcon:

Actionable points:

View for the day Resistance Level Support Levels Neutral 5950 - 6000 5889 5800

Trading strategy:

The previous weeks sharp rally was followed by consolidation in this week. However, Nifty precisely met with our target, of the Channel Pattern, at the 19500 / 5950 level mentioned in our previous report. This level on Nifty coincides with the 78.60% Fibonacci retracement level of the fall from November 5, 2010 (the high was 21109 / 6339) to December 23, 2011 (the low was 15135 / 4531). However, the corresponding level of Sensex is at 19812. This level can be considered as a strong resistance for our market in the near term. Further, we have mentioned a Hanging Man candlestick pattern in our Fridays daily report. The bearish candlestick pattern is still valid but needs confirmation in the form of a closing below 19205 / 5833. Going forward, we reiterate our view that a close below the low of the pattern i.e. 19186 / 5839 would trigger short term pessimism in the market. As a result, indices then may then slide towards 19000 18900 / 5800 5750 levels.

On the flipside, a gap up opening on Monday and a closing above Fridays high of 19562 / 5950 would certainly negate the bearish implication of the Hanging Man pattern. In this scenario, we may witness an extended rally towards 20050 20218 / 6000 6070 levels. Considering the overall weekly chart structure we continue to remain positive on the market and any corrective move towards 19000 18900 / 5800 5750 levels should be used by positional traders as buying opportunity.

www.angelbroking.com

Daily Technical Report

December 10, 2012

Bank Nifty Outlook - (12364)

On Friday, in line with the benchmark indices, the Bank Nifty too opened on a flat note but eventually corrected during the day. At this juncture the index has taken support near the 20 EMA on the hourly chart. However, an overbought condition of momentum oscillators on the Daily chart suggests that a fall below Fridays low of 12306 may lead to a minor correction in the index. In this scenario the index is likely to drift lower towards 12191 12142 levels. On the upside 12439 12481 levels are likely to act as resistance for the day.

Exhibit 2: Bank Nifty Hourly Chart

Actionable points:

View for the day Resistance Levels Support Levels Neutral 12439 12481 12306 - 12191 Source: Falcon:

www.angelbroking.com

Daily Technical Report

December 10, 2012

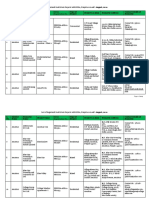

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SIEMENS SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO WIPRO S2 19,251 5,854 12,210 1,393 203 4,261 1,291 1,915 786 314 237 353 329 402 354 212 1,820 350 3,204 601 828 683 1,809 121 522 1,110 171 2,290 297 399 103 656 1,650 587 921 1,463 157 262 808 117 499 819 494 2,279 183 671 689 274 108 385 1,244 1,930 376 S1 19,338 5,881 12,287 1,404 204 4,287 1,310 1,928 792 318 240 355 331 406 359 216 1,830 352 3,226 607 833 688 1,818 123 526 1,121 173 2,305 299 405 104 660 1,663 593 930 1,487 158 265 815 118 503 827 501 2,298 185 677 694 278 109 390 1,254 1,946 378 PIVOT 19,450 5,915 12,382 1,421 207 4,327 1,340 1,946 798 324 244 361 333 411 365 222 1,840 353 3,263 618 841 693 1,826 124 532 1,133 176 2,327 301 409 105 666 1,681 598 940 1,513 160 267 823 119 509 838 510 2,319 189 683 700 283 110 397 1,267 1,969 380 R1 19,536 5,942 12,459 1,432 209 4,353 1,359 1,958 804 328 247 363 335 415 370 227 1,849 354 3,285 624 846 698 1,834 125 536 1,143 179 2,343 303 414 106 669 1,694 603 949 1,537 162 270 830 120 513 846 516 2,337 192 689 706 287 111 401 1,278 1,985 382 R2 19,648 5,977 12,555 1,449 211 4,393 1,389 1,976 810 334 251 369 337 419 376 233 1,860 355 3,322 635 853 703 1,842 126 542 1,155 182 2,364 305 419 107 675 1,712 608 959 1,563 164 272 838 121 519 858 525 2,358 196 695 712 291 112 409 1,291 2,008 385

www.angelbroking.com

Daily Technical Report

December 10, 2012

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

www.angelbroking.com 4

You might also like

- Atestat Limba EnglezaDocument20 pagesAtestat Limba EnglezaAliceNo ratings yet

- Herminio Perez Adames v. Joseph A. Califano, JR., Secretary of Health, Education and Welfare, 552 F.2d 1, 1st Cir. (1977)Document2 pagesHerminio Perez Adames v. Joseph A. Califano, JR., Secretary of Health, Education and Welfare, 552 F.2d 1, 1st Cir. (1977)Scribd Government DocsNo ratings yet

- Anup Paul CaseDocument2 pagesAnup Paul CaseHimesh ChawlaNo ratings yet

- Lime Putty For Structural PurposesDocument2 pagesLime Putty For Structural Purposesasemamaw damtieNo ratings yet

- Technical Format With Stock 17.12.2012Document4 pagesTechnical Format With Stock 17.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 14.12.2012Document4 pagesTechnical Format With Stock 14.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 07.12.2012Document4 pagesTechnical Format With Stock 07.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 12.12.2012Document4 pagesTechnical Format With Stock 12.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 05.12.2012Document4 pagesTechnical Format With Stock 05.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 13.12.2012Document4 pagesTechnical Format With Stock 13.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 08 March 2013Document4 pagesTechnical Format With Stock 08 March 2013Angel BrokingNo ratings yet

- Daily Technical Report, 10.06.2013Document4 pagesDaily Technical Report, 10.06.2013Angel BrokingNo ratings yet

- Daily Technical Report 20th Dec 2012Document4 pagesDaily Technical Report 20th Dec 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17691) / NIFTY (5366)Document4 pagesDaily Technical Report: Sensex (17691) / NIFTY (5366)Angel BrokingNo ratings yet

- Technical Format With Stock 04.12.2012Document4 pagesTechnical Format With Stock 04.12.2012Angel BrokingNo ratings yet

- Daily Technical Report, 25.02.2013Document4 pagesDaily Technical Report, 25.02.2013Angel BrokingNo ratings yet

- Technical Format With Stock 06.12.2012Document4 pagesTechnical Format With Stock 06.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 12.11.2012Document4 pagesTechnical Format With Stock 12.11.2012Angel BrokingNo ratings yet

- Technical Format With Stock 07 March 2013Document4 pagesTechnical Format With Stock 07 March 2013Angel BrokingNo ratings yet

- Technical Format With Stock 03.09Document4 pagesTechnical Format With Stock 03.09Angel BrokingNo ratings yet

- Daily Technical Report, 22.02.2013Document4 pagesDaily Technical Report, 22.02.2013Angel BrokingNo ratings yet

- Daily Technical Report 18.03.2013Document4 pagesDaily Technical Report 18.03.2013Angel BrokingNo ratings yet

- Daily Technical Report, 03.07.2013Document4 pagesDaily Technical Report, 03.07.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17558) / NIFTY (5320)Document4 pagesDaily Technical Report: Sensex (17558) / NIFTY (5320)Angel BrokingNo ratings yet

- Daily Technical Report, 26.04.2013Document4 pagesDaily Technical Report, 26.04.2013Angel BrokingNo ratings yet

- Daily Technical Report 19th Dec 2012Document4 pagesDaily Technical Report 19th Dec 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19664) / NIFTY (5969)Document4 pagesDaily Technical Report: Sensex (19664) / NIFTY (5969)Neha DhuriNo ratings yet

- Daily Technical Report: Sensex (17783) / NIFTY (5387)Document4 pagesDaily Technical Report: Sensex (17783) / NIFTY (5387)Angel BrokingNo ratings yet

- Daily Technical Report, 24.06.2013Document4 pagesDaily Technical Report, 24.06.2013Angel BrokingNo ratings yet

- Daily Technical Report, 29.04.2013Document4 pagesDaily Technical Report, 29.04.2013Angel BrokingNo ratings yet

- Technical Format With Stock 30.10.2012Document4 pagesTechnical Format With Stock 30.10.2012Angel BrokingNo ratings yet

- Daily Technical Report, 04.03.2013Document4 pagesDaily Technical Report, 04.03.2013Angel BrokingNo ratings yet

- Daily Technical Report, 12.03.2013Document4 pagesDaily Technical Report, 12.03.2013Angel BrokingNo ratings yet

- Daily Technical Report, 11.03.2013Document4 pagesDaily Technical Report, 11.03.2013Angel BrokingNo ratings yet

- Daily Technical Report, 03.06.2013Document4 pagesDaily Technical Report, 03.06.2013Angel BrokingNo ratings yet

- Daily Technical Report 15.03.2013Document4 pagesDaily Technical Report 15.03.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Technical Report, 10.05.2013Document4 pagesDaily Technical Report, 10.05.2013Angel BrokingNo ratings yet

- Daily Technical Report 13.03.2013Document4 pagesDaily Technical Report 13.03.2013Angel BrokingNo ratings yet

- Technical Format With Stock 05.11.2012Document4 pagesTechnical Format With Stock 05.11.2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19179) / NIFTY (5837)Document4 pagesDaily Technical Report: Sensex (19179) / NIFTY (5837)Angel BrokingNo ratings yet

- Daily Technical Report 07.02.2013Document4 pagesDaily Technical Report 07.02.2013Angel BrokingNo ratings yet

- Technical Format With Stock 20.09Document4 pagesTechnical Format With Stock 20.09Angel BrokingNo ratings yet

- Technical Format With Stock 19.11.2012Document4 pagesTechnical Format With Stock 19.11.2012Angel BrokingNo ratings yet

- Technical Format With Stock 07.11.2012Document4 pagesTechnical Format With Stock 07.11.2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19765) / NIFTY (6010)Document4 pagesDaily Technical Report: Sensex (19765) / NIFTY (6010)Angel BrokingNo ratings yet

- Daily Technical Report, 05.06.2013Document4 pagesDaily Technical Report, 05.06.2013Angel BrokingNo ratings yet

- Daily Technical Report, 23.04.2013Document4 pagesDaily Technical Report, 23.04.2013Angel BrokingNo ratings yet

- Technical Format With Stock 18.12.2012Document4 pagesTechnical Format With Stock 18.12.2012Angel BrokingNo ratings yet

- Daily Technical Report, 26.03.2013Document4 pagesDaily Technical Report, 26.03.2013Angel BrokingNo ratings yet

- Daily Technical Report, 18.02.2013Document4 pagesDaily Technical Report, 18.02.2013Angel BrokingNo ratings yet

- Daily Technical Report, 25.03.2013Document4 pagesDaily Technical Report, 25.03.2013Angel BrokingNo ratings yet

- Technical Format With Stock 03.12.2012Document4 pagesTechnical Format With Stock 03.12.2012Angel BrokingNo ratings yet

- Technical Format With Stock 01.11.2012Document4 pagesTechnical Format With Stock 01.11.2012Angel BrokingNo ratings yet

- Daily Technical Report, 20.06.2013Document4 pagesDaily Technical Report, 20.06.2013Angel BrokingNo ratings yet

- Daily Technical Report, 20.05.2013Document4 pagesDaily Technical Report, 20.05.2013Angel BrokingNo ratings yet

- Technical Format With Stock 29.10.2012Document4 pagesTechnical Format With Stock 29.10.2012Angel BrokingNo ratings yet

- Daily Technical Report, 22.04.2013Document4 pagesDaily Technical Report, 22.04.2013Angel BrokingNo ratings yet

- Technical Format With Stock 21.09Document4 pagesTechnical Format With Stock 21.09Angel BrokingNo ratings yet

- Daily Technical Report 15.02.2013Document4 pagesDaily Technical Report 15.02.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17233) / NIFTY (5235)Document4 pagesDaily Technical Report: Sensex (17233) / NIFTY (5235)Angel BrokingNo ratings yet

- Technical Format With Stock 30.11.2012Document4 pagesTechnical Format With Stock 30.11.2012Angel BrokingNo ratings yet

- Daily Technical Report, 15.05.2013Document4 pagesDaily Technical Report, 15.05.2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- ATSAP Briefing SheetDocument2 pagesATSAP Briefing Sheetapi-25986578No ratings yet

- Petitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsDocument5 pagesPetitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsAudrey DeguzmanNo ratings yet

- CFO Chief Financial Officer in NJ PA NY Resume Philip BlockerDocument3 pagesCFO Chief Financial Officer in NJ PA NY Resume Philip BlockerPhilipBlockerNo ratings yet

- Authors' Manuscript Submission GuidelinesDocument3 pagesAuthors' Manuscript Submission GuidelinesAnamika ChoudharyNo ratings yet

- Lead Bank SchemeDocument5 pagesLead Bank SchemeGopi ShankarNo ratings yet

- The Acts of The Apostles: Out-Of-Print and in The Public DomainDocument12 pagesThe Acts of The Apostles: Out-Of-Print and in The Public Domain2wrtsxNo ratings yet

- HSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Document15 pagesHSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Madhuritha RajapakseNo ratings yet

- Our Response Is Keyed To (1) Joint Stock Trust Act of 1873, (2) Federal Reserve System, (3) National Bank Acts, and (4) Canon Law.Document4 pagesOur Response Is Keyed To (1) Joint Stock Trust Act of 1873, (2) Federal Reserve System, (3) National Bank Acts, and (4) Canon Law.Gemini Research100% (2)

- PT Alfa YogaDocument6 pagesPT Alfa Yogaghinaa mumthazahrachmatNo ratings yet

- Personal Introduction: Forum: IssueDocument8 pagesPersonal Introduction: Forum: IssueNishu DeswalNo ratings yet

- Mutual NDADocument6 pagesMutual NDAPriyanshu SinghNo ratings yet

- Gmail - USJ-R E-Study LoadDocument1 pageGmail - USJ-R E-Study Loadfrancis albaracinNo ratings yet

- Opyrights AW: Dr. M R Sreenivasa MurthyDocument15 pagesOpyrights AW: Dr. M R Sreenivasa MurthyEpil BodraNo ratings yet

- Opw 2000 Series Installation ManualDocument16 pagesOpw 2000 Series Installation ManualrubenNo ratings yet

- 78 - Heirs of Lorenzo Yap Vs Court of Appeals, Ramon Yap and Benjamin YapDocument2 pages78 - Heirs of Lorenzo Yap Vs Court of Appeals, Ramon Yap and Benjamin YapMaddieNo ratings yet

- Financialreport PttFR2019en 12marchDocument210 pagesFinancialreport PttFR2019en 12marchJanna GunioNo ratings yet

- Instructions: Using The Key Below For The Numeric Value of Each Hebrew Letter, DetermineDocument1 pageInstructions: Using The Key Below For The Numeric Value of Each Hebrew Letter, DetermineRabbi Benyomin HoffmanNo ratings yet

- Gapura Annual Report 2016 PDFDocument184 pagesGapura Annual Report 2016 PDFAhmad NurNo ratings yet

- PTA (TGT) Contract 13012015 RamanDocument15 pagesPTA (TGT) Contract 13012015 Ramanसबका बापNo ratings yet

- NetReveal - Data - Privacy - Agent - FS - US Sep19Document1 pageNetReveal - Data - Privacy - Agent - FS - US Sep19Raja MuzammilNo ratings yet

- Ra 9139Document3 pagesRa 9139Shaira Mae CuevillasNo ratings yet

- List of Registered ProjectsDocument214 pagesList of Registered ProjectsSunny SinghNo ratings yet

- Macroeconomics Principles and Practice Australian 2nd Edition Littleboy Test Bank Full Chapter PDFDocument51 pagesMacroeconomics Principles and Practice Australian 2nd Edition Littleboy Test Bank Full Chapter PDFStevenCookexjrp100% (13)

- Sale Tpa 1882Document8 pagesSale Tpa 1882SamerNo ratings yet

- Murder Suicide A Case ReportDocument4 pagesMurder Suicide A Case ReportCYBERNET ENTERPRISENo ratings yet

- Breakdown of ExpensesDocument6 pagesBreakdown of ExpensesKim SablayanNo ratings yet