Professional Documents

Culture Documents

City A.M.: "Twosome Transforming How We Transfer Money"

City A.M.: "Twosome Transforming How We Transfer Money"

Uploaded by

Donata HugginsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

City A.M.: "Twosome Transforming How We Transfer Money"

City A.M.: "Twosome Transforming How We Transfer Money"

Uploaded by

Donata HugginsCopyright:

Available Formats

ENTREPRENEURS

A measure for the forward-thinking

INNOVATION DIARY

TOM WELSH

cityam.com

MONDAY 10 DECEMBER 2012

19

Annabel Palmer talks currency, Skype, and missionary work with the founders of TransferWise

NE of the most striking probusiness announcements in last weeks Autumn Statement was the increase in the tax relief afforded to company investment in plant and machinery equipment. A miserly allowance of 25,000 jumped ten-fold to a healthier 250,000. Aimed at smallish businesses, its meant to unlock cash for investment. But it comes with some provisos. Any business interested in using the relief should consider the details before splurging their capital. Firstly, what is plant and machinery? The term suggests industrial cleaners or dirty chemical vats, but the definition is actually fairly broad. Debbie Griffiths, entrepreneurial business partner at Deloitte, says it covers most fixed asset additions. Reassuringly for tech companies, it includes computer equipment and some software programmes, so you dont need to be a small-scale manufacturer to take part. There are exceptions, however. You cant claim back the cost of a company car, for instance. This links through to a second word of caution. This is obviously a break from taxation rather than a cash transfer. The 250,000 figure is the money a company can offset from its corporation tax bill, so a business must be profitable before it can be used. If youre making losses anyway, this isnt going to be a policy to help your business grow, says Griffiths. Youve also got to buy the equipment first. So factor in the costs of financing if you dont have the cash sitting in your bank account. Plant and machinery relief may be enough to persuade more forward-thinking and better capitalised businesses to accelerate their capital investments, but it wont pick a struggling firm off the floor. Even if this particular measure wont prove useful, however, the Autumn Statement might have something else for you. Fuel duty has been frozen, of course, so at least the cost of travel wont become more expensive. And better, tapered small business rates relief has been extended until 2014 hopefully giving your business a little more room to breathe. Twitter: @TWWelsh

RISTO Kaarmann and Taavet Hinrikus are the two Estonian founders of TransferWise, the peer-topeer platform for transferring money. Parallels between TransferWise and Skype abound, not least because Hinrikus was Skypes first employee. But the likenesses dont stop there: they want to make the world smaller, just as Skype has done; they want to make transfers cheaper, just as Skype made communication cheaper. Their goal is to lower the cost of transferring money, in stark contrast to banks that seek ways to make it as expensive as possible for the consumer. In 2003, both were working internationally Hinrikus at Skype, Kaarmann at Deloitte and they quickly discovered that tranferring money was expensive. Kaarmann was paid in sterling but owned property in Estonia; Hinrikus was paid in euros but needed living expenses in sterling. So they started a two-man currency transaction service (later expanded to the Skype club a handful of friends that grouped together to save on exchange rates). Simply put, banks dont use the mid-market rate when transferring your money, meaning that customers pay far more than the transaction fee. But people dont necessarily understand that banks make their money on the spread, not the transaction fee. We see ourselves as missionaries, educating people on the true cost of going through a bank. Because, they say, no more effort is required by the bank to send money abroad than is needed to send an email abroad, says Hinrikus. TransferWise charges 1 for transactions up to 300, and above that they will charge a small fee typically 0.5 per cent. A bank will usually end up taking 4.5 per cent. You get the impression that the pair genuinely want to make transferring money as cheap as possible for their customers. They want increased transparency in the industry, because it is very unlikely the government will force banks to be transparent in the near future. And theyre undercutting their competitors by a significant margin. I think my greatest achievement, grins Kaarmann, was making a transfer for the chief executive of a bank yesterday because he wanted to save money on the transaction.

Twosome transforming how we transfer money

CV TAAVET HINRIKUS

Company Name: TransferWise Job Title: Co-founder Age: 31 Studied: MBA from Insead Previous job: Director of strategy at Skype Motto: Never say that it cant be done Drinking: Anything from fermented grapes Heroes: Niklas Zennstrom, founder of Skype and Kazaa

CV KRISTO KAARMANN

Job Title: Co-founder Age: 32 Lives: London Previous job: Consulting at Deloitte and PwC Reading: Narrating People by Svend Age Madsen Talents: Iron Man triathlons Motto: Just do it Drinking: Anything from fermented tea leaves Heroes: Er, Taavet Hinrikus?

Hinrikus (left) and Kaarman (right) have a lot to smile about

TransferWise is growing at 20 to 30 per cent per month. At the start of this year, it had eight members of staff. It now has 21. In their first year of operation, they had 10m in transaction volume. But its a huge market that they are eager to dominate: banks make somewhere in the tens of billions of dollars per year just on the spread. I ask how they went about getting investor support and get an unusual response. It isnt hard to start up a website or build an online business to the first proof of concept stage. Too many entrepreneurs focus on pitching 10,000 word business plans to investors, says Hinrikus. But by the time TransferWise started fundraising, it was busy serving customers. It launched in January 2011, and 15 minutes later its first customer made a transaction of 2,000. The biggest challenge was taking the rough with the smooth. It is a roller coaster. And thats where a lot of people fail, they take it too emotionally, warns Hinrikus. So what advice would they give future entrepreneurs? If you look around us now, everyone has the potential to get a great job. So you are not risking anything by trying to be an entrepreneur. Even if you fail, you will have learnt so much that youll be a better employee afterwards, says Hinrikus. I knew many people at Deloitte who dreamed of starting their own business. And I know that theyre still dreaming of it now, adds Kaarmann. Their goal for TransferWise is simple: to see the company grow (as fast as possible) into a global sustainable business. And a business that is helping people along the way.

My recent attempt to pass on some rock solid business advice

DONT want to study rocks! My teenage son Tom looked at me like I was an ugly alien. We were discussing what he should read at university, and he was keen on economics and maths to pursue a career in finance or business.But I think the big finance boom is over, Tom. And mining is more than rocks; there are lots of opportunities for exciting work and travel. You could start by studying geology and, if you want, do an MBA later. Think of the mines as regular businesses and the rocks as their products. Its not that different. To illustrate my point, I told him about an Australian mining operation Id been following and investing in, led by a very capable man, Peter Cook. Cooky is a trained geologist with an impressive record in mining. His

of a SERIAL ENTREPRENEUR

CONFESSIONS

RICHARD FARLEIGH

successes include the sale of a gold mine for $250m (156m) that he bought for $20m. His latest passion is tin, and his company Metals X is a partner in one of the worlds largest tin mines, located in Tasmania. He says that tin is facing a perfect storm, though I prefer perfect sunshine because it sounds so good. Firstly, tin is benefiting from an increasing aversion to its competitor, lead. Lead has been blamed for the

madness of Caravaggio, the death of Beethoven, and (spuriously) for the infertility and decline of the Roman Empire. In the last few years, theres been increasing legislation against its use and tin is being used as leads replacement. Perhaps youd call it lead led demand. Secondly, there are expected problems with supply. For example, the worlds biggest tin mine in Peru is headed for depletion by 2017. Thirdly, theres a bunch of newlydiscovered uses for tin, such as improving solar panels

Lead may be to blame for the fall of Rome

and tripling the life of lithium batteries. Tin will be the Viagra for the hybrid car industry, says Cooky. So mining is even sexy. Now you would think that with the China story of industrialisation and urbanisation, the mining sector would be booming. But that party was a few years ago and now the sector has a horrid hangover. Everywhere there are unstarted and unfinished projects scrambling for funding, and company valuations are desperately down, including for Metals X. But Metals has actually done well; the tin has made it profitable

and generated a cash pile. So rather than whinge about the cycle, Cooky has used the opportunity to buy cheap gold and nickel assets that could generate enormous value. So, Tom, mining has everything. Competing products, cycles, funding issues, strategyyou name it. Its exciting I would guess that more money has been made and lost in mining than in any other activity. And what did Tom do when I passed on this invaluable insight? He did what every sensible teenager should do listened to the advice and chose his own destiny. It wont be rocks. Richard Farleigh has operated as a business angel for many years, backing more early-stage companies than anyone else in the UK. www.farleigh.com

You might also like

- The End of Venture Capital As We Know It - The InformationDocument13 pagesThe End of Venture Capital As We Know It - The InformationAneel RanadiveNo ratings yet

- The FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and VisionariesFrom EverandThe FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and VisionariesRating: 4.5 out of 5 stars4.5/5 (6)

- LEARNING MODULE Investment and Portfolio ManagementDocument5 pagesLEARNING MODULE Investment and Portfolio ManagementAira Abigail100% (2)

- No B.S. Wealth Attraction In The New EconomyFrom EverandNo B.S. Wealth Attraction In The New EconomyRating: 4 out of 5 stars4/5 (20)

- Done Deals: Venture Capitalists Tell Their StoriesDocument438 pagesDone Deals: Venture Capitalists Tell Their StoriespiscoNo ratings yet

- Digital Transformation at Scale: Why the Strategy Is Delivery: Why the Strategy Is DeliveryFrom EverandDigital Transformation at Scale: Why the Strategy Is Delivery: Why the Strategy Is DeliveryRating: 5 out of 5 stars5/5 (1)

- 17 Rules of Game-Changer Thinking: How to Embrace Change and Ignite Your FutureFrom Everand17 Rules of Game-Changer Thinking: How to Embrace Change and Ignite Your FutureNo ratings yet

- The WEALTHTECH Book: The FinTech Handbook for Investors, Entrepreneurs and Finance VisionariesFrom EverandThe WEALTHTECH Book: The FinTech Handbook for Investors, Entrepreneurs and Finance VisionariesNo ratings yet

- Master Document Seans Group-1Document24 pagesMaster Document Seans Group-1Aryelle Georgie HendricksNo ratings yet

- My First Million5Document203 pagesMy First Million5Meek El100% (13)

- Planet VC: How the globalization of venture capital is driving the next wave of innovationFrom EverandPlanet VC: How the globalization of venture capital is driving the next wave of innovationNo ratings yet

- The Efficiency Capital Bear MarketDocument11 pagesThe Efficiency Capital Bear MarketChandrachud_Ba_9365No ratings yet

- Mackenzie 2015Document4 pagesMackenzie 2015med99yassineNo ratings yet

- The Billion Dollar Byte: Turn Big Data into Good Profits, the Datapreneur WayFrom EverandThe Billion Dollar Byte: Turn Big Data into Good Profits, the Datapreneur WayNo ratings yet

- Jim Davidson January 08Document7 pagesJim Davidson January 08Carl MullanNo ratings yet

- Everybody's Business: The Unlikely Story of How Big Business Can Fix the WorldFrom EverandEverybody's Business: The Unlikely Story of How Big Business Can Fix the WorldRating: 3 out of 5 stars3/5 (1)

- Tix To GoDocument25 pagesTix To Gomert odabasiNo ratings yet

- Ielsts Reading ParagraphsDocument37 pagesIelsts Reading ParagraphsAhmed JavaidNo ratings yet

- How I Made My First Million: 26 self-made millionaires reveal the secrets to their successFrom EverandHow I Made My First Million: 26 self-made millionaires reveal the secrets to their successRating: 5 out of 5 stars5/5 (1)

- Mint ConditionDocument10 pagesMint ConditionKristidis WyllieNo ratings yet

- Growing Business Innovation: Developing, Promoting and Protecting IPFrom EverandGrowing Business Innovation: Developing, Promoting and Protecting IPNo ratings yet

- Allison Nathan, Goldman MarchDocument22 pagesAllison Nathan, Goldman MarchRaquel CadenasNo ratings yet

- Entrepreneurship in EngineeringDocument8 pagesEntrepreneurship in EngineeringSuri SaraiNo ratings yet

- Business: Chartered Surveyors Practice What They PreachDocument1 pageBusiness: Chartered Surveyors Practice What They Preachapi-120443862No ratings yet

- Cap1 Innovation What IsDocument53 pagesCap1 Innovation What IsnikoramossNo ratings yet

- Digital Transformation at Scale: Why the Strategy Is DeliveryFrom EverandDigital Transformation at Scale: Why the Strategy Is DeliveryNo ratings yet

- Muhammad Harith Fadhillah Bin Hamzah - Ba2425b - 2019492308 - IndvidualDocument3 pagesMuhammad Harith Fadhillah Bin Hamzah - Ba2425b - 2019492308 - IndvidualMohd HarithNo ratings yet

- Global Investment Summit 2021Document11 pagesGlobal Investment Summit 2021Qu ScarlettNo ratings yet

- Keynote Introduction: On Booms, Busts, and The Value of Good JudgmentDocument4 pagesKeynote Introduction: On Booms, Busts, and The Value of Good JudgmenthdfcblgoaNo ratings yet

- 10 Billionaire Wealth TipsDocument12 pages10 Billionaire Wealth TipsAmit Kumar Baranwal100% (4)

- The Advice Age: A Letter from the Head of a Financial Services Firm, Circa 2028From EverandThe Advice Age: A Letter from the Head of a Financial Services Firm, Circa 2028No ratings yet

- Blockchain Startups Bitcoin and Ethereum As The Frontier of Finance by King, StefanDocument122 pagesBlockchain Startups Bitcoin and Ethereum As The Frontier of Finance by King, StefanAtiwat Tre100% (1)

- Business English News 35 - Tech Unicorns: Discussion QuestionsDocument10 pagesBusiness English News 35 - Tech Unicorns: Discussion QuestionsPháp Sư Giấu MặtNo ratings yet

- Making Money Truly Mobile.Document2 pagesMaking Money Truly Mobile.AdedNo ratings yet

- Currency News Apr 10Document12 pagesCurrency News Apr 10Laura Catalina CastañedaNo ratings yet

- NAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteFrom EverandNAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteNo ratings yet

- To Innovate or Not to Innovate: A blueprint for the law firm of the futureFrom EverandTo Innovate or Not to Innovate: A blueprint for the law firm of the futureNo ratings yet

- Hyperconnected Economy - Informilo Swift Sibos Magazine October 2012Document11 pagesHyperconnected Economy - Informilo Swift Sibos Magazine October 2012anthemisgroupNo ratings yet

- Farming Is Different in Approach To Accounts: Business ArgusDocument1 pageFarming Is Different in Approach To Accounts: Business Argusapi-120443862No ratings yet

- Press Release Rosler Urbox Wee EN 15 March 2019Document2 pagesPress Release Rosler Urbox Wee EN 15 March 2019AbdcNo ratings yet

- AssignmentDocument3 pagesAssignmentCharlene FiguracionNo ratings yet

- Nab Assignment 1Document2 pagesNab Assignment 1Nabeel HussainNo ratings yet

- Mark Carney Doctoral ThesisDocument5 pagesMark Carney Doctoral Thesisnicolekatholoverlandpark100% (1)

- Traduzione en 20090724 - La RepubblicaDocument4 pagesTraduzione en 20090724 - La RepubblicacorradopasseraNo ratings yet

- Money of The FutureDocument321 pagesMoney of The FutureWeb Financial Group100% (1)

- Whats The Future of WorkDocument112 pagesWhats The Future of WorkJohny DoeNo ratings yet

- Textbook The Finance Curse How Global Finance Is Making Us All Poorer Nicholas Shaxson Ebook All Chapter PDFDocument53 pagesTextbook The Finance Curse How Global Finance Is Making Us All Poorer Nicholas Shaxson Ebook All Chapter PDFrose.bequette425100% (3)

- English LanguageDocument12 pagesEnglish Languageanitatorbica1975No ratings yet

- World Islamic Mint: NewsletterDocument16 pagesWorld Islamic Mint: NewsletterNurindah 'indah' SariiNo ratings yet

- A Healthy Re-Examination of Free Trade's Benefits and Shocks - Open MarketsDocument5 pagesA Healthy Re-Examination of Free Trade's Benefits and Shocks - Open MarketsDEVJONGSNo ratings yet

- Sébastien Ronteau - DBM - The New - de Gruyter (2022)Document268 pagesSébastien Ronteau - DBM - The New - de Gruyter (2022)Nguyễn Huỳnh Phương LinhNo ratings yet

- Magazine: Hamilton: The Next Waterloo?Document24 pagesMagazine: Hamilton: The Next Waterloo?sctaguiamNo ratings yet

- AIDocument59 pagesAIsergioclementeaparicioNo ratings yet

- Business English News 31 - Crowdfunding: Discussion QuestionsDocument9 pagesBusiness English News 31 - Crowdfunding: Discussion QuestionsPháp Sư Giấu MặtNo ratings yet

- Jay Abraham GeniusDocument16 pagesJay Abraham GeniusJustien BautistaNo ratings yet

- The Digital Economy 2016Document11 pagesThe Digital Economy 2016Ahmed Furkan GulNo ratings yet

- Helping Sustainable Currencies To ScaleDocument9 pagesHelping Sustainable Currencies To ScaleP2P_FoundationNo ratings yet

- Sparks Corporation - A SparksLab Global Venture On 5 UK-Based Tech Companies To Watch in 2015Document4 pagesSparks Corporation - A SparksLab Global Venture On 5 UK-Based Tech Companies To Watch in 2015Shanel H. OrtizNo ratings yet

- NBFC MumbaiDocument145 pagesNBFC Mumbai421 Rushikesh Bhavsar IFNo ratings yet

- Management of Default Loan - Global ExperienceDocument3 pagesManagement of Default Loan - Global ExperienceMohammad Shahjahan SiddiquiNo ratings yet

- W13 Class 1 Term Test 2 Practice Case 2 NotesDocument9 pagesW13 Class 1 Term Test 2 Practice Case 2 NotesVijay KumarNo ratings yet

- Credit Risk Management in Commercial Banks Literature ReviewDocument8 pagesCredit Risk Management in Commercial Banks Literature ReviewxdhuvjrifNo ratings yet

- Usdcoins New Payment Method - Toro Advertising: What Are Usd Coins?Document5 pagesUsdcoins New Payment Method - Toro Advertising: What Are Usd Coins?tech metaverNo ratings yet

- BIS Primer PDFDocument71 pagesBIS Primer PDFutah777No ratings yet

- I.F.M.mba Que PaperDocument3 pagesI.F.M.mba Que PaperbabadhirubabaNo ratings yet

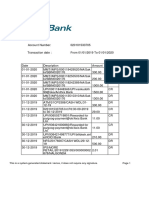

- Account Statement 26-12-2023T11 44 47Document1 pageAccount Statement 26-12-2023T11 44 47Ghs MC SAMANABADNo ratings yet

- Indeginization, Nationalization and PrivatizationDocument12 pagesIndeginization, Nationalization and PrivatizationTemitope AjibodeNo ratings yet

- Margin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikDocument12 pagesMargin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikmusiboyinaNo ratings yet

- March Payroll 2022 F FFFDocument45 pagesMarch Payroll 2022 F FFFJale Ann A. EspañolNo ratings yet

- 1601 EqDocument2 pages1601 EqJam DiolazoNo ratings yet

- Texvalley InvestmentDocument19 pagesTexvalley Investmentkarthick sudharsanNo ratings yet

- Deposit SlipDocument1 pageDeposit SlipSrinivasreddy ChallaNo ratings yet

- Basic Documents and Transactions Related To BankDocument31 pagesBasic Documents and Transactions Related To BankJerima PilleNo ratings yet

- Far Ex1Document3 pagesFar Ex1allyaNo ratings yet

- Chapter One: 1.1. Background of The StudyDocument3 pagesChapter One: 1.1. Background of The Studymubarek oumerNo ratings yet

- Application For EPC DisbursementDocument2 pagesApplication For EPC DisbursementSanjayNo ratings yet

- Chapter 4Document48 pagesChapter 4FadhilahAbdullahNo ratings yet

- Chapter 1 - Time Value of MoneyDocument61 pagesChapter 1 - Time Value of MoneyVishal PathakNo ratings yet

- 4 - Rec Re Analysis 3 6. 2021Document322 pages4 - Rec Re Analysis 3 6. 2021bhobot riveraNo ratings yet

- Questions and Answers For Essay QuestionsDocument12 pagesQuestions and Answers For Essay QuestionsPushpendra Singh ShekhawatNo ratings yet

- Senior Project ReportDocument89 pagesSenior Project Reportharsh agarwalNo ratings yet

- REPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKDocument5 pagesREPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKZaira Gem GonzalesNo ratings yet

- Truth in Lending - Act PDF BookDocument91 pagesTruth in Lending - Act PDF BookBOSSKING DESIGNS67% (3)

- FM11 CH 13 Mini-Case Old3Document14 pagesFM11 CH 13 Mini-Case Old3Wu Tian WenNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument16 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureVinod DharavathNo ratings yet

- Siop Lesson 4-2Document6 pagesSiop Lesson 4-2api-306790814No ratings yet

- Basic Concepts On The Law On Negotiable Instruments LawDocument17 pagesBasic Concepts On The Law On Negotiable Instruments LawJanetGraceDalisayFabrero100% (1)