Professional Documents

Culture Documents

Efile 1099 DIV To IRS - Form 1099 DIV - Dividents & Distributions

Efile 1099 DIV To IRS - Form 1099 DIV - Dividents & Distributions

Uploaded by

ExpressTaxFilingsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Efile 1099 DIV To IRS - Form 1099 DIV - Dividents & Distributions

Efile 1099 DIV To IRS - Form 1099 DIV - Dividents & Distributions

Uploaded by

ExpressTaxFilingsCopyright:

Available Formats

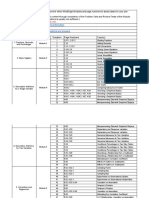

EFILE IRS FORM 1099-DIV

Form 1099-DIV General Information A 1099-DIV form is a yearly tax statement furnished by investment fund companies to investors. Form 1099-DIV includes income from dividends including exempt interest dividends and capital gains dividends of more than $10. The information included on Form 1099-DIV is furnished to the IRS (Internal Revenue Service) / SSA (Social Security Administration) as well as the payee, or person the dividends were paid to. How is Form 1099-DIV Filed? Form 1099-DIV can be both paper filed and E-Filed with the IRS (Internal Revenue Service) / SSA (Social Security Administration). If paper filing, the form 1099-DIV must be filed on or before February 28, 2013 for the 2012 tax year. If E-Filing the 1099-DIV form must be filed on or before April 1, 2013 for the 2012 tax year. Regardless of whether Form 1099-DIV is E-Filed or paper filed they must still be provided to recipients on or before January 31, 2013 for the tax year 2012. E-Filing Form 1099-DIV is a quick and convenient method to file the form. With an E-File provider such as ExpressTaxFilings.com you can both E-File your form 1099-DIV and generate your official copies to be provided to your recipients at the same time. What are the exceptions to filing Form 1099-DIV? There are two exceptions for filing the Form 1099-DIV as follows:

Dividend distributions that are taxable from life insurance contracts and employee stock ownership which need to be reported on Form 1099-R, distributions from pensions, retirement or profit-sharing plans, IRAs, annuities, etc. Substitute payments in lieu of dividends. Payments that are received by a broker on behalf of a client in lieu of dividends resulting from a loan of a clients securities, see box 8 of Form 1099-MISC.

What if Form 1099-DIV is filed late? If 1099-DIV forms are filed late with the IRS (Internal Revenue Service) / SSA (Social Security Administration) or provided to recipients late there will likely be penalties assessed based on the date that you file Form 1099-DIV. Avoid late filing penalties for Form 1099-DIV by submitting your forms for processing as soon as possible. Using the ExpressTaxFilings system is an efficient way to file your Form 1099-DIV and provide copies to your recipients automatically via postal mail. Filing Additional 1099 Forms There are a number of different 1099 form variations available for both paper filing and E-Filing. Form 1099-DIV, Form 1099-INT, Form 1099-MISC and Form 1099-OID are all available for E-Filing with ExpressTaxFilings at this time. In addition to these forms you may also E-File Form W-2 with ExpressTaxFilings. The ExpressTaxZone IRS Authorized product line includes this service as well as ExpressIFTA, ExpressTruckTax and Express Extension.

Copyright 2012 ExpressTaxFilings.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Mooney Itec 7600 Plan For Implementing Personalized LearningDocument12 pagesMooney Itec 7600 Plan For Implementing Personalized Learningapi-726949835No ratings yet

- Swot AnalysisDocument3 pagesSwot AnalysisJasmin Celedonio Laurente100% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Behaviorally Anchored Rating ScalesDocument5 pagesBehaviorally Anchored Rating ScalesAarti Bhoria100% (2)

- Bateman Et Al 2017-ContentsDocument6 pagesBateman Et Al 2017-ContentsJuan Carlos GilNo ratings yet

- Use Passing Chords - LarsenDocument9 pagesUse Passing Chords - Larsenrla97623No ratings yet

- Export Act 1963Document27 pagesExport Act 1963Anonymous OPix6Tyk5INo ratings yet

- Elecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)Document124 pagesElecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)AgusGulman100% (1)

- Kpop Songs LyricsDocument15 pagesKpop Songs LyricsAsh Alizer TesaniNo ratings yet

- 8 Physio OB - Physiology of Labor I - IIDocument14 pages8 Physio OB - Physiology of Labor I - IIArnoldBorromeoNo ratings yet

- Business and Business EnvironmentDocument63 pagesBusiness and Business EnvironmentanFasNo ratings yet

- Chapter 2 - Elementary CryptographyDocument91 pagesChapter 2 - Elementary Cryptographypraveenembd1No ratings yet

- LASALA Partnership Formation SWDocument2 pagesLASALA Partnership Formation SWLizzeille Anne Amor MacalintalNo ratings yet

- COTDocument19 pagesCOTAF Dowell Mirin0% (1)

- Prelim Quiz 2 - Attempt Review PDFDocument4 pagesPrelim Quiz 2 - Attempt Review PDFPeter EcleviaNo ratings yet

- Pareto Dan Pasif KF HBJ 24 Maret 2022Document116 pagesPareto Dan Pasif KF HBJ 24 Maret 2022Indah C. KadullahNo ratings yet

- Opt 101Document31 pagesOpt 101Diego AraújoNo ratings yet

- JW Inmarco Flexible Pure Graphite Gasket SheetDocument2 pagesJW Inmarco Flexible Pure Graphite Gasket SheetNilesh NarkhedeNo ratings yet

- Percakapan Bahasa Inggris SMP Negeri 1 MaduranDocument2 pagesPercakapan Bahasa Inggris SMP Negeri 1 MaduranDevi WulansariNo ratings yet

- Thirumurai 2Document188 pagesThirumurai 2thegodkannanNo ratings yet

- C955 Pre-Assessment - MindEdge Alignment Table - Sheet1Document3 pagesC955 Pre-Assessment - MindEdge Alignment Table - Sheet1Robert Allen Rippey0% (1)

- WK 40 - The Dream of Hamzah Bin Habib Al-ZayyatDocument2 pagesWK 40 - The Dream of Hamzah Bin Habib Al-ZayyatE-Tilawah AcademyNo ratings yet

- BEP 359 - Virtual Teams 1: Video Conference MeetingsDocument12 pagesBEP 359 - Virtual Teams 1: Video Conference MeetingsPatrickNo ratings yet

- 6DVH 3190ubDocument55 pages6DVH 3190ubakshayjauhari100% (1)

- Edward B. Hager v. United States, 993 F.2d 4, 1st Cir. (1993)Document3 pagesEdward B. Hager v. United States, 993 F.2d 4, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- US Open 2022 QuizDocument2 pagesUS Open 2022 QuizNelson D'SouzaNo ratings yet

- 12 Rotations PDFDocument4 pages12 Rotations PDFBrandeice BarrettNo ratings yet

- Creation Centered HymnsDocument4 pagesCreation Centered HymnsJoshua DanielNo ratings yet

- Unit 10: Values: Lesson A Objective: Learn To Talk About Moral DilemmasDocument7 pagesUnit 10: Values: Lesson A Objective: Learn To Talk About Moral DilemmasLiss PeñafielNo ratings yet

- A Hero Is Someone Who Understands The Responsibility That Comes With His FreedomDocument2 pagesA Hero Is Someone Who Understands The Responsibility That Comes With His FreedomellyabNo ratings yet

- Writing The Article: Strategy and Preparations: Lesson SummaryDocument7 pagesWriting The Article: Strategy and Preparations: Lesson SummarySol VirtudazoNo ratings yet