Professional Documents

Culture Documents

GE The Balancing of A Forecast PDF

GE The Balancing of A Forecast PDF

Uploaded by

Mohammed SadhikCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Planet PDFDocument3 pagesPlanet PDFMohammed SadhikNo ratings yet

- Andy McKee - (2007) The Gates of GnomeriaDocument2 pagesAndy McKee - (2007) The Gates of GnomeriarealizadorNo ratings yet

- Beauty StandardsDocument10 pagesBeauty StandardsBet TeixeiraNo ratings yet

- 001 Gmaaeng16apr21 PDFDocument18 pages001 Gmaaeng16apr21 PDFMohammed SadhikNo ratings yet

- Calendar 08 26 2012Document8 pagesCalendar 08 26 2012Mohammed SadhikNo ratings yet

- Dojo PresentationDocument10 pagesDojo PresentationMohammed SadhikNo ratings yet

- Introducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorDocument9 pagesIntroducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorMohammed Sadhik100% (1)

- Sales Manager: About Role at Whitehat JRDocument2 pagesSales Manager: About Role at Whitehat JRjoy 11No ratings yet

- Biology EducationDocument10 pagesBiology EducationAzah BalQisNo ratings yet

- Literary DevicesDocument22 pagesLiterary DevicesHammadJavaid ConceptNo ratings yet

- NegotiatingDocument47 pagesNegotiatingabhijitshinde1702100% (1)

- DSQC 668 Axis Computer: General InformationDocument2 pagesDSQC 668 Axis Computer: General InformationVenkataramanaaNo ratings yet

- Evidence LawDocument16 pagesEvidence Lawanne100% (1)

- Auditing Quiz - Accepting The Engagement and Planning The AuditDocument11 pagesAuditing Quiz - Accepting The Engagement and Planning The AuditMarie Lichelle AureusNo ratings yet

- CorrectionsDocument7 pagesCorrectionsJoshua AbasoloNo ratings yet

- Endocrine Problems of The Adult ClientDocument18 pagesEndocrine Problems of The Adult ClientMarylle AntonioNo ratings yet

- Yoruba and Benin Kingdom - Ile Ife The Final Resting Place of HistoryDocument5 pagesYoruba and Benin Kingdom - Ile Ife The Final Resting Place of HistoryugwakaluNo ratings yet

- LUTHERAN Gregorian Psalter and Canticles Matins Vespers 1897Document488 pagesLUTHERAN Gregorian Psalter and Canticles Matins Vespers 1897Peter Brandt-SorheimNo ratings yet

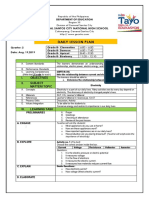

- Course Syllabus: Date Objective Topic References ActivityDocument4 pagesCourse Syllabus: Date Objective Topic References ActivityERIC JOHN VITUGNo ratings yet

- Daily Lesson Plan: I. Objectives II. Subject Matter/ TopicDocument2 pagesDaily Lesson Plan: I. Objectives II. Subject Matter/ TopicANGELIQUE DIAMALONNo ratings yet

- MSC in Clinical Dermatology: (MSCCD) Course ProspectusDocument6 pagesMSC in Clinical Dermatology: (MSCCD) Course ProspectusxaltraNo ratings yet

- Uma Sekaran+Chapter+2Document8 pagesUma Sekaran+Chapter+2Simrah ZafarNo ratings yet

- Administrative 1Document6 pagesAdministrative 1karmay shrimaliNo ratings yet

- List of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMDocument6 pagesList of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMShakeelAhmedNo ratings yet

- Jurnal Koligatif LarutanDocument7 pagesJurnal Koligatif Larutanmuthia shafa nazahraNo ratings yet

- Quantitative Historical Linguistics A Corpus Framework (Oxford Studies in Diachronic and Historical Linguistics)Document247 pagesQuantitative Historical Linguistics A Corpus Framework (Oxford Studies in Diachronic and Historical Linguistics)ChristianNo ratings yet

- ELC550 Annotated Biblography (Sample Article and Question)Document2 pagesELC550 Annotated Biblography (Sample Article and Question)nurul syazwaniNo ratings yet

- ACCA Hedging ForexRisk PDFDocument10 pagesACCA Hedging ForexRisk PDFNewmann Anane-AboagyeNo ratings yet

- A Little Princess ThesisDocument8 pagesA Little Princess Thesisqigeenzcf100% (2)

- The Road To English PDFDocument6 pagesThe Road To English PDFRAGHUBALAN DURAIRAJUNo ratings yet

- Base Paper Employer BrandingDocument13 pagesBase Paper Employer BrandingA K SubramaniNo ratings yet

- Ch9 Long Run Costs and Output DecisionsDocument19 pagesCh9 Long Run Costs and Output Decisionsabhishek yadavNo ratings yet

- Bandhas: TechniqueDocument5 pagesBandhas: TechniqueGurjit Singh BoparaiNo ratings yet

- Punjab CuisineDocument6 pagesPunjab CuisineIbrahim FaRizzNo ratings yet

- The Biology of Belief Book Summary Bruce H Lipton PHDDocument9 pagesThe Biology of Belief Book Summary Bruce H Lipton PHDAyman ShetaNo ratings yet

GE The Balancing of A Forecast PDF

GE The Balancing of A Forecast PDF

Uploaded by

Mohammed SadhikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GE The Balancing of A Forecast PDF

GE The Balancing of A Forecast PDF

Uploaded by

Mohammed SadhikCopyright:

Available Formats

The Balancing of a Forecast written by Robert Giordano (founder of pvtpointmktres.

com) Using the stock General Electric (symbol GE) as our forecasting example, we see some interesting results when properly combined and balanced with the unique key indicators shown above. As we shall see, each single chart is only a small piece to A much larger forecasting system, shown in the following examples.

KEY#1Ganns cycle years (Monthly trend change periods for 2002 and 2003) From this general information we see for the year 2002 the monthly high probability trend change periods are from the 3rd- 5th month, and 7th-10th month.

30 yr. 1972 20 yr. 1982 15 yr. 1987 14 yr. 1988 10 yr. 1992 7 yr. 1995 5 yr. 1997 1 yr. 2001 For 2003 30 yr. 1973 20 yr. 1983 15 yr. 1988 14 yr. 1989 10 yr. 1993 7 yr. 1996 5 yr. 1998 1 yr. 2002

Feb. low April high April high May low April low April low March low

April. High Oct. low June low May low Aug.high July high Aug low Sept. high Oct. low July high May high Oct. low Sept. low

Jan high May low June high Aug. low Jan high May low Feb high March low Feb low April high Feb.high March low April high July high Jan. low March high

From this general information we see for the year 2003 the monthly high probability trend change periods are from: The 1st-3rd month, 5th month and the 7th-8th month KEY #2. Monthly time counts When using the monthly time balancing charts (fig # 1) we see the average MINOR top to top time cycle periods to be 3-5 months and the MAJOR time cycle periods to be 8-10 months.

On the bottom to bottom time cycle counts we find the average MINOR cycle periods to be 2,months, 4months,and 6 months, and 10-13 months for the MAJOR periods. From the low in Sept./01 to the low in July /02 was 10 months From the low in Jan./02 to the low in July/02 was 6 months (these time periods balanced perfectly with key # 1) From the top in March. /02 to the top in Aug./02 was 5 months From the top in Nov./01 to the top in Aug./02 was 9 months (Again these periods balanced with key # 1)

Monthly Charts

Figure 1

Figure 2

KEY #3Monthly fibonacci time counts. 1,1,2,3,5,8,13,21,34,55,ext The low in July/02 was 8 months from the top in Nov./01,was 14 months (1 over) from the top in May /01, and 35 months (1 over) from the Aug./99 bottom. From the top in Aug./02 the fib. # Counts were 8 months from the Jan./02 low, was 12 months (1 short) from the Sept./01 low, and was 21 months from the high in Dec./00.

KEY #4Weekly time counts. As we approach a potential monthly trend change period we use this method to narrow down the time periods to give an estimate of the actual trend change week. (Chart fig. # 2-5) The average weekly top to top time swings are from 3-5 weeks, and 6-7 weeks for MINOR periods, and 9-10,14-15, also 21-25 weeks for the MAJOR swings. From the bottom to bottom swing periods we see 2-3 weeks, 4-5 weeks and 7 weeks for the MINOR periods, and 9-10,12-13,17-19,and 24-26 week for the MAJOR time cycle counts. Using the major weekly low on 7/26/02, it was 25 weeks from the low on 2/01/01,it was 12 weeks from the low on 5/03/02, and it was 7 weeks from the low on 6/7/02 (as we can see each period balanced perfectly with the 7/26/02 low) From the top on 8/23/02 to the top on 5/17/02 was 14 weeks, to the top on 3/08/02 it was 24 weeks, and to the top on 8/09/02 it was 2 weeks (again all periods balanced)

Weekly Charts

Figure 1

Figure 2

Figure 3

Figure 4 KEY #5. Gann Angles (fig #6) When using the Gann angles on the daily chart, along with the proper price scale you can greatly increase your odds for success. This tool giving the approximate trend change date, along with the general price support and resistance levels present at that time.

Gann Angle Charts

Figure 1

Figure 2a

Figure 2b

As we see on the chart the angle of 60 degrees starting from the top on 7/15/02 crossed the exact low on 7/24/02, and the 43 degree angle from the bottom on 7/24/02 crossed the exact price on the final monthly, weekly, and daily time period high on 8/22/02.

KEY #6Planetary number squares (Venus price longitude working off of the square of 12. Fig # 7-8) Going over several years of past daily data on GE and finding the proper price scale, we see when the planet Venus's daily motion is plotted on the 12x12 number square (not the 144 overlay) we see it holds the price of GE almost 70-80%of the timeout shows as you can see on the chart many minor and major price support and resistance levels within its price channels. (Solid lines are price conjunction points 360 degrees, and the broken lines are opposition points, 180 degrees) Combining this data with the Gann angles we see on the exact date of the low on 7/24/02 the price channel was .125 cents off the exact Venus opposition point. On the exact top on 8/22/02 Venus price was conjunct the final high too the penny. Confirming the various other tools.

KEY #7 Astro energy dates (mundane and individual) The dates of most of the high and low trend change periods from both major and minor reversals are also systematically consistent with many of the natural and individual astronomical energy dates (not shown here) from the Bayer,Jensen,Gann, and Dewey research. As we now can see from the amount of time, research, and work that was spent on just one stock, you can now get the general idea of the importance of having the proper tools. Gann grids may only be one small tool in this literally never ending study it however in my opinion, will help you gain a better understanding of this great science by saving you the much needed time for further research.

PS...The balancing of the next major GE cycle period from the monthly, weekly, fib. # counts, and astro data clusters are forming in Jan - Feb of 2003. The astro dates for each month are Jan. 2-3,9th,and*18-22.For Feb. they are *4-5,12-13,and 24th *Means very important periods.

The above information is for research purposes only. It is not intended in any way to be used as trading advice.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Planet PDFDocument3 pagesPlanet PDFMohammed SadhikNo ratings yet

- Andy McKee - (2007) The Gates of GnomeriaDocument2 pagesAndy McKee - (2007) The Gates of GnomeriarealizadorNo ratings yet

- Beauty StandardsDocument10 pagesBeauty StandardsBet TeixeiraNo ratings yet

- 001 Gmaaeng16apr21 PDFDocument18 pages001 Gmaaeng16apr21 PDFMohammed SadhikNo ratings yet

- Calendar 08 26 2012Document8 pagesCalendar 08 26 2012Mohammed SadhikNo ratings yet

- Dojo PresentationDocument10 pagesDojo PresentationMohammed SadhikNo ratings yet

- Introducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorDocument9 pagesIntroducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorMohammed Sadhik100% (1)

- Sales Manager: About Role at Whitehat JRDocument2 pagesSales Manager: About Role at Whitehat JRjoy 11No ratings yet

- Biology EducationDocument10 pagesBiology EducationAzah BalQisNo ratings yet

- Literary DevicesDocument22 pagesLiterary DevicesHammadJavaid ConceptNo ratings yet

- NegotiatingDocument47 pagesNegotiatingabhijitshinde1702100% (1)

- DSQC 668 Axis Computer: General InformationDocument2 pagesDSQC 668 Axis Computer: General InformationVenkataramanaaNo ratings yet

- Evidence LawDocument16 pagesEvidence Lawanne100% (1)

- Auditing Quiz - Accepting The Engagement and Planning The AuditDocument11 pagesAuditing Quiz - Accepting The Engagement and Planning The AuditMarie Lichelle AureusNo ratings yet

- CorrectionsDocument7 pagesCorrectionsJoshua AbasoloNo ratings yet

- Endocrine Problems of The Adult ClientDocument18 pagesEndocrine Problems of The Adult ClientMarylle AntonioNo ratings yet

- Yoruba and Benin Kingdom - Ile Ife The Final Resting Place of HistoryDocument5 pagesYoruba and Benin Kingdom - Ile Ife The Final Resting Place of HistoryugwakaluNo ratings yet

- LUTHERAN Gregorian Psalter and Canticles Matins Vespers 1897Document488 pagesLUTHERAN Gregorian Psalter and Canticles Matins Vespers 1897Peter Brandt-SorheimNo ratings yet

- Course Syllabus: Date Objective Topic References ActivityDocument4 pagesCourse Syllabus: Date Objective Topic References ActivityERIC JOHN VITUGNo ratings yet

- Daily Lesson Plan: I. Objectives II. Subject Matter/ TopicDocument2 pagesDaily Lesson Plan: I. Objectives II. Subject Matter/ TopicANGELIQUE DIAMALONNo ratings yet

- MSC in Clinical Dermatology: (MSCCD) Course ProspectusDocument6 pagesMSC in Clinical Dermatology: (MSCCD) Course ProspectusxaltraNo ratings yet

- Uma Sekaran+Chapter+2Document8 pagesUma Sekaran+Chapter+2Simrah ZafarNo ratings yet

- Administrative 1Document6 pagesAdministrative 1karmay shrimaliNo ratings yet

- List of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMDocument6 pagesList of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMShakeelAhmedNo ratings yet

- Jurnal Koligatif LarutanDocument7 pagesJurnal Koligatif Larutanmuthia shafa nazahraNo ratings yet

- Quantitative Historical Linguistics A Corpus Framework (Oxford Studies in Diachronic and Historical Linguistics)Document247 pagesQuantitative Historical Linguistics A Corpus Framework (Oxford Studies in Diachronic and Historical Linguistics)ChristianNo ratings yet

- ELC550 Annotated Biblography (Sample Article and Question)Document2 pagesELC550 Annotated Biblography (Sample Article and Question)nurul syazwaniNo ratings yet

- ACCA Hedging ForexRisk PDFDocument10 pagesACCA Hedging ForexRisk PDFNewmann Anane-AboagyeNo ratings yet

- A Little Princess ThesisDocument8 pagesA Little Princess Thesisqigeenzcf100% (2)

- The Road To English PDFDocument6 pagesThe Road To English PDFRAGHUBALAN DURAIRAJUNo ratings yet

- Base Paper Employer BrandingDocument13 pagesBase Paper Employer BrandingA K SubramaniNo ratings yet

- Ch9 Long Run Costs and Output DecisionsDocument19 pagesCh9 Long Run Costs and Output Decisionsabhishek yadavNo ratings yet

- Bandhas: TechniqueDocument5 pagesBandhas: TechniqueGurjit Singh BoparaiNo ratings yet

- Punjab CuisineDocument6 pagesPunjab CuisineIbrahim FaRizzNo ratings yet

- The Biology of Belief Book Summary Bruce H Lipton PHDDocument9 pagesThe Biology of Belief Book Summary Bruce H Lipton PHDAyman ShetaNo ratings yet