Professional Documents

Culture Documents

Compass Financial - Job Dislocation Handout 2009

Compass Financial - Job Dislocation Handout 2009

Uploaded by

compassfinancialCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Masters Olympic Lifting Program 4 Weeks 14 March 11 AprilDocument3 pagesMasters Olympic Lifting Program 4 Weeks 14 March 11 AprilGastón Salas50% (2)

- TrainingsDocument4 pagesTrainingstimie_reyesNo ratings yet

- Aug 9 Sbi4u Answers Quiz 4Document3 pagesAug 9 Sbi4u Answers Quiz 4api-216300751No ratings yet

- Compass Financial - Fidelity - Stimulus ScorecardDocument4 pagesCompass Financial - Fidelity - Stimulus Scorecardcompassfinancial100% (2)

- Weekly Market Commentary June 1,2009Document2 pagesWeekly Market Commentary June 1,2009compassfinancialNo ratings yet

- Weekly Economic Commentary Jan 5 2009Document3 pagesWeekly Economic Commentary Jan 5 2009compassfinancialNo ratings yet

- Weekly Market Commentary Jan 20 2009Document3 pagesWeekly Market Commentary Jan 20 2009compassfinancialNo ratings yet

- Compass Financial - Weekly Economic Commentary - Dec 1, 2008Document3 pagesCompass Financial - Weekly Economic Commentary - Dec 1, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary July 28, 2008Document3 pagesCompass Financial - Weekly Market Commentary July 28, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary August 11 2008Document3 pagesCompass Financial - Weekly Market Commentary August 11 2008compassfinancial100% (1)

- Compass Financial - Why Munis Now - Sept 22 2008Document2 pagesCompass Financial - Why Munis Now - Sept 22 2008compassfinancialNo ratings yet

- Compass Financial - Lincoln Anderson Commentary - Peak Oil - July 22, 2008Document4 pagesCompass Financial - Lincoln Anderson Commentary - Peak Oil - July 22, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary July 7 2008Document3 pagesCompass Financial - Weekly Market Commentary July 7 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary May 12, 2008Document2 pagesCompass Financial - Weekly Market Commentary May 12, 2008compassfinancial100% (1)

- Compass Financial - Weekly Market Commentary June 30 2008Document4 pagesCompass Financial - Weekly Market Commentary June 30 2008compassfinancialNo ratings yet

- Compass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008Document6 pagesCompass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary June 16, 2008Document2 pagesCompass Financial - Weekly Market Commentary June 16, 2008compassfinancialNo ratings yet

- Compass Insights July 2008Document2 pagesCompass Insights July 2008compassfinancial100% (2)

- Compass Financial - Raging Bull - Energy Sector Overview - June 25 2008Document6 pagesCompass Financial - Raging Bull - Energy Sector Overview - June 25 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Economic Commentary April 28, 2008Document7 pagesCompass Financial - Weekly Economic Commentary April 28, 2008compassfinancialNo ratings yet

- Compass Financial - Market Update April 30, 2008Document3 pagesCompass Financial - Market Update April 30, 2008compassfinancialNo ratings yet

- Vacuum and Pressure Gauges For Fire Proteccion System 2311Document24 pagesVacuum and Pressure Gauges For Fire Proteccion System 2311Anonymous 8RFzObvNo ratings yet

- Reading U2Document5 pagesReading U2Quỳnh Trang Mai ThịNo ratings yet

- Volume Changes of ConcreteDocument17 pagesVolume Changes of ConcreteAljawhara AlnadiraNo ratings yet

- Mina NEGRA HUANUSHA 2 ParteDocument23 pagesMina NEGRA HUANUSHA 2 ParteRoberto VillegasNo ratings yet

- Dear Teacher AssociateDocument1 pageDear Teacher Associateapi-581171409No ratings yet

- Major Crops and Cropping Pattern For UPSC CSEDocument10 pagesMajor Crops and Cropping Pattern For UPSC CSEjyotiNo ratings yet

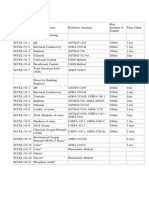

- Water, Soi & Aggregate Testing StandardsDocument2 pagesWater, Soi & Aggregate Testing StandardsSanjeewani Disna JayamaliNo ratings yet

- 1ST Term S1 ChemistryDocument27 pages1ST Term S1 ChemistryPeter Omovigho Dugbo100% (2)

- BSR 560 Jan 2022 Test (w6 Exercise)Document3 pagesBSR 560 Jan 2022 Test (w6 Exercise)Muhammad SahrizatNo ratings yet

- CHIR EndsemDocument516 pagesCHIR EndsemSoikat DasNo ratings yet

- Ijims 2017 105Document7 pagesIjims 2017 105Marcos HoilNo ratings yet

- Presentation Expressing Solution PDFDocument30 pagesPresentation Expressing Solution PDFNSTI WELEAREGAYNo ratings yet

- AG Nessel AmicusDocument66 pagesAG Nessel AmicusGuy Hamilton-Smith100% (1)

- Smitham Intuitive Eating Efficacy Bed 02 16 09Document43 pagesSmitham Intuitive Eating Efficacy Bed 02 16 09Evelyn Tribole, MS, RDNo ratings yet

- Xenon 21-22 Sheet Without Answer (EUDIOMETRY)Document3 pagesXenon 21-22 Sheet Without Answer (EUDIOMETRY)Krishna GoyalNo ratings yet

- Dropped Nucleus ManagementDocument32 pagesDropped Nucleus ManagementNiloy Basak100% (2)

- AdrenalinDocument8 pagesAdrenalinMisha Angela Isabel PerolNo ratings yet

- Hospital ReservesDocument84 pagesHospital ReservesThe Boston GlobeNo ratings yet

- MTH102 Linear AlgebraDocument15 pagesMTH102 Linear AlgebraEisa MohdNo ratings yet

- 101 Negativity KillerDocument30 pages101 Negativity KillerAdeline FamousNo ratings yet

- Installation and Maintenance Manual: GT210, GT410 and GT610 Series Miniature I/P - E/P TransducersDocument8 pagesInstallation and Maintenance Manual: GT210, GT410 and GT610 Series Miniature I/P - E/P TransducersStefano Bbc RossiNo ratings yet

- Five Year Development Plan (2003-2008)Document190 pagesFive Year Development Plan (2003-2008)Saurav SenNo ratings yet

- Neet BiologyDocument9 pagesNeet Biologyjaseelanu2No ratings yet

- Danika Sanders Student Teacher ResumeDocument2 pagesDanika Sanders Student Teacher Resumeapi-496485131No ratings yet

- Practice ExerciseDocument8 pagesPractice ExerciseHassan LatifNo ratings yet

- 17-03-10 Inductive Conductivity Transmitter CIT-8920Document30 pages17-03-10 Inductive Conductivity Transmitter CIT-8920Juan CarvajalNo ratings yet

- Atom Percent Fission in Uranium and Plutonium Fuel (Neodymium-148 Method)Document9 pagesAtom Percent Fission in Uranium and Plutonium Fuel (Neodymium-148 Method)astewayb_964354182No ratings yet

Compass Financial - Job Dislocation Handout 2009

Compass Financial - Job Dislocation Handout 2009

Uploaded by

compassfinancialCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compass Financial - Job Dislocation Handout 2009

Compass Financial - Job Dislocation Handout 2009

Uploaded by

compassfinancialCopyright:

Available Formats

COMPASS FINANCIAL SERVICES • 5015 Grand Ridge Drive, Ste 200

West Des Moines, IA 50265 • 515.327.1020 • www.CompassIowa.com

Job Dislocation: Managing the Financial Impact of Unexpected Job Loss

Y ou may not be able to control if or when your company

closes a plant or lays off workers—but you can plan

ahead and take steps to manage the financial impact of

those events.

Ask the following questions to understand what you get:

1. What are the terms of the plans that cover me? Ask

for the summary plan description (SPD), the document that

contains a complete description of the benefits owed to you

and how they are calculated. Your company’s human resources

department, the plan trustee or administrator, or your labor

union should have a copy of this document.

2. When do I vest and how much is my benefit? The

plan administrator or the company’s human resources depart-

ment should tell you exactly how long you must work before

you become entitled to or vested in your benefits and how

much those benefits will be. Understand how the benefit is

calculated so you can double check that the amount reported to

you is correct.

3. When can I start getting payments? You need to

know when you can start receiving your benefits so you can

This guide is designed to help you: plan accordingly.

Ask the right questions about your company’s Health Insurance: Learn about COBRA to Stay Healthy

benefit plans; One of the most significant risks of job dislocation is the loss

of your health insurance. A federal law, known as COBRA,

Keep your finances on the right track in the event of provides for continuation of health coverage up to 18 months

unemployment; and after a job loss, under certain circumstances.

Protect yourself when getting financial advice. Job Dislocation: What to Do after Your Company An-

nounces a Plant Closing or Layoffs

Understand Your Company’s Benefits

Whatever the reason for your job dislocation, you now face a

The most obvious benefit you get from your company is the period when handling your finances correctly will be critical to

regular paycheck that you count on for doing your job. you and your family. These tips can help you take charge of

Another benefit that you probably use frequently is your health your financial situation:

insurance. Other company benefits, such as a 401(k) or

pension plan, help you build retirement security over time. Act Quickly to Reduce Spending: With less money

Your employer may offer a variety of retirement benefits, and coming in, you should take immediate action to reduce

it is up to you to take the initiative to understand them, sooner spending wherever possible. Resist the temptation to buy

rather than later. Do not be shy about asking questions. Below on credit.

is a brief description of commonly offered plans:

Assess Your Short-Term Situation: Figure out how

Pension Plans: much cash you have readily available or can get on short

These plans usually provide a series of payments, also notice, how much you owe—mortgage, rent, credit cards,

called a defined benefit, after you retire. The amount you car loans—and the monthly payments associated with

receive is normally calculated based on a combination of those and other debts. Establish how long you can make

salary, age and years of service. ends meet on the financial resources that you already have

in hand.

401(k) Plans:

These plans are referred to as defined contribution plans Ask About Dislocated Worker Services: Your employer

because they allow you to contribute a portion of your may work with state and local officials to provide services

salary to retirement savings, and receive certain tax such as job placement, retraining, or resume writing.

benefits. You may move (rollover) your 401(k) savings Maximize your opportunity to get a new position as

when you leave an employer allowing continued deferral quickly as possible by taking advantage of these services

of the taxable portion of your account. - make finding a new job your full-time job.

Cash Balance Plans: Inquire about Unemployment Insurance:

These plans provide for a benefit that is stated in terms of A representative of the state’s unemployment insurance

an account balance. Each employee has an account to office will likely be at your workplace to offer guidance

which the employer contributes a specified dollar amount and assistance in filling out the necessary applications.

every year. Knowing how much you can claim and how long you can

expect to receive unemployment benefits will help you

Employee Profit Sharing Plans: handle your finances.

The company contributes a certain amount of its annual

profits to participating employees. Get Financial Advice: Consider working with a credit

counselor or financial professional who can help you

Employee Stock Bonus Plans: develop a plan to see you through your unemployment

The company contributes a certain number of shares of its period and beyond. See below for tips to protect yourself

own stock to its employees. when considering a financial professional.

COMPASS FINANCIAL SERVICES • 5015 Grand Ridge Drive, Ste 200

West Des Moines, IA 50265 • 515.327.1020 • www.CompassIowa.com

401(k) Hardship Withdrawals—A Choice of Last Resort

Long-Term Job Dislocation: Smart Choices in Difficult

Times - The prospect of an extended period of unemployment Your company’s 401(k) plan may provide for hardship

will require some difficult decisions that could affect your withdrawals. You need to be aware of the tax and long-term

long-term financial health. Managing severance pay, choosing financial consequences before tapping into your retirement

the form of payment from benefit plans, and preserving your funds this way.

retirement funds if you are still years away from retirement

age, are high in that list. Keep in mind the following tips when Protect Yourself: Check Before Hiring an Investment

deciding what to do: Professional

The right investment professional can help you plan for your

financial health from your first day of work. A professional can

also work with you to make good choices during periods of

job dislocation. Legitimate investment professionals must be

properly licensed. To protect yourself when dealing with one:

Always Do a Background Check:

For a broker or brokerage firm, use FINRA BrokerCheck

at www.finra.org/brokercheck or call toll-free

(800) 289-9999.

For an investment adviser, use the SEC’s Investment

Adviser Public Disclosure Web site at www.adviserinfo.

sec.gov or call toll-free (800) SEC-0330.

For an insurance agent, check with your state insurance

department. You will find contact information through the

Conserve Funds Meant for Your Retirement if You National Association of Insurance Commissioners (NAIC)

Can: Tap into your retirement funds to make ends meet at www.naic.org or call toll-free (866) 470-NAIC.

only as a last resort. If you have a choice, choose to keep

those funds invested and working for you until you For brokers and advisers in any state, be sure to call your

actually retire. state securities regulator. Contact the North American

Securities Administrators Association at www.nasaa.org

Understand the Tax Bite: Income taxes apply when you or call (202) 737-0900 for the state’s number.

tap into retirement funds prior to age 59 ½. The plan

administrator is required to withhold 20% of the amount Beware of Investments that Promise Too Much: The

you cash out to ensure that you will pay the taxes that announcement of your plant’s closing or mass layoff may have

apply. An additional 10% penalty tax may apply if you are received national or local press coverage. If all of a sudden

under 59 ½ years of age. In order to avoid income tax and you find that you are receiving unsolicited offers for the

a tax penalty, you must roll over your funds to an Indi investment of a lifetime, beware. If it sounds too good to be

vidual Retirement Account (IRA) or other qualified true, you know it probably is. Avoid becoming a victim by

retirement plan within 60 days of receiving the checking the credentials of the person offering these invest-

retirement funds. ment opportunities.

Use Direct Rollovers to Avoid Potential Taxes: If you

elect to roll over retirement funds, you may avoid tax

complications and the risk that you will not complete a

rollover within the required 60 days of receiving those

funds. Choose a direct rollover by having the plan

administrator transfer the rollover amount directly to an

IRA or other qualified retirement plan.

Spend and Invest Lump Sums Wisely: Receiving a

lump sum may tempt you to spend it on that one thing you

have been wanting all your life. Do yourself a favor and

wait. If you face a long unemployment period, these may

be the only funds you will have to make ends meet. Even

if that is not the case, give yourself time. Consider short

and long term needs before you decide what to do. If you

decide to invest the lump sum, take your time to consider

what you are going to invest in, when you are going to

make the investment, and how much of the lump sum you

want to invest in different types of investment such as

stock, bonds, or non-financial assets.

COMPASS

FINANCIAL SERVICES

Securities offered through LPL Financial

Member FINRA/SIPC

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Masters Olympic Lifting Program 4 Weeks 14 March 11 AprilDocument3 pagesMasters Olympic Lifting Program 4 Weeks 14 March 11 AprilGastón Salas50% (2)

- TrainingsDocument4 pagesTrainingstimie_reyesNo ratings yet

- Aug 9 Sbi4u Answers Quiz 4Document3 pagesAug 9 Sbi4u Answers Quiz 4api-216300751No ratings yet

- Compass Financial - Fidelity - Stimulus ScorecardDocument4 pagesCompass Financial - Fidelity - Stimulus Scorecardcompassfinancial100% (2)

- Weekly Market Commentary June 1,2009Document2 pagesWeekly Market Commentary June 1,2009compassfinancialNo ratings yet

- Weekly Economic Commentary Jan 5 2009Document3 pagesWeekly Economic Commentary Jan 5 2009compassfinancialNo ratings yet

- Weekly Market Commentary Jan 20 2009Document3 pagesWeekly Market Commentary Jan 20 2009compassfinancialNo ratings yet

- Compass Financial - Weekly Economic Commentary - Dec 1, 2008Document3 pagesCompass Financial - Weekly Economic Commentary - Dec 1, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary July 28, 2008Document3 pagesCompass Financial - Weekly Market Commentary July 28, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary August 11 2008Document3 pagesCompass Financial - Weekly Market Commentary August 11 2008compassfinancial100% (1)

- Compass Financial - Why Munis Now - Sept 22 2008Document2 pagesCompass Financial - Why Munis Now - Sept 22 2008compassfinancialNo ratings yet

- Compass Financial - Lincoln Anderson Commentary - Peak Oil - July 22, 2008Document4 pagesCompass Financial - Lincoln Anderson Commentary - Peak Oil - July 22, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary July 7 2008Document3 pagesCompass Financial - Weekly Market Commentary July 7 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary May 12, 2008Document2 pagesCompass Financial - Weekly Market Commentary May 12, 2008compassfinancial100% (1)

- Compass Financial - Weekly Market Commentary June 30 2008Document4 pagesCompass Financial - Weekly Market Commentary June 30 2008compassfinancialNo ratings yet

- Compass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008Document6 pagesCompass Financial - Lincoln Anderson Commentary - Bad Banking - July 22, 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Market Commentary June 16, 2008Document2 pagesCompass Financial - Weekly Market Commentary June 16, 2008compassfinancialNo ratings yet

- Compass Insights July 2008Document2 pagesCompass Insights July 2008compassfinancial100% (2)

- Compass Financial - Raging Bull - Energy Sector Overview - June 25 2008Document6 pagesCompass Financial - Raging Bull - Energy Sector Overview - June 25 2008compassfinancialNo ratings yet

- Compass Financial - Weekly Economic Commentary April 28, 2008Document7 pagesCompass Financial - Weekly Economic Commentary April 28, 2008compassfinancialNo ratings yet

- Compass Financial - Market Update April 30, 2008Document3 pagesCompass Financial - Market Update April 30, 2008compassfinancialNo ratings yet

- Vacuum and Pressure Gauges For Fire Proteccion System 2311Document24 pagesVacuum and Pressure Gauges For Fire Proteccion System 2311Anonymous 8RFzObvNo ratings yet

- Reading U2Document5 pagesReading U2Quỳnh Trang Mai ThịNo ratings yet

- Volume Changes of ConcreteDocument17 pagesVolume Changes of ConcreteAljawhara AlnadiraNo ratings yet

- Mina NEGRA HUANUSHA 2 ParteDocument23 pagesMina NEGRA HUANUSHA 2 ParteRoberto VillegasNo ratings yet

- Dear Teacher AssociateDocument1 pageDear Teacher Associateapi-581171409No ratings yet

- Major Crops and Cropping Pattern For UPSC CSEDocument10 pagesMajor Crops and Cropping Pattern For UPSC CSEjyotiNo ratings yet

- Water, Soi & Aggregate Testing StandardsDocument2 pagesWater, Soi & Aggregate Testing StandardsSanjeewani Disna JayamaliNo ratings yet

- 1ST Term S1 ChemistryDocument27 pages1ST Term S1 ChemistryPeter Omovigho Dugbo100% (2)

- BSR 560 Jan 2022 Test (w6 Exercise)Document3 pagesBSR 560 Jan 2022 Test (w6 Exercise)Muhammad SahrizatNo ratings yet

- CHIR EndsemDocument516 pagesCHIR EndsemSoikat DasNo ratings yet

- Ijims 2017 105Document7 pagesIjims 2017 105Marcos HoilNo ratings yet

- Presentation Expressing Solution PDFDocument30 pagesPresentation Expressing Solution PDFNSTI WELEAREGAYNo ratings yet

- AG Nessel AmicusDocument66 pagesAG Nessel AmicusGuy Hamilton-Smith100% (1)

- Smitham Intuitive Eating Efficacy Bed 02 16 09Document43 pagesSmitham Intuitive Eating Efficacy Bed 02 16 09Evelyn Tribole, MS, RDNo ratings yet

- Xenon 21-22 Sheet Without Answer (EUDIOMETRY)Document3 pagesXenon 21-22 Sheet Without Answer (EUDIOMETRY)Krishna GoyalNo ratings yet

- Dropped Nucleus ManagementDocument32 pagesDropped Nucleus ManagementNiloy Basak100% (2)

- AdrenalinDocument8 pagesAdrenalinMisha Angela Isabel PerolNo ratings yet

- Hospital ReservesDocument84 pagesHospital ReservesThe Boston GlobeNo ratings yet

- MTH102 Linear AlgebraDocument15 pagesMTH102 Linear AlgebraEisa MohdNo ratings yet

- 101 Negativity KillerDocument30 pages101 Negativity KillerAdeline FamousNo ratings yet

- Installation and Maintenance Manual: GT210, GT410 and GT610 Series Miniature I/P - E/P TransducersDocument8 pagesInstallation and Maintenance Manual: GT210, GT410 and GT610 Series Miniature I/P - E/P TransducersStefano Bbc RossiNo ratings yet

- Five Year Development Plan (2003-2008)Document190 pagesFive Year Development Plan (2003-2008)Saurav SenNo ratings yet

- Neet BiologyDocument9 pagesNeet Biologyjaseelanu2No ratings yet

- Danika Sanders Student Teacher ResumeDocument2 pagesDanika Sanders Student Teacher Resumeapi-496485131No ratings yet

- Practice ExerciseDocument8 pagesPractice ExerciseHassan LatifNo ratings yet

- 17-03-10 Inductive Conductivity Transmitter CIT-8920Document30 pages17-03-10 Inductive Conductivity Transmitter CIT-8920Juan CarvajalNo ratings yet

- Atom Percent Fission in Uranium and Plutonium Fuel (Neodymium-148 Method)Document9 pagesAtom Percent Fission in Uranium and Plutonium Fuel (Neodymium-148 Method)astewayb_964354182No ratings yet