Professional Documents

Culture Documents

Module 1 Excel Functions Syntax

Module 1 Excel Functions Syntax

Uploaded by

balki123Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 1 Excel Functions Syntax

Module 1 Excel Functions Syntax

Uploaded by

balki123Copyright:

Available Formats

SYNTAX

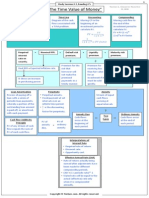

Function FV(rate,nper,pmt,pv,type) PV(rate,nper,pmt,fv,type) PMT(rate,nper,pv,fv,type) IPMT(rate,per,nper,pv,fv,type) NPER(rate, pmt, pv, fv, type) RATE(nper,pmt,pv,fv,type,guess) NPV(rate,value1,value2, ...) IRR(values,guess) YIELD(settlement,maturity,rate, pr,redemption,frequency,basis) YIELDMAT(settlement,maturity, issue,rate,pr,basis) Explanation of Key Words FV Future Value

PV Present Value PMT Payment IPMT Interest Payment NPER Number of Periods RATE Rate of Interest NPV Net Present Value IRR Internal Rate of Return YIELD Yield on a Bond YIELDMAT Yield to Maturity.

RATE is the interest rate per period. NPER is the total number of payment periods in an annuity. PMT is the payment made each period; it cannot change over the life of the annuity. Typically, pmt contains principal and interest but no other fees or taxes. If pmt is omitted, you must include the pv argument. PV is the present value, or the lump-sum amount that a series of future payments is worth right now. If pv is omitted, it is assumed to be 0 (zero), and you must include the pmt argument. TYPE is the number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to be 0. Set type equal to 0 1 Remarks Make sure that you are consistent about the units you use for specifying rate and nper. If you make monthly payments on a four-year loan at 12 percent annual interest, use 12%/12 for rate and 4*12 for nper. If you make annual payments on the same loan, use 12% for rate and 4 for nper. If payments are due At the end of the period At the beginning of the period

For all the arguments, cash you pay out, such as deposits to savings, is represented by negative numbers; cash you receive, such as dividend checks, is represented by positive numbers. PER is the period for which you want to find the interest and must be in the range 1 to nper. GUESS is your guess for what the rate will be. If you omit guess, it is assumed to be 10 percent.

If RATE does not converge, try different values for guess. RATE usually converges if guess is between 0 and 1. Value1, value2, ... are 1 to 29 arguments representing the payments and income. Value1, value2, ... must be equally spaced in time and occur at the end of each period.

NPV uses the order of value1, value2, ... to interpret the order of cash flows. Be sure to enter your payment and income values in the correct sequence. YIELD (settlement,maturity,rate,pr,redemption,frequency,basis) Important Dates should be entered by using the DATE function, or as results of other formulas or functions. For example, use DATE(2008,5,23) for the 23rd day of May, 2008. Problems can occur if dates are entered as text. Settlement is the security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. Maturity is the security's maturity date. The maturity date is the date when the security expires. Rate is the security's annual coupon rate. Pr is the security's price per $100 face value. Redemption is the security's redemption value per $100 face value. Frequency is the number of coupon payments per year. For annual payments, frequency = 1; for semiannual, frequency = 2; for quarterly, frequency = 4. Basis is the type of day count basis to use.

You might also like

- Property Law and PracticeDocument556 pagesProperty Law and PracticeNadine100% (2)

- Fabozzi Bmas8 Ch03 ImDocument26 pagesFabozzi Bmas8 Ch03 ImDavid RouleauNo ratings yet

- Financial Functions Using Microsoft ExcelDocument5 pagesFinancial Functions Using Microsoft Excelarun_idea50No ratings yet

- Financial Functions and CalculationsDocument6 pagesFinancial Functions and CalculationsbertinNo ratings yet

- FVDocument7 pagesFVSarthak SharmaNo ratings yet

- Quant SummaryDocument16 pagesQuant Summarytanya1780No ratings yet

- Financial Function WordDocument9 pagesFinancial Function WordBeing HumanNo ratings yet

- Time Value of Money: Concepts in ValuationDocument4 pagesTime Value of Money: Concepts in ValuationRia GayleNo ratings yet

- Time Value of MoneyDocument52 pagesTime Value of MoneyANKIT AGARWALNo ratings yet

- Financial ClassDocument11 pagesFinancial Classaseret423No ratings yet

- Time Value of Money FMDocument28 pagesTime Value of Money FMMonkey DLuffyyyNo ratings yet

- Excel Financial FunctionsDocument19 pagesExcel Financial FunctionsPhan Huỳnh Châu TrânNo ratings yet

- MirrDocument9 pagesMirralexandremorenoasuarNo ratings yet

- Excel Function For Bond Related CalculationsDocument4 pagesExcel Function For Bond Related Calculationssanjeeva.ktwtindiaNo ratings yet

- Time Value of Money (TVM)Document5 pagesTime Value of Money (TVM)Yesha Jade SaturiusNo ratings yet

- The 10 Most Used Financial Functions in Excel - A Comprehensive Guide - SkillfineDocument21 pagesThe 10 Most Used Financial Functions in Excel - A Comprehensive Guide - SkillfineActi ComputersNo ratings yet

- Lab PKSB Session 1 - BlankDocument34 pagesLab PKSB Session 1 - Blankalanablues1No ratings yet

- PMT FunctionDocument2 pagesPMT FunctionNathaniel WhyteNo ratings yet

- IEDA 3230: Engineering Economy Time Value of Money Using ExcelDocument9 pagesIEDA 3230: Engineering Economy Time Value of Money Using ExceljnfzNo ratings yet

- Bond YieldDocument2 pagesBond YieldShehla M BhattiNo ratings yet

- Excel Cashflow Functions HelpDocument2 pagesExcel Cashflow Functions HelprobinNo ratings yet

- Module 1 Time Value of MoneyDocument52 pagesModule 1 Time Value of MoneyOmar ATENo ratings yet

- Engineering EconomyDocument96 pagesEngineering EconomyHinata UzumakiNo ratings yet

- Level 1: Quantitative Methods: Reading 1 (1 Out of 7) : Time Value of MoneyDocument21 pagesLevel 1: Quantitative Methods: Reading 1 (1 Out of 7) : Time Value of MoneyUtsav PatelNo ratings yet

- Interest Rates and Risk PremiumDocument36 pagesInterest Rates and Risk PremiumPrathiba PereraNo ratings yet

- ANA Finance Toyota Company: Ananda Atika Heru Andhea Alfikha Neny LutfianiDocument13 pagesANA Finance Toyota Company: Ananda Atika Heru Andhea Alfikha Neny LutfianiYulianni ZakariaNo ratings yet

- Excel 2Document6 pagesExcel 2Sai Sriram JNo ratings yet

- Annuities: Capuyon, Kenneth Cardenas, Maritonee Magno, MartinDocument10 pagesAnnuities: Capuyon, Kenneth Cardenas, Maritonee Magno, MartinMaritonee DanielleNo ratings yet

- Chapter 5 MineDocument55 pagesChapter 5 MineDanial HemaniNo ratings yet

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopNo ratings yet

- CH 18Document46 pagesCH 18Michelle LindsayNo ratings yet

- Fin - Group 2Document57 pagesFin - Group 2Heidi NatividadNo ratings yet

- 2024 CFA Level 1 Prerequisite Program Book & Curriculum BookDocument41 pages2024 CFA Level 1 Prerequisite Program Book & Curriculum BookcraigsappletreeNo ratings yet

- Understanding Money: Compound Interest (C.I) (P (1+r/100) T - P)Document4 pagesUnderstanding Money: Compound Interest (C.I) (P (1+r/100) T - P)Ajay CyrilNo ratings yet

- Fixed Income DEBT MARKETDocument16 pagesFixed Income DEBT MARKETgd127205No ratings yet

- Using The Finance App On TI-nspireDocument1 pageUsing The Finance App On TI-nspiredafer krishiNo ratings yet

- Estimation of Forwards & Futures Price MBADocument91 pagesEstimation of Forwards & Futures Price MBAPRANJAL BANSALNo ratings yet

- Silo - Tips - About Compound InterestDocument11 pagesSilo - Tips - About Compound InterestChristian LerrickNo ratings yet

- Chapter 4 - Interest RatesDocument16 pagesChapter 4 - Interest Ratesuyenbp.a2.1720No ratings yet

- 2024 CFA Level 1 Review UWorld Notes (Sample)Document14 pages2024 CFA Level 1 Review UWorld Notes (Sample)craigsappletreeNo ratings yet

- The Time Value of Money: Schweser CFA Level 1 Book 1 - Reading #5Document85 pagesThe Time Value of Money: Schweser CFA Level 1 Book 1 - Reading #5ahmedNo ratings yet

- FIN553 - Ch3 - Interest RatesDocument8 pagesFIN553 - Ch3 - Interest Rates222420087No ratings yet

- Formulas For SOA/CAS Exam FM/2Document15 pagesFormulas For SOA/CAS Exam FM/2jeff_cunningham_11100% (3)

- Week 4Document18 pagesWeek 4jc cNo ratings yet

- Solutions PDFDocument8 pagesSolutions PDFali_zulfikarNo ratings yet

- FE1 Chapter 4Document41 pagesFE1 Chapter 4Hùng PhanNo ratings yet

- Chapter 6 AnnuityDocument35 pagesChapter 6 AnnuityfatinNo ratings yet

- Chapter 5: Introduction To Valuation: The Time Value of MoneyDocument5 pagesChapter 5: Introduction To Valuation: The Time Value of MoneyPhạm Hoàng Diệu VyNo ratings yet

- SemiFinals Topic On InterestDocument9 pagesSemiFinals Topic On InterestNami LaurennnNo ratings yet

- CAIIB Retail Banking - Session 1& IIDocument47 pagesCAIIB Retail Banking - Session 1& IIbhavanakanisettyNo ratings yet

- Quiz Explanations Chapters 8 9Document4 pagesQuiz Explanations Chapters 8 9M Eduardo BasantesNo ratings yet

- The Security. This Measure Examines The Current Price of A Bond, Rather Than Looking at Its Face ValueDocument7 pagesThe Security. This Measure Examines The Current Price of A Bond, Rather Than Looking at Its Face ValueKath MNo ratings yet

- An Introduction To Stock ValuationDocument33 pagesAn Introduction To Stock ValuationDaastaan KhawajaNo ratings yet

- An Introduction To Stock ValuationDocument33 pagesAn Introduction To Stock ValuationDaastaan KhawajaNo ratings yet

- Solution For Financial FunctionsDocument4 pagesSolution For Financial FunctionsJorge JraigeNo ratings yet

- Applications of Financial FunctionsDocument8 pagesApplications of Financial Functionsgoyalprateek92No ratings yet

- Top 15 Financial Functions in ExcelDocument23 pagesTop 15 Financial Functions in ExcelThuy LaNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneyNitin R GondNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Sagar Cement KalyaniDocument1 pageSagar Cement Kalyanibalki123No ratings yet

- MURALI Hero Honda Ltd.Document1 pageMURALI Hero Honda Ltd.balki123No ratings yet

- Shortcut Description: Cell NameDocument4 pagesShortcut Description: Cell Namebalki123No ratings yet

- Risk Management in Banking Sector Project Report Mba FinanceDocument70 pagesRisk Management in Banking Sector Project Report Mba Financebalki12360% (5)

- Fabrication of Pedal-Powered Drilling FinalDocument2 pagesFabrication of Pedal-Powered Drilling Finalbalki123No ratings yet

- Ratio Analysis PROJECT in Steel PlantDocument89 pagesRatio Analysis PROJECT in Steel Plantbalki123No ratings yet

- RK MathDocument6 pagesRK Mathbalki123No ratings yet

- Absent or Absence (Scheduled Time Off)Document9 pagesAbsent or Absence (Scheduled Time Off)balki123No ratings yet

- A Study On "Portfolio Management"Document74 pagesA Study On "Portfolio Management"balki123No ratings yet

- DataDocument10 pagesDatabalki123No ratings yet

- Battle Between BSE NSEDocument39 pagesBattle Between BSE NSERamesh LaishettyNo ratings yet

- Study E Waste Assessment Report LesothoDocument117 pagesStudy E Waste Assessment Report Lesothobalki123No ratings yet

- Chapter-2 Review of LiteratureDocument54 pagesChapter-2 Review of Literaturebalki123No ratings yet

- Functions of Reserve Bank of IndiaDocument18 pagesFunctions of Reserve Bank of Indiayargyal100% (1)

- Housing Register Application: Registration Number: (For Office Use Only)Document21 pagesHousing Register Application: Registration Number: (For Office Use Only)slekNo ratings yet

- Financial Accounting For OnlineDocument137 pagesFinancial Accounting For OnlineAmity-elearning100% (1)

- L FinancialinstrumentsDocument38 pagesL FinancialinstrumentsManraj LidharNo ratings yet

- 2005 To 2014 Mercantile Law Questions Corpo, Fia, SRCDocument25 pages2005 To 2014 Mercantile Law Questions Corpo, Fia, SRCVenturina CaiNo ratings yet

- External Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDocument36 pagesExternal Analysis: Industry Structure, Competitive Forces, and Strategic Groupsjunaid_256No ratings yet

- Predicting Loan Default Data AnalyticsDocument3 pagesPredicting Loan Default Data AnalyticsJad Rizk100% (1)

- Arbitrage: Not To Be Confused With ArbitrationDocument3 pagesArbitrage: Not To Be Confused With ArbitrationJustin O'HaganNo ratings yet

- ROSCA in Housing FinanceDocument12 pagesROSCA in Housing FinanceNandana L SNo ratings yet

- Income Tax Calculation 2010ver 10 3Document31 pagesIncome Tax Calculation 2010ver 10 3Vidya SajitNo ratings yet

- KP Astro-House GroupingDocument7 pagesKP Astro-House GroupingBiswajit Behera100% (1)

- Judicial Affidavit PlaintiffDocument9 pagesJudicial Affidavit PlaintiffBayba TupueNo ratings yet

- Letters of Credit: Need and ScopeDocument22 pagesLetters of Credit: Need and ScopeSidhant NaikNo ratings yet

- PKP3 - Strategic Role of The Private Sector in ARD: ThailandDocument84 pagesPKP3 - Strategic Role of The Private Sector in ARD: ThailandGlobal Donor Platform for Rural Development100% (1)

- Fireforge Games Bankruptcy FilingDocument23 pagesFireforge Games Bankruptcy FilingMichael FutterNo ratings yet

- Application of Payment, Cession, ConsignationDocument4 pagesApplication of Payment, Cession, ConsignationRonald McRonaldNo ratings yet

- Eastspring Investments Dinasti Equity Fund Product HighlightsDocument8 pagesEastspring Investments Dinasti Equity Fund Product HighlightsGrab Hakim RazakNo ratings yet

- Marine InsuranceDocument13 pagesMarine InsuranceAyush KumarNo ratings yet

- Banking ProjectDocument14 pagesBanking Projectankur mukherjeeNo ratings yet

- Working Capital Management at NALCODocument55 pagesWorking Capital Management at NALCOShubhransu Patel100% (1)

- IE Test, LLC v. CarrollDocument7 pagesIE Test, LLC v. CarrollMcDanielLawNo ratings yet

- Mabini Colleges Inc. vs. Atty. Jose Pajarillo FactsDocument2 pagesMabini Colleges Inc. vs. Atty. Jose Pajarillo FactssakuraNo ratings yet

- Mysql Ass 1 2 Class XiDocument2 pagesMysql Ass 1 2 Class XiVarun SangwanNo ratings yet

- Average Student Loan Debt in America Facts & Figures - ValuePenguinDocument11 pagesAverage Student Loan Debt in America Facts & Figures - ValuePenguinTeam USANo ratings yet

- Week 3 - Ch8 - Interest Rate Risk - The Repricing ModelDocument12 pagesWeek 3 - Ch8 - Interest Rate Risk - The Repricing ModelAlana Cunningham100% (1)

- Centre Issues First Zero-Coupon Recap Bonds of 5,500 CR: P&SB To Park Investment in HTM Category Raises ConcernDocument16 pagesCentre Issues First Zero-Coupon Recap Bonds of 5,500 CR: P&SB To Park Investment in HTM Category Raises ConcernGopalakrishnan SivasamyNo ratings yet

- Citibank Basics of Corporate FinanceDocument416 pagesCitibank Basics of Corporate FinanceRalph GedderNo ratings yet

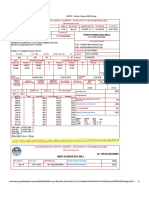

- LESCO - Online Customer Bill Printing PDFDocument1 pageLESCO - Online Customer Bill Printing PDFGulshion Malik100% (1)

- Annuity: A Sequence of Equal Payments Made at Equal Periods of TimeDocument24 pagesAnnuity: A Sequence of Equal Payments Made at Equal Periods of TimeBea SNo ratings yet