Professional Documents

Culture Documents

Macro Update: Slowdown, But Continued Good Resilience in Baltics

Macro Update: Slowdown, But Continued Good Resilience in Baltics

Uploaded by

SEB GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macro Update: Slowdown, But Continued Good Resilience in Baltics

Macro Update: Slowdown, But Continued Good Resilience in Baltics

Uploaded by

SEB GroupCopyright:

Available Formats

The Baltics: Slowdown, but continued good resilience

We are sticking to our forecast of continued gradual recovery in the Baltics, despite indications of somewhat slower growth in Q4 2012 and in early 2013. In Latvia and Lithuania, this slowdown is mainly tied to weak capital spending, while in Estonia exports are sputtering. During Q3 overall growth otherwise rose: Estonias GDP grew by 3.5 per cent year-on-year, up from 2.2 per cent in Q2. Lithuanian growth soared from 2.1 to 4.4 per cent. In Latvia, which has shown more stable performance in the past year, growth climbed marginally to 5.2 per cent in Q3 the fastest in the EU. A robust increase in private consumption will help sustain GDP growth in all three countries, fuelled by gradual labour market improvements, low interest rates and in Estonia and Latvia also positive real wage growth. Meanwhile exports are holding up decently despite scanty Western demand, although short term slowdown in Russia and Poland, in combination with less than expected support from EU structural funds in 2014, has led us to trim our Lithuanian GDP forecasts somewhat compared to Nordic Outlook in November 2012. Exports are competitive after earlier internal devaluations, with inroads being made in new nearby markets as Western Europe has stagnated. But Estonias export growth is relatively sluggish, largely due to this autumns economic deceleration in the key Swedish and Finnish markets.

Key data Percentage change

THURSDAY JANUARY 10, 2013 Mikael Johansson Economic Research +46 8 763 80 93

2011 2012 2013 2014 GDP, Estonia GDP, Latvia GDP, Lithuania Inflation, Estonia Inflation, Latvia Inflation, Lithuania

Source: SEB

8.4 5.5 5.9 5.1 4.2 4.1

3.1 5.3 3.5 3.9 2.2 3.2

3.3 3.8 3.2 4.3 2.1 3.5

4.0 4.5 3.5 4.4 3.0 3.5

Economic Insights

DIVERGENT SENTIMENT SURVEYS LATVIA POISED TO JOIN EURO ZONE, EURO ISSUE STILL ALIVE IN LITHUANIA In recent months, data from the European Commissions sentiment surveys have provided mixed signals: weaker momentum in industry in Estonia but fairly stable trends in Latvia and Lithuania, and a continued positive trend in household confidence except in Estonia where optimism has dwindled lately. The Baltic countries are generally more stable than Western Europe, even though Estonia has wobbled in the past few months. Above all, the composite household and business sentiment indicators in the Baltics are well above those in the euro zone: 105 in Latvia, 102 in Estonia, 101 in Lithuania compared to 87 in the euro zone. The historical averages are 100. Labour markets have continued to improve. According to Eurostats standardised statistics, in both September and October the Baltics showed the EUs largest year-on-year unemployment downturn. According to national data, in Q3 Estonia fell below 10 per cent: 9.7. But Lithuania and Latvia still reported double-digit jobless rates: 12.3 and 13.5 per cent, respectively. Because of lingering uncertainty about capital spending and export trends and the fact that their service sectors have already begun hiring, we predict sluggish downturns in unemployment this year. Latvia has now publicly announced (FM Vilks, December 18) that in February the country will apply for euro zone accession in 2014. We have long predicted that Latvia will also get the green light after the European Union and the European Central Bank have completed their evaluation, probably in May; 1. The Maastricht criteria are within reach: The budget deficit is around 1 per cent of GDP and inflation is low and stable, standing at roughly unchanged 1.5 per cent in the final three months of 2012. 2. Convergence aimed at future euro zone membership was one of the key objectives of the 2008-2011 EU/IMF-led international bail-out package. 3. The EU and ECB want to show that the euro process is alive despite the economic crisis. Lithuanias new leftist-led coalition government, formed in mid-December after the October 2012 election, will loosen somewhat the austerity policies pursued by the previous centre-right government. PM Butkevicius, leader of the Social Democrats, has listed such economic goals as a higher minimum wage from January 1, 2013, a review of the tax system with an eye to cutting income taxes and raising taxes on capital and introduction of targeted tax relief for investments in weak regions. This declaration was not unexpected. More surprising was that the new government would also like Lithuania to adopt the euro as soon as possible, targeting 2015. The previous government targeted 2014. We had thought that given the election outcome, the euro issue would be relegated to an even lower priority. Our forecast has since a year ago been that 2015 is the earliest date for Lithuania to adopt the euro, since the country is in worse shape than Latvia in terms of meeting EU inflation and budget criteria.

You might also like

- Omar AfandyDocument55 pagesOmar AfandyWael Fayez33% (3)

- GB530 Personal Marketing Plan 1318405794Document18 pagesGB530 Personal Marketing Plan 1318405794Mahmoud Ward100% (1)

- Anne Roe S Theory of Occupational ChoiceDocument21 pagesAnne Roe S Theory of Occupational Choicemuhammad_hanis97100% (3)

- Why Does The Latvian Economy Keep Expanding So Fast?Document5 pagesWhy Does The Latvian Economy Keep Expanding So Fast?Swedbank AB (publ)No ratings yet

- Flash Comment: Latvia - February 11, 2013Document1 pageFlash Comment: Latvia - February 11, 2013Swedbank AB (publ)No ratings yet

- How Latvia Can Escape From The Financial CrisisDocument7 pagesHow Latvia Can Escape From The Financial Crisisnuno.nunesNo ratings yet

- BelgiumDocument2 pagesBelgiumHa VoNo ratings yet

- Flash Comment: Latvia - December 7, 2012Document1 pageFlash Comment: Latvia - December 7, 2012Swedbank AB (publ)No ratings yet

- Estonia and The European Debt Crisis: Juhan PartsDocument6 pagesEstonia and The European Debt Crisis: Juhan PartsdfalidasNo ratings yet

- Flash Comment: Latvia - March 11, 2013Document1 pageFlash Comment: Latvia - March 11, 2013Swedbank AB (publ)No ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- Baltic Sea Report, 2010Document76 pagesBaltic Sea Report, 2010Swedbank AB (publ)No ratings yet

- Flash Comment: Estonia - December 7, 2012Document1 pageFlash Comment: Estonia - December 7, 2012Swedbank AB (publ)No ratings yet

- Country Intelligence: Report: TurkeyDocument27 pagesCountry Intelligence: Report: TurkeyFlorian SarkisNo ratings yet

- Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook StableDocument8 pagesLithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook Stableapi-231665846No ratings yet

- ScotiaBank AUG 06 Europe Weekly OutlookDocument3 pagesScotiaBank AUG 06 Europe Weekly OutlookMiir ViirNo ratings yet

- Is Slovenia Next For An EU Bailout?Document13 pagesIs Slovenia Next For An EU Bailout?Edward HughNo ratings yet

- Flash Comment: Latvia - November 8, 2012Document1 pageFlash Comment: Latvia - November 8, 2012Swedbank AB (publ)No ratings yet

- EN EN: European CommissionDocument24 pagesEN EN: European Commissionapi-58353949No ratings yet

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilNo ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Macro Update: Mixed Indicators in Norway But Still OutperformingDocument5 pagesMacro Update: Mixed Indicators in Norway But Still OutperformingSEB GroupNo ratings yet

- Swedbank Economic Outlook Update, November 2015Document17 pagesSwedbank Economic Outlook Update, November 2015Swedbank AB (publ)No ratings yet

- Baltic Sea Report 2015Document31 pagesBaltic Sea Report 2015Swedbank AB (publ)No ratings yet

- SEB Report: Norwegian 2012 Growth Forecast Revised UpDocument4 pagesSEB Report: Norwegian 2012 Growth Forecast Revised UpSEB GroupNo ratings yet

- Fifteen Years of Convergence: East-West Imbalance and What The EU Should Do About ItDocument12 pagesFifteen Years of Convergence: East-West Imbalance and What The EU Should Do About ItBurim GashiNo ratings yet

- Structural Changes in The Economy of Latvia After It Joined The European UnionDocument13 pagesStructural Changes in The Economy of Latvia After It Joined The European UnionBianca HorvathNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- The Finnish Economic Environment 2007 Through 2010Document5 pagesThe Finnish Economic Environment 2007 Through 2010Andreea BrinceanuNo ratings yet

- Baltic Sea Report September 2008Document56 pagesBaltic Sea Report September 2008Swedbank AB (publ)No ratings yet

- Country Economic PrintDocument7 pagesCountry Economic PrintLarisa PîrvuNo ratings yet

- Monthly Bulletin ECB - Okt 2011Document234 pagesMonthly Bulletin ECB - Okt 2011remcoxyiiNo ratings yet

- ScotiaBank JUL 30 Europe Weekly OutlookDocument3 pagesScotiaBank JUL 30 Europe Weekly OutlookMiir ViirNo ratings yet

- Eurozone Forecast Summer 2011 SpainDocument8 pagesEurozone Forecast Summer 2011 Spaindsoto913No ratings yet

- Nordea Bank, Economic Outlook Nordics, Dec 2013. "Divergence"Document14 pagesNordea Bank, Economic Outlook Nordics, Dec 2013. "Divergence"Glenn ViklundNo ratings yet

- Macro Update: Close Call On Recession in FinlandDocument2 pagesMacro Update: Close Call On Recession in FinlandSEB GroupNo ratings yet

- Estonia - An Investor GuideDocument22 pagesEstonia - An Investor GuideVarsha ShirsatNo ratings yet

- Monetary Policy Committee Meeting: Minutes of TheDocument10 pagesMonetary Policy Committee Meeting: Minutes of TheTelegraphUKNo ratings yet

- 18 Econsouth Fourth Quarter 2012Document6 pages18 Econsouth Fourth Quarter 2012caitlynharveyNo ratings yet

- Cork Chamber Economic Bulletin Q1 2013Document12 pagesCork Chamber Economic Bulletin Q1 2013aislinnstantonNo ratings yet

- Weekly Economic Commentary 02-21-12Document5 pagesWeekly Economic Commentary 02-21-12Karen RogersNo ratings yet

- Romania Long Term OutlookDocument5 pagesRomania Long Term OutlooksmaneranNo ratings yet

- Taxation Trends in The European Union - 2012 52Document1 pageTaxation Trends in The European Union - 2012 52d05registerNo ratings yet

- Economic Development of Italy and SpainDocument17 pagesEconomic Development of Italy and SpainAnimesh SinhaNo ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Comparative Analysis of Major Travel and Tourism Indicators: Estonia, Latvia and Lithuania, 2010Document9 pagesComparative Analysis of Major Travel and Tourism Indicators: Estonia, Latvia and Lithuania, 2010stanley0303No ratings yet

- MB 201105 enDocument210 pagesMB 201105 enfrcaNo ratings yet

- Flash Comment: Lithuania - November 8, 2012Document1 pageFlash Comment: Lithuania - November 8, 2012Swedbank AB (publ)No ratings yet

- Romania'S Challenges For Joining The Eu: A Dream Too Far Away?Document4 pagesRomania'S Challenges For Joining The Eu: A Dream Too Far Away?Larisa PîrvuNo ratings yet

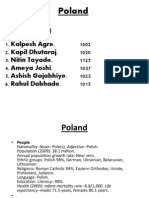

- Poland: Presented byDocument13 pagesPoland: Presented byAbhishek AgarwalNo ratings yet

- Flash Comment: Estonia - November 12, 2012Document1 pageFlash Comment: Estonia - November 12, 2012Swedbank AB (publ)No ratings yet

- Global Economic Forecast: September 13th 2011Document12 pagesGlobal Economic Forecast: September 13th 2011adjie13No ratings yet

- Flash Comment: Lithuania - January 9, 2013Document1 pageFlash Comment: Lithuania - January 9, 2013Swedbank AB (publ)No ratings yet

- Cohesion and Catching Up Policies in Czech Republic: A General OverviewDocument16 pagesCohesion and Catching Up Policies in Czech Republic: A General OverviewValeria Puga ÁlvarezNo ratings yet

- International Macroeconomic Environment: Weaker Global Growth and Geopolitical Tensions Rekindle Financial Sector VolatilitiesDocument11 pagesInternational Macroeconomic Environment: Weaker Global Growth and Geopolitical Tensions Rekindle Financial Sector VolatilitiesБежовска СањаNo ratings yet

- Country Intelligence Report 2Document34 pagesCountry Intelligence Report 2Li JieNo ratings yet

- Moodys Iceland July 2013 NewDocument20 pagesMoodys Iceland July 2013 NewTeddy JainNo ratings yet

- Euro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyDocument16 pagesEuro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyRaluca MarciucNo ratings yet

- Research GateDocument27 pagesResearch GateDHANANJAY MIRLEKARNo ratings yet

- Swiss National Bank Quarterly Bulletin - September 2011Document54 pagesSwiss National Bank Quarterly Bulletin - September 2011rryan123123No ratings yet

- A Strong Shekel and A Weak Construction Sector Are Holding Back Israel's EconomyDocument10 pagesA Strong Shekel and A Weak Construction Sector Are Holding Back Israel's Economyapi-228714775No ratings yet

- Innovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceFrom EverandInnovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceNo ratings yet

- Transformation Index BTI 2012: Regional Findings East-Central and Southeast EuropeFrom EverandTransformation Index BTI 2012: Regional Findings East-Central and Southeast EuropeNo ratings yet

- Insights From 2014 of Significance For 2015Document5 pagesInsights From 2014 of Significance For 2015SEB GroupNo ratings yet

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDocument3 pagesEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupNo ratings yet

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDocument5 pagesEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupNo ratings yet

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDocument4 pagesEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupNo ratings yet

- CFO Survey 1403: Improving Swedish Business Climate and HiringDocument12 pagesCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupNo ratings yet

- SE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Document35 pagesSE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Glenn ViklundNo ratings yet

- ToeicDocument10 pagesToeicyulfiana hariniNo ratings yet

- Akij GroupDocument4 pagesAkij GroupReaz RahmanNo ratings yet

- Apply 3sDocument108 pagesApply 3sbojaNo ratings yet

- Luther Employment LawDocument144 pagesLuther Employment LawAung Ko ZawNo ratings yet

- Fairway Mortgage DocumentsDocument6 pagesFairway Mortgage DocumentsFairway Independent MortgageNo ratings yet

- Gareth R. Jones QuestionsDocument25 pagesGareth R. Jones QuestionsSamuel Whodokweh JacobsNo ratings yet

- A Study On Employees' Retention Strategies in Technical Textile Industries With Special Reference To Coimbatore DistrictDocument27 pagesA Study On Employees' Retention Strategies in Technical Textile Industries With Special Reference To Coimbatore DistrictNishu NishanthNo ratings yet

- The Pentecostal Ethic and The Spirit of Development - Dena FreemanDocument54 pagesThe Pentecostal Ethic and The Spirit of Development - Dena FreemanCleonardo Mauricio JuniorNo ratings yet

- RBI Committee Report On MSMEsDocument142 pagesRBI Committee Report On MSMEsmeenaldutiaNo ratings yet

- Check-List For Principal Employers Engagind CONTRACT LABOURDocument6 pagesCheck-List For Principal Employers Engagind CONTRACT LABOURAbhijit BasakNo ratings yet

- International TradeDocument4 pagesInternational TradeAaYush BadoniYaNo ratings yet

- Control and Performance EvaluationDocument83 pagesControl and Performance EvaluationRafaelDelaCruzNo ratings yet

- A Comparative Study of Industrial Relations in Public and Private Sector Enterprises in IndiaDocument9 pagesA Comparative Study of Industrial Relations in Public and Private Sector Enterprises in IndiaEnayetullah RahimiNo ratings yet

- GL 2022 Global Talent Trends Report EnglishDocument88 pagesGL 2022 Global Talent Trends Report EnglishramNo ratings yet

- PTMW Quick Reference GuideDocument13 pagesPTMW Quick Reference GuideGiancarlo Orbegoso OsorioNo ratings yet

- Meralco Industrial Engineering Services vs. NLRCDocument9 pagesMeralco Industrial Engineering Services vs. NLRCaudreyNo ratings yet

- PICOP Resources, Incorporated (PRI) vs. Dequilla (2011)Document1 pagePICOP Resources, Incorporated (PRI) vs. Dequilla (2011)Vianca MiguelNo ratings yet

- The Practice of Waiting Under Closure in PalestineDocument21 pagesThe Practice of Waiting Under Closure in PalestineTarif Oliveira KanafaniNo ratings yet

- Traces: Details of SalaryDocument4 pagesTraces: Details of SalaryMadu JaguNo ratings yet

- CFLPA ProposalDocument2 pagesCFLPA ProposalkirkpentonNo ratings yet

- Local Conveyance PolicyDocument4 pagesLocal Conveyance PolicyNazneen KhanNo ratings yet

- LYS İngilizce Test SorularıDocument9 pagesLYS İngilizce Test SorularıbluedorNo ratings yet

- Accessories Specialist Inc. v. AlabanzaDocument7 pagesAccessories Specialist Inc. v. AlabanzaHanselNo ratings yet

- Seeker - Vacancy - Detail OverviewDocument4 pagesSeeker - Vacancy - Detail OverviewFamilia LunaNo ratings yet

- 3l/.epubltc of Tb.e Ilbilfpptn.e : $upreme !courtDocument19 pages3l/.epubltc of Tb.e Ilbilfpptn.e : $upreme !courtCesar ValeraNo ratings yet

- Case Study 7 Performance AppraisalDocument7 pagesCase Study 7 Performance Appraisalsaba gul rehmatNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument38 pagesFinancial Statement Analysis: K R Subramanyam John J WildMar SihNo ratings yet