Professional Documents

Culture Documents

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Uploaded by

sharathk916Copyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Feasibility Study (Bite 'N Sip)Document61 pagesFeasibility Study (Bite 'N Sip)Jay Angel64% (14)

- Case Study No. 3 PDFDocument6 pagesCase Study No. 3 PDFMuhammadZahirGulNo ratings yet

- Practical Accounting 2 - SyllabusDocument3 pagesPractical Accounting 2 - SyllabusMaylene Salac Alfaro100% (1)

- Test Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesDocument22 pagesTest Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesIven ChienNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- 29Document3 pages29sharathk916No ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Dileep PreboardDocument10 pagesDileep PreboardmktknpNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Acc Sample Paper 4 Typed by DhairyaDocument6 pagesAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNo ratings yet

- II Pu Acc 23 Dis Pre QprsDocument92 pagesII Pu Acc 23 Dis Pre QprskrupithkNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- AccountancyDocument0 pagesAccountancyJaimangal RajaNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- CBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Document13 pagesCBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Kunal KapoorNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & Accountancyharesh60% (5)

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- ACCOUNTNCY QP Guugram RegionDocument12 pagesACCOUNTNCY QP Guugram Regionvivekdaiv55No ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Mock Paper-4 (With Answer)Document18 pagesMock Paper-4 (With Answer)RNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- Book Keeping and AccountancyDocument9 pagesBook Keeping and AccountancyPriyanka SHELKENo ratings yet

- Accounts First Term Grade 12Document5 pagesAccounts First Term Grade 12NivpreeNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- Class XII Accounts Term 1Document5 pagesClass XII Accounts Term 1Kanika TambiNo ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- Hsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletedDocument8 pagesHsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletednadidawaunionthekkekadNo ratings yet

- Accounting For Partnership Firms: Short Answer Type QuestionsDocument8 pagesAccounting For Partnership Firms: Short Answer Type QuestionssalumNo ratings yet

- Ad Account Question PaperDocument3 pagesAd Account Question PaperAbdul Lathif0% (1)

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- EconomicsDocument5 pagesEconomicssharathk916No ratings yet

- Model Question Paper: EconomicsDocument3 pagesModel Question Paper: Economicssharathk916No ratings yet

- System Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 EconomicsDocument6 pagesSystem Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 Economicssharathk916No ratings yet

- Higher Secondary Model Examination-February 2011: EconomicsDocument5 pagesHigher Secondary Model Examination-February 2011: Economicssharathk916No ratings yet

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocument2 pagesHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916No ratings yet

- 29Document3 pages29sharathk916No ratings yet

- Accountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)Document43 pagesAccountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)sharathk916No ratings yet

- Model Evaluation February 2011 AccountingDocument4 pagesModel Evaluation February 2011 Accountingsharathk916No ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- Cluster Centre MGM HSS: Prepared byDocument6 pagesCluster Centre MGM HSS: Prepared bysharathk916No ratings yet

- Higher Secondary Model Evaluation 2011: Accountancy With Computerised AccountingDocument4 pagesHigher Secondary Model Evaluation 2011: Accountancy With Computerised Accountingsharathk916No ratings yet

- Higher Secondary Model Examination Feb 2011: Accountancy With Computerised AccountingDocument4 pagesHigher Secondary Model Examination Feb 2011: Accountancy With Computerised Accountingsharathk916No ratings yet

- 2 25 ModalDocument5 pages2 25 Modalsharathk916No ratings yet

- Word To PDF Converter - UnregisteredDocument4 pagesWord To PDF Converter - Unregisteredsharathk916No ratings yet

- 2 - 25 - Eco 2Document3 pages2 - 25 - Eco 2sharathk916No ratings yet

- 2 25 Mqfeb2011Document5 pages2 25 Mqfeb2011sharathk916No ratings yet

- Version A-4Document21 pagesVersion A-4Ahmed RamicNo ratings yet

- New Politics Network Accounts Year Ending 31/03/07Document11 pagesNew Politics Network Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Inventory Planning and ControlDocument23 pagesInventory Planning and ControlNavarrete, AliceNo ratings yet

- Bicycles Business ProjectDocument29 pagesBicycles Business ProjectNauman RashidNo ratings yet

- Isabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Document18 pagesIsabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Chraze GBNo ratings yet

- Chapter 7 DepreciationDocument4 pagesChapter 7 DepreciationZwelithini MtsamaiNo ratings yet

- MindChamps - Annual ReportDocument15 pagesMindChamps - Annual ReportChristian?97No ratings yet

- Inventory MGMTDocument155 pagesInventory MGMTogu100% (2)

- SMRT Annual Report 2016Document141 pagesSMRT Annual Report 2016Sassy TanNo ratings yet

- All Grown Up - BareDocument9 pagesAll Grown Up - BareNiamh HawkesNo ratings yet

- Practice Questions # 3 - With AnswersDocument14 pagesPractice Questions # 3 - With AnswersAhadullah KhawajaNo ratings yet

- Business Plan: Submitted in Partial Fulfilment of The Requirements For The Degree of Bachelor ofDocument15 pagesBusiness Plan: Submitted in Partial Fulfilment of The Requirements For The Degree of Bachelor ofHamza khalidNo ratings yet

- AS11 Exchange Rates PDFDocument19 pagesAS11 Exchange Rates PDFShakti ShivanandNo ratings yet

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- Ias 41 ReportDocument10 pagesIas 41 ReportKarlo PalerNo ratings yet

- Part - 1 - Dashboard - LeasesDocument4 pagesPart - 1 - Dashboard - LeasesbagayaobNo ratings yet

- FIN 448 Midterm ProblemsDocument6 pagesFIN 448 Midterm Problemsgilli1trNo ratings yet

- E3-3 (Based On AICPA) General Problems: Balance Sheet AccountsDocument10 pagesE3-3 (Based On AICPA) General Problems: Balance Sheet AccountsSintia Marada Hutagalung50% (2)

- 1 - Accounting - Crossword 3Document2 pages1 - Accounting - Crossword 3Mercy Dioselina Torres SantamariaNo ratings yet

- Ch.5 Cash Flow StatementsDocument18 pagesCh.5 Cash Flow StatementsCA INTERNo ratings yet

- Assignment 5Document1 pageAssignment 5Siva SankariNo ratings yet

- Act 110 Module 2Document28 pagesAct 110 Module 2Nashebah A. BatuganNo ratings yet

- Vertical Analysis: Lesson 2.6Document21 pagesVertical Analysis: Lesson 2.6JOSHUA GABATERO100% (1)

- Assignment 1 - DLF Data - xlsx-2Document30 pagesAssignment 1 - DLF Data - xlsx-2ashishNo ratings yet

- B02030 - Chapter 6-14 - TCDN-PracticeDocument25 pagesB02030 - Chapter 6-14 - TCDN-PracticeHiền TrầnNo ratings yet

- ADAMS - 2021 Adam Sugar Mills Limited BalancesheetDocument6 pagesADAMS - 2021 Adam Sugar Mills Limited BalancesheetAfan QayumNo ratings yet

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Uploaded by

sharathk916Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accounting

Uploaded by

sharathk916Copyright:

Available Formats

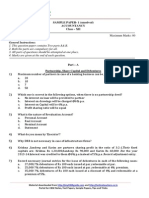

GHSS KODUVAYUR HIGHER SECONDARY MODEL EXAMINATION 2011 ACCOUNTANCY WITH COMPUTERISED ACCOUNTING

HSE 11 Time: 2hours cool off time: 15 minutes max score : 60

1. The balalnce in shares forfeited account is transferred to Account. (Score1) 2. share premium can be used for issuing shares ( Score1) 3. Share of goodwill brought in cash by the new partner is called( Score1) 4. find the odd one and state the reason a. admission of a partner b. retirement of a partner c. insolvency of partner except one. D. dissolution (Score1) 5. A fund created for the redemption of debentures is called ( Score1) 6. A company Ltd made an issue of 50000 shares of Rs. 10 each. Applications were received for 75000 shares a. explain the sitiation. b. alternatives before the directors in such a situation ( Score1) 7. a. Goodwill account .Dr share capital b. Cash account ..Dr old partners capitals c. Share application accountDr sharecapital share allotment bank Analyse the journal entries and write the narration. (Score3) 8. M and N are partners decided to share profits and losses in the ratio of 2:1. they decided to admit p with share in profits with a guaranteed amount for Rs. 25000. Both M and N undertake to meet the liability arising out of the guaranteed amount to P in their respective profit sharing ratio. The profit sharing ratio of M and N does not change. The firm earned a profit of Rs. 81000 for the year 2002. Prepare Profit and Loss Appropriation account. (Score3) 9. A. jack and jill are partners in a firm sharing profits and losses in the ratio . of 7:5. They admit tom in to partnership for a 1/6 share, the old partner

sacrificing equally. Calculate new profit sharing ratio B. Melky and Silky are partners sharing profits and losses in the ratio of 2:3 They admit maloo as a partner for 1/3 share in profit who brings Rs. 20000 as his share of goodwill. The new ratio will be 3:3:2. Melky and Silky withdraws the premium paid by Maloo. Record necessary journal entries in the books of the firm. (Score3) 10. Explain the differences between dissolution of partnership and dissolution of firm (Score3) 11. Black and White are equal partners decided to dissolve partnership as on 31- 3-2001. Their Balancesheet as follows Liabilities Amount Assets Amount Creditors 14000 building 40000 General reserve 8000 machinery 20000 Blacks loan 3000 furniture 10000 capitals debtors 10000 Black 50000 stock 24000 White 40000 90000 bank 11000 TOTAL 115000 115000 1. The assets realized as follows stock Rs.22000, debtors Rs.9500, machinery Rs.21000 and building Rs.30000. 2. White took over the furniture at Rs. 7000. 3. Black agreed to accept Rs. 2500 in full settlement of his loan account 4. Realization expenses amounted to Rs. 2500. Close the books of the firm (Score5) 12. Explain the following terms a. Calls in arrears. b. Forfeiture of shares c. conditions for issuing Shares at Discount d. uses of Share Premium e. ESOP (Score5) 13. write journal entries for the following transactions A. Star Ltd issued 1000, 14% debentures of Rs. 100 each at par redeemable at the end of 5 years at a premium of 10%. B. Blue chips Ltd issued 2000, 16% debentures of Rs. 200 each at a discount of 10% and are redeemable after 3 years at a premium of20%. (Score4)

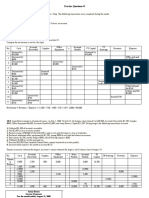

14. Melky and Neethu are partners sharing profits and losses in the ratio of 3:1 their Balancesheet as on 1 st January 2003 as follows. Balance sheet as 1st January 2003 Liabilities Amount rent outstanding 2000 bank overdraft 12000 sundry creditors 15000 general reserve 8000 capitals Melky 120000 Neethu 70000 190000 Assets cash in hand investments stock Debtors 40000 less provision 2000 furniture machinery buildings Amount 6000 70000 25000 38000 18000 30000 40000 227000

19. What are the accounting vouchers available in Tally? (Score2) 20. Give the procedure to display the Trial Balance of a company (Score2) 21. How to enter the value of closing stock in Tally? (Score2) 22. How Budget Variance Report can be displayed? (Score2) 23. Explain how the financial statements of a company are prepared by using a Computerized accounting software (Score5)

Total

227000

On this date they admitted Maloo for th share in profit which she acquires wholly from Melky. The other terms of agreement are as follows 1. Goodwill of the firm was valued at 2 years purchase of the average of the last three years profits. The profits of the last three years were Rs. 40000, Rs 30000 and Rs 500 2. Maloo should bring Rs. 50000 as capital and necessary amount for her share of goodwill. 3. Investments reduced to Rs. 65000. 4. Furniture increased by Rs. 20000. 5. Provision for bad and doubtful debts was found in excess by Rs. 500. 6. Creditors were unrecorded to the extent of Rs. 1000. 7. Stock is found overvalued by Rs. 3000. Prepare Balance sheet of the new firm after the admission of Maloo. (Score8)

PART -B COMPUTERISED ACCOUNTING

15. Find the odd one a. Dac Easy b. Tally c. Peach tree d. M S Office 16. Explain journal voucher with examples 17. Write short notes on a. memo voucher b. contra voucher 18. What is meant by grouping of accounts? (Score1) (Score2) (Score2) (Score2)

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Feasibility Study (Bite 'N Sip)Document61 pagesFeasibility Study (Bite 'N Sip)Jay Angel64% (14)

- Case Study No. 3 PDFDocument6 pagesCase Study No. 3 PDFMuhammadZahirGulNo ratings yet

- Practical Accounting 2 - SyllabusDocument3 pagesPractical Accounting 2 - SyllabusMaylene Salac Alfaro100% (1)

- Test Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesDocument22 pagesTest Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesIven ChienNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- 29Document3 pages29sharathk916No ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Dileep PreboardDocument10 pagesDileep PreboardmktknpNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Acc Sample Paper 4 Typed by DhairyaDocument6 pagesAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNo ratings yet

- II Pu Acc 23 Dis Pre QprsDocument92 pagesII Pu Acc 23 Dis Pre QprskrupithkNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- AccountancyDocument0 pagesAccountancyJaimangal RajaNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- CBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Document13 pagesCBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Kunal KapoorNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & Accountancyharesh60% (5)

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- ACCOUNTNCY QP Guugram RegionDocument12 pagesACCOUNTNCY QP Guugram Regionvivekdaiv55No ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Mock Paper-4 (With Answer)Document18 pagesMock Paper-4 (With Answer)RNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- Book Keeping and AccountancyDocument9 pagesBook Keeping and AccountancyPriyanka SHELKENo ratings yet

- Accounts First Term Grade 12Document5 pagesAccounts First Term Grade 12NivpreeNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityRenieNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- Class XII Accounts Term 1Document5 pagesClass XII Accounts Term 1Kanika TambiNo ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- Hsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletedDocument8 pagesHsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletednadidawaunionthekkekadNo ratings yet

- Accounting For Partnership Firms: Short Answer Type QuestionsDocument8 pagesAccounting For Partnership Firms: Short Answer Type QuestionssalumNo ratings yet

- Ad Account Question PaperDocument3 pagesAd Account Question PaperAbdul Lathif0% (1)

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- EconomicsDocument5 pagesEconomicssharathk916No ratings yet

- Model Question Paper: EconomicsDocument3 pagesModel Question Paper: Economicssharathk916No ratings yet

- System Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 EconomicsDocument6 pagesSystem Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 Economicssharathk916No ratings yet

- Higher Secondary Model Examination-February 2011: EconomicsDocument5 pagesHigher Secondary Model Examination-February 2011: Economicssharathk916No ratings yet

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocument2 pagesHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916No ratings yet

- 29Document3 pages29sharathk916No ratings yet

- Accountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)Document43 pagesAccountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)sharathk916No ratings yet

- Model Evaluation February 2011 AccountingDocument4 pagesModel Evaluation February 2011 Accountingsharathk916No ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- Cluster Centre MGM HSS: Prepared byDocument6 pagesCluster Centre MGM HSS: Prepared bysharathk916No ratings yet

- Higher Secondary Model Evaluation 2011: Accountancy With Computerised AccountingDocument4 pagesHigher Secondary Model Evaluation 2011: Accountancy With Computerised Accountingsharathk916No ratings yet

- Higher Secondary Model Examination Feb 2011: Accountancy With Computerised AccountingDocument4 pagesHigher Secondary Model Examination Feb 2011: Accountancy With Computerised Accountingsharathk916No ratings yet

- 2 25 ModalDocument5 pages2 25 Modalsharathk916No ratings yet

- Word To PDF Converter - UnregisteredDocument4 pagesWord To PDF Converter - Unregisteredsharathk916No ratings yet

- 2 - 25 - Eco 2Document3 pages2 - 25 - Eco 2sharathk916No ratings yet

- 2 25 Mqfeb2011Document5 pages2 25 Mqfeb2011sharathk916No ratings yet

- Version A-4Document21 pagesVersion A-4Ahmed RamicNo ratings yet

- New Politics Network Accounts Year Ending 31/03/07Document11 pagesNew Politics Network Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Inventory Planning and ControlDocument23 pagesInventory Planning and ControlNavarrete, AliceNo ratings yet

- Bicycles Business ProjectDocument29 pagesBicycles Business ProjectNauman RashidNo ratings yet

- Isabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Document18 pagesIsabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Chraze GBNo ratings yet

- Chapter 7 DepreciationDocument4 pagesChapter 7 DepreciationZwelithini MtsamaiNo ratings yet

- MindChamps - Annual ReportDocument15 pagesMindChamps - Annual ReportChristian?97No ratings yet

- Inventory MGMTDocument155 pagesInventory MGMTogu100% (2)

- SMRT Annual Report 2016Document141 pagesSMRT Annual Report 2016Sassy TanNo ratings yet

- All Grown Up - BareDocument9 pagesAll Grown Up - BareNiamh HawkesNo ratings yet

- Practice Questions # 3 - With AnswersDocument14 pagesPractice Questions # 3 - With AnswersAhadullah KhawajaNo ratings yet

- Business Plan: Submitted in Partial Fulfilment of The Requirements For The Degree of Bachelor ofDocument15 pagesBusiness Plan: Submitted in Partial Fulfilment of The Requirements For The Degree of Bachelor ofHamza khalidNo ratings yet

- AS11 Exchange Rates PDFDocument19 pagesAS11 Exchange Rates PDFShakti ShivanandNo ratings yet

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- Ias 41 ReportDocument10 pagesIas 41 ReportKarlo PalerNo ratings yet

- Part - 1 - Dashboard - LeasesDocument4 pagesPart - 1 - Dashboard - LeasesbagayaobNo ratings yet

- FIN 448 Midterm ProblemsDocument6 pagesFIN 448 Midterm Problemsgilli1trNo ratings yet

- E3-3 (Based On AICPA) General Problems: Balance Sheet AccountsDocument10 pagesE3-3 (Based On AICPA) General Problems: Balance Sheet AccountsSintia Marada Hutagalung50% (2)

- 1 - Accounting - Crossword 3Document2 pages1 - Accounting - Crossword 3Mercy Dioselina Torres SantamariaNo ratings yet

- Ch.5 Cash Flow StatementsDocument18 pagesCh.5 Cash Flow StatementsCA INTERNo ratings yet

- Assignment 5Document1 pageAssignment 5Siva SankariNo ratings yet

- Act 110 Module 2Document28 pagesAct 110 Module 2Nashebah A. BatuganNo ratings yet

- Vertical Analysis: Lesson 2.6Document21 pagesVertical Analysis: Lesson 2.6JOSHUA GABATERO100% (1)

- Assignment 1 - DLF Data - xlsx-2Document30 pagesAssignment 1 - DLF Data - xlsx-2ashishNo ratings yet

- B02030 - Chapter 6-14 - TCDN-PracticeDocument25 pagesB02030 - Chapter 6-14 - TCDN-PracticeHiền TrầnNo ratings yet

- ADAMS - 2021 Adam Sugar Mills Limited BalancesheetDocument6 pagesADAMS - 2021 Adam Sugar Mills Limited BalancesheetAfan QayumNo ratings yet