Professional Documents

Culture Documents

Valuation Theories

Valuation Theories

Uploaded by

Srinidhi RangarajanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Citigroup's Exchange OfferDocument3 pagesCitigroup's Exchange Offercarlinchi850% (1)

- Module E & F FinalDocument40 pagesModule E & F Finalonthelinealways100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Telegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleDocument2 pagesTelegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleClari Soto100% (4)

- Automation in Operation ManagementDocument12 pagesAutomation in Operation ManagementSrinidhi Rangarajan100% (1)

- ML4T 2017fall Exam1 Version ADocument8 pagesML4T 2017fall Exam1 Version ADavid LiNo ratings yet

- Analisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantoDocument12 pagesAnalisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantotresnaNo ratings yet

- TBCH 08Document54 pagesTBCH 08Tornike Jashi100% (1)

- TEAM 5 - Leveraging IT For HR Management in FirmsDocument12 pagesTEAM 5 - Leveraging IT For HR Management in FirmsSrinidhi RangarajanNo ratings yet

- Term Loans: Assets and WC MarginsDocument11 pagesTerm Loans: Assets and WC MarginsSrinidhi RangarajanNo ratings yet

- MACR Assignment 1Document5 pagesMACR Assignment 1Srinidhi RangarajanNo ratings yet

- SK TP RMDocument11 pagesSK TP RMSrinidhi RangarajanNo ratings yet

- Final Project Repaired)Document263 pagesFinal Project Repaired)Honey SrivastavaNo ratings yet

- SYLLABUS. BSE FINANCIAL MNGT OkDocument8 pagesSYLLABUS. BSE FINANCIAL MNGT Okkram nhojNo ratings yet

- Square Pharma - ValuationDocument55 pagesSquare Pharma - ValuationFarhan Ashraf SaadNo ratings yet

- IFRIC 13 - Customer Loyalty ProgrammesDocument8 pagesIFRIC 13 - Customer Loyalty ProgrammesTopy DajayNo ratings yet

- Multinational RestructuringDocument30 pagesMultinational RestructuringUmair Khan NiaziNo ratings yet

- Almarai Company: Pre-Eminence Priced inDocument62 pagesAlmarai Company: Pre-Eminence Priced inAREEJMHNo ratings yet

- Rdo 040 Cubao - Do1497Document4 pagesRdo 040 Cubao - Do1497meryl viNo ratings yet

- Centennial Resource Development Investor PresentationDocument52 pagesCentennial Resource Development Investor PresentationshortmycdsNo ratings yet

- Stock Valuation Practice QuestionsDocument3 pagesStock Valuation Practice QuestionsMillat Equipment Ltd Pakistan0% (1)

- Indian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundDocument7 pagesIndian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundsansugeorgeNo ratings yet

- Earthsong Eco-Neighbourhood - Robin Allison - Habitat Award 2008Document34 pagesEarthsong Eco-Neighbourhood - Robin Allison - Habitat Award 2008New Zealand Social Entrepreneur Fellowship - PDF Library100% (4)

- Songbird Estates Research NoteDocument1 pageSongbird Estates Research Noteapi-249461242No ratings yet

- REPUBLIC ACT No 10846 (Sec. 23-25)Document3 pagesREPUBLIC ACT No 10846 (Sec. 23-25)School FilesNo ratings yet

- Indian Accounting Standards and Transition To Ifrs: July 2020Document8 pagesIndian Accounting Standards and Transition To Ifrs: July 2020Ashish ValanjuNo ratings yet

- Corporate BondsDocument36 pagesCorporate BondsCharlene LeynesNo ratings yet

- Free Cash Flow and DCF PresentationDocument3 pagesFree Cash Flow and DCF PresentationJames MitchellNo ratings yet

- MLSCN Technical ProposalDocument75 pagesMLSCN Technical ProposalomoyegunNo ratings yet

- ch09 - PPT - Rankin - 2e RevDocument37 pagesch09 - PPT - Rankin - 2e Revmichele hazelNo ratings yet

- Warehousing Project ManagementDocument7 pagesWarehousing Project ManagementZiad BaherNo ratings yet

- Banking and Finance Dissertation PDFDocument4 pagesBanking and Finance Dissertation PDFAcademicPaperWritingServicesGrandRapids100% (1)

- Sraw Finals QaDocument10 pagesSraw Finals QaVinluan JeromeNo ratings yet

- Chapter 5 - Project Costing and ValuationDocument19 pagesChapter 5 - Project Costing and ValuationfayoNo ratings yet

- SBE Brochure 2014Document40 pagesSBE Brochure 2014Paul Christopher Charlesraj VNo ratings yet

- GSIS Law 1Document13 pagesGSIS Law 1Arbie Dela TorreNo ratings yet

- Ba7202-Financial Management Notes RejinpaulDocument193 pagesBa7202-Financial Management Notes Rejinpauls.muthuNo ratings yet

Valuation Theories

Valuation Theories

Uploaded by

Srinidhi RangarajanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Theories

Valuation Theories

Uploaded by

Srinidhi RangarajanCopyright:

Available Formats

MACR

Term Paper

Mergers Acquisitions & Corporate Reconstructuring

VALUATION APPROACHES

Srinidhi Rangarajan 1PB11MBA34 M.B.A 3rd SEM PESIT

1|Page

MACR

Abstract

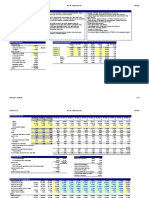

In this paper, the discussion is on the four main groups comprising the most widely used company valuation methods: Balance sheet-based method Income statement-based method Mixed method Cash flow discounting-based method Capitalisation method The methods that are conceptually correct are those based on cash flow Discounting. There is a brief comment on other methods since -even though they are conceptually incorrect- they continue to be used frequently. The paper has been concluded showing the critical steps involved in valuation.

2|Page

MACR

Introduction

Value and Price What purpose does a valuation serve?

Generally speaking, a companys value is different for different buyers and it may also be different for the buyer and the seller. Value should not be confused with price, which is the quantity agreed between the seller and the buyer in the sale of a company. This difference in a specific companys value may be due to a multitude of reasons. For example, a large and technologically highly advanced foreign company wishes to buy a well-known national company in order to gain entry into the local market, using the reputation of the local brand. In this case, the foreign buyer will only value the brand but not the plant, machinery, etc. as it has more advanced assets of its own. However, the seller will give a very high value to its material resources, as they are able to continue producing. From the buyers viewpoint, the basic aim is to determine the maximum value it should be prepared to pay for what the company it wishes to buy is able to contribute. From the sellers viewpoint, the aim is to ascertain what should be the minimum value at which it should accept the operation. These are the two figures that face each other across the table in a negotiation until a price is finally agreed on, which is usually somewhere between the two extremes. A company may also have different values for different buyers due to economies of scale, economies of scope, or different perceptions about the industry and the company.

A valuation may be used for a wide range of purposes:

1. In company buying and selling operations: - For the buyer, the valuation will tell him the highest price he should pay. - For the seller, the valuation will tell him the lowest price at which he should be prepared to sell.

3|Page

MACR

2. Valuations of listed companies: - The valuation is used to compare the value obtained with the shares price on the stock market and to decide whether to sell, buy or hold the shares. - The valuation of several companies is used to decide the securities that the portfolio should concentrate on those that seem to it to be undervalued by the market - The valuation of several companies is also used to make comparisons between companies. For example, if an investor thinks that the future course of GEs share price will be better than that of Amazon, he may buy GE shares and short-sell Amazon shares. With this position, he will gain provided that GEs share price does better (rises more or falls less) than that of Amazon.

3. Public offerings: - The valuation is used to justify the price at which the shares are offered to the public. 4. Inheritances and wills: - The valuation is used to compare the shares value with that of the other assets.

5. Compensation schemes based on value creation: - The valuation of a company or business unit is fundamental for quantifying the value creation attributable to the executives being assessed.

6. Identification of value drivers: - The valuation of a company or business unit is fundamental for identifying and stratifying the main value drivers

7. Strategic decisions on the companys continued existence: - The valuation of a company or business unit is a prior step in the decision to continue in the business, sell, merge, milk, grow or buy other companies.

8. Strategic planning: - The valuation of the company and the different business units is fundamental for deciding what products/business lines/countries/customer, to maintain grow or abandon. The valuation provides a means for measuring the impact of the companys possible policies and strategies on value creation and destruction.

4|Page

MACR

LITERATURE STUDY/THEORITICAL BACKGROUND

Business Valuation: A Guide for Small and Medium Sized Enterprises FEE launched its new paper 'Business Valuation: a guide for Small and Medium Sized Enterprises' which is more guidance to assist with the transfer of a Small and Medium Sized Enterprise.

This guide describes the significant overall principles to be applied in the valuation of enterprises, especially in the case of valuing an SME.

The demand for business valuations may be divided into principally two areas: requirements for statutory rules or contractual agreements. There may be other reasons, dependant on the proprietors needs.

Valuations for contractual reasons occur particularly when partners join or leave a partnership, in relation to inheritance disputes and settlements, as well as for settlements made in accordance with family law. Business valuations are often used for entrepreneurial initiatives such as the purchase or sale of businesses, mergers, additions to equity or thirdparty capital, contributions of non-monetary assets (including the transfer of entire net assets of businesses), initial public offerings, management buy-outs or in connection with valueoriented management concepts.

Business valuations are also carried out based on commercial and tax law valuation questions.

When calculating a business value of small and medium-size entities, particular attention should be paid to determining precisely what makes up the business being valued, determination of management remuneration as part of valuation of the management factor, and the reliability of sources of information.

This guide is structured in a way that general principles for valuing a business are outlined and that specific matters arising for SMEs are explicitly referred to in the context of the relevant general principles.

5|Page

MACR

DIFFERENT APPROACHES

1) Balance sheet-based methods (shareholders equity)

These methods seek to determine the companys value by estimating the value of its assets. These are traditionally used methods that consider that a companys value lies basically in its balance sheet. They determine the value from a static viewpoint, which, therefore, does not take into account the companys possible future evolution, moneys temporary value. These methods do not take into account other factors that also affect the value such as: the industrys current situation, human resources or organizational problems, contracts, etc. that do not appear in the accounting statements. Some of these methods are the following: Book value, Adjusted book value, Liquidation value, and Substantial value.

Book value

A companys book value, or net worth, is the value of the shareholders equity stated in the balance sheet (capital and reserves). This quantity is also the difference between total assets and liabilities, that is, the surplus of the companys total goods and rights over its total debts with third parties. This value suffers from the shortcoming of its own definition criterion: accounting criteria are subject to a certain degree of subjectivity and differ from market criteria, with the result that the book value almost never matches the market value

Adjusted book value

This method seeks to overcome the shortcomings that appear when purely accounting criteria are applied in the valuation. When the values of assets and liabilities match their market value, the adjusted net worth is obtained.

6|Page

MACR

Liquidation value

This is the companys value if it is liquidated, that is, its assets are sold and its debts are paid off. This value is calculated by deducting the businesss liquidation expenses (redundancy payments to employees, tax expenses and other typical liquidation expenses) from the adjusted net worth. Obviously, this methods usefulness is limited to a highly specific situation, namely, when the company is bought with the purpose of liquidating it at a later date. However, it always represents the companys minimum value, as a companys value, assuming it continues to operate, is greater than its liquidation value.

Substantial value

The substantial value represents the investment that must be made to form a company having identical conditions as those of the company being valued. It can also be defined as the assets replacement value, assuming the company continues to operate, as opposed to their liquidation value. Normally, the substantial value does not include those assets that are not used for the companys operations (unused land, holdings in other companies, etc.) Three types of substantial value are usually defined: - Gross substantial value: this is the assets value at market price - Net substantial value or corrected net assets: this is the gross substantial value less liabilities. It is also known as adjusted net worth - Reduced gross substantial value: this is the gross substantial value reduced only by the value of the cost-free debt.

7|Page

MACR

2) Income statement-based methods

Unlike the balance sheet-based methods, these methods are based on the companys income statement. They seek to determine the companys value through the size of its earnings, sales or other indicators. Thus, for example, it is a common practice to perform quick valuations of cement companies by multiplying their annual production capacity (or sales) in metric tons by a ratio (multiple). It is also common to value car parking lots by multiplying the number of parking spaces by a multiple and to value insurance companies by multiplying annual premiums by a multiple. This category includes the methods based on the PER: according to this method, the shares price is a multiple of the earnings.

Value of the Earnings. PER According to this method, the equitys value is obtained by multiplying the annual net income by ratio called PER (price earnings ratio), that is: Equity value = PER x earnings Value of the Dividends Dividends are the part of the earnings effectively paid out to the shareholder and, in most cases, are the only regular flow received by shareholders4. According to this method, a shares value is the net present value of the dividends that we expect to obtain from it. In the perpetuity case, that is, a company from which we expect constant dividends every year, this value can be expressed as follows: Equity value = DPS / Ke Where: DPS = dividend per share distributed by the company in the last year; Ke required return to equity If, on the other hand, the dividend is expected to grow indefinitely at a constant annual rate g, the above formula becomes the following: Equity value = DPS1 / (Ke - g) Where, DPS1 is the dividends per share for the next year. Empirical evidence5 shows that the companies that pay more dividends (as a percentage of their earnings) do not obtain a growth in their share price as a result. This is because when a company distributes more dividends, normally it reduces its growth because it distributes the money to its shareholders instead of ploughing it back into new investments.

8|Page

MACR

Sales multiples

This valuation method, which is used in some industries with a certain frequency, consists of calculating a companys value by multiplying its sales by a number. For example, a pharmacy is often valued by multiplying its annual sales (in dollars) by 2 or another number, depending on the market situation. It is also a common practice to value a soft drink bottling plant by multiplying its annual sales in litres by 500 or another number, depending on the market situation. In order to analyze this methods consistency, Smith Barney analyzed the relationship between the price/sales ratio and the return on equity. The study was carried out in large corporations (capitalization in excess of 150 million dollars) in 22 countries. He divided the companies into five groups depending on their price/sales ratio: group 1 consisted of the companies with the lowest ratio, and group 5 contained the companies with the highest price/sales ratio. The price/sales ratio can be broken down into a further two ratios: Price/sales = (price/earnings) x (earnings/sales) The first ratio (price/earnings) is the PER and the second (earnings/sales) is normally known as return on sales.

Other multiples In addition to the PER and the price/sales ratio, some of the frequently used multiples are: - Value of the company / earnings before interest and taxes (EBIT) - Value of the company / earnings before interest, taxes, depreciation and amortization (EBITDA) - Value of the company / operating cash flow - Value of the equity / book value

9|Page

MACR

3) Goodwill-based methods

Generally speaking, goodwill is the value that a company has above its book value or above the adjusted book value. Goodwill seeks to represent the value of the companys intangible assets, which often do not appear on the balance sheet but which, however, contribute an advantage with respect to other companies operating in the industry (quality of the customer portfolio, industry leadership, brands, strategic alliances, etc.). The problem arises when one tries to determine its value, as there is no consensus regarding the methodology used to calculate it. Some of the methods used to value the goodwill give rise to the various valuation procedures described in this section. These methods apply a mixed approach: on the one hand, they perform a static valuation of the companys assets and, on the other hand, they try to quantify the value that the company will generate in the future. Basically, these methods seek to determine the companys value by estimating the combined value of its assets plus a capital gain resulting from the value of its future earnings: they start by valuing the companys assets and then add a quantity related with future earnings. The classic valuation method This method states that a companys value is equal to the value of its net assets (net substantial value) plus the value of its goodwill. In turn, the goodwill is valued as n times the companys net income, or as a certain percentage of the turnover. According to this method, the formula that expresses a companys value is: V = A + (n x B), or V = A + (z x F) Where: A = net asset value; n = coefficient between 1.5 and 3; B = net income; z = percentage of sales revenue; F = turnover The simplified "abbreviated goodwill income" method According to this method, a companys value is expressed by the following formula: V = A + an (B - iA), where: A = corrected net assets or net substantial value an = present value, at a rate t, of n annuities, with n between 5 and 8 years B = net income for the previous year or that forecast for the coming year i = interest rate obtained by an alternative placement, which could be debentures, the return on equities, or the return on real estate investments (after tax) an (B - iA) = goodwill This formula could be explained in the following manner: the companys value is the value of its adjusted net worth plus the value of the goodwill

10 | P a g e

MACR

4) Cash flow discounting-based methods

These methods seek to determine the companys value by estimating the cash flows it will generate in the future and then discounting them at a discount rate matched to the flows risk. The mixed methods described previously have been used extensively in the past. However, they are currently used increasingly less and it can be said that, nowadays, the cash flow discounting method is generally used because it is the only conceptually correct valuation method. In these methods, the company is viewed as a cash flow generator and the companys value is obtained by calculating these flows present value using a suitable discount rate. Cash flow discounting methods are based on the detailed, careful forecast, for each period, of each of the financial items related with the generation of the cash flows corresponding to the companys operations, such as, for example, collection of sales, personnel, raw materials, administrative, sales, etc. expenses, loan repayments. Consequently, the conceptual approach is similar to that of the cash budget. In cash flow discounting-based valuations, a suitable discount rate is determined for each type of cash flow. Determining the discount rate is one of the most important tasks and takes into account the risk, historic volatilities; in practice, the minimum discount rate is often set by the interested parties (the buyers or sellers are not prepared to invest or sell for less than a certain return, etc.)

Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) methodology expresses the present value of a business as a function of its future cash earnings capacity. This methodology works on the premise that the value of a business is measured in terms of future cash flow streams, discounted to the present time at an appropriate discount rate. This method is used to determine the present value of a business on a going concern assumption. It recognizes that money has a time value by discounting future cash flows at an appropriate discount factor. The DCF methodology depends on the projection of the future cash flows and the selection of an appropriate discount factor.

11 | P a g e

MACR

When valuing a business on a DCF basis, the objective is to determine a net present value of the cash flows ("CF") arising from the business over a future period of time (say 5 years), which period is called the explicit forecast period. Free cash flows are defined to include all inflows and outflows associated with the project prior to debt service, such as taxes, amount invested in working capital and capital expenditure. Under the DCF methodology, value must be placed both on the explicit cash flows as stated above, and the ongoing cash flows a company will generate after the explicit forecast period. The latter value, also known as terminal value, is also to be estimated. The further the cash flows can be projected, the less sensitive the valuation is to inaccuracies in the assumed terminal value. Therefore, the longer the period covered by the projection, the less reliable the projections are likely to be. For this reason, the approach is used to value businesses, where the future cash flows can be projected with a reasonable degree of reliability. For example, in a fast changing market like telecom or even automobile, the explicit period typically cannot be more than at least 5 years. Any projection beyond that would be mostly speculation. The discount rate applied to estimate the present value of explicit forecast period free cash flows as also continuing value, is taken at the "Weighted Average Cost of Capital" (WACC). One of the advantages of the DCF approach is that it permits the various elements that make up the discount factor to be considered separately, and thus, the effect of the variations in the assumptions can be modelled more easily. The principal elements of WACC are cost of equity (which is the desired rate of return for an equity investor given the risk profile of the company and associated cash flows), the post-tax cost of debt and the target capital structure of the company (a function of debt to equity ratio). In turn, cost of equity is derived, on the basis of capital asset pricing model (CAPM), as a function of risk-free rate, Beta (an estimate of risk profile of the company relative to equity market) and equity risk premium assigned to the subject equity market.

12 | P a g e

MACR

5) Capitalization method

This method calculates a business's value by discounting the future business profits or dividends flowing to the entity's owners, which is derived from future commercial profits (statement of earnings). There are two methods:

INCOME CAPITALIZATION VALUATION METHOD: First determine the capitalization rate - a rate of return required to take on the risk of operating the business (the riskier the business, the higher the required return). Earnings are then divided by that capitalization rate. The earnings figure to be capitalized should be one that reflects the true nature of the business, such as the last three years average, current year or projected year. When determining a capitalization rate, compare with rates available to similarly risky investments

DIVIDEND CAPITALIZATION: Since most closely held companies do not pay dividends, when using dividend capitalization consultants first determine dividend paying capacity of a business. Dividend paying capacity depends on net income and on cash flow of the business. To determine dividend paying capacity, near future capital requirements, expansion plans, debt repayment, operation cushion, contractual requirements, past dividend paying history of a business should be studied. After analyzing these factors, percent of average net income and of average cash flow that can be used for the payment of dividends can be estimated. The dividend yield can be also determined by analyzing comparable companies. .

13 | P a g e

MACR

CRITICAL ASPECTS OF A VALUATION

Dynamic, the valuation is a process: The process for estimating expected risks and calibrating the risk of the different businesses and business units is crucial.

Involvement of the company: The Companys managers must be involved in the analysis of the company, of the industry and in the cash flow projections

Multifunctional: The valuation is not a task to be performed solely by financial management. In order to obtain a good valuation, it is vital that managers from other departments take part in estimating future cash flows and their risk.

Strategic: The cash flow restatement technique is similar in all valuations, but estimating the cash flows and calibrating the risk must take into account each business units strategy.

Compensation: The valuations quality is increased when it includes goals (sales, growth, market share, profits, and investments) on which the managers future compensation will depend.

Real options: If the company has real options, these must be valued appropriately. Real options require a totally different risk treatment from the cash flow restatements.

Historic analysis: Although the value depends on future expectations, a thorough historic analysis of the financial, strategic and competitive evolution of the different business units helps assess the forecasts consistency.

Technically correct: a) b) c) d) Calculation of the cash flows Adequate treatment of risk Treatment of residual value Treatment of risk

14 | P a g e

MACR

Conclusion

To conclude, a valuation provides the foundation for skilled business appraisers to estimate what your business is worth. Valuation is frequently used in setting a price for an enterprise that is being bought or sold. Professional valuations are now also being used by financial institutions to determine the amount of credit that should be extended to a company, by courts in determining litigation settlement amounts and by investors in evaluating performance of company management. Lastly, a valuation is often required under a variety of accounting and tax regulations. Hence, there are many important reasons that business owners should know the value of their businesses long before they decided to sell

REFERENCE

1) Google.com 2) Wikipedia 3) Scribd.com 4) Oppapers.com 5) A few financial management text books by Reddy and Appannaiah

15 | P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Citigroup's Exchange OfferDocument3 pagesCitigroup's Exchange Offercarlinchi850% (1)

- Module E & F FinalDocument40 pagesModule E & F Finalonthelinealways100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Telegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleDocument2 pagesTelegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleClari Soto100% (4)

- Automation in Operation ManagementDocument12 pagesAutomation in Operation ManagementSrinidhi Rangarajan100% (1)

- ML4T 2017fall Exam1 Version ADocument8 pagesML4T 2017fall Exam1 Version ADavid LiNo ratings yet

- Analisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantoDocument12 pagesAnalisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantotresnaNo ratings yet

- TBCH 08Document54 pagesTBCH 08Tornike Jashi100% (1)

- TEAM 5 - Leveraging IT For HR Management in FirmsDocument12 pagesTEAM 5 - Leveraging IT For HR Management in FirmsSrinidhi RangarajanNo ratings yet

- Term Loans: Assets and WC MarginsDocument11 pagesTerm Loans: Assets and WC MarginsSrinidhi RangarajanNo ratings yet

- MACR Assignment 1Document5 pagesMACR Assignment 1Srinidhi RangarajanNo ratings yet

- SK TP RMDocument11 pagesSK TP RMSrinidhi RangarajanNo ratings yet

- Final Project Repaired)Document263 pagesFinal Project Repaired)Honey SrivastavaNo ratings yet

- SYLLABUS. BSE FINANCIAL MNGT OkDocument8 pagesSYLLABUS. BSE FINANCIAL MNGT Okkram nhojNo ratings yet

- Square Pharma - ValuationDocument55 pagesSquare Pharma - ValuationFarhan Ashraf SaadNo ratings yet

- IFRIC 13 - Customer Loyalty ProgrammesDocument8 pagesIFRIC 13 - Customer Loyalty ProgrammesTopy DajayNo ratings yet

- Multinational RestructuringDocument30 pagesMultinational RestructuringUmair Khan NiaziNo ratings yet

- Almarai Company: Pre-Eminence Priced inDocument62 pagesAlmarai Company: Pre-Eminence Priced inAREEJMHNo ratings yet

- Rdo 040 Cubao - Do1497Document4 pagesRdo 040 Cubao - Do1497meryl viNo ratings yet

- Centennial Resource Development Investor PresentationDocument52 pagesCentennial Resource Development Investor PresentationshortmycdsNo ratings yet

- Stock Valuation Practice QuestionsDocument3 pagesStock Valuation Practice QuestionsMillat Equipment Ltd Pakistan0% (1)

- Indian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundDocument7 pagesIndian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundsansugeorgeNo ratings yet

- Earthsong Eco-Neighbourhood - Robin Allison - Habitat Award 2008Document34 pagesEarthsong Eco-Neighbourhood - Robin Allison - Habitat Award 2008New Zealand Social Entrepreneur Fellowship - PDF Library100% (4)

- Songbird Estates Research NoteDocument1 pageSongbird Estates Research Noteapi-249461242No ratings yet

- REPUBLIC ACT No 10846 (Sec. 23-25)Document3 pagesREPUBLIC ACT No 10846 (Sec. 23-25)School FilesNo ratings yet

- Indian Accounting Standards and Transition To Ifrs: July 2020Document8 pagesIndian Accounting Standards and Transition To Ifrs: July 2020Ashish ValanjuNo ratings yet

- Corporate BondsDocument36 pagesCorporate BondsCharlene LeynesNo ratings yet

- Free Cash Flow and DCF PresentationDocument3 pagesFree Cash Flow and DCF PresentationJames MitchellNo ratings yet

- MLSCN Technical ProposalDocument75 pagesMLSCN Technical ProposalomoyegunNo ratings yet

- ch09 - PPT - Rankin - 2e RevDocument37 pagesch09 - PPT - Rankin - 2e Revmichele hazelNo ratings yet

- Warehousing Project ManagementDocument7 pagesWarehousing Project ManagementZiad BaherNo ratings yet

- Banking and Finance Dissertation PDFDocument4 pagesBanking and Finance Dissertation PDFAcademicPaperWritingServicesGrandRapids100% (1)

- Sraw Finals QaDocument10 pagesSraw Finals QaVinluan JeromeNo ratings yet

- Chapter 5 - Project Costing and ValuationDocument19 pagesChapter 5 - Project Costing and ValuationfayoNo ratings yet

- SBE Brochure 2014Document40 pagesSBE Brochure 2014Paul Christopher Charlesraj VNo ratings yet

- GSIS Law 1Document13 pagesGSIS Law 1Arbie Dela TorreNo ratings yet

- Ba7202-Financial Management Notes RejinpaulDocument193 pagesBa7202-Financial Management Notes Rejinpauls.muthuNo ratings yet