Professional Documents

Culture Documents

Daily Agri Report, 28th January 2013

Daily Agri Report, 28th January 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report, 28th January 2013

Daily Agri Report, 28th January 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

News in brief

Sugar mills margin to remain under pressure this year

Squeezed between high production cost and lower realisation, sugar mills margins are likely to remain under pressure this sugar year (October- September). Against the average realisation of Rs. 32.5 a kg, the cost of production works out to Rs. 33- 34 a kg in north Indian states where state- advised price ( SAP) determines payments to mills. In nonSAP states, where cane prices to farmers are fixed on the basis of the fair and remunerative price fixed by the Centre, the cost of production works out to Rs. 30- 32 a kg. (Source: Business Standard)

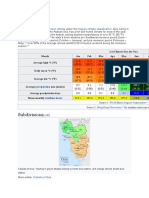

Market Highlights (% change)

Last Prev. day

as on Jan 25, 2013

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

20104 6075 53.8 95.88 1656

0.90 0.92 0.17 -0.07 -0.78

0.32 0.17 0.10 0.33 -1.79

3.39 2.81 -1.75 5.59 0.09

16.65 16.71 8.92 -3.70 -4.35

.Source: Reuters

Maize prices soar, put starch makers in a spot

The unprecedented surge in maize prices has put starch manufacturers in aquandary. Bulk buyers are negotiating annual purchase contracts for starch and its byproducts (glucose and dextrose) at Rs. 22- 24 a kg. Starch manufacturers say they are incurring heavy losses, as prices below Rs. 26 a kg arent viable for them. The failure of the maize crop in Maharashtra, Karnataka and Madhya Pradesh due to scanty rainfall has raised corn prices to Rs. 1,500- 1,600 a quintal ( for different varieties). Last year, prices stood at Rs. 1,000- 1,100 a quintal. High prices of corn in the US market are also exerting pressure on domestic prices, as Indian exporters are finding it lucrative to export corn. Corn prices in the US stand at about Rs. 1,900 a quintal, a viable proposition for exporters. Those engaged in the poultry, liquor and feedstock businesses were hit severely, as maize accounted for substantial input costs in these industries. (Source: Business Standard)

AP to set up panel on exclusive budget for agriculture

The Andhra Pradesh Government will appoint a coordination committee to finalise the proposal to go for the exclusive budget for the agricultural sector. The Finance Minister has agreed to carve out a separate budget for the primary sector. But we need to distinguish allocations for this sector and other allied sectors, the official said. The Ministers, Principal Secretaries and Commissioners of these sectors are expected to be members of the committee, which will discuss the nitty-gritty of the upcoming Budget. Though time is very short for preparation of the budget, the Government has decided to go ahead with the separate budget for agriculture, a top official of Agriculture Ministry told Business Line. (Source: Business Line)

Govt may drop move to tax commodity futures trading

There may be no change in the rate of the Securities Transaction Tax or introduction of Commodities Transaction Tax in this years Budget. Finance Minister P. Chidambaram, in his first Budget speech during the UPA-I regime, way back in 2004, introduced Securities Transaction Tax (STT) as a tool to track equities trade. STT rates have undergone changes several times. At present, an investor pays STT at the rate of 0.1 per cent on delivery-based transactions in the stock market. It means he will have to pay Rs 100 on a transaction of Rs 1 lakh. Interestingly, in the 2008-09 Budget, Chidambaram proposed the introduction of the Commodities Transaction Tax (CTT) on the lines of STT on options and futures. His argument was that transactions in commodity futures had come of age. However, this proposal was not notified and was finally dropped after the Prime Ministers Economic Advisory Council raised questions on the justification. (Source: Business Line)

Cotton yarn exports to touch record high in FY13

This financial year, cotton yarn exports are expected to touch an all time high, owing to good demand from China. Textile Commissioner A B Joshi said in 2012- 13, about 1,000 mn kg of yarn was expected to be exported. Earlier, he had estimated cotton yarn exports at 920 mn kg. Last year, exports stood at 827.68 mn kg. During the Apr- Dec period, 758 mn kg had been exported, 20% higher compared to the year- ago, according to sources in the textile commissioners office. In April- November, cotton yarn production stood at 2,317 mn kg, 14% higher compared to the yearago period. China accounts for 30% of Indias cotton yarn exports, while Bangladesh accounts for 16%. (Source: Business Standard)

Minimum export price for onion likely

Seven months after its abolition, the government is considering levying the Minimum Export Price (MEP) on onions once again, trade sources believe. The government is all set to levy MEP at $ 700/tn to discourage exports from India. This is because of shortage of good quality onion in the recently ended kharif season and the ongoing rabi harvesting season, which hiked its prices by up to 250% in the week between January 5-10, 2013 compared to the same period last year. The government had abolished the MEP on onion in May 2012, thereby, allowing traders to take advantage of rising prices in the global markets. But traders are not happy with the likely move. Currently, Indian exporters are executing orders from Middle Eastern importers at $ 420/tn. At $ 700, therefore, Indian orders which already have been low, would be shifted to countries like Pakistan, said a trader. (Source: Business Standard)

Govt hikes base price for crude edible oil imports

The Government has almost doubled the base price or tariff value for import of crude edible oils linking it to global prices of the commodity. However, there is no change in the base price for refined oil imports. The base price for crude palm oil (CPO) has been hiked to $802 a tonne from the earlier $447. For refined, bleached and de-odourised (RBD) palm oil, the base price now stands at $853 against the earlier $476. For crude palmolein, the base price has been set at $860 from $481 earlier , while for crude soyabean oil the base price has been more than doubled to $1,190 a tonne from the earlier $580 a tonne. The edible oil industry fears that the latest hike in tariff value would result in more import of refined oil affecting the domestic refiners. (Source: Business Line)

Policy makers turn jittery as unsold fertiliser stocks pile up

It is not just surplus foodgrain stocks in Government godowns that is giving policy makers the nightmares. The coming days could see a similar crisis with regard to unsold fertiliser stocks, disposing of which may eventually lead to a burden on the exchequer. The fertiliser industry is expected to start the next financial year with record high stocks of close to 8 mn tn. According to estimates, as on April 1, the opening stocks of di-ammonium phosphate (DAP) alone would be about 3.1 mt. This includes 0.6 mt with the companies and another 2.5 mt that they have already sold and billed to dealers, but would go unlifted by farmers.

(Source: Business Line)

Cotton body contests Govts opening stock estimate

The Cotton Association of India (CAI) has contested the revised opening stock of 40 lakh bales arrived at the Cotton Advisory Board (CAB) meeting held on Wednesday. The Association feels that the correction undertaken by CAB is not enough and the opening stock for 2012-13 should be 50 lakh bales given the prevailing weak price trend. CAB had made a one-time correction for the past errors by revising the opening stock to 40 lakh bales instead of 29 lakh bales shown as closing stock for the previous season. The various stock figures adopted at the successive meetings of the CAB were leading to lower stock estimates in the system and therefore CAI had urged the Board repeatedly to correct the same.

(Source: Business Line)

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Chana

Chana futures extended the gains of the previous session and settled 0.81% higher on Thursday. Reports of extreme cold and ground frost in north India may hamper chana cop yield. Although chana prices witnessed 17% gains in 2012 on the back of lower availability, sentiments prices remained under downside pressure during the period December 2012 till mid January 2013 on account of continuous supplies of imported chana from Australia coupled with higher output expectations.

Market Highlights

Unit Rs/qtl Rs/qtl Last 3950 3624 Prev day 0.64 0.81

as on Jan 24, 2013 % change WoW MoM 1.28 -3.91 -8.35 -9.96 YoY 21.54 13.68

Chana Spot - NCDEX (Delhi) Chana- NCDEX Apr'13 Futures

Source: Reuters

Sowing progress

Total pulses acreage as on 18th Jan 2013 stood at 1142.33 lakh ha, down by 0.6% yoy. As on 11th Jan 2013, pulses acreage was up by 0.4%. Chana sowing is almost complete and acreage so far is at 91.9 lakh ha, up by 3.4% as on 18th Jan. Chana acreage is marginally higher by 3% this year in Rajasthan at 14.80 lakh ha, In Maharashtra, Chana acreage is up at 10.92 lakh ha as on 11th Jan 2013 vs normal area of 10.6 lakh ha and 2012 area of 7.04 lakh ha. While in AP it is up at 7.14 lakh ha as on 11th Jan 2013, up by 26%. (Source: State farm dept)

Technical Chart - Chana

NCDEX April contract

Demand supply fundamentals

Although Farm ministry has targeted 7.9 mn tn Chana output for 2012-13 season, higher compared to 7.58 mn tn in 2011-12, the final output would depend on the weather conditions in the major growing regions. Chana fresh crop arrivals have started in Karnataka, Andhra Pradesh and in small quantities in Maharashtra too. However, arrival pressure will built up February onwards when harvesting commence in MP. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. The Commission for Agriculture Costs and Prices (CACP) has suggested 10 per cent import duty on pulses to encourage domestic production. in the first six months of the new fiscal that is from April to September this year, imports were an estimated 12 lakh tonnes. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch).

Source: Telequote

Technical Outlook

Contract Chana Apr Futures Unit Rs./qtl Support

valid for Jan 28, 2013 Resistance 3640-3660

3565-3595

Trade Scenario

In Australia, total chickpea production in 201213 is estimated to have increased to a record of around 746000 tones as compared with 485000 tons in 2011-12. India imports Chana mainly from Australia and Canada and higher availability in these countries at comparatively cheaper rates is seen boosting imports of Chana to meet the domestic shortfall.

Outlook

Chana Futures may continue to trade with upward bias on account of adverse weather conditions in North India. Although prices may remain firm in the near term, arrival pressure will cap sharp upside in the short term .

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Sugar

Sugar futures declined further on poor demand and comparatively higher supplies, however, prices witnessed short coverings towards the end and thus settled marginally lower by 0.53% on Thursday. Weak overseas markets have also added downside pressure on the domestic sugar prices. There are reports that drought in parts of Maharashtra and Karnataka has hurt fresh sugarcane plantings, which may affect cane availability for sugar year 2013-14 starting October. Although this will have long term implications, outlook for short term remains bleak amid sufficient supplies. Government has allocated total 70 lac tons of non-levy sugar quota for Dec-March 2012-13 period which is higher from 59.5 lac tons last year. Raw sugar futures on ICE as well as Liffe white sugar corrected on Friday and settled 0.12% and 0.59% lower due to a supply glut situation on the back of a sugar surplus for the third consecutive year has led to a sharp downside in the prices. Currently the prices are trading around 2 year lows.

Market Highlights

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX Feb'13 Futures Rs/qtl Last 3254

as on Jan 24, 2013 % Change Prev. day WoW -0.31 0.11 MoM -0.91 YoY 12.82

Rs/qtl

3195

-0.53

-1.24

-2.08

12.78

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMar'13 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 486.7 408.44

as on Jan 25, 2013 % Change Prev day WoW -0.12 -0.59 -1.08 0.05 MoM -6.10 -4.52 YoY -23.68 -24.08

Domestic Production and Exports

Mills in the country have produced 7.96 mln tn sugar in the first three months of the season, up nearly 2.5% a year ago. In Maharashtra, the largest sugar producer in the country, 155 mills are operational and have produced 1.88 mln tn sugar till Dec 15, compared with 1.83 mln produced a year ago by 165 mills. In Uttar Pradesh, the second largest sugar producer in the country, total output as on Dec 15 was 1.03 mln tn, about 20% lower on year, as some mills in the eastern part of the state are still to commence cane crushing. The producers body has estimated sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Industry body ISMA has estimated 6.5 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 1.5 mn tn sugar in 2012-13. With the opening stocks of 6.5 mn tn, domestic Sugar supplies are estimated at 30.5 mn tn against the domestic consumption of around 22. 5mln tn for 2012-13.

.Source: Reuters

Technical Chart - Sugar

NCDEX Feb contract

Source: Telequote

Technical Outlook

Contract Sugar Feb NCDEX Futures Unit Rs./qtl Support

valid for Jan 28, 2013 Resistance 3210-3220

Global Sugar Updates

According to the Brazil Agriculture Ministry, The 2012/13 cane crush was at 531.35 million tonnes as of Dec. 31, up from 491.16 million tonnes crushed the previous year. The 2013/14 crush will likely surpass the current one. Brazil's main center-south cane crop will produce between 580 million and 590 million tonnes of sugar cane in 2013/14. Brazil will likely favor ethanol production over sugar from the 2013/14 cane crop. The 2012/13 sugar crop in Thailand, the world's second-biggest exporter, could drop below a forecast 9.4 million tonnes due to lower-thanexpected yield. The crushing season started on Nov. 15 and 1.9 million tonnes of sugar has been produced so far (Source: Reuters)

3175-3185

Outlook

Sugar prices may trade with downward bias on account of higher supplies and poor demand in the domestic markets. However, sharp downside may be capped on reports of lower cane plantings for next season in some parts of Maharashtra and Karnataka. Further, it is expected that government will take some measure to control prices, which are below the cost of production levels, from falling further so as to protect the interest of the millers.

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Oilseeds

Soybean: After gaining significantly since last one week, Soybean

futures witnessed correction on Wednesday and thus settled 0.47% lower. However, spot settled 0.94% higher on account of dwindling supplies in the domestic markets. Arrivals in the domestic markets declined to 1.5 lakh bags, while demand is comparatively lower amid crushing disparity. Soy meal exports fell by 34% in December to 5.10 lakh tn, according to SOPA. The country had exported 7,78,382 tn in December 2011. During the first three months of the current oil year (Oct-Sep), exports declined by 27% to 10.78 lakh tn.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Feb '13 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Feb '13 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3332 3256 755.7 729.6

as on Jan 24, 2013 % Change Prev day 0.94 -0.47 0.01 0.60 WoW 2.52 1.62 1.19 -2.25 MoM 0.57 0.81 5.83 5.13 YoY 33.98 28.07 6.50 3.32

International Markets

Soybean futures on the CBOT settled 0.4% higher on Friday on account of short coverings. Rain forecast in Argentina pressurized prices at higher levels. Soybean prices had gained earlier on reports of downward revision in Argentina soy crop forecast by oil world. The weather conditions in Argentina in coming weeks will determine further price trend in Soybean. Oil World forecasts Argentinas 2012-13 harvest at 52.0 mn tn, down from 53 mn tn in December 2012, however, it is still higher compared with 39 mn tn produced in 2011-12 season. According to the USDA monthly crop report, Brazil will produce a record 82.5 mn tn of soybeans in 2012-13 due to hefty expansion in acreage and improving yield prospects. With the harvest just beginning in some areas, Brazil's planted area will likely increase by 9.2 percent to 27.34 mn ha.

Source: Reuters

as on Jan 25, 2013 International Prices Soybean- CBOTMar'13 Futures Soybean Oil - CBOTMar'13 Futures Unit USc/ Bushel USc/lbs Last 1441 52.1 Prev day 0.40 -0.02 WoW -1.28 3.85 MoM 0.09 6.46

Source: Reuters

YoY 18.21 0.99

Crude Palm Oil

as on Jan 25, 2013 % Change Prev day WoW -1.16 0.66 1.66 -0.07

Unit

CPO-Bursa Malaysia Feb '13 Contract CPO-MCX- Jan '13 Futures

Last 2382 441.1

MoM 4.34 8.33

YoY -24.07 -16.06

MYR/Tonne Rs/10 kg

Refined Soy Oil: Ref soy oil & CPO recovered from lower levels on

Thursday and settled 0.6% and 0.66% higher respectively. India's palm oil imports rose 27.4% on month at 783,091 tn in December, boosted mainly by poor domestic supply of alternatives and attractive overseas prices due to record stocks in key supplier Malaysia. To reduce imports and protect domestic industries, govt lifted duty on crude palm oil from 0 % to 2.5 % and also stated that the base import price on crude palm oil which is currently $447 per ton may be reviewed fortnightly. Exports of Malaysian palm oil products for Jan. 1-20 fell 19.9 percent to 813,778 tonnes compared with 1,015,440 tonnes shipped during Dec. 1-20, cargo surveyor Societe Generale de Surveillance said on Monday.

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Apr'13 Futures Rs/100 kgs Rs/100 kgs Last 4200 3475 Prev day -1.18 -0.54

as on Jan 24, 2013 WoW 1.33 -15.12 MoM -2.89 -16.77

Source: Reuters

YoY 19.83 2.27

Technical Chart Soybean

NCDEX Feb contract

Rape/mustard Seed: Mustard seed Futures which gained sharply

earlier in the week on reports of extreme cold in north India, witnessed profit booking and settled lower by 0.54% on Thursday. Rabi oilseeds sowing are now up by 2.23% at 8.54 mn ha as of Jan. 18. Arrivals are expected to commence in February and thus no major upside in the prices is seen if weather condition improve in the coming days. Rapeseed area stood at 6.7 mn ha as of Jan. 18, up by 2.8% from a year ago.

Outlook

Soybean complex may extend the losses of the previous session on profit taking. Mustard seed prices are likely to improve on reports of ground frost in Rajasthan which may hamper the mustard crop yield. CPO may trade with negative bias taking cues from the weak Malaysian palm oil futures.

Source: Telequote

Technical Outlook

Contract Soy Oil Feb NCDEX Futures Soybean NCDEX Feb Futures RM Seed NCDEX Apr Futures CPO MCX Jan Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Jan 28, 2013 Support 717-723 3210-3230 3435-3455 432-437 Resistance 733-737 3275-3290 3495-3510 444-448

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Black Pepper

Pepper Futures traded on a positive note for the third consecutive session on Thursday on account of low stocks and thin supplies. Good winter demand also supported the prices. Prices have also increased due to arrivals of good quality pepper from Kerala. Earlier, prices had corrected as Food Safety and Standards Authority of India sealed the entire quantity of pepper stored in six warehouses in Kerala of about 8,000 tonnes. Harvesting of the fresh crop has commenced and is expected to gain momentum in the coming days. However, winter demand coupled with low stocks in the domestic markets has supported prices at lower levels. Exports demand for Indian pepper in the international markets is also weak due to price parity. The Spot as well as the Futures settled 1.56% and 1.03% higher on Thursday. Spices Board has announced plans to import high yielding Madagascar variety that was behind the record productivity in Vietnam. It could raise productivity of Indian pepper from 2,000 kg/ha to 7,000 kg/ha. Pepper prices in the international market are being quoted at $8,100/tn(C&F Europe). Vietnam, Malaysia and Indonesia Austa variety are quoted at $7,000/tn and Brazil black pepper is quoted at $6,600/tn.

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Feb'13 Futures Rs/qtl Rs/qtl Last 39779 38185 % Change Prev day 1.56 1.03

as on Jan 24, 2013 WoW 2.45 3.29 MoM 4.49 9.35 YoY 23.79 17.35

Source: Reuters

Technical Chart Black Pepper

NCDEX Feb contract

Exports and Imports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of pepper during Jan-Oct 2012 stood at 102,340 mt, lower by 12% as compared to 1,15,780 mt in the same period last year. Total exports in 2012 are forecasted at around 1,10,000 tonnes. Pepper imports by U.S. the largest consumer of the spice declined 26% during January-September 2012 period to 41,923 tn as compared to 52,489 tn in the same period previous year. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. Brazil exported 25,900 tn pepper during Jan-Nov 2012, around 20% lower compared with 32,650 tn in the same period last year. Exports from Malaysia 8,300 tn pepper during Jan-Oct 2012, lower by 30% last year while exports in October stood at 1,077 mt in.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Feb Futures Unit Rs/qtl

valid for Jan 28, 2013 Support 37490-37840 Resistance 38450-38730

Production and Arrivals

The arrivals in the spot market were reported at 5 tonnes while off takes were reported at 5 tonnes on Thursday. Markets remained closed on Friday on account of Eid-E-Milad festival. As per IPC, Global pepper production in 2012 is projected at 3.27 lk tn, up compared with 3.18 lk tn in 2011. Production for 2013 is projected at 316832 tn. Indonesian pepper output is expected to rise by 24% and in Vietnam by 10%. According to previous estimates, pepper output in Vietnam is estimated to be 1 lakh tonne in 2012 as compared to 1.1 lakh tonne in 2011. Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) Pepper production in 2012-13 is expected around 60,000-63,000 tonnes. Currently, pepper is in the fruit formation stage in Kerala.

Outlook

Pepper is expected to continue to trade on a positive note on account of low stocks coupled with thin arrivals. Winter buying demand may also support prices. However, increasing supplies coupled with higher output expectations may cap sharp gains. FSSAIs sealing of huge quantity of pepper and FMCs probe into complaints against price movement may also pressurize the prices.

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Jeera

Jeera Futures traded with a negative bias on Thursday hitting fresh contract lows. Prices have corrected sharply tracking higher sowing figures. However, fresh enquiries restrained a major downside. Higher sowing as well as conducive weather in Gujarat, the main jeera growing region have pressurized prices. Sowing is complete. According to Gujarat State Agri Dept. sowing in Gujarat is reported at 3.244 lakh ha till Jan, 2013 compared with 3.64 lakh ha last year. In Rajasthan, sowing is expected to increase by 10-15%. The spot as well as the Futures settled 0.46% and 1.18% lower on Thursday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,925 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 5-6 lakh bags.

Market Highlights

Unit Jeera Spot- NCDEX (Unjha) Jeera- NCDEX Mar '13 Futures Rs/qtl Rs/qtl Last 14095 13445 Prev day -0.46 -1.18

as on Jan 24, 2013 % Change WoW -1.53 -4.14 MoM -6.25 -11.98 YoY -12.23 -15.75

Source: Reuters

Technical Chart Jeera

NCDEX March contract

Production, Arrivals and Exports

Arrivals in Unjha were reported at 3,200 tn on Friday. Production of Jeera in 2011-12 is expected around 40 lakh bags as against 29 lakh bags in 2010-11 (55 kgs each). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.04 -1.08

as on Jan 24, 2013 % Change

Outlook

Jeera is expected to trade with on a negative today. Higher sowing figures coupled with conducive weather in Gujarat may pressurize prices. However, export demand at lower levels may support prices. Demand from domestic traders and millers at lower levels may also support prices. In the medium term, prices are likely to stay firm as Syria and Turkey have stopped shipments.

Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Apr '13 Futures

Unit Rs/qtl Rs/qtl

Last 5452 6200

WoW -3.31 -6.06

MoM 3.42 -1.49

YoY 12.35 34.72

Turmeric

Turmeric Futures corrected on Thursday after witnessing short coverings in the preceding session. Huge carryover stocks have pressurized prices over the last few days. Good demand from upcountry market has supported the prices. Lower production estimates have also supported the prices. There are reports of some crop damage in Erode region. Expectations are that production may be lower by 40-50%. Production is expected around 55 lakh bags. It is estimated that next years carryover stocks would be around 10 lakh bags. There are reports that Turmeric Farmers Association of India have decided to fix their own MSP of Rs.10000/qtl. The Spot settled marginally higher by 0.04% while the Futures settled 1.08% lower on Thursday.

Technical Chart Turmeric

NCDEX April contract

Source: Telequote

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 4,000 bags and 2,000 bags respectively on Thursday. Turmeric production in 2012-13 is expected around 55 lakh bags. Production in 2011-12 is projected at historical high of 10.62 lakh tn. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric is expected to trade with downward bias today as higher carryover stocks and weak overseas demand is expected to pressurize prices. However, lower output concerns coupled with demand from stockists may support prices at lower levels.

.

Technical Outlook

Unit Jeera NCDEX March Futures Turmeric NCDEX April Futures Rs/qtl Rs/qtl

Valid for Jan 28, 2013

Support 13280-13360 6100-6150 Resistance 13570-13690 6270-6350

www.angelcommodities.com

Commodities Daily Report

Monday| January 28, 2013

Agricultural Commodities

Kapas

NCDEX Kapas settled 0.83% higher as an upward revision in the exports and domestic consumption coupled downward revision in the output estimates have created positive market sentiments. The Cotton Advisory Board, which met in Mumbai on Wednesday, has estimated cotton production this season (Oct 2012 to Sep 2013) will be 330 lakh bales against the previous estimates in October at 334 lakh bales. Also, exports and domestic consumption has been revised upward to 253 and 80 lakh bales respectively from 250 and 70 lakh bales estimated earlier. As on January 9 this year, nearly 38 lakh bales were registered for exports. Cotton Association of India (CAI), expects output to be around 353 lakh bales in 2012-13. According to the data released by Cotton Corporation of India, Supplies until Jan 13 are down 6.3 percent to 12.5 mn bales of 170 kg each, down from 12.9 mn bales a year earlier. Arrivals were down by 10 percent as th on 16 Dec. ICE Cotton corrected sharply on Friday on account of profit taking and settled 2.86% lower. Prices have traded on a bullish note hitting a fresh 8 month high last week on back of index buying. Hopes of demand from China led to a sharp increase over the week. Concerns about the quality of cotton to be released by China also supported the prices.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 908.5 16370

as on Jan 24, 2013 % Change Prev. day WoW MoM 0.83 -1.52 -10.58 0.43 0.06 0.06 YoY #N/A -7.67

NCDEX Kapas Apr Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit USc/Lbs Last 80.52 81.35

as on Jan 25, 2013 % Change Prev day WoW -2.86 2.51 0.00 0.00 MoM 5.70 0.00 YoY -15.78 -29.20

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) estimates (23 Jan 2013) for 2012-13 season that commenced in October, domestic cotton production is pegged 330 lakh bales, down from the previous years estimates of 353 lakh bales. However, higher exports and domestic consumption can be met through revised higher opening stocks of 40 lakh bales and higher imports. After witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 80 lakh bales this season, compared with 128.8 lakh bales last year.

th

Source: Telequote

Technical Chart - Cotton

MCX Jan contract

Global Cotton Updates

China, the world's biggest buyer of cotton, began selling a tiny fraction of its massive stockpile of the fibre on Monday, in a move to ease domestic supply shortages. Beijing has been building a strategic stockpile of cotton since 2011, paying above global prices to support its farmers, but the policy has hurt China's textile mills, which have been struggling with tight supplies, and high prices, at home. Many in the industry were expecting China to reward mills that buy state reserves with new import quotas enabling them to buy cheaper overseas supplies. But no such deal was announced. Brazils 2012-13 cotton production forecast at 6.3 million bales, down 27 percent from 2011/12 production now estimated at 8.6 million bales. (USDA attach report)

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Futures Cotton MCX Jan Futures Unit Rs/20 kgs Rs/bale

valid for Jan 28, 2013 Support 890-900 16250-16310 Resistance 915-925 165410-16450

Outlook

Cotton prices may trade on a mixed note today. Higher output expectations by Cotton Association of India have turned the sentiments negative for the cotton prices. However, downside may be limited as farmers may not sell their stocks at lower prices. Reports that the Government may purchase cotton from farmers to avoid distress sales may also support prices. Also, anticipated export demand from the neighboring countries may support prices.

www.angelcommodities.com

You might also like

- Daily Agri Report, February 27Document8 pagesDaily Agri Report, February 27Angel BrokingNo ratings yet

- Daily Agri Report, May 02Document8 pagesDaily Agri Report, May 02Angel BrokingNo ratings yet

- Daily Agri Report, March 02Document8 pagesDaily Agri Report, March 02Angel BrokingNo ratings yet

- Daily Agri Report 20th DecDocument8 pagesDaily Agri Report 20th DecAngel BrokingNo ratings yet

- Daily Agri Report, February 12Document8 pagesDaily Agri Report, February 12Angel BrokingNo ratings yet

- Daily Agri Report Nov 15Document8 pagesDaily Agri Report Nov 15Angel BrokingNo ratings yet

- Daily Agri Report Oct 22Document8 pagesDaily Agri Report Oct 22Angel BrokingNo ratings yet

- Daily Agri Report, April 05Document8 pagesDaily Agri Report, April 05Angel BrokingNo ratings yet

- Daily Agri Report, March 18Document8 pagesDaily Agri Report, March 18Angel BrokingNo ratings yet

- Daily Agri Report, February 22Document8 pagesDaily Agri Report, February 22Angel BrokingNo ratings yet

- Daily Agri Report 07 March 2013Document8 pagesDaily Agri Report 07 March 2013Angel BrokingNo ratings yet

- Daily Agri Report Oct 6Document8 pagesDaily Agri Report Oct 6Angel BrokingNo ratings yet

- Daily Agri Report 26th DecDocument8 pagesDaily Agri Report 26th DecAngel BrokingNo ratings yet

- Daily Agri Report, April 13Document8 pagesDaily Agri Report, April 13Angel BrokingNo ratings yet

- Daily Agri Report, March 25Document8 pagesDaily Agri Report, March 25Angel BrokingNo ratings yet

- Daily Agri Report, February 18Document8 pagesDaily Agri Report, February 18Angel BrokingNo ratings yet

- Daily Agri Report Aug 13Document8 pagesDaily Agri Report Aug 13Angel BrokingNo ratings yet

- Daily Agri Report, March 12Document8 pagesDaily Agri Report, March 12Angel BrokingNo ratings yet

- Daily Agri Report Nov 8Document8 pagesDaily Agri Report Nov 8Angel BrokingNo ratings yet

- Daily Agri Report, April 03Document8 pagesDaily Agri Report, April 03Angel BrokingNo ratings yet

- Daily Agri Report 31st DecDocument8 pagesDaily Agri Report 31st DecAngel BrokingNo ratings yet

- Daily Agri Report Sep 29Document8 pagesDaily Agri Report Sep 29Angel BrokingNo ratings yet

- Daily Agri Report, August 07 2013Document9 pagesDaily Agri Report, August 07 2013Angel BrokingNo ratings yet

- Daily Agri Report Oct 18Document8 pagesDaily Agri Report Oct 18Angel BrokingNo ratings yet

- Daily Agri Report, February 11Document8 pagesDaily Agri Report, February 11Angel BrokingNo ratings yet

- Daily Agri Report Oct 11Document8 pagesDaily Agri Report Oct 11Angel BrokingNo ratings yet

- Daily Agri Report Sep 6Document8 pagesDaily Agri Report Sep 6Angel BrokingNo ratings yet

- Daily Agri Report Nov 12Document8 pagesDaily Agri Report Nov 12Angel BrokingNo ratings yet

- Daily Agri Report 14th JanDocument8 pagesDaily Agri Report 14th JanAngel BrokingNo ratings yet

- Daily Agri Report Oct 12Document8 pagesDaily Agri Report Oct 12Angel BrokingNo ratings yet

- Daily Agri Report Oct 10Document8 pagesDaily Agri Report Oct 10Angel BrokingNo ratings yet

- Daily Agri Report, May 07Document7 pagesDaily Agri Report, May 07Angel BrokingNo ratings yet

- Daily Agri Report, June 05Document7 pagesDaily Agri Report, June 05Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report Nov 7Document8 pagesDaily Agri Report Nov 7Angel BrokingNo ratings yet

- Daily Agri Report, February 15Document8 pagesDaily Agri Report, February 15Angel BrokingNo ratings yet

- Daily Agri Report September 06 2013Document9 pagesDaily Agri Report September 06 2013Angel BrokingNo ratings yet

- Daily Agri Tech ReportDocument8 pagesDaily Agri Tech ReportAngel BrokingNo ratings yet

- Daily Agri Report, April 26Document8 pagesDaily Agri Report, April 26Angel BrokingNo ratings yet

- Daily Agri Report 9th JanDocument8 pagesDaily Agri Report 9th JanAngel BrokingNo ratings yet

- Daily Agri Report Oct 8Document8 pagesDaily Agri Report Oct 8Angel BrokingNo ratings yet

- Content: News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/CottonDocument8 pagesContent: News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/CottonAngel BrokingNo ratings yet

- Daily Agri Report, May 16Document7 pagesDaily Agri Report, May 16Angel BrokingNo ratings yet

- Daily Agri Report 10th JanDocument8 pagesDaily Agri Report 10th JanAngel BrokingNo ratings yet

- Daily Agri Report, August 06 2013Document9 pagesDaily Agri Report, August 06 2013Angel BrokingNo ratings yet

- Daily Agri Report September 11 2013Document9 pagesDaily Agri Report September 11 2013Angel BrokingNo ratings yet

- Daily Agri Report, February 19Document8 pagesDaily Agri Report, February 19Angel BrokingNo ratings yet

- Daily Agri Report Oct 25Document8 pagesDaily Agri Report Oct 25Angel BrokingNo ratings yet

- Daily Agri Report, May 10Document7 pagesDaily Agri Report, May 10Angel BrokingNo ratings yet

- Daily Agri Report Sep 27Document8 pagesDaily Agri Report Sep 27Angel BrokingNo ratings yet

- Commodity Report September 2311 88240911Document8 pagesCommodity Report September 2311 88240911Abhinav JainNo ratings yet

- Daily Agri Report, March 13Document8 pagesDaily Agri Report, March 13Angel BrokingNo ratings yet

- Daily Agri Report Aug 24Document8 pagesDaily Agri Report Aug 24Angel BrokingNo ratings yet

- Daily Agri Report Oct 27Document8 pagesDaily Agri Report Oct 27Angel BrokingNo ratings yet

- Daily Agri Report 3rd JanDocument8 pagesDaily Agri Report 3rd JanAngel BrokingNo ratings yet

- Daily Agri Report Nov 9Document8 pagesDaily Agri Report Nov 9Angel BrokingNo ratings yet

- Daily Agri Report, 24 January 2013Document8 pagesDaily Agri Report, 24 January 2013Angel BrokingNo ratings yet

- Daily Agri Report 28th DecDocument8 pagesDaily Agri Report 28th DecAngel BrokingNo ratings yet

- Daily Agri Report, August 16 2013Document9 pagesDaily Agri Report, August 16 2013Angel BrokingNo ratings yet

- Farm Products Raw Materials Agents & Brokers Revenues World Summary: Market Values & Financials by CountryFrom EverandFarm Products Raw Materials Agents & Brokers Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Exposeal UWDocument2 pagesExposeal UWVenkata Raju KalidindiNo ratings yet

- Case Study On North India Floods (2016)Document8 pagesCase Study On North India Floods (2016)Niranjana NairNo ratings yet

- Bulletin 11B Shelf Life of SABO FOAMSDocument2 pagesBulletin 11B Shelf Life of SABO FOAMSAhmad TalaatNo ratings yet

- Environmental ChallengesDocument20 pagesEnvironmental ChallengesAbdulla - Al KafyNo ratings yet

- Duck Confit SaladDocument2 pagesDuck Confit SaladpermilosNo ratings yet

- Vapor Compression Test RigDocument3 pagesVapor Compression Test RigTARUN DHUNNA0% (1)

- THE NEW YORK TIMES - APRIL 22 TH 2020Document58 pagesTHE NEW YORK TIMES - APRIL 22 TH 2020Carlos MedinaNo ratings yet

- Measurement of The Gas Constant and Molar Volume of Oxygen GasDocument12 pagesMeasurement of The Gas Constant and Molar Volume of Oxygen GasJennifer Im0% (1)

- RAC Lesson Planning-BDocument2 pagesRAC Lesson Planning-Bsurajit biswasNo ratings yet

- Important Cases of Environmental LawDocument48 pagesImportant Cases of Environmental LawAbhishekGautamNo ratings yet

- Road Construction MethodsDocument163 pagesRoad Construction MethodsMichael Tan100% (1)

- Heritae Auctions - Art of The American West Art Auction 5085 - Dallas TexasDocument130 pagesHeritae Auctions - Art of The American West Art Auction 5085 - Dallas TexasHeritage AuctionsNo ratings yet

- Build Your Own Solar Water HeaterDocument3 pagesBuild Your Own Solar Water HeaterRossen Ivanov100% (1)

- 120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnDocument9 pages120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnAlex TranNo ratings yet

- Directfillinggold-Final Yr BDSDocument17 pagesDirectfillinggold-Final Yr BDSHanna AdnanNo ratings yet

- Philippines' Country Profile: I. General InformationDocument38 pagesPhilippines' Country Profile: I. General InformationMark VillanuevaNo ratings yet

- BU Exam-I Score SheetDocument1 pageBU Exam-I Score SheetdashrillaNo ratings yet

- C.B.S.E. 2011 Sample Papers For IX Science (37 Sets) Summative Assessement IDocument604 pagesC.B.S.E. 2011 Sample Papers For IX Science (37 Sets) Summative Assessement IVinod KumarNo ratings yet

- Steps in Surgical Hand WashingDocument2 pagesSteps in Surgical Hand Washingtintin275100% (1)

- Gujarat Technological University Environmental EngineeringDocument3 pagesGujarat Technological University Environmental EngineeringHarshil KachhadiyaNo ratings yet

- Recycling Hot-Mix Asphalt PavementsDocument28 pagesRecycling Hot-Mix Asphalt PavementsRaghavNo ratings yet

- Report KhanyarDocument64 pagesReport KhanyarSumaira SyedNo ratings yet

- Kendriya Vidyalaya Sangathan English PaperDocument14 pagesKendriya Vidyalaya Sangathan English PaperAtul PandeyNo ratings yet

- Reading Comprehension: (Vol.-II)Document146 pagesReading Comprehension: (Vol.-II)NimishaNo ratings yet

- Las Vegas Is The Largest City in The State of NevadaDocument7 pagesLas Vegas Is The Largest City in The State of NevadaPatricia Trueba BlancoNo ratings yet

- Chinese Dragon ReikiDocument13 pagesChinese Dragon Reikij182razor100% (8)

- Subdivisions: ClimateDocument3 pagesSubdivisions: ClimateNatia SaginashviliNo ratings yet

- Answers To Cambridge Checkpoint English Workbook 2: 1 Descriptive Writing To Create An Atmosphere or SettingDocument10 pagesAnswers To Cambridge Checkpoint English Workbook 2: 1 Descriptive Writing To Create An Atmosphere or SettingAnonymous cht358No ratings yet

- KJHHHHVDocument4 pagesKJHHHHVBinay kumar B.kNo ratings yet

- CF 1000Document4 pagesCF 1000Anonymous 3eHGEDbxNo ratings yet