Professional Documents

Culture Documents

Sharekhan Top Picks: February 02, 2013

Sharekhan Top Picks: February 02, 2013

Uploaded by

nit111Copyright:

Available Formats

You might also like

- A Note On Venture Capital IndustryDocument9 pagesA Note On Venture Capital Industryneha singhNo ratings yet

- Sharekhan Top Picks: January 01, 2013Document7 pagesSharekhan Top Picks: January 01, 2013Rajiv MahajanNo ratings yet

- Sharekhan Top Picks: October 26, 2012Document7 pagesSharekhan Top Picks: October 26, 2012Soumik DasNo ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Weekly Wrap: Investment IdeaDocument4 pagesWeekly Wrap: Investment IdeaAnonymous 0JhO3KdjNo ratings yet

- IEA Report 22th DecemberDocument21 pagesIEA Report 22th DecembernarnoliaNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- Shriram Transport Finance LTD.: Concerns OverdoneDocument17 pagesShriram Transport Finance LTD.: Concerns OverdoneDhina KaranNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Stock Update Wonderla Holidays Viewpoint Zee Learn: IndexDocument4 pagesStock Update Wonderla Holidays Viewpoint Zee Learn: IndexRajasekhar Reddy AnekalluNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- India Equity Analytics Today: Hold Rating On Prestige Estates StockDocument25 pagesIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- HDFC Bank - Visit Update - Oct 14Document9 pagesHDFC Bank - Visit Update - Oct 14Pradeep RaghunathanNo ratings yet

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocument4 pagesTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152No ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- Market Outlook 16th September 2011Document6 pagesMarket Outlook 16th September 2011Angel BrokingNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Document20 pagesWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeNo ratings yet

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDocument12 pagesHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalNo ratings yet

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Document5 pagesFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarNo ratings yet

- Analyst Report Issued by IIFL (Company Update)Document16 pagesAnalyst Report Issued by IIFL (Company Update)Shyam SunderNo ratings yet

- KRBL ReportDocument28 pagesKRBL ReportHardeep Singh SohiNo ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Stock Update PTC India: IndexDocument6 pagesStock Update PTC India: IndexRam NarayananNo ratings yet

- SharekhanTopPicks 030811Document7 pagesSharekhanTopPicks 030811ghachangfhuNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Arman F L: Inancial Services TDDocument10 pagesArman F L: Inancial Services TDJatin SoniNo ratings yet

- PC Jeweller LTD IER InitiationReport 2Document28 pagesPC Jeweller LTD IER InitiationReport 2Himanshu JainNo ratings yet

- Stock Update Yes Bank Stock Update Persistent Systems: IndexDocument8 pagesStock Update Yes Bank Stock Update Persistent Systems: IndexShivam DaveNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- 10 MidcapsDocument1 page10 MidcapspuneetdubeyNo ratings yet

- Indian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Document21 pagesIndian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Narnolia Securities LimitedNo ratings yet

- IEA Report 23rd DecemberDocument24 pagesIEA Report 23rd DecembernarnoliaNo ratings yet

- Sharekhan Top Picks: April 03, 2010Document6 pagesSharekhan Top Picks: April 03, 2010Kripansh GroverNo ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Initiating Coverage HDFC Bank - 170212Document14 pagesInitiating Coverage HDFC Bank - 170212Sumit JatiaNo ratings yet

- Aug 11Document18 pagesAug 11randeepsNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Which Sensex Stocks Should You Bet On - The Economic Times On MobileDocument22 pagesWhich Sensex Stocks Should You Bet On - The Economic Times On MobileKirti NagdaNo ratings yet

- PSO Detailed Report 2Document9 pagesPSO Detailed Report 2Javaid IqbalNo ratings yet

- Maruti Suzuki Financial Ratios, Dupont AnalysisDocument12 pagesMaruti Suzuki Financial Ratios, Dupont Analysismayankparkhi100% (1)

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Diwali Icici 081112Document8 pagesDiwali Icici 081112Mintu MandalNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Reliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee SuganyaDocument8 pagesReliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee Suganyachitu1992No ratings yet

- Annual Report 2012-2013 Federal BankDocument192 pagesAnnual Report 2012-2013 Federal BankMoaaz AhmedNo ratings yet

- Indag Rubber Note Jan20 2016Document5 pagesIndag Rubber Note Jan20 2016doodledeeNo ratings yet

- Diwali-Picks Microsec 311013 PDFDocument14 pagesDiwali-Picks Microsec 311013 PDFZacharia VincentNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Khadim India LTD - IPO NoteDocument3 pagesKhadim India LTD - IPO Notenit111No ratings yet

- E Copy 32Document50 pagesE Copy 32nit111No ratings yet

- Company Analysis - NESCO LTDDocument3 pagesCompany Analysis - NESCO LTDnit111No ratings yet

- Accounting FraudsDocument34 pagesAccounting Fraudsnit111No ratings yet

- Session 5 Technology Cases IndiaDocument14 pagesSession 5 Technology Cases Indianit111No ratings yet

- Value Investors Group PDFDocument11 pagesValue Investors Group PDFnit111100% (1)

- Corporation Bank ReportDocument11 pagesCorporation Bank Reportnit111No ratings yet

- Wednesday July 31, 2013: Sensex Nifty RS./$Document3 pagesWednesday July 31, 2013: Sensex Nifty RS./$nit111No ratings yet

- Jyoti Structures (JYOSTR) : When Interest Burden Outweighs AllDocument10 pagesJyoti Structures (JYOSTR) : When Interest Burden Outweighs Allnit111100% (1)

- Multi Commodity Exchange of IndiaDocument6 pagesMulti Commodity Exchange of Indianit111No ratings yet

- BUY BUY BUY BUY: Apollo Hospitals Enterprise LTDDocument14 pagesBUY BUY BUY BUY: Apollo Hospitals Enterprise LTDnit111No ratings yet

- CeraSanitaryware 1QFY2014RU - PDF 110713Document15 pagesCeraSanitaryware 1QFY2014RU - PDF 110713nit111No ratings yet

- Reliance Capital - Initiating Coverage - Centrum 06122012Document19 pagesReliance Capital - Initiating Coverage - Centrum 06122012nit111No ratings yet

- Tracking Technicals DrreddysDocument1 pageTracking Technicals Drreddysnit111No ratings yet

- ExchangeDocument6 pagesExchangeBea Marie Dejillas0% (1)

- DTT Effectively Stopping Continuation SetupsDocument9 pagesDTT Effectively Stopping Continuation Setupsmangelbel6749100% (1)

- CRISIL Research Ier Report Fortis HealthcareDocument28 pagesCRISIL Research Ier Report Fortis HealthcareSai SantoshNo ratings yet

- Ifrs PDFDocument6 pagesIfrs PDFkeenu23No ratings yet

- Physical Meaning of SMDocument39 pagesPhysical Meaning of SMVikas MehtaNo ratings yet

- International Banking Blackbook Final ProjectDocument76 pagesInternational Banking Blackbook Final ProjectDILIP JAIN50% (2)

- Backbase Becoming Digital-First WhitepaperDocument20 pagesBackbase Becoming Digital-First Whitepaperjsconrad12100% (1)

- St. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDocument9 pagesSt. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDianna Tercino IINo ratings yet

- Time Value of Money FormulasDocument8 pagesTime Value of Money FormulasrovosoloNo ratings yet

- Setting Up of A Small Business EnterpriseDocument36 pagesSetting Up of A Small Business EnterprisesukanyaNo ratings yet

- Yaokasin vs. Commissioner of CustomsDocument27 pagesYaokasin vs. Commissioner of CustomsPen MalubagNo ratings yet

- Legal Framework The Report Myanmar 2017Document11 pagesLegal Framework The Report Myanmar 2017chaw htet myatNo ratings yet

- Ansoff MatrixDocument4 pagesAnsoff Matrixpushpane100% (3)

- Optimised Funds Fairbairn Capital's Investment Frontiers From Old MutualDocument2 pagesOptimised Funds Fairbairn Capital's Investment Frontiers From Old MutualTiso Blackstar GroupNo ratings yet

- Concept of Capital StructureDocument22 pagesConcept of Capital StructurefatimamominNo ratings yet

- Bucharest Hotel ProjectsDocument8 pagesBucharest Hotel ProjectsLili LewhitteNo ratings yet

- Oil Money 2015 BrochureDocument6 pagesOil Money 2015 BrochureTwirXNo ratings yet

- JR Cover Letter-SIFDocument2 pagesJR Cover Letter-SIFrwomubitooke johnNo ratings yet

- Ghatna EnglishDocument20 pagesGhatna EnglishSachin SarwadeNo ratings yet

- Types of Financial Model: Why Financial Models Are Prepared?Document4 pagesTypes of Financial Model: Why Financial Models Are Prepared?2460985No ratings yet

- Questions FinmanDocument8 pagesQuestions FinmanNiña Rhocel YangcoNo ratings yet

- Sequences and Series NotesDocument26 pagesSequences and Series Notesapi-231638444No ratings yet

- Tutorial 5 Basic Group AccountingDocument5 pagesTutorial 5 Basic Group AccountingKelvin LeongNo ratings yet

- SIP PROJECT REPORT FOR College RealDocument60 pagesSIP PROJECT REPORT FOR College RealTanaya GhosalNo ratings yet

- Midterm Exam FABM 2Document2 pagesMidterm Exam FABM 2Vee Ma100% (2)

- ENR Top 225 International Design Firms 2014Document83 pagesENR Top 225 International Design Firms 2014vhiribarneNo ratings yet

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateDocument8 pagesSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerNo ratings yet

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet

Sharekhan Top Picks: February 02, 2013

Sharekhan Top Picks: February 02, 2013

Uploaded by

nit111Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sharekhan Top Picks: February 02, 2013

Sharekhan Top Picks: February 02, 2013

Uploaded by

nit111Copyright:

Available Formats

Visit us at www.sharekhan.

com

February 02, 2013

Sharekhan Top Picks

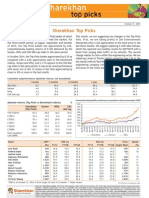

The market continued to move in a fairly narrow range in January 2013. The better than expected results in the initial part of the result season, positive global cues and monetary easing (policy rate cut by 25 basis points and cash reserve ratio reduced by 25 basis points) failed to push the market beyond the 6100 level on the Nifty. The foreign investors continue to keep faith in the Indian market but the persistent selling by the domestic investors seems to be putting pressure on the market. Consequently, the market has been largely flat since our last update on January 1, 2013. Accordingly, the Top Picks basket has also remained marginally negative in this period. With the important event of Union Budget ahead, we are making three changes in the Top Picks basket this month. As part of the churn in the pharmaceutical sector, we are replacing

Absolute outperformance (returns in %)

210.0% 180.0% 150.0% 120.0% 90.0% 60.0% 30.0% 0.0% -30.0% -60.0% CY2012 CY2011 CY2010 CY2009 Sensex Since Jan 2009 Nifty

Dishman Pharma with a more stable and front-line company, Sun Pharmaceuticals. Given the governments focus on reforms in the oil & gas sector, we are introducing Oil India in place of Bharat Heavy Eelectricals, which is struggling to procure fresh orders due to tough conditions in the power generation sector. Lastly, we believe that it is better to avoid Mahindra and Mahindra (M&M) before the Union Budget as the noises related to a higher tax on diesel vehicles are getting louder. Moreover, the move to reduce diesel under-recoveries by regularly hiking the retail price of diesel would also affect sentiments for M&M due to the companys dependence on the diesel-powered portfolio of automobiles. We are introducing United Phosphorous in place of M&M due to the latters strong performance in Q3FY2013 and attractive valuation.

Constantly beating Nifty and Sensex (cumulative returns in %)

300 250 200 150 100 50 0 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11 Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12 Jan-13 Sharekhan Sensex Nif ty

Sharekhan (Top Picks)

Name CanFin Homes Federal Bank GCPL ICICI Bank Larsen & Toubro OIL India Relaxo Footwear Reliance Sun Pharmaceutical Industries United Phosphorous Zee Entertainment Enterprises

* CMP as on February 01, 2013

CMP* (Rs) 169 511 711 1,171 1,535 526 809 893 720 132 231

FY12 7.9 11.3 36.1 20.9 22.1 9.2 24.3 14.6 28.8 11.0 37.9

PER (x) FY13E 6.4 10.3 26.4 16.4 19.6 8.5 18.7 14.2 25.4 8.4 31.2

FY14E 5.0 8.6 21.0 14.2 17.4 7.9 13.9 13.7 21.4 8.1 25.4

FY12 13.3 14.4 26.3 11.2 18.1 27.0 20.3 11.5 21.3 13.3 18.1

RoE (%) FY13E 14.5 14.1 23.2 13.0 17.7 28.2 20.4 10.6 19.1 15.2 19.2

FY14E 16.4 15.0 27.4 13.8 17.3 26.8 20.6 9.9 19.0 13.8 20.7

Price target 220 590 811 1,320 1,790 600 885 1,010 775 171 280

Upside (%) 30 15 14 13 17 14 9 13 8 30 21

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai 400 042, Maharashtra. Tel: 022 - 61150000. BSE Cash-INB011073351; F&OINF011073351; NSE INB/INF231073330; CD - INE231073330; MCX Stock Exchange: CD - INE261073330 DP: NSDL-IN-DP-NSDL233-2003; CDSL-IN-DP-CDSL-271-2004; PMS INP000000662; Mutual Fund: ARN 20669. Sharekhan Commodities Pvt. Ltd.: MCX10080; (MCX/TCM/CORP/0425); NCDEX -00132; (NCDEX/TCM/CORP/0142)

sharekhan top picks Name CMP (Rs) CanFin Homes Remarks: 169 FY12 7.9 PER (x) FY13E 6.4 FY14E 5.0 FY12 13.3 RoE (%) FY13E 14.5 FY14E 16.4 Price target 220 Upside (%) 30

CanFin Homes has renewed its focus on growth and the recent aggressive expansion of its branch network has put it on a high-growth path for the next few years. It has added 26 branches since March 2011 which amounts to an increase of close to 60% in its current branch network of 67 outlets. Consequently, we expect the companys disbursement to grow at about 60% CAGR resulting in a 38% CAGR in the loan book over FY2012-14. The companys branches are strategically located (outside cities) and serve customers requiring relatively smaller loans (of below Rs10 lakh), which are eligible for interest subvention. Further, the company gets refinancing from the National Housing Board at competitive rates due to lending in semi-urban rural areas (that account for about 40% of its loan book). Thus, we expect CanFins NIM to sustain at over 3% going ahead. The asset quality of the company is strong as its gross NPAs were under 1% of the advances and its net NPAs were nil in FY2012. This is mainly possible due to stringent credit appraisals (customer referrals preferred) and efficient recoveries. We believe the operational performance and return ratios of CanFin are improving which should lead to a rerating of the stock. We continue to value the company at 1x FY2014E BV and recommend Buy with price target of Rs220.

Federal Bank Remarks:

511

11.3

10.3

8.6

14.4

14.1

15.0

590

15

Federal Bank is an old private bank with a network of over 1,000 branches and a dominant presence in south India. Under a new management the bank is working on a strategy to gain pan-Indian presence, shift the loan book to better-rated corporates, increase the fee income, become more efficient and improve the asset quality. The asset quality of the bank has remained steady after showing some strain initially. The slippages from the SME and retail accounts have declined substantially while the slippages from the corporate accounts remain stable. Going forward, with the initiatives undertaken the recoveries could pick up and the NPAs may decline. Federal Banks loan growth has slowed over the past few quarters as the bank is cautious in view of the weakness in the economy. However, the loan growth is likely to be in line with the industry while risk adjusted margins may improve, thereby driving the operating performance. The banks return ratios are likely to go up led by an increase in the profits. We expect an RoE of ~16% and an RoA of around 1.2% by FY2015 led by a 17% CAGR in the earnings. We have revised the price target to Rs590 (1.4x FY2014E book value [BV]) and maintained our Buy rating on the stock.

sharekhan top picks Name CMP (Rs) GCPL Remarks: 711 FY12 36 PER (x) FY13E 26.4 FY14E 21.0 FY12 26.3 RoE (%) FY13E 23.2 FY14E 27.4 Price target 811 Upside (%) 14

Godrej Consumer Products Ltd (GCPL) is a major player in the Indian fast-moving consumer goods (FMCG) market with a strong presence in the personal care, hair care and home care segments in India. The recent acquisitions (in line with the 3x3 strategy) have immensely improved the long-term growth prospects of the company. On the back of a strong distribution network, and advertising and promotional support, we expect GCPL to sustain the market share in its core categories of soap and hair colour in the domestic market. On the other hand, continuing its strong growth momentum, the household insecticide business is expected to grow by ~20% YoY. In the international markets, the Indonesian and Argentine businesses are expected to achieve a revenue growth of around 25% and 35% CAGR respectively over FY2012-15. This along with the recently acquired Darling Group would help GCPL to post a top line CAGR of ~24% over FY2012-15. Due to the recent domestic and international acquisitions, the companys business has transformed from a commodities soap business into the business of value-added personal care and home care products. Therefore, we expect its OPM to be in the range of 16-18% in the coming years. Overall, we expect GCPLs bottom line to grow at a CAGR of above 25% over FY2012-15. We believe the increased competitive activity in the personal care and hair care segments and the impact of high food inflation on the demand for its products are the key risks to the companys profitability. At the current market price, the stock trades at 36.1x FY2013E EPS of Rs19.7 and 26.3x FY2014E EPS of Rs27.0.

ICICI Bank Remarks:

1,171

20.9

16.4

14.2

11.2

13.0

13.8

1,320

13

ICICI Bank continues to report a strong growth in advances with stable margins of ~3%. We expect the advances of the bank to grow by 20% CAGR over FY2012-15. This should lead to a ~21% CAGR growth in the net interest income in the same period. ICICI Banks asset quality has shown a turnaround as its NPAs have continued to decline over the last eleven quarters led by contraction in slippages. This has led to a sharp reduction in the provisions and an increase in the profitability. Going forward, we expect the NPAs to decline further which will lead to lower NPA provisions and hence aid the profit growth. Led by a pick-up in the business growth and an improvement in the margins the RoEs are likely to expand to about 15.1% by FY2015 while the RoA would improve to 1.7%. This would be driven by a 21% CAGR in profits over FY2012-15. The stock trades at 1.9x FY2014E BV. Moreover, given the improvement in the profitability led by lower NPA provisions, a healthy growth in the core income and improved operating metrics we recommend Buy with a price target of Rs1,320.

Sharekhan

February 2013

sharekhan top picks Name CMP (Rs) Larsen & Toubro Remarks: 1,535 FY12 22.1 PER (x) FY13E 19.6 FY14E 17.4 FY12 18.1 RoE (%) FY13E 17.7 FY14E 17.3 Price target 1,790 Upside (%) 17

Larsen & Toubro (L&T), the largest engineering and construction company in India, is a direct beneficiary of the strong domestic infrastructure development and industrial capital expenditure (capex) boom. L&T continues to impress us with its good execution skills, reporting decent numbers throughout the year despite the slowdown in the industrial capex cycle. We have also seen order inflow traction in recent quarters. Despite challenges like deferral of award decisions and stiff competition, the company has given respectable guidance of a 15-20% growth in revenues and order inflow for FY2013. We believe the company will manage to meet its guidance. A sound execution track record, bulging order book and strong performance of its subsidiaries reinforce our faith in L&T. With the company entering new verticals, namely solar and nuclear power, railways, and defence, there appears a huge scope for growth. At the current market price, the stock is trading at 17.4x its FY2014E consolidated earnings.

Oil India Remarks:

526

9.2

8.5

7.9

27.0

28.2

26.8

600

14

Oil India Ltd (OIL) has several hydrocarbon discoveries across reserves in Rajasthan and the north-eastern region of India. The total 1P (proven) and 2P (proven and probable) reserves of the company stood at 505 million barrels (mmbbls) and 944mmbbls in March 2012. In addition to the huge oil reserves, the companys reserve-replacement ratio (RRR) is quite healthy at 1.42x which implies a comfortable level of accretion of oil reserves through new discoveries. Recent proposal by the oil ministry to partially deregulate the diesel prices and the proposal by the Rangarajan Committee to increase the price of gas up to $8.0-8.5 per mmbtu augurs well for the company and will significantly increase the earnings of the company going ahead. Further, OIL has cash of around Rs10,935 crore (Rs182 per share) as of March 2012 and offers a healthy dividend pay-out (a dividend yield of 4.3%) which provides comfort to the investor. The key risks remain any adverse movement in the price of crude oil and failure in proper utilisation of the huge cash. We remain bullish on OIL because its huge reserves and healthy RRR would provide a reasonably stable revenue growth outlook and its stock is available at an attractive valuation. The stock is likely to be rerated on account of the partial deregulation of diesel prices. The fair value works out to Rs600 per share (based on the average fair value arrived at using the DCF, PE and EV/EBIDTA valuation methods).

Sharekhan

February 2013

sharekhan top picks Name CMP (Rs) Relaxo Footwears Remarks: 809 FY12 24.3 PER (x) FY13E 18.7 FY14E 13.9 FY12 20.3 RoE (%) FY13E 20.4 FY14E 20.6 Price target 885 Upside (%) 9

Relaxo Footwears is present in the Indian organised footwear market and is involved in the manufacturing and trading of footwear through its retail and wholesale networks. The companys top brands, namely Hawaii, Sparx, Flite and Schoolmate, have an established presence among their respective segments. The company has displayed an impressive growth rate in its top line and bottom line in the last couple of years and is expected to maintain the performance going forward. With an established distribution set-up and aggressive plans of opening own retail outlets called Relaxo Retail Shoppe, the company should be able to gain market share in the coming years. The softening rubber prices should provide a boost to the companys margins and profitability. We believe a rise in the raw material prices and a continuous slowdown in the discretionary spending remain the key risks to our volume and profitability estimates. At the current market price, the stock trades at 18.7x its FY2013E EPS of Rs43.2 and 13.9x its FY2014E EPS of Rs58.3.

Relaince Remarks:

893

14.6

14.2

13.7

11.5

10.6

9.9

1,010

13

Reliance Industries Ltd (RIL) has a strong presence in the refining, petrochemical and upstream exploration business. The refining division of the company is the highest contributor to the companys earnings and is operating efficiently with a better gross refining margin (GRM) compared with its peers in the domestic market due to the ability of its plant to refine more of heavier crude. However, the gas production from the Krishna-Godavari-D6 field has fallen significantly in the past one year. With the government approval for additional capex, we believe production will improve going ahead. In case of the upstream exploration business, the company has recently got the nod for further investments in exploration at the Krishna-Godavari basin, which augurs well for the company and could address the issue of falling gas output. Further, the new gas pricing formula recommended by the Rangarajan panel augurs well for the company and could provide further upside to the earnings. The key concerns remain a lower than expected GRM, declining profitability of the petrochemical division and the companys inability to address the issue of falling gas output in the near term. At the current market price the stock is trading at PE of 13.7x its FY2014E EPS.

Sharekhan

February 2013

sharekhan top picks Name CMP (Rs) Sun Pharma Remarks: 720 FY12 28.8 PER (x) FY13E 25.4 FY14E 21.4 FY12 21.3 RoE (%) FY13E 19.1 FY14E 19.0 Price target 775 Upside (%) 8

The combination of Sun Pharma and Taro offers an excellent business model for Sun Pharma, as has been reflected in the 50% Y-o-Y growth in revenues and a 55% growth in the profit in H1FY2013. Though Taro may not show a similar performance in the next quarter, but we expect a better performance from Sun Pharma going forward mainly driven by (1) the resumption of sales from the US based subsidiary Caraco Pharma post-USFDA clearance, (2) contribution from newly acquired Dusa Pharma and URL Pharma in the USA, and (3) the launch of key products in the US and emerging markets including India. Sun Pharma seeks to acquire the remaining equity in Taro and, if successful, that will not only help achieve better synergy but also boost earnings from the first year itself. We expect 22% and 16% revenue and PAT CAGR respectively over FY2012-1E. With a strong cash balance, Sun Pharma is well positioned to capitalise on the growth opportunities. Its debt-free balance sheet insulates it from the negative impact of volatile currency. Due to provisions of Union Budget 2012-13, which imposed Alternate Minimum Tax on partnership-based units availing of various tax concessions, Sun Pharmas earnings are likely to reduce by 9% in FY2013. At the current market price, Sun Pharma is trading at 25.4x FY2013E and 21.4x FY2014E EPS respectively. We maintain our Buy recommendation on the stock with a price target of Rs775, which implies 23x FY2014E EPS.

United Phosphorus Remarks:

132

11.0

8.4

8.1

13.3

15.2

13.8

171

30

United Phosphorus Ltd (UPL) is the leading global producer of crop protection products, intermediates, specialty chemicals and other industrial chemicals. It is the largest manufacturer of agro chemicals in India, it manufactures a wide range of products including insecticides, fungicides, herbicides, fumigants, PGR and rodenticides. UPL ranks amongst the top 5 post-patent agro chemical companies in the world. It has 23 manufacturing sites (nine in India, four in France, two in Spain, three in Argentina, one each in UK, Vietnam, Netherlands, Italy, and China) and capability in applied R&D. The business environment for the agro chemical industry is likely to witness a gradual improvement, driven by strong agri-commodity prices and a low base effect. Europe is also witnessing a recovery in growth as the environment is becoming favourable for agriculture. The company is already recording a good growth in India and the Rest of the World markets due to the favourable weather conditions. With the acquisition of SIB and DVA Agro Brazil it has established a strong foothold in one of the largest markets for agro-chemicals. While these acquisitions will be the key growth driver over the next two to three years, they will also reduce the seasonality in the business, as UPL now has a reasonable presence in both the northern and the southern hemisphere. The performance of UPL in Q3FY2013 was ahead of our estimate and its margin was largely in line with our estimate. The commentary of the management also indicated a revival in demand along with a growth in volume in Latin America and North America. We have broadly maintained our earnings estimates for the company and rolled over our target multiple to the FY2015 estimate. Consequently, we have increased our price target to Rs171 and maintained our Buy rating on the stock.

Sharekhan

February 2013

sharekhan top picks Name CMP (Rs) Zee Entertainment Enterprises Remarks: 231 FY12 37.9 PER (x) FY13E 31.2 FY14E 25.4 FY12 18.1 RoE (%) FY13E 19.2 FY14E 20.7 Price target 280 Upside (%) 21

Among the key stakeholders of the domestic TV industry, we expect broadcasters to be the prime beneficiary of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry. Zee TV climbed to the top position in the Hindi GEC (general entertainment channel) hierarchy in the fourth week of 2013, after almost 19 weeks. Zee TV's upward crawl to the No. 1 position was driven by Zee Cine Awards, which got a whopping 3.9 Television Viewer Rating (TVR), contributing 31 gross rating points, as Zee TV collected 237 points in the week ended January 26, 2013. Zee TVs return to the number 1 spot among the GECs is a positive development for ZEEs advertisement revenues and the companys ability to command premium advertisement rates compared with its competitors. ZEEs earnings are expected to grow at a CAGR of 25% over FY2013-15. Further, strong cash levels would drive the management to reward the shareholders which would act as a positive trigger for the stock. At the current market price of Rs236, the stock trades at 26x on FY2014E and 21x FY2015 earnings estimates. We maintain our Buy rating on the stock with a price target of Rs280.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Disclaimer This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report. The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements 2013 February made herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Sharekhan

You might also like

- A Note On Venture Capital IndustryDocument9 pagesA Note On Venture Capital Industryneha singhNo ratings yet

- Sharekhan Top Picks: January 01, 2013Document7 pagesSharekhan Top Picks: January 01, 2013Rajiv MahajanNo ratings yet

- Sharekhan Top Picks: October 26, 2012Document7 pagesSharekhan Top Picks: October 26, 2012Soumik DasNo ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Weekly Wrap: Investment IdeaDocument4 pagesWeekly Wrap: Investment IdeaAnonymous 0JhO3KdjNo ratings yet

- IEA Report 22th DecemberDocument21 pagesIEA Report 22th DecembernarnoliaNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- Shriram Transport Finance LTD.: Concerns OverdoneDocument17 pagesShriram Transport Finance LTD.: Concerns OverdoneDhina KaranNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Stock Update Wonderla Holidays Viewpoint Zee Learn: IndexDocument4 pagesStock Update Wonderla Holidays Viewpoint Zee Learn: IndexRajasekhar Reddy AnekalluNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- India Equity Analytics Today: Hold Rating On Prestige Estates StockDocument25 pagesIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- HDFC Bank - Visit Update - Oct 14Document9 pagesHDFC Bank - Visit Update - Oct 14Pradeep RaghunathanNo ratings yet

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocument4 pagesTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152No ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- Market Outlook 16th September 2011Document6 pagesMarket Outlook 16th September 2011Angel BrokingNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Document20 pagesWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeNo ratings yet

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDocument12 pagesHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalNo ratings yet

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Document5 pagesFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarNo ratings yet

- Analyst Report Issued by IIFL (Company Update)Document16 pagesAnalyst Report Issued by IIFL (Company Update)Shyam SunderNo ratings yet

- KRBL ReportDocument28 pagesKRBL ReportHardeep Singh SohiNo ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Stock Update PTC India: IndexDocument6 pagesStock Update PTC India: IndexRam NarayananNo ratings yet

- SharekhanTopPicks 030811Document7 pagesSharekhanTopPicks 030811ghachangfhuNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Arman F L: Inancial Services TDDocument10 pagesArman F L: Inancial Services TDJatin SoniNo ratings yet

- PC Jeweller LTD IER InitiationReport 2Document28 pagesPC Jeweller LTD IER InitiationReport 2Himanshu JainNo ratings yet

- Stock Update Yes Bank Stock Update Persistent Systems: IndexDocument8 pagesStock Update Yes Bank Stock Update Persistent Systems: IndexShivam DaveNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- 10 MidcapsDocument1 page10 MidcapspuneetdubeyNo ratings yet

- Indian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Document21 pagesIndian Equity Market Capitalization Today - Buy Stocks of Emami LTD With Target Price Rs 635.Narnolia Securities LimitedNo ratings yet

- IEA Report 23rd DecemberDocument24 pagesIEA Report 23rd DecembernarnoliaNo ratings yet

- Sharekhan Top Picks: April 03, 2010Document6 pagesSharekhan Top Picks: April 03, 2010Kripansh GroverNo ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Initiating Coverage HDFC Bank - 170212Document14 pagesInitiating Coverage HDFC Bank - 170212Sumit JatiaNo ratings yet

- Aug 11Document18 pagesAug 11randeepsNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Which Sensex Stocks Should You Bet On - The Economic Times On MobileDocument22 pagesWhich Sensex Stocks Should You Bet On - The Economic Times On MobileKirti NagdaNo ratings yet

- PSO Detailed Report 2Document9 pagesPSO Detailed Report 2Javaid IqbalNo ratings yet

- Maruti Suzuki Financial Ratios, Dupont AnalysisDocument12 pagesMaruti Suzuki Financial Ratios, Dupont Analysismayankparkhi100% (1)

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Diwali Icici 081112Document8 pagesDiwali Icici 081112Mintu MandalNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Reliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee SuganyaDocument8 pagesReliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee Suganyachitu1992No ratings yet

- Annual Report 2012-2013 Federal BankDocument192 pagesAnnual Report 2012-2013 Federal BankMoaaz AhmedNo ratings yet

- Indag Rubber Note Jan20 2016Document5 pagesIndag Rubber Note Jan20 2016doodledeeNo ratings yet

- Diwali-Picks Microsec 311013 PDFDocument14 pagesDiwali-Picks Microsec 311013 PDFZacharia VincentNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Khadim India LTD - IPO NoteDocument3 pagesKhadim India LTD - IPO Notenit111No ratings yet

- E Copy 32Document50 pagesE Copy 32nit111No ratings yet

- Company Analysis - NESCO LTDDocument3 pagesCompany Analysis - NESCO LTDnit111No ratings yet

- Accounting FraudsDocument34 pagesAccounting Fraudsnit111No ratings yet

- Session 5 Technology Cases IndiaDocument14 pagesSession 5 Technology Cases Indianit111No ratings yet

- Value Investors Group PDFDocument11 pagesValue Investors Group PDFnit111100% (1)

- Corporation Bank ReportDocument11 pagesCorporation Bank Reportnit111No ratings yet

- Wednesday July 31, 2013: Sensex Nifty RS./$Document3 pagesWednesday July 31, 2013: Sensex Nifty RS./$nit111No ratings yet

- Jyoti Structures (JYOSTR) : When Interest Burden Outweighs AllDocument10 pagesJyoti Structures (JYOSTR) : When Interest Burden Outweighs Allnit111100% (1)

- Multi Commodity Exchange of IndiaDocument6 pagesMulti Commodity Exchange of Indianit111No ratings yet

- BUY BUY BUY BUY: Apollo Hospitals Enterprise LTDDocument14 pagesBUY BUY BUY BUY: Apollo Hospitals Enterprise LTDnit111No ratings yet

- CeraSanitaryware 1QFY2014RU - PDF 110713Document15 pagesCeraSanitaryware 1QFY2014RU - PDF 110713nit111No ratings yet

- Reliance Capital - Initiating Coverage - Centrum 06122012Document19 pagesReliance Capital - Initiating Coverage - Centrum 06122012nit111No ratings yet

- Tracking Technicals DrreddysDocument1 pageTracking Technicals Drreddysnit111No ratings yet

- ExchangeDocument6 pagesExchangeBea Marie Dejillas0% (1)

- DTT Effectively Stopping Continuation SetupsDocument9 pagesDTT Effectively Stopping Continuation Setupsmangelbel6749100% (1)

- CRISIL Research Ier Report Fortis HealthcareDocument28 pagesCRISIL Research Ier Report Fortis HealthcareSai SantoshNo ratings yet

- Ifrs PDFDocument6 pagesIfrs PDFkeenu23No ratings yet

- Physical Meaning of SMDocument39 pagesPhysical Meaning of SMVikas MehtaNo ratings yet

- International Banking Blackbook Final ProjectDocument76 pagesInternational Banking Blackbook Final ProjectDILIP JAIN50% (2)

- Backbase Becoming Digital-First WhitepaperDocument20 pagesBackbase Becoming Digital-First Whitepaperjsconrad12100% (1)

- St. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDocument9 pagesSt. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDianna Tercino IINo ratings yet

- Time Value of Money FormulasDocument8 pagesTime Value of Money FormulasrovosoloNo ratings yet

- Setting Up of A Small Business EnterpriseDocument36 pagesSetting Up of A Small Business EnterprisesukanyaNo ratings yet

- Yaokasin vs. Commissioner of CustomsDocument27 pagesYaokasin vs. Commissioner of CustomsPen MalubagNo ratings yet

- Legal Framework The Report Myanmar 2017Document11 pagesLegal Framework The Report Myanmar 2017chaw htet myatNo ratings yet

- Ansoff MatrixDocument4 pagesAnsoff Matrixpushpane100% (3)

- Optimised Funds Fairbairn Capital's Investment Frontiers From Old MutualDocument2 pagesOptimised Funds Fairbairn Capital's Investment Frontiers From Old MutualTiso Blackstar GroupNo ratings yet

- Concept of Capital StructureDocument22 pagesConcept of Capital StructurefatimamominNo ratings yet

- Bucharest Hotel ProjectsDocument8 pagesBucharest Hotel ProjectsLili LewhitteNo ratings yet

- Oil Money 2015 BrochureDocument6 pagesOil Money 2015 BrochureTwirXNo ratings yet

- JR Cover Letter-SIFDocument2 pagesJR Cover Letter-SIFrwomubitooke johnNo ratings yet

- Ghatna EnglishDocument20 pagesGhatna EnglishSachin SarwadeNo ratings yet

- Types of Financial Model: Why Financial Models Are Prepared?Document4 pagesTypes of Financial Model: Why Financial Models Are Prepared?2460985No ratings yet

- Questions FinmanDocument8 pagesQuestions FinmanNiña Rhocel YangcoNo ratings yet

- Sequences and Series NotesDocument26 pagesSequences and Series Notesapi-231638444No ratings yet

- Tutorial 5 Basic Group AccountingDocument5 pagesTutorial 5 Basic Group AccountingKelvin LeongNo ratings yet

- SIP PROJECT REPORT FOR College RealDocument60 pagesSIP PROJECT REPORT FOR College RealTanaya GhosalNo ratings yet

- Midterm Exam FABM 2Document2 pagesMidterm Exam FABM 2Vee Ma100% (2)

- ENR Top 225 International Design Firms 2014Document83 pagesENR Top 225 International Design Firms 2014vhiribarneNo ratings yet

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateDocument8 pagesSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerNo ratings yet

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet