Professional Documents

Culture Documents

International Commodities Evening Update, February 07 2013

International Commodities Evening Update, February 07 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Commodities Evening Update, February 07 2013

International Commodities Evening Update, February 07 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Evening Update

Thursday | February 7, 2013

International Commodities

Content

Days overview Market Highlights Outlook Important Events for Today

Overview:

Research Team

Nalini Rao - Sr. Research Analyst nalini.rao@angelbroking.com (022) 2921 2000 Extn. 6135 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn. 6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

Commodities Evening Update

Thursday | February 7, 2013

International Commodities

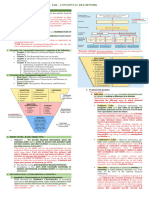

News and Analysis UKs Manufacturing Production increased 1.6 percent in December. Indian government has lowered forecast to 5 percent for FY 12-13. French Trade Balance was at a deficit of 5.3 bn Euros in December. Indian government has lowered the forecast to 5 percent for Fiscal Year 2012-2013 from previous estimates of 6.2 percent. Farm growth in the country is expected to grow by 1.8 percent and manufacturing growth forecasted at 1.9 percent in the Financial Year 2012-13. Also, International Monetary Fund (IMF) on Wednesday has lowered Indias growth forecast to 5.4 percent for the current fiscal year from earlier estimates of 6.2 percent. French Trade Balance was at a deficit of 5.3 billion Euros in December as against a previous deficit of 4.3 billion Euros in November. UKs Manufacturing Production increased by 1.6 percent in December as against a decline of 0.3 percent a month ago. Trade Balance was at a deficit of 8.9 billion Pounds in December from earlier deficit of 9.2 billion Pounds in November. Industrial Production grew by 1.1 percent in December as compared to rise of 0.3 percent in prior month. Spot gold prices are trading on a flat note on the back of rise in risk appetite in the global markets sentiments. Additionally, weakness in the DX also supported an upside in the gold prices. The yellow metal touched an intra-day high of $1680.95/oz and hovered around $1677.10/tonne in todays trade. In the Indian markets, depreciation in the Indian Rupee supported an upside in the prices. Taking cues from rise in gold prices along with upside in base metals prices, Spot silver prices gained marginally and traded on a flat note. Additionally, weakness in the DX also acted as a positive factor for the white metal prices. On the domestic front, prices gained on the back of depreciation in the Indian Rupee. The base metals complex traded on a mixed note today ahead of the European zone policymakers meeting. Further mixed LME inventories along with weakness in the DX also supported an upside in the prices. In the Indian markets, depreciation in the Rupee acted as a positive factor for the prices on the MCX. Nymex crude oil prices increased by 0.35 percent taking cues from decline in supplies at the Cushing, Okhlama biggest delivery point for crude in US. Weakness in the DX also supported an upside in the crude prices. Crude oil prices touched an intra-day high of $96.99/bbl and was trading at $96.96/bbl today till 4:30pm IST. On the domestic bourses, prices rose marginally and traded on flat note on account of depreciation in the Indian Rupee. Performance during the day

Index Nifty Sensex Nikkei Kospi FTSE Open 5936.45 19589.44 11406.32 1939.42 16635.69 High 5978.50 19702.56 11446.81 1946.67 16796.97

as at 4.30 pm 07 February 13

Low 5927.60 19540.08 11295.62 1931.10 16565.48 Last 5938.80 19580.32 11357.07 1931.77 16565.48 % Chg from Prev day -0.34 -0.30 -0.93 -0.23 0.78

Source: Reuters

as at 4.30 pm 07 February 13

Currency Dollar Index Euro/$ Spot INR/$ Spot Open 79.81 1.352 53.06 High 79.86 1.3577 53.325 Low 79.58 1.3502 53.04 Current 79.595 1.3571 53.26 % Chg from Prev day -0.22 0.38 0.20

Source: Reuters

as at 4.30 pm 07 February 13

Commodity Spot Gold Comex Gold Mar13 MCX Gold Apr13 Spot Silver Comex Silver Mar13 MCX Silver Mar 13 Crude Oil Nymex Feb 13 ICE -Brent Crude Oil* MCX Crude Oil Feb 13 Copper LME - 3 Month MCX Copper Feb13 Zinc LME - 3 Month Zinc MCX - Feb13 Lead LME - 3 Month Lead MCX - Feb13 Nickel LME - 3 Month Nickel MCX Feb13 Aluminum LME - 3 Month Aluminum MCX Feb13 Unit Open High Low Last % Chg from Prev day

$/oz $/oz Rs/10g ms $/oz $/oz Rs/kg $/bbl $/bbl Rs/bbl $/tonne Rs/kg $/tonne Rs/kg $/tonne Rs/kg $/tonne Rs/kg $/tonne Rs/kg

1677.10 1677.00 30721.00 31.80 28.23 58369 96.86 116.90 5144 8245.25 440.15 2167.25 114.10 2425.25 128.40 18353 982.80 2101.0 110.45

1680.95 1680.60 30775.0 31.88 31.92 58480 96.99 117.72 5172 8264.25 442.60 2167.50 114.70 2425.25 128.80 18360 987.40 2106.75 111.15

1674.74 1674.80 30692.0 31.70 31.84 58292 96.44 116.75 5142 8211.0 439.70 2144.0 113.75 2395.25 127.70 18220 982.30 2082.0 110.0

1677.10 1674.80 30711.00 31.81 31.861 58376 96.96 117.64 5139 8263.0 442.60 2160.0 114.45 2420.0 128.80 18320 985.70 2106.75 111.10

0.00 -0.17 0.00 0.00 0.01 0.00 0.35 0.78 0.00 0.34 0.66 -0.22 0.04 0.00 0.19 -0.16 0.12 0.24 0.45

Source: Reuters.

Commodities Evening Update

Thursday | February 7, 2013

International Commodities

Outlook In the evening session, we expect precious metals, base metals and crude oil prices to trade on a positive note on the back of expectations of favorable unemployment claims data from US coupled with weakness in the DX. Addiitionally, rise in the German Industrial Production and increase in UKs manufacturing and industrial production will also support an upside in the prices. Further, any optimistic statement from Euro Zone policymakers meeting will also act as a positive factor for the prices.

Technical Outook for evening session 7 February 13 ( CMP as of 5.00 pm)

Commodity Gold April '13 Spot Gold Silver Mar13 Spot Silver Crude Oil Feb'13 Nymex Crude Oil Feb13 Natural Gas Feb13 Copper Feb 13 Zinc Feb13 Lead Feb13 Aluminum Feb13 Nickel Feb13 Unit Rs/10 gm $/oz Rs /kg $/oz Rs /bbl $/bbl Rs /mmBtu Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg Support 2 30611 1670 58140 31.58 5094 95.55 180.7 438.2 113.35 127 109.7 959 Support 1 30692 1675 58317 31.7 5132 96.3 182.4 439.65 113.65 127.6 110 967 CMP 30746 1676.8 58450 31.81 5170 96.95 184 442.45 114.5 128.7 111.1 976 Resistance1 30805 1682 58577 31.94 5198 97.5 185.7 442.8 114.95 129.4 111.45 980.5 Resistance 2 30870 1687 58746 32.07 5236 98.2 187.6 444.8 115.45 130.15 111.9 987.6

Important Events for Today

Indicator Core Machinery Orders m/m EU Economic Summit Manufacturing Production m/m Trade Balance BOE Gov-Designate Carney Speaks French 10-y Bond Auction German Industrial Production m/m Asset Purchase Facility Official Bank Rate MPC Rate Statement Minimum Bid Rate ECB Press Conference Unemployment Claims Prelim Nonfarm Productivity q/q Prelim Unit Labor Costs q/q FOMC Member Stein Speaks NIESR GDP Estimate Country Japan Euro UK UK UK Euro Euro UK UK UK Euro Euro US US US US UK Time (IST) 5:20am Day 1 3:00pm 3:00pm 3:15pm Tentative 4:30pm 5:30pm 5:30pm Tentative 6:15pm 7:00pm 7:00pm 7:00pm 7:00pm 8:00pm 8:30pm Actual 2.8% 1.6% -8.9B 1.1% 0.3% Forecast -0.7% 0.7% -8.9B 0.2% 375B 0.50% 0.75% 361K -0.8% 2.8% Previous 3.9% -0.3% -9.2B 2.07/1.7 -0.2% 375B 0.50% 0.75% 368K 2.9% -1.9% -0.3% Impact Medium High High Medium High Medium Medium High High High High High High Medium Medium Medium Medium

You might also like

- Business Benchmark Advanced Students Book Bec Sample PagesDocument4 pagesBusiness Benchmark Advanced Students Book Bec Sample PagesEduardo de Zaira0% (1)

- Final Case Study Investment AnalysisDocument4 pagesFinal Case Study Investment AnalysisMuhammad Ahsan MubeenNo ratings yet

- Accra Beach Hotel Case - RespuestasssDocument3 pagesAccra Beach Hotel Case - RespuestasssDianita PizarroNo ratings yet

- International Commodities Evening Update 07 March 2013Document3 pagesInternational Commodities Evening Update 07 March 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 20 2013Document3 pagesInternational Commodities Evening Update, June 20 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 27 2013Document3 pagesInternational Commodities Evening Update, June 27 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, May 22 2013Document3 pagesInternational Commodities Evening Update, May 22 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, August 14 2013Document3 pagesInternational Commodities Evening Update, August 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 16 2013Document3 pagesInternational Commodities Evening Update, July 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, May 23 2013Document3 pagesInternational Commodities Evening Update, May 23 2013Angel BrokingNo ratings yet

- International Commodities Evening Update May 10 2013Document3 pagesInternational Commodities Evening Update May 10 2013Angel BrokingNo ratings yet

- International Commodities Evening Update December 6Document3 pagesInternational Commodities Evening Update December 6Angel BrokingNo ratings yet

- International Commodities Evening Update, June 10 2013Document3 pagesInternational Commodities Evening Update, June 10 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 10 2013Document3 pagesInternational Commodities Evening Update, July 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 9 2013Document6 pagesDaily Metals and Energy Report, May 9 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, May 30 2013Document3 pagesInternational Commodities Evening Update, May 30 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 24 2013Document3 pagesInternational Commodities Evening Update, June 24 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 19 2013Document3 pagesInternational Commodities Evening Update, June 19 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, May 24 2013Document3 pagesInternational Commodities Evening Update, May 24 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 24 2013Document3 pagesInternational Commodities Evening Update, July 24 2013Angel BrokingNo ratings yet

- March 092012 - 66090312Document3 pagesMarch 092012 - 66090312Pradeep BhimaneniNo ratings yet

- International Commodities Evening Update, July 29 2013Document3 pagesInternational Commodities Evening Update, July 29 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, August 19 2013Document3 pagesInternational Commodities Evening Update, August 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 17 2013Document3 pagesInternational Commodities Evening Update, June 17 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 11 2013Document3 pagesInternational Commodities Evening Update, July 11 2013Angel BrokingNo ratings yet

- International Commodities Evening Update August 29 2013Document3 pagesInternational Commodities Evening Update August 29 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 11 2013Document3 pagesInternational Commodities Evening Update, June 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 17 2013Document6 pagesDaily Metals and Energy Report, May 17 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 14 2013Document3 pagesInternational Commodities Evening Update, June 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update November 14Document3 pagesInternational Commodities Evening Update November 14Angel BrokingNo ratings yet

- International Commodities Evening Update November 22Document3 pagesInternational Commodities Evening Update November 22Angel BrokingNo ratings yet

- International Commodities Evening Update 06 March 2013Document3 pagesInternational Commodities Evening Update 06 March 2013Angel BrokingNo ratings yet

- International Commodities Evening Update November 29Document3 pagesInternational Commodities Evening Update November 29Angel BrokingNo ratings yet

- International Commodities Evening Update August 28 2013Document3 pagesInternational Commodities Evening Update August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update July 18 2013Document3 pagesInternational Commodities Evening Update July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 21 2013Document6 pagesDaily Metals and Energy Report, May 21 2013Angel BrokingNo ratings yet

- International Commodities Evening Update November 19Document3 pagesInternational Commodities Evening Update November 19Angel BrokingNo ratings yet

- International Commodities Evening Update July 25 2013Document3 pagesInternational Commodities Evening Update July 25 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report October 23Document6 pagesDaily Metals and Energy Report October 23Angel BrokingNo ratings yet

- International Commodities Evening Update, June 12 2013Document3 pagesInternational Commodities Evening Update, June 12 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, June 26 2013Document3 pagesInternational Commodities Evening Update, June 26 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, August 22 2013Document3 pagesInternational Commodities Evening Update, August 22 2013Angel BrokingNo ratings yet

- International Commodities Evening Update August 27 2013Document3 pagesInternational Commodities Evening Update August 27 2013Angel Broking100% (1)

- Daily Metals and Energy Report, February 12Document6 pagesDaily Metals and Energy Report, February 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 16 2013Document6 pagesDaily Metals and Energy Report, July 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update November 23Document3 pagesInternational Commodities Evening Update November 23Angel BrokingNo ratings yet

- International Commodities Evening Update, June 21 2013Document3 pagesInternational Commodities Evening Update, June 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report October 11Document6 pagesDaily Metals and Energy Report October 11Angel BrokingNo ratings yet

- International Commodities Evening Update, May 20 2013Document3 pagesInternational Commodities Evening Update, May 20 2013Angel BrokingNo ratings yet

- International Commodities Evening Update July 17 2013Document3 pagesInternational Commodities Evening Update July 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 07 2013Document6 pagesDaily Metals and Energy Report, February 07 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 18Document6 pagesDaily Metals and Energy Report, April 18Angel BrokingNo ratings yet

- International Commodities Evening Update, August 21 2013Document3 pagesInternational Commodities Evening Update, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 23Document6 pagesDaily Metals and Energy Report, April 23Angel BrokingNo ratings yet

- International Commodities Evening Update, July 30 2013Document3 pagesInternational Commodities Evening Update, July 30 2013Angel BrokingNo ratings yet

- Daily Metal and Energy Report, 24 January 2013Document6 pagesDaily Metal and Energy Report, 24 January 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 15 2013Document3 pagesInternational Commodities Evening Update, July 15 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, May 21 2013Document3 pagesInternational Commodities Evening Update, May 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 23Document6 pagesDaily Metals and Energy Report August 23Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- 2011 Jun 10 Steven Hodgson and Sarah Asham Have AgreedDocument1 page2011 Jun 10 Steven Hodgson and Sarah Asham Have AgreedMiroslav GegoskiNo ratings yet

- Equitymaster-Knowledge Centre-Intelligent Investing PDFDocument176 pagesEquitymaster-Knowledge Centre-Intelligent Investing PDFarif420_999No ratings yet

- Entrepreneurship J BDocument39 pagesEntrepreneurship J BSUBHASMITA SAHUNo ratings yet

- Industrialization in PakistanDocument27 pagesIndustrialization in PakistanMuhammad faisalNo ratings yet

- Writing Your 1st Business Plan (Ebook)Document21 pagesWriting Your 1st Business Plan (Ebook)tinoyan100% (1)

- IFC Brazil InvestmentsDocument105 pagesIFC Brazil InvestmentsWagner V. Veríssimo (wvverissimo)No ratings yet

- Far Reviewer - Conceptual FrameworkDocument3 pagesFar Reviewer - Conceptual Frameworkprish yeolhanNo ratings yet

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocument11 pagesChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Ghana Saluminum LarsHildebrandDocument37 pagesGhana Saluminum LarsHildebrandSolo NunooNo ratings yet

- Swot Analysis of Apparel Export Business For Bangladesh With Respect To IndiaDocument15 pagesSwot Analysis of Apparel Export Business For Bangladesh With Respect To IndiaGovindasamy ArumugamNo ratings yet

- Political InstitutionsDocument18 pagesPolitical Institutionswgl.joshiNo ratings yet

- SPS Watershed Works Manual EngDocument320 pagesSPS Watershed Works Manual EngtejaschimoteNo ratings yet

- Accounting For Business Combination PART 1Document30 pagesAccounting For Business Combination PART 1Niki DimaanoNo ratings yet

- Working Capital Management in HCL InfosystemDocument30 pagesWorking Capital Management in HCL InfosystemCyril ChettiarNo ratings yet

- Burgundy - MosDocument4 pagesBurgundy - MosvunguyenorbisNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Project ReportDocument52 pagesProject ReportAkanksha SinhaNo ratings yet

- Ford Decline MOdelDocument5 pagesFord Decline MOdelRikesh BhattacharyyaNo ratings yet

- MCB - Standlaone Accounts 2007Document83 pagesMCB - Standlaone Accounts 2007usmankhan9No ratings yet

- Sahyadri Farmers Producer Company LimitedDocument9 pagesSahyadri Farmers Producer Company LimitedKamlakar AvhadNo ratings yet

- Report On Vietnam Textile and Garment Industry: Page 1 of 34Document34 pagesReport On Vietnam Textile and Garment Industry: Page 1 of 34NoumanKhanNo ratings yet

- GML Investissement Ltée AND Ireland Blyth Limited: Amalgamation ProposalDocument44 pagesGML Investissement Ltée AND Ireland Blyth Limited: Amalgamation Proposalelvis007No ratings yet

- Chapter 2: Concept and Role of A Mutual FundDocument9 pagesChapter 2: Concept and Role of A Mutual FundshubhamNo ratings yet

- RM Roll No 25 STD Id 42293 Bhoir Yudhira SubhashDocument21 pagesRM Roll No 25 STD Id 42293 Bhoir Yudhira Subhashyudhira BhoirNo ratings yet

- 1.5 Energy Action PlanningDocument31 pages1.5 Energy Action PlanningAshutosh Singh100% (2)

- Chapter 10 Hitt PP SlidesDocument16 pagesChapter 10 Hitt PP SlidesPriyanka DhawanNo ratings yet