Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1K viewsFinancial Statements

Financial Statements

Uploaded by

CherokeeMetroCHEROKEE METROPOLITAN

DISTRICT

FINANCIAL STATEMENTS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tap Schedule 2016Document1 pageTap Schedule 2016CherokeeMetroNo ratings yet

- 50 Cross-Connection Questions, Answers & IllustrationsDocument12 pages50 Cross-Connection Questions, Answers & IllustrationsCherokeeMetro100% (1)

- Call For NominationsDocument1 pageCall For NominationsCherokeeMetroNo ratings yet

- Sundance Water Supply Project Purpose & BackgroundDocument2 pagesSundance Water Supply Project Purpose & BackgroundCherokeeMetroNo ratings yet

- Cherokee Metro Parks and Open Spaces MapDocument1 pageCherokee Metro Parks and Open Spaces MapCherokeeMetro100% (1)

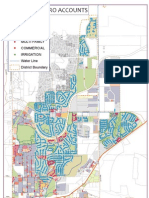

- Cherokee Metro AccountsDocument1 pageCherokee Metro AccountsCherokeeMetroNo ratings yet

- Water ReturnsDocument2 pagesWater ReturnsCherokeeMetroNo ratings yet

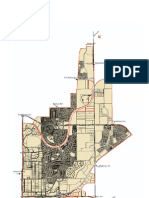

- Cherokee Boundaries MapDocument1 pageCherokee Boundaries MapCherokeeMetroNo ratings yet

- Sundance Water Supply ProjectDocument14 pagesSundance Water Supply ProjectCherokeeMetroNo ratings yet

- El Paso Household Waste FlyerDocument1 pageEl Paso Household Waste FlyerCherokeeMetroNo ratings yet

Financial Statements

Financial Statements

Uploaded by

CherokeeMetro0 ratings0% found this document useful (0 votes)

1K views48 pagesCHEROKEE METROPOLITAN

DISTRICT

FINANCIAL STATEMENTS

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCHEROKEE METROPOLITAN

DISTRICT

FINANCIAL STATEMENTS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

1K views48 pagesFinancial Statements

Financial Statements

Uploaded by

CherokeeMetroCHEROKEE METROPOLITAN

DISTRICT

FINANCIAL STATEMENTS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 48

CEE

CHEROKEE METROPOLITAN DISTRICT

BASIC FINANCIAL STATEMENTS

AND SUPPLEMENTAL INFORMATION

With Independent Auditors’ Report

‘YEAR ENDED DECEMBER 31, 2015

BOARD OF TRUSTEES

President, Janet Cederberg

Vice President, Dave Mattes

Secretary, Melody Helton

Director Larry Keleher

Director David Hacker

CHEROKEE METROPOLITAN DISTRICT

‘TABLE OF CONTENTS.

INDEPENDENT AUDITORS’ REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

BASIC FINANCIAL STATEMENTS AS OF AND FOR THE

‘YEAR ENDED DECEMBER 31,2015:

Government-vide Financial Statements:

‘Statement of Net Postion

Statement of Activities

nd Financial Statements:

‘Balance Shest ~ Gavernmental Funds and Reconciliation ofthe Governmental

‘und Balance Shoo othe Statement of Net Postion

Statement of Revenues, Expenditures and Changes in Fund Balance —

Governmental Funds

Reconciliation ofthe Statement of Revenues, Expenditures and Changes in

Fund Balance ~ Governmental Fund othe Statement of Net Position

Statement of Net Postion ~ Proprietary Funds

‘Statement of Revenurs, Expenses and Change in Net Position ~

Propriotary Funds

‘Statement of Cath Flows ~ Proprietary Funds

Schedule of Revenuss, Expenditures and Change in Fund Balance ~ Budget and Actual ~

‘General Fund

‘Schedule of Revenues, Expenditures and Change in Fund Balance Budget and Actual—

Darks Fund

[Notes to the Financial Statements

‘SUPPLEMENTAL INFORMATION

Schedule of Revenues, Expenses and Change in Funds Available ~ Budget and Actual

(Non-GAAP Budgetary Basis) ~ Water and Wastewater Fund

Schedule of Revenues, Expenses and Change in Funds Available Budget and Actual

‘(Noa-GAAP Budgelary Basis)~ Golf Course Fund

Debt Service Coverage and Reserve Requirements

Page

L

10

n

BR

a

Seal

INDEPENDENT AUDITORS!’ REPORT

Board of Director:

(Cherokee Metropolitan Distict

Colorado Springs, Colorado

‘We have ated the accompanying financial statements ofthe govemmental activities, the business ¢ype

activites, and each major fund of Cherokee Metropolitan Distt, (dhe Distt) as of and for the year

ended December 31, 2015, andthe related nots to the financial statzments, which collectively comprise

the Distr: basic financial statements as listed in the table of contents,

‘Management's Responsibility forthe Financial Statements

‘Management i8 responsible for the preparation and fair presentation of those financial statements in

sccordance with accounting principles gencrally accepted inthe United States of America; his includes

the design, implementation, and maintenance of intemal control relevant to the preparation and fair

presentation of financial statoments tat are fice from material misstatement, whether duc to fraud of

Auditors! Responsibility

Our responsiblity is to express opinions on these financial statements based on our audit. We conducted

‘our audit in acordance with auditing standards generally accepted inthe United States of America. Those

standards requite that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are fie from material misstatement.

‘An audit ivolvs performing procedures to obsin audit evidence about the amounts and disclosures in

the financial statements. The procedures selected depend on the auditors judgment, including the

assessment ofthe risk of material misstatement of the financial statements, whether due to fraud or ero.

In making those risk assesements, the auditor considers internal contol relevant tothe ents preparation

and fair presentation of the financial statements inorder to design auit procedures that ae appropritc in

the cireumstancss, but not forthe purpose of expressing an opinion on the effoiveness of the entity's

intemal control. Accoadinly, wo express 20 such opinion. An audit also includes evaluating the

appropriateness of accounting policies used and the reasonableness of significant accounting estimates

‘made by management, as well as evaluating the overall presentation of the financial statements.

We teliove thatthe uit evidence we have obtained is sufficient and appropriate to provide a bass for

vr it opinions,

c iuors [102 N. Concade Avenve, Suite 400, Coloredo Spring

Opinions

In our opinion, the financial statcments refered to above present fisly, in all material respects, the

respective financial position of the governmental activites, the businss-type activities and each major

find of the Distt as of Docembr 31, 2015, and the respective changes in nancial postion and, where

applicable, cash flows thereof forthe year then ended in accordance with secounting principles generally

accepted inthe United States of America.

Report on Required Supplemental Information

‘Accounting principles gonemlly nccopted inthe United States of Amevica rogue thatthe management's

discussion and analysis on pages 1 Unough 5 be presented to supplomont the basic financial statomonts.

Such information, although not a part of the basic financial statements is required by'the Governmental

[Accounting Standards Board, who considers itt bean escatial part of financial reporting fo placing the

‘basi financial statements in an appropriate operational, economic or historical context. We have applied

‘certain limited procedures tothe required supplemental information in accordance with auditing standaads

senerally accepted inthe United States of America, which consisted of inquires of management about the

‘methods of proping the information and comparing the information fo consistency with management's

responses to our inquiries, the basic financial statements and other knowledge we obtained during out

audit ofthe basic financial statements. We do not express an opinion or provide any assurance on the

infomation because the limited procedures do not provide us with sufficient evidence to express an

pinion or provide any assurance,

Report on Other Supplemental Information

‘Our ait was conducted forthe purpose of forming opinions onthe financial statements that collectively

comprise the Districts basic financial statements. The supplemental schedules are presented for purposes

‘of additional analysis and are nota required part of the base financial statements

‘Tho supplemental schodules on pages 38 though 40 are the responsibility of management and were

derived from and relate directly tothe underlying accounting and other records ued to prepare the basic

financial statements. Such information has boen subjected tothe auditing procedures applied in the audit

ofthe basic financial statements and certain additonal procedurs, including comparing and reconciling

such information directly to the underying accounting and otber records used to prepare the basic

financial statements oF to the basic financial statements themselves, and other addtional procedures in

sccordance with auditing standards generally accepted inthe United States of Ameria. In our opinion,

the information i fairly state in all material respects in tlation to the basic financial statements as a

whole

Stockman Kase Ryan & Co. LLP

‘September 28, 2016

MANAGEMENT'S DISCUSSION AND ANALYSIS.

CHEROKEE METROPOLITAN DISTRICT

(MANAGEMENT'S DISCUSSION AND ANALYSIS

‘Th Management Discussion and Analysis (MD&A) is presented to provide an overview ofthe Financia

ssctivites and conditions fr the fiscal year ended on December 31,2015. The MD&A contains information

Currently known to management as ofthe date of the auditor's report. The MDA&A should be readin

conjunction with the District financial statements hat aesompany this repor.

FINANCIAL HIGHLIGHTS

‘Total Assets equaled: $108,662, 193 for 2015,

Cash, Cash Equivalent and Investments 25 cf December 31,2015 were $7,204,206.

“Total Liabilities for 2015, ss of December 31,2015, equaled $30,909,617

[Net Position, at of December 31,2015, totaled $78,752,576

Governmental change in Net Postion from 2015 to 2014 totaled $115,564

Basinesstype change in Net Position from 2015 to 2014 totaled $4,260,620.

FINANCIAL STATEMENTS

“The financial statements consist of thre parts - management discussion and analysis, the basic inaneial

slatements and supplemental information. The basic financial statements include two kinds of statements

that present different views ofthe distr:

+The first twa are governmentowvide statements that provide both long-term and short-term

information abou the Distiet’s overall financial status,

“+The remaining statements are fund financial statements that focus on individual pats of the

Distt government, eporting the Districts operations in more detail than the government-wide

statements

‘The financial statements also include notes that explain some of the infomation in the financial

statements and provide more detailed data, The statements ate followed by a section of supplemental

information that further explains and suppors the information in the financial statements,

Government-wide Statements — The government-wide statements consist of the Statement of Net

Position andthe Statement of Activites, Thse statements report information about the District as a whole

tnd neo ll gsets end aliie using the accrual basi of accounting. Alf the caren yes evennas

dnd expenses are taken ito sccount regardless of when the cash is received or paid.

“These two statements report the Distit’s net postion and changes in thom. The Distrt'snet position, the

difference between assets and liabilities, is one way to measure the District's nancial stats, or financial

position, Overtime increases or decreases in the Distr et positon is one indicator wheter financial

health is improving or deteriorating.

‘Fund Financial Statements — The fund financial statements provide more detailed information about

the Distr’ funds, focusing on its most significant funds, not the District asa whole. ‘The Distiet's two

kinds of funds, governmental and proprictary, use different accounting approaches,

1

Governmental Pannds —The asivty ofthe Districts General fund is reported as a goveramental fund,

hich focuses on how money flo into and out of the General fund, ‘This fund i reported using the

modified accrual accounting method, which measures cash and all of the other financial assets that ean

readily be converted to cash. The governmental fd statement provides a detailed short-term view ofthe

Distit's general governmental operations and the basic services it provides. Governmental fund

information helps to determine whether thee are more or less financial resources tat canbe spent inthe

ea fur to finance the Distrit’s programs.

Proprietary (Enterprise) Funds — The activity of the Distot Enterprise funds is to report the sme vay

that ll activities are reported inthe Statoment of Net Poston and the Statement of Activites. In fc, the

District’ Enterprise find isthe same a the busnes-ype activites reported in the governmentabvide

staterents but provides more detailed and addtional information, such as cash flows,

District Specific — The Cherokee Metropotitan Distict utilizes two separate financial categories of

ctiviies; one forthe general distri functions and one for tho enterprise, or busines-ype unetions. Each

ofthese, in tor, is segregated into operational and capital funetions. Together, these comprise the overall

fovermentwide statements. The Governmental, or general, category covers the public functions

lnvolvng:sret lighting and parks. ‘The Proprietary, or Businesséype, category involve the public

provision of water, wastewater, re water, clated administration, and golf course functions. The

Governmental finctions are funded by fees and conservation trust funds. The Proprietary functions are

fanded by water and sewer user charges, ap fees, got fes, an, similarly, bond financing when required

for capital projects

FINANCIAL POSITION & RESULTS FROM OPERATIONS

NET POSITION:

‘heiles | Acie Teal

assers

ber S$ RMI $ 93697 S967 § 2SAIE OIA 5 LOsIAHs

a 2ass9 * oonidzu * soonsis asim _suxmo — saison

oat es Ss? S.1006151 S.iungoniea $467.40 STI98L.08 $.1un4shand

LuaBiLies|

Terese

Tot aie:

er postion

Inve aston

ested poston

‘Unrest pain

Tol poston

gs frie

Opeating ps

“edits

Cl as

‘nln

levee earings

ther rvenee

wa torent

‘olen

FUNCTIONAL

Sree ht

“i

‘GereramenaT Basins ‘Grvernmental Tans vpe

“Kees Aciides Total Ae Acer Tot

Rested

Sas s asuasm sass S 4ase76 $aasrare

SUIS E niiser * auimer —_ __aeugais __aaisa

Lass Sumas snows $___ oman s_oraast

S$ nason9 $ Micra § mMaTSE Ss 2sLmE Ss eryR INE > mAsnaOe

mist” “Voasact > “2atzea * oasaa * “taneise © “Zon

ep emis sien asap __dougssi __4047

S_stuome Spoor $_mamst6 $_awrsen S_Tagunrse $s

Condensed Statements of Activites forthe years ended December 31,2015 and 2014

Gevermmeal Basie Governmental Busines Type

ite rot “Aether Aetviie Tot

Reve

Samay § Mamas $ Lyme sz —STTIMED SUL3I94

1ogo04 ovo on ona

200 2219196 224186 stsea7—s0so7

st Bos R86 tone igure

so 238983 aise 215883

—_, —Fiam 235mm __ _sm0

asi See ae ae sis SLs

ue loess logan

Hailes tera tenast

sonsee 9m izo9321—taa0832

Golecuse

Tol expedies

ames postion

etpation

ening ot year

Reroute sre

‘tepryens

et pan

cele

soos _“Snsing __ ‘a0, as

99880 _oe50 gman) 1101606 uses

420 sss __ 490 uma __uswizis

gos Maram 40nse7 ONS OND

—loowns9s. _inasnses

$.mLWwsm 5 mrmsI6 $__467490 $_m0n7m $_nisi6.92

Both Goveramental and Business-4ype Activities exhibited a postive change in net position primarily

_tsibutable to monitoring appropiate expetues in conjunction with increasing fe revene,

ANALYSIS OF POSITION

‘Tho overall financial position of the Distt improved during 2015, due to continued monitoring of

operating expenditures

During 2015, supplementary appropriations approved by the District's Board of Directors motifid the

apropriation from $113,700 t0 $116,824 io tho General fund to account for addtional unanticipated

‘expenditures incured in 2015.

‘Capra ase fr bots Governmental and Busines-ype Asivilcy incase as dhe Distt coutiaues to

make improverents tis parks and water and wastewater infasructue

CAPITAL ASSET:

———— me

Toraaneatt Fanner Torermmretat Benepe

‘Revie Acer” Total acini Aciniia” — Toa

nsicearfind —$ Siaams $ mans Sings $ 10.9925

catteune Sosa S37

oncinpore 898 sisi soos san 08

Rennie eprtaion 3208) QL gsgom) cusseasy Gow) (asym, can)

trate 65.10 —isssom “isan

ses) SO

PMocioenee CARED Balsa Leis KALE Taam’ Tmo

“The long-term liabilities decreased during 2015 by $1,255,122 inthe Water and Wastewater fund due to

significant principal payments being made.on oustanding debt

LONG-TERM DEBT:

"quiniie Acnoe” —Totst_ Retna Acviiar” Tota

aves

Bouispuybie Sinaia $746,186 5 "Tetonse: $ o04ou2

Noes mabe ina, avast $ wus —_U.si0x.

“ou det 5 + Lmusn $ mss7 $__, 520414819 $ 2614812

UTURE TRENDS AND ECONOMIC FACTORS

‘While Colorado's economy has experienced amore robust grow facto than the national economy,

Cherokee Metropolitan District's position hat maintained a record of moderate but steady growth. The

Distet has successfully refinanced some existing debt, thereby lowering ongoing interest payments, and

sta will continue to Took for innovative ways o reduce operating expenditures while mainsining hight

level of customer service, AS of December 31,2015 thre are 7,091 residential taps and 576 commercial

taps being serviced bythe District.

Recent acministratve rulings regering water quality wil make itecesary forthe Distt lther design

‘and construct water filtration facilis or purchase new renewable water resources, inorder to improve

4

retur flow qualities. As a result, the District as contracted with a consling frm to perform arate and

{fe study in anticipation of acquiring futre debt o finance these nitive. Is antilpated that increased

rates will be phased in over period of years meet the District's planned infestructure upgrade,

‘CONTACTING THE DISTRICT'S FINANCIAL MANAGEMENT

“This financial report is designed to provide « gonecal overview of tho Charokee Metropolitan District's

finanees forall those with an interest inthe Dist’ finances. Questions concerning any ofthe information

provided in this report or request for additional information should be addressed to Kurt Schlegel, General

Manager, at (719) 597-5080,

FINANCIAL STATEMENTS

(CHEROKEE METROPOLETAN DISTRICT

‘STATEMENT OF NET FOSITION

ASSETS

‘Cashand nh equiaents

(Chand nk alain rested

"Tote an eas gave

‘Accounts resvble

Inventories

Propel expenses

uo) moter nds

Copal se, et of cumulated

‘precision

“oi ats

‘IAILETIES|

“Accounsppable

‘Aco expenses

‘accredit

{stare deposits

omar ies

‘Due within one year

ue smote oe yen

“Total ie

er PosrTi0N

‘Nelvestnst in capil ass

Retrited

Unrated

“ola et postion

Decenber:

Goverment BasaesType

‘tives __ Activites Toul

s = $ agesais $4sssais

2208901

Fone

2258381

a0

s213

19.52.95,

saan

tss204

asi

s246

tystst

2a3s9601

30909617

ussg09—Toeisi8 TaD

mis gasaet 2212392

wo somes __ guinea

ser Caes Tams

“These financial statements shouldbe reed only in connection with

the accompanying notesto financial statements

6

a

“soups eoueUy or sejou Suedoo2e a

"gus wonosunco Su peat aq pods SUSWATNS TIoUeUY ASK,

‘Buurdog- vod.

‘2 ody weunip apron,

oda: Koran se a30 Squutog - waned K,

ogtsod ou 8m

(CHEROKEE METROPOLITAN DISTRICT

BALANCE SHEET

(GOVERNMENTAL FUNDS

December 31,2015,

‘Total

General Parks Governmental

ud und Funds

ASSETS

Tesi ash and ea quien s

Due rm athe finds

“otal asets E

LIABILITIES, DEFERRED INFLOWS OF RESOURCES AND

FUND BALANCE

Accounts payable Ss 98es

uso other fds

"Tota iabltes oa

FUND BALANCE

Rested sot 223607 2s

‘Unsigned 18376 3,09) 893947

Total fn balance BLAST 1 Bir 075

‘TOTAL LIABILITIES AND FUND BALANCES sia sms 355401

‘Reconciliation of the Governmental Fund Balance Sheet fo the Statement of Net Position:

‘Total und bance, governmental and s sinors

Amouns reported for government activites in the Statement |

fof NetPostion aeierent bens:

Capital apes wed In governmental tivities are not ian |

resources and, tharefore, ae not reported inthe uns

‘Capa ses 265,

Net positon of governmental actives 3 si.004_

“Those financial statements shouldbe read only in connection with

the accompanying notes to financial statements,

CHPROKEE METROPOLITAN DISTRICT

STATEMENT OF REVENUES, EXPENDITURES AND CHANGES

IN FUND BALANCE GOVERNMENTAL FUNDS.

Year Kaded December 31,2018,

‘Total

Genera Parks Governmental

end Bond Fonds

[REVENUES

Fess S 116685 $3784 S$ 280439

Commreton Tot de rago08 tos.o08

(Gran EPC - 25,000 125,000

Interetincome 31 1

“Toa revenues Teas Bene __ ae

EXPENDITURES.

Lighting 624 e 4

Parks, lndscape and pen space 196013, 196.013

‘Tota expenicues Tae 196015, 52,07

[EXCESS OF REVENUE OVER (UNDER) EXPENDITURES. 039) 100.96, 100687

[NEP CHANGE IN FUND BALANCE 039) 100,796 10,657

UND BALANCE - BEGINNING OF YEAR 122,016 9402 216.418

FUND BALANCE END OF YEAR Suis? $__1psio sions

“These financial stutements shouldbe readonly in connection with

the accompanying notes to Financial statements,

(CHEROKEE METROPOLITAN DISTRICT

RECONCILIATION OF THE STATEMENT OF REVENUES,

EXPENDITURES AND CHANGES IN FUND BALANCE - GOVERNMENTAL

FUND TO THE STATEMENT OF ACTIVITIES.

Year Ended December 31,2015

‘A reconciliation reflecting the differences between the governmental funds net

change in fund balancos and change in net position reported for

‘Eovernmentl aoivtos in the Statement of Activities as follow:

[Net change in fund balances - Total governmental finds

‘Governmental funds report capital outlays as expenditures. However, inthe

‘satement of activities the costs of those assets is allocated over the

‘stmated useful lives and reported as depreciation expense, This is

the amoust by which depreciation exceeded capital outlays forthe period 14907

‘Change in net postion - Governmental activities $115,564

“These financial statoments should be real only in connection with

the accompanying nots to financial statements

10.

(CHEROKEE METROPOLITAN DISTRICT

STATEMENT OF NET POSITION

PROPRIETARY FUNDS

December 31,2018

ASSETS Gatt course

(Cureat assets Fund

CCesh nd cash equivalents sae

Inventories : 2230

‘Propald expenses ss203

Die om oer funds 12304 :

“Tal cureat assets ne. ae

Noneurent asset

‘Restricted eth andes gulvalents Lossee :

Capita ass, net of depreciation 7351380 __2,161854

Tota noncaren assets s9s36o48 2,167,854

TOTAL ASSETS 106909,723, _ 2275508

LIABILITIES AND NET POSITION

Creat Lshlites

“Accounts payable s suas

‘Aceued expenses 1ots62 Lae

‘Acerved intrest aaa °

uo o other fans E 119,080

Customer depois 73206 :

‘Notes payable eutent portion 97924

‘Band pyable- current portion 500,000

“otal creat abies 258517 Ta

Non-cen Libis

‘Notes payable o913s11

Bond payable 17446,186

‘otal non-core bites 2359.91 =

Total uabiities sosas2i4 ans

NET POSITION

‘Net avestneat n copi assets e7g97s9 2,167,884

Rearited 198526 :

rested 042 86 19791)

“Total at poston 7521509 2,148,053

‘TOTALLIABILITIES AND NETPOSITION —_$ 106,908,723 _$_ 2275508

“These financial sttements shouldbe readonly in connection with

the accompanying notes to financial statements,

oe

Total

F 4995315

2288381

32230

135213,

1ase4

ao

19ss264

9.719234

101,704,458,

109.185234

wos13st1

1744686

28,559.07

31015659

mi6613

asst

6.025595

F157

$109 185231,

‘CHEROKEE METROPOLITAN pistHICT.

‘STATEMENT OF REVENUES, EXPENSES, AND CHANGES IN NET POSITION

‘PROPRIETARY FUNDS

‘Year led December 31,2015

OPERATING REVENUE

Water ses

Gatfrerenes

Rewle

‘Tot operating revere

(OPERATING EXPENSES

Wate syste

Wise system

Goi couse operations

‘ene and ire

Depreaton

‘ot opesng epee

OPERATING INCOME

NONOPERATING REVENUE AND (EXPENSES)

“Tp foes

Inet icone

Mircelneous incre

etre expense

Tot onoperaing revenue (expense)

[CHANGER NET POSITION

[NET FOSITION. BEGINNING OF YEAR, previously reported

Retronctive aries for por years

[NBT POSITION - BEGINNING OF YAR. Restated

NET POSITION -END OF YEAR

Water and

Wastonter

Fund

5 6309gz8

sens

$s 2anom0

oigao ——2xaor0

‘aes

sms $s _usgm

(CHEROKEE METROPOLITAN DISTRICT

NOTES TO FINANCIAL STATEMENTS.

NOTES - NET POSITION

‘The District has net position consisting of three components ~ net investment in capital assets,

restricted, and unrestricted.

[Net investment in capital asset consiste of capital arrotz act of accumulated depreciation rnced

by outstanding debt that is attibutable to the acquisition, constuction, or improvement of those

assets, As of December 31, 2015, the Distrit had net investment in capital assets, net of related

debt as follows:

Netinesant naples rte eb

opt ast st of depen SH 8516

ead dt (09357621)

Tolinete incapal set, oe debt Smansee

Restricted net position is restricted for use either externally imposed by creditors, grantors,

conttibulors, or laws and regulations of other govemments; or imposed by law through

constitutional provisions or enabling legislation, As of December 31, 2015, the District had

restricted net position as follows:

Restted for

Debt service 8 Lsigo1s

Parks 23607

Customer deposits

‘TABOR

“Total resisted net assets

NOTE 10- PENSION

‘Ihe Distriet provides pension benefits through a SIMPLE IRA, All full-tinie eployces who are

21 years of age and have been in service in Tanuary for one year are eligible o participate. Eligible

‘employees immediately vest. The District can make an elective contribution of up to 4% of an

‘employee's regular salary annually, Contributions for 2015 totaled $49,457

2

(CHEROKEE METROPOLITAN DISTRICT

NOTES TO FINANCIAL STATEMENTS,

NOTE 11 - RISK MANAGEMENT

‘The Districts exposed to various rsks of losses related to torts; theft of, damage to and destruction

injuries to employees; and natural disasters.

of assets; erors and omission

“The District certes commercial insurance for these risk of loss, including worker's compensation,

Settled claims resulting from these risks have not exceeded commercial insurance coverage during

the past three fiscal years. Further, he District practices water supply planning and shor term

contracting to ensure adequate supplis for the community.

NOTE 12 - INTERGOVERNMENTAL AGREEMENTS (IGA)

“The District has entered into several agreements with other governmental entities to provide water

and wastewater treatment. These agreements stipulate various means to obiain, trade, or provide

‘water. These agreements are a normal part of the operations of the District and management

believes that these agreements do not constitute significant long-term commitment ofthe District

‘which would require additional disclosures.

‘Specific information conceming the summaries of certain intergovernmental agreements can be

obtained from the District.

NOTE 13 - COMMITMENTS AND CONTINGENCIES

Litigation - The Distict is involved in soveral ponding or threatened lawsuits and claims the most

significant of which are described below. While the District and its legal counsel estimate thatthe

potential claims against the Distt, if any, not covered by insurance or accrued for, resulting from.

such litigation, would not materially affect the financial statements ofthe Di

In 138A330, the Colorado Supreme Court issued Ordert in June of 2015 affirming the District

Courts decision in favor of Cherokee, but adding some clarifying language regarding its

interpretation of the 1999 Stipulation and Release between Cherokee and Upper Black Squirrel

Creek Groundwater Management District and related objectors in 98CW80 Water Court diligence

case on the Sweetwater conditional water rights, The Supreme Court held that Meridian Service

“Metro Distrit and others using Cherokees regional wastewater treatment and reclamation facility

(WWIPIWRE) were not obligated to return any portion of thei fully consumable water rights to

1s result ofthe language in 98CW80 Stipulation and Relesse referenced

3

(CHEROKEE METROPOLITAN DISTRICT.

NOTES TO FINANCIAL STATEMENTS

ined

NOTE 13- COMMITMENTS AND CONTINGENCIES-co

above, This ruling limits liability that Cherokee could have faced ftom regional and

intergovernmental agreement partners in the WWTP/WRF who were concemed that impacts of

tho ruling could have encumbered thie rtwin flaw water right following the wastewater treatment

tnd reclamation process. The limitation of impacts to third parties further enhances the

marketability of the excess capacity in the WWTP/WRE to potential third part users in the Future,

‘The ruling in 138A330 does appear to limit Cherokee’s ability to directly reuse return flows from

those water rights asthe subject of 98CW80 water court diligence ease and possibly other water

rights owned at the time of the 1999 Stipulation and Release; but does not prohibit or preclude

Cherokee from puiting those water rights into the replacement reuse plan, The Orders impact

CCherokee’s ability to lease all non-potable treated wastewater return flows to the Bracket Creek

Farms which curently uses a portion of the treated WWTP/WRE effluent as iigation water under

1 State Depertment of Public Health permit under Regulation 84. The Districts lease of return

flows is availability dependent and the lease price is minimal for non-potable water ($25 per acre-

oot, $0 the restriction on direct reuse will impact the Districts finances immaterially.

Cherokee well nos, 14-17 - The Colorado Supreme Court ruled that the District hed abandoned

certain portions oftheir conditional water rights, which were associated with well nos. 14-17. The

District sought to have those conditional rights made absolute and the Upper Black Squirrel

Management District objected on the grounds thatthe time period for filing had passed and the

‘wells were therefore abandoned, The Colorado Supreme Court agreed; however they indicated in

‘the ruling thatthe remaining conditional rights were still available for District use. That issue was

‘brought to the Division 2 Water Court, which ruled that those remaining conditional rights were

also abandoned. The District appealed tis ruling to the Colorado Supreme Court who issued an

order on June 6, 2012, remanding the ease tothe District Water Court to resolve ambiguity in the

status of the remaining conditéonals. During 2014 a sotiement agreement was reached whereby

the District received absolute water rights totaling 609 acre feet, while abandoning three well sits.

‘The Colorado Supreme Court issued an opinion, case 1384330, affirming the lower court's ruling,

but containing language which may be seon as contradictory as it relates to the availabilty of

credits relating fo the reuse ofthe return flows, The District received a settlement in relation to this

case from thie former wate attorney, The initial settlement was for $275,000 which was received

in 2015. ‘The final settlement for an addtional $2,000,000 was received in 2016. The District

recorded the $275,000 in 2015, no amount was recorded in 2015 related to the $2,000,000 as the

settlement was not complete as of December 31, 2015.

Fn

(CHEROKEE METROPOLITAN DISTRICT

NOTES TO FINANCIAL STATEMENTS.

NOTE 13- COMMITMENTS AND CONTINGENCIES-continued

1n 2014, the District also entered into an agreement with a customer to provide up to 400 acre-feet

of irrigation water. The Upper Black Squirrel Ground Water Management District (UBS), is

challenging the Distict’s right to the reuse of water relating tothe return Hows back into the

‘basin, The Distict's ability to meet the demands ofthe 2014 agreement of 400 acre-feet, and other

‘customers agreements is contingent on the outcome of the litigation relating tothe rease rights,

Which as of December 31, 2015, could not be estimated as to a potential liability

‘Change of water rights - As the Distict obtains water rights itis sometimes necessary to change

the type of right prior to usage. During fiscal year 2014, the District entered into a case to augment

‘the ground water rights purchased purchased from Black Forest. The District anticipates a

favorable outcome,

‘The District has been working to purchase water relating to Albrecht water rights. Prior to

‘completing the purchase, the District requested a change of use tothe Ground Water Commission

[As of September 23, 2016 a settlement has been reached between all involved parties that

climinates the need fora hearing before the Ground Water Commission.

Cherokee Wells Nos. 1-8 - The District is in litigation relating to the water tights for wells Nos.

1-8, In 1999, the District agreed to no longer export water from these wells, but rather the wells

‘would only befor in-basin use. Further, the court ruled that Cherokee could not use these wells to

supply any agreements post 1999, UBS is curently contesting the Distriet’s ights to provide water

‘to customers using these wells and contesting thatthe Districts expanding its use of the wells. In

2015, the District filed a complaint with the water cour, Division 2. The eas is set for a hearing

‘before the Ground Water Commission in March of 2017,

Schriever Air Force Base wastewater treatment - On November 6, 2000, the District was

awarded a fity-year contract to provide wastewater treatment service forthe base. Ou May 4,

‘2009, the District agreed to provide water and sanitation taps to the Tierra Vista Communities

evelopment on Schriever Air Force Base, The agreement between the District and the developer

includes 242 water and sewer tap with a cumulative fee of $3,777,136 payable to the District over

seven years, Payments were received by the District in annual inerements of $500,000 through

2015. The final amount of $277,136 is due in 2016.

Environmental violations ~ As of December 31, 2015, District personne! were in ongoing,

negotiations with the Colorado Department of Public Health and Environment (CDPHE) in segards

35

(CHEROKEE METROPOLITAN DISTRICT

NOTES TO FINANCIAL STATEMENTS.

NOTE 13- COMMITMENTS AND CONTINGENCIES-continued

to two water quality parameters that have been out of compliance at the District's wastewater

treatment and water reclamation facility. The first parameter is Total Dissolved Solids (TDS),

which are primarily salts, The District's wastewater treatment facility was not designed to remove

“TDS, and conventional wastewater treatment process does not remove TDS. The feclity was

designed to mect the Preliminary Effluent Limits (PELs) as specified by the CDPHE in the facility

planning process. When the District received its draft permit in early 2010, a limit for TDS of 400

‘g/l was included, which was not included in the PELs, Historical data from the Districts

decommissioned wastewater plants effluent indicated TDS concentrations over 500 mg/l, and

‘consequently the new facility would not be able to meet the 400 mg/l limit. Based upon these

‘violations, the Distict negotiated with the CDPHE to agree to a “Compliance Order on Consent”

(COC) enforcement order to be able fo meet the TDS limit in the future. The COC compliance

schedule became effective July 2014 and requires the Distict to determine a solution (treatment

‘processes tha can effectively teat the wastewater stream to meet TDS permit limits. The second

parametet in violation has been Total Inorganic Nitrogen (TIN). The treatment facility has been

‘unable to meet the 10 mg/l TEN limit due to insufficient biochemical oxygen demand and carbon

loading. The District installed a preliminary screening treatment facility at the cost of

approximately $2,800,000 to increase the organic loading and minimize sewage age and

degradation at the treatment facility. This fueility was completed in May 2014, and has

significantly improved wastewater quality and treatment processes, To mest the discharge permit

parameter and primary drinking water standard for nitrate, methanol (a supplement earbon source)

is being added to supply the carbon needed for biological de-nitification. This supplemental

source as been ested in its impact on treatment under 2 CDPHE approved pilot study, and the

District has eurrent approval to make application forthe pennit from the CDPHE to implement

{ull scale carbon addition, and bas issued a notice of awaed on the installation construction project

commenced in June 2014,

“The District appealed the CDPHE's environmental rung and requested an alternate TDS effluent

limit of 500 mg/L be approved. The Colorado Ground Water Quality Commission met in August

cof 2016 to heat Cherokeo's request and subsequently denied this request, ‘The District is now

reviewing options available to meet the State Standard and will choose and implement a solution

to meet the Standard by 2022.

36

(CHEROKEE METROPOLITAN DISTRICT

‘NOTES TO FINANCIAL STATEMENTS.

NOTE 14~ NET POSITION RESTATEMENT

“The District has restated the prior year’s net postion due to eliminating accumulated depreciation

for Water Rights, adjusting the outstanding leave accrual, and correcting the reporting of bond

premiums and related amortization, The net change is as follows:

[Net positon ~ business-type activities ~as originally

reported at December 31,2014 8 63,759,927

‘Adjustment for accumulated depreciation of water

rights 10,040,895

Adjustment for leave accrual 143,862

Adjustment to correct the amortization of bond premiums

and capitalization of related interest 5.93

Net postion, business-type activities restated December 31, 2014 $21,908,752

‘The effet of these adjustments on the 2014 Water and Wastewater financial statements was to

increase net position as of January 1, 2014 by $10,040,895, decrease 2014 expense by $107,990

and increase net position as of December 31, 2014 by $10,148,825.

NOTE 15 - AMENDMENT TO COLORADO CONSTITUTION

In November 1992, the voters of Colorado approved the Taxpayer's Bill of Rights (TABOR),

whieh added Section 20 to Article X, ofthe Colorado Constitution. In general, TABOR restricts

the ability of the State and local governments to increase revenues and spending, to impose taxes,

and to issue debt and certain other types of obligations without vote approval. TABOR generally

applies tothe State and all local governments, including the District.

Fiscal year spending and revenue limits are determined based on prior year spending adjusted for

inflation and local grovvth, Revenue in excess ofthe limit must be refunded unless the voters

approve retention of such revenue. TABOR requires local governments to establish Emergency

Reserves. ‘Those reserves must be at least 3% of Fiscal Year Spending (excluding bonded debt

service). Local governments are not allowed to use the emergency reserves to compensate for

‘economic conditions, evenue shortflls or salary or benefit increases

‘TABOR is complex and subject to judicial interpretation, The District believes iis in compliance

with the requirements of the amendment. However, the District has made certain interpretations

of the amendment’ language in order to determine its compliance. The District does not receive

any mill levy revenues, and is therefore not subject to the revenue limitations of TABOR.

a

SUPPLEMENTAL INFORMATION

‘CHEROKEE METROFOLITAN DISTRICT

‘SCHEDULE OF REVENUES, EXPENDITURES AND CHANGES I

[NEF POSITION (NON-GAAP BUDGETARY A815)

Forth Yar Ended December 31,2015

Variance wit

edged na eage-

Amounts ite

Origa inal _ Acta zn

REVENUES,

‘We es S625 $ ap9san $user)

Severs Shes * anus “asus

Water lwo se Tinos 2219196 are

mitment owo.00 ‘msm sou)

inet toon sooo S945 3308

rans nae 8397 2598 rn

“oa Rees Tamssi7 —_—Bsm6r ano

Wes

cued wae 33,00 23533 se

pi 4318 sae ease

Tratnet 9303 195107 134196

‘mein and ion ose 856 gers

Gone sevice S07 sos (et

“onl Waterson Ziv. —— Fas SHA

Tt assem sea.zas

Feast 35619 "aims

Cole sen? soa

(Carer sce tam ans

ove 900 a

“ot Wasenser tem Zue1a0 ——aawa2

‘Gener an aint aaouis——asmse 39)

(ip oxen tomo demise 1138

Dekel pam Tietgohietaie ®

Irs a bond er ‘soagis 96809 rot

Tate ‘00 0.000

“et Oe samy apy ame

“Toad eens arse __aosase 2.60584

EXCISS OF REVENUE OVER (UNDER)

PXPENSES pom) ssi _s2s330

GAAP Adasen

Copal expences smog

Pla pment on 161810

Depress a3

Changin nt patton om

8

‘CHEROKEE METROPOLITAN pistRICT

[SCHEDULK OF REVENUES, EXPENDITURES AND CHANGES IN

[NET FOSITION (NON-GAAP BUDGETARY BASIS)

‘GOLF COURSE FUND

ore Yer Radi December 3, 2015

Acton Negative)

REVENUES

Gotfrevensee seas $— 6as

ele 217798 9798

ao e 0.00,

Tol Revenss 00° a a3

EXPENDITURES

‘pering expense sroats pa

Renesas 127000 7s)

Gener a dinitrate 217380 au

Copegus 16200 as

Tot Expenses wi on

[EXCESS OF REVENUE OVER (UNDER)

EXPENDITURES, 2219) 25486 23,705

‘GAAP Adjustments

apt expentinnes 16s

Deprecaion ma,

(Change ne penton sass

(CHEROKEE METROPOLITAN DISTRICT

DEBT SERVICE COVERAGE AND RESERVE REQUIREMENTS

‘Year Ended December 31,2018

Revenues

‘Water sles

Sewer charges

Tap fees

Lawl stloment

Interest income

Miscellaneous income

‘TOTAL REVENUES

Operating Expenses

Less: depreciation

NET OPERATING EXPENSES

[NET REVENUES (PLEDGED PROPERTY)

‘Maximum debt service requirement

DEBT SERVICE COVERAGE FACTOR

S$ 6309928

42915115

22219,196,

275,000

54s

235985

836,745

1,759,364

7,381

S_ 6,262,786

$2218.79

210.26

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tap Schedule 2016Document1 pageTap Schedule 2016CherokeeMetroNo ratings yet

- 50 Cross-Connection Questions, Answers & IllustrationsDocument12 pages50 Cross-Connection Questions, Answers & IllustrationsCherokeeMetro100% (1)

- Call For NominationsDocument1 pageCall For NominationsCherokeeMetroNo ratings yet

- Sundance Water Supply Project Purpose & BackgroundDocument2 pagesSundance Water Supply Project Purpose & BackgroundCherokeeMetroNo ratings yet

- Cherokee Metro Parks and Open Spaces MapDocument1 pageCherokee Metro Parks and Open Spaces MapCherokeeMetro100% (1)

- Cherokee Metro AccountsDocument1 pageCherokee Metro AccountsCherokeeMetroNo ratings yet

- Water ReturnsDocument2 pagesWater ReturnsCherokeeMetroNo ratings yet

- Cherokee Boundaries MapDocument1 pageCherokee Boundaries MapCherokeeMetroNo ratings yet

- Sundance Water Supply ProjectDocument14 pagesSundance Water Supply ProjectCherokeeMetroNo ratings yet

- El Paso Household Waste FlyerDocument1 pageEl Paso Household Waste FlyerCherokeeMetroNo ratings yet