Professional Documents

Culture Documents

PNB v. CA and Ramon Lopez

PNB v. CA and Ramon Lopez

Uploaded by

Rebecca ChanCopyright:

Available Formats

You might also like

- Add Tradelines To Credit Report - UCC Filings PDFDocument18 pagesAdd Tradelines To Credit Report - UCC Filings PDFmatt96% (85)

- Complaint Affidavit SampleDocument2 pagesComplaint Affidavit SampleRebecca Chan88% (25)

- Complaint AffidavitDocument2 pagesComplaint AffidavitRebecca Chan0% (1)

- Bonds Exam Cheat SheetDocument2 pagesBonds Exam Cheat SheetSergi Iglesias CostaNo ratings yet

- Sworn Statement SampleDocument2 pagesSworn Statement SampleRebecca Chan100% (6)

- BIR Ruling 555-12Document4 pagesBIR Ruling 555-12Rebecca ChanNo ratings yet

- Hollywood Rules CaseDocument9 pagesHollywood Rules CasePhilip Lahm0% (2)

- Ocampo-Paule vs. CADocument2 pagesOcampo-Paule vs. CARemelyn SeldaNo ratings yet

- Towne & City Devt v. Voluntad - People's Industrial v. CADocument5 pagesTowne & City Devt v. Voluntad - People's Industrial v. CAIyahNo ratings yet

- Oblicon Cases 1156 1162Document16 pagesOblicon Cases 1156 1162Ailene Heramil PonioNo ratings yet

- Tomimbang V TomimbangDocument11 pagesTomimbang V TomimbangChristiane Marie BajadaNo ratings yet

- Berot Vs SiapnoDocument2 pagesBerot Vs SiapnoAlykNo ratings yet

- Timoteo Baluyot, Et Al. vs. Court of AppealsDocument3 pagesTimoteo Baluyot, Et Al. vs. Court of AppealsRommel Mancenido LagumenNo ratings yet

- Moreno-Lentfer v. WolffDocument2 pagesMoreno-Lentfer v. WolffAlfaria Ayan CharpangNo ratings yet

- Barzaga V CADocument1 pageBarzaga V CAEiffel Usman MarrackNo ratings yet

- Marquez Vs ElisanDocument34 pagesMarquez Vs ElisanJP TolNo ratings yet

- Case No. 122Document2 pagesCase No. 122Dhaniella De GuzmanNo ratings yet

- Legarda Vs MiailheDocument1 pageLegarda Vs Miailhemcris101No ratings yet

- CASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009Document2 pagesCASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009philamiasNo ratings yet

- SHUY Vs - SPs. Maulawin Case Digest 2012Document2 pagesSHUY Vs - SPs. Maulawin Case Digest 2012Sam Leynes100% (2)

- PNB Vs The Philippine Vegetable Oil CoDocument2 pagesPNB Vs The Philippine Vegetable Oil Comickeysdortega_41120100% (4)

- Pilar Pagsibigan vs. Court of AppealsDocument4 pagesPilar Pagsibigan vs. Court of AppealsFairyssa Bianca SagotNo ratings yet

- Marquez Vs ElisanDocument2 pagesMarquez Vs ElisanHarold EstacioNo ratings yet

- 133 Geraldo V PeopleDocument2 pages133 Geraldo V PeopleJudy Ann ShengNo ratings yet

- (SANTOS) Ledonio v. Capitol Development CorporationDocument2 pages(SANTOS) Ledonio v. Capitol Development CorporationRenzoSantos100% (2)

- Quinto v. PeopleDocument2 pagesQuinto v. PeopleamberspanktowerNo ratings yet

- Ong v. CA, 310 SCRA 1 (1999)Document2 pagesOng v. CA, 310 SCRA 1 (1999)Rebuild BoholNo ratings yet

- GR. No. 158138 April 12, 2005 Pbcom vs. Lim FactsDocument2 pagesGR. No. 158138 April 12, 2005 Pbcom vs. Lim FactsJanette TitoNo ratings yet

- REYES, Petitioner, v. ASUNCION, RespondentDocument2 pagesREYES, Petitioner, v. ASUNCION, RespondentKatrina Ysobelle Aspi HernandezNo ratings yet

- Azcona v. JamandreDocument1 pageAzcona v. JamandreAnsai Claudine Calugan100% (1)

- Deiparine Vs CADocument9 pagesDeiparine Vs CAbchiefulNo ratings yet

- 044 Trans-Pacific v. CA (Salvador, A.)Document2 pages044 Trans-Pacific v. CA (Salvador, A.)Antonio Salvador100% (1)

- Florention vs. EscarnacionDocument2 pagesFlorention vs. EscarnacionRed-gelo Matuts AgbayaniNo ratings yet

- 214 Spouses Lam v. Kodak Phils., Ltd.Document1 page214 Spouses Lam v. Kodak Phils., Ltd.VEDIA GENONNo ratings yet

- Occena V CADocument2 pagesOccena V CAFina Schuck0% (1)

- Yek Tong Lin Fire Versus YusingcoDocument1 pageYek Tong Lin Fire Versus YusingcoRogelio Rubellano IIINo ratings yet

- Gonzales vs. Heirs of ThomasDocument2 pagesGonzales vs. Heirs of ThomasDongkaeNo ratings yet

- 24 Laperal v. Solid HomesDocument2 pages24 Laperal v. Solid HomesnoonalawNo ratings yet

- PNB vs. CA, GR 108052, 24 July 1996Document6 pagesPNB vs. CA, GR 108052, 24 July 1996Lourdes Loren CruzNo ratings yet

- Oblicon - Digest - March 6Document15 pagesOblicon - Digest - March 6Admin DivisionNo ratings yet

- De Leon V. Ong G.R. No. 170405 February 2, 2010Document1 pageDe Leon V. Ong G.R. No. 170405 February 2, 2010Paula TorobaNo ratings yet

- Piltel Vs TecsonDocument1 pagePiltel Vs TecsonArmand Patiño AlforqueNo ratings yet

- 17 Stronghold v. CADocument2 pages17 Stronghold v. CAMiggy CardenasNo ratings yet

- DBP v. Confesor G.R. No. 48889Document1 pageDBP v. Confesor G.R. No. 48889Rizchelle Sampang-ManaogNo ratings yet

- So V Food Fest LandDocument3 pagesSo V Food Fest LandFranz BiagNo ratings yet

- 01 People v. Bayabos MALLARIDocument2 pages01 People v. Bayabos MALLARIAbigael SeverinoNo ratings yet

- Articles 1170 1171 1338 and 1344Document9 pagesArticles 1170 1171 1338 and 1344Paulo HernandezNo ratings yet

- G.R. No. L-42542 August 5, 1991 CARLOS DIMAYUGA, Petitioner, Philippine Commercial & Industrial Bank and Court of APPEALS, RespondentsDocument1 pageG.R. No. L-42542 August 5, 1991 CARLOS DIMAYUGA, Petitioner, Philippine Commercial & Industrial Bank and Court of APPEALS, RespondentsAnonymous eNHo8720% (2)

- PEOPLE Vs DE GUZMANDocument1 pagePEOPLE Vs DE GUZMANIkko EspornaNo ratings yet

- Chen Teck Lao v. Republic 55 SCRA 1Document2 pagesChen Teck Lao v. Republic 55 SCRA 1Per-Vito DansNo ratings yet

- Philippine Economic Zone Authority (Peza) vs. Pilhino Sales Corp. G.R. No. 185765, September 28, 2016Document7 pagesPhilippine Economic Zone Authority (Peza) vs. Pilhino Sales Corp. G.R. No. 185765, September 28, 2016Mogsy PernezNo ratings yet

- Bonrostro Vs LunaDocument2 pagesBonrostro Vs LunaBianca HerreraNo ratings yet

- Paguio Vs PLDTDocument2 pagesPaguio Vs PLDTAlexandra Nicole Manigos BaringNo ratings yet

- Ramos Vs ObispoDocument5 pagesRamos Vs ObispoNandie JoyNo ratings yet

- Khe Hong Seng v. CADocument3 pagesKhe Hong Seng v. CAEmir Mendoza100% (2)

- CreditTrans People Vs Montemayor GR No. L 17449Document2 pagesCreditTrans People Vs Montemayor GR No. L 17449Jimenez Lorenz100% (1)

- People V Sope, 1946Document2 pagesPeople V Sope, 1946Leo Mark LongcopNo ratings yet

- Manila Trading & Supply Co. vs. Medina (G.R. No. l-16477, May 31, 1961)Document1 pageManila Trading & Supply Co. vs. Medina (G.R. No. l-16477, May 31, 1961)Imee CallaoNo ratings yet

- Gotesco Properties, Inc., Jose C. Go, Et Al., vs. Spouses Eugenio and Angelina FajardoDocument1 pageGotesco Properties, Inc., Jose C. Go, Et Al., vs. Spouses Eugenio and Angelina FajardoPau VillegasNo ratings yet

- Millar V CADocument3 pagesMillar V CALiaa AquinoNo ratings yet

- Philippine National Bank Vs Lilibeth ChanDocument14 pagesPhilippine National Bank Vs Lilibeth ChanJoatham GenovisNo ratings yet

- Hermosa vs. Longara Case DigestDocument2 pagesHermosa vs. Longara Case DigestElla Tho100% (7)

- Cui V CuiDocument3 pagesCui V CuiLawdemhar CabatosNo ratings yet

- General Milling v. Sps. RamosDocument1 pageGeneral Milling v. Sps. RamosDGDelfinNo ratings yet

- Full Obligations and Contracts Digested PDFDocument817 pagesFull Obligations and Contracts Digested PDFJul A.No ratings yet

- Siguan Vs Lim Et Al - DigestDocument3 pagesSiguan Vs Lim Et Al - DigestLiaa Aquino100% (2)

- PNB Vs Sapphire Shipping DIGESTDocument3 pagesPNB Vs Sapphire Shipping DIGESTGellomar AlkuinoNo ratings yet

- Waiver and Confession of Melanie BatumbakalDocument1 pageWaiver and Confession of Melanie BatumbakalRebecca Chan100% (1)

- PALE - in RE GuttierezDocument1 pagePALE - in RE GuttierezRebecca ChanNo ratings yet

- Far Eastern Shipping Company vs. CADocument2 pagesFar Eastern Shipping Company vs. CARebecca Chan100% (2)

- PALE - Misamin Vs San JuanDocument1 pagePALE - Misamin Vs San JuanRebecca ChanNo ratings yet

- PALE - Montecillo and Del Mar Vs Francisco Gica Et AlDocument21 pagesPALE - Montecillo and Del Mar Vs Francisco Gica Et AlRebecca ChanNo ratings yet

- Oronce V CaDocument5 pagesOronce V CaRebecca Chan100% (1)

- PALE - People vs. MaderaDocument1 pagePALE - People vs. MaderaRebecca ChanNo ratings yet

- SANTIAGO Vs BautistaDocument2 pagesSANTIAGO Vs BautistaRebecca ChanNo ratings yet

- Corporation Case - CocofedDocument231 pagesCorporation Case - CocofedRebecca Chan100% (1)

- Evidence CasesDocument14 pagesEvidence CasesRebecca ChanNo ratings yet

- Visitacion Vs ManitDocument2 pagesVisitacion Vs ManitRebecca ChanNo ratings yet

- Zenith Insurance v. CADocument3 pagesZenith Insurance v. CARebecca Chan100% (3)

- Ra 7641 & 7549 ProvisionsDocument3 pagesRa 7641 & 7549 ProvisionsRebecca ChanNo ratings yet

- In Re ArgosinoDocument1 pageIn Re ArgosinoRebecca Chan100% (1)

- Art. 6 CasesDocument6 pagesArt. 6 CasesRebecca ChanNo ratings yet

- Philamcare Health Systems V CADocument2 pagesPhilamcare Health Systems V CARebecca ChanNo ratings yet

- Banda v. ErmitaDocument16 pagesBanda v. ErmitaRebecca ChanNo ratings yet

- Credit and Background: Microfinance Flow ChartDocument21 pagesCredit and Background: Microfinance Flow ChartJerry Sarabia JordanNo ratings yet

- Study of Assessment Methods of Working Capital RequirementDocument92 pagesStudy of Assessment Methods of Working Capital RequirementABHIJIT S. SARKARNo ratings yet

- Part 1-3Document15 pagesPart 1-3Christina AureNo ratings yet

- 1601-FQ Final Jan 2018 Rev DPADocument2 pages1601-FQ Final Jan 2018 Rev DPAMarvin AmparadoNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesHussen AbdulkadirNo ratings yet

- Byf Student Book 4Document53 pagesByf Student Book 4sritraderNo ratings yet

- Ratio AnalysisDocument65 pagesRatio AnalysisAakash ChhariaNo ratings yet

- Segregation of DutiesDocument5 pagesSegregation of DutiesShailendra Singh100% (1)

- Unit 11 Corporate Advisory Services: ObjectivesDocument14 pagesUnit 11 Corporate Advisory Services: ObjectivesamitprgmrNo ratings yet

- Chee Kiong Yam vs. Hon. Malik, G.R. Nos. L-50550-52, 31 October 1979Document2 pagesChee Kiong Yam vs. Hon. Malik, G.R. Nos. L-50550-52, 31 October 1979Robinson MojicaNo ratings yet

- Ronald Crisden 2Document2 pagesRonald Crisden 2dcrisdenNo ratings yet

- Term Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"Document12 pagesTerm Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"hina4No ratings yet

- Corpo 12Document17 pagesCorpo 12Gabe BedanaNo ratings yet

- CSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHDocument4 pagesCSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHCFE International Consultancy GroupNo ratings yet

- Note Issuance FacilitiesDocument6 pagesNote Issuance Facilitiesanish2408No ratings yet

- Indian Bank Case StudyDocument9 pagesIndian Bank Case Studyz12z0% (2)

- United States Court of Appeals First CircuitDocument3 pagesUnited States Court of Appeals First CircuitScribd Government DocsNo ratings yet

- Customer Management Procedure A Study On Some Private Commercial Banks of BangladeshDocument118 pagesCustomer Management Procedure A Study On Some Private Commercial Banks of BangladeshSharifMahmudNo ratings yet

- AccaDocument3 pagesAccaVinitha VenuNo ratings yet

- Overview of Structured Finance and Securitization: Group 05Document12 pagesOverview of Structured Finance and Securitization: Group 05Ankur TulsyanNo ratings yet

- Best Deadline Story 2009Document13 pagesBest Deadline Story 2009Melbourne Press ClubNo ratings yet

- Poornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651Document21 pagesPoornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651sumeet_jayNo ratings yet

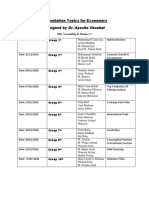

- Presentation Topics For EconomicsDocument1 pagePresentation Topics For Economicsusama ijazNo ratings yet

- GEN1602Attach18450018SLDB UncDocument2 pagesGEN1602Attach18450018SLDB UncjuandroaNo ratings yet

- MCB ReportDocument40 pagesMCB ReportMuzammil Iqbal Qaim KhaniNo ratings yet

- Chile HandbookDocument106 pagesChile HandbookAlejandro Quezada VerdugoNo ratings yet

- Contracts - Ong Lim Sing V FebDocument2 pagesContracts - Ong Lim Sing V FeblauraNo ratings yet

PNB v. CA and Ramon Lopez

PNB v. CA and Ramon Lopez

Uploaded by

Rebecca ChanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PNB v. CA and Ramon Lopez

PNB v. CA and Ramon Lopez

Uploaded by

Rebecca ChanCopyright:

Available Formats

PNB v. CA Facts: PNB applied the amounts of $2,627.11 and Php34,340.

38 from remittances of the defendant, Ramon Lopezs, principals abroad. The first remittance was made by the NCB of Jeddah for the benefit of the plaintiff, to be credited to his account at Citibank, Greenhills Branch; and the second was from Libya, and was intended to be deposited into the plaintiff's account. Afterward, Lopez made a written demand to PNB for the remittance of the equivalent of $2,627.11. It was later found out that Lopezs account had been doubly credited in two instances, with the total amounting to Php87,380.00. Acting upon this information, PNB made a demand from the Lopez to refund the amount of the duplicated credits which, created an extra-contractual obligation under the principle of solutio indebti. To this effect, the amount remittance requested by the defendant had been intercepted and taken by PNB by way of compensation. Upon trial with the lower court, Lopez raised the defense that there had been no compensation under Art. 1279 since, because of their situation, they were both creditors and debtors to each other, with respect to their monetary demands with each other. The trial court, however, said that the relationship between the two of them as creditor and debtor only applies to the fact that Lopez is a depositor in the bank, but by way of solution indebti, he is currently bound to return the amount he had received by mistake as a debtor. However, with respect to the $2627.11, the bank had no right to interfere with the money transfer and retain it as payment for the double credit since it is only a trustee under a stipulation pour atrui, which favors third parties, in that it functions only as a holder in trust of such property before it is claimed by the said third party. On appeal to the Court of Appeals, the bank continued to insist that it validly retained the $2,627.11 in payment of the private respondent's indebtedness by way of compensation or set-off, as provided under Art. 1279 of the Civil Code. The Court of Appeals sided with the trial court and rejected the argument, saying that the money transfer should have been credited in the account of Lopez with Citibank. They should have just transferred the money. Issue: Although the respondent court was correct in saying that the respondent, Ramon Lopez, was bound to return the sum of $2,627.11 to PNB, it erred in not ruling that there had already been a legal compensation that had occurred when the bank was ordered to return to the respondent the same amount. Held: The petitioner liable to the private respondent for the sum of $2,627.11, or its peso equivalent. Ratio: The petitioner contends that since respondent Court found that private respondent is an obligor of PNB and the latter has become an obligor of private respondent, they should be able to hold on to the amount requested by Lopez as a form of first payment. PNB was effectively saying that since the respondent Court of Appeals ruled that petitioner bank could not do a shortcut and simply intercept funds being coursed through it for transfer to another

bank, for transmittal to another bank, and eventually to be deposited to the account of an individual who happens to owe some amount of money to the petitioner, and because respondent Court order petitioner bank to return intercepted amount to said individual, who in turn was found by the appellate Court to be indebted to petitioner bank, there must now be legal compensation of the amounts each owes the other, and hence, there is no need for petitioner bank to actually return the amount, in effect returning to their first position which had already been declared unlawful by the lower courts. This cannot be done. The bank could have just easily disposed of this by exchanging with Lopez checks of equal amounts, but instead wants to make the Court its tool for collection.

You might also like

- Add Tradelines To Credit Report - UCC Filings PDFDocument18 pagesAdd Tradelines To Credit Report - UCC Filings PDFmatt96% (85)

- Complaint Affidavit SampleDocument2 pagesComplaint Affidavit SampleRebecca Chan88% (25)

- Complaint AffidavitDocument2 pagesComplaint AffidavitRebecca Chan0% (1)

- Bonds Exam Cheat SheetDocument2 pagesBonds Exam Cheat SheetSergi Iglesias CostaNo ratings yet

- Sworn Statement SampleDocument2 pagesSworn Statement SampleRebecca Chan100% (6)

- BIR Ruling 555-12Document4 pagesBIR Ruling 555-12Rebecca ChanNo ratings yet

- Hollywood Rules CaseDocument9 pagesHollywood Rules CasePhilip Lahm0% (2)

- Ocampo-Paule vs. CADocument2 pagesOcampo-Paule vs. CARemelyn SeldaNo ratings yet

- Towne & City Devt v. Voluntad - People's Industrial v. CADocument5 pagesTowne & City Devt v. Voluntad - People's Industrial v. CAIyahNo ratings yet

- Oblicon Cases 1156 1162Document16 pagesOblicon Cases 1156 1162Ailene Heramil PonioNo ratings yet

- Tomimbang V TomimbangDocument11 pagesTomimbang V TomimbangChristiane Marie BajadaNo ratings yet

- Berot Vs SiapnoDocument2 pagesBerot Vs SiapnoAlykNo ratings yet

- Timoteo Baluyot, Et Al. vs. Court of AppealsDocument3 pagesTimoteo Baluyot, Et Al. vs. Court of AppealsRommel Mancenido LagumenNo ratings yet

- Moreno-Lentfer v. WolffDocument2 pagesMoreno-Lentfer v. WolffAlfaria Ayan CharpangNo ratings yet

- Barzaga V CADocument1 pageBarzaga V CAEiffel Usman MarrackNo ratings yet

- Marquez Vs ElisanDocument34 pagesMarquez Vs ElisanJP TolNo ratings yet

- Case No. 122Document2 pagesCase No. 122Dhaniella De GuzmanNo ratings yet

- Legarda Vs MiailheDocument1 pageLegarda Vs Miailhemcris101No ratings yet

- CASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009Document2 pagesCASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009philamiasNo ratings yet

- SHUY Vs - SPs. Maulawin Case Digest 2012Document2 pagesSHUY Vs - SPs. Maulawin Case Digest 2012Sam Leynes100% (2)

- PNB Vs The Philippine Vegetable Oil CoDocument2 pagesPNB Vs The Philippine Vegetable Oil Comickeysdortega_41120100% (4)

- Pilar Pagsibigan vs. Court of AppealsDocument4 pagesPilar Pagsibigan vs. Court of AppealsFairyssa Bianca SagotNo ratings yet

- Marquez Vs ElisanDocument2 pagesMarquez Vs ElisanHarold EstacioNo ratings yet

- 133 Geraldo V PeopleDocument2 pages133 Geraldo V PeopleJudy Ann ShengNo ratings yet

- (SANTOS) Ledonio v. Capitol Development CorporationDocument2 pages(SANTOS) Ledonio v. Capitol Development CorporationRenzoSantos100% (2)

- Quinto v. PeopleDocument2 pagesQuinto v. PeopleamberspanktowerNo ratings yet

- Ong v. CA, 310 SCRA 1 (1999)Document2 pagesOng v. CA, 310 SCRA 1 (1999)Rebuild BoholNo ratings yet

- GR. No. 158138 April 12, 2005 Pbcom vs. Lim FactsDocument2 pagesGR. No. 158138 April 12, 2005 Pbcom vs. Lim FactsJanette TitoNo ratings yet

- REYES, Petitioner, v. ASUNCION, RespondentDocument2 pagesREYES, Petitioner, v. ASUNCION, RespondentKatrina Ysobelle Aspi HernandezNo ratings yet

- Azcona v. JamandreDocument1 pageAzcona v. JamandreAnsai Claudine Calugan100% (1)

- Deiparine Vs CADocument9 pagesDeiparine Vs CAbchiefulNo ratings yet

- 044 Trans-Pacific v. CA (Salvador, A.)Document2 pages044 Trans-Pacific v. CA (Salvador, A.)Antonio Salvador100% (1)

- Florention vs. EscarnacionDocument2 pagesFlorention vs. EscarnacionRed-gelo Matuts AgbayaniNo ratings yet

- 214 Spouses Lam v. Kodak Phils., Ltd.Document1 page214 Spouses Lam v. Kodak Phils., Ltd.VEDIA GENONNo ratings yet

- Occena V CADocument2 pagesOccena V CAFina Schuck0% (1)

- Yek Tong Lin Fire Versus YusingcoDocument1 pageYek Tong Lin Fire Versus YusingcoRogelio Rubellano IIINo ratings yet

- Gonzales vs. Heirs of ThomasDocument2 pagesGonzales vs. Heirs of ThomasDongkaeNo ratings yet

- 24 Laperal v. Solid HomesDocument2 pages24 Laperal v. Solid HomesnoonalawNo ratings yet

- PNB vs. CA, GR 108052, 24 July 1996Document6 pagesPNB vs. CA, GR 108052, 24 July 1996Lourdes Loren CruzNo ratings yet

- Oblicon - Digest - March 6Document15 pagesOblicon - Digest - March 6Admin DivisionNo ratings yet

- De Leon V. Ong G.R. No. 170405 February 2, 2010Document1 pageDe Leon V. Ong G.R. No. 170405 February 2, 2010Paula TorobaNo ratings yet

- Piltel Vs TecsonDocument1 pagePiltel Vs TecsonArmand Patiño AlforqueNo ratings yet

- 17 Stronghold v. CADocument2 pages17 Stronghold v. CAMiggy CardenasNo ratings yet

- DBP v. Confesor G.R. No. 48889Document1 pageDBP v. Confesor G.R. No. 48889Rizchelle Sampang-ManaogNo ratings yet

- So V Food Fest LandDocument3 pagesSo V Food Fest LandFranz BiagNo ratings yet

- 01 People v. Bayabos MALLARIDocument2 pages01 People v. Bayabos MALLARIAbigael SeverinoNo ratings yet

- Articles 1170 1171 1338 and 1344Document9 pagesArticles 1170 1171 1338 and 1344Paulo HernandezNo ratings yet

- G.R. No. L-42542 August 5, 1991 CARLOS DIMAYUGA, Petitioner, Philippine Commercial & Industrial Bank and Court of APPEALS, RespondentsDocument1 pageG.R. No. L-42542 August 5, 1991 CARLOS DIMAYUGA, Petitioner, Philippine Commercial & Industrial Bank and Court of APPEALS, RespondentsAnonymous eNHo8720% (2)

- PEOPLE Vs DE GUZMANDocument1 pagePEOPLE Vs DE GUZMANIkko EspornaNo ratings yet

- Chen Teck Lao v. Republic 55 SCRA 1Document2 pagesChen Teck Lao v. Republic 55 SCRA 1Per-Vito DansNo ratings yet

- Philippine Economic Zone Authority (Peza) vs. Pilhino Sales Corp. G.R. No. 185765, September 28, 2016Document7 pagesPhilippine Economic Zone Authority (Peza) vs. Pilhino Sales Corp. G.R. No. 185765, September 28, 2016Mogsy PernezNo ratings yet

- Bonrostro Vs LunaDocument2 pagesBonrostro Vs LunaBianca HerreraNo ratings yet

- Paguio Vs PLDTDocument2 pagesPaguio Vs PLDTAlexandra Nicole Manigos BaringNo ratings yet

- Ramos Vs ObispoDocument5 pagesRamos Vs ObispoNandie JoyNo ratings yet

- Khe Hong Seng v. CADocument3 pagesKhe Hong Seng v. CAEmir Mendoza100% (2)

- CreditTrans People Vs Montemayor GR No. L 17449Document2 pagesCreditTrans People Vs Montemayor GR No. L 17449Jimenez Lorenz100% (1)

- People V Sope, 1946Document2 pagesPeople V Sope, 1946Leo Mark LongcopNo ratings yet

- Manila Trading & Supply Co. vs. Medina (G.R. No. l-16477, May 31, 1961)Document1 pageManila Trading & Supply Co. vs. Medina (G.R. No. l-16477, May 31, 1961)Imee CallaoNo ratings yet

- Gotesco Properties, Inc., Jose C. Go, Et Al., vs. Spouses Eugenio and Angelina FajardoDocument1 pageGotesco Properties, Inc., Jose C. Go, Et Al., vs. Spouses Eugenio and Angelina FajardoPau VillegasNo ratings yet

- Millar V CADocument3 pagesMillar V CALiaa AquinoNo ratings yet

- Philippine National Bank Vs Lilibeth ChanDocument14 pagesPhilippine National Bank Vs Lilibeth ChanJoatham GenovisNo ratings yet

- Hermosa vs. Longara Case DigestDocument2 pagesHermosa vs. Longara Case DigestElla Tho100% (7)

- Cui V CuiDocument3 pagesCui V CuiLawdemhar CabatosNo ratings yet

- General Milling v. Sps. RamosDocument1 pageGeneral Milling v. Sps. RamosDGDelfinNo ratings yet

- Full Obligations and Contracts Digested PDFDocument817 pagesFull Obligations and Contracts Digested PDFJul A.No ratings yet

- Siguan Vs Lim Et Al - DigestDocument3 pagesSiguan Vs Lim Et Al - DigestLiaa Aquino100% (2)

- PNB Vs Sapphire Shipping DIGESTDocument3 pagesPNB Vs Sapphire Shipping DIGESTGellomar AlkuinoNo ratings yet

- Waiver and Confession of Melanie BatumbakalDocument1 pageWaiver and Confession of Melanie BatumbakalRebecca Chan100% (1)

- PALE - in RE GuttierezDocument1 pagePALE - in RE GuttierezRebecca ChanNo ratings yet

- Far Eastern Shipping Company vs. CADocument2 pagesFar Eastern Shipping Company vs. CARebecca Chan100% (2)

- PALE - Misamin Vs San JuanDocument1 pagePALE - Misamin Vs San JuanRebecca ChanNo ratings yet

- PALE - Montecillo and Del Mar Vs Francisco Gica Et AlDocument21 pagesPALE - Montecillo and Del Mar Vs Francisco Gica Et AlRebecca ChanNo ratings yet

- Oronce V CaDocument5 pagesOronce V CaRebecca Chan100% (1)

- PALE - People vs. MaderaDocument1 pagePALE - People vs. MaderaRebecca ChanNo ratings yet

- SANTIAGO Vs BautistaDocument2 pagesSANTIAGO Vs BautistaRebecca ChanNo ratings yet

- Corporation Case - CocofedDocument231 pagesCorporation Case - CocofedRebecca Chan100% (1)

- Evidence CasesDocument14 pagesEvidence CasesRebecca ChanNo ratings yet

- Visitacion Vs ManitDocument2 pagesVisitacion Vs ManitRebecca ChanNo ratings yet

- Zenith Insurance v. CADocument3 pagesZenith Insurance v. CARebecca Chan100% (3)

- Ra 7641 & 7549 ProvisionsDocument3 pagesRa 7641 & 7549 ProvisionsRebecca ChanNo ratings yet

- In Re ArgosinoDocument1 pageIn Re ArgosinoRebecca Chan100% (1)

- Art. 6 CasesDocument6 pagesArt. 6 CasesRebecca ChanNo ratings yet

- Philamcare Health Systems V CADocument2 pagesPhilamcare Health Systems V CARebecca ChanNo ratings yet

- Banda v. ErmitaDocument16 pagesBanda v. ErmitaRebecca ChanNo ratings yet

- Credit and Background: Microfinance Flow ChartDocument21 pagesCredit and Background: Microfinance Flow ChartJerry Sarabia JordanNo ratings yet

- Study of Assessment Methods of Working Capital RequirementDocument92 pagesStudy of Assessment Methods of Working Capital RequirementABHIJIT S. SARKARNo ratings yet

- Part 1-3Document15 pagesPart 1-3Christina AureNo ratings yet

- 1601-FQ Final Jan 2018 Rev DPADocument2 pages1601-FQ Final Jan 2018 Rev DPAMarvin AmparadoNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesHussen AbdulkadirNo ratings yet

- Byf Student Book 4Document53 pagesByf Student Book 4sritraderNo ratings yet

- Ratio AnalysisDocument65 pagesRatio AnalysisAakash ChhariaNo ratings yet

- Segregation of DutiesDocument5 pagesSegregation of DutiesShailendra Singh100% (1)

- Unit 11 Corporate Advisory Services: ObjectivesDocument14 pagesUnit 11 Corporate Advisory Services: ObjectivesamitprgmrNo ratings yet

- Chee Kiong Yam vs. Hon. Malik, G.R. Nos. L-50550-52, 31 October 1979Document2 pagesChee Kiong Yam vs. Hon. Malik, G.R. Nos. L-50550-52, 31 October 1979Robinson MojicaNo ratings yet

- Ronald Crisden 2Document2 pagesRonald Crisden 2dcrisdenNo ratings yet

- Term Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"Document12 pagesTerm Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"hina4No ratings yet

- Corpo 12Document17 pagesCorpo 12Gabe BedanaNo ratings yet

- CSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHDocument4 pagesCSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHCFE International Consultancy GroupNo ratings yet

- Note Issuance FacilitiesDocument6 pagesNote Issuance Facilitiesanish2408No ratings yet

- Indian Bank Case StudyDocument9 pagesIndian Bank Case Studyz12z0% (2)

- United States Court of Appeals First CircuitDocument3 pagesUnited States Court of Appeals First CircuitScribd Government DocsNo ratings yet

- Customer Management Procedure A Study On Some Private Commercial Banks of BangladeshDocument118 pagesCustomer Management Procedure A Study On Some Private Commercial Banks of BangladeshSharifMahmudNo ratings yet

- AccaDocument3 pagesAccaVinitha VenuNo ratings yet

- Overview of Structured Finance and Securitization: Group 05Document12 pagesOverview of Structured Finance and Securitization: Group 05Ankur TulsyanNo ratings yet

- Best Deadline Story 2009Document13 pagesBest Deadline Story 2009Melbourne Press ClubNo ratings yet

- Poornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651Document21 pagesPoornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651sumeet_jayNo ratings yet

- Presentation Topics For EconomicsDocument1 pagePresentation Topics For Economicsusama ijazNo ratings yet

- GEN1602Attach18450018SLDB UncDocument2 pagesGEN1602Attach18450018SLDB UncjuandroaNo ratings yet

- MCB ReportDocument40 pagesMCB ReportMuzammil Iqbal Qaim KhaniNo ratings yet

- Chile HandbookDocument106 pagesChile HandbookAlejandro Quezada VerdugoNo ratings yet

- Contracts - Ong Lim Sing V FebDocument2 pagesContracts - Ong Lim Sing V FeblauraNo ratings yet