Professional Documents

Culture Documents

MR A Imporatant Dates 2013

MR A Imporatant Dates 2013

Uploaded by

Ravi KureemunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MR A Imporatant Dates 2013

MR A Imporatant Dates 2013

Uploaded by

Ravi KureemunCopyright:

Available Formats

MRA Important Dates 2013

JANUARY

By 14th January -Payment of Rum and Liquor Licence. *By 20th January -Submission of monthly/ quarterly VAT return and payment of tax -Remittance of PAYE collections by employers (other than through electronic) -Payment of Environment Protection Fee -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors By 31st January -Submission of APS for quarter ending 31 October 2012by companies. -Submission of return and payment of tax by companies with accounting year ending 31 July 2012. -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld. -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 28th February -Submission of APS for quarter ending 30 November 2012 by companies. -Submission of return and payment of tax by companies with accounting year ending 31 August 2012 -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

APRIL

By 15th April -Submission of Annual Returns and Payment of tax electronically for Individuals. *By 20th April -Submission of monthly/ quarterly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 30th April -Submission of APS for quarter ending 31 January 2013by companies. -Submission of return and payment of tax by companies with accounting year ending 31 October 2012 -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

MARCH

By 20th March -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. *By 31st March -Submission of APS for quarter ending 31 December 2012 by companies -Submission of return and payment of tax by companies with accounting year ending 30 September 2012 -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld. -Submission of Annual Returns and payment of tax for Individuals.

FEBRUARY

By 15th February -Submission of return of employees to MRA -Statement of Emoluments to employees By 17th February - Payment of the first instalment for Advertising Structure Fee By 20th February -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic)

MAY

By 17th May - Payment of the second instalment for Advertising Structure Fee By 20th May -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee.

Diary 2013 MRA Important Dates 2013

-Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 31st May -Submission of APS for quarter ending 28 February 2013by companies. -Submission of return and payment of tax by companies with accounting year ending 30 November 2012 -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

JULY

*By 20th July -Submission of monthly/quarterly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 31st July -Submission of APS statement and payment of tax by companies for quarter ending 30 April 2013. -Submission of return and payment of tax by companies with accounting year ending 31 January 2013. -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

By 31st August -Submission of APS statement and payment of tax by companies for quarter ending 31 May2013. -Submission of return and payment of tax by companies with accounting year ending 28 February 2013. -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

SEPTEMBER

*By 20th September -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. *By 30th September - Submission of CPS statement and payment of tax by individuals for quarter ending 30 June 2013. - Submission of APS statement and payment of tax by companies for quarter ending 30 June 2013. - Submission of return and payment of tax by companies with accounting year ending 31 March 2013. - Remittance of Passenger Fee/ Passenger Solidarity Levy. - Electronic PAYE return and remittance of tax withheld. - End of MRA Incentive Schemes

JUNE

By 20th June -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. *By 30th June -Submission of CPS Statement & Payment of tax for quarter ending 31March 2013 by individuals. -Submission of APS for quarter ending 31 March 2013 by companies. -Submission of return and payment of tax by companies with accounting year ending 31 December 2012 -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

AUGUST

By 17th August - Payment of the third instalment for Advertising Structure Fee *By 20th August -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors.

MRA Important Dates 2013

OCTOBER

*By 20th October -Submission of monthly/ quarterly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 31st October -Submission of APS statement and payment of tax by companies for quarter ending 31 July 2013. -Submission of return and payment of tax by companies with accounting year ending 30 April 2013. -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

NOVEMBER

By 17th November - Payment of the last instalment for Advertising Structure Fee By 20th November -Submission of monthly/quarterly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 30th November -Submission of APS statement and payment of tax by companies for quarter ending 31 August 2013. -Submission of return and payment of tax by companies with accounting year ending 30 May 2013. -Remittance of Passenger Fee / Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

DECEMBER

By 20th December -Submission of monthly VAT return and payment of tax. -Remittance of PAYE collections by employers (other than through electronic). -Payment of Environment Protection Fee. -Remittance of Tax Deducted at Source with regard to royalties, rent and payments to service providers, contractors and sub-contractors. By 27th December -Submission of CPS Statement & Payment of tax for quarter ending 30September 2013 by individuals. -Submission of APS statement and payment of tax by companies for quarter ending 30 September 2013. -Submission of return and payment of tax by companies with accounting year ending 30 June 2013. -Remittance of Passenger Fee/ Passenger Solidarity Levy. -Electronic PAYE return and remittance of tax withheld.

* (Note: when the date for submission of any return and payment of tax falls on Saturday, Sunday or public holiday, the return and the payment may be made on the following working day).

You might also like

- Mlro Annual ReportDocument2 pagesMlro Annual ReportRavi Kureemun0% (1)

- SAMPLE MidtermDocument2 pagesSAMPLE MidtermPatricia Ann GuetaNo ratings yet

- The International Tax HandbookDocument962 pagesThe International Tax HandbookDiego Serrano Dotte100% (1)

- MRA Important Dates: January AprilDocument3 pagesMRA Important Dates: January AprilGamil PardhunNo ratings yet

- Important Dates 2015: JanuaryDocument7 pagesImportant Dates 2015: JanuaryGamil PardhunNo ratings yet

- 2018 Tax Calendar - SlovakiaDocument28 pages2018 Tax Calendar - SlovakiaAccaceNo ratings yet

- Defășurarea Afacerii În RomaniaDocument17 pagesDefășurarea Afacerii În RomaniaAnda PopaNo ratings yet

- TaxationDocument13 pagesTaxationShaz BurkNo ratings yet

- Compliance Calendar 2013-14Document1 pageCompliance Calendar 2013-14Amitmil MbbsNo ratings yet

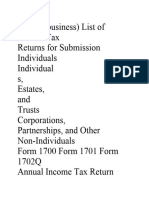

- Submission BirDocument9 pagesSubmission Bir332156879554No ratings yet

- 12 Compliance ChartDocument19 pages12 Compliance CharttabrezullakhanNo ratings yet

- Tax System: About Region Business Infrastructure Investor Guide OffersDocument2 pagesTax System: About Region Business Infrastructure Investor Guide OffersAp VirtuosoNo ratings yet

- Luxembourg VAT GuidebookDocument5 pagesLuxembourg VAT GuidebookmanicpaniNo ratings yet

- Tax Returns and Tax PaymentsDocument19 pagesTax Returns and Tax PaymentsAnthonette QuiamcoNo ratings yet

- Advance Tax Vat II Jj2024Document40 pagesAdvance Tax Vat II Jj2024cnarinNo ratings yet

- Part Two Value Added Tax VATDocument54 pagesPart Two Value Added Tax VATSawsan HatemNo ratings yet

- Lecture Witholding TaxDocument152 pagesLecture Witholding Taxemytherese100% (2)

- Calendar 2013 (Small)Document18 pagesCalendar 2013 (Small)Geeta RamsinghNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- PICPA Webinar - Tax Updates 07152020Document2 pagesPICPA Webinar - Tax Updates 07152020Kirt Russelle PeconadaNo ratings yet

- Bir Updates - GacpaDocument38 pagesBir Updates - GacpaAngelo GasatanNo ratings yet

- SlideshowDocument37 pagesSlideshowBhavesh AgrawalNo ratings yet

- Business Tax 2nd Sem FinalDocument3 pagesBusiness Tax 2nd Sem FinalRizeth GarayNo ratings yet

- Tax System of Azerbaijan and Forms of TaxationDocument17 pagesTax System of Azerbaijan and Forms of TaxationgunayNo ratings yet

- Taxes: Viko Óvida Burbiene Faculty of Economics, 2004Document9 pagesTaxes: Viko Óvida Burbiene Faculty of Economics, 2004Daiva ValienėNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Value Added Tax (Vat)Document40 pagesValue Added Tax (Vat)Phuong TrangNo ratings yet

- CAP2 Tax Reference Material (ROI) - 2013 ExamsDocument15 pagesCAP2 Tax Reference Material (ROI) - 2013 ExamsXiaojie LiuNo ratings yet

- Value Added Tax in Romania VAT TVADocument6 pagesValue Added Tax in Romania VAT TVAmondlyNo ratings yet

- 2013 Tax Card: Rulings Contact UsDocument2 pages2013 Tax Card: Rulings Contact UsLoredanaBaciuNo ratings yet

- BUDGET 2015: Central Excise, Customs, & Service Tax ProposalsDocument12 pagesBUDGET 2015: Central Excise, Customs, & Service Tax ProposalshareshmsNo ratings yet

- BMTAXDocument13 pagesBMTAXKHYSHA NICOLE PALTINGNo ratings yet

- Malta Income Tax For An IndividualDocument4 pagesMalta Income Tax For An IndividualCristina PopescuNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesShaheen MahmudNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- THE Ministry of FinanceDocument19 pagesTHE Ministry of FinancePhương Trần Đỗ NgọcNo ratings yet

- Tax Breaking News Tax - Breaking News: Updated InformationDocument2 pagesTax Breaking News Tax - Breaking News: Updated Informationbama_parisNo ratings yet

- Tax Assignment 1Document16 pagesTax Assignment 1Tunvir Islam Faisal100% (2)

- Tax1 NotesDocument21 pagesTax1 NotesSoothing BlendNo ratings yet

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- Understand Your Self Assessment Tax Bill - GOV - UKDocument3 pagesUnderstand Your Self Assessment Tax Bill - GOV - UKLenvion LNo ratings yet

- Acca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsDocument2 pagesAcca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsSumiya YousefNo ratings yet

- CLNPHARMA FiscalAgent&Import CEDocument3 pagesCLNPHARMA FiscalAgent&Import CEpoyoyi7009No ratings yet

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockNo ratings yet

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- Income Slabs Income Tax RateDocument4 pagesIncome Slabs Income Tax RateSavoir PenNo ratings yet

- Bir Vat QueriesDocument8 pagesBir Vat QueriesMinerva Bautista RoseteNo ratings yet

- June 2018 Module 3.02 (Suggested Solutions)Document13 pagesJune 2018 Module 3.02 (Suggested Solutions)futurepatent20No ratings yet

- 2020 12 14 GST For FPOsDocument15 pages2020 12 14 GST For FPOschaithanya CRDSNo ratings yet

- I 2290Document11 pagesI 2290Alys AlysNo ratings yet

- Additonal Disclosure RR 15 2010Document5 pagesAdditonal Disclosure RR 15 2010Emil A. MolinaNo ratings yet

- New Tax Campaign 2024 DumagueteDocument14 pagesNew Tax Campaign 2024 DumaguetebugsparNo ratings yet

- 130 2016 TT-BTC 323146Document15 pages130 2016 TT-BTC 323146LET LEARN ABCNo ratings yet

- Tax Management CIA 1.2Document16 pagesTax Management CIA 1.2Priyanshi Agrawal 1820149No ratings yet

- Day 1 - Training MaterialsDocument12 pagesDay 1 - Training MaterialsFarjana AkterNo ratings yet

- Tax Review Wooppp WooooDocument8 pagesTax Review Wooppp Wooookaren perrerasNo ratings yet

- 30 - Dinh Phuc UyenDocument6 pages30 - Dinh Phuc UyenĐinh Phúc UyênNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Tax Administration ActDocument52 pagesTax Administration Actasiphileamagiqwa25No ratings yet

- Qrops Amendments To Rules 2015Document4 pagesQrops Amendments To Rules 2015Ravi KureemunNo ratings yet

- FATCA and The Common Reporting StandardDocument14 pagesFATCA and The Common Reporting StandardRavi KureemunNo ratings yet

- Bramer Listing Particlars Bookletpg Whole DocDocument32 pagesBramer Listing Particlars Bookletpg Whole DocRavi KureemunNo ratings yet

- Income Tax Act - Allowable V/s Non AllowableDocument1 pageIncome Tax Act - Allowable V/s Non AllowableRavi KureemunNo ratings yet

- Handbook On E-Way Bill - June 2018 Edn - CA Pritam Mahure and CA Vaishali KhardeDocument250 pagesHandbook On E-Way Bill - June 2018 Edn - CA Pritam Mahure and CA Vaishali KhardeVaishali KhardeNo ratings yet

- Syllabus Bainctax Income Taxationpdf PDF FreeDocument8 pagesSyllabus Bainctax Income Taxationpdf PDF FreePaul Edward GuevarraNo ratings yet

- Solved Lori Is A Student Who Teaches Golf On The WeekendDocument1 pageSolved Lori Is A Student Who Teaches Golf On The WeekendM Bilal SaleemNo ratings yet

- Value Added Tax Definition Examples InvestopediaDocument7 pagesValue Added Tax Definition Examples InvestopediaZicoNo ratings yet

- OD123019702243056000Document1 pageOD123019702243056000Subhajit DasNo ratings yet

- CTT EXAMINATION REVIEWER - Compilation of MCQs (Key)Document33 pagesCTT EXAMINATION REVIEWER - Compilation of MCQs (Key)James RelletaNo ratings yet

- Chapter 9 Percentage TaxDocument25 pagesChapter 9 Percentage TaxTrisha Mae BoholNo ratings yet

- Central Sales Tax-2Document8 pagesCentral Sales Tax-2Krystle DseuzaNo ratings yet

- RMC 1-2019 PDFDocument1 pageRMC 1-2019 PDFJhenny Ann P. SalemNo ratings yet

- Cta 00 CV 05378 D 1997sep01 RefDocument8 pagesCta 00 CV 05378 D 1997sep01 RefStephany PolinarNo ratings yet

- Section 2: Influence of Access To Finance, Infrastructure, Market, Government Policy, Entrepreneurial Influence and Technology On The Growth of SmesDocument7 pagesSection 2: Influence of Access To Finance, Infrastructure, Market, Government Policy, Entrepreneurial Influence and Technology On The Growth of SmesaleneNo ratings yet

- Acc 407 Individual Assignment 1 Semester 1, 2022Document3 pagesAcc 407 Individual Assignment 1 Semester 1, 2022Saaliha SaabiraNo ratings yet

- 8 - Deductions From Gross Income 1Document14 pages8 - Deductions From Gross Income 1RylleMatthanCorderoNo ratings yet

- Atwork Butuan or and Ar May 2023Document4 pagesAtwork Butuan or and Ar May 2023AXZEEN SECURITY AGENCY BUTUANNo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- Mediamark InvoiceDocument1 pageMediamark InvoiceScribdTranslationsNo ratings yet

- UNIT II Tax RemediesDocument17 pagesUNIT II Tax RemediesAl BertNo ratings yet

- Agency Mentor Monthly, Annual Scheme FY 19-20Document8 pagesAgency Mentor Monthly, Annual Scheme FY 19-20Prasad KVNo ratings yet

- Tax 2 Syllabus 2019 PDFDocument10 pagesTax 2 Syllabus 2019 PDFKarinNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Certificate PDFDocument2 pagesCertificate PDFDurgesh RaghuvanshiNo ratings yet

- Steel BillDocument1 pageSteel Billtahajulislam1996No ratings yet

- Rechnung S Nach Rich T 400411107920231106151244Document1 pageRechnung S Nach Rich T 400411107920231106151244dmariann4080No ratings yet

- BLGF Opinion March 17 2011Document7 pagesBLGF Opinion March 17 2011mynet_peterNo ratings yet

- Final 1st Year Bds Fee Schedule For 2023Document1 pageFinal 1st Year Bds Fee Schedule For 2023fareedahmad3221No ratings yet

- Abakada Guro Party List Case DigestDocument2 pagesAbakada Guro Party List Case DigestCarmelito Dante Clabisellas100% (1)

- Legal Opinion de MinimisDocument6 pagesLegal Opinion de MinimisjoyiveeongNo ratings yet