Professional Documents

Culture Documents

Element Global Opportunities Equity Portfolio - February 2011

Element Global Opportunities Equity Portfolio - February 2011

Uploaded by

FilipeCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dispensing, Incompatibilities, and Adverse Drug Reactions Answer Key-PINK PACOPDocument78 pagesDispensing, Incompatibilities, and Adverse Drug Reactions Answer Key-PINK PACOPBilly Vince AlquinoNo ratings yet

- Hertz Limo Service Was Organized To Provide Limousine Service BetweenDocument1 pageHertz Limo Service Was Organized To Provide Limousine Service Betweentrilocksp Singh0% (1)

- Element Global Value - Year End Letter 2014Document12 pagesElement Global Value - Year End Letter 2014FilipeNo ratings yet

- Element Global Value - 2Q14Document6 pagesElement Global Value - 2Q14FilipeNo ratings yet

- Element Global Value - 3Q13Document4 pagesElement Global Value - 3Q13FilipeNo ratings yet

- Element Global Value - May 2013Document3 pagesElement Global Value - May 2013FilipeNo ratings yet

- Element Global Opportunities Equity Portfolio - May 2011Document2 pagesElement Global Opportunities Equity Portfolio - May 2011FilipeNo ratings yet

- Laughter Is Best Essay OtherDocument2 pagesLaughter Is Best Essay OtherArchana SharmaNo ratings yet

- MARATHON - 5 Hour - 6 Month Training ProgramDocument1 pageMARATHON - 5 Hour - 6 Month Training ProgrammiroswatNo ratings yet

- Lefatshe La Botswana)Document21 pagesLefatshe La Botswana)nicNo ratings yet

- Kingfisher BeerDocument41 pagesKingfisher BeersatyashilsNo ratings yet

- Pityriasis RoseaDocument20 pagesPityriasis RoseaMendy Herianto100% (1)

- Outline Report PFR 2015 2018 CASESDocument5 pagesOutline Report PFR 2015 2018 CASESPaul ValerosNo ratings yet

- User Analysis SampleDocument8 pagesUser Analysis Samplecece vergieNo ratings yet

- UNIT 3 Animal ProductionDocument15 pagesUNIT 3 Animal ProductionCarla Angela AngwasNo ratings yet

- Checklist For Visa Application Tourism and Visit To Family / FriendsDocument4 pagesChecklist For Visa Application Tourism and Visit To Family / FriendsBepdjNo ratings yet

- Lifting Operations AZDP Directive 008 - Edition 4.0: U:TobeusedasisDocument7 pagesLifting Operations AZDP Directive 008 - Edition 4.0: U:TobeusedasisSiddharth AsthanaNo ratings yet

- Cloze Passage PDFDocument2 pagesCloze Passage PDFFidah MhNo ratings yet

- Sea 7001GDocument2 pagesSea 7001Gmercury7k29750No ratings yet

- Certificate IV in Commercial Cookery Sit 40516Document13 pagesCertificate IV in Commercial Cookery Sit 40516Tikaram GhimireNo ratings yet

- A Guide To Crane and DerricksDocument222 pagesA Guide To Crane and Derricksrafaqat hussainNo ratings yet

- TỔNG HỢP CÁC ĐỀ CHUYÊN ANH QUỐC HỌC CÁC NĂMDocument61 pagesTỔNG HỢP CÁC ĐỀ CHUYÊN ANH QUỐC HỌC CÁC NĂMLan Phong TranNo ratings yet

- Unit ConversionsDocument2 pagesUnit Conversionsangry_granNo ratings yet

- GlyphosateDocument7 pagesGlyphosateantonio leonNo ratings yet

- Complete ABB BA Solutions 2018Document123 pagesComplete ABB BA Solutions 2018Ayoub DjemaciNo ratings yet

- Earthquake Preparedness: Emergency Plan: What To Do Before An Earthquake - Be Prepared!Document16 pagesEarthquake Preparedness: Emergency Plan: What To Do Before An Earthquake - Be Prepared!Lenaj EbronNo ratings yet

- Pyrometallurgy Lecture 1. Introduction and Roasting ThermodynamicsDocument22 pagesPyrometallurgy Lecture 1. Introduction and Roasting ThermodynamicsNhut NguyenNo ratings yet

- MnemonicDocument33 pagesMnemonicyanot0206No ratings yet

- Notice of Non Consent LiabilityDocument3 pagesNotice of Non Consent LiabilityandrewmmwilmotNo ratings yet

- MSDS - Rilsan NylonDocument13 pagesMSDS - Rilsan NylonDv Maria PradhikaNo ratings yet

- 1.1 Flodis, DN 15 ... 32 MM, Pliant, en PDFDocument4 pages1.1 Flodis, DN 15 ... 32 MM, Pliant, en PDFAnonymous HC0tWeNo ratings yet

- Anti-Drunk and Drugged Driving Act of 2013Document19 pagesAnti-Drunk and Drugged Driving Act of 2013Atoy Liby OjeñarNo ratings yet

- Whistle Blowing PolicyDocument5 pagesWhistle Blowing PolicyAlexandry-Leviasse Levi Mbanzu LuembaNo ratings yet

- Resistance Training: FW01 Physical Activities Toward Health and Fitness 1Document7 pagesResistance Training: FW01 Physical Activities Toward Health and Fitness 1Jerome SadulloNo ratings yet

- RENOLD (Worm Gear - Models PH)Document60 pagesRENOLD (Worm Gear - Models PH)Rodrigo Leal GuzmanNo ratings yet

Element Global Opportunities Equity Portfolio - February 2011

Element Global Opportunities Equity Portfolio - February 2011

Uploaded by

FilipeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Element Global Opportunities Equity Portfolio - February 2011

Element Global Opportunities Equity Portfolio - February 2011

Uploaded by

FilipeCopyright:

Available Formats

Element Global Opportunities Equity Fund

February 2011

The Element Global Opportunities Equity Fund has a mandate to go anywhere in pursuit of attractive investment opportunities using a bottom-up investment approach. The Fund will have at least 70% of its assets invested in the international equity markets. The Fund uses the MSCI World as a benchmark, but does not seek to mimic or track this index in any way, which may lead both country and sectorial allocation to differ considerably from the benchmark.

Fund Details

Net Asset Value (): Assets Under Management (): Launch date: Portfolio Managers: 100.48 25200 14-January-2011 Filipe Alves da Silva Afonso Janurio

Investment Highlights

The Fund underperformed its benchmark by 1.72% in February, due to a high cash position (26%) and underperformances from MRV Engenharia, IBM and Microsoft. In February the Fund increased its positions in IBM and Telefnica, and added La Seda de Barcelona, a restructuring play that we think has a very attractive risk-return profile. During the implementation phase, the fund is using MSCI World Index ETFs (which include Emerging Markets) to maintain an exposure to equity markets of at least 70%. Our objective is to have the fund 100% invested within the next 2 to 3 months, and to wind down the ETF positions in the following 6 months.

Investment Guidelines

Maximum Long Exposure: Minimum Long Exposure: Market Exposure Hedging2 : 130% 70% Fund may use options on single name equities or equity indexes to hedge downside risk Hedged on a best effort basis

Currency Hedging:

Weekly Performance Chart

104

102

100

98

96

14-Jan

21-Jan

28-Jan

31-Jan

4-Feb

11-Feb

18-Feb

25-Feb

28-Feb

Monthly Performance

Jan 2011 -1,11% Feb 1,61% Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD 0,48%

Element Global Opportunities Equity Fund

Allocation by Sector

Cash Utilities Telecommunication Services 2,3% 6,8% 4,6% 26,7%

Cash Others Brazil China Netherlands Italy Sweden Spain Switzerland Germany Australia France Canada United Kingdom Japan United States

Allocation by Country

26,7%

13,3% 3,6% 3,1% 0,7% 0,7% 0,7% 6,1% 1,8% 1,9% 2,0% 2,2% 2,7% 5,0% 5,1% 24,5%

Materials

Health Care Consumer Staples Consumer Discretionary Energy Industrials

5,0%

5,3% 5,6% 6,0% 9,8% 13,9%

Information Technology

Financials

13,7% 0% 5% 10% 15% 20% 25% 30%

0%

5%

10%

15%

20%

25%

30%

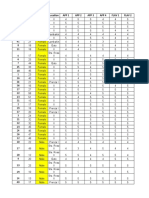

Top 10 Positions

i Sha res MSCI Al l Country ETF i Sha res MSCI Worl d ETF IBM Tel efoni ca MRV Engenha ri a Mi cros ft Corpora ti on Cni ns ure La Seda de Ba rcel ona

Weight

36,6% 19,1% 4,5% 4,2% 2,8% 2,8% 2,2% 1,0%

100%

80,2%

Currency Exposure

80%

60%

40%

20%

14,8%

2,2%

2,8%

BRL

Total

73,3%

0% EUR USD CNY

Glossary

Bottom-up Investing A bottom-up strategy overlooks broad sector and economic conditions and instead focuses on selecting a stock based on the individual attributes of a company. Advocates of the bottom-up approach simply seek strong companies with good prospects, regardless of industry or macroeconomic factors. Net Asset Value The total value of a companys assets less the total value of its liabilities is its net asset value (NAV). For valuation purposes it is common to divide net assets by the number of shares in issue to give the net assets per share, also known as the price per share. Long Exposure Percentage of the Funds assets that are invested in equity markets and that benefit from the appreciation of equity markets. Currency Hedging Transaction implemented to protect the Funds foreign currency positions (non-Euro) from an unwanted move in exchange rates. Top 10 Positions Top holdings are those securities in which the latest percentage of the Funds total assets are invested. They do not include hedging derivatives. A full list of holdings, including derivatives, is available upon request

E L E M E N T C A P I T A L

Contacts

For more informations please contact Afonso Janurio or Filipe Alves da Silva directly or send an email to element.cap@gmail.com

LONDON

GENEVA

Disclamer: Past performance is not indicative of future performance. Reference in this document to specific securities should not be construed as a

recommendation to buy or sell these securities.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dispensing, Incompatibilities, and Adverse Drug Reactions Answer Key-PINK PACOPDocument78 pagesDispensing, Incompatibilities, and Adverse Drug Reactions Answer Key-PINK PACOPBilly Vince AlquinoNo ratings yet

- Hertz Limo Service Was Organized To Provide Limousine Service BetweenDocument1 pageHertz Limo Service Was Organized To Provide Limousine Service Betweentrilocksp Singh0% (1)

- Element Global Value - Year End Letter 2014Document12 pagesElement Global Value - Year End Letter 2014FilipeNo ratings yet

- Element Global Value - 2Q14Document6 pagesElement Global Value - 2Q14FilipeNo ratings yet

- Element Global Value - 3Q13Document4 pagesElement Global Value - 3Q13FilipeNo ratings yet

- Element Global Value - May 2013Document3 pagesElement Global Value - May 2013FilipeNo ratings yet

- Element Global Opportunities Equity Portfolio - May 2011Document2 pagesElement Global Opportunities Equity Portfolio - May 2011FilipeNo ratings yet

- Laughter Is Best Essay OtherDocument2 pagesLaughter Is Best Essay OtherArchana SharmaNo ratings yet

- MARATHON - 5 Hour - 6 Month Training ProgramDocument1 pageMARATHON - 5 Hour - 6 Month Training ProgrammiroswatNo ratings yet

- Lefatshe La Botswana)Document21 pagesLefatshe La Botswana)nicNo ratings yet

- Kingfisher BeerDocument41 pagesKingfisher BeersatyashilsNo ratings yet

- Pityriasis RoseaDocument20 pagesPityriasis RoseaMendy Herianto100% (1)

- Outline Report PFR 2015 2018 CASESDocument5 pagesOutline Report PFR 2015 2018 CASESPaul ValerosNo ratings yet

- User Analysis SampleDocument8 pagesUser Analysis Samplecece vergieNo ratings yet

- UNIT 3 Animal ProductionDocument15 pagesUNIT 3 Animal ProductionCarla Angela AngwasNo ratings yet

- Checklist For Visa Application Tourism and Visit To Family / FriendsDocument4 pagesChecklist For Visa Application Tourism and Visit To Family / FriendsBepdjNo ratings yet

- Lifting Operations AZDP Directive 008 - Edition 4.0: U:TobeusedasisDocument7 pagesLifting Operations AZDP Directive 008 - Edition 4.0: U:TobeusedasisSiddharth AsthanaNo ratings yet

- Cloze Passage PDFDocument2 pagesCloze Passage PDFFidah MhNo ratings yet

- Sea 7001GDocument2 pagesSea 7001Gmercury7k29750No ratings yet

- Certificate IV in Commercial Cookery Sit 40516Document13 pagesCertificate IV in Commercial Cookery Sit 40516Tikaram GhimireNo ratings yet

- A Guide To Crane and DerricksDocument222 pagesA Guide To Crane and Derricksrafaqat hussainNo ratings yet

- TỔNG HỢP CÁC ĐỀ CHUYÊN ANH QUỐC HỌC CÁC NĂMDocument61 pagesTỔNG HỢP CÁC ĐỀ CHUYÊN ANH QUỐC HỌC CÁC NĂMLan Phong TranNo ratings yet

- Unit ConversionsDocument2 pagesUnit Conversionsangry_granNo ratings yet

- GlyphosateDocument7 pagesGlyphosateantonio leonNo ratings yet

- Complete ABB BA Solutions 2018Document123 pagesComplete ABB BA Solutions 2018Ayoub DjemaciNo ratings yet

- Earthquake Preparedness: Emergency Plan: What To Do Before An Earthquake - Be Prepared!Document16 pagesEarthquake Preparedness: Emergency Plan: What To Do Before An Earthquake - Be Prepared!Lenaj EbronNo ratings yet

- Pyrometallurgy Lecture 1. Introduction and Roasting ThermodynamicsDocument22 pagesPyrometallurgy Lecture 1. Introduction and Roasting ThermodynamicsNhut NguyenNo ratings yet

- MnemonicDocument33 pagesMnemonicyanot0206No ratings yet

- Notice of Non Consent LiabilityDocument3 pagesNotice of Non Consent LiabilityandrewmmwilmotNo ratings yet

- MSDS - Rilsan NylonDocument13 pagesMSDS - Rilsan NylonDv Maria PradhikaNo ratings yet

- 1.1 Flodis, DN 15 ... 32 MM, Pliant, en PDFDocument4 pages1.1 Flodis, DN 15 ... 32 MM, Pliant, en PDFAnonymous HC0tWeNo ratings yet

- Anti-Drunk and Drugged Driving Act of 2013Document19 pagesAnti-Drunk and Drugged Driving Act of 2013Atoy Liby OjeñarNo ratings yet

- Whistle Blowing PolicyDocument5 pagesWhistle Blowing PolicyAlexandry-Leviasse Levi Mbanzu LuembaNo ratings yet

- Resistance Training: FW01 Physical Activities Toward Health and Fitness 1Document7 pagesResistance Training: FW01 Physical Activities Toward Health and Fitness 1Jerome SadulloNo ratings yet

- RENOLD (Worm Gear - Models PH)Document60 pagesRENOLD (Worm Gear - Models PH)Rodrigo Leal GuzmanNo ratings yet