Professional Documents

Culture Documents

Yonkers

Yonkers

Uploaded by

Jon CampbellOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yonkers

Yonkers

Uploaded by

Jon CampbellCopyright:

Available Formats

OFFICE OF THE NEW YORK STATE COMPTROLLER

Thomas P. DiNapoli State Comptroller

CITY OF YONKERS

Overview

The City of Yonkers is the fourth largest city in the State, with a 2010 population of 195,976. Yonkers is located just north of the New York City borough of the Bronx, and is the largest city in Westchester County. By several measures, Yonkers is better off than many other cities in the State. The Citys population enjoys a higher median household income ($55,715 compared to $37,607 for the median city), fewer families live in poverty (11.1 percent compared to 13.7 percent for the median city), and median home values are significantly higher ($428,900 compared to $96,000 for the median city) than for cities generally. Yonkers also receives more State revenue sharing aid per capita than the median city ($552 compared to $147), although total State aid for the City declined by 5.1 percent between 2010 and 2011. Despite these advantages, the City has been challenged by significant structural budget gaps. One factor that has contributed to these budget gaps is a dependent school district for which the City must raise taxes and issue debt. An additional component that has recently impacted City finances is a decline in property values driven by a general downturn in the housing market. By the end of its 2011 fiscal year, the City had essentially depleted its general fund reserves. Over the past several years, the City has struggled with a number of troubling issues that threaten its fiscal stability. In addition, the Fiscal Agent Act requires that the Office of the State Comptroller (OSC) conduct regular budget reviews. Recent reviews have found that the City has made use of non-recurring revenues to balance budgets. Recently, the City has begun making tough choices needed to bring the budget into structural balance. Recent events have put significant downward pressure on the Citys revenues. Property values declined 24 percent from 2008 to 2011, which negatively affected property tax revenues. The City relies on State aid more than other cities. State aid declined by 5.1 percent from 2010 to 2011. The City has faced large budget gaps over the last several years, and relied on non-recurring revenues to help close them. As a result, its fund balance has declined by 69 percent, from $47.1 million in 2006 to $14.5 million in 2011. Expenditures grew by 47.4 percent, or at an average annual rate of 4.0 percent, from 2001 to 2011. Enrollment for the dependent Yonkers School District increased by nearly 6 percent, adding pressure on the City budget.

2013 FISCAL PROFILE

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Population and Economic Factors

While Yonkers gained population rapidly through 1960, the Citys population has been relatively stable since, gaining only 2.8 percent through 2010. During the same period Westchester Countys population grew by 17.3 percent. The City is home to large numbers of immigrants and second-generation Americans, which may present service delivery challenges. For instance, 13 percent of the students in the Yonkers city schools have limited English proficiency, compared to the statewide rate of 8 percent. On the other hand, only about 11.1 percent of the Citys families are living in poverty, lower than the median city rate of 13.7 percent. The City had an unemployment rate of 8.3 percent in November 2012, slightly higher than the statewide rate of 7.9 percent.1

Yonkers and Neighboring Areas

Westchester Rockland

Legend

New York City Other Cities Villages Towns

Yonkers

Tax Base

Full assessed property value in Yonkers increased at an average annual rate of 7.1 percent from 2001 to 2011. Although Yonkers benefited from a 161 percent increase in property values from 2001 to 2008, values declined by 24 percent from 2008 to 2011. The City has exhausted 68.2 percent of its constitutional tax limit (CTL), less than the other Big Four cities (i.e., cities that have dependent school districts not including New York City, namely Buffalo, Rochester, Syracuse and Yonkers). Yonkers high property values helped to lower the amount of the CTL exhausted. While property values are relatively Housing Statistics high in Yonkers, the home ownership rate of 46.1 percent Home Ownership is lower than that of the median city (49.5 percent). Tax exempt Median Home Value properties are also more numerous, Vacant Units 36.7 percent, than in the State Exempt from Tax as a whole 32.0 percent. The City is beginning an inventory of properties that are vacant, and in most cases delinquent in taxes. It is currently estimated that there are at least 400 vacant buildings, though vacancy rates are lower than the statewide average, 7.3 percent versus 9.2 percent.

Yonkers

46.1% $428,900 7.3% 36.7%

Median City

49.5% $96,000 9.2% 32.0%

Percentage of Constitutional Tax Limit Exhausted as of 2012

Buffalo Rochester Syracuse Yonkers

71.2% 74.9% 68.6% 68.2%

Throughout this report, references to all cities or median city exclude New York City.

2013 FISCAL PROFILE

Division of Local Government and School Accountability

The City has been promoting economic development initiatives which it believes should have a positive impact on City and school district finances. These include the addition of slot machines at the Yonkers Raceway and Empire City Casino, Ridge Hill a mixeduse residential and retail development, and the redevelopment of the Citys waterfront.

Revenues and Expenditures

The Citys revenues grew 51.4 percent, an average annual rate of 4.2 percent, from 2001 to 2011, compared to 39.2 percent, an average growth rate of 3.4 percent, for all cities in the State.2 The largest source of revenue for the City in 2011 was State aid, which accounted for 34 percent of all City revenues, compared to 31 percent for the Big Four cities and 20 percent for all cities. As with the other Big Four cities, Yonkers high level of State Aid compared to all cities in the State is driven partly by its dependent school district. State aid grew at an average annual rate of 6.9 percent from 2001 to 2010 but declined by 5.1 percent from 2010 to 2011. The majority of State aid for cities is in Aid and Incentives for Municipalities, or revenuesharing payments. Yonkers received $552 per capita in State revenuesharing aid. The median city received $147 per capita. Like all cities, Yonkers has little control over State aid, making it vulnerable to fluctuations that reflect the changing needs and priorities of the State government.

Comparison of Revenue Sources, 2011

35%

30%

25%

Yonkers Big 4 All Cities

20% 15%

10%

5%

0%

Property Tax Sales Personal Charges Misc. State and Income for Local Aid Use Tax Tax Services Revenues Federal Aid

State Aid to the City of Yonkers

$160 $150 $140

Millions

$130 $120 $110 $100 $90 $80

Preliminary 2012 financial data is available for Yonkers. However, for comparative purposes this report will use data from 2001 to 2011

Thomas P. DiNapoli New York State Comptroller

2013 FISCAL PROFILE

Property taxes make up 24 percent of total City revenues, compared to 16 percent for Big Four cities and 26 percent for all cities. Sales taxes account for 16 percent of total revenues, compared to 21 percent for Big Four cities and 19 percent for all cities. Yonkers has its own sales tax, pre-empting part of the county sales tax, at a local rate of 4 percent. Yonkers also receives about 7 percent of its revenues from a city income tax, a revenue source that only Yonkers and New York City have among the States cities, and which has fluctuated significantly in recent years. The Citys dependent school district also relies on State aid and property taxes for the majority of its revenues. The school districts State aid was increased after the settlement of a desegregation suit in 2002, and comprised 46 percent of district revenues in 2011. The district receives $218 million in property tax revenue from the City, which generally cannot be reduced due to a State-mandated maintenance of effort requirement.3

Comparison of Expenditures, 2011

35% 30%

Yonkers Big 4 All Cities

25%

20% 15%

10%

5% 0%

Public General Employee TransDebt Other Expenditures in Yonkers increased Safety Government Benefits portation Service Expenditures* by 47.4 percent, an average annual * Other Expenditures include: Communitiy services, Culture and recreation, Economic development, rate of 4.0 percent from 2001 to Sanitation, Social services, Transportation, and Utilities. 2011, more rapidly than the 34.2 percent growth for cities generally, an average annual rate of 3.4 percent. Like most cities, Yonkers spends a large amount on public safety (police and fire protection, etc.), 31 percent of expenditures, compared to 29 percent in Big Four cities and 26 percent in all cities. Employee benefits (health insurance and retirement benefits, etc.), make up 24 percent of expenditures, the same as in the Big Four cities and slightly higher than the 22 percent share in all cities. General government (administration, operations and judgments, etc), accounted for 14 percent of expenditures, less than the 17 percent in the Big Four cities but nearly the same as in all cities. The Citys expenditures for debt service 8.9 percent are above the median city average of 8.2 percent, and increased at an average annual rate of 8.7 percent from 2001 to 2011. Part of this debt burden is the result of borrowing to pay high tax certiorari claims. Employee benefits increased at a rapid rate of 9.1 percent, which is about the same as the increase for cities statewide.

Education Law, section 2576 (5-b).

2013 FISCAL PROFILE

Division of Local Government and School Accountability

Current and Projected Budget Situation

The Citys budget for the 2013 fiscal year increases appropriations for City purposes by 2.5 percent from the prior year, while school district appropriations increase by 3.1 percent. The property tax levy (City and school district combined) increased by 3.9 percent. The City received a spin-up (an acceleration of State aid from future years) of $11.9 million for fiscal year 2013. The Citys general fund balance declined by 75 percent over four years, from $47.1 million in 2006 to $11.6 million in 2010. While the Citys general fund balance increased slightly to $14.5 million in 2011, the City still lacks adequate and stable reserves going forward. A new City administration came into office at the beginning of 2012. At that time, officials ordered a hiring freeze and began to merge some City departments. However, the City still projects that under current policies, large budget gaps will appear over the next few years, from $86 million in 2014, up to $187 million in 2016 for the City and school district combined.

City of Yonkers General Fund Balance

$50

$40

Millions

$30

$20

$10

$0

2006

2007

2008

2009

2010

2011

From the City of Yonkers Comprehensive Annual Financial Reports.

Enrollment for the dependent Yonkers school district increased by almost 6 percent from fiscal year 2009 to fiscal year 2012, while overall state public school enrollment declined by 0.8 percent. This enrollment increase has added to the pressures on the Citys budget. Assuming the budget gap is filled in part by utilizing fund balance, the City could quickly exhaust its balance. The City is considering possible gap closing measures including increases in the City income tax, property tax and real estate transfer tax, as well as increases in the contribution rates of employee health plans and limiting growth in the school districts operating costs. The City is also advocating for the reassessment of all properties in Westchester County in the hope that this will save money by reducing the number of tax certiorari claims. OSC has an on-going involvement in monitoring the fiscal policies of Yonkers due to the Fiscal Agent Act. OSC must verify that proposed revenues and expenditures are in compliance with the Act, and may compel changes in the budget prior to its adoption. OSC has also conducted audits of the Citys financial operations that have examined some budget-related issues in more depth.

Thomas P. DiNapoli New York State Comptroller

2013 FISCAL PROFILE

Bond Ratings and Debt

Moodys gave the Citys debt a rating of Baa1 with a stable outlook in December 2012, which indicates a moderate credit risk. Moodys analysts were impressed by the new administrations management and by the potential of the planned revaluation of the Citys property to limit the number of tax appeals. In addition, they noted a sizable tax base and the positive effects of the Fiscal Agent Act. However, they also remained concerned about large projected budget gaps and limited financial flexibility. Standard and Poors gave the Citys debt a BBB+ rating with a stable outlook in October 2011, indicating an adequate capacity to meet financial commitments, but subject to adverse economic conditions. Analysts cite such problems as the property tax levy limitation, declining State aid and increasing fixed costs. However, they see the City as benefiting from its participation in the New York City metropolitan areas diverse economy, OSCs oversight under the Fiscal Agent Act and a moderate debt burden.

Percentage of Constitutional Debt Limit Exhausted as of 2011

Buffalo Rochester Syracuse Yonkers

57.3% 60.8% 52.9% 18.4%

While the City has high debt service costs, it has only exhausted 18.4 percent of its Constitutional Debt Limit, due in part to its relatively high property values. The City had outstanding debt of $479 million at the end of 2011. Debt service costs were 9.6 percent, higher than the 8.2 percent average for all cities in the State, and the 7.5 percent average for the Big Four cities.

2013 FISCAL PROFILE

Division of Local Government and School Accountability

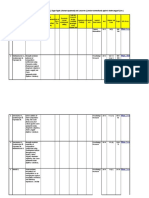

Yonkers vs. All Cities and New York State

Population 2010: 195,976

Demographic Indicators Percent Change in Population 1950-2010 Median Household Income, 2010 Percentage of Families in Poverty 2010 Unemployment Rate November 2012 Property Value Indicators Median Home Value 2010 Percent Change in Full Value 2007-2012 Owner-Occupied Housing Units 2010 Property Vacancy Rate 2010 Percentage of Property Value That is Tax Exempt 2010 Revenue and Tax Indicators State Revenue Sharing Aid (AIM) per Capita SFY 2012-13 Tax Limit Exhausted 2012 GF Unreserved Fund Balance as a % of Revenue 2007 GF Unreserved Fund Balance as a % of Revenue 2011 $552.19 68% 12.1% 3.9% $146.80 44% 13.1% 10.1% $289.50 N/A 15.7% 13.2% N/A N/A N/A N/A $428,900 -10.7% 46.1% 7.3% 36.7% $96,000 11.6% 49.5% 9.2% 32.0% N/A -1.3% 45.4% 10.4% 34.9% $303,900 5.4% 53.3% 9.7% 25.6% 28% $55,715 11.1% 8.3% -20% $37,607 13.7% N/A -25% N/A 16.6% N/A 31% $55,603 10.8% 7.9%

City of Yonkers

All Cities (excluding NYC) Median Aggregate

New York State

Source: U.S. Census Bureau, American Community Survey, 5-year estimates, 2006-2010 and 2010 Census; Department of Taxation and Finance; New York State Labor Department; Office of the State Comptroller.

Thomas P. DiNapoli New York State Comptroller

2013 FISCAL PROFILE

Thomas P. DiNapoli New York State Comptroller

Division of Local Government and School Accountability

Central Office Directory

Andrew A. SanFilippo, Executive Deputy Comptroller

(Area code for the following is 518 unless otherwise specified)

Executive ..................................................................................................................................................................474-4037 Steven J. Hancox, Deputy Comptroller Nathaalie N. Carey, Assistant Comptroller Audits, Local Government Services and Professional Standards .................................................474-5404 (Audits, Technical Assistance, Accounting and Audit Standards) Local Government and School Accountability Help Line ...............................(855)478-5472 or 408-4934 (Electronic Filing, Financial Reporting, Justice Courts, Training)

New York State Retirement System

Retirement Information Services Inquiries on Employee Benefits and Programs .................................................................474-7736 Bureau of Member Services ................................................................................................................474-1101 Monthly Reporting Inquiries ................................................................................................... 474-1080 Audits and Plan Changes .......................................................................................................... 474-0167 All Other Employer Inquiries....................................................................................................474-6535

Division of Legal Services Other OSC Offices

Municipal Law Section ........................................................................................................................474-5586

Bureau of State Expenditures ..........................................................................................................486-3017 Bureau of State Contracts .................................................................................................................. 474-4622

Mailing Address for all of the above: 8

Office of the State Comptroller, 110 State St., Albany, New York 12236 email: localgov@osc.state.ny.us

Division of Local Government and School Accountability

2013 FISCAL PROFILE

Division of Local Government and School Accountability

Regional Office Directory

Andrew A. SanFilippo, Executive Deputy Comptroller Steven J. Hancox, Deputy Comptroller (518) 474-4037 Nathaalie N. Carey, Assistant Comptroller

Cole H. Hickland, Director Jack Dougherty, Director Direct Services (518) 474-5480 BINGHAMTON REGIONAL OFFICE - H. Todd Eames, Chief Examiner

State Office Building, Suite 1702 44 Hawley Street Binghamton, New York 13901-4417 Tel (607) 721-8306 Fax (607) 721-8313 Email: Muni-Binghamton@osc.state.ny.us Serving: Broome, Chenango, Cortland, Delaware, Otsego, Schoharie, Sullivan, Tioga, Tompkins counties

BUFFALO REGIONAL OFFICE Robert Meller, Chief Examiner

295 Main Street, Suite 1032 Buffalo, New York 14203-2510 Tel (716) 847-3647 Fax (716) 847-3643 Email: Muni-Buffalo@osc.state.ny.us Serving: Allegany, Cattaraugus, Chautauqua, Erie, Genesee, Niagara, Orleans, Wyoming counties

GLENS FALLS REGIONAL OFFICE - Jeffrey P. Leonard, Chief Examiner

One Broad Street Plaza Glens Falls, New York 12801-4396 Tel (518) 793-0057 Fax (518) 793-5797 Email: Muni-GlensFalls@osc.state.ny.us Serving: Albany, Clinton, Essex, Franklin, Fulton, Hamilton, Montgomery, Rensselaer, Saratoga, Schenectady, Warren, Washington counties

HAUPPAUGE REGIONAL OFFICE Ira McCracken, Chief Examiner

NYS Office Building, Room 3A10 Veterans Memorial Highway Hauppauge, New York 11788-5533 Tel (631) 952-6534 Fax (631) 952-6530 Email: Muni-Hauppauge@osc.state.ny.us Serving: Nassau, Suffolk counties

NEWBURGH REGIONAL OFFICE Tenneh Blamah, Chief Examiner

33 Airport Center Drive, Suite 103 New Windsor, New York 12553-4725 Tel (845) 567-0858 Fax (845) 567-0080 Email: Muni-Newburgh@osc.state.ny.us Serving: Columbia, Dutchess, Greene, Orange, Putnam, Rockland, Ulster, Westchester counties

ROCHESTER REGIONAL OFFICE Edward V. Grant Jr., Chief Examiner

The Powers Building 16 West Main Street Suite 522 Rochester, New York 14614-1608 Tel (585) 454-2460 Fax (585) 454-3545 Email: Muni-Rochester@osc.state.ny.us Serving: Cayuga, Chemung, Livingston, Monroe, Ontario, Schuyler, Seneca, Steuben, Wayne, Yates counties

SYRACUSE REGIONAL OFFICE Rebecca Wilcox, Chief Examiner

State Office Building, Room 409 333 E. Washington Street Syracuse, New York 13202-1428 Tel (315) 428-4192 Fax (315) 426-2119 Email: Muni-Syracuse@osc.state.ny.us Serving: Herkimer, Jefferson, Lewis, Madison, Oneida, Onondaga, Oswego, St. Lawrence counties

STATEWIDE AUDIT - Ann C. Singer, Chief Examiner

State Office Building, Suite 1702 44 Hawley Street Binghamton, New York 13901-4417 Tel (607) 721-8306 Fax (607) 721-8313

Thomas P. DiNapoli New York State Comptroller

2013 FISCAL PROFILE

New York State Office of the State Comptroller Division of Local Government and School Accountability 110 State Street, 12th Floor Albany, New York 12236

February 2013

You might also like

- Dallas Mayor's Poverty Task Force Issues RecommendationsDocument20 pagesDallas Mayor's Poverty Task Force Issues RecommendationsKERANewsNo ratings yet

- Automobile Insurance: Allstate Northbrook Indemnity CompanyDocument1 pageAutomobile Insurance: Allstate Northbrook Indemnity Companydebanjan907No ratings yet

- Workday RecruitingDocument29 pagesWorkday Recruitingvani sureshNo ratings yet

- Stronger Neighborhoods PAC/LatimerDocument2 pagesStronger Neighborhoods PAC/LatimerJon CampbellNo ratings yet

- Comptroller's DRAFT Audit of SchenectadyDocument19 pagesComptroller's DRAFT Audit of SchenectadyDavid LombardoNo ratings yet

- Dutchess County UnemploymentDocument10 pagesDutchess County Unemploymentapi-107641637No ratings yet

- MN Vulnerable CitiesDocument64 pagesMN Vulnerable CitiescommersNo ratings yet

- The Local Squeeze: Falling Revenues and Growing Demand For Services Challenge Cities, Counties, and School DistrictsDocument32 pagesThe Local Squeeze: Falling Revenues and Growing Demand For Services Challenge Cities, Counties, and School DistrictsJbrownie HeimesNo ratings yet

- Nyc Public HousingDocument32 pagesNyc Public Housingfromatob3404No ratings yet

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Document45 pagesBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationNo ratings yet

- Countdown To Zero FINALDocument10 pagesCountdown To Zero FINALtscupeNo ratings yet

- Payments in Lieu of TaxesDocument52 pagesPayments in Lieu of TaxesLincoln Institute of Land PolicyNo ratings yet

- Anatomy of Successful US Cities: Special CommentDocument12 pagesAnatomy of Successful US Cities: Special Commentapi-63385278No ratings yet

- 2010 State of The CityDocument33 pages2010 State of The CityerikvsorensenNo ratings yet

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorNo ratings yet

- Philippines Decentralisation RRLDocument13 pagesPhilippines Decentralisation RRLDaniel Paulo MangampatNo ratings yet

- 2016 Annual Report On Local Governments: ComptrollerDocument31 pages2016 Annual Report On Local Governments: ComptrollerNick ReismanNo ratings yet

- Property Tax and Income - Brief - FINALDocument9 pagesProperty Tax and Income - Brief - FINALThe GazetteNo ratings yet

- FY 2011-12 New York State Executive Budget TestimonyDocument13 pagesFY 2011-12 New York State Executive Budget TestimonyjspectorNo ratings yet

- City of Oakland Budget Facts 2011Document6 pagesCity of Oakland Budget Facts 2011oaklocNo ratings yet

- 2010 Albany BudgetDocument187 pages2010 Albany BudgettulocalpoliticsNo ratings yet

- Costs OkanoganDocument19 pagesCosts Okanoganapi-242006552No ratings yet

- Budget OpinionnaireDocument22 pagesBudget OpinionnaireVivek JhaNo ratings yet

- Pcei Report 2010 FinalDocument26 pagesPcei Report 2010 FinalBrackett427No ratings yet

- Crisis BudgetingDocument59 pagesCrisis BudgetinghellomaxwalkerNo ratings yet

- Big Bank Tax DrainDocument25 pagesBig Bank Tax DrainpublicaccountabilityNo ratings yet

- The Impact of Credit On Village Economies: American Economic Journal: Applied Economics 2012, 4 (2) : 98-133Document36 pagesThe Impact of Credit On Village Economies: American Economic Journal: Applied Economics 2012, 4 (2) : 98-133Feryanto W. Karo-KaroNo ratings yet

- TN Finances 20 ReportDocument181 pagesTN Finances 20 ReportinforumdocsNo ratings yet

- Designing Comprehensive Privatization Programs For Cities: ExecutiveDocument26 pagesDesigning Comprehensive Privatization Programs For Cities: ExecutivereasonorgNo ratings yet

- 2012 Budget BookDocument27 pages2012 Budget BookGerrie SchipskeNo ratings yet

- Property Tax Reform PresentationDocument29 pagesProperty Tax Reform PresentationStatesman JournalNo ratings yet

- Commission of Inquiry Report 4 - 4Document8 pagesCommission of Inquiry Report 4 - 4michael_olson6605No ratings yet

- 6.4.20 Letter To Mayor de BlasioDocument4 pages6.4.20 Letter To Mayor de BlasioSaraNo ratings yet

- Illinois IllustratedDocument64 pagesIllinois IllustratedReboot Illinois100% (1)

- Companion Report Episode 53Document45 pagesCompanion Report Episode 53Valerie F. LeonardNo ratings yet

- Fiscal Stress Monitoring System Results For Municipalities:: ComptrollerDocument12 pagesFiscal Stress Monitoring System Results For Municipalities:: ComptrollerjspectorNo ratings yet

- Miner Joint Budget Hearing 2-25-2015Document8 pagesMiner Joint Budget Hearing 2-25-2015Tim KnaussNo ratings yet

- Intergovernmental Relations: Miftahudin Rian SashaDocument34 pagesIntergovernmental Relations: Miftahudin Rian SashaRian FahminuddinNo ratings yet

- Community Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)Document19 pagesCommunity Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)crotondemsNo ratings yet

- Tax BriefDocument3 pagesTax BriefHelen BennettNo ratings yet

- Informal TaxationDocument28 pagesInformal Taxationadib dewasaNo ratings yet

- 0416BUS EconsnapshotDocument1 page0416BUS EconsnapshotThe Dallas Morning NewsNo ratings yet

- BP65 2010 Burdens ReportDocument12 pagesBP65 2010 Burdens ReportjspectorNo ratings yet

- Volume VIII Economic DevelopmentDocument51 pagesVolume VIII Economic DevelopmentFred WilderNo ratings yet

- See Chapter 20 of 48 U.S. CodeDocument4 pagesSee Chapter 20 of 48 U.S. CodeMetro Puerto RicoNo ratings yet

- IIF SettlementFunds Report PDFDocument2 pagesIIF SettlementFunds Report PDFjspectorNo ratings yet

- Revenue Sharing ReportDocument12 pagesRevenue Sharing ReportMaine Policy InstituteNo ratings yet

- Economic Snapshot For June 2011Document4 pagesEconomic Snapshot For June 2011Center for American ProgressNo ratings yet

- Summary Sheet: ESI-UrbanizationDocument26 pagesSummary Sheet: ESI-UrbanizationAbhey RattanNo ratings yet

- Case Study VietnamDocument11 pagesCase Study VietnamThanh NguyenNo ratings yet

- Local Government in FinlandDocument5 pagesLocal Government in FinlandGianina LăscaeNo ratings yet

- Financing Municipalities: Evaluation of Canadian System in Indian PerspectiveDocument10 pagesFinancing Municipalities: Evaluation of Canadian System in Indian PerspectiveKrishna Kumar DwivediNo ratings yet

- 2 D & C Income Decline 10-28-09 3pDocument3 pages2 D & C Income Decline 10-28-09 3pxjaxNo ratings yet

- Wrrbfy14 BudgetDocument18 pagesWrrbfy14 BudgetMass LiveNo ratings yet

- California and the American Tax Revolt: Proposition 13 Five Years LaterFrom EverandCalifornia and the American Tax Revolt: Proposition 13 Five Years LaterTerry SchwadronNo ratings yet

- Governing Metropolitan Toronto: A Social and Political Analysis, 1953 - 1971From EverandGoverning Metropolitan Toronto: A Social and Political Analysis, 1953 - 1971No ratings yet

- Educating Voters for Rebuilding America: National Goals and Balanced BudgetFrom EverandEducating Voters for Rebuilding America: National Goals and Balanced BudgetNo ratings yet

- Sexual Offense Evidence Kit Inventory Report 3-1-17Document26 pagesSexual Offense Evidence Kit Inventory Report 3-1-17Jon Campbell100% (1)

- Opinion Re Legislative LawDocument4 pagesOpinion Re Legislative LawCasey SeilerNo ratings yet

- AttyAffirmation For Omnibus Motion - FinalDocument4 pagesAttyAffirmation For Omnibus Motion - FinalJon CampbellNo ratings yet

- Acacia v. SUNY RF Et AlDocument12 pagesAcacia v. SUNY RF Et AlJon CampbellNo ratings yet

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490No ratings yet

- NYS Department of Health Aca Repeal AnalysisDocument2 pagesNYS Department of Health Aca Repeal AnalysisMatthew HamiltonNo ratings yet

- FHWA Nov 2016 LetterDocument2 pagesFHWA Nov 2016 LetterJon CampbellNo ratings yet

- Gaddy SummonsDocument2 pagesGaddy SummonsJon CampbellNo ratings yet

- US v. Percoco Et Al Indictment - Foreperson SignedDocument36 pagesUS v. Percoco Et Al Indictment - Foreperson SignedNick ReismanNo ratings yet

- FHWA DOT LettersDocument4 pagesFHWA DOT LettersJon CampbellNo ratings yet

- Schneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitDocument33 pagesSchneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitMatthew HamiltonNo ratings yet

- Chamber of CommerceDocument1 pageChamber of CommerceRyan WhalenNo ratings yet

- 2016 Environmental Scorecard PDFDocument28 pages2016 Environmental Scorecard PDFrkarlinNo ratings yet

- Trump Foundation Notice of Violation 9-30-16Document2 pagesTrump Foundation Notice of Violation 9-30-16Cristian Farias100% (1)

- Two Year Medical Marijuana ReportDocument14 pagesTwo Year Medical Marijuana ReportMatthew HamiltonNo ratings yet

- CES Order PDFDocument163 pagesCES Order PDFrkarlinNo ratings yet

- Oag Report - Putnam CountyDocument84 pagesOag Report - Putnam CountyJon CampbellNo ratings yet

- Letter To EPA 8 30 16Document3 pagesLetter To EPA 8 30 16Casey SeilerNo ratings yet

- Orange County CaseDocument42 pagesOrange County CaseJon CampbellNo ratings yet

- McCarthy To Zucker and Seggos 09-01-16Document3 pagesMcCarthy To Zucker and Seggos 09-01-16Matthew HamiltonNo ratings yet

- New York State Offshore Wind BlueprintDocument24 pagesNew York State Offshore Wind BlueprintJon CampbellNo ratings yet

- STARTUPNY Appendix ParticipatingBusinesses2015Document4 pagesSTARTUPNY Appendix ParticipatingBusinesses2015Jon CampbellNo ratings yet

- Module 8 Review 1 25 QuestionsDocument4 pagesModule 8 Review 1 25 QuestionsIbrahim FareedNo ratings yet

- Effects of Land-Use Types On Some Soil Properties in Tsinipanbe, Chunku, Wukari L.G.a, Taraba State, NigeriaDocument8 pagesEffects of Land-Use Types On Some Soil Properties in Tsinipanbe, Chunku, Wukari L.G.a, Taraba State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PPTDocument17 pagesPPTTamil Videos100% (1)

- Philippine Rehabilitation InstituteDocument3 pagesPhilippine Rehabilitation InstituteExpecto ZacNo ratings yet

- The Hole Problem in Knit GoodsDocument13 pagesThe Hole Problem in Knit GoodsKathirrveluSubramainanNo ratings yet

- DC MachineDocument35 pagesDC Machinehs637717No ratings yet

- Modicon TM3 - TM3DI16Document8 pagesModicon TM3 - TM3DI16Abdan SyakuraNo ratings yet

- RTN 320 V100 Quick Installation Guide 02Document37 pagesRTN 320 V100 Quick Installation Guide 02Juan Pablo CharrisNo ratings yet

- Dental Orthodontics MCQsDocument23 pagesDental Orthodontics MCQsSuraj RaiNo ratings yet

- Chapter 6vat On SalesDocument24 pagesChapter 6vat On SalesNoriel Justine QueridoNo ratings yet

- Power Plant Project ReportDocument66 pagesPower Plant Project ReportPoojit PopliNo ratings yet

- RRLDocument5 pagesRRLAyen Alecksandra CadaNo ratings yet

- Basic Concepts of Organic ChemistryDocument112 pagesBasic Concepts of Organic ChemistryNavya KuchanaNo ratings yet

- Energy Levels & Energy BandsDocument18 pagesEnergy Levels & Energy Bandsrizal123No ratings yet

- GEMU090 Iceomatic Service ManualDocument25 pagesGEMU090 Iceomatic Service Manualdan themanNo ratings yet

- Storage PotatoDocument14 pagesStorage PotatoSunil PareekNo ratings yet

- H2 Sin Oil WellsDocument7 pagesH2 Sin Oil WellsAyadi_AymanNo ratings yet

- Science - Issue 6550 Volume 373 2 July 2021Document176 pagesScience - Issue 6550 Volume 373 2 July 2021GmkalyLinux100% (1)

- Informal LetterDocument2 pagesInformal LettereiyrulNo ratings yet

- Serie-6-Ttv Brochure enDocument16 pagesSerie-6-Ttv Brochure envaneaNo ratings yet

- SOP Facility and Equipment HygieneDocument6 pagesSOP Facility and Equipment HygieneHenry Taguma100% (1)

- 10P 2L8M D5 V3 Product SpecificationsDocument6 pages10P 2L8M D5 V3 Product SpecificationsAnkur PrasadNo ratings yet

- 2016 Glencolmcille Show Entry BookletDocument24 pages2016 Glencolmcille Show Entry BookletGlencolmcille ShowNo ratings yet

- Legal Med CasesDocument22 pagesLegal Med CasesGraceNo ratings yet

- MVR Pro HD Introduction 2019-07Document57 pagesMVR Pro HD Introduction 2019-07Nguyen Tuan ThanhNo ratings yet

- Unit 4 - GeneticsDocument28 pagesUnit 4 - GeneticsRughaya SalsabilaNo ratings yet

- Demand Side Policies CanadaDocument3 pagesDemand Side Policies CanadaIva ChadikovskaNo ratings yet

- Medical Terminolgy Trans 1 115 SlidesDocument14 pagesMedical Terminolgy Trans 1 115 SlidesSophia Nicole LibaoNo ratings yet