Professional Documents

Culture Documents

Legislative Wrap Up February 18-22

Legislative Wrap Up February 18-22

Uploaded by

delegatearoraCopyright:

Available Formats

You might also like

- 2ND QTR - ExamDocument4 pages2ND QTR - ExamLeoj Jelfemar Dizor100% (1)

- Rob Corry: Amendment 64 RecommendationsDocument30 pagesRob Corry: Amendment 64 RecommendationsMichael_Lee_RobertsNo ratings yet

- MUN Position Paper HRCDocument3 pagesMUN Position Paper HRCK.Gayathri Naidu100% (2)

- Request For CCTV FootageDocument1 pageRequest For CCTV FootageMartiniRivera75% (4)

- 257 The Count's RevengeDocument6 pages257 The Count's Revengemuhammaduzair38100% (1)

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument10 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument4 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Week 7 Reg. SessionDocument3 pagesWeek 7 Reg. SessionRepNLandryNo ratings yet

- BPAG Insurance Bulletin 1-23-15Document7 pagesBPAG Insurance Bulletin 1-23-15The Bose Insurance BlogNo ratings yet

- 2014 Indiana Legislative Update # 4Document5 pages2014 Indiana Legislative Update # 4The Bose Insurance BlogNo ratings yet

- Legislative Wrap Up February 4-8 2013Document6 pagesLegislative Wrap Up February 4-8 2013delegatearoraNo ratings yet

- New Minnesota LawsDocument9 pagesNew Minnesota LawsWCCO - CBS MinnesotaNo ratings yet

- Pages From Ballot ItDocument8 pagesPages From Ballot ItTeaPartyCheerNo ratings yet

- Legislative Wrap Up February 25-March 1Document7 pagesLegislative Wrap Up February 25-March 1delegatearoraNo ratings yet

- 2013 House Notes - Week 2Document3 pages2013 House Notes - Week 2RepNLandryNo ratings yet

- PDAF WriteupDocument9 pagesPDAF WriteupRojbNo ratings yet

- BPAG Insurance Bulletin 2-20-15Document7 pagesBPAG Insurance Bulletin 2-20-15The Bose Insurance BlogNo ratings yet

- 2014 House Notes Week ThreeDocument6 pages2014 House Notes Week ThreeRepNLandryNo ratings yet

- 2013 House Notes - Week 7Document4 pages2013 House Notes - Week 7RepNLandryNo ratings yet

- Legislative Session ReviewDocument4 pagesLegislative Session ReviewCarisa AzariaNo ratings yet

- Belgica Vs OchoaDocument10 pagesBelgica Vs OchoaCJ HernandezNo ratings yet

- BELGICA V. EXECUTIVE SECRETARY OCHOA G.R. NO. 208566 2014 NOVEMBER 19 2014 Case DigestDocument5 pagesBELGICA V. EXECUTIVE SECRETARY OCHOA G.R. NO. 208566 2014 NOVEMBER 19 2014 Case DigestFaithleen Mae LacreteNo ratings yet

- CJR Coalition LetterDocument4 pagesCJR Coalition LetterJason PyeNo ratings yet

- Consti 2 DigestsDocument52 pagesConsti 2 DigestsMasterbolero100% (1)

- BELGICA, Et Al v. EXECUTIVE SEC (2013)Document6 pagesBELGICA, Et Al v. EXECUTIVE SEC (2013)Iris GodoyNo ratings yet

- StatCon Digest - Belgica V Executive SecretaryDocument8 pagesStatCon Digest - Belgica V Executive SecretaryLianne Carmeli B. FronterasNo ratings yet

- 2014 House Notes Week OneDocument3 pages2014 House Notes Week OneRepNLandryNo ratings yet

- House Republican Conference 4-10-11Document2 pagesHouse Republican Conference 4-10-11TEA_Party_RockwallNo ratings yet

- MADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Document7 pagesMADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Louis BourbonNo ratings yet

- Belgica v. Ochoa (2013)Document9 pagesBelgica v. Ochoa (2013)Jonathan BerdinNo ratings yet

- Committees: Litigation Reform Judiciary UtilitiesDocument2 pagesCommittees: Litigation Reform Judiciary UtilitiesMegan WolfeNo ratings yet

- Newsletter - June 11, 2010Document2 pagesNewsletter - June 11, 2010Betsy Fleming GrayNo ratings yet

- New Virginia Laws Taking Effect July 1, 2017Document15 pagesNew Virginia Laws Taking Effect July 1, 2017FOX 5 NewsNo ratings yet

- LegislativeUpdate3 22 13Document1 pageLegislativeUpdate3 22 13Dave ThompsonNo ratings yet

- BPAG Legislative Insurance Bulletin 2-27-15Document2 pagesBPAG Legislative Insurance Bulletin 2-27-15The Bose Insurance BlogNo ratings yet

- 2022.09.26 TPPA Weekly Washington ReportDocument8 pages2022.09.26 TPPA Weekly Washington ReportTea Party PatriotsNo ratings yet

- 6 3 14 Udall Amendment Letter - FINALDocument8 pages6 3 14 Udall Amendment Letter - FINALJohn Hinderaker100% (1)

- Belgica, Et Al. vs. Executive Secretary, Et Al., G.R. Nos. 208566, 208493 & 209251, November 19, 2013Document9 pagesBelgica, Et Al. vs. Executive Secretary, Et Al., G.R. Nos. 208566, 208493 & 209251, November 19, 2013Von Erbin BravanteNo ratings yet

- Homeless Person's Bill of Rights and Fairness ActDocument31 pagesHomeless Person's Bill of Rights and Fairness ActDowning Post NewsNo ratings yet

- 2013 House Notes Final Wrap UpDocument9 pages2013 House Notes Final Wrap UpRepNLandryNo ratings yet

- 2022.07.18 TPPA Weekly Washington ReportDocument9 pages2022.07.18 TPPA Weekly Washington ReportTea Party PatriotsNo ratings yet

- Case Digest I IIDocument64 pagesCase Digest I IIJasmin CuliananNo ratings yet

- LegislativeUpdate4 22-29 13Document1 pageLegislativeUpdate4 22-29 13Dave ThompsonNo ratings yet

- HB3653 ComplaintDocument26 pagesHB3653 Complaintmaribeth wilsonNo ratings yet

- Final Shelby 1 6 19Document4 pagesFinal Shelby 1 6 19Jamie WhiteNo ratings yet

- Belgica Vs Ochoa: Jurisdiction Case Digest Tropang PotchiDocument76 pagesBelgica Vs Ochoa: Jurisdiction Case Digest Tropang PotchijamezmarcosNo ratings yet

- 2011 Senior Fair Slated For Sept. 9: 2011-12 State BudgetDocument4 pages2011 Senior Fair Slated For Sept. 9: 2011-12 State BudgetPAHouseGOPNo ratings yet

- Belgica vs. Executive Secretary Ochoa, November 11, 2013 FactsDocument16 pagesBelgica vs. Executive Secretary Ochoa, November 11, 2013 FactsBoredpandaNo ratings yet

- BelgicaDocument14 pagesBelgicalaysa mae guardianoNo ratings yet

- FINAL DRAFT Problem Finals Moot CourtDocument4 pagesFINAL DRAFT Problem Finals Moot CourtNoel Jehoshaphat TunacaoNo ratings yet

- BL Draft 1Document10 pagesBL Draft 1Rukshana KitchilNo ratings yet

- Racial Discrimination ActDocument3 pagesRacial Discrimination ActDiana NguyenNo ratings yet

- Issue 2 Talking Points - 9-25-15Document4 pagesIssue 2 Talking Points - 9-25-15api-291984455No ratings yet

- Final - 2016 Newsletter - DraftDocument2 pagesFinal - 2016 Newsletter - Draftapi-263289045No ratings yet

- Federal Grants and Cannabis LobbyingDocument21 pagesFederal Grants and Cannabis Lobbying420leaksNo ratings yet

- Assignment #2Document9 pagesAssignment #2Mare CatoNo ratings yet

- Mission Accomplished: Oberlander-Enhanced Home Sprinkler Mandate Repeal Bill Now LawDocument4 pagesMission Accomplished: Oberlander-Enhanced Home Sprinkler Mandate Repeal Bill Now LawPAHouseGOPNo ratings yet

- AILAJ On Replacing of Criminal CodesDocument3 pagesAILAJ On Replacing of Criminal Codespratyush1917No ratings yet

- LibertyIndex 2010 General Acts 37 To 59 GRADEDDocument8 pagesLibertyIndex 2010 General Acts 37 To 59 GRADEDbobguzzardiNo ratings yet

- Internal Test - Remedies in TortsDocument5 pagesInternal Test - Remedies in TortsRONSHA ROYS ANNANo ratings yet

- House Notes: The Latest News From The State Capitol Louisiana House of Representatives Regular Session May 4, 2012Document4 pagesHouse Notes: The Latest News From The State Capitol Louisiana House of Representatives Regular Session May 4, 2012RepNLandryNo ratings yet

- 2015 House Notes Week 2Document7 pages2015 House Notes Week 2RepNLandryNo ratings yet

- Democracy Inc.: How Members of Congress Have Cashed In On Their JobsFrom EverandDemocracy Inc.: How Members of Congress Have Cashed In On Their JobsRating: 5 out of 5 stars5/5 (1)

- 3D Gun Printing BillDocument2 pages3D Gun Printing BilldelegatearoraNo ratings yet

- Pepco Evening Hearing Notice - 9311Document2 pagesPepco Evening Hearing Notice - 9311delegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument4 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument10 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap Up February 25-March 1Document7 pagesLegislative Wrap Up February 25-March 1delegatearoraNo ratings yet

- Legislative Wrap Up February 4-8 2013Document6 pagesLegislative Wrap Up February 4-8 2013delegatearoraNo ratings yet

- 2012 Annapolis Report From The District 19 TeamDocument4 pages2012 Annapolis Report From The District 19 TeamdelegatearoraNo ratings yet

- Mo119 Flyer Final 081312Document1 pageMo119 Flyer Final 081312delegatearoraNo ratings yet

- MD 28 Final ConfigurationDocument1 pageMD 28 Final ConfigurationdelegatearoraNo ratings yet

- Redesign of Intersection of 97 and 28Document1 pageRedesign of Intersection of 97 and 28delegatearoraNo ratings yet

- Traffic Alertfor I370 and MD97 MD28Document1 pageTraffic Alertfor I370 and MD97 MD28delegatearoraNo ratings yet

- Kendall McClennon's LawsuitDocument27 pagesKendall McClennon's LawsuitChicago Public MediaNo ratings yet

- 10 G.R. No. 1445 US V FelicianoDocument1 page10 G.R. No. 1445 US V FelicianoCovidiaNo ratings yet

- 214214111-Ms Word Project 2-ICT.Document4 pages214214111-Ms Word Project 2-ICT.Bagus Arya YKNo ratings yet

- Occasionalpapers: Centre0Fafricanstudies EdinburghuniversityDocument33 pagesOccasionalpapers: Centre0Fafricanstudies EdinburghuniversityAsadiq Ibn Al AmiinNo ratings yet

- Physical Evidence Bulletin: Collection of Evidence in Sexual Assault InvestigationsDocument6 pagesPhysical Evidence Bulletin: Collection of Evidence in Sexual Assault InvestigationsAndreea AndreeiutaNo ratings yet

- Harrison v. Westinghouse Savannah, 4th Cir. (1999)Document27 pagesHarrison v. Westinghouse Savannah, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Trend of Botnet ActivitiesDocument7 pagesTrend of Botnet Activitiesdont4getNo ratings yet

- Rules of Badminton - Doubles: A Point To Its ScoreDocument4 pagesRules of Badminton - Doubles: A Point To Its ScoreAriel QuintanaNo ratings yet

- NPC Advisory 2017 01 SGDDocument9 pagesNPC Advisory 2017 01 SGDkarl_baqNo ratings yet

- MemorandumDocument2 pagesMemorandumDonna Ingusan-BollozosNo ratings yet

- A17 MSC Cyber ForensicDocument1 pageA17 MSC Cyber ForensicAnonymous rePT5rCrNo ratings yet

- ISMS Risk Calculator Spread SHT v0.1Document67 pagesISMS Risk Calculator Spread SHT v0.1Danushka Sakuntha PereraNo ratings yet

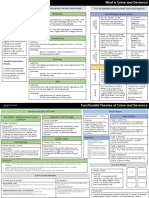

- #Crime Summary Sheets - CompletedDocument42 pages#Crime Summary Sheets - CompletedGabi YaxleyNo ratings yet

- Restorative JusticeDocument8 pagesRestorative JusticejazzpianoNo ratings yet

- Citation MessageDocument2 pagesCitation MessagetofanNo ratings yet

- State of Florida v. Courtney Clenney - Order Denying Release (F22-14137)Document6 pagesState of Florida v. Courtney Clenney - Order Denying Release (F22-14137)Michelle Solomon100% (3)

- People v. BayotasDocument1 pagePeople v. BayotasRyw100% (1)

- Test Bank For Essentials of Assistive Technologies 1st Edition Albert M Cook DownloadDocument36 pagesTest Bank For Essentials of Assistive Technologies 1st Edition Albert M Cook Downloadremovaltinemangkvk100% (50)

- Synopsis On Dead and NecrophiliaDocument9 pagesSynopsis On Dead and NecrophiliaTushar KapoorNo ratings yet

- Presumptions DoctrinesDocument7 pagesPresumptions DoctrinesKen ArnozaNo ratings yet

- Maximo v. Villapando (G.R. No. 214925, April 26, 2017)Document31 pagesMaximo v. Villapando (G.R. No. 214925, April 26, 2017)JNo ratings yet

- United States v. Nathaniel Williams, 47 F.3d 658, 4th Cir. (1995)Document10 pagesUnited States v. Nathaniel Williams, 47 F.3d 658, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- Santosh ResumeDocument6 pagesSantosh ResumerohitandaniNo ratings yet

- CDI 8-A Content - Based Module For Facilitating LearningDocument5 pagesCDI 8-A Content - Based Module For Facilitating LearningJud AurintoNo ratings yet

- Cfs 1050-21 Mandated Reporter ManualDocument52 pagesCfs 1050-21 Mandated Reporter ManualekvkrugNo ratings yet

- Bateman V AP - 2012-11-13 - ECF 3 - ComplaintDocument11 pagesBateman V AP - 2012-11-13 - ECF 3 - ComplaintJack RyanNo ratings yet

Legislative Wrap Up February 18-22

Legislative Wrap Up February 18-22

Uploaded by

delegatearoraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Legislative Wrap Up February 18-22

Legislative Wrap Up February 18-22

Uploaded by

delegatearoraCopyright:

Available Formats

The

Legislative Wrap-Up

February 18-22, 2013

Maryland Legal Services Corporation (MLSC) Several pieces of legislation this session deal with the MLSC, established by the Maryland General Assembly in 1982. The MLSC receives and distributes grants for legal assistance to eligible clients in civil cases. The bills are: SB 640/HB 838, which extend indefinitely the law enacted in 2010 increasing the surcharge on fees, charges, and costs in civil cases. Money from the surcharge is deposited into the MLSC Fund to finance civil legal services for indigent clients; and SB 809/HB 1303, which increase, from $500,000 to $3 million, the amount the Comptroller is required to distribute from abandoned property funds to MLSC and clarifies that the money is to be distributed to the MLSC Fund. The bill also repeals provisions requiring the Governor to appropriate the specified funding.

Library and Information Services, Department of Legislative Services

Issue 13-7 WOMAN SUFFRAGE MARCH OF 1913

On Friday morning, the Senate and House convened in a joint floor session to celebrate the 100th anniversary of the Woman Suffrage March of 1913. On February 12, 1913, 16 women left New York City to walk to Washington, D.C. Others joined along the way. On February 20, the original marchers crossed into Maryland and during the march through the State were greeted by well wishers and dignitaries, as well as hecklers. Subsequently, on March 3, 1913, a parade of more than 5,000 marchers seeking the right to vote, with more than 20 floats and numerous bands, paraded down Pennsylvania Avenue on the day before the inauguration of President Woodrow Wilson. Women finally obtained that right in the United States in 1920 after ratification of the 19th amendment to the United States Constitution. During the joint session led by Senator Catherine E. Pugh, President of the Women Legislators of Maryland, current women legislators celebrated the march with pageantry, song, poetry, and, by reading one after another, providing details of the march and the womens suffrage movement. President Mike Miller, Speaker Mike Busch, Senator Pugh, and other Maryland dignitaries also saluted both former and present women legislators and other women who have served and are serving as leaders of the State.

CRIMES, CORRECTIONS, AND PUBLIC SAFETY

Death Penalty Repeal Late this week, a Senate committee voted favorably with amendments on SB 276, the Administration bill that repeals Marylands death penalty. The committee agreed to remove the provision requiring the Governor to include $500,000 for the State Victims of Crime Fund in the annual budget. Some members were concerned that the appropriation to the fund might preclude a referendum on this bill in 2014, since appropriation bills may not be petitioned to referendum. Under the bill, instead of being sentenced to death, an individual found guilty of first degree murder would be sentenced to life imprisonment or life imprisonment without the possibility of parole. The bill is expected to be reported to the Senate floor for consideration early next week. HB 295 is the companion bill. Firearm Safety Act of 2013 After a very lengthy meeting on Friday, a Senate committee gave the Administration gun bill (SB 281) a

COURTS AND CIVIL PROCEEDINGS

Injury or Death Caused by Dog The House unanimously passed HB 78, an emergency bill that establishes that in an action for damages against an owner when a dog causes personal injury or death, evidence that the dog caused the personal injury or death creates a rebuttable presumption that shifts to the defendant the burden of production of evidence that the owner knew or should have known that the dog was inclined to be vicious or dangerous. The common law of liability relating to attacks by dogs as it existed on April 1, 2012, is retained without regard to the dogs breed or heritage. The Senate companion bill is SB 160, heard earlier this month.

The Legislative Wrap-up

favorable vote with amendments. The bill is expected to be debated by the full Senate floor early next week and will be open to floor amendments at that time. The measure continues to ban assault weapons and high capacity magazines and to require a licensing system including a background check and fingerprinting for those who purchase, rent, or receive handguns. Committee amendments add a prohibition on gun possession by anyone who has been involuntarily committed to a mental hospital, reduce fees for license renewals, and cut the cost and hours of a required safety training course for gun owners. Another amendment also strengthens police oversight regarding straw purchases of guns by one person for someone else. HB 294 is scheduled for a committee hearing on Friday, March 1. Human Trafficking This week, a House committee heard testimony on HB 713, which authorizes law enforcement agencies to seize property in connection with a human trafficking violation; establishes procedures for the seizure, forfeiture, and sale of property related to human trafficking violations; and establishes the Anti-Human Trafficking Fund to benefit human trafficking victims and organizations and agencies that combat human trafficking. Offenses included as human trafficking violations include sexual solicitation of a minor, child pornography, receiving the earnings of a prostitute, and abduction of a child under age 16. Two other bills (SB 215/HB 1188) establish that the current statutory prohibition and penalties for human trafficking of a minor apply to a victim who is younger than 21 years of age. Contraband Telecommunication Devices Penalty HB 651, heard this week, prohibits a person from attempting to deliver a telecommunication device such as a cell phone to a person detained in a place of confinement. The bill specifies that a sentence imposed for the knowing possession or receipt of a telecommunication device by a detained or confined person must be consecutive to any sentence that the person was serving at the time of the crime or that had been imposed but was not yet being served. A second or subsequent violation of offenses pertaining to communications devices in places of confinement is classified as a felony, subject to increased penalties. The companion bill is SB 478. Synthetic Marijuana After extensive floor debate, a bill related to synthetic marijuana passed the House this week. HB 1 codifies the addition of cannabimimetic agents to the list of Schedule I controlled dangerous substances for purposes

2

of designating substances that may not be legally used, possessed, or distributed. Another debated measure, HB 262, also with House approval, requires a court, in determining if a person has violated the prohibition against dangerous substances by representing a noncontrolled substance as a controlled substance or a fake drug, to consider whether the chemical structure of the noncontrolled substance is substantially similar to the chemical structure of a controlled dangerous substance. SB 348 is the companion measure. Several bills that would have made changes in the current law related to Schedule I controlled dangerous substances were reported unfavorably out of committee this week (HB 267, HB 482, and HB 483 (all failed)). Wheeled Carts Originally increasing the penalty for the theft of a wheeled shopping cart, HB 156, as amended and passed by the House, repeals the crime of theft of a wheeled cart. The Judiciary advises that there were 11 cases for wheeled cart violations in the District Court during fiscal 2011. There were no cases in fiscal 2012. The original companion bill, SB 191, remains in committee.

ECONOMIC AND BUSINESS ISSUES

Passed Legislation Gas Companies Surcharge With final House approval, SB 8 now goes to the Governor for consideration. The bill establishes a process for a gas company to file a plan with the Public Service Commission (PSC) requesting authorization to accelerate infrastructure replacement and to finance the reasonable and prudent costs of the work by a surcharge on customers bills. The bill further specifies the required components of a plan and cost calculations and limits the monthly surcharge for residential and other gas customers. The limit on the surcharge is $2 per month for each residential gas customer. The surcharge for a nonresidential customer must not be less than the fixed annual surcharge applicable to a residential customer, but must be capped at a level proportionate to the residential surcharge. Maryland Offshore Wind Energy Act of 2013 Governor OMalleys offshore wind energy bill passed the House. HB 226 creates a market for offshore wind energy through establishment of a carve-out for energy derived from offshore wind in the State Renewable Energy Portfolio Standard. Beginning in 2017, State

The Legislative Wrap-up

electricity sales are required to include an amount derived from offshore wind. Qualified offshore wind projects must be approved by the PSC, which may not approve an offshore wind project unless the project is beneficial to the State, the projected rate impact does not exceed $1.50 per month for the average residential customer in 2012 dollars, and does not exceed 1.5% of nonresidential customers total annual electric bills. A Maryland Offshore Wind Business Development Fund and a Maryland Offshore Wind Business Development Advisory Committee are to provide financial and business development assistance, as well as employee training opportunities to emerging wind energy businesses in the State. As amended, the measure establishes the Clean Energy Program Task Force to study and make recommendations regarding the feasibility of establishing a degree or certificate program in clean energy at one or more colleges or universities in Maryland. The companion bill, SB 275, remains in a Senate committee. Maryland Employment Advancement Right Now (EARN) Another Administration proposal, SB 278, establishes the EARN program within the Department of Labor, Licensing and Regulation (DLLR). As amended and passed by the Senate, the program approves grants for industry-led partnerships that identify high demand occupations and strategies to meet workforce needs in targeted industries. Under the measure, DLLR must implement strategies to identify State government positions in need of skilled employees and mechanisms to provide training for State employees that may result in advancement. A Train Maryland website must also be developed to promote training programs available in the State. Among the bills amendments is a requirement that any intellectual property developed with State funds remain as much as is practicable in the public domain, as well as a requirement that regional and demographic information be added to reporting information DLLR must provide. The Governors budget proposes $2.5 million for the program. The crossfiled measure, HB 227, remains in a House committee.

evening or weekend class that will cover compulsory school attendance laws, the effects of truancy, statistics on truancy and school dropout rates, and resources available to students. The program also must assign the parent or guardian a case manager for one year. Among other duties, the case manager will maintain a relationship with the parent or guardian and meet with the family of the student for two to three hours each month. The program will be carried out by the Office of Pupil Personnel Services in each county and is subject to the availability of State funds.

ELECTIONS AND ETHICS

Access to Voting Maryland voters have the option of voting at an early voting center prior to election day or by absentee ballot, as alternatives to voting at a polling place on election day. These options are relatively recent changes to Maryland law. In-person early voting at early voting centers was first implemented in 2010, and no excuse absentee voting (not requiring a reason that a voter cannot vote on election day) was first allowed in 2006. This session, a number of bills make further changes in Maryland election laws related to voter access. Legislation proposed by the Governor (SB 279/HB 224): increases the number of early voting centers in certain counties including raising the number in Frederick County from one to three sites and in Baltimore, Montgomery, and Prince Georges Counties from five to eight sites; establishes an eight-day early voting period with longer operating hours for the 2014 election and beyond; allows for an individual to register to vote or update an existing voter registration address and to vote, under specified circumstances, during early voting at an early voting center; and makes changes to absentee voting provisions by expanding and clarifying the methods by which a voter may request to receive an absentee ballot including permitting voters to obtain the ballot via the Internet and use an online ballot marking tool to assist them with making their selections on the ballot.

EDUCATION

Truancy Education Program Parents and Guardians A House committee recently considered HB 657, a bill creating a Truancy Education Program for parents or guardians of students who are chronically truant. Parents or guardians entering the program must be offered an

3

The State Board of Elections (SBE) developed an online ballot marking tool in 2012 for the use of military and overseas voters voting absentee during the 2012 general election. The online ballot marking tool allows a voter to fill out a ballot sent electronically and print and mail in

The Legislative Wrap-up

the ballot, which shows the voters selections and contains a barcode encapsulating the voters selections. A local board of elections uses the barcode to print a duplicate ballot on a ballot card that can be scanned by an optical scan voting machine, verifies that the duplicate ballot matches the selections shown on the ballot mailed in by the voter, and then scans the duplicate ballot into the optical scan voting machine. Other measures that address voter access with a committee hearing on the House side include: SB 518 /HB 17, which amend the Maryland Constitution to give the General Assembly the power to provide by law a process to allow registration and election day voting; SB 519/HB 242, which allow an individual to register to vote at an early voting center during early voting and to vote a provisional ballot at the time the individual applies to become a registered voter; SB 497/HB 481, which repeal provisions that determine the number of early voting centers in each county based on the number of registered voters in the county and instead requires that each county have one early voting center established in each General Assembly legislative district located in whole or in part in the county; and HB 427, which requires that an absentee ballot returned to a local board of elections by an absent uniformed services voter or an overseas voter, be considered timely if the absentee ballot is mailed on or before election day and received by the local board at any time before the certification of the election results by the board of canvassers. This time frame for these absentee ballots reflects SBEs current practice.

formed for referendum and charter-related petition efforts, subject to requirements for reporting of contributions and expenditures made to support the collection of signatures for a petition. There are various new requirements governing the signature collection process and determinations of petition sufficiency, including a notice that petitions are open to public inspection. Additionally, there are prohibitions against compensation of petition circulators based on the number of signatures collected (bounty payments), requirements for online training of circulators, and requirements for certifying that each signature was personally witnessed by the circulators. The legislation also prohibits the use of petition signature information for commercial solicitation. Another measure, HB 221, offers other changes to Marylands petition laws: by expanding the existing prohibition against a person willfully and knowingly obtaining, or attempting to obtain, any signature to a petition by fraud, duress, or force to also include doing so by threat, menace, or intimidation; and by prohibiting a person from willfully and knowingly preventing, hindering, or delaying another person who has a lawful right to sign a petition from signing a petition through the use of fraud, duress, force, threat, menace, or intimidation.

ENVIRONMENT, NATURAL RESOURCES, AND AGRICULTURE

SB 391/HB 106 (both failed) would have repealed the Sustainable Growth and Agriculture Preservation Act of 2012 and the requirements placed on local jurisdictions to create growth tiers to define areas within the jurisdictions development and zoning plans. Both received unfavorable committee votes.

Petitions Referenda Protection of confidentiality and privacy of personal information for those who sign petitions are cited as primary concerns addressed under SB 367/HB 729. These bills prohibit the public inspection of a petition once the petition is filed with the appropriate election authority, with an exception to facilitate judicial review concerning the sufficiency of the petition. Currently, there is no restriction on public access to a petition. Another controversial and complicated proposal, under companion bills SB 673/HB 493, also drew lengthy commentary before a House committee. The legislation makes various changes to statutory provisions governing petitions for submitting laws to referendum and other purposes. The changes include a requirement that a ballot issue committee (a campaign finance entity) be

4

FISCAL MATTERS

Transportation Funding A Senate committee has considered SB 830, the Transportation Financing Act, which authorizes the Maryland Transit Administration (MTA) to establish two transit benefit districts to finance, construct, and operate and maintain transit facilities and transit services. MTA may establish one district in the Baltimore metropolitan area and one in the Washington metropolitan area. Each transit benefit district is authorized to impose a property tax and to issue bonds.

The Legislative Wrap-up

The bill also imposes an additional 3% sales and use tax equivalent rate on all fuels except aviation gasoline and turbine fuel based on the retail price of gasoline, excluding State and federal taxes, and authorizes counties to impose a motor fuel tax of up to five cents per gallon. Beginning in calendar 2017, the bill will impose a motor fuel tax in any county that does not impose a tax at the maximum rate, in the amount of the difference between the motor fuel tax rate the county imposes and five cents. The bill takes effect June 1, 2013, except for the motor fuel tax provisions that take effect January 1, 2014. Other legislation related to mass transit funding includes: SB 652, which imposes an additional tax on motor fuel sold by a distributor to retail service stations located in any county in which the MTA or the Washington Metropolitan Area Transit Authority (WMATA) provides any service. The tax rate is equal to 2.1% of the sales price charged by a distributor. The bill establishes in the Transportation Trust Fund (TTF) a Mass Transit Account to receive the revenues from the tax to pay for the cost of light rail and Metro subway transit facilities and transit service in those jurisdictions; SB 653, which increases the State sales tax rate from 6% to 6.5% in any county in which the MTA or WMATA provides any service. The bill also establishes in the TTF a Mass Transit Account to receive 7.7% of sales tax revenues collected on sales in these counties to pay for the cost of light rail and Metro subway transit facilities and transit service in those jurisdictions. Of the funds in the TTF that are not credited to the Mass Transit Account, the Maryland Department of Transportation (MDOT) may not budget an amount to pay transit costs in excess of the amount budgeted for that purpose in fiscal 2012 unless the excess amount is paid from the Mass Transit Account; HB 771, which establishes a Mass Transit Trust Fund in MDOT. This fund is to be the sole source of funding for operating and capital expenses of MTA, WMATA, and grants to local jurisdictions for transit operating and capital expenses. The department is to identify and establish a separate funding source for mass transit in the State; and SB 1013, which establishes a Mass Transit Account in the TTF that receives revenues from increased transit fares, a county transportation property tax, or a county motor fuel tax. Those counties served by

5

either MTA or WMATA may impose the county transportation property tax and the county motor fuel tax. The revenue from these taxes may only be used to fund transit facilities or service in the county where collected. The percentage of the TTF that may be used for transit services, other than revenue to the Mass Transit Account, declines under this bill from 44.36% in fiscal 2014 to 37.8% in fiscal 2018 and subsequent years, and the percentage of the TTF, other than revenue to the Mass Transit Account, increases under this bill from 26.71% in fiscal 2014 to 33.55% in fiscal 2018 and subsequent years. Public-private Partnerships (P3s) SB 538/HB 560, Administration bills, establish a State policy on the use of public-private partnerships (P3s) and expressly authorize specified State agencies to enter into P3s. The bills establish a process and associated reporting requirements for State oversight of P3s and institute a process for both solicited and unsolicited P3 proposals that must be followed before the Board of Public Works may approve a P3 agreement. A public-private partnership is defined as a method for delivering public infrastructure assets using a long-term, performance-based agreement between specified State reporting agencies and a private entity where appropriate risks and benefits can be allocated in a costeffective manner between the contract partners, in which: a private entity performs functions normally undertaken by the government, but the reporting agency remains ultimately accountable for the public infrastructure asset and its public function; and the State may retain ownership of the public infrastructure asset and the private entity may be given additional decision-making rights in determining how the asset is financed, developed, constructed, operated, and maintained over its life cycle.

A public infrastructure asset is a capital facility or structure, including systems and equipment related to the facility or structure intended for public use. Only reporting agencies identified in the bill may establish a P3. These are the Department of General Services, which oversees building purchases and leases for most of State government, the Maryland Department of Transportation, the Maryland Transportation Authority, and State higher education institutions. Oyster Shells Recycling SB 484/HB 184 create a nonrefundable tax credit against the State income tax equal to $1.00 for each bushel of

The Legislative Wrap-up

oyster shells recycled during the taxable year, not to exceed $750 per tax return. The bill takes effect July 1, 2013, and applies to tax year 2013 and beyond.

GAMING, RACING, AND SPORTS

Purchase of Lottery Tickets Online The Senate gave preliminary approval to SB 272. As amended, the bill prohibits the State Lottery Agency from allowing a person to purchase a State lottery ticket through an electronic device that connects to the Internet.

Montgomery and Prince Georges counties, that a person aggrieved by a development rights and responsibilities agreement may not file an administrative appeal and may seek direct judicial review of the agreement in circuit court by filing a request with the circuit court of the county. The judicial review must be in accordance with Title 7, Chapter 200 of the Maryland Rules. Solar Energy Grant Program SB 136 received an unfavorable committee report. The bill would have expanded the stated purpose of the Solar Energy Grant Program to include providing grants to cooperative housing corporations, councils of unit owners of condominiums, and homeowners associations for a portion of the costs of acquiring and installing photovoltaic property and solar water heating property.

HEALTH CARE AND HEALTH INSURANCE

Bona Fide Wellness Program Crossfiled bills SB 224/HB 391, heard recently by legislative committees, create a bona fide wellness program for State employees and retirees. The Secretary of Budget and Management, in consultation with the Secretary of Health and Mental Hygiene, must develop and implement a program (State plan). The bills also require consideration of merging sick leave and annual leave into a single leave benefit for State employees and of including a high deductible health plan with a health savings account as an option in the State plan. Additionally, the program must include a health risk assessment for all State plan enrollees and aim to achieve savings in the State plan over time that exceed the costs of the program, among other requirements. The program may include incentives for achieving health goals, including discounted premiums, waivers of costsharing mechanisms, and additional benefits. A report is due on implementation of the legislation by January 1, 2014. At least 20 states have some type of wellness program for public employees. Typically, employees participate in a screening that focuses on key health measures such as body mass index, smoking, blood pressure, cholesterol, and physical activity. Many states offer participants premium discounts, while some offer cash incentives for participation or measurable improvement on specific health indicators.

TRANSPORTATION

Cell Phones Heard by a committee this week, SB 339 specifies that the prohibition against the use of a wireless communication device by a driver younger than age 18 applies to operating a motor vehicle in the travel portion of the roadway. Primary enforcement is authorized, as the provision limiting enforcement to a secondary action is repealed. The bill also expands, to the travel portion of the roadway, the prohibition against using a handheld telephone by the operator of a school vehicle that is carrying passengers and for fully licensed adult drivers, except as specified. Primary enforcement for the operators of school vehicles and adult drivers is also authorized. The House companion bill, HB 753, is scheduled for a hearing next week. Drivers Licenses Testimony was heard this week on SB 715, which expands the authority of the Motor Vehicle Administration (MVA) to issue or renew a drivers license, identification card, or moped operators permit to an individual who does not have a Social Security number or lawful status by repealing a current requirement that the individual must have held one of those documents on April 18, 2009. The bill also repeals the termination date of July 1, 2015, for the authority for MVA to issue or renew one of these documents to an applicant without lawful status or a Social Security number. Under current law, no MVA document issued to, or renewed by, an applicant who cannot provide satisfactory evidence of lawful status or a valid Social Security number is valid beyond July 1, 2015. The companion bill is HB 789.

6

REAL PROPERTY, ESTATES, AND TRUSTS

Land Use Direct Judicial Review Heard recently in a House committee, HB 256 specifies, under provisions applicable to jurisdictions other than

The Legislative Wrap-up

Speed Cameras Recently considered by a committee, SB 207 alters the definition of a recorded image as it applies to speed monitoring and work zone speed control systems to require the inclusion of sufficient information to allow for the calculation of the speed of a motor vehicle based on the two currently required time-stamped images. A local government must apply markings on the portion of the roadway on which violations are recorded by a speed monitoring system to aid in the calculation. The bill also restricts the implementation of speed monitoring systems in school zones so that they may be used only near elementary and secondary schools. A speed monitoring system in a school zone must be placed within 500 feet of the school property. Finally, the bill alters the prohibition on the payment to contractors of a fee contingent on the number of citations issued or paid by specifying that the prohibition applies to contractors that administer and process civil citations. Under current law, a recorded image is defined as an image recorded by a speed monitoring or work zone speed control system on a photograph, microphotograph, electronic image, videotape, or any other medium that shows the rear of a motor vehicle, at least two timestamped images of the motor vehicle that include the same stationary object near the motor vehicle, and, on at least one image or portion of tape, a clear and legible identification of the entire registration plate number of the motor vehicle. Other measures that deal with speed monitoring devices were also heard by a committee this week: SB 389 alters the requirements for persons who may sign a statement that alleges a violation of highway speed laws, including a work zone speed violation, to include any authorized person specially trained in speed monitoring system enforcement and not necessarily a law enforcement officer. These individuals may not receive any payment for services from the contractor that operates a speed monitoring system for a local jurisdiction or police department; and SB 785 repeals the authorization for the use of speed monitoring and work zone speed control systems.

Failed Bills A House committee voted unfavorably on HB 619 (failed). The bill would have established a maximum speed limit on the Intercounty Connector (ICC) highway of 60 miles per hour. The companion bill, SB 206, remains in a Senate committee.

Legislators will hear testimony in coming weeks on additional bills (HB 166 , HB 251, HB 421, HB 435, HB 929, and HB 1103) concerning speed control monitoring devices.

You might also like

- 2ND QTR - ExamDocument4 pages2ND QTR - ExamLeoj Jelfemar Dizor100% (1)

- Rob Corry: Amendment 64 RecommendationsDocument30 pagesRob Corry: Amendment 64 RecommendationsMichael_Lee_RobertsNo ratings yet

- MUN Position Paper HRCDocument3 pagesMUN Position Paper HRCK.Gayathri Naidu100% (2)

- Request For CCTV FootageDocument1 pageRequest For CCTV FootageMartiniRivera75% (4)

- 257 The Count's RevengeDocument6 pages257 The Count's Revengemuhammaduzair38100% (1)

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument10 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument4 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Week 7 Reg. SessionDocument3 pagesWeek 7 Reg. SessionRepNLandryNo ratings yet

- BPAG Insurance Bulletin 1-23-15Document7 pagesBPAG Insurance Bulletin 1-23-15The Bose Insurance BlogNo ratings yet

- 2014 Indiana Legislative Update # 4Document5 pages2014 Indiana Legislative Update # 4The Bose Insurance BlogNo ratings yet

- Legislative Wrap Up February 4-8 2013Document6 pagesLegislative Wrap Up February 4-8 2013delegatearoraNo ratings yet

- New Minnesota LawsDocument9 pagesNew Minnesota LawsWCCO - CBS MinnesotaNo ratings yet

- Pages From Ballot ItDocument8 pagesPages From Ballot ItTeaPartyCheerNo ratings yet

- Legislative Wrap Up February 25-March 1Document7 pagesLegislative Wrap Up February 25-March 1delegatearoraNo ratings yet

- 2013 House Notes - Week 2Document3 pages2013 House Notes - Week 2RepNLandryNo ratings yet

- PDAF WriteupDocument9 pagesPDAF WriteupRojbNo ratings yet

- BPAG Insurance Bulletin 2-20-15Document7 pagesBPAG Insurance Bulletin 2-20-15The Bose Insurance BlogNo ratings yet

- 2014 House Notes Week ThreeDocument6 pages2014 House Notes Week ThreeRepNLandryNo ratings yet

- 2013 House Notes - Week 7Document4 pages2013 House Notes - Week 7RepNLandryNo ratings yet

- Legislative Session ReviewDocument4 pagesLegislative Session ReviewCarisa AzariaNo ratings yet

- Belgica Vs OchoaDocument10 pagesBelgica Vs OchoaCJ HernandezNo ratings yet

- BELGICA V. EXECUTIVE SECRETARY OCHOA G.R. NO. 208566 2014 NOVEMBER 19 2014 Case DigestDocument5 pagesBELGICA V. EXECUTIVE SECRETARY OCHOA G.R. NO. 208566 2014 NOVEMBER 19 2014 Case DigestFaithleen Mae LacreteNo ratings yet

- CJR Coalition LetterDocument4 pagesCJR Coalition LetterJason PyeNo ratings yet

- Consti 2 DigestsDocument52 pagesConsti 2 DigestsMasterbolero100% (1)

- BELGICA, Et Al v. EXECUTIVE SEC (2013)Document6 pagesBELGICA, Et Al v. EXECUTIVE SEC (2013)Iris GodoyNo ratings yet

- StatCon Digest - Belgica V Executive SecretaryDocument8 pagesStatCon Digest - Belgica V Executive SecretaryLianne Carmeli B. FronterasNo ratings yet

- 2014 House Notes Week OneDocument3 pages2014 House Notes Week OneRepNLandryNo ratings yet

- House Republican Conference 4-10-11Document2 pagesHouse Republican Conference 4-10-11TEA_Party_RockwallNo ratings yet

- MADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Document7 pagesMADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Louis BourbonNo ratings yet

- Belgica v. Ochoa (2013)Document9 pagesBelgica v. Ochoa (2013)Jonathan BerdinNo ratings yet

- Committees: Litigation Reform Judiciary UtilitiesDocument2 pagesCommittees: Litigation Reform Judiciary UtilitiesMegan WolfeNo ratings yet

- Newsletter - June 11, 2010Document2 pagesNewsletter - June 11, 2010Betsy Fleming GrayNo ratings yet

- New Virginia Laws Taking Effect July 1, 2017Document15 pagesNew Virginia Laws Taking Effect July 1, 2017FOX 5 NewsNo ratings yet

- LegislativeUpdate3 22 13Document1 pageLegislativeUpdate3 22 13Dave ThompsonNo ratings yet

- BPAG Legislative Insurance Bulletin 2-27-15Document2 pagesBPAG Legislative Insurance Bulletin 2-27-15The Bose Insurance BlogNo ratings yet

- 2022.09.26 TPPA Weekly Washington ReportDocument8 pages2022.09.26 TPPA Weekly Washington ReportTea Party PatriotsNo ratings yet

- 6 3 14 Udall Amendment Letter - FINALDocument8 pages6 3 14 Udall Amendment Letter - FINALJohn Hinderaker100% (1)

- Belgica, Et Al. vs. Executive Secretary, Et Al., G.R. Nos. 208566, 208493 & 209251, November 19, 2013Document9 pagesBelgica, Et Al. vs. Executive Secretary, Et Al., G.R. Nos. 208566, 208493 & 209251, November 19, 2013Von Erbin BravanteNo ratings yet

- Homeless Person's Bill of Rights and Fairness ActDocument31 pagesHomeless Person's Bill of Rights and Fairness ActDowning Post NewsNo ratings yet

- 2013 House Notes Final Wrap UpDocument9 pages2013 House Notes Final Wrap UpRepNLandryNo ratings yet

- 2022.07.18 TPPA Weekly Washington ReportDocument9 pages2022.07.18 TPPA Weekly Washington ReportTea Party PatriotsNo ratings yet

- Case Digest I IIDocument64 pagesCase Digest I IIJasmin CuliananNo ratings yet

- LegislativeUpdate4 22-29 13Document1 pageLegislativeUpdate4 22-29 13Dave ThompsonNo ratings yet

- HB3653 ComplaintDocument26 pagesHB3653 Complaintmaribeth wilsonNo ratings yet

- Final Shelby 1 6 19Document4 pagesFinal Shelby 1 6 19Jamie WhiteNo ratings yet

- Belgica Vs Ochoa: Jurisdiction Case Digest Tropang PotchiDocument76 pagesBelgica Vs Ochoa: Jurisdiction Case Digest Tropang PotchijamezmarcosNo ratings yet

- 2011 Senior Fair Slated For Sept. 9: 2011-12 State BudgetDocument4 pages2011 Senior Fair Slated For Sept. 9: 2011-12 State BudgetPAHouseGOPNo ratings yet

- Belgica vs. Executive Secretary Ochoa, November 11, 2013 FactsDocument16 pagesBelgica vs. Executive Secretary Ochoa, November 11, 2013 FactsBoredpandaNo ratings yet

- BelgicaDocument14 pagesBelgicalaysa mae guardianoNo ratings yet

- FINAL DRAFT Problem Finals Moot CourtDocument4 pagesFINAL DRAFT Problem Finals Moot CourtNoel Jehoshaphat TunacaoNo ratings yet

- BL Draft 1Document10 pagesBL Draft 1Rukshana KitchilNo ratings yet

- Racial Discrimination ActDocument3 pagesRacial Discrimination ActDiana NguyenNo ratings yet

- Issue 2 Talking Points - 9-25-15Document4 pagesIssue 2 Talking Points - 9-25-15api-291984455No ratings yet

- Final - 2016 Newsletter - DraftDocument2 pagesFinal - 2016 Newsletter - Draftapi-263289045No ratings yet

- Federal Grants and Cannabis LobbyingDocument21 pagesFederal Grants and Cannabis Lobbying420leaksNo ratings yet

- Assignment #2Document9 pagesAssignment #2Mare CatoNo ratings yet

- Mission Accomplished: Oberlander-Enhanced Home Sprinkler Mandate Repeal Bill Now LawDocument4 pagesMission Accomplished: Oberlander-Enhanced Home Sprinkler Mandate Repeal Bill Now LawPAHouseGOPNo ratings yet

- AILAJ On Replacing of Criminal CodesDocument3 pagesAILAJ On Replacing of Criminal Codespratyush1917No ratings yet

- LibertyIndex 2010 General Acts 37 To 59 GRADEDDocument8 pagesLibertyIndex 2010 General Acts 37 To 59 GRADEDbobguzzardiNo ratings yet

- Internal Test - Remedies in TortsDocument5 pagesInternal Test - Remedies in TortsRONSHA ROYS ANNANo ratings yet

- House Notes: The Latest News From The State Capitol Louisiana House of Representatives Regular Session May 4, 2012Document4 pagesHouse Notes: The Latest News From The State Capitol Louisiana House of Representatives Regular Session May 4, 2012RepNLandryNo ratings yet

- 2015 House Notes Week 2Document7 pages2015 House Notes Week 2RepNLandryNo ratings yet

- Democracy Inc.: How Members of Congress Have Cashed In On Their JobsFrom EverandDemocracy Inc.: How Members of Congress Have Cashed In On Their JobsRating: 5 out of 5 stars5/5 (1)

- 3D Gun Printing BillDocument2 pages3D Gun Printing BilldelegatearoraNo ratings yet

- Pepco Evening Hearing Notice - 9311Document2 pagesPepco Evening Hearing Notice - 9311delegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument4 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDocument10 pagesLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNo ratings yet

- Legislative Wrap Up February 25-March 1Document7 pagesLegislative Wrap Up February 25-March 1delegatearoraNo ratings yet

- Legislative Wrap Up February 4-8 2013Document6 pagesLegislative Wrap Up February 4-8 2013delegatearoraNo ratings yet

- 2012 Annapolis Report From The District 19 TeamDocument4 pages2012 Annapolis Report From The District 19 TeamdelegatearoraNo ratings yet

- Mo119 Flyer Final 081312Document1 pageMo119 Flyer Final 081312delegatearoraNo ratings yet

- MD 28 Final ConfigurationDocument1 pageMD 28 Final ConfigurationdelegatearoraNo ratings yet

- Redesign of Intersection of 97 and 28Document1 pageRedesign of Intersection of 97 and 28delegatearoraNo ratings yet

- Traffic Alertfor I370 and MD97 MD28Document1 pageTraffic Alertfor I370 and MD97 MD28delegatearoraNo ratings yet

- Kendall McClennon's LawsuitDocument27 pagesKendall McClennon's LawsuitChicago Public MediaNo ratings yet

- 10 G.R. No. 1445 US V FelicianoDocument1 page10 G.R. No. 1445 US V FelicianoCovidiaNo ratings yet

- 214214111-Ms Word Project 2-ICT.Document4 pages214214111-Ms Word Project 2-ICT.Bagus Arya YKNo ratings yet

- Occasionalpapers: Centre0Fafricanstudies EdinburghuniversityDocument33 pagesOccasionalpapers: Centre0Fafricanstudies EdinburghuniversityAsadiq Ibn Al AmiinNo ratings yet

- Physical Evidence Bulletin: Collection of Evidence in Sexual Assault InvestigationsDocument6 pagesPhysical Evidence Bulletin: Collection of Evidence in Sexual Assault InvestigationsAndreea AndreeiutaNo ratings yet

- Harrison v. Westinghouse Savannah, 4th Cir. (1999)Document27 pagesHarrison v. Westinghouse Savannah, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Trend of Botnet ActivitiesDocument7 pagesTrend of Botnet Activitiesdont4getNo ratings yet

- Rules of Badminton - Doubles: A Point To Its ScoreDocument4 pagesRules of Badminton - Doubles: A Point To Its ScoreAriel QuintanaNo ratings yet

- NPC Advisory 2017 01 SGDDocument9 pagesNPC Advisory 2017 01 SGDkarl_baqNo ratings yet

- MemorandumDocument2 pagesMemorandumDonna Ingusan-BollozosNo ratings yet

- A17 MSC Cyber ForensicDocument1 pageA17 MSC Cyber ForensicAnonymous rePT5rCrNo ratings yet

- ISMS Risk Calculator Spread SHT v0.1Document67 pagesISMS Risk Calculator Spread SHT v0.1Danushka Sakuntha PereraNo ratings yet

- #Crime Summary Sheets - CompletedDocument42 pages#Crime Summary Sheets - CompletedGabi YaxleyNo ratings yet

- Restorative JusticeDocument8 pagesRestorative JusticejazzpianoNo ratings yet

- Citation MessageDocument2 pagesCitation MessagetofanNo ratings yet

- State of Florida v. Courtney Clenney - Order Denying Release (F22-14137)Document6 pagesState of Florida v. Courtney Clenney - Order Denying Release (F22-14137)Michelle Solomon100% (3)

- People v. BayotasDocument1 pagePeople v. BayotasRyw100% (1)

- Test Bank For Essentials of Assistive Technologies 1st Edition Albert M Cook DownloadDocument36 pagesTest Bank For Essentials of Assistive Technologies 1st Edition Albert M Cook Downloadremovaltinemangkvk100% (50)

- Synopsis On Dead and NecrophiliaDocument9 pagesSynopsis On Dead and NecrophiliaTushar KapoorNo ratings yet

- Presumptions DoctrinesDocument7 pagesPresumptions DoctrinesKen ArnozaNo ratings yet

- Maximo v. Villapando (G.R. No. 214925, April 26, 2017)Document31 pagesMaximo v. Villapando (G.R. No. 214925, April 26, 2017)JNo ratings yet

- United States v. Nathaniel Williams, 47 F.3d 658, 4th Cir. (1995)Document10 pagesUnited States v. Nathaniel Williams, 47 F.3d 658, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- Santosh ResumeDocument6 pagesSantosh ResumerohitandaniNo ratings yet

- CDI 8-A Content - Based Module For Facilitating LearningDocument5 pagesCDI 8-A Content - Based Module For Facilitating LearningJud AurintoNo ratings yet

- Cfs 1050-21 Mandated Reporter ManualDocument52 pagesCfs 1050-21 Mandated Reporter ManualekvkrugNo ratings yet

- Bateman V AP - 2012-11-13 - ECF 3 - ComplaintDocument11 pagesBateman V AP - 2012-11-13 - ECF 3 - ComplaintJack RyanNo ratings yet