Professional Documents

Culture Documents

International Financial System: The Financial System Is A Set of Institutional

International Financial System: The Financial System Is A Set of Institutional

Uploaded by

Al AminCopyright:

Available Formats

You might also like

- Practica Asist Socialeintre Religios Si SecularDocument12 pagesPractica Asist Socialeintre Religios Si Seculargabriela100% (2)

- Introduction To Financial SystemDocument13 pagesIntroduction To Financial SystemM Haseeb TalibNo ratings yet

- Forex NotesDocument9 pagesForex NotesPrasad NaikNo ratings yet

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Functions of MoneyDocument4 pagesFunctions of MoneylucasNo ratings yet

- Plastic Money Full Project Copy ARNABDocument41 pagesPlastic Money Full Project Copy ARNABarnab_b8767% (3)

- Foreign Exchange Market For Currencies 2.8.2023Document14 pagesForeign Exchange Market For Currencies 2.8.2023Dennis KamauNo ratings yet

- International Financial SystemDocument22 pagesInternational Financial SystemMonika SainiNo ratings yet

- International LiquidityDocument4 pagesInternational LiquidityAshish TagadeNo ratings yet

- The Meaning and Essence of The Concept of National CurrencyDocument5 pagesThe Meaning and Essence of The Concept of National CurrencyAcademic JournalNo ratings yet

- Money and Credit 3 PDFDocument38 pagesMoney and Credit 3 PDFDan CeresauNo ratings yet

- Economic Project On MoneyDocument14 pagesEconomic Project On MoneyAshutosh RathiNo ratings yet

- Overview of Financial MarketsDocument18 pagesOverview of Financial MarketsVivek BhedaNo ratings yet

- FUNDAMENTALS (Introduction) Financial MarketsDocument18 pagesFUNDAMENTALS (Introduction) Financial MarketslykaNo ratings yet

- Market:: I. Foreign Exchange MarketDocument4 pagesMarket:: I. Foreign Exchange MarketAyesha AhmadNo ratings yet

- BCom-VI-INTERNATIONAL FINANCIAL MARKETSDocument4 pagesBCom-VI-INTERNATIONAL FINANCIAL MARKETSsami ullahNo ratings yet

- Monetary Economics 1-3Document105 pagesMonetary Economics 1-3kakujirexNo ratings yet

- Unit 5Document27 pagesUnit 5123kasaragod123No ratings yet

- Unit - 3 Foreign Exchange MarketDocument27 pagesUnit - 3 Foreign Exchange Marketrajsp2208No ratings yet

- FinMar PrelimDocument6 pagesFinMar PrelimCeline Therese BuNo ratings yet

- Bus 420 International Monetary SystemDocument7 pagesBus 420 International Monetary SystemYomi BrainNo ratings yet

- Ty Bba Project1Document37 pagesTy Bba Project1Shivam KharuleNo ratings yet

- Money and BankingDocument19 pagesMoney and Bankinggnxdh8z2thNo ratings yet

- Monetary SystemDocument2 pagesMonetary Systemjonathanpiers909No ratings yet

- Internation FinanceDocument49 pagesInternation FinancebalochmetroNo ratings yet

- What Are The Functions of The Foreign Exchange Market?Document31 pagesWhat Are The Functions of The Foreign Exchange Market?carolsaviapetersNo ratings yet

- International Finance NotesDocument42 pagesInternational Finance NotesShilu MNo ratings yet

- Chapter 7Document26 pagesChapter 7Alliyah KayeNo ratings yet

- Activiy 3 (Finals)Document1 pageActiviy 3 (Finals)Shiela DimaculanganNo ratings yet

- International Financial MarketsDocument55 pagesInternational Financial MarketsPanashe MachekepfuNo ratings yet

- Real Value 1/the Average Price Level in The EconomyDocument7 pagesReal Value 1/the Average Price Level in The EconomyMamitoNo ratings yet

- International Financial MarketsDocument92 pagesInternational Financial MarketsSarvar Alam100% (2)

- Chapter-01 Overview of Financial System and Financial Markets and InstitutionsDocument5 pagesChapter-01 Overview of Financial System and Financial Markets and InstitutionsDibakar DasNo ratings yet

- Money and Banking 22-23Document17 pagesMoney and Banking 22-23larissa nazarethNo ratings yet

- Three Types-Financial InstrumentDocument1 pageThree Types-Financial InstrumentAlvin Jan Cayog AlonzoNo ratings yet

- AN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortDocument6 pagesAN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortNavidEhsanNo ratings yet

- MONEY MARKET Project - McomDocument50 pagesMONEY MARKET Project - McomRavi Sahani100% (1)

- Eurocurrency Market: Submitted By: Group 3Document19 pagesEurocurrency Market: Submitted By: Group 3Anonymous tgYyno0w6No ratings yet

- Money and CreditDocument10 pagesMoney and CreditParul VermaNo ratings yet

- Chapter 13 Money and BankingDocument13 pagesChapter 13 Money and BankingJay Lord FlorescaNo ratings yet

- W W N F E: Currency or Monetary Unit-Its Dollar, Its PesoDocument5 pagesW W N F E: Currency or Monetary Unit-Its Dollar, Its PesoriverratNo ratings yet

- Tugas Makro Mereview Uang - Nurafni HanapiDocument9 pagesTugas Makro Mereview Uang - Nurafni HanapiAfny HnpiNo ratings yet

- Introducción TTTTTTTTTTTTTTTTTTTTTTTDocument31 pagesIntroducción TTTTTTTTTTTTTTTTTTTTTTTmelizaNo ratings yet

- Financial Market DefinitionDocument9 pagesFinancial Market DefinitionMARJORIE BAMBALANNo ratings yet

- What Is Financial Market?: Equities Currencies DerivativesDocument4 pagesWhat Is Financial Market?: Equities Currencies DerivativesSyed Raheel HassanNo ratings yet

- M & B - Lecture 2Document12 pagesM & B - Lecture 2Maria TariqNo ratings yet

- Unit 4 World Financial EnvironmentDocument6 pagesUnit 4 World Financial EnvironmentTharun VelammalNo ratings yet

- Cppy of FM-1Document70 pagesCppy of FM-1Rishika ParmarNo ratings yet

- Definition of MoneyDocument4 pagesDefinition of MoneysofiaNo ratings yet

- Money MarketsDocument4 pagesMoney Marketskrissamarie.chuaNo ratings yet

- Unit 3 - Foreign Exchange MarketDocument3 pagesUnit 3 - Foreign Exchange MarketmanishaNo ratings yet

- THE FOREIGN EXCHANGE MARKET HandoutDocument6 pagesTHE FOREIGN EXCHANGE MARKET HandoutNoeline ParafinaNo ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- AssignmentDocument30 pagesAssignmentKavita BagewadiNo ratings yet

- CurrencyDocument1 pageCurrencyRangan NagarajanNo ratings yet

- Euro Currency MarketDocument24 pagesEuro Currency MarketAlina RajputNo ratings yet

- Management of Forex TransactionsDocument64 pagesManagement of Forex TransactionsasifanisNo ratings yet

- Euro Currency Market and Its Instruments: Presentation byDocument21 pagesEuro Currency Market and Its Instruments: Presentation bypavan3690No ratings yet

- Money and BankingDocument18 pagesMoney and BankingGuptaji gamingNo ratings yet

- ABIYDocument9 pagesABIYEyob HaylemariamNo ratings yet

- Beyond Risk - Bacterial Biofilms and Their Regulating ApproachesDocument20 pagesBeyond Risk - Bacterial Biofilms and Their Regulating ApproachesVictor HugoNo ratings yet

- (M. J. Edwards) The ''Epistle To Rheginus'' ValenDocument17 pages(M. J. Edwards) The ''Epistle To Rheginus'' ValenGlebMatveevNo ratings yet

- Quail Farming Business Plan PDF OverviewDocument5 pagesQuail Farming Business Plan PDF OverviewhenrymcdoNo ratings yet

- 2015 - Soil Mechanics II - Final - enDocument7 pages2015 - Soil Mechanics II - Final - enjohn cambixNo ratings yet

- Chapter 15 Hormones & Endocrine Glands - Lecture NotesDocument5 pagesChapter 15 Hormones & Endocrine Glands - Lecture Notesapi-3728508100% (3)

- Replica Metallography and Penetrant TestingDocument14 pagesReplica Metallography and Penetrant TestingBala Singam100% (1)

- Creator Excerpt PsycanicsDocument40 pagesCreator Excerpt Psycanicscheshirecatz348No ratings yet

- 10 Traditional Chilean Desserts - Insanely Good PDFDocument1 page10 Traditional Chilean Desserts - Insanely Good PDFMarilynn SpringerNo ratings yet

- 1.introduction To HydraulicsDocument32 pages1.introduction To HydraulicsJet Espejon JavierNo ratings yet

- Soil Pollution: Causes, Effects and Control: January 2016Document15 pagesSoil Pollution: Causes, Effects and Control: January 2016Nagateja MondretiNo ratings yet

- Dehyquart EDocument2 pagesDehyquart EarguijNo ratings yet

- Appendix 11 Design FMEA ChecklistDocument16 pagesAppendix 11 Design FMEA ChecklistDearRed FrankNo ratings yet

- Mathematics Course Code: 4300001: Page 1 of 10Document10 pagesMathematics Course Code: 4300001: Page 1 of 10jigarNo ratings yet

- Al Handal Contracting Company ProfileDocument20 pagesAl Handal Contracting Company Profilerecca23267% (3)

- Testing and CommissioningDocument18 pagesTesting and CommissioningAbdullah Afif100% (2)

- Helukabel Cables Wires 2012 2013Document1,124 pagesHelukabel Cables Wires 2012 2013Anonymous QhHiwA5sA5No ratings yet

- Manual de Taller Maxxforce 11y13 2010Document510 pagesManual de Taller Maxxforce 11y13 2010ANA ISABEL LOPEZ - LOYANo ratings yet

- Interviw With Martin DavisDocument12 pagesInterviw With Martin DavisraktimddkNo ratings yet

- Smart Dallas RoadmapDocument45 pagesSmart Dallas RoadmapAshish MohanNo ratings yet

- Introduction To Ipgcl & PPCLDocument31 pagesIntroduction To Ipgcl & PPCLSahil SethiNo ratings yet

- 6.MAY DIEN TIM 6-12 KENH - GreyDocument3 pages6.MAY DIEN TIM 6-12 KENH - GreyPhạm Thanh VyNo ratings yet

- AlgecirasDocument7 pagesAlgecirasEvrenNo ratings yet

- Galvafroid Data SheetDocument13 pagesGalvafroid Data SheetAdam HughesNo ratings yet

- Watson InformationDocument17 pagesWatson InformationJorge ForeroNo ratings yet

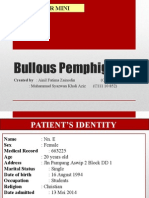

- Bullous PemphigoidDocument21 pagesBullous PemphigoidChe Ainil ZainodinNo ratings yet

- Ossiano PDFDocument14 pagesOssiano PDFBishoy SeifNo ratings yet

- Helicopter SafetyDocument11 pagesHelicopter SafetyWilliam Greco100% (2)

- MH370 (MAS370) Malaysia Airlines Flight Tracking and History 11-Mar-2014 (KUL - WMKK-PEK - ZBAA) - FlightAwareDocument2 pagesMH370 (MAS370) Malaysia Airlines Flight Tracking and History 11-Mar-2014 (KUL - WMKK-PEK - ZBAA) - FlightAware陳佩No ratings yet

- Mento - Katalog Master Flo Choke Valves - 17.08.20 - LowDocument37 pagesMento - Katalog Master Flo Choke Valves - 17.08.20 - Lowsherif aymanNo ratings yet

International Financial System: The Financial System Is A Set of Institutional

International Financial System: The Financial System Is A Set of Institutional

Uploaded by

Al AminOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Financial System: The Financial System Is A Set of Institutional

International Financial System: The Financial System Is A Set of Institutional

Uploaded by

Al AminCopyright:

Available Formats

International Financial system: The financial system is a set of institutional arrangements through which financial surpluses in the economy

are mobilized from surplus units and transferred to deficit spenders. The process of fund mobilization from surplus units and subsequent transferring the same to deficit units in the international setting is known as International Financial System. Money: A current medium of exchange in the form of coins and banknotes. What are the Forms of Money? In the modern monetary systems, there are three forms of money in actual use: (i) Metallic Money, (ii) Paper Money, and (iii) Credit Money. The first two kinds of money are in the form of currency money and the last one is credit or bank money. Metallic Money: Metallic money refers to coins made out of various metals like gold, silver, bronze, nickel, etc. Since all types of coins are issued by the state authorities either the Treasury or the Central Bank of the country they are regarded as legal tender. Legal tender money's acceptability is sanctioned of backed up by law; Paper Money: Paper money consists of currency notes issued by the State Treasury or the Central Bank of the country. Credit Money: In modern economic societies, with the development of banking activity, along with paper money, another form of convertible money has developed in the form of credit money or bank money. Bank demand deposits, withdrawal by issuing cheques, have started functioning as money, and cheques are now conventionally accepted as a mode of payment by the business community in general. It must be noted that a cheque by itself is just a credit instrument. Actually it is the bank deposit behind the cheque that serves as money.

Special drawing rights Special drawing rights (SDRs) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged. As they can only be exchanged for Euros, Japanese yen, pounds sterling, or US dollars, SDRs may actually represent a potential claim on IMF member countries' nongold foreign exchange reserve assets, which are usually held in those currencies. While they may appear to have a far more important part to play, or, perhaps, an important future role, being the unit of account for the IMF has long been the main function of the SDR. International monetary system A monetary system centers around medium of exchange. International monetary system therefore, focuses on International medium of exchange. IMS essentially includes currency convertibility and exchange rate policies and systems of different national monetary systems. A financial market is a market in which people and entities can trade financial securities, commodities, and other fungible items of value at low transaction costs and at prices that reflect supply and demand. Securities include stocks and bonds, and commodities include precious metals or agricultural goods. A financial instrument is a tradable asset of any kind; either cash, evidence of an ownership interest in an entity, or a contractual right to receive or deliver cash or another financial instrument. Eurocurrency Any currency banked outside of its country of origin. Eurocurrency market A money market for currencies held in the form of deposits in countries other than that where the currency is issued.

You might also like

- Practica Asist Socialeintre Religios Si SecularDocument12 pagesPractica Asist Socialeintre Religios Si Seculargabriela100% (2)

- Introduction To Financial SystemDocument13 pagesIntroduction To Financial SystemM Haseeb TalibNo ratings yet

- Forex NotesDocument9 pagesForex NotesPrasad NaikNo ratings yet

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Functions of MoneyDocument4 pagesFunctions of MoneylucasNo ratings yet

- Plastic Money Full Project Copy ARNABDocument41 pagesPlastic Money Full Project Copy ARNABarnab_b8767% (3)

- Foreign Exchange Market For Currencies 2.8.2023Document14 pagesForeign Exchange Market For Currencies 2.8.2023Dennis KamauNo ratings yet

- International Financial SystemDocument22 pagesInternational Financial SystemMonika SainiNo ratings yet

- International LiquidityDocument4 pagesInternational LiquidityAshish TagadeNo ratings yet

- The Meaning and Essence of The Concept of National CurrencyDocument5 pagesThe Meaning and Essence of The Concept of National CurrencyAcademic JournalNo ratings yet

- Money and Credit 3 PDFDocument38 pagesMoney and Credit 3 PDFDan CeresauNo ratings yet

- Economic Project On MoneyDocument14 pagesEconomic Project On MoneyAshutosh RathiNo ratings yet

- Overview of Financial MarketsDocument18 pagesOverview of Financial MarketsVivek BhedaNo ratings yet

- FUNDAMENTALS (Introduction) Financial MarketsDocument18 pagesFUNDAMENTALS (Introduction) Financial MarketslykaNo ratings yet

- Market:: I. Foreign Exchange MarketDocument4 pagesMarket:: I. Foreign Exchange MarketAyesha AhmadNo ratings yet

- BCom-VI-INTERNATIONAL FINANCIAL MARKETSDocument4 pagesBCom-VI-INTERNATIONAL FINANCIAL MARKETSsami ullahNo ratings yet

- Monetary Economics 1-3Document105 pagesMonetary Economics 1-3kakujirexNo ratings yet

- Unit 5Document27 pagesUnit 5123kasaragod123No ratings yet

- Unit - 3 Foreign Exchange MarketDocument27 pagesUnit - 3 Foreign Exchange Marketrajsp2208No ratings yet

- FinMar PrelimDocument6 pagesFinMar PrelimCeline Therese BuNo ratings yet

- Bus 420 International Monetary SystemDocument7 pagesBus 420 International Monetary SystemYomi BrainNo ratings yet

- Ty Bba Project1Document37 pagesTy Bba Project1Shivam KharuleNo ratings yet

- Money and BankingDocument19 pagesMoney and Bankinggnxdh8z2thNo ratings yet

- Monetary SystemDocument2 pagesMonetary Systemjonathanpiers909No ratings yet

- Internation FinanceDocument49 pagesInternation FinancebalochmetroNo ratings yet

- What Are The Functions of The Foreign Exchange Market?Document31 pagesWhat Are The Functions of The Foreign Exchange Market?carolsaviapetersNo ratings yet

- International Finance NotesDocument42 pagesInternational Finance NotesShilu MNo ratings yet

- Chapter 7Document26 pagesChapter 7Alliyah KayeNo ratings yet

- Activiy 3 (Finals)Document1 pageActiviy 3 (Finals)Shiela DimaculanganNo ratings yet

- International Financial MarketsDocument55 pagesInternational Financial MarketsPanashe MachekepfuNo ratings yet

- Real Value 1/the Average Price Level in The EconomyDocument7 pagesReal Value 1/the Average Price Level in The EconomyMamitoNo ratings yet

- International Financial MarketsDocument92 pagesInternational Financial MarketsSarvar Alam100% (2)

- Chapter-01 Overview of Financial System and Financial Markets and InstitutionsDocument5 pagesChapter-01 Overview of Financial System and Financial Markets and InstitutionsDibakar DasNo ratings yet

- Money and Banking 22-23Document17 pagesMoney and Banking 22-23larissa nazarethNo ratings yet

- Three Types-Financial InstrumentDocument1 pageThree Types-Financial InstrumentAlvin Jan Cayog AlonzoNo ratings yet

- AN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortDocument6 pagesAN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortNavidEhsanNo ratings yet

- MONEY MARKET Project - McomDocument50 pagesMONEY MARKET Project - McomRavi Sahani100% (1)

- Eurocurrency Market: Submitted By: Group 3Document19 pagesEurocurrency Market: Submitted By: Group 3Anonymous tgYyno0w6No ratings yet

- Money and CreditDocument10 pagesMoney and CreditParul VermaNo ratings yet

- Chapter 13 Money and BankingDocument13 pagesChapter 13 Money and BankingJay Lord FlorescaNo ratings yet

- W W N F E: Currency or Monetary Unit-Its Dollar, Its PesoDocument5 pagesW W N F E: Currency or Monetary Unit-Its Dollar, Its PesoriverratNo ratings yet

- Tugas Makro Mereview Uang - Nurafni HanapiDocument9 pagesTugas Makro Mereview Uang - Nurafni HanapiAfny HnpiNo ratings yet

- Introducción TTTTTTTTTTTTTTTTTTTTTTTDocument31 pagesIntroducción TTTTTTTTTTTTTTTTTTTTTTTmelizaNo ratings yet

- Financial Market DefinitionDocument9 pagesFinancial Market DefinitionMARJORIE BAMBALANNo ratings yet

- What Is Financial Market?: Equities Currencies DerivativesDocument4 pagesWhat Is Financial Market?: Equities Currencies DerivativesSyed Raheel HassanNo ratings yet

- M & B - Lecture 2Document12 pagesM & B - Lecture 2Maria TariqNo ratings yet

- Unit 4 World Financial EnvironmentDocument6 pagesUnit 4 World Financial EnvironmentTharun VelammalNo ratings yet

- Cppy of FM-1Document70 pagesCppy of FM-1Rishika ParmarNo ratings yet

- Definition of MoneyDocument4 pagesDefinition of MoneysofiaNo ratings yet

- Money MarketsDocument4 pagesMoney Marketskrissamarie.chuaNo ratings yet

- Unit 3 - Foreign Exchange MarketDocument3 pagesUnit 3 - Foreign Exchange MarketmanishaNo ratings yet

- THE FOREIGN EXCHANGE MARKET HandoutDocument6 pagesTHE FOREIGN EXCHANGE MARKET HandoutNoeline ParafinaNo ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- AssignmentDocument30 pagesAssignmentKavita BagewadiNo ratings yet

- CurrencyDocument1 pageCurrencyRangan NagarajanNo ratings yet

- Euro Currency MarketDocument24 pagesEuro Currency MarketAlina RajputNo ratings yet

- Management of Forex TransactionsDocument64 pagesManagement of Forex TransactionsasifanisNo ratings yet

- Euro Currency Market and Its Instruments: Presentation byDocument21 pagesEuro Currency Market and Its Instruments: Presentation bypavan3690No ratings yet

- Money and BankingDocument18 pagesMoney and BankingGuptaji gamingNo ratings yet

- ABIYDocument9 pagesABIYEyob HaylemariamNo ratings yet

- Beyond Risk - Bacterial Biofilms and Their Regulating ApproachesDocument20 pagesBeyond Risk - Bacterial Biofilms and Their Regulating ApproachesVictor HugoNo ratings yet

- (M. J. Edwards) The ''Epistle To Rheginus'' ValenDocument17 pages(M. J. Edwards) The ''Epistle To Rheginus'' ValenGlebMatveevNo ratings yet

- Quail Farming Business Plan PDF OverviewDocument5 pagesQuail Farming Business Plan PDF OverviewhenrymcdoNo ratings yet

- 2015 - Soil Mechanics II - Final - enDocument7 pages2015 - Soil Mechanics II - Final - enjohn cambixNo ratings yet

- Chapter 15 Hormones & Endocrine Glands - Lecture NotesDocument5 pagesChapter 15 Hormones & Endocrine Glands - Lecture Notesapi-3728508100% (3)

- Replica Metallography and Penetrant TestingDocument14 pagesReplica Metallography and Penetrant TestingBala Singam100% (1)

- Creator Excerpt PsycanicsDocument40 pagesCreator Excerpt Psycanicscheshirecatz348No ratings yet

- 10 Traditional Chilean Desserts - Insanely Good PDFDocument1 page10 Traditional Chilean Desserts - Insanely Good PDFMarilynn SpringerNo ratings yet

- 1.introduction To HydraulicsDocument32 pages1.introduction To HydraulicsJet Espejon JavierNo ratings yet

- Soil Pollution: Causes, Effects and Control: January 2016Document15 pagesSoil Pollution: Causes, Effects and Control: January 2016Nagateja MondretiNo ratings yet

- Dehyquart EDocument2 pagesDehyquart EarguijNo ratings yet

- Appendix 11 Design FMEA ChecklistDocument16 pagesAppendix 11 Design FMEA ChecklistDearRed FrankNo ratings yet

- Mathematics Course Code: 4300001: Page 1 of 10Document10 pagesMathematics Course Code: 4300001: Page 1 of 10jigarNo ratings yet

- Al Handal Contracting Company ProfileDocument20 pagesAl Handal Contracting Company Profilerecca23267% (3)

- Testing and CommissioningDocument18 pagesTesting and CommissioningAbdullah Afif100% (2)

- Helukabel Cables Wires 2012 2013Document1,124 pagesHelukabel Cables Wires 2012 2013Anonymous QhHiwA5sA5No ratings yet

- Manual de Taller Maxxforce 11y13 2010Document510 pagesManual de Taller Maxxforce 11y13 2010ANA ISABEL LOPEZ - LOYANo ratings yet

- Interviw With Martin DavisDocument12 pagesInterviw With Martin DavisraktimddkNo ratings yet

- Smart Dallas RoadmapDocument45 pagesSmart Dallas RoadmapAshish MohanNo ratings yet

- Introduction To Ipgcl & PPCLDocument31 pagesIntroduction To Ipgcl & PPCLSahil SethiNo ratings yet

- 6.MAY DIEN TIM 6-12 KENH - GreyDocument3 pages6.MAY DIEN TIM 6-12 KENH - GreyPhạm Thanh VyNo ratings yet

- AlgecirasDocument7 pagesAlgecirasEvrenNo ratings yet

- Galvafroid Data SheetDocument13 pagesGalvafroid Data SheetAdam HughesNo ratings yet

- Watson InformationDocument17 pagesWatson InformationJorge ForeroNo ratings yet

- Bullous PemphigoidDocument21 pagesBullous PemphigoidChe Ainil ZainodinNo ratings yet

- Ossiano PDFDocument14 pagesOssiano PDFBishoy SeifNo ratings yet

- Helicopter SafetyDocument11 pagesHelicopter SafetyWilliam Greco100% (2)

- MH370 (MAS370) Malaysia Airlines Flight Tracking and History 11-Mar-2014 (KUL - WMKK-PEK - ZBAA) - FlightAwareDocument2 pagesMH370 (MAS370) Malaysia Airlines Flight Tracking and History 11-Mar-2014 (KUL - WMKK-PEK - ZBAA) - FlightAware陳佩No ratings yet

- Mento - Katalog Master Flo Choke Valves - 17.08.20 - LowDocument37 pagesMento - Katalog Master Flo Choke Valves - 17.08.20 - Lowsherif aymanNo ratings yet