Professional Documents

Culture Documents

Submittedeconpaper

Submittedeconpaper

Uploaded by

api-207294683Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Submittedeconpaper

Submittedeconpaper

Uploaded by

api-207294683Copyright:

Available Formats

Mo r ho lt |1

Michelle Eva Morholt Prof Wilson ECON 1010 July 24, 2012

Our House of Cards: Assessing the Recession of 2008-09

The global financial crisis that boiled over in September, 2008 has had systemic effects and catapulted economies around the world into recession. The foundations of this crisis were laid well before the domino effect of the bankruptcies suffered by American consumers and producers alike, as well as banks, municipalities, and government institutions. The resulting firestorm has had a far reaching effect that the world economy is still reacting to and recovering from. This weeks current events regarding the continuing LIBOR scandal1 only provides more evidence that we may very well still be in the heart of this debacle. In an attempt to understand this continuing whirlwind of this financial disaster, this report will summarize the major contributing factors of our ongoing global crisisthe American housing and credit bubbles and the practices of national and international banking institutions. Building Houses of Cards

Fig. 1. Harvard University State of the Nationss Housing Report 2008. Source: Data from US Census Bureau as reported by Harvard University. Web. July 19, 2012. http://www.census.gov/hhes/www/housing/hvs/historic/index.html

In an effort to stimulate the economy and encourage aggregate

London Interbank Offered Rate is determined by leading banks in London, namely Barclays. LIBOR is the average interest rate estimated that would be charged to banks if they borrowed money from other banks. A study conducted by the Wall Street Journal in May 2008 (Mollenkamp et al.) first reported the banks may be attempting to make the banking system appear healthier than it was. It has been proposed a blind eye was turned to these practices because many banks sought to make substantial profits on their large Libor interest linked portfolios.

Mo r ho lt |2

demand, our government has implemented Keynesian theory via fiscal and monetary policies over the past half century. Recently, the credit boom initiated by monetary policies of The Federal Reserve lowering interest rates peaked in mid-2007 and continued to historic lows by 2010 (Schiller, 243). This trend is continued today with mortgage rates at the time of this report ranging from all time lows of 2.3% to 3.25% for 15 to 30-year mortgages.2 With conditions that made it easy to obtain credit, banks began to issue large amounts of mortgages (Fig 1). The result of Americans obtaining low interest mortgages, which is essentially cheaper money, enabled Americans to accrue real assets and wealth (Fig. 2). Consequentially, this influenced housing prices to steadily rise every year from 2001 to 2006 (Schiller, 238). In an article entitled CSI: Credit Crunch, it was reported that between 1997 and 2006, the price of the typical American house increased by 124% (The Economist). This access to easy credit was not only taken advantage of by the average American. Financial institutions also over extenuated and over leveraged their balance sheets. Quite rapidly, Americans were taking on unprecedented debt loads.

Houses of Cards Collapse Our credit saturated economy

was further undermined by the

Fig. 2. Median and Average Sale Price of New Homes Sold in US. (2011). Source: United States Census Bureau. Web. July, 21, 2012. http://www.mediafire.com/view/?2rpufd8gvjwjz8k

Current 15 year refinance and 30 year home purchase mortgage rates as of July 20, 2012. http://www.mortgagenewsdaily.com/mortgage_rates/

Mo r ho lt |3

meltdown of subprime mortgages3 and securitized products. Suddenly, almost overnight, the real wealth and leverage to obtain credit for the over extenuated American consumer vanished. By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak (United States Department of Commerce). As prices declined, borrowers with adjustablerate mortgages4 could not refinance to avoid the higher payments associated with rising interest rates and began to default. Foreclosures on properties increased 79% from 2006 to 2007 involving nearly 1.3 million properties (RealtyTrac). But that was just the beginning. In 2008 another 2.3 million foreclosures occurred (RealtyTrac). From August 2008 to September 2009, U.S. mortgages that were either delinquent or in foreclosure had risen from 9.2% to 14.4% (Mortgage Bankers Association). The housing bubble did not merely pop, it exploded.

Financial Institutions Falter As the American dream of home ownership was crumbling, financial institutions began to show signs of

Fig 3. Source: Data is the 2007 Annual Reports (SEC Form 10K) for each firm. Web. July 22, 2012.

weakness. Highly leveraged banking firms were continually engaging in risky investments. The above visual (Fig.

3 4

A subprime mortgage refers to mortgages offered to less than creditworthy borrowers. Abbreviated as ARMs and also known as variable-rate mortgage, or tracker mortgage are mortgages where the interest rate is periodically adjusted based on an index that reflects the cost to the lender of borrowing on the credit markets.

Mo r ho lt |4

3) clearly depicts how rapidly and thoroughly banks engaged in this irresponsible behavior. Clearly we can see how each of the five largest investment banks5 took on greater risk leading up to the subprime crisis. A high leverage ratio6 indicates more risk. From 2003-2007, these firms drastically increased their leverage ratios. Typically, a conservative bank takes on a leverage ratio of 10-15. These firms had ratios approaching 30. The resulting concerns about the health of financial institutions became a full-blown banking panic following the failures of the three major US investing banks, Bear Sterns, Lehman Brothers and Merrill Lynch (Eatwell, 7). Subsequently, other major banking titans like Washington Mutual, Wachovia and Citigroup crumbled. Prominent financial investment institutions, Goldman Sachs and Morgan Stanley, in an effort to avoid similar fates converted to commercial banks (Eatwell, 8). Government takeovers of Fannie Mae, Freddie Mac, and AIG only further exasperated consumers and lenders alike. Although the panic subsided briefly after a variety of government fiscal and monetary actions to promote the liquidity and solvency of the financial sector, prices across most asset classes and commodities continued to fall drastically, the stock markets have severely suffered, the cost of corporate and bank borrowing rose substantially, and financial market volatility rose to levels that have rarely, if ever, been seen. The Aftermath A wide range of sources from the United States National Bureau of Economic Research, to popular news sources like Time Magazine, to President Obama; claim that the recession and financial crisis that erupted December 2007 was extinguished quickly. On January 27, 2010, in his State of the Union Address, President Barack Obama assured the American citizens the markets are now stabilized, and we've recovered most of the money we spent on the banks

5 6

Bear Sterns, Lehman Brothers, Goldman Sachs, Morgan Stanley, and Merrill Lynch. Leverage ratio is the ratio of total debt to total equity.

Mo r ho lt |5

(Obama). While economists and other policy makers have a greater understanding of the reasons for the recessions on 2008-09 and the necessary actions to remedy the subsequent financial crises that culminated after the housing market fell, the average American has yet to be convinced we have fully recovered. Although the latest consumer indexes have increased to 1.7% this June, a gain of almost 2% from the all-time low consumer confidence of -0.4 in 2009, Americans are still economically strapped and weary to spend (United States Census Bureau). Unemployment rates continue to disappoint, as we saw this past month, which reported that over 12.7 million Americans are unemployed5.4 million of which are considered to be long-term unemployed of 27 weeks or more. This June 80,000 jobs have been added to the employment sector, however unemployment rates have remained 8.2%, unchanged from the previous month (U.S. Bureau of Labor). In conclusion, the aftermath of the Recession of 2008-09 and the tactics of solving the financial crisis, has left a lot of Americans uncertain of the future and angry. Every American and world economy has been affected by the Recession 2008-09. As America diligently attempts to restore the prosperity we enjoyed in the late 90s, contentions continue to rise in the wake of scandals such as LIBOR7, response to bonuses paid to executive who represented companies that received government bailouts8, and occupy Wall Street. Perhaps fiscally we are on track to a full recovery of this recession. However, our emotional and mental psyches have yet to heal. Disillusion, mistrust, and a nation divided are other economic costs that remain to be remedied from this disaster.

It is the opinion of this author that there is no problem with banks making profits. However, one should make money off of the bet, not rigging the bet. 8 It is the opinion of this author that this practice has further disillusioned Americans. Who amongst us has ever been so exorbitantly rewarded for so thoroughly failing and disrupting world economies and individuals?

Mo r ho lt |6

Works Cited Annual Percent Changes From Prior Year in Consumer Price Indexes (CPI-U)--Selected Areas: 2010. (June 2010). United States Census Bureau. United States Department of Commerce. Web. July 23, 2012. http://www.census.gov/compendia/statab/2012/tables/12s0726.pdf CSI: Credit Crunch. (October 18, 2007). The Economist. Economist Newspaper Limited, London. Web July 21, 2012. http://www.economist.com/node/9972489?story_id=9972489 Delinquencies Continue to Climb in Latest MBA National Delinquency Survey. (November 19, 2009). Mortgage Bankers Association. Web. July 21,2012. http://www.mbaa.org/NewsandMedia/PressCenter/71112.htm Eatwell, John. 2008--Banking Crisis, 2011--Sovereign Debt Crisis: Two Sides Of The Same Coin?. JASSA: The Finsia Journal Of Applied Finance 4 (2011): 6-10. EconLit. Economist-A Helping Hand to Homeowners (October 23, 2008). The Economist. Economist Newspaper Limited, London. Web July 21, 2012. http://www.economist.com/finance/displaystory.cfm?story_id=12470547. The End of the Affair. (October 30, 2008). The Economist. The Economist Newspaper Limited, London. Web July 20, 2012. http://www.economist.com/node/12637090?story_id=12637090 Harvard University State of the Nationss Housing Report 2008. Image. Data from US Census Bureau as reported by Harvard University. Web. July 19, 2012. http://www.census.gov/hhes/www/housing/hvs/historic/index.html Median and Average Sales Prices of New Homes Sold in United States. (2006). United States Census Bureau, United States Department of Commerce. Web. July 19,2012. http://www.census.gov/const/uspriceann.pdf Median and Average Sale Price of New Homes Sold in US. (2011). Image. Source: United States Census Bureau. United States Department of Commerce. Web. July, 21, 2012. http://www.mediafire.com/view/?2rpufd8gvjwjz8k Moessner, Richhild and William A. Allen. "Banking Crises and the International Monetary System in the Great Depression and Now." Financial History Review 18, no. 1 (2011): 120. Web. July 19,2012. http://search.proquest.com/docview/856893828?accountid=14989 Mollenkamp, Carrick; Whitehouse, Mark (May 29 2008). Study Casts Doubt on Key Rate. The Wall Street Journal. Web. July 19, 2012. http://online.wsj.com/article/SB121200703762027135.html

Mo r ho lt |7

RealtyTrac Press Release 2008FY. RealtyTrac. (January 15, 2009). Web July 19,2012. http://www.realtytrac.com/content/press-releases/foreclosure-activity-increases-81percent-in-2008-4551?accnt=64847

Schiller, Bradley R. (2011). Essentials of Economics. 8th ed. Boston: McGraw-Hill/Irwin, Print.

State of the Union Address: President Barack Obama. (January 27, 2010). Web. July 23, 2012. http://photos.state.gov/libraries/ukraine/164171/pdf/state_union10.pdf US Economy Adds 80K Jobs in June, Unemployment holds at 8.2%. (June 6, 2012). TradingEconomics.com, U.S. Bureau of Labor. Statistics report of June 2012. Web. July 24, 2012. http://www.tradingeconomics.com/united-states/unemployment-rate US Foreclosure activity increases 75% in 2007. (January 29, 2008). RealtyTrac. Web. July 19, 2012. http://www.realtytrac.com/content/press-releases/us-foreclosure-activity-increases75-percent-in-2007-3604?accnt=64847

You might also like

- Too Big To FailDocument9 pagesToo Big To FailPriyank Hariyani0% (1)

- Lyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Document18 pagesLyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Abdullah QureshiNo ratings yet

- Reflection PaperDocument27 pagesReflection PaperBon Ryan LeonardoNo ratings yet

- Case DIgest - CIR vs. Bicolandia Drug Corp. GR 148083, July 21, 2006Document2 pagesCase DIgest - CIR vs. Bicolandia Drug Corp. GR 148083, July 21, 2006Lu CasNo ratings yet

- Assignment 2Document7 pagesAssignment 2Wasim Bin ArshadNo ratings yet

- HVS US Hotel Valuation Index (HVI)Document50 pagesHVS US Hotel Valuation Index (HVI)Abdellah EssonniNo ratings yet

- Financial Turmoil Evokes Comparison To 2008 CrisisDocument3 pagesFinancial Turmoil Evokes Comparison To 2008 CrisisDac Nguyen HuyNo ratings yet

- Running Head: Us Financial CrisisDocument7 pagesRunning Head: Us Financial CrisisSanjeevan SivapaleswararajahNo ratings yet

- HRN 20121016 Part 01 Headline A Final and Total CatastropheDocument14 pagesHRN 20121016 Part 01 Headline A Final and Total CatastropheJim LetourneauNo ratings yet

- Economic Recession 2008Document6 pagesEconomic Recession 2008Osama AhmedNo ratings yet

- Global Economic RecoveryDocument13 pagesGlobal Economic RecoveryvilasshenoyNo ratings yet

- Financial CrisisDocument6 pagesFinancial Crisisfelix kimiluNo ratings yet

- Faces of Death: The US Dollar in CrisisDocument12 pagesFaces of Death: The US Dollar in CrisisRon HeraNo ratings yet

- Notes On The Political and Economic Crisis of The World Capitalist System and The Perspective and Tasks of The Socialist Equality PartyDocument9 pagesNotes On The Political and Economic Crisis of The World Capitalist System and The Perspective and Tasks of The Socialist Equality PartyKatisha KaylaNo ratings yet

- Financial Crisis of 2007-2010Document36 pagesFinancial Crisis of 2007-2010fcfroic100% (2)

- Crisis and 2008 Financial Crisis, Is Considered by Many Economists To Be The WorstDocument54 pagesCrisis and 2008 Financial Crisis, Is Considered by Many Economists To Be The Worstdineshpatil186No ratings yet

- Financial Crisis of 2007-2010: Winston W. ChangDocument35 pagesFinancial Crisis of 2007-2010: Winston W. ChangSam GitongaNo ratings yet

- Stock Market Crash of 2008Document4 pagesStock Market Crash of 2008Azzia Morante LopezNo ratings yet

- EliteEssays - HW2Document5 pagesEliteEssays - HW2Noor EldenyaNo ratings yet

- The Political and Economic Crisis Ofthe World Capitalist SystemDocument4 pagesThe Political and Economic Crisis Ofthe World Capitalist Systemanwar abdullah qabajaNo ratings yet

- Macro 7Document12 pagesMacro 7Àlex SolàNo ratings yet

- Why Financial Repression Will FailDocument10 pagesWhy Financial Repression Will FailRon HeraNo ratings yet

- The Global Financial Crisis: Overview: A Supplement To Macroeconomics (W.W. Norton, 2008)Document26 pagesThe Global Financial Crisis: Overview: A Supplement To Macroeconomics (W.W. Norton, 2008)Zer Nathan Gonzales RubiaNo ratings yet

- Global Financial CrisisDocument9 pagesGlobal Financial CrisisMohit Ram KukrejaNo ratings yet

- Global Financial Crisis OverviewDocument26 pagesGlobal Financial Crisis Overviewjulia.luthorNo ratings yet

- The Fall and Rise of The WestDocument6 pagesThe Fall and Rise of The WestmhdjNo ratings yet

- Economic and Market: A U.S. Recession?Document16 pagesEconomic and Market: A U.S. Recession?dpbasicNo ratings yet

- Assgnment 3 PaperDocument4 pagesAssgnment 3 Paperapi-285991802No ratings yet

- Tushar Xaxa July2022Document5 pagesTushar Xaxa July2022Mayank AggarwalNo ratings yet

- Economics ProjectDocument34 pagesEconomics ProjectRuhan MasaniNo ratings yet

- Crisis Financiera UsaDocument10 pagesCrisis Financiera UsaRox BenaducciNo ratings yet

- The Financial Crisis and Its Impact To The US Economy-FinalVDocument19 pagesThe Financial Crisis and Its Impact To The US Economy-FinalVGlenn MöllerNo ratings yet

- A Brief Analysis of The Documentary Movie "Inside Job": Submitted To: Dr. Umer Iftikhar Malik (Iftikhar@ndu - Edu.pk)Document7 pagesA Brief Analysis of The Documentary Movie "Inside Job": Submitted To: Dr. Umer Iftikhar Malik (Iftikhar@ndu - Edu.pk)Haseeb AhmedNo ratings yet

- Great RecessionDocument34 pagesGreat Recessionbrian3442No ratings yet

- Mayank Aggarwal - JULY REPORTDocument5 pagesMayank Aggarwal - JULY REPORTMayank AggarwalNo ratings yet

- 2008_GlobalFinancialCrisisDocument13 pages2008_GlobalFinancialCrisisAdithya SNo ratings yet

- Economic Insights 25 02 13Document16 pagesEconomic Insights 25 02 13vikashpunglia@rediffmail.comNo ratings yet

- Final Days of The Dollar 11 22 10Document13 pagesFinal Days of The Dollar 11 22 10exDemocratNo ratings yet

- A Simple Model of The Financial Crisis of 2007-9Document24 pagesA Simple Model of The Financial Crisis of 2007-9Kofi Appiah-DanquahNo ratings yet

- Financial CrisisDocument11 pagesFinancial CrisisBlake MirandaNo ratings yet

- Double Dip Recession USA 2011Document3 pagesDouble Dip Recession USA 2011papa_terakhirNo ratings yet

- 6 - Trần Thị Thu Trang - E4Document17 pages6 - Trần Thị Thu Trang - E4Trang TrầnNo ratings yet

- The Global Financial CrisisDocument11 pagesThe Global Financial CrisisAmogh AroraNo ratings yet

- Assingment TahirDocument3 pagesAssingment TahirabbasdabkalanNo ratings yet

- Bordo (2012) 'Did Inequality Lead To The CrisisDocument29 pagesBordo (2012) 'Did Inequality Lead To The CrisisJoeNo ratings yet

- Financial Crisis of 2008 Momodou JallowDocument17 pagesFinancial Crisis of 2008 Momodou JallowJester BorresNo ratings yet

- MBF Group AsgnmentDocument10 pagesMBF Group AsgnmentEshahumayounNo ratings yet

- Ho Chi Minh City International University Critical ThinkingDocument25 pagesHo Chi Minh City International University Critical ThinkingChi NguyenNo ratings yet

- Financial MarketDocument10 pagesFinancial MarketwildahNo ratings yet

- The U.S. Economic Crisis: Causes and Solutions: by Fred MoseleyDocument3 pagesThe U.S. Economic Crisis: Causes and Solutions: by Fred MoseleySirbu CatalinNo ratings yet

- Basic Points: Homeicide: The Crime of The CenturyDocument40 pagesBasic Points: Homeicide: The Crime of The Centuryvb12wxNo ratings yet

- MONEY AND BANKING (School Work)Document9 pagesMONEY AND BANKING (School Work)Lan Mr-aNo ratings yet

- Actualrseminaepg 3 Rdsem RepairedDocument16 pagesActualrseminaepg 3 Rdsem RepairedanabNo ratings yet

- Derivatives (Fin402) : Assignment: EssayDocument5 pagesDerivatives (Fin402) : Assignment: EssayNga Thị NguyễnNo ratings yet

- Zezza - The Effects of A Declining Housing Market On The US Economy - 2007Document21 pagesZezza - The Effects of A Declining Housing Market On The US Economy - 2007sankaratNo ratings yet

- Valpy Fitzgerald Oxford Department of International Development Undp HDR Course, ST Catherine S College, Oxford 22 September 2008Document29 pagesValpy Fitzgerald Oxford Department of International Development Undp HDR Course, ST Catherine S College, Oxford 22 September 2008Ziaul Pervez ChowdhuryNo ratings yet

- Financial Crisis 2008Document15 pagesFinancial Crisis 2008Samar Javed100% (1)

- Government Policy and The Markets:: Prepare For Some Big ChangesDocument22 pagesGovernment Policy and The Markets:: Prepare For Some Big Changesrichardck50No ratings yet

- Late-2000s Financial Crisis SubprimeDocument32 pagesLate-2000s Financial Crisis SubprimeJayati BhasinNo ratings yet

- Letriciasteedlor MorholteportfolioDocument1 pageLetriciasteedlor Morholteportfolioapi-207294683No ratings yet

- Spring 2015 HoursDocument1 pageSpring 2015 Hoursapi-207294683No ratings yet

- Statsgroup 5 SmallgroupprojectDocument17 pagesStatsgroup 5 Smallgroupprojectapi-207294683No ratings yet

- Timesheetsum 14 Fall 14Document1 pageTimesheetsum 14 Fall 14api-207294683No ratings yet

- Community Assessment of Ballet West and Ballet WestDocument27 pagesCommunity Assessment of Ballet West and Ballet Westapi-207294683No ratings yet

- The Secrets To Our DivisionDocument9 pagesThe Secrets To Our Divisionapi-207294683No ratings yet

- Morholt AroomofherownDocument7 pagesMorholt Aroomofherownapi-207294683No ratings yet

- DiabetesdoneDocument7 pagesDiabetesdoneapi-207294683No ratings yet

- Bluedart Express (Bludar) : E-Com Momentum Fading B2B Remains CrucialDocument13 pagesBluedart Express (Bludar) : E-Com Momentum Fading B2B Remains CrucialDinesh ChoudharyNo ratings yet

- List of Pfrs 2018Document5 pagesList of Pfrs 2018Myda Rafael100% (1)

- The Anatomy of The Forex Market - Pepperstone InfographicDocument1 pageThe Anatomy of The Forex Market - Pepperstone Infographicadmin2919No ratings yet

- Financial Derivatives: Sessions 1-2Document8 pagesFinancial Derivatives: Sessions 1-2Amit babarNo ratings yet

- Fm-Pur-007 Subcon Accreditation Form Rev.00Document8 pagesFm-Pur-007 Subcon Accreditation Form Rev.00Muji JaafarNo ratings yet

- Depreciation DBM DDBM SYDM For UploadDocument15 pagesDepreciation DBM DDBM SYDM For UploadSabellano, Athena Winna – DalapagNo ratings yet

- Capital MarketDocument10 pagesCapital Marketसम्राट सुबेदीNo ratings yet

- National Rural Livelihoods Mission PDFDocument10 pagesNational Rural Livelihoods Mission PDFprathapNo ratings yet

- Turner ConstructionDocument22 pagesTurner ConstructionGilang Restriwan KurniaNo ratings yet

- Forex NumericalsDocument8 pagesForex NumericalsVenkata Raman Redrowtu100% (1)

- The Business, Tax, and Financial EnvironmentsDocument21 pagesThe Business, Tax, and Financial EnvironmentsMoaviaAbdulWaheedNo ratings yet

- 5 IIM Graduates Who Quit Job To Become EntrepreneursDocument19 pages5 IIM Graduates Who Quit Job To Become EntrepreneursCharu ModiNo ratings yet

- Martin Pring 1 and 2 Bar Price PatternsDocument71 pagesMartin Pring 1 and 2 Bar Price PatternsCynthia Serrao0% (1)

- T1-FRM-4-Ch4-20.7-v1 - Practice QuestionsDocument5 pagesT1-FRM-4-Ch4-20.7-v1 - Practice QuestionscristianoNo ratings yet

- Cyanamid Phil Vs CADocument2 pagesCyanamid Phil Vs CAMarife MinorNo ratings yet

- ABC Ratio AnalysisDocument73 pagesABC Ratio Analysisamitliarliar100% (1)

- Oblicon 48 Insular Life Vs Asset BuildersDocument5 pagesOblicon 48 Insular Life Vs Asset BuildersZhadlerNo ratings yet

- Maths Work SheetDocument2 pagesMaths Work SheetAbrha636No ratings yet

- Module 5 CFMADocument28 pagesModule 5 CFMAk 3117No ratings yet

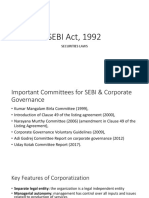

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- IAPMDocument70 pagesIAPMHarshNo ratings yet

- @icmaifamily CA CMA Final SFM Theory NotesDocument156 pages@icmaifamily CA CMA Final SFM Theory NotesOmkar Pednekar100% (1)

- Bharti Axa Life InsuranceDocument75 pagesBharti Axa Life InsuranceShahbazHasanNo ratings yet

- Index CalculationDocument13 pagesIndex Calculationshehry .CNo ratings yet

- Chapter No. 16 The Financial System: Presented by Muhammad Shahid Iqbal MP-13-20Document23 pagesChapter No. 16 The Financial System: Presented by Muhammad Shahid Iqbal MP-13-20Shahid IqbalNo ratings yet

- Novus OverlapDocument8 pagesNovus OverlaptabbforumNo ratings yet

- Corporate FinanceDocument24 pagesCorporate Financehello_world_111100% (3)

- Portfolio Management TheoryDocument40 pagesPortfolio Management Theorymohammedakbar88No ratings yet