Professional Documents

Culture Documents

Supply of Brisbane Land Lots Shrinks

Supply of Brisbane Land Lots Shrinks

Uploaded by

Jason NorthwoodCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Your Train Leaves in 10 YearsDocument2 pagesYour Train Leaves in 10 YearsJason NorthwoodNo ratings yet

- 170,000 New Homes For SydneyDocument2 pages170,000 New Homes For SydneyJason NorthwoodNo ratings yet

- Melbourne Supply BestDocument1 pageMelbourne Supply BestJason NorthwoodNo ratings yet

- Sunland To Embark On $700m Residential ProjectDocument2 pagesSunland To Embark On $700m Residential ProjectJason NorthwoodNo ratings yet

- Construction Groups Shy of NBN WorkDocument2 pagesConstruction Groups Shy of NBN WorkJason NorthwoodNo ratings yet

- Expensive Housing Turning Australia Into A Nation of RentersDocument3 pagesExpensive Housing Turning Australia Into A Nation of RentersJason NorthwoodNo ratings yet

- Demand For Hotel Rooms Bodes Well For DevelopersDocument2 pagesDemand For Hotel Rooms Bodes Well For DevelopersJason NorthwoodNo ratings yet

- Brillantes v. Concepcion NotesDocument3 pagesBrillantes v. Concepcion NotesWilliam AzucenaNo ratings yet

- E.O. (BPFSDC)Document1 pageE.O. (BPFSDC)anabel100% (4)

- The Partition and LiteratureDocument20 pagesThe Partition and LiteratureMoshei KhanNo ratings yet

- Full Download PDF of Our Social World: Introduction To Sociology 6th Edition (Ebook PDF) All ChapterDocument43 pagesFull Download PDF of Our Social World: Introduction To Sociology 6th Edition (Ebook PDF) All Chapterzhibobowy100% (9)

- Qatar Labour Law: by Dhiauddin AbbasDocument2 pagesQatar Labour Law: by Dhiauddin AbbasmrepzzzNo ratings yet

- School Project Rowlatt ActDocument15 pagesSchool Project Rowlatt ActP. ChaudhuriNo ratings yet

- LaosDocument15 pagesLaosJake SantosNo ratings yet

- Law and Procedures of MeetingDocument4 pagesLaw and Procedures of MeetingJaber RahmanNo ratings yet

- Edwin Rivera v. Philip Coombe, JR., Superintendent, 683 F.2d 697, 2d Cir. (1982)Document11 pagesEdwin Rivera v. Philip Coombe, JR., Superintendent, 683 F.2d 697, 2d Cir. (1982)Scribd Government DocsNo ratings yet

- PPSJ Arugay AccountabilityDeficitAug2005 1 1Document29 pagesPPSJ Arugay AccountabilityDeficitAug2005 1 1Aries ArugayNo ratings yet

- EthiopiaDocument264 pagesEthiopiaWubetie Mengist100% (5)

- Llorente Vs CADocument4 pagesLlorente Vs CAIvan Montealegre ConchasNo ratings yet

- TGIJP Annual Report 2014-2015Document12 pagesTGIJP Annual Report 2014-2015TGI Justice ProjectNo ratings yet

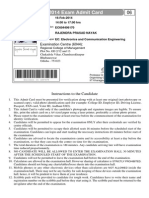

- GATE 2014 Exam Admit Card: Examination Centre (6044)Document1 pageGATE 2014 Exam Admit Card: Examination Centre (6044)Rajendra NayakNo ratings yet

- Unprecedented Actions by Global Action For Burma GABDocument25 pagesUnprecedented Actions by Global Action For Burma GABPugh Jutta100% (2)

- C.2 Home Guaranty V R II BuildersDocument5 pagesC.2 Home Guaranty V R II BuildersMp CasNo ratings yet

- History of Community DevelopmentDocument8 pagesHistory of Community DevelopmentJudea AlviorNo ratings yet

- Event Summary - US Africa BizMatch Forum 2022Document3 pagesEvent Summary - US Africa BizMatch Forum 2022James WilliamsNo ratings yet

- School Form 2 (SF2) Daily Attendance Report of LearnersDocument3 pagesSchool Form 2 (SF2) Daily Attendance Report of LearnersRoxan DosdosNo ratings yet

- Bank of The Philippine Island V MendozaDocument1 pageBank of The Philippine Island V MendozaKya CabsNo ratings yet

- Aquino-Sarmiento Vs MoratoDocument7 pagesAquino-Sarmiento Vs MoratoNarciso Javelosa III100% (1)

- Ang Ladlad V ComelecDocument22 pagesAng Ladlad V ComelecRuab PlosNo ratings yet

- Press Article-JacoMUNDocument2 pagesPress Article-JacoMUNPromit Biswas100% (1)

- Death of Bhutto: After Months of Litigation and Appeals For Clemency, Zulfikar Ali Bhutto Is Finally SilencedDocument4 pagesDeath of Bhutto: After Months of Litigation and Appeals For Clemency, Zulfikar Ali Bhutto Is Finally SilencedShahid AbbasNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- F4-24-2023 DirectorDocument2 pagesF4-24-2023 DirectorShahzeb ShafiNo ratings yet

- WaveDocument14 pagesWaveJatin PahujaNo ratings yet

- Rules of RAFFWU Ver 1Document33 pagesRules of RAFFWU Ver 1Jesse Michael YoungNo ratings yet

- Attenuated Democracy BlogDocument3 pagesAttenuated Democracy Blogapi-302047774No ratings yet

- Greco Antonious Beda B. Belgica v. Executive Secretary Paquito N. Ochoa, Jr. GR No 208566, November 19, 2013, 710 SCRA 1Document2 pagesGreco Antonious Beda B. Belgica v. Executive Secretary Paquito N. Ochoa, Jr. GR No 208566, November 19, 2013, 710 SCRA 1Jeorge VerbaNo ratings yet

Supply of Brisbane Land Lots Shrinks

Supply of Brisbane Land Lots Shrinks

Uploaded by

Jason NorthwoodOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supply of Brisbane Land Lots Shrinks

Supply of Brisbane Land Lots Shrinks

Uploaded by

Jason NorthwoodCopyright:

Available Formats

Supply of Brisbane land lots shrinks

PUBLISHED: 05 Mar 2013 PRINT EDITION: 05 Mar 2013 Gift Article: 100

Matthew Cranston Brisbane lot production has more than halved since the financial crisis in 2007, according to the Urban Development Institute of Australia. The size of land lots has also fallen from 600 square metres to 513 sq m and prices have risen, contributing to an erosion in home affordability. UDIA Queensland vice-president Neil OConnor said buyers had been sitting on their hands waiting for better value. People are nervous about buying anything; there is a concern about jobs and interstate migration is historically low. When buyers do decide to move, they will only buy what they can afford and developers are only building things that give them a significant enough return. Mr OConnor conceded that some developers might have over-estimated price growth and may have to peg back their expectations in order to start new lot production again. During the financial crisis the median price for Brisbane land lots grew marginally from $198,750 to $219,000, leaving them only $3000 cheaper than lots in Melbourne. But Mr OConnor believes Queensland is still the most affordable eastern state and, as such, net immigration to Queensland will rebound. CBRE managing director for residential projects in Brisbane, Paul Barratt, said the lack of production in new land lots was heavily related to an unfounded lack of confidence in the local market. With the reduction in the value proposition being a combination of the size and quality of offering versus the price I think the very fact that that offering has diminished is contributing to the reduced volume of sales, or demand, Mr Barratt said. Infrastructure charges are also high on the list of reasons why land was still so unaffordable. Chairman of peak housing advocacy organisation, National Shelter, Adrian Pisarski, said a new approach to infrastructure charges, continued funding from federal and state governments and a price check from developers would all contribute to improved land affordability. There is an argument to say we need a broader approach to infrastructure charging, Mr Pisarski said. But there needs to be more work done on land release. You cant just keep releasing land on the outskirts of town it just keeps adding to day-to-day living costs. The Australian Financial Review

Create an alert

Click on the links below to create an alert and receive the latest news as it happens Topics Property - Residential/Land, Property - Residential/Sales & Auctions

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Your Train Leaves in 10 YearsDocument2 pagesYour Train Leaves in 10 YearsJason NorthwoodNo ratings yet

- 170,000 New Homes For SydneyDocument2 pages170,000 New Homes For SydneyJason NorthwoodNo ratings yet

- Melbourne Supply BestDocument1 pageMelbourne Supply BestJason NorthwoodNo ratings yet

- Sunland To Embark On $700m Residential ProjectDocument2 pagesSunland To Embark On $700m Residential ProjectJason NorthwoodNo ratings yet

- Construction Groups Shy of NBN WorkDocument2 pagesConstruction Groups Shy of NBN WorkJason NorthwoodNo ratings yet

- Expensive Housing Turning Australia Into A Nation of RentersDocument3 pagesExpensive Housing Turning Australia Into A Nation of RentersJason NorthwoodNo ratings yet

- Demand For Hotel Rooms Bodes Well For DevelopersDocument2 pagesDemand For Hotel Rooms Bodes Well For DevelopersJason NorthwoodNo ratings yet

- Brillantes v. Concepcion NotesDocument3 pagesBrillantes v. Concepcion NotesWilliam AzucenaNo ratings yet

- E.O. (BPFSDC)Document1 pageE.O. (BPFSDC)anabel100% (4)

- The Partition and LiteratureDocument20 pagesThe Partition and LiteratureMoshei KhanNo ratings yet

- Full Download PDF of Our Social World: Introduction To Sociology 6th Edition (Ebook PDF) All ChapterDocument43 pagesFull Download PDF of Our Social World: Introduction To Sociology 6th Edition (Ebook PDF) All Chapterzhibobowy100% (9)

- Qatar Labour Law: by Dhiauddin AbbasDocument2 pagesQatar Labour Law: by Dhiauddin AbbasmrepzzzNo ratings yet

- School Project Rowlatt ActDocument15 pagesSchool Project Rowlatt ActP. ChaudhuriNo ratings yet

- LaosDocument15 pagesLaosJake SantosNo ratings yet

- Law and Procedures of MeetingDocument4 pagesLaw and Procedures of MeetingJaber RahmanNo ratings yet

- Edwin Rivera v. Philip Coombe, JR., Superintendent, 683 F.2d 697, 2d Cir. (1982)Document11 pagesEdwin Rivera v. Philip Coombe, JR., Superintendent, 683 F.2d 697, 2d Cir. (1982)Scribd Government DocsNo ratings yet

- PPSJ Arugay AccountabilityDeficitAug2005 1 1Document29 pagesPPSJ Arugay AccountabilityDeficitAug2005 1 1Aries ArugayNo ratings yet

- EthiopiaDocument264 pagesEthiopiaWubetie Mengist100% (5)

- Llorente Vs CADocument4 pagesLlorente Vs CAIvan Montealegre ConchasNo ratings yet

- TGIJP Annual Report 2014-2015Document12 pagesTGIJP Annual Report 2014-2015TGI Justice ProjectNo ratings yet

- GATE 2014 Exam Admit Card: Examination Centre (6044)Document1 pageGATE 2014 Exam Admit Card: Examination Centre (6044)Rajendra NayakNo ratings yet

- Unprecedented Actions by Global Action For Burma GABDocument25 pagesUnprecedented Actions by Global Action For Burma GABPugh Jutta100% (2)

- C.2 Home Guaranty V R II BuildersDocument5 pagesC.2 Home Guaranty V R II BuildersMp CasNo ratings yet

- History of Community DevelopmentDocument8 pagesHistory of Community DevelopmentJudea AlviorNo ratings yet

- Event Summary - US Africa BizMatch Forum 2022Document3 pagesEvent Summary - US Africa BizMatch Forum 2022James WilliamsNo ratings yet

- School Form 2 (SF2) Daily Attendance Report of LearnersDocument3 pagesSchool Form 2 (SF2) Daily Attendance Report of LearnersRoxan DosdosNo ratings yet

- Bank of The Philippine Island V MendozaDocument1 pageBank of The Philippine Island V MendozaKya CabsNo ratings yet

- Aquino-Sarmiento Vs MoratoDocument7 pagesAquino-Sarmiento Vs MoratoNarciso Javelosa III100% (1)

- Ang Ladlad V ComelecDocument22 pagesAng Ladlad V ComelecRuab PlosNo ratings yet

- Press Article-JacoMUNDocument2 pagesPress Article-JacoMUNPromit Biswas100% (1)

- Death of Bhutto: After Months of Litigation and Appeals For Clemency, Zulfikar Ali Bhutto Is Finally SilencedDocument4 pagesDeath of Bhutto: After Months of Litigation and Appeals For Clemency, Zulfikar Ali Bhutto Is Finally SilencedShahid AbbasNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- F4-24-2023 DirectorDocument2 pagesF4-24-2023 DirectorShahzeb ShafiNo ratings yet

- WaveDocument14 pagesWaveJatin PahujaNo ratings yet

- Rules of RAFFWU Ver 1Document33 pagesRules of RAFFWU Ver 1Jesse Michael YoungNo ratings yet

- Attenuated Democracy BlogDocument3 pagesAttenuated Democracy Blogapi-302047774No ratings yet

- Greco Antonious Beda B. Belgica v. Executive Secretary Paquito N. Ochoa, Jr. GR No 208566, November 19, 2013, 710 SCRA 1Document2 pagesGreco Antonious Beda B. Belgica v. Executive Secretary Paquito N. Ochoa, Jr. GR No 208566, November 19, 2013, 710 SCRA 1Jeorge VerbaNo ratings yet