Professional Documents

Culture Documents

TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving Measures

TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving Measures

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving Measures

TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving Measures

Uploaded by

Impulsive collectorCopyright:

Available Formats

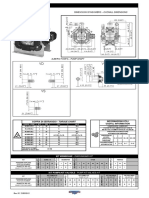

theSun | FRIDAY FEBRUARY 27 2009 15

business KLCI

STI

893.42

1,617.44

3.09

0.65

Nikkei

TSEC

7,457.93

4,518.56

3.29

24.82

Hang Seng 12,894.94 110.14 KOSPI 1,054.79 12.29

SCI 2,121.25 85.32 S&P/ASX200 3,345.530 18.00

RBS unveils £24b loss market summary

MAS to continue with

LONDON: Royal Bank of Scotland yes- FEBRUARY 26, 2009

terday reported a loss of £24.1 billion

(RM129.6 billion) for 2008, the biggest in

KLCI INDICES CHANGE

UK corporate history, and said it planned dragged FBMEMAS 5,856.59 -24.76

COMPOSITE 893.42 -3.09

to place £325 billion of assets in a state

insurance scheme.

down by INDUSTRIAL 2,112.10 -1.04

The bank said the record deficit re- finance CONSUMER PROD 282.11 -1.01

cost-saving measures

INDUSTRIAL PROD 66.34 -0.39

flected a £16.2 billion write-down against

acquisitions, including its takeover of parts stocks CONSTRUCTION

TRADING/SERVICES

165.85 -0.71

118.24 UNCH

of Dutch rival ABN Amro in 2007, plus a SHARE prices on FINANCE 7,010.09 -106.66

further £7.9 billion in operating losses. Bursa Malaysia PROPERTIES 525.50 -1.32

RBS also announced plans to raise ended lower yes- PLANTATIONS 4,416.01 +39.55

a further £13 billion from the govern- MINING 231.01 UNCH

terday, dragged

ment through the issuance of B shares, PETALING JAYA: Malaysia Airlines barrel. FBMSHA 6,108.18 +10.42

down by finance FBM2BRD 3,963.50 -29.27

and unveiled a cost-cutting programme (MAS), which aims to achieve between “Last year, MAS did not incur any out-

counters and TECHNOLOGY 12.59 -0.14

aimed at reducing expenses by £2.5 bil- RM700 million and RM1 billion in cost sav- standing losses on its fuel hedging position.

mild selling on

lion. – Reuters ings this year, will continue to implement Overall, we broke even,” he said. TURNOVER VALUE

selected big cap

tough measures amid a difficult environ- He said MAS was also exploring strate-

stocks, dealers 332.422mil RM599.722mil

ment due to the global recession. gic alliances.

Sime Darby’s profit Managing director/chief executive “We are holding talks with one of the

said.

declines to RM1.7b They said market players are concerned over banks’

officer Datuk Seri Idris Jala said the French rail companies on the possibility of

net interest margins and balance sheet following the 50

KUALA LUMPUR: Sime Darby Bhd measures included a 7% budget cut a strategic alliance,” he said.

basis points cut to 2% in the overnight policy rate (OPR).

recorded a pre-tax profit of RM1.7 across-the-board, freeze on all recruit- For the financial year ended Dec 31,

Losses on finance stocks pushed the benchmark KLCI

billion for its first half financial year ment, discretionary training and travelling, 2008, MAS recorded a net profit of RM244

down 3.09 points to close at 893.42.

ended Dec 31, 2008, a drop of 24% stopping discretionary expenditure and the million, down from RM851.4 million in

Bumiputra-Commerce and Maybank dropped 10 sen

from the profit seen in the corre- prioritising projects that were only profit- 2007.

each to RM6.70 and RM5.25 respectively. Maybank is

sponding period of 2007. able. The net profit in the three months to

scheduled to release its financial results today.

The drop in performance was at- “This is the toughest year in the airline December was RM46 million, down from

However, the dealers said, losses were capped by

tributed mainly to the decreased con- history. Many airlines will lose money RM241.9 million a year ago.

gains on plantation counters amid a healthy export

tribution from the plantation division. this year unless drastic measures are Idris said the solid performance came

figure.

The division recorded a decrease taken now,” Idris told a media briefing to amid the global economic downturn, over-

IOI Corp gained six sen to RM3.78, Kuala Lumpur

of 28% in operating profit during the announce the national carrier’s financial capacity in the Asia Pacific region and oil

Kepong surged 10 sen to RM10 and IJM Plantations rose

period following a drop in the average results for financial year 2008. price volatility.

three sen to RM2.04.

price of crude palm oil (CPO), its presi- He said MAS achieved a cost saving of “More than 30 airlines have failed, many

The dealers said overall trading was thin ahead of the

dent and group chief executive Datuk RM936 million for financial year 2008. carriers have announced substantial losses

2008 fourth quarter gross domestic product (GDP) figure

Seri Ahmad Zubir Murshid said. Idris said currently, MAS has hedged and only a handful have posted profits,” he

announcement today. – Bernama

For the second quarter, the group its fuel at US$100 (RM364 million) per said. – Bernama

recorded a pre-tax profit of RM413.8

million versus a pre-tax profit of TMI posts lower net profit

RM1.194 billion in the previous cor-

responding quarter while revenue of RM498mil for FY08 Honda M’sia

declined to RM7.3 billion from RM8.1

billion. – Bernama KUALA LUMPUR: TM Inter-

achieves “Similarly, the pre-paid seg-

national Bhd posted a net

profit of RM498 million for

ment saw net additions rising

to 1.1 million on the back of

record sales

CIMB offers to reduce FY08, down 72% from RM1.78 successful segment-based KUALA LUMPUR: Honda

loan repayments billion a year ago. However, marketing campaigns,” he Malaysia Sdn Bhd has recorded

KUALA LUMPUR: CIMB Bank Bhd and its revenue increased 14% to said, adding mobile broad- the highest monthly sales ever

CIMB Islamic Bank yesterday announced RM11.35 billion, from RM10 band saw continued success achieved in history of 3,815

they will further reduce their base lending billion previously. with a striking 27% growth units in January this year.

rate (BLR) and base financing rate (BFR) to It reported a net loss of quarter-on-quarter. Managing director/chief

5.55% with effect from Monday, March 2. RM515.25 million for the fourth Jamaludin said the company executive officer Atsushi Fu-

In a statement, CIMB Group also quarter ended Dec 31, 2008 hopes to do better this year jimoto said the achievement

announced that all its CIMB Bank and compared to a net profit of despite a challenging year. “We also meant the company had

CIMB Islamic mortgage customers will RM519.92 million in the previ- are still concerned with the captured 10% of the total

have the opportunity to enjoy reduced ous year corresponding period. impact of the global crisis on industry volume market share

monthly instalments for their existing Its revenue for the quarter de- the economy and the industry. as reported by Malaysian Auto-

mortgages with the bank. clined to RM2.418 billion from “On the other hand, given motive Association recently.

Monthly instalments for all mortgage RM2.754 billion a year earlier. the group is well positioned “The tremendous sales

borrowers of CIMB Islamic will be re- Speaking at a media brief- to add significant value to the result is due to the newly-

duced automatically, whilst those with ing, its president and chief operations and given that the launched all-new City, which

conventional mortgages can request for executive officer Datuk Seri inflation is subsiding, we are contributed almost 50% of the

a reduced monthly instalment by calling Jamaludin Ibrahim said the quite hopeful we will do better total sales with 1,737 units

the CIMB Bank Call Centre at 1-300-880- higher revenue for FY08 was this year,” he added. sold,” he said in a statement

900. – Bernama due to continued momentum He said TMI will undertake here yesterday.

at Celcom (Malaysia) Bhd and a renounceable rights issue Fujimoto said in order to

strong performance at PT Ex- to raise gross proceeds of

Moody’s affirms M’sia’s cope with the overwhelming

celcomindo Pratama Tbk (XL). RM5.25 billion to reduce its

demand of the model, Honda has

rating, outlook However, weakening cur- overall debts and achieve an

increased the production by 20%

rencies, particularly against optimal capital structure.

KUALA LUMPUR: Moody’s Investors to shorten the waiting period.

the ringgit and the US dollar He said the company would

Service, in its annual report on the He said the Civic, Accord and

affected contributions from seek shareholders’ approval

Malaysian government, has affirmed CR-V also registered healthy

regional operating companies for the issue by end-March.

the sovereign A3 bond rating and stable numbers of with 734, 803 and

and the group, he said. He said its largest sharehold-

outlook, citing Malaysia’s moderate 413 units respectively.

Jamaludin said Celcom er, Khazanah Nasional Bhd, sup-

economic strength as the support. “With the great head-start

recorded a solid revenue of ported the issue and has agreed

The country’s economic strength in shown in January, we are truly

RM5.6 billion, up 10% year-on- to undertake to subscribe to its

turn is underpinned by the substantial motivated and are confident

year. “Total subscribers grew full entitlement in the rights and

scale of its economy and its highly open of achieving our annual sales

to 8.8 million with 483,000 additional amounts, subject to

and well-diversified external sector, it target of 35,000 units,” he said.

post-paid net additions driven regulatory and shareholder ap-

said in a statement yesterday. – Bernama

by new acquisition drive. provals. – Bernama

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- The Royal Bank of Scotland GroupDocument4 pagesThe Royal Bank of Scotland GroupIpshita MazumdarNo ratings yet

- The Royal Bank of Scotland GroupDocument2 pagesThe Royal Bank of Scotland GroupaditprasNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Case Study Royal Bank of Scotland (RBS)Document20 pagesCase Study Royal Bank of Scotland (RBS)Vadan Mehta100% (2)

- Ivey - Case Book - 2005Document26 pagesIvey - Case Book - 2005g_minotNo ratings yet

- Royal Bank of ScotlandDocument17 pagesRoyal Bank of Scotlandrosy oliNo ratings yet

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDocument1 pageTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDocument1 pageThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- The Sun 2008-10-30 Page22Document1 pageThe Sun 2008-10-30 Page22Impulsive collectorNo ratings yet

- The Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryDocument1 pageThe Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- TheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownDocument1 pageTheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Daily 01-05-2023Document1 pageDaily 01-05-2023Andi RiyantoNo ratings yet

- Se210997 (1) - PáginasDocument1 pageSe210997 (1) - PáginasCésar DiazNo ratings yet

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDocument1 pageTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNo ratings yet

- Quantos Fiéis Senhor - Sax Alto (Em A)Document1 pageQuantos Fiéis Senhor - Sax Alto (Em A)Luis Felipe CavatteNo ratings yet

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsDocument1 pageThesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Daily 02-07-2023Document2 pagesDaily 02-07-2023Andi RiyantoNo ratings yet

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDocument1 pageThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDocument1 pageThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNo ratings yet

- Sem 2 ResultDocument1 pageSem 2 Resultamanchoudhary2824No ratings yet

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDocument1 pageThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNo ratings yet

- Thesun 2009-03-03 Page13 Property Mart Likely To Be BearishDocument1 pageThesun 2009-03-03 Page13 Property Mart Likely To Be BearishImpulsive collectorNo ratings yet

- Thesun 2009-07-07 Page13 Great Eastern Targets 25pct Growth in Premiums This YearDocument1 pageThesun 2009-07-07 Page13 Great Eastern Targets 25pct Growth in Premiums This YearImpulsive collectorNo ratings yet

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDocument1 pageTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisDocument1 pageTheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaDocument1 pageTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- TheSun 2008-10-29 Page18: Deliver or Lose Licence, WiMax Operator ToldDocument1 pageTheSun 2008-10-29 Page18: Deliver or Lose Licence, WiMax Operator ToldImpulsive collectorNo ratings yet

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDocument1 pageTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNo ratings yet

- Thesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyDocument1 pageThesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyImpulsive collectorNo ratings yet

- TheSun 2009-04-10 Page17 PAC To Call Up Protom Over MV Agusta SaleDocument1 pageTheSun 2009-04-10 Page17 PAC To Call Up Protom Over MV Agusta SaleImpulsive collectorNo ratings yet

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinDocument1 pageThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- DHROL BOQ (Abstract)Document1 pageDHROL BOQ (Abstract)O Vijay ChandNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- Poly 2180 PDFDocument2 pagesPoly 2180 PDFArpad BartiNo ratings yet

- TheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerDocument1 pageTheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerImpulsive collectorNo ratings yet

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDocument1 pageTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDocument1 pageThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNo ratings yet

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- SBI Small Cap Fund FactsheetDocument1 pageSBI Small Cap Fund FactsheetPalam PvrNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- TheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangDocument1 pageTheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangImpulsive collectorNo ratings yet

- Thesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesDocument1 pageThesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesImpulsive collectorNo ratings yet

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersDocument1 pageTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- The Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingFrom EverandThe Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- UK Banks - JP Morgan CazenoveDocument48 pagesUK Banks - JP Morgan CazenoveDaniel HanNo ratings yet

- FaysalbankDocument541 pagesFaysalbankAnnie DollNo ratings yet

- RBS - The Rhythm of TimeDocument84 pagesRBS - The Rhythm of TimeTofuRock100% (1)

- Cityam 2012-01-31Document48 pagesCityam 2012-01-31City A.M.No ratings yet

- Strategic Human Resource Rbs CaseDocument21 pagesStrategic Human Resource Rbs CaseAhmadNo ratings yet

- Announcement RBS Annual Results 2010Document273 pagesAnnouncement RBS Annual Results 2010mrbananas100% (1)

- Royal Bank of Scotland: Corporate Rap SheetDocument9 pagesRoyal Bank of Scotland: Corporate Rap SheetMohsen KhanNo ratings yet

- April 2014: 36 ST Andrew Square, Edinburgh, EH2 2YBDocument2 pagesApril 2014: 36 ST Andrew Square, Edinburgh, EH2 2YBSurya SaysNo ratings yet

- Cityam 2012-06-26Document32 pagesCityam 2012-06-26City A.M.No ratings yet

- Cityam 2012-02-23Document36 pagesCityam 2012-02-23City A.M.No ratings yet

- Cultural Change at Direct Line GroupDocument7 pagesCultural Change at Direct Line GroupRajendra PetheNo ratings yet

- Cityam 2012-05-31Document39 pagesCityam 2012-05-31City A.M.No ratings yet

- Top 25 Banking European Edition 2010Document271 pagesTop 25 Banking European Edition 2010Nick EwenNo ratings yet

- Shareholder and Stakeholder Theory - After The Financial Crisis-1Document13 pagesShareholder and Stakeholder Theory - After The Financial Crisis-1Mohammed Elassad Elshazali100% (1)

- Merger and Acquisitions - A Case Study PDFDocument6 pagesMerger and Acquisitions - A Case Study PDFUsama Jahangir BabarNo ratings yet

- Richard Dennis and Sonterra V ANZ and Others Gov - Uscourts.nysd.461685.1.0Document88 pagesRichard Dennis and Sonterra V ANZ and Others Gov - Uscourts.nysd.461685.1.0Maverick MinitriesNo ratings yet

- A6967DE8-A1F0-446A-B423-6FB2815A2E4D (3)Document18 pagesA6967DE8-A1F0-446A-B423-6FB2815A2E4D (3)zainNo ratings yet

- Financial Service UK Banks Performance Benchmarking Report HY Results 2011Document66 pagesFinancial Service UK Banks Performance Benchmarking Report HY Results 2011Amit JainNo ratings yet

- Sample - Gap Analysis IndonesiaDocument101 pagesSample - Gap Analysis IndonesiapalmkodokNo ratings yet

- Markets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSDocument48 pagesMarkets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSCity A.M.No ratings yet

- Acquisition of RBS by Faysal Bank Pre AnDocument28 pagesAcquisition of RBS by Faysal Bank Pre AnhamzaNo ratings yet

- Cityam 2012-09-25Document36 pagesCityam 2012-09-25City A.M.No ratings yet

- Ian Hamilton Q.C. PursuerDocument2 pagesIan Hamilton Q.C. Pursuermary engNo ratings yet

- RBS ReportDocument27 pagesRBS ReportElmira GamaNo ratings yet