Professional Documents

Culture Documents

Research Paperbse & Nse

Research Paperbse & Nse

Uploaded by

740858Copyright:

Available Formats

You might also like

- SAP Customer ListDocument76 pagesSAP Customer ListAjay Kumar Khattar0% (1)

- List of All Company Names Listed On BSE and NSE Stock Exchanges - Last Trading Price, Current Price, Volume, BSE Code, NSE Symbol, BSE Price, NSE Price - Market On MobileDocument669 pagesList of All Company Names Listed On BSE and NSE Stock Exchanges - Last Trading Price, Current Price, Volume, BSE Code, NSE Symbol, BSE Price, NSE Price - Market On MobileSrinivasulu MachavaramNo ratings yet

- Investment Management Final Project.Document30 pagesInvestment Management Final Project.Eshita NaiduNo ratings yet

- SynopsisDocument12 pagesSynopsisNikshithaNo ratings yet

- A Study of The Optimal Portfolio Construction Using Sharpe's Single Index ModelDocument100 pagesA Study of The Optimal Portfolio Construction Using Sharpe's Single Index ModelPrakash Reddy100% (1)

- Exploring The Volatility of Stock Markets: Indian ExperienceDocument15 pagesExploring The Volatility of Stock Markets: Indian ExperienceShubham GuptaNo ratings yet

- What Are Stock Market Indices?Document11 pagesWhat Are Stock Market Indices?Anonymous rCK2NujLy2No ratings yet

- Managerial Economics Project 2010Document12 pagesManagerial Economics Project 2010Divakar NarayanNo ratings yet

- Time Varying Volatility in The Indian Stock Market: ResearchDocument18 pagesTime Varying Volatility in The Indian Stock Market: Researchamazing_1No ratings yet

- A Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeDocument45 pagesA Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeBalakrishna ChakaliNo ratings yet

- Stock Market IndicesDocument3 pagesStock Market IndicesNatural agroNo ratings yet

- Volatility in Indian Stock MarketDocument6 pagesVolatility in Indian Stock MarketUpender GoelNo ratings yet

- An Empirical Analysis of Volatility in Bombay Stock Exchange LimitedDocument9 pagesAn Empirical Analysis of Volatility in Bombay Stock Exchange LimitedNishatNo ratings yet

- Market Indices/ Stock IndexDocument2 pagesMarket Indices/ Stock IndexDipikaVermaniNo ratings yet

- Investigating Expiration - Day Effects - 2Document11 pagesInvestigating Expiration - Day Effects - 2Saurabh RathiNo ratings yet

- Index PageDocument42 pagesIndex PageBalakrishna ChakaliNo ratings yet

- Chart Analysis: Fundamental Analysis Intrinsic ValueDocument9 pagesChart Analysis: Fundamental Analysis Intrinsic ValueSurya VamshiNo ratings yet

- The Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketDocument11 pagesThe Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketAssociation for Pure and Applied ResearchesNo ratings yet

- Main PartDocument53 pagesMain PartAbdullah Mamun Al SaudNo ratings yet

- Digital Assignment 2Document7 pagesDigital Assignment 2Prithish PreeNo ratings yet

- Project 222Document18 pagesProject 222RajkamalChichaNo ratings yet

- Chapter 8 2 Indices NSEDocument10 pagesChapter 8 2 Indices NSEben kookNo ratings yet

- (Aman Pathak) RESEARCH METHODOLOGYDocument4 pages(Aman Pathak) RESEARCH METHODOLOGYAman PathakNo ratings yet

- Project 2 Nse BseDocument12 pagesProject 2 Nse BseIshita BansalNo ratings yet

- Technical Analysis On Banks Dissertation PDFDocument18 pagesTechnical Analysis On Banks Dissertation PDFWaibhav KrishnaNo ratings yet

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathNo ratings yet

- A Study To Understand The Stock Market Volatility With Reference To Bse (Sensex) and Nse (Nifty)Document9 pagesA Study To Understand The Stock Market Volatility With Reference To Bse (Sensex) and Nse (Nifty)harshit singhNo ratings yet

- Technical Analysis Why Technical Analysis?: Shishir SrivastavaDocument12 pagesTechnical Analysis Why Technical Analysis?: Shishir SrivastavaShishir Srivastava100% (1)

- Technical AnalysisDocument60 pagesTechnical AnalysisSoma ShekarNo ratings yet

- Business Statistics Project 2010Document21 pagesBusiness Statistics Project 2010Aayush AkhauriNo ratings yet

- Analysis On Share Prices BY Oddysoft Company: A Project Report ONDocument42 pagesAnalysis On Share Prices BY Oddysoft Company: A Project Report ONSoumya SinghNo ratings yet

- IJRAR21D1055Document23 pagesIJRAR21D1055Mansi ChauhanNo ratings yet

- A Study On Volatility in Indian Stock MarketDocument13 pagesA Study On Volatility in Indian Stock MarketjakikhanNo ratings yet

- Volatility in The Indian Stock Market: A Case of Individual SecuritiesDocument12 pagesVolatility in The Indian Stock Market: A Case of Individual SecuritiesKarthik KarthikNo ratings yet

- Technical Study of Pharmaceutical StocksDocument4 pagesTechnical Study of Pharmaceutical StockssaravanawillbeNo ratings yet

- Review of Literature On Stock Market IndicesDocument6 pagesReview of Literature On Stock Market Indicesafmabzmoniomdc100% (1)

- A Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Document20 pagesA Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Jayanta DuttaNo ratings yet

- 292-Article Text-1387-1-10-20170213Document18 pages292-Article Text-1387-1-10-20170213Zyve AfricaNo ratings yet

- Modeling Volatility of Indian Stock Market Evidence From BEKK ModelDocument8 pagesModeling Volatility of Indian Stock Market Evidence From BEKK ModelarcherselevatorsNo ratings yet

- Stock Market Indices (BBA)Document5 pagesStock Market Indices (BBA)Akshita DhyaniNo ratings yet

- Technical Analysis ArticleDocument7 pagesTechnical Analysis ArticleABOOBAKKERNo ratings yet

- Analysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadaviDocument24 pagesAnalysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadavimndeepikaNo ratings yet

- Index Derivatives: H.R.College of Commerce and Economics T.Y.B.F.MDocument23 pagesIndex Derivatives: H.R.College of Commerce and Economics T.Y.B.F.Madi809hereNo ratings yet

- Neural Network Models For Forecasting Mutual Fund Net Asset ValueDocument18 pagesNeural Network Models For Forecasting Mutual Fund Net Asset ValueClara Agustin StephaniNo ratings yet

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- NIFTYIndexand Its Correlationwith Sectorial IndexesDocument12 pagesNIFTYIndexand Its Correlationwith Sectorial IndexesaaaaaaaNo ratings yet

- Pranat Mangla - 221VMCR00721 SynopsisDocument4 pagesPranat Mangla - 221VMCR00721 SynopsisPRANAT MANGLANo ratings yet

- My ProjectDocument93 pagesMy Projectramaa bhat0% (1)

- Hiren M Maniar, DR - Rajesh Bhatt, DR - Dharmesh M ManiyarDocument28 pagesHiren M Maniar, DR - Rajesh Bhatt, DR - Dharmesh M Maniyarguptapunit03No ratings yet

- Correlation Between NSE and BSE Indices: Project Work OnDocument27 pagesCorrelation Between NSE and BSE Indices: Project Work OnKishan SekhadaNo ratings yet

- Lecture-16 Stock Market IndicesDocument7 pagesLecture-16 Stock Market IndicesMRIDUL GOELNo ratings yet

- Executive SummaryDocument17 pagesExecutive SummarySiva GuruNo ratings yet

- Report On EQUITY MarketDocument41 pagesReport On EQUITY MarketAbhinandhan ReddyNo ratings yet

- Cia - Iii: Final Model and Report BY Raghav Agarwal 2028004Document12 pagesCia - Iii: Final Model and Report BY Raghav Agarwal 2028004Raghav AgrawalNo ratings yet

- SSRN Id3138554 PDFDocument17 pagesSSRN Id3138554 PDFGTNo ratings yet

- Conceptual School Work On Stock IndicesDocument73 pagesConceptual School Work On Stock IndicesFawaz MushtaqNo ratings yet

- Iiswbm Finance ProjectDocument48 pagesIiswbm Finance Projectjhawar sales agenciesNo ratings yet

- MBA Final Sem Project ReportDocument85 pagesMBA Final Sem Project ReportMd Hassan100% (1)

- A Study On Mutual Funds in IndiaDocument18 pagesA Study On Mutual Funds in IndiarnbiswalNo ratings yet

- Demystifying Managed FuturesDocument29 pagesDemystifying Managed Futuresjchode69No ratings yet

- Analysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeDocument14 pagesAnalysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeDr-Kiran JameelNo ratings yet

- Final Project On Volatility - New 2Document99 pagesFinal Project On Volatility - New 2vipul099No ratings yet

- Modifed SaDocument34 pagesModifed SaPooja LilaniNo ratings yet

- A Study On Mutual Funds in IndiaDocument31 pagesA Study On Mutual Funds in Indianikhil5822No ratings yet

- Stock Market and Foreign Exchange Market: An Empirical GuidanceFrom EverandStock Market and Foreign Exchange Market: An Empirical GuidanceNo ratings yet

- Parsvnath Develpoers ProjectDocument88 pagesParsvnath Develpoers ProjectTanmoy ChakrabortyNo ratings yet

- Broad Status 07Document106 pagesBroad Status 07rishabhNo ratings yet

- Victory Velly 21Document2 pagesVictory Velly 21Ashwini SinghNo ratings yet

- State Bank of IndiaDocument1,604 pagesState Bank of IndiaNarasimman MNo ratings yet

- RefineriesMap PDFDocument2 pagesRefineriesMap PDFingbarragan87No ratings yet

- GRI Reports List LimitedDocument26 pagesGRI Reports List LimitedsimaproindiaNo ratings yet

- Bank Branch List For The Website Sl. No. Branch Name Branch IDDocument10 pagesBank Branch List For The Website Sl. No. Branch Name Branch IDmayankgalwarNo ratings yet

- Bajaj Discover 100Cc, Bajaj M80Document1 pageBajaj Discover 100Cc, Bajaj M80Raunak Vi100% (1)

- Security Analysis and Portfolio Management v1.1Document82 pagesSecurity Analysis and Portfolio Management v1.1Harsh SarafNo ratings yet

- BS 000 BSDocument18 pagesBS 000 BSPrekke SrinivasNo ratings yet

- Investment Procss of Unicon (Tufail)Document55 pagesInvestment Procss of Unicon (Tufail)Tufail KhanNo ratings yet

- Lucknow Circle and BranchesDocument23 pagesLucknow Circle and BranchesShashank Dohrey60% (5)

- Crazy Frog, Technical Analysis ScannerDocument4 pagesCrazy Frog, Technical Analysis ScannerShub ShahNo ratings yet

- History of Indian Stock Market - Read 140 Year Long Journey!Document6 pagesHistory of Indian Stock Market - Read 140 Year Long Journey!swati prasadNo ratings yet

- APTUS ResultsDocument1 pageAPTUS ResultsramsinxNo ratings yet

- DEAF Portal Codes and Details RBIDocument38 pagesDEAF Portal Codes and Details RBIAlok PaulNo ratings yet

- POP DetailsDocument15 pagesPOP DetailsJitender KumarNo ratings yet

- Account STMT XX0226 19122023Document13 pagesAccount STMT XX0226 19122023rdineshyNo ratings yet

- Mumbai Data CFODocument1,200 pagesMumbai Data CFOManoj KumarNo ratings yet

- SHAREKHANDocument63 pagesSHAREKHANShivani GoelNo ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Average Market Capitalizationoflistedcompaniesduringthesixmonthsended 31 Dec 2023Document84 pagesAverage Market Capitalizationoflistedcompaniesduringthesixmonthsended 31 Dec 2023Nirvana BoyNo ratings yet

- Broad Status-01 PDFDocument116 pagesBroad Status-01 PDFMALLINo ratings yet

- A Summer Internship ReportDocument33 pagesA Summer Internship ReportPrateek BissaNo ratings yet

- Circle Office ListDocument7 pagesCircle Office ListSushil ParmanikNo ratings yet

Research Paperbse & Nse

Research Paperbse & Nse

Uploaded by

740858Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research Paperbse & Nse

Research Paperbse & Nse

Uploaded by

740858Copyright:

Available Formats

Is the BSE Sensitive Index Better than the National Index?

Jayanth Rama Varma* Abstract Stock price indices are used extensively by investors, brokers and portfolio managers as a general indicator of the stock market conditions. They are also used extensively in finance theory notably in operationalizing the popular Capital Asset Pricing Model (CAPM). In recent years, the indices published by the Bombay Stock Exchange (BSE) - the Sensitive Index (Sensex) of 30 scrips in Bombay and the 100 share National Index (Natex) - have become extremely popular with academics and practitioners alike. Anecdotal evidence suggests that the Sensex is by far the more popular index among brokers and lay investors while the Natex is the index of choice among mutual funds, professional investors, foreign investment agencies and academics. This paper studies the two BSE indices and their inter-relationship. The analysis in this paper indicates: 1. The Natex is a sluggish index which responds too slowly to market conditions. Changes which are reflected in the Sensex on any day are completely reflected in the Natex only by the next day. Sensex is more volatile than Natex, but this difference is accounted for by two factors - (a) the autocorrelation of the Natex which conceals the true volatility of Natex, and (b) a higher beta of Sensex relative to Sensex. Therefore, the excess volatility of Sensex is not a matter of serious concern. In many applications, however, the higher beta of Sensex is worrisome, but it is easy to correct for it.

The conclusion, therefore, is that those who follow the Natex because of its greater comprehensiveness and theoretical appeal may be mistaken. The Sensex needs to be taken more seriously as a sound market index. The observed deficiencies of the Natex raise several disturbing questions for finance theorists and researchers. Is the market for the less well traded securities in the market inefficient? Do the scrips constituting the Sensex lead the other scrips? If so, can this relationship be used to make extra normal returns? Does the Bombay market lead other exchanges which are also represented in the Natex? These issues call for further research.

This work was partially supported by a research grant from the Indian Institute of Management, Ahmedabad.

Is the BSE Sensitive Index Better than the National Index? Jayanth Rama Varma Introduction Stock price indices are used extensively by investors, brokers and portfolio managers as a general indicator of the stock market conditions. The financial newspapers publish several different indices every day. Some indices are, in fact, available virtually on a minute to minute basis as the trading goes on. The stock price indices are also used extensively in finance theory. The popular Capital Asset Pricing Model (CAPM) gives a special place to the market portfolio consisting of all asset traded in the market. Accounting to the CAPM, the riskiness of a security in defined as the responsiveness of the security to movements in the value of this market portfolio as this measures the component of risk which cannot be diversified away by distributing one's wealth across a large number of securities. The concept of market portfolio is operationalized through a market index. The underlying theory suggests that the market index should ideally be a value weighted index of all stocks in the market. The theoretical literature (Roll, 1977) suggests that the use of the correct market index is of considerable importance. Thus the choice of index to be used is a matter of equal importance to academics and practitioners. While there is a profusion of stock price indices in the Indian market, in recent years, the indices published by the Bombay Stock Exchange (BSE) have become extremely popular with academics and practitioners alike. The BSE publishes two indices: (a) the 30 share sensitive index (henceforth called Sensex) which consists of the most heavily traded stocks in the BSE which is the country's premier stock market, and the 100 shares national index (henceforth called Natex) which includes the 100 most important stocks nation-wide.

(b)

Anecdotal evidence suggests that the Sensex is by far the most popular among brokers and lay investors while the Natex is the index of choice among mutual funds, professional investors, foreign investment agencies and by academics. (Many academics, of course use the older Economic Times, Financial Express and Reserve Bank of India indices, sometimes by force of habit, more often because these indices are available for a much longer time period). This of course, is similar to what is observed in other countries. For example, in the United States, the Dow Jones index is widely used by lay investors and the 500 share S&P index is preferred by professionals and academics. In this context, this paper seeks to examine the two popular BSE indices in greater detail and study their inter- relationships.

This analysis would help both researchers and practitioners decide which index is more suitable for their purpose. Construction and Coverage of the Two Indices The Sensex is a market value weighted average of 30 shares from the Bombay Stock Exchange. The shares have been chosen on the basis of the volume of trading activity with due representation to major industry groups (Bombay Stock Exchange, 1991a). The Natex is a broader index covering 100 shares form all major stock exchanges in the country. The price is taken form the exchange in which the share is actively traded; where there is more than one such exchange, the average of these prices is taken (Bombay Stock Exchange 1991b). The Natex is also market value weighted. Data The Sensex was introduced by the BSE only in 1986 and the Natex even later, but the Sensex (base year 1978/79 = 100) has been back computed upto 1/4/1979 and the Natex (base year 1983/84 = 100) has been back computed upto 1/4/1984. Since both indices are available from 1/4/1984 onwards, the daily values of these indices for the period 1/4/1984 to 31/10/1991 have been used in this study. Statistical Characteristics of a Good Index The main choice in designing an index is that of sensitiveness versus comprehensiveness. A comprehensive index may respond sluggishly to rapid movements in the market while a sensitive index of a few scrips may respond very rapidly but may be buffeted around by factors specific to its constituent companies and therefore show a lot of random fluctuations unconnected with the broader market trends . These conflicting considerations can be summed up in two statistical measures. 1.Volatility: This statistical measure is the standard deviation of daily percentage changes in the index. A narrowly constructed index will display excessive volatility representing random movements specific to constituents of the index. 2.Autocorrelation: A broad based index would typically include a large number of poorly traded stocks whose prices do not immediately respond to rapid changes in the market. This failure to respond may be because the share has not traded at all on that day or because the trades that did take place were on the basis of old orders placed before the market movement was known. At the same time, the more active stocks in the broad based index would respond immediately to sharp changes in the market. The result of this divergence between some stocks responding immediately while other respond only the next day or later is an autocorrelation in the broad based index. If the broad based index goes up today, chances are that some stocks in the index have not adjusted themselves to the new level yet; as these stocks rise tomorrow, the index will tend to rise tomorrow also. Similarly if the index has fallen today, chances are that it will fall tomorrow also.

This phenomenon also manifests itself in a tendency for the broad based index to follow the more sensitive index with a time lag. Results and Conclusions The first step of the analysis was to examine the relationship between the two indices over the entire time period. We look at the returns on the two indices - the return was defined logarithmically as ln(It/It-1) where It is the value of the index on day t. The logarithmic return is approximately the same as the percentage change in the index on day t ([It - It-1]/It-1); the logarithmic returns are preferred in the finance literature mainly for econometric reasons as they are more nearly normally distributed than the percentage changes. The logarithmic return on the Sensex is henceforth referred to as SenRet and similarly the logarithmic return on Natex is called NatRet. The investigation of the relationship between SenRet and NatRet showed the following: 1. SenRet and NatRet are quite closely related. The r-square between the two is 0.813. A regression between returns is like a regression in first difference form and an r-square of 0.8 is very high indicating a close relationship between the two indices. The Sensex showed sharper movements that the Natex. The regression coefficient when NatRet is regressed on SenRet is 0.731, while when SenRet is regressed on NatRet, the coefficient is 1.113. In terms of finance theory. if Natex is regarded as the market index, then Sensex has a beta of 1.113; similarly when Sensex is treated as the market index, Natex has a beta of only 0.731. Closer analysis indicated that some structural changes have taken place in the relationships between the two indices. The Natex beta of Sensex which was only 0.453 in 1984-85 rose to 1.039 in 1985-86 before stabilizing at 1.174 in later years. This structural break is significant at the 0.1% level by the Chow test.

2.

3.

Because of the structural changes that took place in the first two years, it was decided to drop these two years from the analysis and use the data from 1/4/1986 onward for more detailed analysis. Over this period the relationship between Sensex and Natex may be summarized as follows: 1.Natex beta of Sensex = 1.174. 2.Sensex beta of Natex = 0.738. T-statistic = 86.75. P < 0.001. R-Square = 0.866.)

3.Sensex is not significantly autocorrelated (rho = 0.066. T-statistic = 2.25. P = 0.024. R-Squared = 0.004)

4.Natex is significantly autocorrelated (rho = 0.144. T-statistic = 4.95. P < 0.001. R-Squared = 0.021) 5.Sensex has significantly greater volatility (annualized standard deviation of daily returns) than Natex (27.18% as against 21.54%). The F-ratio of 1.59 with (1163,1163) df is significant at the 0.1% level. Is Natex a Sluggish Index? This statistical evidence indicates that Natex is a sluggish index which does not fully reflect the movements in the market on the same day. The movement which is reflected in Sensex on any day is reflected in Natex partly on the same day and partly on the next day. The phenomenon is shown very clearly in a regression of Natex return on Sensex returns and the previous days Sensex returns. NatRet = 0.024% + 0.731 SenRet + 0.103 Lagged SenRet (1.62) (91.57) (12.92) R2 = 0.883 The above regression on lagged Sensex returns can be combined with the autoregression of Natex returns on lagged Natex returns into a single regression specification. NatRet = 0.03% + 0.730 SenRet -0.201 Lagged NatRet (2.14) (93.54) (-7.48) + 0.251 Lagged SenRet (11.80) The hypothesis that the coefficients of the lagged Sensex and Natex returns are equal but of opposite sign is rejected at the 0.1% level (T statistic = 4.81). The regression result showing opposite signs for Sensex and Natex raises the interesting possibility that what these two terms in the regression equation are trying to capture is a discordant movement of the two indices. Such a discordant movement of the two indices is best captured by the residual from a simple regression of Natex on Sensex. We therefore consider a regression in which lagged values of the indices are replaced by lagged values of the residual. The regression output is: NatRet = .034% + 0.736 SenRet -0.200 Lagged Residual (2.18) (88.34) (-6.96) R2 = 0.872

This means that when the Sensex and Natex move discordantly on any day, about 20% of this discordance is corrected by a compensating movement of the Natex on the next day. Since the least squares regression is highly sensitive to extreme values, it is useful to look at large values of the lagged residual separately. Running the above regressions separately for the days

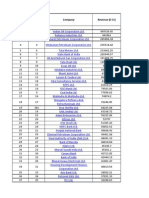

when the lagged residual is greater than 1% and less than 1% yielded coefficients of -0.295 (T-statistic = -3.54) and -0.089 (T-statistic = -2.86) respectively. While both coefficients are significant at the 1% level there is a sharp divergence between their values. While only 9% of a moderate discordance between the indices is corrected on the next day, as much as 30% of a large discordance is so corrected. Incidentally, there is no question that the correction is taking place in the Natex and not on Sensex. (When Sensex is regressed on the lagged residual alone the coefficient is insignificant (T-statistic = -0.70) while when Natex is regressed on the lagged residual alone the coefficient is -0.252 (T-statistic = -3.16, P = 0.002). All these results show the Natex in a rather poor light. It is rather slow to respond to rapid market movements and when it behaves discordantly with the Sensex, chances are that a significant part of that discordance would be corrected by the delayed response of the Natex the next day. In the presence of significant non trading bias, the betas that we have calculated for Sensex and Natex with respect to each other are not valid. Scholes and Williams (1977) have shown how to compute an unbiased and consistent estimate of the "true" beta correcting for the effect of non trading. The Scholes-Williams beta is defined as follows: 0 + + + = 1 + 2*pm where 0, + and - are respectively the ordinary beta, the leading beta (regressing the security return on the next period market return) and the lagged beta (regressing the security return on the prior period market return) and pm is the autocorrelation of the market return. All these regressions have to be run using only returns computed from two consecutive trading days; if the security is not traded on a day the return straddling the non trading day is to be ignored. Using this procedure yielded the following results: 0 Natex on Sensex Sensex on Natex + pm Scholes-Williams Beta 0.824 1.157

0.737 0.046 0.154 0.069 1.175 0.246 0.073 0.146

Even after correcting for the non trading bias, it is seen that Sensex has a beta greater than unity and correspondingly Natex has a beta less than unity when regressed against the other index. This is an important dimension of the evaluation of Sensex as a stock price index which we shall take up now.

Is Sensex too Volatile? The worrying things about the Sensex are its high volatility and high beta. Is the price for the greater sensitivity of the Sensex paid in the form of a greater vulnerability to random movements? Before we can answer this question unequivocally, we must recognize that the autocorrelation in the Natex means that its volatility is not directly comparable to that of Sensex. Natex is behaving like a smoothed version of the true index (recall the relationship with Sensex and lagged Sensex) and the smoothing reduces the volatility in the short run. Put differently, for a smoothed series, the volatility of daily returns understates the volatility of longer period returns. Suppose, for example that NatRet is a smoothed version of the true index N so that NatRett = (1 - ) Nt + Nt-1

Then it is easy to see that Var(Natret) = [(1 - )2 + 2] Var(N) (1 - 2) Var(N) neglecting terms of order 2. This implies that the standard deviation of Natret is about (1 - ) times that of N. The autocorrelation of Natret is about 0.15 indicating a value of in the same range; the volatility of Natret is about 15% less than that of the "true" index N. Hence we must adjust the volatility of Natret by this factor before comparing it with the Sensex. We saw earlier that the Sensex has a volatility about 25% higher than that of Natex. The adjustment for auto-correlation cannot account for the entire excess volatility. (All the more so when we recognize that the Sensex too has a slight though statistically insignificant autocorrelation). At the same time, the higher beta of the Sensex would imply a higher volatility. An index which is perfectly correlated with the true index but has a higher than unity would have a volatility times that of the true index. The Scholes-Williams procedure which adjusts for non trading bias indicates a beta of about 1.15 for Sensex. This higher beta coupled with the autocorrelation of Natex is sufficient to account for the entire excess volatility of the Sensex. This analysis suggests that the higher volatility of Sensex is not per se a matter of much concern. The only thing to worry about is the higher beta of Sensex. In many applications, the higher beta is not a serious problem; even where it is, it is easy to adjust for this excess beta. For example, if we use the Sensex as the market index to compute the beta of any security, we should keep in mind that the beta relative to Natex would be about 15% higher than our value.

Conclusion The analysis in this paper indicates: 1. The Natex is a sluggish index which responds too slowly to market conditions. Changes which are reflected in the Sensex on any day are completely reflected in the Natex only by the next day. This manifests itself statistically in an autocorrelation of Natex returns and a positive correlation with lagged Sensex returns. Sensex is more volatile than Natex, but this difference is accounted for by two factors - (a) the autocorrelation of the Natex which conceals the true volatility of Natex, and (b) a higher beta of Sensex relative to Sensex. Therefore, the excess volatility of Sensex is not a matter of serious concern. In many applications, however, the higher beta of Sensex is worrisome, but it is easy to correct for it.

2.

The conclusion, therefore, is that those who follow the Natex because of its greater comprehensiveness and theoretical appeal may be mistaken. The Sensex needs to be taken more seriously as a sound market index. The observed deficiencies of the Natex raises several disturbing questions for finance theorists and researchers. Is the market for the less well traded securities in the market inefficient? Do the scrips constituting the Sensex lead the other scrips? If so, can this relationship be used to make extra normal returns. Does the Bombay market lead other exchanges which are also represented in the Natex? These issues call for further research.

REFERENCES Bombay Stock Exchange (1991a) The Stock Exchange Sensitive Index of Equity Prices (1978-79 =100). Bombay Stock Exchange (1991b) The Stock Exchange National Index of Equity Prices (1983-84 =100). Roll, R. (1977) "A Critique of the Asset Pricing Theory's Tests: Part I: On Past and Potential Testability of the Theory", Journal of Financial Economics, 4(2), 129-176. Scholes, M. and Williams, J. (1977) "Estimating Betas from Asynchronous Data", Journal of Financial Economics, 5, 309-327.

You might also like

- SAP Customer ListDocument76 pagesSAP Customer ListAjay Kumar Khattar0% (1)

- List of All Company Names Listed On BSE and NSE Stock Exchanges - Last Trading Price, Current Price, Volume, BSE Code, NSE Symbol, BSE Price, NSE Price - Market On MobileDocument669 pagesList of All Company Names Listed On BSE and NSE Stock Exchanges - Last Trading Price, Current Price, Volume, BSE Code, NSE Symbol, BSE Price, NSE Price - Market On MobileSrinivasulu MachavaramNo ratings yet

- Investment Management Final Project.Document30 pagesInvestment Management Final Project.Eshita NaiduNo ratings yet

- SynopsisDocument12 pagesSynopsisNikshithaNo ratings yet

- A Study of The Optimal Portfolio Construction Using Sharpe's Single Index ModelDocument100 pagesA Study of The Optimal Portfolio Construction Using Sharpe's Single Index ModelPrakash Reddy100% (1)

- Exploring The Volatility of Stock Markets: Indian ExperienceDocument15 pagesExploring The Volatility of Stock Markets: Indian ExperienceShubham GuptaNo ratings yet

- What Are Stock Market Indices?Document11 pagesWhat Are Stock Market Indices?Anonymous rCK2NujLy2No ratings yet

- Managerial Economics Project 2010Document12 pagesManagerial Economics Project 2010Divakar NarayanNo ratings yet

- Time Varying Volatility in The Indian Stock Market: ResearchDocument18 pagesTime Varying Volatility in The Indian Stock Market: Researchamazing_1No ratings yet

- A Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeDocument45 pagesA Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeBalakrishna ChakaliNo ratings yet

- Stock Market IndicesDocument3 pagesStock Market IndicesNatural agroNo ratings yet

- Volatility in Indian Stock MarketDocument6 pagesVolatility in Indian Stock MarketUpender GoelNo ratings yet

- An Empirical Analysis of Volatility in Bombay Stock Exchange LimitedDocument9 pagesAn Empirical Analysis of Volatility in Bombay Stock Exchange LimitedNishatNo ratings yet

- Market Indices/ Stock IndexDocument2 pagesMarket Indices/ Stock IndexDipikaVermaniNo ratings yet

- Investigating Expiration - Day Effects - 2Document11 pagesInvestigating Expiration - Day Effects - 2Saurabh RathiNo ratings yet

- Index PageDocument42 pagesIndex PageBalakrishna ChakaliNo ratings yet

- Chart Analysis: Fundamental Analysis Intrinsic ValueDocument9 pagesChart Analysis: Fundamental Analysis Intrinsic ValueSurya VamshiNo ratings yet

- The Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketDocument11 pagesThe Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketAssociation for Pure and Applied ResearchesNo ratings yet

- Main PartDocument53 pagesMain PartAbdullah Mamun Al SaudNo ratings yet

- Digital Assignment 2Document7 pagesDigital Assignment 2Prithish PreeNo ratings yet

- Project 222Document18 pagesProject 222RajkamalChichaNo ratings yet

- Chapter 8 2 Indices NSEDocument10 pagesChapter 8 2 Indices NSEben kookNo ratings yet

- (Aman Pathak) RESEARCH METHODOLOGYDocument4 pages(Aman Pathak) RESEARCH METHODOLOGYAman PathakNo ratings yet

- Project 2 Nse BseDocument12 pagesProject 2 Nse BseIshita BansalNo ratings yet

- Technical Analysis On Banks Dissertation PDFDocument18 pagesTechnical Analysis On Banks Dissertation PDFWaibhav KrishnaNo ratings yet

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathNo ratings yet

- A Study To Understand The Stock Market Volatility With Reference To Bse (Sensex) and Nse (Nifty)Document9 pagesA Study To Understand The Stock Market Volatility With Reference To Bse (Sensex) and Nse (Nifty)harshit singhNo ratings yet

- Technical Analysis Why Technical Analysis?: Shishir SrivastavaDocument12 pagesTechnical Analysis Why Technical Analysis?: Shishir SrivastavaShishir Srivastava100% (1)

- Technical AnalysisDocument60 pagesTechnical AnalysisSoma ShekarNo ratings yet

- Business Statistics Project 2010Document21 pagesBusiness Statistics Project 2010Aayush AkhauriNo ratings yet

- Analysis On Share Prices BY Oddysoft Company: A Project Report ONDocument42 pagesAnalysis On Share Prices BY Oddysoft Company: A Project Report ONSoumya SinghNo ratings yet

- IJRAR21D1055Document23 pagesIJRAR21D1055Mansi ChauhanNo ratings yet

- A Study On Volatility in Indian Stock MarketDocument13 pagesA Study On Volatility in Indian Stock MarketjakikhanNo ratings yet

- Volatility in The Indian Stock Market: A Case of Individual SecuritiesDocument12 pagesVolatility in The Indian Stock Market: A Case of Individual SecuritiesKarthik KarthikNo ratings yet

- Technical Study of Pharmaceutical StocksDocument4 pagesTechnical Study of Pharmaceutical StockssaravanawillbeNo ratings yet

- Review of Literature On Stock Market IndicesDocument6 pagesReview of Literature On Stock Market Indicesafmabzmoniomdc100% (1)

- A Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Document20 pagesA Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Jayanta DuttaNo ratings yet

- 292-Article Text-1387-1-10-20170213Document18 pages292-Article Text-1387-1-10-20170213Zyve AfricaNo ratings yet

- Modeling Volatility of Indian Stock Market Evidence From BEKK ModelDocument8 pagesModeling Volatility of Indian Stock Market Evidence From BEKK ModelarcherselevatorsNo ratings yet

- Stock Market Indices (BBA)Document5 pagesStock Market Indices (BBA)Akshita DhyaniNo ratings yet

- Technical Analysis ArticleDocument7 pagesTechnical Analysis ArticleABOOBAKKERNo ratings yet

- Analysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadaviDocument24 pagesAnalysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadavimndeepikaNo ratings yet

- Index Derivatives: H.R.College of Commerce and Economics T.Y.B.F.MDocument23 pagesIndex Derivatives: H.R.College of Commerce and Economics T.Y.B.F.Madi809hereNo ratings yet

- Neural Network Models For Forecasting Mutual Fund Net Asset ValueDocument18 pagesNeural Network Models For Forecasting Mutual Fund Net Asset ValueClara Agustin StephaniNo ratings yet

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- NIFTYIndexand Its Correlationwith Sectorial IndexesDocument12 pagesNIFTYIndexand Its Correlationwith Sectorial IndexesaaaaaaaNo ratings yet

- Pranat Mangla - 221VMCR00721 SynopsisDocument4 pagesPranat Mangla - 221VMCR00721 SynopsisPRANAT MANGLANo ratings yet

- My ProjectDocument93 pagesMy Projectramaa bhat0% (1)

- Hiren M Maniar, DR - Rajesh Bhatt, DR - Dharmesh M ManiyarDocument28 pagesHiren M Maniar, DR - Rajesh Bhatt, DR - Dharmesh M Maniyarguptapunit03No ratings yet

- Correlation Between NSE and BSE Indices: Project Work OnDocument27 pagesCorrelation Between NSE and BSE Indices: Project Work OnKishan SekhadaNo ratings yet

- Lecture-16 Stock Market IndicesDocument7 pagesLecture-16 Stock Market IndicesMRIDUL GOELNo ratings yet

- Executive SummaryDocument17 pagesExecutive SummarySiva GuruNo ratings yet

- Report On EQUITY MarketDocument41 pagesReport On EQUITY MarketAbhinandhan ReddyNo ratings yet

- Cia - Iii: Final Model and Report BY Raghav Agarwal 2028004Document12 pagesCia - Iii: Final Model and Report BY Raghav Agarwal 2028004Raghav AgrawalNo ratings yet

- SSRN Id3138554 PDFDocument17 pagesSSRN Id3138554 PDFGTNo ratings yet

- Conceptual School Work On Stock IndicesDocument73 pagesConceptual School Work On Stock IndicesFawaz MushtaqNo ratings yet

- Iiswbm Finance ProjectDocument48 pagesIiswbm Finance Projectjhawar sales agenciesNo ratings yet

- MBA Final Sem Project ReportDocument85 pagesMBA Final Sem Project ReportMd Hassan100% (1)

- A Study On Mutual Funds in IndiaDocument18 pagesA Study On Mutual Funds in IndiarnbiswalNo ratings yet

- Demystifying Managed FuturesDocument29 pagesDemystifying Managed Futuresjchode69No ratings yet

- Analysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeDocument14 pagesAnalysis of Volatility and Forecasting General Index of Dhaka Stock ExchangeDr-Kiran JameelNo ratings yet

- Final Project On Volatility - New 2Document99 pagesFinal Project On Volatility - New 2vipul099No ratings yet

- Modifed SaDocument34 pagesModifed SaPooja LilaniNo ratings yet

- A Study On Mutual Funds in IndiaDocument31 pagesA Study On Mutual Funds in Indianikhil5822No ratings yet

- Stock Market and Foreign Exchange Market: An Empirical GuidanceFrom EverandStock Market and Foreign Exchange Market: An Empirical GuidanceNo ratings yet

- Parsvnath Develpoers ProjectDocument88 pagesParsvnath Develpoers ProjectTanmoy ChakrabortyNo ratings yet

- Broad Status 07Document106 pagesBroad Status 07rishabhNo ratings yet

- Victory Velly 21Document2 pagesVictory Velly 21Ashwini SinghNo ratings yet

- State Bank of IndiaDocument1,604 pagesState Bank of IndiaNarasimman MNo ratings yet

- RefineriesMap PDFDocument2 pagesRefineriesMap PDFingbarragan87No ratings yet

- GRI Reports List LimitedDocument26 pagesGRI Reports List LimitedsimaproindiaNo ratings yet

- Bank Branch List For The Website Sl. No. Branch Name Branch IDDocument10 pagesBank Branch List For The Website Sl. No. Branch Name Branch IDmayankgalwarNo ratings yet

- Bajaj Discover 100Cc, Bajaj M80Document1 pageBajaj Discover 100Cc, Bajaj M80Raunak Vi100% (1)

- Security Analysis and Portfolio Management v1.1Document82 pagesSecurity Analysis and Portfolio Management v1.1Harsh SarafNo ratings yet

- BS 000 BSDocument18 pagesBS 000 BSPrekke SrinivasNo ratings yet

- Investment Procss of Unicon (Tufail)Document55 pagesInvestment Procss of Unicon (Tufail)Tufail KhanNo ratings yet

- Lucknow Circle and BranchesDocument23 pagesLucknow Circle and BranchesShashank Dohrey60% (5)

- Crazy Frog, Technical Analysis ScannerDocument4 pagesCrazy Frog, Technical Analysis ScannerShub ShahNo ratings yet

- History of Indian Stock Market - Read 140 Year Long Journey!Document6 pagesHistory of Indian Stock Market - Read 140 Year Long Journey!swati prasadNo ratings yet

- APTUS ResultsDocument1 pageAPTUS ResultsramsinxNo ratings yet

- DEAF Portal Codes and Details RBIDocument38 pagesDEAF Portal Codes and Details RBIAlok PaulNo ratings yet

- POP DetailsDocument15 pagesPOP DetailsJitender KumarNo ratings yet

- Account STMT XX0226 19122023Document13 pagesAccount STMT XX0226 19122023rdineshyNo ratings yet

- Mumbai Data CFODocument1,200 pagesMumbai Data CFOManoj KumarNo ratings yet

- SHAREKHANDocument63 pagesSHAREKHANShivani GoelNo ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Average Market Capitalizationoflistedcompaniesduringthesixmonthsended 31 Dec 2023Document84 pagesAverage Market Capitalizationoflistedcompaniesduringthesixmonthsended 31 Dec 2023Nirvana BoyNo ratings yet

- Broad Status-01 PDFDocument116 pagesBroad Status-01 PDFMALLINo ratings yet

- A Summer Internship ReportDocument33 pagesA Summer Internship ReportPrateek BissaNo ratings yet

- Circle Office ListDocument7 pagesCircle Office ListSushil ParmanikNo ratings yet