Professional Documents

Culture Documents

Currency Daily Report, March 11

Currency Daily Report, March 11

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, March 11

Currency Daily Report, March 11

Uploaded by

Angel BrokingCopyright:

Available Formats

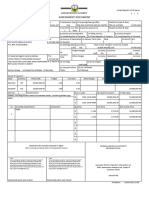

Currencies Daily Report

Monday| March 11, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any co mmodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Monday| March 11, 2013

Highlights

US Non-Farm Employment Change rose to 2,36,000 in February. UKs Consumer Inflation Expectations rose by 3.6 percent in Q1 2013. US Unemployment Rate declined to 7.7 percent in the last month. Chinas Consumer Price Index (CPI) increased to 3.2 percent in Feb. US Non-Farm Employment Change rose by 1,17,000 to 2,36,000 in February as against a rise of 1,19,000 in January. Unemployment Rate declined to 7.7 percent in February from earlier rise of 7.9 percent a month ago. Average Hourly Earnings was at 0.2 percent in last month as compared to rise of 0.1 percent in January. Wholesale Inventories increased by 1.2 percent in January with respect to rise of 0.1 percent in earlier month. Chinas Consumer Price Index (CPI) increased to 3.2 percent in February as against a rise of 2 percent in January. Producer Price Index (PPI) remained unchanged at -1.6 percent in the last month. Fixed Asset Investment rose by 21.2 percent in January from earlier rise of 20.6 percent a month ago. Industrial Production increased at slow pace of 9.9 percent in January with respect to previous rise of 10.3 percent in December.

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Apr13) - $/bbl Comex Gold (Apr13) - $/oz Comex Silver(Mar13) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% Yield 5945.7 19683.2 14397.07 1551.2 16204.0 2006.0 58497.8 12283.6 91.95 1576.60 2890.90 7749.00 102.09 Prev. day 1.4 1.4 0.5 0.4 1.6 0.1 0.2 2.6 0.4 0.1 0.0 0.0 0.0

as on March 8, 2013 WoW 4.0 4.0 2.2 2.2 3.4 2.8 -0.1 1.4 0.3 1.6 0.4 0.5 MoM 0.7 1.0 2.9 2.2 -2.6 3.8 0.0 8.6 -3.9 -4.3 -6.4 -1.2 0.1 YoY 11.5 7.6 11.5 13.6 -2.8 2.8 -12.3 25.7 -13.7 -7.2 -15.4 -7.0 -1.2

US Dollar Index

US Dollar Index (DX) appreciated by 0.5 percent in the last week on the back of US Gross Domestic (GDP) which grew at slower pace of 0.1 percent than the forecast data leading to concerns over the the global economic growth. However, sharp upside was not witnessed on account of rise in risk appetite in the global market sentiments which led to fall in demand for the low yielding currency. Additionally, favorable economic data from US and Euro Zone also capped sharp gains in the currency. The currency touched a weekly high of 82.95 and closed at 82.73 on Friday.

Source: Reuters

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR Mar13 Futures (NSE) US $ / INR Mar13 Futures (MCX-SX) 82.73 54.34 54.54 71.56 Prev. day 0.7 0.2 -0.48 30.57

as on March 8, 2013 WoW 0.5 1.0 -1.28 29.53 MoM 3.0 -1.4 1.48 33.16 YoY 4.1 -7.9 7.96 41.65

Dollar/INR

The Indian Rupee appreciated by 1 percent in the last week. The currency appreciated on the back of selling of dollars from exporters and some custodian banks. Additionally, upbeat global market sentiments coupled with inflow of dollars from Power Grid's bond issue which raised up to 20 billion rupees ($364.66 million) through sale of bonds also supported an upside in the currency. However, strength in the DX capped sharp gains in the currency. The Indian Rupee touched a weekly high of 54.265 and closed at 54.34 against dollar on Friday. For the month of March 2013, FII inflows totaled at Rs.1,410.90 crores ($254.37 million) as on 8th March 2013. Year to date basis, net capital inflows stood at Rs.47,909.0 crores ($8,889.0 million) till 8th March 2013. Outlook From the intra-day perspective, we expect Indian Rupee to appreciate on the back of upbeat global market sentiments coupled with weakness in the DX. Additionally, selling of dollars from exporters and custodian banks will also support an upside in the currency.

Source: Reuters

Technical Chart USD/INR

Source: Telequote

Technical Outlook

Trend US Dollar/INR Mar13 (NSE/MCX-SX) Down

valid for March 11, 2013 Support 54.40/54.25 Resistance 54.70/54.90

www.angelbroking.com

Currencies Daily Report

Monday| March 11, 2013

Euro/INR

The Euro depreciated by 0.1 percent on weekly basis on the back of decline in Europes Sentix investor confidence, decline in Spanish services PMI coupled with strength in DX. Further, Revised Euro GDP data showed that Euro zone growth declines by 0.6 percent, negative German factory orders and Flat German industrial production also added downside pressure. However, optimistic global market sentiments, decline in borrowing cost for Spain and ECB decision to keep its benchmark interest rates unchanged to 0.75 percent cushioned the sharp depreciation in the currency. Additionally, ECB president Draghi comment that region economy will become stable also prevented sharp depreciation. French Gov Budget Balance was at a deficit of 12.8 billion Euros in January as against a previous deficit of 87.2 billion Euros a month ago. The Euro touched a weekly low of 1.2955 and closed at 1.3004 against dollar on Friday. Outlook In todays session, we expect Euro to appreciate on account of optimistic global market sentiment. However, French industrial production is expected to come unchanged which may cap sharp appreciation in the currency. Technical Outlook valid for March 11, 2013

Trend Euro/INR Mar13 (NSE/MCX-SX) Up 71.40/71.20 71.70/71.90 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR Mar 13 Futures (NSE) Euro / INR Mar13 Futures (MCX-SX) 1.3004 70.54 71.6 71.6 Prev. day -0.8 1.1 0.35 0.34

as on March 8, 2013 WoW -0.1 1.5 -0.50 -0.52 MoM -2.7 1.5 -0.68 -0.68 7.87 7.85 YoY -2.0

Source: Reuters

Technical Chart Euro

Source: Telequote

GBP (% change)

Last $ / GBP (Spot) GBP / INR (Spot) GBP / INR Mar13 Futures (NSE) GBP / INR Mar 13 Futures (MCX-SX) 1.4915 81.099 54.54 Prev. day -0.65 -1.08 -33.68

as on March 8, 2013

WoW -0.8 -1.80 -34.28

MoM -5.6 -4.22 -35.59

YoY -5.7 2.52 -31.37

GBP/INR

On the Weekly basis, Sterling Pound depreciated by 0.8 percent on the back of decline in construction PMI coupled with strength in DX. Additionally, rise in consumer Inflation expectation added further downside pressure. However, decision by Bank of England (BOE) to keep its Official Bank Rate and asset purchase facility unchanged coupled with optimistic global market sentiments cushioned the sharp depreciation in currency. Additionally, positive services PMI from UK also prevented sharp downside in currency. UKs Consumer Inflation Expectations rose by 3.6 percent in Q1 of 2013 from earlier rise of 3.5 percent in Q4 of 2012. The Sterling Pound touched a low of 1.4884 and closed at 1.4915 against dollar on Friday. Outlook We expect Sterling Pound to trade on a positive note in todays trade on the back of optimistic global market sentiment coupled with weakness in DX. Technical Outlook

Trend GBP/INR Mar 13 (NSE/MCX-SX) Down valid for March 11, 2013 Support 81.80/81.62 Resistance 82.20/82.40

82.04

-0.21

-1.11

-3.10

3.29

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Monday| March 11, 2013

JPY/INR

JPY (% change) The Japanese Yen depreciated by 2.6 percent yesterday in the last week as a result of rise in risk appetite in the global market sentiments which will lead to fall in demand for the low yielding currency. However, sharp downside in the currency was cushioned on account of favorable economic data from the country. Japans Economy Watchers Sentiment rose by 3.7 points to 53.2-mark in February as against a rise of 49.5-level in January. Core Machinery Orders declined by 13.1 percent in January as against a rise of 2.8 percent a month ago. M2 Money Stock increased by 2.9 percent in February from earlier rise of 2.7 percent in January. The Yen touched a low of 96.54 in the last week and closed at 96.02 against dollar on Friday. Outlook For the intra-day, we expect yen to depreciate taking cues from rise in risk appetite in the global market sentiments which will lead to fall in demand for the low yielding currency. Additionally, decline in machinery orders data from the country will also add downside pressure on the currency. Technical Outlook

Trend JPY/INR Mar 13 (NSE/MCX-SX) Down valid for March 11, 2013 Support 56.85/56.70 Resistance 57.35/57.70

Source: Telequote

as on March 8, 2013 Last 96.02 0.5659 57.06 57.07 Prev day 1.3 -1.55 -2.03 -1.98 WoW 2.6 -3.55 -4.02 -4.04 MoM 3.6 -99.03 -1.92 -1.92 YoY 17.7 -8.47 -8.84 -8.80

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR Mar13 Futures (NSE) JPY 100 / INR Mar13 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Economic Indicators to be released on March 11, 2013

Indicator Core Machinery Orders m/m French Industrial Production m/m Country Japan Europe Time (IST) 5:20am 1:15pm Actual -13.1% Forecast -1.6% -0.1% Previous 2.8% -0.1% Impact Medium Medium

www.angelbroking.com

You might also like

- Sanction Letter A2301300139 1Document1 pageSanction Letter A2301300139 1Mohammed Masood50% (2)

- (Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesDocument47 pages(Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesSiddhantNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 28Document4 pagesCurrency Daily Report, February 28Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, February 18Document4 pagesCurrency Daily Report, February 18Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 10Document4 pagesCurrency Daily Report, April 10Angel BrokingNo ratings yet

- Currency Daily Report, April 17Document4 pagesCurrency Daily Report, April 17Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Currency Daily Report, March 21Document4 pagesCurrency Daily Report, March 21Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 23 2013Document4 pagesCurrency Daily Report, May 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 21Document4 pagesCurrency Daily Report, February 21Angel BrokingNo ratings yet

- Currency Daily Report, July 17 2013Document4 pagesCurrency Daily Report, July 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily Report, May 17 2013Document4 pagesCurrency Daily Report, May 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 25Document4 pagesCurrency Daily Report, February 25Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 22Document4 pagesCurrency Daily Report, March 22Angel BrokingNo ratings yet

- Currency Daily Report, February 26Document4 pagesCurrency Daily Report, February 26Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, April 25Document4 pagesCurrency Daily Report, April 25Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, February 22Document4 pagesCurrency Daily Report, February 22Angel BrokingNo ratings yet

- Currency Daily Report, March 20Document4 pagesCurrency Daily Report, March 20Angel BrokingNo ratings yet

- Currency Daily Report, March 26Document4 pagesCurrency Daily Report, March 26Angel BrokingNo ratings yet

- Currency Daily Report, April 22Document4 pagesCurrency Daily Report, April 22Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 28Document4 pagesCurrency Daily Report, March 28Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, June 04 2013Document4 pagesCurrency Daily Report, June 04 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- WMAI - Project Synopsis - Group 12Document4 pagesWMAI - Project Synopsis - Group 12Varun SharmaNo ratings yet

- Redemption of P. SharesDocument4 pagesRedemption of P. SharesYashitha CaverammaNo ratings yet

- BookDocument111 pagesBookRey Salvador Batan, Jr.No ratings yet

- Macro & Micro Indicators of Business EnvironmentDocument25 pagesMacro & Micro Indicators of Business EnvironmentRavi Mishra75% (4)

- MCQs 3133 Indian and Global Economic DevelopmentDocument47 pagesMCQs 3133 Indian and Global Economic DevelopmentAtul BorbaneNo ratings yet

- Byars 10e ch01Document39 pagesByars 10e ch01KarazayNo ratings yet

- 13 Mbfi - at - 191104 PDFDocument2 pages13 Mbfi - at - 191104 PDFAkshayNo ratings yet

- Assessment Document TZDL 22 1197501Document2 pagesAssessment Document TZDL 22 1197501danyjustine96No ratings yet

- 22-23 Olp 604666Document1 page22-23 Olp 604666HehshsNo ratings yet

- Metrices and MeasuresDocument11 pagesMetrices and MeasuresVIPUL ThakurNo ratings yet

- Importance of Advertising in A Marketing MixDocument4 pagesImportance of Advertising in A Marketing MixAshutosh AgrahariNo ratings yet

- Duration: 2 Hours Total Marks: 30 Term-II Instructions: All Questions Are CompulsaryDocument13 pagesDuration: 2 Hours Total Marks: 30 Term-II Instructions: All Questions Are CompulsaryAdiNo ratings yet

- Cash Management Cover LetterDocument9 pagesCash Management Cover Letterrqaeibifg100% (2)

- Applied AuditingDocument2 pagesApplied AuditingjjabarquezNo ratings yet

- THBT Social Deprivation Causes CrimesDocument3 pagesTHBT Social Deprivation Causes CrimesArifAkmal0% (1)

- FFM Group 3 PresentationDocument5 pagesFFM Group 3 Presentationlohithagowda122001No ratings yet

- Work ReportDocument25 pagesWork ReportOKALEBO SAMUELNo ratings yet

- SWOT Analysis - People, Process and Product FlashcardsDocument6 pagesSWOT Analysis - People, Process and Product FlashcardsHugh Fox IIINo ratings yet

- Aadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaDocument1 pageAadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaLesego MoabiNo ratings yet

- Assignment On Decision Making ProcessDocument23 pagesAssignment On Decision Making ProcessMuhammad SaeedNo ratings yet

- Handling Prolongation and Disruption ClaimsDocument0 pagesHandling Prolongation and Disruption ClaimsAnonymous pGodzH4xL100% (1)

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Ipcc Capsule PDFDocument189 pagesIpcc Capsule PDFnikita kambliNo ratings yet

- Affle Job Description - Business Development Executive MAASDocument2 pagesAffle Job Description - Business Development Executive MAASpranav nalawadeNo ratings yet

- Section B: Sustainable Development and Use of ResourcesDocument11 pagesSection B: Sustainable Development and Use of ResourcesTrini OrgNo ratings yet

- Women's Empowerment, SDGs and ICTDocument60 pagesWomen's Empowerment, SDGs and ICToeamaoesahaNo ratings yet

- Operational ExcellenceDocument16 pagesOperational ExcellenceRakesh VanamaliNo ratings yet

- Cost ReconcillationDocument6 pagesCost ReconcillationmahendrabpatelNo ratings yet