Professional Documents

Culture Documents

Employment Scenario in The Banking Sector

Employment Scenario in The Banking Sector

Uploaded by

Sahil MahajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employment Scenario in The Banking Sector

Employment Scenario in The Banking Sector

Uploaded by

Sahil MahajanCopyright:

Available Formats

The Banking Sector in India

The Banking sector in India has always been one of the most preferred avenues of employment. In the current decade, this has emerged as a resurgent sector in the Indian economy. As per the McKinsey report India Banking 2010, the banking sector index has grown at a compounded annual rate of over 51 per cent since the year 2001, as compared to a 27 per cent growth in the market index during the same period. It is projected that the sector has the potential to account for over 7.7 per cent of GDP with over Rs.7,500 billion in market cap, and to provide over 1.5 million jobs. Today, banks have diversified their activities and are getting into new products and services that include opportunities in credit cards, consumer finance, wealth management, life and general insurance, investment banking, mutual funds, pension fund regulation, stock broking services, custodian services, private equity, etc. Further, most of the leading Indian banks are going global, setting up offices in foreign countries, by themselves or through their subsidiaries.

Top

Employment Scenario in the Banking Sector

As reported in the Economic Times, the countrys leading public sector bank, State Bank of India has plans to recruit 25,000 employees in the year 2009. Besides, its life insurance venture, SBI Life, has plans to hire 13,000 agents and 200 sales managers. Also, Punjab National Bank, the country's second largest public sector lender, and Union Bank of India have plans of hiring 5,000 people each. The financial year 2008-09 has already shown the banking sector to be among the largest job providers in the country with over 50,000 vacancies being notified and filled up in the public sector banks alone.

Top

Major Recruiters of Banking Industry

Public Sector Banks are the major recruiters of candidates aspiring for bank jobs. These banks are: 1. The State Bank of India Group (Total:8 Banks) namely SBI (State Bank of India), State Bank of Indore, SBBJ (..Bikaner & Jaipur), SBH (..Hyderabad), SBM (..Mysore), SBP (..Patiala), SBS (..Saurashtra), and SBT (..Travancore). 2. Nationalised Banks (Total: 19 Banks) namely Allahabad Bank, Andhra Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Corporation Bank, Dena Bank, Indian Bank, Indian Overseas Bank, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, Syndicate Bank, UCO Bank, United Bank of India, Union Bank of India and Vijaya Bank. 3. Other Public Sector Bank i.e. IDBI Bank Limited. 4. Private Sector Banks (Total: 27 Banks). The major recruiters in the private sector include the ICICI Bank, HDFC Bank, Axis Bank, Federal Bank, Centurion Bank of Punjab, Indusind Bank, Kotak Mahindra Bank, Yes Bank, ING Vysya Bank, Bank of Rajasthan, Karur Vysya Bank, Karnataka Bank, Jammu & Kashmir Bank, South Indian Bank, Bharat Overseas Bank, etc. These banks conduct their own exams, but normally follow patterns similar to those of the exams of the public sector banks. 5. Co-operative Banks: All major National and State Cooperative Banks and Scheduled Urban Co-operative Banks conduct their own exams to recruit staff. Their recruitment exams, too, are generally similar to the exams of the public sector banks.

State Bank Of India

State Bank of India (SBI) is a banking and financial services company based in India. It is a state-owned corporation with its headquarters in Mumbai, Maharashtra. As of March 2012, it had assets of US$360 billion and 14,119 branches, including 173 foreign offices in 37 countries across the globe making it the largest banking and financial services company in India. The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banksBank of Calcutta and Bank of Bombay to form the Imperial Bank of India, which in turn became the State Bank of India. The Government of India nationalised the Imperial Bank of India in 1955, with the Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. SBI has been ranked 285th in the Fortune Global 500 rankings of the world's biggest corporations for the year 2012.[1] SBI provides a range of banking products through its network of branches in India and overseas, including products aimed at non-resident Indians (NRIs). SBI has 14 regional hubs and 57 Zonal Offices that are located at important cities throughout the country. SBI is a regional banking behemoth and has 20% market share in deposits and loans among Indian commercial banks.[2]

The State Bank of India was named the 29th most reputed company in the world according to Forbes 2009 rankings[3] and was the only bank featured in the "top 10 brands of India" list in an annual survey conducted by Brand Finance and The Economic Times in 2010.[4]

WE have choosen State Bank Of India ,Sector 22-C ,BRANCH

Address: SCO NO.291516,SECTOR 22C,CHANDIGARH,PIN 160022 Contact: 0172-2721059 01722700151 (FAX) IP-400456 Branch Code: Last six characters of IFSC Code represent Branch code. MICR Code: 160002015

Bank Type: Nationalised Business Loans: Business Loans, Loan Against Deposit, Professional Loan, Project Finance, Self Help Group Finance, Term Finance, Trade Finance Corporate Credit Card, Credit Card, Debit Card, E-Shop Card, Loyalty Cards, Remittance Card, Travel Currency Card Current Account, Demat Account, Fixed Deposit Account, Recurring Deposit Account, Saving Account Agricultural Loan Schemes, Commercial Vehicle Loan, Consumer Goods Loan, Educational Loan, Four Wheeler Loan, Home Improvement Loan, Housing Loan, Loan Against Deposit, Loan Against Gold, Loan Against Property, Loan Against Share, Loan Against Vehicle, Personal Loan, Two Wheeler Loan Monday To Friday 9:30 Am To 4:30 Pm, Saturday9:30am-12:30pm Bonds, Equity, Fixed Deposit, Flexible Deposit, Insurance, Mutual Fund, Stock Invest Card To Card Money Transfer, Currency Exchange,

Cards:

Account Types: Personal Loans:

Business Hours: Investment Products: Services:

Demat Services, Direct Tax Payment, Electronic Clearing Service, Mobile Phone Banking, Multi City Cheque Facility, Net Banking, Pension Disbursement, Personal Tax Assistance & Investment, Portfolio Management, Retail Sale Of Gold Coin, Wealth Management Service URL: sbi.co.in

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Federal Reserve Routing NumbersDocument19 pagesFederal Reserve Routing NumbersPaul926875% (4)

- Banking Sector VeraDocument3 pagesBanking Sector Verarupeshverma491993No ratings yet

- Fundamental Analysis of Private and Public Sector - 230131 - 103604Document57 pagesFundamental Analysis of Private and Public Sector - 230131 - 103604Abirami ThevarNo ratings yet

- INDIAN MirrorDocument14 pagesINDIAN MirrordevrajkinjalNo ratings yet

- Comparative Study of Top 5 Banks in IndiaDocument11 pagesComparative Study of Top 5 Banks in Indiajakharpardeepjakhar_No ratings yet

- I Am Sharing 'Fundamental Analysis of Private and Public Sector - 230131 - 103604' With YouDocument45 pagesI Am Sharing 'Fundamental Analysis of Private and Public Sector - 230131 - 103604' With YouAbirami ThevarNo ratings yet

- Project Vijaya Bank FinalDocument62 pagesProject Vijaya Bank FinalNalina Gs G100% (1)

- Banking Sector in Indi1Document3 pagesBanking Sector in Indi1Pankaj DhootNo ratings yet

- Icici BankDocument43 pagesIcici BankRosalie StryderNo ratings yet

- Vinnu Final ProjectDocument76 pagesVinnu Final ProjectOm Prakash RêígñßNo ratings yet

- Credit Appraisal ProjectDocument109 pagesCredit Appraisal ProjectAshwath KodaguNo ratings yet

- Outlook Task2Document79 pagesOutlook Task2Rajveer singh PariharNo ratings yet

- Credit Appraisal in Sbi Bank Project6 ReportDocument106 pagesCredit Appraisal in Sbi Bank Project6 ReportVenu S100% (1)

- Statistical Review On The Nationalized Banks in IndiaDocument12 pagesStatistical Review On The Nationalized Banks in IndiaMohammad MiyanNo ratings yet

- Introduction To Banking Sector & SbiDocument106 pagesIntroduction To Banking Sector & Sbiaparajitha lalasaNo ratings yet

- Structure of Management in The Banking SectorDocument16 pagesStructure of Management in The Banking Sectoranimesh RanjanNo ratings yet

- Industry ProfileDocument16 pagesIndustry Profileactive1cafeNo ratings yet

- A Project ReportDocument5 pagesA Project ReportHimanshu KumarNo ratings yet

- Banking Term PaperDocument18 pagesBanking Term PaperSangeeta ChakiNo ratings yet

- Comparative Study On Personal Banking of SBI and HDFCDocument14 pagesComparative Study On Personal Banking of SBI and HDFCsaurabhm707No ratings yet

- Comparative Study On Personal Banking of SBI and HDFCDocument14 pagesComparative Study On Personal Banking of SBI and HDFCsaurabhm707No ratings yet

- PpojDocument25 pagesPpojshubhambachhav47No ratings yet

- Security Analysis and Portfolio ManagementDocument6 pagesSecurity Analysis and Portfolio ManagementKshama_Shukla_7080No ratings yet

- Indian Banking Industry - CHALLENGES DTDocument8 pagesIndian Banking Industry - CHALLENGES DTShadab AshfaqNo ratings yet

- History of Banking IndustryDocument66 pagesHistory of Banking IndustryJissy ShravanNo ratings yet

- Function of Public Sector BanksDocument51 pagesFunction of Public Sector BanksdynamicdeepsNo ratings yet

- Emerging Issues in Indian Banking SectorDocument31 pagesEmerging Issues in Indian Banking SectorShradha JindalNo ratings yet

- Banking SectorDocument12 pagesBanking SectorVijay RaghunathanNo ratings yet

- A) Banking in IndiaDocument19 pagesA) Banking in IndiaSindhu PoyyeriNo ratings yet

- Dena BNK Project FinalDocument82 pagesDena BNK Project FinalNirmal MudaliyarNo ratings yet

- AcknowlegdementDocument29 pagesAcknowlegdementYamini MehtaNo ratings yet

- Industry Analysis: Current Trends in The IndustryDocument7 pagesIndustry Analysis: Current Trends in The IndustryAshish GutgutiaNo ratings yet

- Introduction To Banking Sector & SbiDocument107 pagesIntroduction To Banking Sector & SbiTanushreeNo ratings yet

- Investment Banking Prospects in IndiaDocument17 pagesInvestment Banking Prospects in Indiajagadeesh143No ratings yet

- A Study On Recent Trends of Banking Sector in India: M.Sujatha, N.V Haritha, P. Sai SreejaDocument8 pagesA Study On Recent Trends of Banking Sector in India: M.Sujatha, N.V Haritha, P. Sai Sreejasomprakash giriNo ratings yet

- Banking FinalDocument174 pagesBanking FinalRashesh DoshiNo ratings yet

- Project Report On Indian Banking SectorDocument15 pagesProject Report On Indian Banking SectorAbhishek MohantyNo ratings yet

- G H Raisoni Institute of Engineering & Technology, NagpurDocument34 pagesG H Raisoni Institute of Engineering & Technology, NagpurPratik JainNo ratings yet

- A Study of Financial Performance: A Comparative Analysis of Sbi and Icici BankDocument17 pagesA Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bankganesh dvssNo ratings yet

- FMI PresentationDocument15 pagesFMI PresentationVishal JoganiNo ratings yet

- Banking DetailsDocument9 pagesBanking DetailsModi HaniNo ratings yet

- MRP On HDFC BankDocument27 pagesMRP On HDFC BankRampal Singh Sengar100% (1)

- Icici Vs SbiDocument16 pagesIcici Vs SbiJay KoliNo ratings yet

- Ib Presen SandyDocument20 pagesIb Presen Sandysandeepbist88No ratings yet

- One Liner Updates Banking Awareness SBI Clerk Mains1Document19 pagesOne Liner Updates Banking Awareness SBI Clerk Mains1Neradabilli EswarNo ratings yet

- Synopsis Icici & Customer SatisfactionDocument17 pagesSynopsis Icici & Customer SatisfactionbhatiaharryjassiNo ratings yet

- A Study On Attrition Rate in Standard Chartered BankDocument55 pagesA Study On Attrition Rate in Standard Chartered BankAjay RohillaNo ratings yet

- Research MethodologyDocument12 pagesResearch MethodologyKuldeep KaushikNo ratings yet

- CITIBANKDocument28 pagesCITIBANKAnirudh SinghNo ratings yet

- Banking Sector3Document21 pagesBanking Sector3santhoshniNo ratings yet

- Research MethodologyDocument12 pagesResearch MethodologySulo's SoulNo ratings yet

- BFSI Skills Requirements by Me FINALDocument76 pagesBFSI Skills Requirements by Me FINALTusharNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiaMitisha GaurNo ratings yet

- State Bank of India: The Banker To Every IndianDocument4 pagesState Bank of India: The Banker To Every IndianSrinivas NandikantiNo ratings yet

- State Bank of India: The Banker To Every IndianDocument4 pagesState Bank of India: The Banker To Every IndianSrinivas NandikantiNo ratings yet

- Project SBIDocument66 pagesProject SBIsourabh tyagiNo ratings yet

- SBI SoubikaDocument70 pagesSBI SoubikaSidharth Gupta0% (1)

- 1 .4 Limitations of The StudyDocument10 pages1 .4 Limitations of The Studychinmay ajgaonkarNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- YASH Banking ReportDocument37 pagesYASH Banking ReportYashNo ratings yet

- Case Study Solution - Portfolio AllocationDocument45 pagesCase Study Solution - Portfolio AllocationAryan PandeyNo ratings yet

- Regional Sme Care Centre List With AddressDocument7 pagesRegional Sme Care Centre List With AddressYokesh ElangovanNo ratings yet

- EXIMBANK - реквизиты - 27.01.2020 PDFDocument7 pagesEXIMBANK - реквизиты - 27.01.2020 PDFRoxana RusuNo ratings yet

- Sadaf StatementDocument37 pagesSadaf StatementadilfaqiNo ratings yet

- M 8 CH PZBQB FJHIUg DDocument13 pagesM 8 CH PZBQB FJHIUg DhosantoshNo ratings yet

- VC FirmsDocument6 pagesVC FirmsPulkit ZaveriNo ratings yet

- RHB RHB RHB RHB Islamic Islamic Islamic Islamic Bank Berhad Bank Berhad Bank Berhad Bank BerhadDocument1 pageRHB RHB RHB RHB Islamic Islamic Islamic Islamic Bank Berhad Bank Berhad Bank Berhad Bank Berhadmuhammad irfanNo ratings yet

- IDFCFIRSTBankstatement 52005195725Document17 pagesIDFCFIRSTBankstatement 52005195725madhukar sahayNo ratings yet

- Moniepoint Document 2024-03-19T12 16Document46 pagesMoniepoint Document 2024-03-19T12 16Sandra DreNo ratings yet

- Correspondent BanksDocument4 pagesCorrespondent BankscharrisedelarosaNo ratings yet

- Presentation On: of Top 5 Private BanksDocument23 pagesPresentation On: of Top 5 Private BanksTarunveerNo ratings yet

- Acct Statement - XX8615 - 21012023Document9 pagesAcct Statement - XX8615 - 21012023NAGIREDDY ROHITNo ratings yet

- Mortgage SampleDocument10 pagesMortgage SampleIlankumaran kNo ratings yet

- Bank List 1502Document6 pagesBank List 1502neeraj.parasharNo ratings yet

- HUBC List of Shareholders As of 30-06-2023Document16 pagesHUBC List of Shareholders As of 30-06-2023pagay66625No ratings yet

- Banks DataDocument3,429 pagesBanks DatabharthiaeNo ratings yet

- 30 Days Sedekah JourneyDocument1 page30 Days Sedekah JourneySasha EddyNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument17 pagesNumbers Sheet Name Numbers Table NamepoluNo ratings yet

- Acct Statement - XX4077 - 20042024Document82 pagesAcct Statement - XX4077 - 20042024dotcnnctNo ratings yet

- PmsbyDocument32 pagesPmsbyy.d.dastagiriNo ratings yet

- The Merger and Acquisition of Nigerian Banks From 2007 Till Date by ARTICLES - Published: JUNE 11, 2013 The Merger and Acquisition of Nigerian Banks From 2007 Till DateDocument7 pagesThe Merger and Acquisition of Nigerian Banks From 2007 Till Date by ARTICLES - Published: JUNE 11, 2013 The Merger and Acquisition of Nigerian Banks From 2007 Till Datefisayobabs11No ratings yet

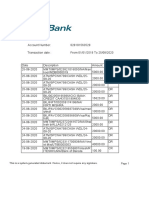

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument33 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul RaoNo ratings yet

- FAI Dealing Directory 2018Document43 pagesFAI Dealing Directory 2018Rohit DsouzaNo ratings yet

- Acct Statement XX9972 01082022Document35 pagesAcct Statement XX9972 01082022Ashik AshiNo ratings yet

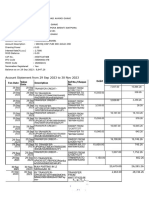

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitNo ratings yet

- Mutual Funds in IndiaDocument6 pagesMutual Funds in IndiaK. SwathiNo ratings yet

- Bank Statement2023 12 02 15 56 04 7980Document5 pagesBank Statement2023 12 02 15 56 04 7980kazeemshaikNo ratings yet

- Structure of Commercial Banking in IndiaDocument56 pagesStructure of Commercial Banking in IndiaSamridhi Goad86% (7)