Professional Documents

Culture Documents

Lesson # 14 Posting To Ledgers and Recording of Stock

Lesson # 14 Posting To Ledgers and Recording of Stock

Uploaded by

ranawaseemCopyright:

Available Formats

You might also like

- Introduction To HDocument3 pagesIntroduction To Hagga1111No ratings yet

- Project On Technical AnalysisDocument82 pagesProject On Technical Analysistulasinad12375% (8)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Chapter 1 Solutions To Suggested Homework ProblemsDocument5 pagesChapter 1 Solutions To Suggested Homework ProblemsZeren BegumNo ratings yet

- Case XiameterDocument3 pagesCase XiameterYavnish GargNo ratings yet

- SAP New GL AccountingDocument120 pagesSAP New GL AccountingJyotiraditya BanerjeeNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Quiz 2 3 Sample 1 SolvedDocument6 pagesQuiz 2 3 Sample 1 SolvedJan Mohammad BalochNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- CA Foundation Accounts A MTP 2 Dec 2022Document11 pagesCA Foundation Accounts A MTP 2 Dec 2022shagana212005No ratings yet

- Ledger Posting With OE GL UTB SamplesDocument46 pagesLedger Posting With OE GL UTB SamplesZamantha OliverosNo ratings yet

- Name:I: SL Nique Code Name (BCDocument12 pagesName:I: SL Nique Code Name (BC4279v5yhqkNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- LBB206 LBC206 (M)Document3 pagesLBB206 LBC206 (M)Md ZiyaNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- 5 Accounts From Incomplete Records 168Document14 pages5 Accounts From Incomplete Records 168sunil.h68 SunilNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- Tools: IndustrialDocument18 pagesTools: IndustrialHVFTOOLS HVFNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- Accounts QP 3Document9 pagesAccounts QP 3Sarun ChhetriNo ratings yet

- Financial AccountingDocument8 pagesFinancial AccountingSri AnishNo ratings yet

- Acc 135 Jan Past ExamDocument4 pagesAcc 135 Jan Past ExamNatasha MugoniNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Topper'S Classes: Ca-Foundation (U-86)Document4 pagesTopper'S Classes: Ca-Foundation (U-86)RishabhNo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- Cafc Test Paper Acc 03Document9 pagesCafc Test Paper Acc 03Vandana GuptaNo ratings yet

- Final Accounts of Company - PracticalDocument4 pagesFinal Accounts of Company - Practicalguddujan00015No ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- QuestionPaperDec 2010Document50 pagesQuestionPaperDec 2010Md.Reza HussainNo ratings yet

- 06 Single Entry PQ SolDocument30 pages06 Single Entry PQ Soltyagivansh1200No ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- 2023 EACC 1614 - Test 2Document8 pages2023 EACC 1614 - Test 2asandantlumayo77No ratings yet

- Revision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownDocument5 pagesRevision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownKys AlinaNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Accounting For Managers (B) - Jobaida Khanom Final ExamDocument5 pagesAccounting For Managers (B) - Jobaida Khanom Final ExamTanveer AhmedNo ratings yet

- Intermediate - Accounts (19.07.2019)Document10 pagesIntermediate - Accounts (19.07.2019)Åådil MirNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Suggested Answers For Ca Final Financial ReportingDocument17 pagesSuggested Answers For Ca Final Financial ReportingSamuel AnthrayoseNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Csec Poa January 2013 p2Document12 pagesCsec Poa January 2013 p2Renelle RampersadNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Lab Test - Jan 2023Document3 pagesLab Test - Jan 2023Siti Nurul AtiqahNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Financial Accounting 2 Assignment 1 2020 PDFDocument7 pagesFinancial Accounting 2 Assignment 1 2020 PDFclaudiogiro23No ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Basic Principles of Accounting: National Law University Odisha, CuttackDocument2 pagesBasic Principles of Accounting: National Law University Odisha, CuttackAnanya SonakiyaNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- 4120504Document3 pages4120504m_gadhvi6840No ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- 921 Financial Accounting Reporting Sep Oct 2022Document4 pages921 Financial Accounting Reporting Sep Oct 2022supritha724No ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Acc01a1 SuppDocument10 pagesAcc01a1 SuppmunenebrigaliaNo ratings yet

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocument7 pagesUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNo ratings yet

- VU Accounting Lesson 29Document4 pagesVU Accounting Lesson 29ranawaseemNo ratings yet

- VU Accounting Lesson 27Document5 pagesVU Accounting Lesson 27ranawaseemNo ratings yet

- VU Accounting Lesson 24Document6 pagesVU Accounting Lesson 24ranawaseemNo ratings yet

- Lesson # 7 Basic Books of Accounts Areas Covered in This LectureDocument4 pagesLesson # 7 Basic Books of Accounts Areas Covered in This LectureranawaseemNo ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- Lesson # 6 Flow of Transactions Learning ObjectiveDocument5 pagesLesson # 6 Flow of Transactions Learning Objectiveranawaseem100% (1)

- VU Lesson 5Document4 pagesVU Lesson 5ranawaseemNo ratings yet

- Cadbury Nigeria PLC 2005Document29 pagesCadbury Nigeria PLC 2005Ada TeachesNo ratings yet

- 1 Corporate Income Taxation - IntroductionDocument7 pages1 Corporate Income Taxation - IntroductionIvy ObligadoNo ratings yet

- SecuritizationDocument28 pagesSecuritizationMohit MakhijaNo ratings yet

- AT 13 - Materiality in Plannng and Performing An AuditDocument3 pagesAT 13 - Materiality in Plannng and Performing An AuditGlenn DeTorresNo ratings yet

- Pas 8Document5 pagesPas 8Angelica Danuco25% (4)

- Ms April 2022Document16 pagesMs April 2022Kuok Hei LeungNo ratings yet

- B.B.A.-I Semester-II Marketing Management, Paper-II: PeriodsDocument2 pagesB.B.A.-I Semester-II Marketing Management, Paper-II: PeriodsgaureshraoNo ratings yet

- Lukoil A-Vertically Integrated Oil CompanyDocument20 pagesLukoil A-Vertically Integrated Oil CompanyhuccennNo ratings yet

- cs01 2023-03-07Document5 pagescs01 2023-03-07Nebojsa MarjanovicNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Markon or Initial MarkupDocument6 pagesMarkon or Initial MarkupMarc AndalloNo ratings yet

- A2 Work DistributionDocument1 pageA2 Work DistributionjabranNo ratings yet

- SWOT Analysis-KrogerDocument2 pagesSWOT Analysis-KrogerAspenNo ratings yet

- Chapter 14 Engaging Consumers and Communicating Customer Value: Integrated Marketing Communications StrategyDocument21 pagesChapter 14 Engaging Consumers and Communicating Customer Value: Integrated Marketing Communications StrategyRosyLeeNo ratings yet

- Nas 2 PDFDocument10 pagesNas 2 PDFsandeep gyawaliNo ratings yet

- Segment Reporting and Decentralization: Chapter TwelveDocument91 pagesSegment Reporting and Decentralization: Chapter TwelveLeo CerenoNo ratings yet

- WCM in Textile Industry in BangladeshDocument18 pagesWCM in Textile Industry in BangladeshMahesh BendigeriNo ratings yet

- Hallmark International AuditorsDocument9 pagesHallmark International AuditorsSreeja SubhashNo ratings yet

- Global Strategic AlliancesDocument40 pagesGlobal Strategic AlliancesDhruv AroraNo ratings yet

- Coffee Shop Business PlanDocument16 pagesCoffee Shop Business Plansasyeda100% (3)

- Edexcel Economics 3.1 Business Growth MS Digital DownloadDocument8 pagesEdexcel Economics 3.1 Business Growth MS Digital Downloadnoreply828202633No ratings yet

- Goran RossDocument5 pagesGoran RossHarman SandhuNo ratings yet

- Business OrganizationDocument3 pagesBusiness Organizationaayer3123No ratings yet

- Advertising and Sales Promotion ManagementDocument3 pagesAdvertising and Sales Promotion ManagementSumanth PotlamarriNo ratings yet

- Shobha Talent Acquisition Project Report PDFDocument77 pagesShobha Talent Acquisition Project Report PDFSiddhi kumariNo ratings yet

Lesson # 14 Posting To Ledgers and Recording of Stock

Lesson # 14 Posting To Ledgers and Recording of Stock

Uploaded by

ranawaseemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson # 14 Posting To Ledgers and Recording of Stock

Lesson # 14 Posting To Ledgers and Recording of Stock

Uploaded by

ranawaseemCopyright:

Available Formats

Financial Accounting - I – MGT101 VU

Lesson # 14

POSTING TO LEDGERS AND RECORDING OF STOCK

We have demonstrated the carrying forward of balances in lecture-13. Another solved example

is given below:

Illustration

Following is the Trial Balance of Rahil & Co. for the month ended January 31, 2002.

Rahil & Co..

Trial Balance

As on January 31, 2002

Title of Account Code Dr. Rs. Cr. Rs.

Cash Account 01 30,000

Accrued expense Account 02 10,000

Bank Account 03 50,000

Loan Account 04 100,000

Furniture Account 05 20,000

Office Equipment 06 10,000

Debtors account 07 12,000

Creditors account 08 10,000

Sales account 09 20,000

Purchase account 10 18,000

Total 140,000 140,000

During the month, following entries took place:

No. Date Particulars

01 Feb 07 They purchased stationery worth of Rs. 3,000

02 Feb 10 They paid their first installment of loan Rs. 12,000

03 Feb 12 They received a cheque from a customer of Rs. 5,000

04 Feb 13 They paid a cheque of Rs. 8,000 to a creditor

05 Feb 15 Purchased goods of Rs 6,000 & paid through cheque

06 Feb 17 Accrued expenses of Rs. 5,000 are paid.

07 Feb 20 They purchased furniture of Rs. 2,000

08 Feb 21 Sold goods for cash Rs.5,000

09 Feb 22 Purchased goods on credit Rs. 5,000

10 Feb 23 Office equipment of Rs. 5,000 is Purchased

11 Feb 25 Staff salaries are paid by cheque Rs. 15,000

12 Feb 28 Utility expenses of Rs. 3,000 are accrued.

© Copyright Virtual University of Pakistan 108

Financial Accounting - I – MGT101 VU

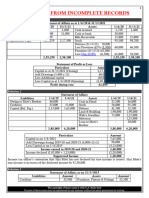

Ledger accounts of Rahil & Co. during the month will show following picture:

Cash Account Account code # 1

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

1-2-02 Balance c/f 01 30,000 7-2-02 Stationery a/c 10 3,000

21-2-02 Sold a/c 09 5,000

10-2-02 Loan a/c 04 12,000

17-2-02 Accrued 02

expenses 5,000

05 2,000

Furniture a/c

23-2-02 06 5,000

Office equipment

8,000

Balance c/d

Total 35,000 Total 35,000

Accrued Expenses Account Account code # 2

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

17-2-02 Accrued 01 5,000 1-1-02 Balance c/f 10,000

expenses Expenses accrued 3,000

Balance c/d 8,000

Total 13,000 Total 13,000

Bank Account Account code # 3

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

Balance c/f 50,000 13-2-02 Paid to creditors 08 8,000

12-2-02 Cheque 15-2-02 Purchases 10 6,000

received 07 5,000 25-2-02 Salaries a/c 11 15,000

Balance c/d 26,000

Total 55,000 Total 55,000

Loan Account Account code # 4

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

10-2-02 Installment 01 12,000 Balance c/f 100,000

paid

88,000

Balance c/d

Total 100,000 Total 100,000

© Copyright Virtual University of Pakistan 109

Financial Accounting - I – MGT101 VU

Furniture Account Account code # 5

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

10-2-02 Balance c/f 20,000 23-2-02

20-2-02 Furniture a/c 01 2,000

Balance c/d 22,000

Total 22,000 Total 22,000

Office Equipment Account Account code # 6

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

Balance c/f 10,000

23-2-02 Office 01 5,000

Equipment a/c

Balance c/d 15,000

Total 15,000 Total 15,000

Debtors Account Account code # 7

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

Balance c/f 12,000 12-2-02 Cheque received 03 5,000

Balance c/d 7,000

Total 12,000 Total 12,000

Creditors Account Account code # 8

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

13-2-02 Paid to 03 8,000 Balance c/f 10,000

creditors 22-2-02 Purchases a/c 10 5,000

Balance c/d

7,000

Total 15,000 Total 15,000

© Copyright Virtual University of Pakistan 110

Financial Accounting - I – MGT101 VU

Sales AccountAccount code # 9

Date Particulars Code Amount Date Particulars Code Amount

# Rs. # Rs.

(Dr.) (Cr.)

Balance c/f 20,000

21-2-02 Sales a/c 01 5,000

Balance c/d 25,000

Total 25,000 Total 25,000

Purchases Account Account code # 10

Date Particulars Code Amount Date Particulars Code Amount

# Rs. (Dr.) # Rs.

(Cr.)

Balance c/f 18,000

15-2-02 Purchases a/c 03 6,000

22-2-02 Purchases a/c 07 5,000 Balance c/d 29,000

Total 29,000 Total 29,000

Salaries Account Account code # 11

Date Particulars Code Amount Date Particulars Code Amount

# Rs. (Dr.) # Rs.

(Cr.)

25-2-02 Salaries a/c 03 15,000

Balance c/d 15,000

Total 15,000 Total 15,000

Stationery Account Account code # 12

Date Particulars Code Amount Date Particulars Code Amount

# Rs. (Dr.) # Rs.

(Cr.)

25-2-02 Stationery a/c 01 3,000

Balance c/d 3,000

Total 3,000 Total 3,000

Utility Expenses Account Account code # 13

Date Particulars Code Amount Date Particulars Code Amount

# Rs. (Dr.) # Rs.

(Cr.)

28-2-02 Accrued 02 3,000 Balance c/d 3,000

utility exp

Total 3,000 Total 3,000

© Copyright Virtual University of Pakistan 111

Financial Accounting - I – MGT101 VU

The Trial Balance at the end of the month is as follows:

Rahil & Co..

Trial Balance

As on January 31, 2002

Title of Account Code Dr. Rs. Cr. Rs.

Cash Account 01 8,000

Accrued expense Account 02 8,000

Bank Account 03 26,000

Loan Account 04 88,000

Furniture Account 05 22,000

Office Equipment 06 15,000

Debtors account 07 7,000

Creditors account 08 7,000

Sales account 09 25,000

Purchase account 10 29,000

Salaries Account 11 15,000

Stationery Account 12 3,000

Utility Expenses Account 13 3,000

Total 128,000 128,000

Difference between expenses & Purchases

• If business purchases items for its own use (items that are not meant to be resold) such

items are charged to expense account.

• If business purchases items for resale purposes, such items are charged to purchases

account.

Stock

Stock is the quantity of unutilized or unsold goods lying with the organization.

Stock is termed as “the value of goods available to the business that are ready for sale”. For

accounting purposes, stock is of two types:

1. In trading concern, Stock consists of goods that are purchased for the purpose of resale,

but not sold in that accounting period. Trading concern is that organization, which

purchases items for resale purposes.

2. In manufacturing concern, (an organization that converts raw material into finished

product by putting it in a process) stock consists of:

o Raw material

o Work in process

o Finished goods

© Copyright Virtual University of Pakistan 112

Financial Accounting - I – MGT101 VU

Raw Material

Raw material is the basic part of an item, which is processed to make a complete item.

Work in Process

In manufacturing concern, raw material is put into process to convert it into finished goods. At

the end of the year, some part of raw material remains under process. It is neither in shape of

raw material nor in shape of finished goods. Such items are taken in stock as work in process.

Finished Goods

Finished goods contain items that are ready for sale, but could not be sold at the end of

accounting period.

Recording of Stock Account

• Stock Account is Debited with the Value of the Goods Purchased

• Stock account is credited with the Purchase Price of the Goods Sold / Issued for

Production.

• Stock Account shows the cost / purchase value of unsold goods.

In manufacturing concern, entries for stock are:

For Purchase of Stock

Debit: Stock Account

Credit: Cash/Supplier /Creditors Account

When the stock is purchased, stock account gets the benefit, so it is debited & cash or supplier

account provides the benefit, so it is credited.

For Payment to Creditors

Debit: ` Supplier / Creditors account

Credit: Cash account

For Consumption of goods

Debit: Cost of goods sold

Credit: Stock Account

Cost of goods sold

Cost of goods sold is different in both forms of organizations:

• In trading concern, cost of goods sold is the value of goods unsold (goods stands for the

items purchased for resale purpose)

• In manufacturing concern, cost of goods sold is the value of raw material consumed

plus any other manufacturing cost. e.g., salaries of labor cost of machinery etc.

© Copyright Virtual University of Pakistan 113

Financial Accounting - I – MGT101 VU

Stock and cost of goods sold in manufacturing concern

Raw Material Stock Other Costs Accounts

Work in Process Account

Finished Goods Account

Cost of Goods Sold Account

In manufacturing concern, Raw material stock is put into process. For accounting purposes, all

value of stock and other manufacturing costs are charged to work in process account. When the

process is completed and the goods are prepared, all the value of work in process is charged to

finished goods account. The business sells finished goods for the whole accounting year. At the

end of the year, goods that are unsold are deducted from cost of goods sold account.

© Copyright Virtual University of Pakistan 114

You might also like

- Introduction To HDocument3 pagesIntroduction To Hagga1111No ratings yet

- Project On Technical AnalysisDocument82 pagesProject On Technical Analysistulasinad12375% (8)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Chapter 1 Solutions To Suggested Homework ProblemsDocument5 pagesChapter 1 Solutions To Suggested Homework ProblemsZeren BegumNo ratings yet

- Case XiameterDocument3 pagesCase XiameterYavnish GargNo ratings yet

- SAP New GL AccountingDocument120 pagesSAP New GL AccountingJyotiraditya BanerjeeNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Quiz 2 3 Sample 1 SolvedDocument6 pagesQuiz 2 3 Sample 1 SolvedJan Mohammad BalochNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- CA Foundation Accounts A MTP 2 Dec 2022Document11 pagesCA Foundation Accounts A MTP 2 Dec 2022shagana212005No ratings yet

- Ledger Posting With OE GL UTB SamplesDocument46 pagesLedger Posting With OE GL UTB SamplesZamantha OliverosNo ratings yet

- Name:I: SL Nique Code Name (BCDocument12 pagesName:I: SL Nique Code Name (BC4279v5yhqkNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- LBB206 LBC206 (M)Document3 pagesLBB206 LBC206 (M)Md ZiyaNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- 5 Accounts From Incomplete Records 168Document14 pages5 Accounts From Incomplete Records 168sunil.h68 SunilNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- Tools: IndustrialDocument18 pagesTools: IndustrialHVFTOOLS HVFNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- Accounts QP 3Document9 pagesAccounts QP 3Sarun ChhetriNo ratings yet

- Financial AccountingDocument8 pagesFinancial AccountingSri AnishNo ratings yet

- Acc 135 Jan Past ExamDocument4 pagesAcc 135 Jan Past ExamNatasha MugoniNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Topper'S Classes: Ca-Foundation (U-86)Document4 pagesTopper'S Classes: Ca-Foundation (U-86)RishabhNo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- Cafc Test Paper Acc 03Document9 pagesCafc Test Paper Acc 03Vandana GuptaNo ratings yet

- Final Accounts of Company - PracticalDocument4 pagesFinal Accounts of Company - Practicalguddujan00015No ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- QuestionPaperDec 2010Document50 pagesQuestionPaperDec 2010Md.Reza HussainNo ratings yet

- 06 Single Entry PQ SolDocument30 pages06 Single Entry PQ Soltyagivansh1200No ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- 2023 EACC 1614 - Test 2Document8 pages2023 EACC 1614 - Test 2asandantlumayo77No ratings yet

- Revision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownDocument5 pagesRevision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownKys AlinaNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Accounting For Managers (B) - Jobaida Khanom Final ExamDocument5 pagesAccounting For Managers (B) - Jobaida Khanom Final ExamTanveer AhmedNo ratings yet

- Intermediate - Accounts (19.07.2019)Document10 pagesIntermediate - Accounts (19.07.2019)Åådil MirNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Suggested Answers For Ca Final Financial ReportingDocument17 pagesSuggested Answers For Ca Final Financial ReportingSamuel AnthrayoseNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Csec Poa January 2013 p2Document12 pagesCsec Poa January 2013 p2Renelle RampersadNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Lab Test - Jan 2023Document3 pagesLab Test - Jan 2023Siti Nurul AtiqahNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Financial Accounting 2 Assignment 1 2020 PDFDocument7 pagesFinancial Accounting 2 Assignment 1 2020 PDFclaudiogiro23No ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Basic Principles of Accounting: National Law University Odisha, CuttackDocument2 pagesBasic Principles of Accounting: National Law University Odisha, CuttackAnanya SonakiyaNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- 4120504Document3 pages4120504m_gadhvi6840No ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- 921 Financial Accounting Reporting Sep Oct 2022Document4 pages921 Financial Accounting Reporting Sep Oct 2022supritha724No ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Acc01a1 SuppDocument10 pagesAcc01a1 SuppmunenebrigaliaNo ratings yet

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocument7 pagesUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNo ratings yet

- VU Accounting Lesson 29Document4 pagesVU Accounting Lesson 29ranawaseemNo ratings yet

- VU Accounting Lesson 27Document5 pagesVU Accounting Lesson 27ranawaseemNo ratings yet

- VU Accounting Lesson 24Document6 pagesVU Accounting Lesson 24ranawaseemNo ratings yet

- Lesson # 7 Basic Books of Accounts Areas Covered in This LectureDocument4 pagesLesson # 7 Basic Books of Accounts Areas Covered in This LectureranawaseemNo ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- Lesson # 6 Flow of Transactions Learning ObjectiveDocument5 pagesLesson # 6 Flow of Transactions Learning Objectiveranawaseem100% (1)

- VU Lesson 5Document4 pagesVU Lesson 5ranawaseemNo ratings yet

- Cadbury Nigeria PLC 2005Document29 pagesCadbury Nigeria PLC 2005Ada TeachesNo ratings yet

- 1 Corporate Income Taxation - IntroductionDocument7 pages1 Corporate Income Taxation - IntroductionIvy ObligadoNo ratings yet

- SecuritizationDocument28 pagesSecuritizationMohit MakhijaNo ratings yet

- AT 13 - Materiality in Plannng and Performing An AuditDocument3 pagesAT 13 - Materiality in Plannng and Performing An AuditGlenn DeTorresNo ratings yet

- Pas 8Document5 pagesPas 8Angelica Danuco25% (4)

- Ms April 2022Document16 pagesMs April 2022Kuok Hei LeungNo ratings yet

- B.B.A.-I Semester-II Marketing Management, Paper-II: PeriodsDocument2 pagesB.B.A.-I Semester-II Marketing Management, Paper-II: PeriodsgaureshraoNo ratings yet

- Lukoil A-Vertically Integrated Oil CompanyDocument20 pagesLukoil A-Vertically Integrated Oil CompanyhuccennNo ratings yet

- cs01 2023-03-07Document5 pagescs01 2023-03-07Nebojsa MarjanovicNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Markon or Initial MarkupDocument6 pagesMarkon or Initial MarkupMarc AndalloNo ratings yet

- A2 Work DistributionDocument1 pageA2 Work DistributionjabranNo ratings yet

- SWOT Analysis-KrogerDocument2 pagesSWOT Analysis-KrogerAspenNo ratings yet

- Chapter 14 Engaging Consumers and Communicating Customer Value: Integrated Marketing Communications StrategyDocument21 pagesChapter 14 Engaging Consumers and Communicating Customer Value: Integrated Marketing Communications StrategyRosyLeeNo ratings yet

- Nas 2 PDFDocument10 pagesNas 2 PDFsandeep gyawaliNo ratings yet

- Segment Reporting and Decentralization: Chapter TwelveDocument91 pagesSegment Reporting and Decentralization: Chapter TwelveLeo CerenoNo ratings yet

- WCM in Textile Industry in BangladeshDocument18 pagesWCM in Textile Industry in BangladeshMahesh BendigeriNo ratings yet

- Hallmark International AuditorsDocument9 pagesHallmark International AuditorsSreeja SubhashNo ratings yet

- Global Strategic AlliancesDocument40 pagesGlobal Strategic AlliancesDhruv AroraNo ratings yet

- Coffee Shop Business PlanDocument16 pagesCoffee Shop Business Plansasyeda100% (3)

- Edexcel Economics 3.1 Business Growth MS Digital DownloadDocument8 pagesEdexcel Economics 3.1 Business Growth MS Digital Downloadnoreply828202633No ratings yet

- Goran RossDocument5 pagesGoran RossHarman SandhuNo ratings yet

- Business OrganizationDocument3 pagesBusiness Organizationaayer3123No ratings yet

- Advertising and Sales Promotion ManagementDocument3 pagesAdvertising and Sales Promotion ManagementSumanth PotlamarriNo ratings yet

- Shobha Talent Acquisition Project Report PDFDocument77 pagesShobha Talent Acquisition Project Report PDFSiddhi kumariNo ratings yet