Professional Documents

Culture Documents

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Uploaded by

rocknroll_mahive1789Copyright:

Available Formats

You might also like

- Pope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media NetworkDocument2 pagesPope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media Network:Aaron :Eil®©™86% (7)

- Test Bank For Race Ethnicity Gender and Class 8th Edition Joseph F Healey Eileen Obrien DownloadDocument20 pagesTest Bank For Race Ethnicity Gender and Class 8th Edition Joseph F Healey Eileen Obrien Downloadkennethmataqfsdwnxcot100% (25)

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- London Diplomatic List - February 2020.odtDocument146 pagesLondon Diplomatic List - February 2020.odtRbNo ratings yet

- Week 3 PPT Ucsp 12Document35 pagesWeek 3 PPT Ucsp 12Jella Secreto100% (4)

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Jet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRDocument7 pagesJet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRanshulrao29No ratings yet

- E15 CLSDocument2 pagesE15 CLSnabeelniniNo ratings yet

- Company Law Amendments For Dec 23 NEW SYLLABUS CS Vikas Vohra, YESDocument12 pagesCompany Law Amendments For Dec 23 NEW SYLLABUS CS Vikas Vohra, YESDivyansh BhatnagarNo ratings yet

- General Milling vs. ViajarDocument3 pagesGeneral Milling vs. ViajarIrish Asilo Pineda100% (2)

- QUESTIONSDocument13 pagesQUESTIONSriyaNo ratings yet

- KingfisherDocument18 pagesKingfisherpavitra_15_jadhavNo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- Ca Final Advanced ManagementDocument114 pagesCa Final Advanced ManagementMohammed IrfanNo ratings yet

- Weekly Updates 16th Apr 2023 To 22nd Apr 2023Document7 pagesWeekly Updates 16th Apr 2023 To 22nd Apr 2023Swathi JainNo ratings yet

- Markets Today: World Indices & Indian Adrs (Us$)Document8 pagesMarkets Today: World Indices & Indian Adrs (Us$)nmkgmkNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- Landmark Cases 439Document17 pagesLandmark Cases 439Anand Kumar KediaNo ratings yet

- Holding On Operation - 16.06.2022Document4 pagesHolding On Operation - 16.06.2022ajay khandelwalNo ratings yet

- Vijay Mallya Faces Non-Bailable Warrant in Hyderabad Court 1) Vijay Mallya's Journey From A Businessman To A FraudsterDocument15 pagesVijay Mallya Faces Non-Bailable Warrant in Hyderabad Court 1) Vijay Mallya's Journey From A Businessman To A FraudsterArun KumarNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument10 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- MCF Vendor Registration Form - 2Document44 pagesMCF Vendor Registration Form - 2Mohatshim AhmadNo ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- Statement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Document5 pagesStatement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Kingifisher Airlines - A SummaryDocument6 pagesKingifisher Airlines - A SummaryCritlord Here100% (1)

- Interim Order in The Matter of Amazan Agro Products LimitedDocument14 pagesInterim Order in The Matter of Amazan Agro Products LimitedShyam SunderNo ratings yet

- Winding Up by NCLT Winding Up Provisions & Its Process: (Sec 270-303) (Sec 324-365)Document8 pagesWinding Up by NCLT Winding Up Provisions & Its Process: (Sec 270-303) (Sec 324-365)Nikhil AgarwalNo ratings yet

- Assignment On ChargesDocument3 pagesAssignment On ChargesSrishti SharmaNo ratings yet

- Sahara LIC Order20201230Document21 pagesSahara LIC Order20201230Puran Singh LabanaNo ratings yet

- EIH NCLT OrderDocument14 pagesEIH NCLT OrderkavyareddyNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- Press ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECDocument4 pagesPress ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECKweku ZurekNo ratings yet

- DT New Case LawDocument32 pagesDT New Case LawJohn WilliamNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShivanshu sethiaNo ratings yet

- Ravi Poddar Jaipur Vs Acit Jaipur On 24 March 2017Document12 pagesRavi Poddar Jaipur Vs Acit Jaipur On 24 March 2017praveen chokhaniNo ratings yet

- Adjudication Order in Respect of M/s. Steel Exchange Inida Limited in Ther Matter of M/s. Steel Exchange Inida LimitedDocument18 pagesAdjudication Order in Respect of M/s. Steel Exchange Inida Limited in Ther Matter of M/s. Steel Exchange Inida LimitedShyam SunderNo ratings yet

- Scope of Audit - Changing DimensionsDocument8 pagesScope of Audit - Changing DimensionsNehaNo ratings yet

- Law T3Document7 pagesLaw T3Badhrinath ShanmugamNo ratings yet

- ITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurDocument16 pagesITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurMohan ChoudharyNo ratings yet

- In The National Company Law Tribunal Kochi Bench: CA/123/KOB/2020Document6 pagesIn The National Company Law Tribunal Kochi Bench: CA/123/KOB/2020NITESH JAINNo ratings yet

- Aurtus Flash Alert 1714458676Document3 pagesAurtus Flash Alert 1714458676Sangeetha NaharNo ratings yet

- LAW Smart WorkDocument10 pagesLAW Smart WorkmaacmampadNo ratings yet

- Sandeep Agarwal CaseDocument3 pagesSandeep Agarwal CaseElsa ShaikhNo ratings yet

- Company Law-Ii, Mid Term Examination, Only QuestionDocument2 pagesCompany Law-Ii, Mid Term Examination, Only QuestionSittu RajNo ratings yet

- Case StudyDocument9 pagesCase StudyKaushal AgrawalNo ratings yet

- Corporate and Economic Laws Test 4 May Test 1609311095Document9 pagesCorporate and Economic Laws Test 4 May Test 1609311095CAtestseriesNo ratings yet

- Imp_new que_ICAIDocument13 pagesImp_new que_ICAIHarsh pRAJAPATINo ratings yet

- Corporate Laws2008Document3 pagesCorporate Laws2008askermanNo ratings yet

- Factual Matrix ExplanationDocument7 pagesFactual Matrix ExplanationavinashNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument11 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- Bmt5121 Corporate Goverance and Ethics Digital Assignment 3Document17 pagesBmt5121 Corporate Goverance and Ethics Digital Assignment 3Barani Kumar NNo ratings yet

- Shree Rama Multi-Tech Ltd1 140114Document2 pagesShree Rama Multi-Tech Ltd1 140114Chaitanya JagarlapudiNo ratings yet

- Super Test-2Document6 pagesSuper Test-2RitikaNo ratings yet

- GM Test Series: Top 50 QuestionsDocument46 pagesGM Test Series: Top 50 QuestionsShruti JhaNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Order in The Matter of M - S Sahara India Life Insurance Co LTDDocument21 pagesOrder in The Matter of M - S Sahara India Life Insurance Co LTDkarthik kpNo ratings yet

- Revised Legal Updates 23.03.2024 SDocument3 pagesRevised Legal Updates 23.03.2024 SParina TyagiNo ratings yet

- The Singareni Collieries Company Limited: TH THDocument5 pagesThe Singareni Collieries Company Limited: TH THసింగరేణి ఆర్మీNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Wargames Illustrated #127Document64 pagesWargames Illustrated #127Анатолий Золотухин100% (1)

- RMC No. 25-2024Document1 pageRMC No. 25-2024Anostasia NemusNo ratings yet

- 4 DCD Construction vs. Republic G.R. No. 179978 March 2 2007Document11 pages4 DCD Construction vs. Republic G.R. No. 179978 March 2 2007Alelojo, NikkoNo ratings yet

- (WWW - Entrance-Exam - Net) - List of Schools in MumbaiDocument14 pages(WWW - Entrance-Exam - Net) - List of Schools in MumbaiSiddhesh KolgaonkarNo ratings yet

- United States Ex Rel. Leguillou v. Davis, 212 F.2d 681, 3rd Cir. (1954)Document5 pagesUnited States Ex Rel. Leguillou v. Davis, 212 F.2d 681, 3rd Cir. (1954)Scribd Government DocsNo ratings yet

- People Vs ObreroDocument13 pagesPeople Vs ObreroNadzlah BandilaNo ratings yet

- Khutba e Hujja Tul VidaDocument5 pagesKhutba e Hujja Tul VidaTayyab AliNo ratings yet

- First Voyage and The Propaganda Movement: Rizal in EuropeDocument11 pagesFirst Voyage and The Propaganda Movement: Rizal in EuropeFrancis Lloyd TongsonNo ratings yet

- Introduction To World War 1 Learning Check Quiz PDFDocument3 pagesIntroduction To World War 1 Learning Check Quiz PDFapi-237267589100% (1)

- Norton Vs Shelby - Political Review IDocument1 pageNorton Vs Shelby - Political Review IJohn Benedict TigsonNo ratings yet

- M 480Document5 pagesM 480KumaraShanNo ratings yet

- Mandatory Restitution 2 Proof Shaunel Is InnocentDocument11 pagesMandatory Restitution 2 Proof Shaunel Is InnocentSue BozgozNo ratings yet

- Part 4 International Transactions, Ch.14 Treaties, Character and Function of TreatiesDocument19 pagesPart 4 International Transactions, Ch.14 Treaties, Character and Function of TreatiesTemo TemoNo ratings yet

- Rizal's Annotation To Morga's Sucesos de Las Islas FilipinasDocument36 pagesRizal's Annotation To Morga's Sucesos de Las Islas FilipinasJerald Jay Catacutan100% (1)

- York County Court of Common Pleas For July 15, 2016Document16 pagesYork County Court of Common Pleas For July 15, 2016Kevin FrischNo ratings yet

- Presentation of Women in Nigeria Music VideosDocument51 pagesPresentation of Women in Nigeria Music VideosRinret Jonathan100% (4)

- Part 2 Imperialism - Impact in Africa Gallery Walk CompletedDocument6 pagesPart 2 Imperialism - Impact in Africa Gallery Walk CompletedSoren GasnerNo ratings yet

- 09 BibliographyDocument4 pages09 Bibliographyyosh61926No ratings yet

- Extremism: Causes and SolutionDocument4 pagesExtremism: Causes and SolutionwaqarNo ratings yet

- F.F. Bruce - The Early Church in The Roman EmpireDocument3 pagesF.F. Bruce - The Early Church in The Roman EmpireDonald LeonNo ratings yet

- Ousman Mohammednur AffidavitDocument5 pagesOusman Mohammednur AffidavitEmily BabayNo ratings yet

- PIU 20-019 TranscriptsDocument413 pagesPIU 20-019 TranscriptsSarah Eisenmenger100% (2)

- The Chinese Way of LifeDocument4 pagesThe Chinese Way of LifeSarah SaritaNo ratings yet

- People v. ReyesDocument2 pagesPeople v. Reyesdylabolante921No ratings yet

- Parliamentary ProceduresDocument31 pagesParliamentary ProceduresJasmin Abas100% (1)

- Revised Rules of Evidence 2019Document33 pagesRevised Rules of Evidence 2019Michael James Madrid Malingin100% (1)

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Uploaded by

rocknroll_mahive1789Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Special Court Issues Summons To Vijay Mallya: Kingfisher Down 5% After Govt Cancels Int'l Flying Rights

Uploaded by

rocknroll_mahive1789Copyright:

Available Formats

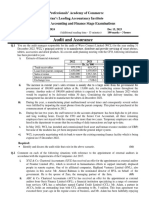

Special court issues summons to Vijay Mallya

I-T officials filed a criminal complaint against Kingfisher and Mallya for failure to remit TDS

Thu, Feb 21 2013. 02 58 PM IST

In fresh trouble for the head of crisis-ridden Kingfisher Airlines Ltd, Vijay Mallya, the special court for economic offences has issued summons to him on an income-tax (I-T) department criminal case for not remitting to government the tax deducted at source (TDS) from salaries of its employees. The courts action came after it took cognizance of the offence under sections 276B and 278B of the Income Tax Act, 1962, for not remitting Rs.74.94 crore deducted as TDS in 2009-10 fiscal andRs.23.70 crore imposed as interest for not meeting the deadline stipulated for payment.

Feb 26, 2013, 03.40 PM IST

Kingfisher down 5% after govt cancels int'l flying rights

Shares of Kingfisher Airlines (KFA) tumbled around 5 percent to Rs 10.74 after the civil aviation ministry withdrew its international flying rights along with cancellation of slots at domestic airports.

KFA offered over 3,500 seats each day on international network and now these will be given away to other airlines that operate on same routes. Simultaneously, the airline's domestic will also be given away to other carriers.

Kingfisher agrees to pay 6-month salary; stock up 5%

hares of Kingfisher Airlines (KFA) were locked at 5 percent upper circuit on Friday after the company agreed to

pay six months' salary to its employees.

Meanwhile, DGCA told KFA that paying salaries is not sufficient to revoke licence suspension. "We want assurance on payment to other stakeholders and credible revival plan with financial details," DGCA said, according to government sources.

Mar 09, 2013, 01.00 PM IST

SC dismisses KFA's plea on depositing Rs 185cr to IT dept

The Supreme Court today rejected Kingfisher Airlines' plea against the Karnataka High Court's order directing it to deposit around Rs 185 crore with the Income Tax Department as TDS from its employees' wages.

The apex court, which had asked the cash-strapped airlines to deposit the money within four weeks, refused to extend the time limit as sought by the Kingfisher's counsel.

The bench headed by Justice R M Lodha rejected the airline's plea to give three more weeks. The Vijay Mallyaowned airlines had challenged the December 5 order of the high court directing it to deposit 50 per cent of the Rs 371 crore to IT department. It had also asked the company to furnish bank guarantee for the remaining amount within six weeks.

The company had contended that the amount due is much less than the demand made by the IT Department and the department had not given it a proper opportunity to hear its case.

It said the Department had issued notices without providing the company reasonable and sufficient opportunity of being heard.

The Department had claimed that the company had illegally withheld the revenue even after deducting the said amount from various sources, including by way of tax deducted at source (TDS).

The Department, in December 2011, had demanded payment of about Rs 372 crore as TDS from the company for the assessment years 2010-11,and 2011-12 following analysis of records.

Mar 14, 2013, 09.40 PM IST

SBI board gives nod for recovery proceedings against KFA

SBI board today gave a formal approval to the management for issuing the recall notice to Kingfisher.

The board has also asked the bank to go ahead and start recovery proceedings. A committee of four lenders has also been set up to look into the ways of recovery. This includes sale of Kingfisher's Mumbai office and property in Goa and sale ofUnited Spirits Limited shares pledged with the banks. Lenders can also invoke personal guarantees of Vijay Mallya.

You might also like

- Pope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media NetworkDocument2 pagesPope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media Network:Aaron :Eil®©™86% (7)

- Test Bank For Race Ethnicity Gender and Class 8th Edition Joseph F Healey Eileen Obrien DownloadDocument20 pagesTest Bank For Race Ethnicity Gender and Class 8th Edition Joseph F Healey Eileen Obrien Downloadkennethmataqfsdwnxcot100% (25)

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- London Diplomatic List - February 2020.odtDocument146 pagesLondon Diplomatic List - February 2020.odtRbNo ratings yet

- Week 3 PPT Ucsp 12Document35 pagesWeek 3 PPT Ucsp 12Jella Secreto100% (4)

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Jet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRDocument7 pagesJet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRanshulrao29No ratings yet

- E15 CLSDocument2 pagesE15 CLSnabeelniniNo ratings yet

- Company Law Amendments For Dec 23 NEW SYLLABUS CS Vikas Vohra, YESDocument12 pagesCompany Law Amendments For Dec 23 NEW SYLLABUS CS Vikas Vohra, YESDivyansh BhatnagarNo ratings yet

- General Milling vs. ViajarDocument3 pagesGeneral Milling vs. ViajarIrish Asilo Pineda100% (2)

- QUESTIONSDocument13 pagesQUESTIONSriyaNo ratings yet

- KingfisherDocument18 pagesKingfisherpavitra_15_jadhavNo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- Ca Final Advanced ManagementDocument114 pagesCa Final Advanced ManagementMohammed IrfanNo ratings yet

- Weekly Updates 16th Apr 2023 To 22nd Apr 2023Document7 pagesWeekly Updates 16th Apr 2023 To 22nd Apr 2023Swathi JainNo ratings yet

- Markets Today: World Indices & Indian Adrs (Us$)Document8 pagesMarkets Today: World Indices & Indian Adrs (Us$)nmkgmkNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- Landmark Cases 439Document17 pagesLandmark Cases 439Anand Kumar KediaNo ratings yet

- Holding On Operation - 16.06.2022Document4 pagesHolding On Operation - 16.06.2022ajay khandelwalNo ratings yet

- Vijay Mallya Faces Non-Bailable Warrant in Hyderabad Court 1) Vijay Mallya's Journey From A Businessman To A FraudsterDocument15 pagesVijay Mallya Faces Non-Bailable Warrant in Hyderabad Court 1) Vijay Mallya's Journey From A Businessman To A FraudsterArun KumarNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument10 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- MCF Vendor Registration Form - 2Document44 pagesMCF Vendor Registration Form - 2Mohatshim AhmadNo ratings yet

- Chapter 12 - DebenturesDocument3 pagesChapter 12 - Debenturesmian UmairNo ratings yet

- Statement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Document5 pagesStatement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Kingifisher Airlines - A SummaryDocument6 pagesKingifisher Airlines - A SummaryCritlord Here100% (1)

- Interim Order in The Matter of Amazan Agro Products LimitedDocument14 pagesInterim Order in The Matter of Amazan Agro Products LimitedShyam SunderNo ratings yet

- Winding Up by NCLT Winding Up Provisions & Its Process: (Sec 270-303) (Sec 324-365)Document8 pagesWinding Up by NCLT Winding Up Provisions & Its Process: (Sec 270-303) (Sec 324-365)Nikhil AgarwalNo ratings yet

- Assignment On ChargesDocument3 pagesAssignment On ChargesSrishti SharmaNo ratings yet

- Sahara LIC Order20201230Document21 pagesSahara LIC Order20201230Puran Singh LabanaNo ratings yet

- EIH NCLT OrderDocument14 pagesEIH NCLT OrderkavyareddyNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- Press ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECDocument4 pagesPress ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECKweku ZurekNo ratings yet

- DT New Case LawDocument32 pagesDT New Case LawJohn WilliamNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShivanshu sethiaNo ratings yet

- Ravi Poddar Jaipur Vs Acit Jaipur On 24 March 2017Document12 pagesRavi Poddar Jaipur Vs Acit Jaipur On 24 March 2017praveen chokhaniNo ratings yet

- Adjudication Order in Respect of M/s. Steel Exchange Inida Limited in Ther Matter of M/s. Steel Exchange Inida LimitedDocument18 pagesAdjudication Order in Respect of M/s. Steel Exchange Inida Limited in Ther Matter of M/s. Steel Exchange Inida LimitedShyam SunderNo ratings yet

- Scope of Audit - Changing DimensionsDocument8 pagesScope of Audit - Changing DimensionsNehaNo ratings yet

- Law T3Document7 pagesLaw T3Badhrinath ShanmugamNo ratings yet

- ITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurDocument16 pagesITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurMohan ChoudharyNo ratings yet

- In The National Company Law Tribunal Kochi Bench: CA/123/KOB/2020Document6 pagesIn The National Company Law Tribunal Kochi Bench: CA/123/KOB/2020NITESH JAINNo ratings yet

- Aurtus Flash Alert 1714458676Document3 pagesAurtus Flash Alert 1714458676Sangeetha NaharNo ratings yet

- LAW Smart WorkDocument10 pagesLAW Smart WorkmaacmampadNo ratings yet

- Sandeep Agarwal CaseDocument3 pagesSandeep Agarwal CaseElsa ShaikhNo ratings yet

- Company Law-Ii, Mid Term Examination, Only QuestionDocument2 pagesCompany Law-Ii, Mid Term Examination, Only QuestionSittu RajNo ratings yet

- Case StudyDocument9 pagesCase StudyKaushal AgrawalNo ratings yet

- Corporate and Economic Laws Test 4 May Test 1609311095Document9 pagesCorporate and Economic Laws Test 4 May Test 1609311095CAtestseriesNo ratings yet

- Imp_new que_ICAIDocument13 pagesImp_new que_ICAIHarsh pRAJAPATINo ratings yet

- Corporate Laws2008Document3 pagesCorporate Laws2008askermanNo ratings yet

- Factual Matrix ExplanationDocument7 pagesFactual Matrix ExplanationavinashNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument11 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- Bmt5121 Corporate Goverance and Ethics Digital Assignment 3Document17 pagesBmt5121 Corporate Goverance and Ethics Digital Assignment 3Barani Kumar NNo ratings yet

- Shree Rama Multi-Tech Ltd1 140114Document2 pagesShree Rama Multi-Tech Ltd1 140114Chaitanya JagarlapudiNo ratings yet

- Super Test-2Document6 pagesSuper Test-2RitikaNo ratings yet

- GM Test Series: Top 50 QuestionsDocument46 pagesGM Test Series: Top 50 QuestionsShruti JhaNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Order in The Matter of M - S Sahara India Life Insurance Co LTDDocument21 pagesOrder in The Matter of M - S Sahara India Life Insurance Co LTDkarthik kpNo ratings yet

- Revised Legal Updates 23.03.2024 SDocument3 pagesRevised Legal Updates 23.03.2024 SParina TyagiNo ratings yet

- The Singareni Collieries Company Limited: TH THDocument5 pagesThe Singareni Collieries Company Limited: TH THసింగరేణి ఆర్మీNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Wargames Illustrated #127Document64 pagesWargames Illustrated #127Анатолий Золотухин100% (1)

- RMC No. 25-2024Document1 pageRMC No. 25-2024Anostasia NemusNo ratings yet

- 4 DCD Construction vs. Republic G.R. No. 179978 March 2 2007Document11 pages4 DCD Construction vs. Republic G.R. No. 179978 March 2 2007Alelojo, NikkoNo ratings yet

- (WWW - Entrance-Exam - Net) - List of Schools in MumbaiDocument14 pages(WWW - Entrance-Exam - Net) - List of Schools in MumbaiSiddhesh KolgaonkarNo ratings yet

- United States Ex Rel. Leguillou v. Davis, 212 F.2d 681, 3rd Cir. (1954)Document5 pagesUnited States Ex Rel. Leguillou v. Davis, 212 F.2d 681, 3rd Cir. (1954)Scribd Government DocsNo ratings yet

- People Vs ObreroDocument13 pagesPeople Vs ObreroNadzlah BandilaNo ratings yet

- Khutba e Hujja Tul VidaDocument5 pagesKhutba e Hujja Tul VidaTayyab AliNo ratings yet

- First Voyage and The Propaganda Movement: Rizal in EuropeDocument11 pagesFirst Voyage and The Propaganda Movement: Rizal in EuropeFrancis Lloyd TongsonNo ratings yet

- Introduction To World War 1 Learning Check Quiz PDFDocument3 pagesIntroduction To World War 1 Learning Check Quiz PDFapi-237267589100% (1)

- Norton Vs Shelby - Political Review IDocument1 pageNorton Vs Shelby - Political Review IJohn Benedict TigsonNo ratings yet

- M 480Document5 pagesM 480KumaraShanNo ratings yet

- Mandatory Restitution 2 Proof Shaunel Is InnocentDocument11 pagesMandatory Restitution 2 Proof Shaunel Is InnocentSue BozgozNo ratings yet

- Part 4 International Transactions, Ch.14 Treaties, Character and Function of TreatiesDocument19 pagesPart 4 International Transactions, Ch.14 Treaties, Character and Function of TreatiesTemo TemoNo ratings yet

- Rizal's Annotation To Morga's Sucesos de Las Islas FilipinasDocument36 pagesRizal's Annotation To Morga's Sucesos de Las Islas FilipinasJerald Jay Catacutan100% (1)

- York County Court of Common Pleas For July 15, 2016Document16 pagesYork County Court of Common Pleas For July 15, 2016Kevin FrischNo ratings yet

- Presentation of Women in Nigeria Music VideosDocument51 pagesPresentation of Women in Nigeria Music VideosRinret Jonathan100% (4)

- Part 2 Imperialism - Impact in Africa Gallery Walk CompletedDocument6 pagesPart 2 Imperialism - Impact in Africa Gallery Walk CompletedSoren GasnerNo ratings yet

- 09 BibliographyDocument4 pages09 Bibliographyyosh61926No ratings yet

- Extremism: Causes and SolutionDocument4 pagesExtremism: Causes and SolutionwaqarNo ratings yet

- F.F. Bruce - The Early Church in The Roman EmpireDocument3 pagesF.F. Bruce - The Early Church in The Roman EmpireDonald LeonNo ratings yet

- Ousman Mohammednur AffidavitDocument5 pagesOusman Mohammednur AffidavitEmily BabayNo ratings yet

- PIU 20-019 TranscriptsDocument413 pagesPIU 20-019 TranscriptsSarah Eisenmenger100% (2)

- The Chinese Way of LifeDocument4 pagesThe Chinese Way of LifeSarah SaritaNo ratings yet

- People v. ReyesDocument2 pagesPeople v. Reyesdylabolante921No ratings yet

- Parliamentary ProceduresDocument31 pagesParliamentary ProceduresJasmin Abas100% (1)

- Revised Rules of Evidence 2019Document33 pagesRevised Rules of Evidence 2019Michael James Madrid Malingin100% (1)