Professional Documents

Culture Documents

Term Paper Bachelor IT 16s.unlocked

Term Paper Bachelor IT 16s.unlocked

Uploaded by

visaguyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Term Paper Bachelor IT 16s.unlocked

Term Paper Bachelor IT 16s.unlocked

Uploaded by

visaguyCopyright:

Available Formats

Dell Computers

The Value Chain of Dell Computers 2006

Dell Computers Introduction The value chain of a company, the concept introduced by Porter (1985) is its entire product flow from the suppliers to the customers and managing the information

flow seamlessly such that the customer derives maximum satisfaction while the company maximizes its profits. Dell Computers value chain is unique in the sense that the company sources all its components from vendors across the world, undertakes the final assembly and sells it directly to the consumer. Dells direct model of selling and build-toorder supply chain have been the main driving forces that have enabled it to gain advantage over other players in the computer industry that can be described as highly competitive according to Porters (1980) Five Forces model. The Industry Structure The computer industry is a highly competitive one. According to Porters (1980) theory, the level of competition in an industry is defined by the five forces: The threat of entry of new competitors (new entrants) The threat of substitutes The bargaining power of buyers The bargaining power of suppliers The degree of rivalry between existing competitors

The model can be elaborated in the following diagram.

Dell Computers

The threat of new entrants raises the level of competition in the industry. The computer industry is highly competitive because of the high degree of commoditization that is, uniformity and availability of technology and little scope of differentiation of the products resulting in little customer switching costs that enable any of the vendors of computer parts or a new player to develop assembling capabilities. There are no large benefits to Dell from economies of scale neither does assembling require huge capital investments. Similarly, the threat of substitutes is also high since products from Dell are essentially similar to those from HP, Compaq and Gateway. However, Dell has been able to sell at lower margins since it saves on the margins charged by wholesalers and traders. The relative price and the performance determine customer preferences and Dell has taken advantage of the market preferences. Dells suppliers do not have a high level of bargaining power since Dell dictates the terms and schedules of delivery. Besides, in an industry that is characterized by innumerable suppliers, who are not in a cartel, and a few dominant buyers of components

Dell Computers that are individually low-value and undifferentiated, suppliers cannot have a high degree of bargaining power.

Similarly, the buyers of computers, too, do not have a high bargaining power that could reduce the attractiveness of the industry. There are a large number and a wide variety of customers from corporate to individual customers for desktop to laptop PCs, as well as for storage, servers and printers that the players can target. The intensity of rivalry between players depends on the number and size of players, cost structure of the industry, level of product differentiation, customerswitching costs, level of aggression by players and exit barriers. In these terms, when Dell entered the market, it found an intensely competitive market, which is highly fragmented and produce a commodity that is nearly undifferentiable and customer switching costs in the market are low. Hence, the players are highly aggressive and evolve different selling strategies. This resulted Dell in forming its unique direct model since it realized that with competition, returns and margins inevitably comes down. Hence, there was an imminent pressure to maintain margins, which it could do with the direct model. Thus, although the buyers of computers and the suppliers of parts do not have much bargaining power in the industry because of their large numbers, the other three forces namely the threat of rivalry or new competitors, the threat of substitutes and the intensity of industry competitors are acute enough for Dell to formulate a new operation and selling strategy in terms of its value chain.

Dell Computers

Dells Value Chain (application of Porters 1985 model)

Corporate Infrastructure Support Human Resource Management & Training Research & Development Margin

Inbound component logistics

Final Assembly

Outbound supply logistics

Direct marketing & sales

Product Service

Primary Activities

Current Functional Level Strategy Dell outsources all its component manufacturing, including sub-assemblies like motherboards and nearly the entire production chain for notebook PCs. However, it does not outsource the final configuration and keeps control over the production and supply chains. In the initial years, the company shipped parts and components mostly from Asia. More recently, regional components manufacturers which again may be units of Asian, European and American companies- are increasingly supplying to Dell. Typically, components like disk drives, CD-ROM drives, power systems, cables and connectors are shipped from Asia while motherboards are largely procured locally. Since Dell follows build-to-order and just-in-time policies, the inventory remains in the supplierss books till Dell puts the order. Intel is the only exception since its market strength is large enough to force Dell take over its inventory before acquiring the final customer (Byrnes, 2003). Dells direct-selling model depends critically on lead-time management so that inefficient lead conversion time would not leave the company with overage or underage

Dell Computers of components. Once an order matures either over the phone or through the internet -

the sales executive is entirely responsible to run the product chain to ensure it is delivered on time. The pricing is also tailored to the companys demand forecasts that are strictly monitored on a weekly basis (Byrnes, 2003). Dell has eliminated from its value chain the intermediaries, who would have charged a 20-30 percent margin, from the value chain, taking orders over phones and since the late 1990s over the Internet and aligning the supply chain closely to the assembly factories and the order-taking system (Achtmeyer, 2002). Dell has integrated the direct-selling model intricately with the supply chain. Even though the company assembles 80,000 PCs a day, it does not have any warehouse, the assembly factories hold inventories for a maximum of two days while the entire operation inventory is a maximum of 72 hours (Byrnes, 2003). Current Business Level Strategy When Dell entered the market in 1984, the market had already become fragmented and players were hard-selling their products. Michael Dell realized that the consumers, who were buying their second computers or replacing their old ones, had already matured to the extent that they knew the technology parameters and required less of onsite training or persuasion. Hence, Dell embarked on its direct model has given the company a competitive edge through the low selling price that it can give to customers. Recently, Dell has also entered the printer market with low-cost MFP printers with no prvious experience in laser or inkjet printers. Once again, Dell adopted a unique selling strategy by partnering with the competitors of HP, the leader in the printer market, like Lexmark, Samsung, Kodak and Fuji Xerox. In the server storage business, another

Dell Computers line that Dell has entered recently, it has partnered with industry leaders like Intel, Microsoft, Oracle, Red Hat (Melenovsky, 2004). Resources

Dell spends little on research and development, at $400 million in 2003, a fraction of HPs $4 billion (Maney, 2003). Yet, it manages the supply chain so efficiently that its production process is near perfect. Also, the assembly operations are highly efficient and designed such that a PC is assembled by one worker so that any defect can be traced down to him and made accountable. The main strength of Dell is in its inventory management. As the company sells 90 percent of its products through the direct model, it mostly receives payments from its customers immediately online or through the credit card. It then places orders on the component vendors and proceeds on the assembly but pays to the suppliers only 36 days after the product is shipped to the customer. As a result, the cash-conversion ratio for Dell is negative 36. On the other hand, other PC makers pay suppliers immediately for the components, assemble them and receive payment from customers on delivery. The process takes roughly 30 days hence the cash-conversion ratio is typicall positive 30 days for the other PC-makers (Breen, 2004). Capabilities Dell has developed its tangible capabilities in terms of financial advantages of maintaining low inventories and elimination of the wholesalers and retailers, thereby eliminating the 20-30 percent that would have to be passed on to these intermediaries otherwise.

Dell Computers Dell has developed the intangible capabilities which, according to the VIRO (Valuable, Rarity, Immitability, Organization) model, developed by Barney (2005), are required for it to maintain strategic competitive advantage. However, in the more recent years, there are doubts raised over its sustainability. For example, the value that the company derives through its direct selling model in conjunction with the build-to-order

model may be neutralized as the industry becomes commoditized, the production process easier and other companies including those which are Dells supplier now develop their capabilities. Of course, Dells resources and capabilities that have made it valuable, has not yet been replicated by any of the competitors so it may genuinely be expected that Dells competitive advantage will remain for some time to come. Dells first mover advantage in the direct selling model has given it an edge that competitors will find it difficult to imitate. Besides, Dell has refined the value chain to such an extent that it has its entire organization including its sales executives, assemblers and sub-assemblers streamlined extremely efficiently. Recommendations To sustain the competitive advantage that Dell has developed over the years, the company should treat the corporate and individual clients. It should adopt different strategies for the two sets of clients: 1) For corporate clients, Dell should focus more on the enterprise solutions that medium-sized companies are increasingly adopting while concentrating on the storage and server business for large companies,

Dell Computers 2) For individual companies, Dells capabilities through the direct model are more related to high-end products. The entry into the low-end products should be done in a more thoughtful manner. Combining the direct model with the retail model. Dells buyer profile is tilted towards the technology savvy customers corporate

or individual who are either buying a second or subsequent product or replacing the old one. For these buyers, Dells direct selling model fits in perfectly. The corporate clients make up the bulk of the online sales. About 15 percent of the e-commerce revenues are B2C while the rest is B2B. It is recommended that Dell attempts to enlarge the corporate e-commerce clientele, with more services and product combos specifically targeted at the enterprise levels. Recently, Dell has incorporated hard-selling into its direct-seelling mdel for lowend products, buyers of which are typically first-time users. In a bid to capture market share, the company has opened 10 by 12 feet kiosks at shopping malls and connected them to the Dell site online as well as give consumers a touch and feel of the product. However, analysts have noted that the malls have the largest footfalls from women and not a large share of leads are converted to purchases (Magure, 2003). For the individual customers of low value products, the direct model has limited success and a more aggressive combination of direct and retail selling is recommended. The company should realize that with commoditization of the computer market, more players will enter in to market and the company should now begin to focus more on volumes than margins.

Dell Computers Conclusion Dells USP of direct selling and build-to-order has given it a unique position in

10

the industry, enabling to rise to the top of the competition in two decades despite being a late entrant. The sustainability of the competitive edge, though difficult in the fastcommoditizing industry, depends on continuation of its power to harness all the resources and capabilities it has developed over the years.

Works Cited

Achtmeyer, William, F., Dell Computer Corporation, Center for Global Leadership,

Tuck School of Business, Dartmouth, 2002, available at

http://mba.tuck.dartmouth.edu/pdf/2002-2-0014.pdf Barney, Jay B., Gaining Sustainable Competitive Advantage, 2nd Edition, Prentice Hall; 2 edition, 2001 Byrnes, Jonathan, Dell Manages Profitability, Not Inventory, Harvard Business School Working Knowledge of Leaders, available at http://hbswk.hbs.edu/item.jhtml?id=3497&t=dispatch Dedrick, Jason and Kraemer, Kenneth, L, Asias Computer Challenge: Threat or

Opportunity for the United States and the World? New York: Oxford University

Press, 1998 Dell, Michael and Catherine Fredman, Direct from Dell: Strategies that Revolutionized

and Industry, Collins, 2000

Maguire, James, Case Study: Dell.com, March 3, 2003, e-commerce guide.com, available at http://www.ecommerce-guide.com/news/trends/article.php/10417_2013731

Dell Computers Maney, Kevin, Dell Business Model Turns to Muscle as Rivals Struggle, USA Today, available at http://www.usatoday.com/money/industries/technology/2003-01-19 dell-cover_x.htm Porter, Michael, Competitive Strategy, Free Press, 1980.

11

Porter, Michael, Competitive Advantage: Creating and Sustaining Superior Performance, New York, Free Press, 1985

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ISO 31000 and Integrated Risk ManagementDocument36 pagesISO 31000 and Integrated Risk Managementfrakuk91% (11)

- CI-F-0030 Internal ISM Document of Compliance ChecklistDocument14 pagesCI-F-0030 Internal ISM Document of Compliance Checklistsergiy100% (1)

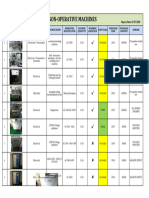

- Non Operative MachinesDocument1 pageNon Operative MachinesvisaguyNo ratings yet

- Holiday Budget PlannerDocument2 pagesHoliday Budget PlannervisaguyNo ratings yet

- Power Electronics LectureDocument84 pagesPower Electronics LecturevisaguyNo ratings yet

- ps25251 DatasheetDocument6 pagesps25251 DatasheetvisaguyNo ratings yet

- Process Map ExampleDocument3 pagesProcess Map ExamplevisaguyNo ratings yet

- Velocity of Sound On Kundts TubeDocument7 pagesVelocity of Sound On Kundts Tubevisaguy100% (1)

- IBPS Clerk Vacancies Analysis byDocument1 pageIBPS Clerk Vacancies Analysis byvisaguyNo ratings yet

- Power Spectral Density CodeDocument4 pagesPower Spectral Density CodevisaguyNo ratings yet

- Making Sentences - EnglishDocument10 pagesMaking Sentences - Englishrjumaat100% (2)

- At CommandDocument9 pagesAt CommandvisaguyNo ratings yet

- Alernate FuelsDocument4 pagesAlernate FuelsvisaguyNo ratings yet

- Strategic AlliancesDocument17 pagesStrategic AlliancesYasser Hassan100% (1)

- RBD-17 09 2020Document137 pagesRBD-17 09 2020hishamndtNo ratings yet

- IFA Executive Summary PDFDocument2 pagesIFA Executive Summary PDFtryNo ratings yet

- Procedure of Concrete & Steel StructureDocument28 pagesProcedure of Concrete & Steel StructureAchmad SyifniNo ratings yet

- Crane Lift RAMsDocument18 pagesCrane Lift RAMsKaren Olivier100% (1)

- HydelPoleline CatalogueS PDFDocument78 pagesHydelPoleline CatalogueS PDFRuben MoralesNo ratings yet

- 2G ScamDocument15 pages2G ScamIshan AggarwalNo ratings yet

- Product ManagementDocument108 pagesProduct ManagementEvan Sen100% (2)

- DGL 34-431Document77 pagesDGL 34-431S SeedyNo ratings yet

- 8803578Document90 pages8803578Andrea DetomasNo ratings yet

- KNM GroupDocument3 pagesKNM GroupLiew Yau WeiNo ratings yet

- Control Volume Part 1Document42 pagesControl Volume Part 1Teja MaruvadaNo ratings yet

- Jsa (Ercction of Tower Crane) G-11Document4 pagesJsa (Ercction of Tower Crane) G-11khurram shahzadNo ratings yet

- T-ENG CardDocument14 pagesT-ENG CardViswaChaitanya NandigamNo ratings yet

- VX800 Shop Manaul PlusDocument1,178 pagesVX800 Shop Manaul PlusTerry Hoey67% (3)

- Gas Cap BlowdownDocument59 pagesGas Cap BlowdownkavanayenNo ratings yet

- SQL Server Backup and RestoreDocument8 pagesSQL Server Backup and RestoreVenice DatoNo ratings yet

- LABCW Guidance - Vibro Stone ColumnsDocument2 pagesLABCW Guidance - Vibro Stone ColumnsDr Ganesh Kame (Dr Kame)No ratings yet

- MD ST C - 28420101020en00010047Document47 pagesMD ST C - 28420101020en00010047Armin-NerminMujanovicNo ratings yet

- HR ConsultancyDocument47 pagesHR ConsultancyAbhilasha Kapoor100% (1)

- What Is SAP Extended Warehouse ManagementDocument7 pagesWhat Is SAP Extended Warehouse ManagementShyamNo ratings yet

- Planning: Processes and TechniquesDocument18 pagesPlanning: Processes and TechniquesSunil JoshiNo ratings yet

- TheL&T IteApril June 2014forwebDocument40 pagesTheL&T IteApril June 2014forwebdeepak_gupta_pritiNo ratings yet

- NDT Request Form (Piping) : Wara Pressure Maintenance ProjectDocument7 pagesNDT Request Form (Piping) : Wara Pressure Maintenance ProjectVimin PrakashNo ratings yet

- FMEADocument42 pagesFMEAibal_machine100% (1)

- Water Meter Box KSADocument2 pagesWater Meter Box KSArashidNo ratings yet

- IIT Ropar TenderDocument1 pageIIT Ropar TendersachinoakNo ratings yet