Professional Documents

Culture Documents

Daily Metals and Energy Report, March 19

Daily Metals and Energy Report, March 19

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Metals and Energy Report, March 19

Daily Metals and Energy Report, March 19

Uploaded by

Angel BrokingCopyright:

Available Formats

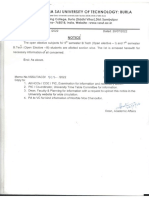

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Overview

Italian Trade Balance was at a deficit of 1.62 billion Euros in January. US NAHB Housing Market Index declined to 44-mark in March. European Trade Balance was at a surplus of 9 billion Euros in January. Asian markets recovered from yesterdays fall which had slipped on the back of expectations that Euro region will fall into its debt crisis. US National Association of Home Builders (NAHB) Housing Market Index declined by 2 points to 44-mark in March as against a rise of 46-level in February. Chinas Conference Board (CB) Leading Index remained unchanged at 1.3 percent in the month of February. Foreign Direct Investment fell by 1.4 percent in February as against a previous decline of 7.3 percent in January. US Dollar Index (DX) appreciated by 0.4 percent in the yesterdays trading session on the back of rise in risk aversion in the global market sentiments which led to increase in demand for the low yielding currency. Additionally, tax levied on the bank deposits in Cyprus which is plan of bailout package led to expectations of reemergence in the Euro Zone debt crisis. Further, US equities traded on a negative which also acted as a favorable factor for the DX. The currency touched an intra-day high of 82.83 and closed at 82.574 on Monday. The Indian Rupee depreciated by 0.1 percent in yesterdays trading session. The currency depreciated on the back of weak global and domestic market sentiments after bailout plan for Cyprus levied tax on bank deposits which led to reemergence of Euro Zone debt crisis. However, sharp downside in the currency was cushioned on account of expectations of cut in interest rates by the central bank of the country on Tuesday. The Indian Rupee touched an intra-day low of 54.34 and closed at 54.07 against dollar on Monday. For the month of March 2013, FII inflows totaled at Rs.6,613.40 crores th ($1,212.41 million) as on 18 March 2013. Year to date basis, net capital th inflows stood at Rs.53,111.60 crores ($9,847.0 million) till 18 March 2013.

Market Highlights (% change)

Last INR/$ (Spot) 54.07 Prev day -0.1

as on 18 March, 2013 w-o-w 0.5 m-o-m 0.3 y-o-y -7.3

$/Euro (Spot)

1.2954

-0.9

-0.7

-3.0

-1.7

Dollar Index NIFTY

82.57

0.4

0.0

2.5

3.9

5835.3

-0.6

-1.8

-1.1

11.0

SENSEX

19293.2

-0.7

-1.8

-1.1

5.5

DJIA

14452.1

-0.4

0.0

3.0

9.2

S&P

1552.1

-0.6

-0.3

2.1

10.5

Source: Reuters

The Euro depreciated by 0.9 percent in yesterdays trade on the back of worries over Cyprus bailout as the European Finance Ministers decided to levy special tax on the bank deposits of Cyprus. Further, weak global market sentiments coupled with strength in DX added downside pressure on the currency. Italian Trade Balance was at a deficit of 1.62 billion Euros in January as against a previous surplus of 2.11 billion Euros a month ago. European Trade Balance was at a surplus of 9 billion Euros in January from earlier surplus of 10.3 billion in December. The Euro touched an intra-day low of 1.288 and closed at 1.2954 against dollar on Monday.

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Bullion Gold

Spot gold prices increased by 0.8 percent in the yesterday trading session on the back of worries over Cyprus bailout, driving investors to buy gold as safe haven . However, strength in DX capped sharp gains in prices. The yellow metal touched an intra-day high of $1610.81/oz and closed at $1604.8/oz in yesterdays trading session. In the Indian markets, prices ended on positive note in the yesterday trading session on the back of depreciation in the Indian rupee and closed at Rs.29547/10 gms after touching an intra-day high of Rs. 29644/10 gms on Monday. Market Highlights - Gold (% change)

Gold Gold (Spot) Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (April13) MCX Gold (April13) Unit $/oz Rs/10 gms $/oz Last 1604.8 29525.0 Prev. day 0.8 0.6 as on 18 March, 2013 WoW 1.5 0.9 MoM -0.3 -0.7 YoY -3.3 7.2

1603.8

0.5

1.6

-0.4

-3.3

$/oz

1604.6

0.9

1.7

0.1

-3.3

Rs /10 gms

29547.0

0.6

0.8

-2.1

6.1

Silver

Source: Reuters

Taking cues from rise in gold prices, spot silver prices ended on positive note by 0.4 percent on Monday. However, weak global market sentiments coupled with strength in DX capped sharp upside movement in the prices. The white metal prices touched an intra-day high of $29.12 /oz and closed at $28.8/oz in yesterdays trade. On the domestic front, prices ended on a positive note by 0.2 percent and closed at Rs. 54321/kg after touching an intra-day high of Rs. 54555/kg on Monday. Depreciation in the Indian rupee supported prices to trade green.

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (May13) MCX Silver (May13) Unit $/oz Rs/1 kg Last 28.8 54750.0 Prev day 0.4 0.3

as on18 March, 2013 WoW -0.4 -1.5 MoM -3.7 -4.8 YoY -11.3 -3.4

$/oz $/ oz

2880.0 2884.1

-0.4 0.1

-0.3 0.1

-4.0 -1.9

-10.8 -11.5

Outlook

In the intraday, we expect precious metals to trade on a positive note due to worries over Cyprus bailout and expectation of rise in Inflation data from UK will lead to increase in demand for the safe haven investment. Further, weakness in DX may support prices to trade positive. Appreciation in the Indian Rupee will cap sharp gains in the prices on the MCX. Technical Outlook

Unit Spot Gold MCX Gold Apr13 Spot Silver MCX Silver May13 $/oz Rs/10 gms $/oz Rs/kg valid for March 19, 2013 Support 1597/15952 29440/29340 28.75/28.60 54060/53800 Resistance 1609/1614 29650/29750

Rs / kg

54321.0

0.2

-0.5

-3.4

-5.1

Source: Reuters

Technical Chart Spot Gold

Source: Telequote

29.00/29.15 54550/54800

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Energy

Market Highlights - Crude Oil (% change)

as on 18 March, 2013 WoW 1.8 -0.1 1.8 MoM -7.5 -3.0 YoY -12.4 -13.1 -12.4

Crude Oil

Crude Oil Unit $/bbl $/bbl $/bbl Last 93.7 109.7 93.7

Nymex crude oil prices recovered from its losses and increase by 0.3 percent yesterday taking cues from shutdown in the crude pipeline in Libya after the protests by the fuel truck drivers. However, sharp upside in the prices was capped on account of weak global market sentiments, concerns for the Euro Zone debt crisis along with strength in the DX. Crude oil prices touched an intra-day high of $93.94/bbl and closed at $93.70/bbl in yesterdays trading session. On the domestic bourses, prices declined by 0.1 percent and closed at Rs.5,056/bbl after touching an intra-day low of Rs.4,973/bbl on Monday. Depreciation in the Indian Rupee cushioned sharp fall in the prices on the MCX. API Inventories Forecast The American Petroleum Institute (API) is scheduled to release its weekly inventories today and US crude oil inventories are expected to rise by 2.0 million barrels for the week ending on 15th March 2013. Gasoline stocks are expected to decline by 2.5 million barrels and distillate inventories are expected to fall by 1.2 million barrels for the same week. Outlook From the intra-day perspective, we expect crude oil to trade higher on the back of upbeat global market sentiments coupled with weakness in the DX. Additionally, shutdown in pipeline in Libya will also support an upside in the prices. However, sharp upside will be capped on account of rise in the crude output from Saudi Arabia and Iraq, Cyprus bailout issue along with expectations of rise in US crude oil inventories from API. In the Indian markets, appreciation in the Rupee will cap sharp gains in the prices on the MCX. Technical Outlook

Unit valid for March 19, 2013 Support Resistance

WTI (Spot) Brent (Spot) Nymex Crude (April 13) ICE Brent Crude (March13) MCX Crude (Mar 13)

Prev. day 0.2 -0.7 0.3

$/bbl

109.5

-0.3

-0.6

-6.7

-13.0

Rs/bbl

5056.0

-0.1

1.6

-2.5

-5.2

Source: Reuters

Market Highlights - Natural Gas (% change)

Natural Gas (NG) Nymex NG MCX NG (Mar 13) Unit $/mmbtu Rs/ mmbtu Last 3.882 212.3 Prev. day 0.5 1.7

as on 18 March, 2013

WoW 6.71 7.06

MoM 22.31 22.79

YoY 67.04 81.61

Source: Reuters

Technical Chart NYMEX Crude Oil

SSource: Telequote

Technical Chart NYMEX Natural Gas

NYMEX Crude Oil MCX Crude March 13

$/bbl Rs/bbl

93.10/92.20 5020/4970

94.40/95.10 5090/5130

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Base Metals

The base metals pack traded on a negative note on the back of worries over Cyprus bailout as the European finance minister decided to levy special taxes on the bank deposits of Cyprus. Further, weak global market sentiments coupled with strength in DX added downside pressure on the prices. Additionally, rise in LME inventories, except Lead also acted as a negative factor for the base metal prices. On the MCX, depreciation in the Indian Rupee cushioned sharp fall in the prices. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (April13) LME Aluminum (3 month) MCX Aluminum (Mar13) LME Nickel $/tonne 16628.0 -1.8 -1.3 -7.3 -12.4 Rs /kg 103.2 -1.5 -1.6 -9.1 -7.9 $/tonne 1936.0 -1.5 -1.1 -8.8 -14.3 Rs/kg 412.7 -2.6 -3.0 -6.7 -4.5 $/tonne Last 7567.0 Prev. day -2.5 as on 18 March, 2013 WoW -2.6 MoM -3.6 YoY -11.3

Copper

Copper, the leader of the base metal pack decreased by 2.5 percent in yesterdays trade on the back of worries over Cyprus bailout. Further, weak global market sentiments coupled with strength in DX added downside pressure. Additionally, sharp rise in LME Copper inventories by 3.4 percent which stood at 543,925 tonnes kept the prices under pressure. The red metal touched an intra-day low of $7545.75/tonne and closed at $7567/tonne yesterdays trading session. On the domestic front, prices fell by 2.6 percent and closed at Rs. 412.7/kg on Monday after touching an intra-day low of Rs 412.2/kg. Depreciation in the Indian Rupee prevented sharp fall in the prices on the MCX. Outlook In the intra-day, we expect base metals prices to trade on the positive note on the back of expectation of positive economic data from US. Further, optimistic global market sentiments coupled with weakness in DX will support prices to gain strength. However, worries over Cyprus bailout, expectation of negative Industrial production data from Italy and decline in German ZEW economic sentiments may cap sharp gains in prices. Technical Outlook

Unit MCX Copper April13 MCX Zinc Mar 13 MCX Lead Mar 13 MCX Aluminum Mar13 MCX Nickel Mar 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for March 19, 2013 Support 410/407 101.8/100.7 116.5/115.8 102.7/102 888/880 Resistance 415/419 103.5/104.5 118/119.8 104/104.8 904/912

(3 month) MCX Nickel (Mar13) LME Lead (3 month) MCX Lead (Mar13) LME Zinc (3 month) MCX Zinc (Mar13)

Source: Reuters

Rs /kg

896.7

-2.0

-2.1

-7.6

-6.1

$/tonne

2176.8

-2.0

-1.2

-9.3

3.1

Rs /kg

117.3

-2.0

-1.6

-9.5

11.1

$/tonne

1920.8

-1.9

-2.2

-10.9

-7.4

Rs /kg

102.7

-2.1

-3.2

-11.6

-1.1

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 18th March 543,925 5,182,175 162,306 1,205,125 275,500 15th March 525,825 5,173,075 161,544 1,204,550 277,500 Actual Change 18,100 9,100 762 575 -2,000 (%) Change 3.4 0.2 0.5 0.0 -0.7

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Tuesday| March 19, 2013

International Commodities

Important Events for Today

Indicator CPI y/y PPI Input m/m RPI y/y German ZEW Economic Sentiment ZEW Economic Sentiment BOE Inflation Letter Building Permits Housing Starts Country UK UK UK Europe Europe UK US US Time (IST) 3:00pm 3:00pm 3:00pm 3:30pm 3:30pm Tentative 6:00pm 6:00pm Actual Forecast 2.8% 1.6% 3.3% 47.9 43.7 0.93M 0.92M Previous 2.7% 1.3% 3.3% 48.2 42.4 0.90M 0.89M Impact High High Medium High Medium High High Medium

www.angelcommodities.com

You might also like

- 1 Novacron S OverviewDocument3 pages1 Novacron S OverviewsaskoNo ratings yet

- Introduction To Criminology (Review Materials For 2013 Criminology Board Examination)Document43 pagesIntroduction To Criminology (Review Materials For 2013 Criminology Board Examination)Clarito Lopez88% (33)

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 02Document6 pagesDaily Metals and Energy Report, April 02Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 20Document6 pagesDaily Metals and Energy Report, March 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 26Document6 pagesDaily Metals and Energy Report, April 26Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 21 2013Document6 pagesDaily Metals and Energy Report, May 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 22Document6 pagesDaily Metals and Energy Report, March 22Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 18Document6 pagesDaily Metals and Energy Report, April 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 21Document6 pagesDaily Metals and Energy Report, March 21Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 23Document6 pagesDaily Metals and Energy Report, April 23Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 15Document6 pagesDaily Metals and Energy Report, March 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 16 2013Document6 pagesDaily Metals and Energy Report, May 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 28Document6 pagesDaily Metals and Energy Report, March 28Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 13Document6 pagesDaily Metals and Energy Report, March 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 12Document6 pagesDaily Metals and Energy Report, February 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 3 2013Document6 pagesDaily Metals and Energy Report, July 3 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 16 2013Document6 pagesDaily Metals and Energy Report, July 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 25Document6 pagesDaily Metals and Energy Report, March 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 18Document6 pagesDaily Metals and Energy Report, March 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 16Document6 pagesDaily Metals and Energy Report, April 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 21Document6 pagesDaily Metals and Energy Report, February 21Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 10 2013Document6 pagesDaily Metals and Energy Report, May 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 4 2013Document6 pagesDaily Metals and Energy Report, July 4 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 14Document6 pagesDaily Metals and Energy Report, February 14Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 14 2013Document6 pagesDaily Metals and Energy Report, June 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 20 2013Document6 pagesDaily Metals and Energy Report, May 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 25Document6 pagesDaily Metals and Energy Report, February 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 31 2013Document6 pagesDaily Metals and Energy Report, May 31 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 19Document6 pagesDaily Metals and Energy Report, February 19Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 12 2013Document6 pagesDaily Metals and Energy Report, July 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 13 2013Document6 pagesDaily Metals and Energy Report, June 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report January 16Document6 pagesDaily Metals and Energy Report January 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 22Document6 pagesDaily Metals and Energy Report, February 22Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 17 2013Document6 pagesDaily Metals and Energy Report, May 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 13 2013Document6 pagesDaily Metals and Energy Report, May 13 2013Angel BrokingNo ratings yet

- Daily Metal and Energy Report, 24 January 2013Document6 pagesDaily Metal and Energy Report, 24 January 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- MATH CHALLENGE GRADE 2 - Google FormsDocument5 pagesMATH CHALLENGE GRADE 2 - Google FormsAivy YlananNo ratings yet

- TL-WN722N (UN) (US) V2 Datasheet PDFDocument4 pagesTL-WN722N (UN) (US) V2 Datasheet PDFBender :DNo ratings yet

- Abcp Offering CircularDocument2 pagesAbcp Offering Circulartom99922No ratings yet

- Examen Blanc Et Corrige 3ASLLE Anglais 2e Sujet 2017Document4 pagesExamen Blanc Et Corrige 3ASLLE Anglais 2e Sujet 2017dila sailNo ratings yet

- Real Exam 22.03.2024 (With Answers) - UpdatedDocument12 pagesReal Exam 22.03.2024 (With Answers) - Updatedtd090404No ratings yet

- PSS Siquijor TeamFAZ MCMFDocument21 pagesPSS Siquijor TeamFAZ MCMFMVSNo ratings yet

- Dilla University College of Engineering and Technology School of Computing and Informatics Department of Computer ScienceDocument11 pagesDilla University College of Engineering and Technology School of Computing and Informatics Department of Computer ScienceTekalegnNo ratings yet

- Review Questions IODocument9 pagesReview Questions IOMarionne DagolsapoNo ratings yet

- Lucies Farm Data Protection ComplaintDocument186 pagesLucies Farm Data Protection ComplaintcraigwalshNo ratings yet

- F5 Exam Report June 2012Document3 pagesF5 Exam Report June 2012Muhammad Khaleel RashidNo ratings yet

- Philips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFDocument53 pagesPhilips+22PFL3403-10+Chassis+TPS1 4E+LA+LCD PDFparutzu0% (1)

- Chem 26.1 Lab Manual 2017 Edition (2019) PDFDocument63 pagesChem 26.1 Lab Manual 2017 Edition (2019) PDFBea JacintoNo ratings yet

- ARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFDocument371 pagesARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFJuanManuelAmaroLuisNo ratings yet

- Argument Forms: Proving InvalidityDocument13 pagesArgument Forms: Proving InvalidityDaniel Emmanuel De LeonNo ratings yet

- HetzerDocument4 pagesHetzerGustavo Urueña ANo ratings yet

- Form PDF 870914450231220Document8 pagesForm PDF 870914450231220Sachin KumarNo ratings yet

- Job Description - CRM Marketing SpecialistDocument1 pageJob Description - CRM Marketing SpecialistMichael-SNo ratings yet

- (Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Document16 pages(Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Dương Viết ĐạtNo ratings yet

- Antena Parabolica HP4 71W P3A A RPE Andrew 12Document7 pagesAntena Parabolica HP4 71W P3A A RPE Andrew 12eduardo-mwNo ratings yet

- Neuromusic IIIDocument3 pagesNeuromusic IIIJudit VallejoNo ratings yet

- Sales Budget in Millions $Document13 pagesSales Budget in Millions $IkramNo ratings yet

- Palm Oil MillDocument52 pagesPalm Oil MillengrsurifNo ratings yet

- Kult - The Dark Art PDFDocument7 pagesKult - The Dark Art PDFalnevoNo ratings yet

- Grade 7 Module Answer SheetsDocument12 pagesGrade 7 Module Answer SheetsArian May MarcosNo ratings yet

- What A Body Can DoDocument26 pagesWhat A Body Can DoMariana Romero Bello100% (1)

- Notice 1658958950Document64 pagesNotice 1658958950Subrat NaikNo ratings yet

- OJ L 2021 231 FULL en TXT Regolamentary PackageDocument710 pagesOJ L 2021 231 FULL en TXT Regolamentary PackageLuca CarusoNo ratings yet

- Hemanth PHP Resume-1Document3 pagesHemanth PHP Resume-1hemanthjinnala777No ratings yet