Professional Documents

Culture Documents

Cash Flow

Cash Flow

Uploaded by

Yadi VrsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow

Cash Flow

Uploaded by

Yadi VrsCopyright:

Available Formats

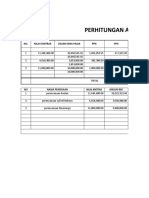

Tabel 10.

11 ALIRAN KAS (RP 000)

PT. BANGKA PRIMA TIN PERIODE JANUARI - DESEMBER 2011

No.

DISKRIPSI

Modal

Jan

2010

Feb

Mar

Apr

Mei

Jun

1.

Jul

Agst

Sep

Okt

Nov

Des

TOTAL

PENERIMAAN

1.

Setoran Awal

2.

Penjualan

Jumlah Penerimaan

37.400.000

37.400.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

83.160.000

37.400.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

6.930.000

120.560.000

2.

PENGELUARAN

1.

Biaya Ekplorasi

1.600.000

1.600.000

2.

Amdal & FS

500.000

500.000

3.

Biaya Kesungguhan

150.000

150.000

4.

Biaya Jaminan

Reklamasi 182 ha

1.250.000

1.250.000

5.

Konstruksi &

Rekayasa

33.700.000

33.700.000

6.

Sarana & Prasarana

200.000

200.000

7.

Biaya Operasional

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

21.708.996

Total Pengeluaran

37.400.000

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

1.809.083

59.108.996

Surplus/Defisit (1-2)

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

5.120.917

61.451.004

Saldo Awal

5.120.917

10.241.834

15.362.751

20.483.668

25.604.585

30.725.502

35.846.419

40.967.336

46.088.253

51.209.170

56.330.087

Saldo Akhir

5.120.917

10.241.834

15.362.751

20.483.668

25.604.585

30.725.502

35.846.419

40.967.336

46.088.253

51.209.170

56.330.087

61.451.004

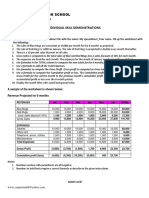

Tabel 10.12 ALIRAN KAS, DALAM (RP 000)

PT. BANGKA PRIMA TIN PERIODE TAHUN 2011 2018

No.

DISKRIPSI

Tahun (1)

2010

Tahun (2)

2011

Tahun (3)

2012

1.

Tahun (4)

2013

Tahun (5)

2014

Tahun (6)

2015

Tahun (7)

2016

Tahun (8)

2017

Tahun (9)

2018

TOTAL

PENERIMAAN

1. Setoran Awal

2. Penjualan

Jumlah Penerimaan

37.400.000

37.400.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

665.280.000

37.400.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

702.680.000

2.

PENGELUARAN

1. B. Ekplorasi

1.600.000

1.600.000

2. Amdal & FS

500.000

500.000

3. B. Kesungguhan

4. Biaya Jaminan

Reklamasi 182 ha

5. Konstruksi &

Rekayasa

150.000

150.000

1.250.000

1.250.000

33.700.000

33.700.000

200.000

200.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

173.671.968

6. Sarana &

Prasarana

7. B. Operasional

Total Pengeluaran

37.400.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

211.071.968

Surplus/Defisit (1-2)

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

491.608.032

Saldo Awal

61.451.004

122.902.008

184.353.012

245.804.016

307.255.020

368.706.024

430.157.028

Saldo Akhir

61.451.004

122.902.008

184.353.012

245.804.016

307.255.020

368.706.024

430.157.028

491.608.032

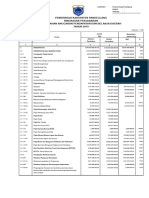

Tabel 10.13 NET PRESENT VALUE (NPV) DALAM RP (000)

No

DISKRIPSI

Tahun (1)

0

Tahun (2)

2011

Tahun (3)

2012

Tahun (4)

2013

Tahun (6)

2015

Tahun (7)

2016

Tahun (8)

2017

Tahun (9)

2018

TOTAL

PENERIMAAN

1

Hasil Penjualan

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

Jumlah Penerimaan

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

BIAYA

a. Biaya Modal

37.400.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

Total Pengeluaran

37.400.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

Pendapatan Kotor

(1 2)

(37.400.000)

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

61.451.004

Pajak 10 %

6.145.100

6.145.100

6.145.100

6.145.100

6.145.100

6.145.100

6.145.100

6.145.100

Net Profit

55.305.904

55.305.904

55.305.904

55.305.904

55.305.904

55.305.904

55.305.904

55.305.904

0,909

0,826

0,751

0,683

0,621

0,564

0,513

0,466

(37.400.000)

50.273.067

45.682.677

41.534.734

37.773.932

34.344.966

31.192.530

28.371.929

25.772.551

b. Biaya Operasional

Tahun (5)

2014

Andai DF=10%

(tabel DF)

NPV DF=10%

442.447.232

294.946.386

NPV at DF = 10% = 294.946.386.000 37.400.000.000 = 257.546.386.000

Angka 257.546.386.000, berarti hasil bersih (net profit) yang kita terima selama 8 tahun mendatang sebesar = Rp 442.447.232.000, nilai sekarang (NPV) sebesar Rp 294.946.386.000

dengan memperhitungkan asumsi bahwa bunga adalah 10 % setiap tahun selama 8 tahun.

Tabel 10.14 BENEFIT COST RATIO, B/C DALAM RP (000)

No

Tahun (1)

0

DISKRIPSI

Tahun (2)

2011

Tahun (3)

2012

Tahun (4)

2013

Tahun (5)

2014

Tahun (6)

2015

Tahun (7)

2016

Tahun (8)

2017

Tahun (9)

2018

TOTAL

PENERIMAAN

Hasil Penjualan

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

Keuntungan Kotor

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

83.160.000

DF = 10%

0,909

0,826

0,751

0,683

0,621

0,564

0,513

0,466

75.592.440

68.690.160

62.453.160

56.798.280

51.642.360

46.902.240

42.661.080

38.752.560

Discounted Gross

Benefit

443.492.280

BIAYA

2

Biaya Modal (Ko)

37.400.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

37.400.000

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

21.708.996

0,909

0,826

0,751

0,683

0,621

0,564

0,513

0,466

(37.400.000)

19.733.477

17.931.631

16.303.456

14.827.244

13.481.287

12.243.874

11.136.715

10.116.392

Biaya Operasional

Biaya Kotor

3

Andai DF=10%

(Tabel DF)

Discounted Gross

Cost

Keterangan :

Total discounted gross benefit = 443.492.280.000 , dicerminkan dengan rumus :

B

C

Karena

443 . 492 . 280 . 000

115. 774 . 076 . 000 37 . 400 . 000 . 000

, rencana tambang adalah Feasible.

2 , 90

115.774.076

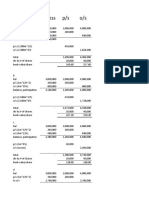

Tabel 10.15 INTERNATIONAL RATE OF RETURN (IRR)

Tahun

Net Benefit

2010

2011

2012

2013

2014

2015

2016

2017

2018

(37.400.000)

55.305.904

55.080.907

55.080.907

55.080.907

55.080.907

55.080.907

55.080.907

55.080.907

Jumlah

IRR = 10% +

IRR = 10% +

DF

10%

1.000

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.466

(37.400.000)

50.273.067

45.682.677

41.534.734

37.773.932

34.344.966

31.192.530

28.371.929

25.772.551

294.946.386

294.946.386.000

x (12 10)

294.946.386.000 192.636.914.000

294.946.386.000

102.309.472.000

DF

12%

1.000

0.893

0.797

0.712

0.636

0.567

0.507

0.452

0.404

NPV

NPV

(37.400.000)

44.893.849

36.409.094

29.572.731

24.024.221

19.473.596

15.814.613

12.824.112

10.412.111

193.424.325

x2

IRR = 10% + 5,77 = 15,77%

Jadi IRR = 15,77%, %, artinya returns to capital invested selama umur ekonomis proyek (8

tahun) adalah 15,77%.

You might also like

- Laporan Keuangan'10 WaserdaDocument25 pagesLaporan Keuangan'10 WaserdaRafid Putrane pak'MudadiNo ratings yet

- SPH - Penggambaran As Built Hotel BaliDocument5 pagesSPH - Penggambaran As Built Hotel BaliBasit Al HanifNo ratings yet

- Harga Perhitungan Sendiri (HPS) : Dinas Permukiman Dan Prasarana Wilayah Kabupaten KupangDocument12 pagesHarga Perhitungan Sendiri (HPS) : Dinas Permukiman Dan Prasarana Wilayah Kabupaten KupangTino SogenNo ratings yet

- Pak NotoDocument9 pagesPak NotopanjiNo ratings yet

- Harga Saham (Y) (RP) X1 X2Document22 pagesHarga Saham (Y) (RP) X1 X2moch riyan riswandiNo ratings yet

- F.M Rev 2019Document17 pagesF.M Rev 2019AA BB MMNo ratings yet

- HPS Master Plan BandaraDocument8 pagesHPS Master Plan BandarairianaNo ratings yet

- Contoh Working Balance SheetDocument4 pagesContoh Working Balance SheetVebyrahmadara100% (3)

- Maulana Ma'rufDocument24 pagesMaulana Ma'rufDennysa AlhikmahNo ratings yet

- 0b. Rab SPV Spam Kalimantong KSB 2017Document2 pages0b. Rab SPV Spam Kalimantong KSB 2017laludafaNo ratings yet

- Copy of Form-Kertas Kerja Jurnal Khusus 1Document85 pagesCopy of Form-Kertas Kerja Jurnal Khusus 107 Angga DiantaraNo ratings yet

- 2016 Example OilMBEDocument10 pages2016 Example OilMBEChristian AvilaNo ratings yet

- Rab Sentra Ikm OkDocument10 pagesRab Sentra Ikm OkJumailMamangNo ratings yet

- Perhitungan Ashadi: NO. Nilai Kontrak Dasar Kena Pajak PPN PPHDocument22 pagesPerhitungan Ashadi: NO. Nilai Kontrak Dasar Kena Pajak PPN PPHSaiful AnwarNo ratings yet

- Kas Piutang Usaha Perlengkapan Studio: Tulis Angka Pengurang Dengan Tanda Minus Di DepannyaDocument4 pagesKas Piutang Usaha Perlengkapan Studio: Tulis Angka Pengurang Dengan Tanda Minus Di Depannyategoeh wiwitNo ratings yet

- Example of CalculationDocument1 pageExample of CalculationAnna Mariana SitungkirNo ratings yet

- Chapter 2Document14 pagesChapter 2Kumar ShivamNo ratings yet

- Spreadsheet Graded ActivityDocument1 pageSpreadsheet Graded ActivityWilliam P. InteNo ratings yet

- Rincian Anggaran Belanja (Rab) TAHUN 2019Document1 pageRincian Anggaran Belanja (Rab) TAHUN 2019kholid iskandarNo ratings yet

- Lampiran IDocument100 pagesLampiran IFebri YantoNo ratings yet

- Rencana Anggaran Biaya (Rab)Document3 pagesRencana Anggaran Biaya (Rab)Exschel Putra SinexNo ratings yet

- Matricial ProcvDocument10 pagesMatricial ProcvRichard Anderson F OliveiraNo ratings yet

- Tabel 2.2. Neraca Sumber Daya Dan Cadangan: Tidak Ada Produksi Tahun 2017Document7 pagesTabel 2.2. Neraca Sumber Daya Dan Cadangan: Tidak Ada Produksi Tahun 2017Ahmad JalaluddinNo ratings yet

- Rab Final Fix Edit 200Document153 pagesRab Final Fix Edit 200Najieb MuhammadNo ratings yet

- CBE 5 Module 5 TrueDocument8 pagesCBE 5 Module 5 TrueChristian John Resabal BiolNo ratings yet

- Kunci Jawaban Soal No. 3.01 SD 3.04Document12 pagesKunci Jawaban Soal No. 3.01 SD 3.04Abdurahman YafieNo ratings yet

- Profil BajaDocument8 pagesProfil BajaAgung ZarkasyNo ratings yet

- EF343. CFS (AL-I) Solution CMA May-2023 Exam.Document8 pagesEF343. CFS (AL-I) Solution CMA May-2023 Exam.GT Moringa LimitedNo ratings yet

- Rab Pasar - KoperasiDocument179 pagesRab Pasar - KoperasialanNo ratings yet

- SMK Bina Teknologi Purwokerto Proyeksi Cash Flow Teaching Factory Tahun 2009/2010Document12 pagesSMK Bina Teknologi Purwokerto Proyeksi Cash Flow Teaching Factory Tahun 2009/2010krismadwibrataNo ratings yet

- Revision - 29 Aug, 28 Aug 2022Document9 pagesRevision - 29 Aug, 28 Aug 2022Kartik SujanNo ratings yet

- Biaya PariswisataDocument32 pagesBiaya Pariswisatayudha trimuliadiNo ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Proposed Budget For NARC Project (AZRI Bhakkar)Document17 pagesProposed Budget For NARC Project (AZRI Bhakkar)Pak CareerNo ratings yet

- invvDocument2 pagesinvvRendra MurviNo ratings yet

- No. Deskripsi Pekerjaan Unit Harga (RP) KeteranganDocument9 pagesNo. Deskripsi Pekerjaan Unit Harga (RP) Keteranganbesolusi tekNo ratings yet

- Rab & Back Up DataDocument104 pagesRab & Back Up DataminthoenaauluNo ratings yet

- Rab WinshoesDocument7 pagesRab WinshoesRatri Devy ArimbiNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- Chapter 6 Invetsment ExercisesDocument14 pagesChapter 6 Invetsment ExercisesAntonio Jose DuarteNo ratings yet

- Ee Masjid 1,2 MDocument20 pagesEe Masjid 1,2 Msigi dinkesNo ratings yet

- CV Usaha JayaDocument57 pagesCV Usaha JayaIndra GunawanNo ratings yet

- HPS Jasa Cleaning Service 2020Document5 pagesHPS Jasa Cleaning Service 2020enoNo ratings yet

- Kunci Jawaban Pra UasDocument7 pagesKunci Jawaban Pra UasKiki Saskia Marta BelaNo ratings yet

- SPPB Metal Deck & End Stop RevDocument1 pageSPPB Metal Deck & End Stop RevYon Galang FebriawanNo ratings yet

- Engineering EconomicDocument10 pagesEngineering EconomicNguyễn Ý100% (1)

- Harga Perhitungan Sendiri: RekapitulasiDocument3 pagesHarga Perhitungan Sendiri: RekapitulasiCholilah MachrusNo ratings yet

- Trabajador Cedula Cargo Departamento: Año A PagarDocument25 pagesTrabajador Cedula Cargo Departamento: Año A PagarJesús EspinozaNo ratings yet

- RAB Mess Saree..Document1 pageRAB Mess Saree..SyuhadaNo ratings yet

- Retail Sales of Grocery Retail Sales of Grocery Goods Business Goods BusinessDocument7 pagesRetail Sales of Grocery Retail Sales of Grocery Goods Business Goods BusinessCSCSANTANUNo ratings yet

- Annuity DepreciationDocument2 pagesAnnuity DepreciationanisahNo ratings yet

- Rencana Anggaran Biaya (Modal Awal) : No Kebutuhan Quantity BeayaDocument6 pagesRencana Anggaran Biaya (Modal Awal) : No Kebutuhan Quantity BeayaArie Hardianto An-nahdliyyinNo ratings yet

- El Modelo de Baumol: Tasa de Interés AnualDocument6 pagesEl Modelo de Baumol: Tasa de Interés AnualvaleriaNo ratings yet

- Soal UAS MOUP-FPIK MLG-MIMIT-23-12-2020Document2 pagesSoal UAS MOUP-FPIK MLG-MIMIT-23-12-2020Sandi TjokroNo ratings yet

- Biaya TowerDocument78 pagesBiaya Towermarnichihui80% (5)

- RAB Rehabilitasi Landscape ALT 1Document11 pagesRAB Rehabilitasi Landscape ALT 1HERU PUTRONo ratings yet

- INTACCDocument6 pagesINTACCAeliey AceNo ratings yet

- DA6 - KCN Bac Cu ChiDocument22 pagesDA6 - KCN Bac Cu ChiChinh Le DinhNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet