Professional Documents

Culture Documents

Long Term Mar09Long-Term Economic Forecast

Long Term Mar09Long-Term Economic Forecast

Uploaded by

International Business TimesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long Term Mar09Long-Term Economic Forecast

Long Term Mar09Long-Term Economic Forecast

Uploaded by

International Business TimesCopyright:

Available Formats

www.td.

com/economics

TD Economics

Long-Term Economic Forecast

March 12, 2009

HIGHLIGHTS

• Following a deep recession in both Canada and the capital formation following the recession cycle. And

U.S. in 2009, the following year is expected to mark then there’s also the influence of a slowing demographic

the first leg of the recovery phase. However, particu- trend, especially in the case of Canada.

larly in the case of the U.S., the recovery in 2010 and • Under these assumptions for potential real GDP growth,

the following years will be shallow relative to historical the output gaps for Canada and the U.S. do not close

experience due to the lingering economic costs from over our forecast horizon, though they do narrow signifi-

recapitalization, deleveraging among businesses and cantly (graphs). In both cases, this would mark the

households, and huge public sector dissaving that will slowest recovery back to the status-quo in post-war his-

need to be reversed. tory.

• The economic recovery gains speed in 2011 and 2012 • The slow uptake in the output gap should mitigate the

with quarterly annualized growth rates of 4% or more in risk that inflation will become problematic once some

Canada and the U.S. However, substantial output gaps of the global and domestic risks abate. This will allow

will remain in both countries during this period, in spite central banks on both sides of the border time to pull

of the fact that we have applied conservative estimates liquidity out of the financial system as the recovery takes

for potential real GDP growth of only 2% in Canada and hold. As such, interest rates will likely remain at a

2.3% in the United States. Both of these are below more accommodative stance for a longer period than

central bank estimates. We’ve incorporated these es- traditionally seen. We don’t believe the Bank of Canada

timates due in part to the impact of the structural eco- will return the overnight rate to a ‘neutral’ stance of 4.00%

nomic influences cited above, but also because we have until nearly the end of the forecast horizon (second half

assumed a downward cyclical influence on the rate of of 2013).

economic growth stemming from depressed levels of Beata Caranci 416-982-8067

CANADIAN OUTPUT GAP U.S. OUTPUT GAP

Per cent of potential GDP Per cent of potential GDP

6 6

4 Excess supply Fcst. 4 Excess supply Fcst.

2 2

0 0

-2 -2

-4 -4

-6 Excess demand -6 Excess demand

-8 -8

-10 -10

81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 11 13 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 11 13

Forecasted by TD Economics as at March 2009. Forecasted by TD Economics as at March 2009.

Source: Bank of Canada Source: Congressional Budget Office

Long-term Economic Forecast 1 March 12, 2009

www.td.com/economics

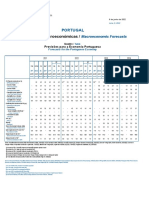

CANADIAN ECONOMIC OUTLOOK:

Period-Over-Period Annualized Per Cent Change Unless Otherwise Indicated

Annual Average 4th Qtr/4th Qtr

08 09F 10F 11F 12F 13F 08 09F 10F 11F 12F 13F

Real GDP 0.5 -2.4 1.3 3.3 4.1 3.2 -0.7 -1.9 2.3 3.9 4.1 2.7

Consumer Expenditure 3.0 -2.0 0.9 2.9 4.7 4.2 0.3 -1.9 2.0 3.7 5.0 3.6

Durable Goods 5.2 -8.3 -0.2 4.9 9.3 7.2 -0.4 -6.6 1.8 7.1 9.2 6.4

Business Investment 1.7 -7.5 -1.3 4.0 6.9 5.3 -2.9 -6.2 1.0 5.4 7.0 4.6

Non-Res. Structures 1.1 -1.1 -0.6 3.6 6.1 3.9 4.1 -3.1 1.1 4.7 6.1 2.9

Machinery & Equipment 2.0 -12.9 -2.0 4.5 7.7 6.7 -8.8 -8.9 0.9 6.1 7.8 6.3

Residential Investment -2.9 -11.1 -1.5 4.4 6.7 3.7 -9.0 -8.2 1.7 5.8 6.1 2.8

Government Expenditure

on Goods & Services 3.4 4.2 4.2 0.8 -0.7 1.3 2.0 6.2 2.1 0.1 -0.6 2.1

Final Domestic Demand 2.5 -1.1 1.4 2.6 3.7 3.6 -0.3 -0.9 2.0 3.1 3.9 3.3

Exports -4.7 -15.2 -1.5 4.8 7.0 5.4 -7.4 -13.9 2.3 6.5 6.6 4.9

Imports 0.7 -14.9 -1.4 3.6 5.8 6.4 -8.4 -12.1 1.5 4.7 6.2 6.4

Change in Non-Farm

Inventories ($97 Bn) 5.5 0.2 -0.7 0.6 2.8 3.2 --- --- --- --- --- ---

Final Sales 0.6 -1.5 1.4 3.0 4.2 3.4 0.4 -1.1 2.2 3.7 4.2 2.9

International Current

Account Balance ($Bn) 10.1 -42.7 -33.6 -24.3 -8.8 -9.5 --- --- --- --- --- ---

% of GDP 0.6 -2.8 -2.2 -1.5 -0.5 -0.5 --- --- --- --- --- ---

Pre-tax Corp. Profits 6.4 -31.4 3.3 20.2 11.8 7.3 -7.3 -25.3 16.7 16.9 9.8 6.0

% of GDP 13.5 9.7 9.9 11.3 11.9 12.1 --- --- --- --- --- ---

GDP Deflator (Y/Y) 3.9 -2.2 0.4 1.4 2.0 1.8 1.8 -0.9 0.5 1.8 2.0 1.7

Nominal GDP 4.4 -4.5 1.7 4.8 6.2 5.1 1.0 -2.8 2.8 5.8 6.1 4.5

Labour Force 1.7 1.0 0.3 0.7 0.9 0.8 1.4 0.7 0.2 0.9 0.9 0.8

Employment (%) 1.5 -2.1 -0.6 1.2 1.7 2.0 0.8 -3.0 0.5 1.4 1.8 2.1

Employment ('000s) 258 -365 -106 194 279 337 134 -520 81 231 304 356

Unemployment Rate (%) 6.2 9.0 9.9 9.5 8.8 7.8 --- --- --- --- --- ---

Personal Disp. Income 6.0 0.4 1.9 3.7 5.1 5.5 5.0 -0.5 3.0 4.2 5.2 5.2

Pers. Savings Rate (%) 3.7 6.0 6.6 6.4 6.7 6.7 --- --- --- --- --- ---

Cons. Price Index (Y/Y) 2.4 -0.8 0.8 1.2 1.7 1.9 1.9 -0.5 1.0 1.5 1.8 2.0

Core CPI (Y/Y) 1.7 0.9 0.8 1.1 1.5 1.8 2.2 0.3 0.9 1.3 1.6 2.0

Housing Starts ('000s) 211 129 135 150 171 175 --- --- --- --- --- ---

Productivity:

Real GDP / worker (Y/Y) -1.1 0.0 2.0 2.0 2.7 1.3 -1.2 1.3 1.8 2.4 2.5 0.8

F: Forecast by TD Economics as at March 2009

Source: Statistics Canada, Bank of Canada, Canada Mortgage and Housing Corporation, Haver Analytics

Long-term Economic Forecast 2 March 12, 2009

www.td.com/economics

U.S. ECONOMIC OUTLOOK:

Period-Over-Period Annualized Per Cent Change Unless Otherwise Indicated

Annual Average 4thQtr/4th Qtr

08 09F 10F 11F 12F 13F 08 09F 10F 11F 12F 13F

Real GDP 1.1 -3.1 1.4 3.6 4.5 3.5 -0.8 -2.1 2.4 4.4 4.2 3.2

Consumer Expenditure 0.2 -1.6 1.2 2.9 3.6 2.9 -1.5 -0.3 2.0 3.6 3.4 2.7

Durable Goods -4.3 -7.7 5.6 9.9 10.9 9.4 -11.4 0.2 7.1 11.3 10.5 8.9

Business Investment 1.7 -16.7 -6.5 5.7 11.9 8.2 -5.0 -17.6 -0.7 9.8 11.3 6.6

Non-Res. Structures 11.5 -10.8 -4.5 0.6 0.4 -0.1 7.3 -15.2 -0.7 0.8 0.3 -0.3

Machinery & Equipment -3.0 -19.9 -7.8 9.3 19.3 12.6 -11.2 -19.1 -0.8 16.0 17.9 10.0

Residential Construction -20.7 -25.1 -0.2 25.6 26.9 13.4 -19.3 -22.9 12.1 29.5 23.4 8.7

Govt. Consumption

& Gross Investment 2.9 2.5 2.1 0.3 -0.6 0.6 3.3 2.4 1.3 -0.5 -0.1 1.1

Final Domestic Demand 0.0 -3.1 0.7 3.1 4.1 3.3 -1.7 -2.2 1.9 3.9 4.0 3.0

Exports 6.2 -9.1 2.5 6.5 8.8 7.9 -1.8 -5.3 3.9 8.3 8.5 7.5

Imports -3.4 -10.4 0.7 6.0 7.2 5.6 -7.1 -7.2 3.4 6.9 7.0 4.9

Change in Non-Farm

Inventories ($96 Bn) -32.8 -72.9 -16.5 36.5 70.6 72.4 --- --- --- --- --- ---

Final Sales 1.4 -2.7 0.9 3.1 4.2 3.5 -0.7 -1.8 1.9 3.9 4.0 3.3

International Current

Account Balance ($Bn) -660 -514 -525 -578 -633 -702 --- --- --- --- --- ---

% of GDP -4.6 -3.7 -3.7 -3.9 -4.0 -4.2 --- --- --- --- --- ---

Pre-tax Corporate Profits

including IVA&CCA -10.5 -28.2 11.9 17.8 14.2 12.2 -23.3 -14.6 18.9 15.6 15.1 10.5

% of GDP 10.3 7.5 8.3 9.3 10.1 10.8 --- --- --- --- --- ---

GDP Deflator (Y/Y) 2.2 1.4 0.2 0.7 1.3 1.6 2.0 1.0 0.1 1.1 1.4 1.7

Nominal GDP 3.3 -1.7 1.6 4.3 5.8 5.1 1.2 -1.2 2.5 5.5 5.6 4.9

Labour Force 0.8 -0.3 0.2 0.8 1.1 1.1 0.7 -0.6 0.5 0.9 1.1 1.1

Employment -0.4 -3.5 -0.8 2.0 3.0 2.6 -1.6 -3.5 0.5 2.7 2.9 2.4

Change in Empl. ('000s) -558 -4,759 -1,120 2,664 3,986 3,608 -2,239 -4,781 717 1,632 2,386 3,049

Unemployment Rate (%) 5.8 8.9 10.1 9.6 8.4 7.5 --- --- --- --- --- ---

Personal Disp. Income 4.7 1.9 1.2 3.8 5.3 4.7 2.9 2.0 1.9 5.1 5.0 4.6

Pers. Savings Rate (%) 1.8 5.2 4.8 4.8 4.9 4.9 --- --- --- --- --- ---

Cons. Price Index (Y/Y) 3.8 -0.9 0.5 1.0 1.5 1.9 1.5 -0.1 0.6 1.2 1.7 2.1

Core CPI (Y/Y) 2.3 1.0 0.5 0.8 1.4 1.9 2.0 0.6 0.6 1.0 1.6 2.1

Housing Starts (mns) 0.90 0.44 0.53 0.87 1.23 1.40 --- --- --- --- --- ---

Productivity:

Real Output per hour (y/y) 2.2 1.7 2.8 2.1 1.8 1.4 1.1 1.8 2.5 2.1 1.7 1.2

F: Forecast by TD Economics as at March 2009

Source: U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, TD Economics

Long-term Economic Forecast 3 March 12, 2009

www.td.com/economics

This report is provided by TD Economics for customers of TD Bank Financial Group. It is for information purposes only and may not

be appropriate for other purposes. The report does not provide material information about the business and affairs of TD Bank

Financial Group and the members of TD Economics are not spokespersons for TD Bank Financial Group with respect to its

business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not

guaranteed to be accurate or complete. The report contains economic analysis and views, including about future economic and

financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and

uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that

comprise TD Bank Financial Group are not liable for any errors or omissions in the information, analysis or views contained in this

report, or for any loss or damage suffered.

Long-term Economic Forecast 4 March 12, 2009

You might also like

- Clickworker AnswersDocument11 pagesClickworker Answersmohcen haji60% (63)

- Financial and Management Accounting QuizDocument5 pagesFinancial and Management Accounting Quizvignesh100% (1)

- Group D - Case 18 Worldwide Paper CompanyDocument13 pagesGroup D - Case 18 Worldwide Paper CompanyVinithi Thongkampala100% (1)

- Harold Camping: We Are Almost There!Document80 pagesHarold Camping: We Are Almost There!International Business Times100% (3)

- Reserve Bank of India: Attn BeneficiaryDocument17 pagesReserve Bank of India: Attn BeneficiaryVineet GuptaNo ratings yet

- Delhi Public School Sangrur: Multiple Choice QuestionsDocument9 pagesDelhi Public School Sangrur: Multiple Choice Questionsprateek gargNo ratings yet

- Whitney Houston Coroner ReportDocument42 pagesWhitney Houston Coroner ReportSharonWaxman100% (4)

- Assignment - Writing Business CommunicationDocument8 pagesAssignment - Writing Business CommunicationRohan NandiNo ratings yet

- GS FX TearsheetsDocument11 pagesGS FX TearsheetsZerohedgeNo ratings yet

- Weekly Trends July 23Document12 pagesWeekly Trends July 23derailedcapitalism.comNo ratings yet

- Economic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Document3 pagesEconomic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Rhb InvestNo ratings yet

- Economic Forecast ColombiaDocument3 pagesEconomic Forecast Colombiasuper_sumoNo ratings yet

- Crisil Economy First Cut Cutting GDP Growth To 6point3percent in Fiscal 2020Document8 pagesCrisil Economy First Cut Cutting GDP Growth To 6point3percent in Fiscal 2020VibWho R EahNo ratings yet

- State Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeDocument18 pagesState Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeFrank A. Cusumano, Jr.No ratings yet

- Yardeni - Stategist Handbook - 2019Document24 pagesYardeni - Stategist Handbook - 2019scribbugNo ratings yet

- Gross National ProductDocument1 pageGross National ProductJoy CaliaoNo ratings yet

- BNSMT - December 4 - 2009Document12 pagesBNSMT - December 4 - 2009Miir ViirNo ratings yet

- Forecast 2019Q3Document6 pagesForecast 2019Q3Muhammad HarunrashidNo ratings yet

- Economic Highlights - A Smaller Current Account Surplus in The 2Q - 03/09/2010Document3 pagesEconomic Highlights - A Smaller Current Account Surplus in The 2Q - 03/09/2010Rhb InvestNo ratings yet

- BOC Policy RPT July 2010Document4 pagesBOC Policy RPT July 2010Douglas FunkNo ratings yet

- South Africa 2021 Budget PresentationDocument20 pagesSouth Africa 2021 Budget PresentationReynold HopeNo ratings yet

- 1SOMEA2022002Document108 pages1SOMEA2022002South West Youth Council AssociationNo ratings yet

- State of Pakistan EconomyDocument8 pagesState of Pakistan EconomyMuhammad KashifNo ratings yet

- Budget Call Circular FY2017 39 - 080716Document13 pagesBudget Call Circular FY2017 39 - 080716sorenttoNo ratings yet

- Chart PackDocument83 pagesChart PackDksndNo ratings yet

- Economic Highlights: Vietnam: Real GDP Picked Up in The 1Q, Economic Outlook Remains Bright-01/04/2010Document3 pagesEconomic Highlights: Vietnam: Real GDP Picked Up in The 1Q, Economic Outlook Remains Bright-01/04/2010Rhb InvestNo ratings yet

- 1CRIEA2022001Document115 pages1CRIEA2022001anastasiabeauty1803No ratings yet

- Spanish Treasury Chart Pack: April 2022Document81 pagesSpanish Treasury Chart Pack: April 2022andres rebosoNo ratings yet

- Yuhgfdvcxswert SdhgfscedrftDocument4 pagesYuhgfdvcxswert Sdhgfscedrftsolomonberak56No ratings yet

- 48 - IEW March 2014Document13 pages48 - IEW March 2014girishrajsNo ratings yet

- Previsões para A Economia PortuguesaDocument1 pagePrevisões para A Economia Portuguesairina2304No ratings yet

- Consumer Outlook: September 2009Document23 pagesConsumer Outlook: September 2009Lynk CusNo ratings yet

- ScotiaBank JUN 11 Weekly TrendDocument9 pagesScotiaBank JUN 11 Weekly TrendMiir ViirNo ratings yet

- Fiji's Economy: The Challenge of The FutureDocument41 pagesFiji's Economy: The Challenge of The FutureFederico YouNo ratings yet

- Scotia Weekly TrendsDocument11 pagesScotia Weekly Trendsdaniel_austinNo ratings yet

- Economic Highlights - Current Account Surplus Widened in The 1Q - 10/6/2010Document2 pagesEconomic Highlights - Current Account Surplus Widened in The 1Q - 10/6/2010Rhb InvestNo ratings yet

- U.S. Watch: U.S.: Make The Budget Deficit Great AgainDocument3 pagesU.S. Watch: U.S.: Make The Budget Deficit Great AgainJustinC.PaoliniNo ratings yet

- Quarterly Economic DataDocument1 pageQuarterly Economic Dataapi-25887578No ratings yet

- No More TimeDocument7 pagesNo More TimeJorge Monzó BergéNo ratings yet

- OECD's Interim AssessmentDocument23 pagesOECD's Interim AssessmentTheGlobeandMailNo ratings yet

- Market Review - March 2024 (Yearly Update)Document9 pagesMarket Review - March 2024 (Yearly Update)Akshay ChaudhryNo ratings yet

- 2010 Annual OutlookDocument28 pages2010 Annual OutlookTRIFMAKNo ratings yet

- Jamaica:: Taming The Fiscal Beast or Saddling More Debt?Document14 pagesJamaica:: Taming The Fiscal Beast or Saddling More Debt?api-55502024No ratings yet

- RBC Provincial UpdateDocument6 pagesRBC Provincial UpdateagampasivNo ratings yet

- Forecast 2018q4Document8 pagesForecast 2018q4Muhammad HarunrashidNo ratings yet

- Fin - Accounts DecemberDocument198 pagesFin - Accounts DecemberAdm TntNo ratings yet

- Budget 2010Document42 pagesBudget 2010Swarup Kumar PaniNo ratings yet

- ITC Quarterly Result Presentation Q3 FY2021Document46 pagesITC Quarterly Result Presentation Q3 FY2021Vineet UttamNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- Second Quarterly ReportDocument67 pagesSecond Quarterly ReportsultanabidNo ratings yet

- Philippines Economic Outlook RESIDE2Document61 pagesPhilippines Economic Outlook RESIDE2Renato E. Reside Jr.No ratings yet

- Cambodia Recent Macroeconomic and Financial Sector Developments 2008Document114 pagesCambodia Recent Macroeconomic and Financial Sector Developments 2008Chan RithNo ratings yet

- Budget FY12: Where Is The Headroom, Mr. Mukherjee?Document5 pagesBudget FY12: Where Is The Headroom, Mr. Mukherjee?Hitesh GuptaNo ratings yet

- Somalia-IMF Review ReportDocument60 pagesSomalia-IMF Review ReportdavidxyNo ratings yet

- Outlooked EconomyDocument1 pageOutlooked Economyshaan1001gbNo ratings yet

- Economic Outlook: 1.1 OverviewDocument12 pagesEconomic Outlook: 1.1 OverviewMuhammad AbrarNo ratings yet

- 1390-Quarterly Fiscal Bulletin 4Document44 pages1390-Quarterly Fiscal Bulletin 4Macro Fiscal PerformanceNo ratings yet

- Weekly Economic & Financial Commentary 14octDocument13 pagesWeekly Economic & Financial Commentary 14octErick Abraham MarlissaNo ratings yet

- (IMF Working Papers) Barbados' 2018-19 Sovereign Debt Restructuring-A Sea ChangeDocument23 pages(IMF Working Papers) Barbados' 2018-19 Sovereign Debt Restructuring-A Sea ChangeEmiliaNo ratings yet

- StillwaterDocument14 pagesStillwaterrock7902No ratings yet

- Global Financial Crisis and Short Run Prospects by Raghbander ShahDocument24 pagesGlobal Financial Crisis and Short Run Prospects by Raghbander ShahakshaywaikersNo ratings yet

- Business in Portuguese BICDocument26 pagesBusiness in Portuguese BICRadu Victor TapuNo ratings yet

- Foundry Industry 2025 - Tomorrow S Challenges Due To Changing Market ConditionsDocument40 pagesFoundry Industry 2025 - Tomorrow S Challenges Due To Changing Market ConditionsVALANSNo ratings yet

- CF 2023 Module IIDocument270 pagesCF 2023 Module IIFabio MotaNo ratings yet

- UK Macro Strategy - 21 November 2019Document16 pagesUK Macro Strategy - 21 November 2019Nikolaus HildebrandNo ratings yet

- Crushed & Broken Stone Products World Summary: Market Values & Financials by CountryFrom EverandCrushed & Broken Stone Products World Summary: Market Values & Financials by CountryNo ratings yet

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Immigration Standards 3 0Document1 pageImmigration Standards 3 0International Business TimesNo ratings yet

- Gang of Eight Immigration ProposalDocument844 pagesGang of Eight Immigration ProposalThe Washington PostNo ratings yet

- Έρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)Document108 pagesΈρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)LawNetNo ratings yet

- CPAC ScheduleDocument18 pagesCPAC ScheduleFoxNewsInsiderNo ratings yet

- HHS Letter-February Sequester HearingDocument3 pagesHHS Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Department of Commerce Sequestration Letter To CongressDocument4 pagesDepartment of Commerce Sequestration Letter To CongressFedScoopNo ratings yet

- Homeland Letter-February Sequester HearingDocument3 pagesHomeland Letter-February Sequester HearingInternational Business TimesNo ratings yet

- University of Notre Dame v. HHS Et AlDocument57 pagesUniversity of Notre Dame v. HHS Et AlDoug MataconisNo ratings yet

- Supreme Court of The United States: Wal-Mart Stores, Inc. V. DukesDocument53 pagesSupreme Court of The United States: Wal-Mart Stores, Inc. V. DukesInternational Business TimesNo ratings yet

- EtfilesDocument33 pagesEtfilesInternational Business TimesNo ratings yet

- Supreme Court of The United States: Wal-Mart Stores, Inc. V. DukesDocument53 pagesSupreme Court of The United States: Wal-Mart Stores, Inc. V. DukesInternational Business TimesNo ratings yet

- EtfilesDocument33 pagesEtfilesInternational Business TimesNo ratings yet

- Walmart Stores v. Dukes Et AlDocument42 pagesWalmart Stores v. Dukes Et AlDoug MataconisNo ratings yet

- Intelligent Investor UK Edition. March 2 2011Document5 pagesIntelligent Investor UK Edition. March 2 2011International Business TimesNo ratings yet

- Fao Global Information and Early Warning System On Food and Agriculture (Giews)Document4 pagesFao Global Information and Early Warning System On Food and Agriculture (Giews)International Business TimesNo ratings yet

- Us 2012 Budget - Gov Isbn 978 0 16 087366 9Document216 pagesUs 2012 Budget - Gov Isbn 978 0 16 087366 9UCSDresearchNo ratings yet

- US Inflation '10, Y-O-Y % ChangeDocument2 pagesUS Inflation '10, Y-O-Y % ChangeInternational Business TimesNo ratings yet

- Sept 5 2002 US Iraq WMD ReportDocument9 pagesSept 5 2002 US Iraq WMD ReportInternational Business TimesNo ratings yet

- Tax Calculation Summary Notes: 6 April 2015 To 5 April 2016Document46 pagesTax Calculation Summary Notes: 6 April 2015 To 5 April 2016coolmanzNo ratings yet

- The Time Value of MoneyDocument68 pagesThe Time Value of MoneyTayyaba JawedNo ratings yet

- 2022 08-16-2020 1st Year 2nd Semester Time Table Copy 3Document15 pages2022 08-16-2020 1st Year 2nd Semester Time Table Copy 3Aruna DeepalNo ratings yet

- Business Studies - MR 6pointsDocument77 pagesBusiness Studies - MR 6pointsCalebNo ratings yet

- FF77A6D5-64BF-42A6-AAA0-8B1EFB89153FDocument3 pagesFF77A6D5-64BF-42A6-AAA0-8B1EFB89153FSebastian ContrerasNo ratings yet

- Cairns India Private LimitedDocument25 pagesCairns India Private LimitedSuruchi GoyalNo ratings yet

- FRIA Case Digests 2020Document21 pagesFRIA Case Digests 2020Mae100% (1)

- Changes in Marginal Cost of Lending Rate (MCLR) (Company Update)Document1 pageChanges in Marginal Cost of Lending Rate (MCLR) (Company Update)Shyam SunderNo ratings yet

- Tower Signals: As Rentals Decline, Valuations Come Into FocusDocument7 pagesTower Signals: As Rentals Decline, Valuations Come Into FocusHari SreyasNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- Risk Return AnalysisDocument108 pagesRisk Return AnalysisduraiworldNo ratings yet

- Co Operative BankDocument19 pagesCo Operative BankritzchavanNo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- Lost Decade (1988-1999)Document26 pagesLost Decade (1988-1999)Shaheen WaheedNo ratings yet

- Research Study On Puravankara Limited: Umang ShekarDocument13 pagesResearch Study On Puravankara Limited: Umang ShekarUmang ShekarNo ratings yet

- Elena Presentation enDocument32 pagesElena Presentation enSorin DinuNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- Investment Tips For The BeginnerDocument11 pagesInvestment Tips For The Beginnerfly2vvNo ratings yet

- Week 7 Seminar QuestionsDocument4 pagesWeek 7 Seminar QuestionsBhanu TejaNo ratings yet

- Answer - Alex Rodriguez CaseDocument8 pagesAnswer - Alex Rodriguez CaseNice Dela RocaNo ratings yet

- Bank Confirmation LetterDocument3 pagesBank Confirmation Lettertmir_1100% (1)

- AssignmentDocument3 pagesAssignmentjanineNo ratings yet

- Financial Stability Report June 2022.pdf - ENDocument112 pagesFinancial Stability Report June 2022.pdf - ENFatiha YagoubNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet