Professional Documents

Culture Documents

March Update 2013

March Update 2013

Uploaded by

Holly BrattCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

March Update 2013

March Update 2013

Uploaded by

Holly BrattCopyright:

Available Formats

The Best Budget in Canada

Saskatchewan has another balanced budget. Despite pressure on oil and potash revenues, and growth-driven demand for infrastructure, we are the only province living on the money we make. Why such a big deal? Because governments that give in to borrowing find it very, very difficult to kick the habit. We all like the public programs that subsidize us. Governments that reduce our favourite programs usually get punished. So not taking that first puff of addictive borrowing is important - just say NO. The present government is strict about debt. When potash revenue dropped a massive $2 billion in 2010, they found ways to economize. And when they had a windfall in 2008, they paid off debt instead of spending it all. Today we have the lowest provincial debt in Canada. A few months ago, Finance Minister Ken Krawetz asked your Government Affairs committee to suggest priorities for this budget. The top recommendation: Do not borrow; stay in the black. There is a cost to staying in balance: liquor and smoking will cost more; the corporate income tax will not be reduced as planned; education spending is going to be limited. But, this isnt a mean budget. People with disabilities will get higher allowances. Student aid is going up. Theres more money for cutting surgery waits and raising housing supplements. Cities are getting 12% more in revenue sharing. Uranium royalties are being changed to encourage new investment. Choices were made, money is moving around inside the government to reflect priorities, not just demands.

Housing Gets Attention

The 10% rental tax credit, introduced last year, is continuing this year. It offers lower taxes on income from new rental buildings. This innovative and unique-inCanada idea makes excellent use of public funds, as an incentive to attract new private investment into a high-need sector. Uptake on the credit is slow. One reason is many investors arent aware of it. Another reason is opportunity cost even with the credit, money can turn over faster in building to sell. But the principle is sound and will eventually take hold as the market adjusts.

March 2013 - #42

Housing Gets Attention - contd

Two changes will help with the rental shortage. One is simple: open more land to build on. We need new thinking in community planning processes and priorities. Approvals are complex, and process is slow. The current fad in planning is densification, which translates into less land being developed and allocated for multi-unit development. We need more land, not less; we need plans that reflect Saskatchewan reality instead of the latest fashions in Vancouver or Toronto. The second change will have to come from the market. Real estate investment trusts can recycle dollars used to build rental apartments. Stable long-term returns are highly marketable in todays low-interest environment. The key is reviving Saskatchewans rental construction sector, and linking it to the REIT demand for returns.

Assessment and Property Taxes

The budget changes how the government sets its mill rate on commercial property. Up to now, the rate has varied, going up as assessed value rises. Going forward a single 8.28 mill rate will apply to all commercial property, and a separate class is being created for resource property. Simplification is good. Upcharging resource investment is hopefully a short-term transitional measure. The larger issue is why we tax property on its assessed value. The disruption created by this years reassessment points out the need for a better alternative. ASR has asked the government to begin work on a new model for property tax that doesnt rely on appraised value. Assessment is clumsy and costly, and slow. No sooner is an assessment rolled out than it is outdated by the market. Worse, taxing on the basis of value sets up a disincentive to improve and creates a tax on capital. We need a new, less expensive and much more flexible model. And while were at it, lets look at consolidating how we tax homes, farms and businesses under a common system.

Government Relations Committee Members

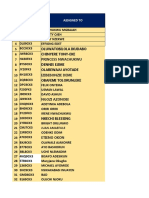

Al Didur, Co-Chairperson Ian Johnston, Co-Chairperson Gord Archibald Al Weiler Jason Yochim Len Wassill Alek Arsenic Saskatoon Regina Regina Lloydminster Saskatoon Yorkton Regina 373.7520 533.7421 791.2700 821.6262 343.3440 728.4600 359.1900 955.6235 525.1433 781.7940 780.875.5584 343.1420 728.2103 352.9696 aldidur@realtyexecutives.com ianjohnston@sasktel.net garchibald@reginarealtors.com al.weiler@bhgress.ca Jason@srar.ca Len.wassill@century21.ca alek58@hotmail.com

March 2013 - #42

You might also like

- Guideline For Developing Utility Scale Solar Project in Nepal, 2018Document239 pagesGuideline For Developing Utility Scale Solar Project in Nepal, 2018Swatantra KarnaNo ratings yet

- Governor Maggie Hassan's 2015 Budget AddressDocument16 pagesGovernor Maggie Hassan's 2015 Budget AddressRebecca LavoieNo ratings yet

- October 5, 2018: Andrew M. Cuomo Robert F. Mujica Jr. Sandra L. BeattieDocument2 pagesOctober 5, 2018: Andrew M. Cuomo Robert F. Mujica Jr. Sandra L. BeattieNick ReismanNo ratings yet

- International Facility Management Association Certified Facility Manager® (CFM®) Competency GuideDocument11 pagesInternational Facility Management Association Certified Facility Manager® (CFM®) Competency Guidegangulyranjith6112No ratings yet

- Joint Tax Hearing-Ron DeutschDocument18 pagesJoint Tax Hearing-Ron DeutschZacharyEJWilliamsNo ratings yet

- DOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)Document6 pagesDOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)NorwichBulletin.comNo ratings yet

- 2 0 1 2 P A: U NY: Olicy Genda NlockDocument8 pages2 0 1 2 P A: U NY: Olicy Genda NlockNick ReismanNo ratings yet

- Danny Tarkanian News Release 2-8-2010Document5 pagesDanny Tarkanian News Release 2-8-2010amandahurl1010No ratings yet

- IDC Historic Rehabilitation Tax Credit Report - March 16, 2011Document16 pagesIDC Historic Rehabilitation Tax Credit Report - March 16, 2011robertharding22No ratings yet

- ECON 13 - Reflection Paper No. 1Document1 pageECON 13 - Reflection Paper No. 1Leianneza PioquintoNo ratings yet

- Wealth Tax Commission Final ReportDocument10 pagesWealth Tax Commission Final Report张楚涵No ratings yet

- Budget Deficit ThesisDocument5 pagesBudget Deficit ThesisErica Thompson100% (1)

- Tax Thesis TopicsDocument6 pagesTax Thesis Topicsiinlutvff100% (2)

- Budget Balance (Chapter 12) + Calculating Different Types of Budget Deficit in EgyptDocument24 pagesBudget Balance (Chapter 12) + Calculating Different Types of Budget Deficit in EgyptEl jokerNo ratings yet

- Budget 2014 IMP PointsDocument1 pageBudget 2014 IMP PointsMpathak28No ratings yet

- Capitol Update 11Document2 pagesCapitol Update 11Terri BonoffNo ratings yet

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- B. Tech Cs Vi Semester (Section - C) Eco307 Fundamentals of Economics Assignment - 1Document6 pagesB. Tech Cs Vi Semester (Section - C) Eco307 Fundamentals of Economics Assignment - 1Vartika AgrawalNo ratings yet

- CFO Opening StatementDocument3 pagesCFO Opening StatementThe Daily LineNo ratings yet

- Cutting Popular U.S. Tax Programs Could Harm Tax-Exempt Bond IssuersDocument8 pagesCutting Popular U.S. Tax Programs Could Harm Tax-Exempt Bond Issuersapi-227433089No ratings yet

- Embargoed Until Speech DeliveryDocument7 pagesEmbargoed Until Speech DeliveryEnvironmental CapitalNo ratings yet

- The Low-Income Housing Tax Credit: How It Works and Who It ServesDocument28 pagesThe Low-Income Housing Tax Credit: How It Works and Who It ServesAna Milena Prada100% (1)

- New York at A Crossroads: A Transformation Plan For A New New YorkDocument31 pagesNew York at A Crossroads: A Transformation Plan For A New New YorkwqwerNo ratings yet

- Research Paper On Income TaxDocument7 pagesResearch Paper On Income Taxafedonkfh100% (1)

- WFP MemoDocument3 pagesWFP MemoJimmyVielkindNo ratings yet

- Thesis Pending Council TaxDocument4 pagesThesis Pending Council Taxsherielliottbillings100% (2)

- Progressive Principles of Tax ReformDocument3 pagesProgressive Principles of Tax ReformNational JournalNo ratings yet

- Nunavut Finance Minister 2017-18 Budget AddressDocument14 pagesNunavut Finance Minister 2017-18 Budget AddressNunatsiaqNewsNo ratings yet

- Tax Answer BankDocument13 pagesTax Answer BankShadreck VanganaNo ratings yet

- Empire State Freedom Plan - 9-28-18Document23 pagesEmpire State Freedom Plan - 9-28-18MolinaroNo ratings yet

- Hydro ReportDocument42 pagesHydro ReportNational PostNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Citi Ar 2008Document252 pagesCiti Ar 2008kiwilanderNo ratings yet

- Cutting The Cost of Government: Uniting Finance and Technology For InnovationDocument8 pagesCutting The Cost of Government: Uniting Finance and Technology For InnovationMike JohnsonNo ratings yet

- Bam q2 2015 LTR To ShareholdersDocument6 pagesBam q2 2015 LTR To ShareholdersDan-S. ErmicioiNo ratings yet

- Replacing The Home Mortgage Interest DeductionDocument5 pagesReplacing The Home Mortgage Interest DeductionKaren L YoungNo ratings yet

- Revenue Sharing ReportDocument12 pagesRevenue Sharing ReportMaine Policy InstituteNo ratings yet

- Tonys View 30 May 2024Document5 pagesTonys View 30 May 2024fwan010No ratings yet

- Citigroup TARP ReportDocument43 pagesCitigroup TARP ReportFOXBusiness.com100% (6)

- The Fed Is TrappedDocument25 pagesThe Fed Is TrappedYog MehtaNo ratings yet

- Executive Budget FY 18 Briefing BookDocument140 pagesExecutive Budget FY 18 Briefing BookMatthew HamiltonNo ratings yet

- Horizon Real EstateDocument72 pagesHorizon Real EstateShobhit GoswamiNo ratings yet

- Discussion Paper - Municipal BondsDocument3 pagesDiscussion Paper - Municipal BondsmalyalarahulNo ratings yet

- BED1201Document3 pagesBED1201cyrusNo ratings yet

- Barbados InsolvencyDocument7 pagesBarbados InsolvencyGeorgeConnollyNo ratings yet

- Tom Killion: Dear NeighborDocument4 pagesTom Killion: Dear NeighborPAHouseGOPNo ratings yet

- Australia: Open For BusinessDocument7 pagesAustralia: Open For Businessapi-81108585No ratings yet

- Chapter 1 Taxation 2 Onsite Bba3 June To August 2021Document20 pagesChapter 1 Taxation 2 Onsite Bba3 June To August 2021hamidNo ratings yet

- ECO209 Present OutlineDocument3 pagesECO209 Present OutlineManda ChungNo ratings yet

- Dissertation Taxation TopicsDocument5 pagesDissertation Taxation TopicsPurchaseCollegePapersOlathe100% (1)

- Background and Summary of Fiscal Commission PlanDocument8 pagesBackground and Summary of Fiscal Commission PlanCommittee For a Responsible Federal BudgetNo ratings yet

- Horizon Real EstateDocument71 pagesHorizon Real EstateAshutoshSharmaNo ratings yet

- Fair Economic ReturnDocument24 pagesFair Economic ReturngaryhostNo ratings yet

- MadeInAmericaTaxPlan ReportDocument19 pagesMadeInAmericaTaxPlan ReportZerohedge100% (1)

- Notes On Gov. Deval Patrick's Proposed Tax Reforms, As Provided by The State Office of Administration and FinanceDocument2 pagesNotes On Gov. Deval Patrick's Proposed Tax Reforms, As Provided by The State Office of Administration and FinanceMassLiveNo ratings yet

- Company Tax Change in Limbo: Sneak PeekDocument6 pagesCompany Tax Change in Limbo: Sneak PeekAnonymous bxETEAczsNo ratings yet

- Although The Zimbabwean Government and Other Supporting Institutions Are Fully Committed To Support The Emerging Potential EntrepreneursDocument3 pagesAlthough The Zimbabwean Government and Other Supporting Institutions Are Fully Committed To Support The Emerging Potential EntrepreneursJames Mabasanwa VashiriNo ratings yet

- Understanding The Budget Proposal 2019Document6 pagesUnderstanding The Budget Proposal 2019Rainwalker Tatterheart100% (1)

- Ricardian Equivalnce: What Does It Mean?Document4 pagesRicardian Equivalnce: What Does It Mean?sakshi sharmaNo ratings yet

- New PC Allocation RegistryDocument67 pagesNew PC Allocation RegistryDaniel AbrahamNo ratings yet

- Ifrs6 en PDFDocument5 pagesIfrs6 en PDFrobbi ajaNo ratings yet

- Developing A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanDocument32 pagesDeveloping A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanBhagyanath MenonNo ratings yet

- Cadre Review Trade Notice NO 01/2014-CC (LZ) DATED 08.10.2014Document2 pagesCadre Review Trade Notice NO 01/2014-CC (LZ) DATED 08.10.2014SUSHIL KUMARNo ratings yet

- Present Value of A Single Amount TableDocument1 pagePresent Value of A Single Amount TableAntonette CastilloNo ratings yet

- Entrepreneurship Development Project - Old Age HomeDocument53 pagesEntrepreneurship Development Project - Old Age Hometanime67% (3)

- Kamus Candle StickDocument89 pagesKamus Candle Stickrudi eko prasetyoNo ratings yet

- Department of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityDocument1 pageDepartment of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityRay FaustinoNo ratings yet

- Scrum Master AgreementDocument5 pagesScrum Master AgreementNoorul AmeenNo ratings yet

- Strategic Business Management July 2016 Exam PaperDocument20 pagesStrategic Business Management July 2016 Exam PaperWong AndrewNo ratings yet

- Reftop Gardens Faq PDFDocument4 pagesReftop Gardens Faq PDFRuthNo ratings yet

- Sprott Money Ltd. DAF and Referral DisclosureDocument4 pagesSprott Money Ltd. DAF and Referral DisclosureSoodooNavindraNo ratings yet

- FIRB-Approved ProjectsDocument4 pagesFIRB-Approved ProjectsRapplerNo ratings yet

- Taxation LawDocument4 pagesTaxation Lawvisha183240No ratings yet

- Political Activism of Social Work Educators Nancy L. Mary, DSWDocument21 pagesPolitical Activism of Social Work Educators Nancy L. Mary, DSWAmory JimenezNo ratings yet

- Chapter 19Document5 pagesChapter 19Tabib HabibNo ratings yet

- Working Capital Assesment: Turn Over Method (For Micro and Small Units Upto Rs 500 Lacs and For Others Upto Rs 100 LacsDocument2 pagesWorking Capital Assesment: Turn Over Method (For Micro and Small Units Upto Rs 500 Lacs and For Others Upto Rs 100 LacsChirpi CeliaNo ratings yet

- Opm Pmac ExampleDocument21 pagesOpm Pmac Exampleענת מדמוני100% (1)

- 1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageDocument109 pages1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageIsaiah WaltersNo ratings yet

- City of Iloilo vs. Smart CommunicationsDocument7 pagesCity of Iloilo vs. Smart CommunicationsDivinoCzarA.AndalesNo ratings yet

- Presentation On Foreign Banks in IndiaDocument20 pagesPresentation On Foreign Banks in IndiaPranshu021100% (1)

- WEYCO GROUP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document2 pagesWEYCO GROUP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.com0% (1)

- Encl.13 Ikatan Otoriti PemohonDocument51 pagesEncl.13 Ikatan Otoriti PemohonCheong YuthengNo ratings yet

- Theory Questions 1 FMDocument3 pagesTheory Questions 1 FMQuestionscastle Friend100% (1)

- Income 2023 Notification PDFDocument2 pagesIncome 2023 Notification PDFsaicharan0022No ratings yet

- Finance 100: Corporate Finance: Professor Michael R. Roberts Quiz 3 November 28, 2007Document8 pagesFinance 100: Corporate Finance: Professor Michael R. Roberts Quiz 3 November 28, 2007pvaibhyNo ratings yet

- All SAP Reports-TcodesDocument16 pagesAll SAP Reports-Tcodesmano0% (1)

- Special Resident Retirees Visa SRRV InfoDocument6 pagesSpecial Resident Retirees Visa SRRV InfoMary Heide H. AmoraNo ratings yet