Professional Documents

Culture Documents

Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite Slowdown

Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite Slowdown

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite Slowdown

Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite Slowdown

Uploaded by

Impulsive collectorCopyright:

Available Formats

18 theSun | MONDAY MARCH 16 2009

business

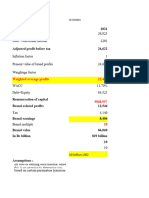

KL market summary

Banks committed to supporting

MARCH 13, 2009

INDICES CHANGE

FBMEMAS 5473.82 +31.97

COMPOSITE 843.45 +5.06

INDUSTRIAL 2042.61 +6.34

CONSUMER PROD 278.30 -0.13

INDUSTRIAL PROD 63.97 +0.18

customers despite slowdown

CONSTRUCTION 160.61 +0.30

TRADING/SERVICES 112.82 +0.82

FINANCE 6141.01 +5.04

PROPERTIES 495.47 +0.03

PLANTATION 4414.83 +54.29

MINING 241.15 0.00

FBMSHA 5890.48 +37.58

by Tan Yi Liang banks can continue to lend as they are well strong external trade position as well as FBM2BRD 3813.22 +19.67

TECHNOLOGY 12.23 +0.51

newsdesk@thesundaily.com capitalised to withstand any shock to the sys- low and stable interest rates going back

tem,” said Abdul Hamidy. to 1998, the system is well supported TURNOVER VALUE

PETALING JAYA: Commercial banks will Abdul Hamidy, who spoke at ABM’s dialogue, to extend financing to all sectors of the 301.107mil RM487.047mil

remain committed to supporting customers titled “The 2009 Economic Barometer - Why economy,” he said.

despite the current slowdown, and will remain do we say the Malaysian financial industry is Fellow panelist Malaysian Institute

positive about giving loans, said the chairman liquid”, said banks will remain committed to of Economic Research Senior Research

of the Association of Banks in Malaysia (ABM), working closely with viable customers to face

Datuk Seri Abdul Hamidy the economic slowdown.

Fellow K.K. Foong said the proposed

Working Capital Guaranteed Scheme

Share prices

Abdul Hafiz.

Abdul Hamidy, who also

As a result of a

stronger financial

He said innovation is a key

requirement to discovering

under the mini-budget announced last

week further guarantees small and expected to be

expressed confidence that the

loans growth projection will system, banks can continue

exceed the projected gross to lend as they are well

new approaches to lending.

Meanwhile, RAM Hold-

medium enterprises access to credit and

cushions banks from any rise in non- rangebound

ings group chief economist performing loans.

domestic produce for this capitalised to withstand any Yeah Kim Leng agreed with Standard Chartered’s regional head of SHARE prices on Bursa Malaysia are set to

year, said the financial sector Abdul Hamidy, saying that a research (Southeast Asia) Tai Cheung Hui be traded rangebound this week as bargain

has “evolved” since the 1997 shock to the system.” recent analysis of bank lend- said now is not the time to despair despite hunting is expected to be offset by external

financial crisis. - ABM chairman Abdul Hamidy ing trends and patterns lent factors such as lingering concerns about the

weak economic indicators worldwide.

“Lenders are not pulling support to the assertion that “Central banks the world over are in- global economic crisis and the direction of Wall

lines unjustly and unreasonably. Banks are bank lending is not pro-cyclical. jecting liquidity into the system but need to Street, dealers said.

stronger now compared to the last financial Cheah said overall loans growth is found to ensure funds are moved around and used The KLCI is set to move in the 830-860 range

crisis in 1997. The financial sector has evolved be negatively correlated with GDP growth with effectively by target groups,” said Tai, who as any upside would be capped by an expected

and revamped to the point that we are not some variation across sectors and that loans remained optimistic that banks in Asia limited bargain hunting amid current concerns,

distracted like 12 years ago by non-performing growth is more positively correlated with GDP and Malaysia will continue to enjoy strong while downside would be limited by possible

loans which hampered lending,” said Abdul growth over longer growth cycle as in the 2002 credibility and trust from customers unlike intervention from institutional investors, they

Hamidy, who added that banks today can con- - 05 period. in the US, where the sub-prime housing said. “The market will continue to take its cue

tinue lending despite the crisis worldwide. “With Malaysia’s rate of savings exceeding meltdown has severely damaged stake- from regional markets and the overnight per-

“As a result of a stronger financial system, investment by 12-15% of GDP annually plus a holder trust in banks. formance on Wall Street,” said a dealer.

Another dealer said in this tough times,

investors will be looking at the ability of com-

panies to survive and even prosper, such as

Sipro seeks Japanese those that could secure new contracts amid

partners to expand tough competition or able to penetrate new

TOKYO: Sipro Plastic Industries Sdn Bhd, a lead- markets as it will mean they are likely to be in

ing manufacturer and assembler of plastic parts pole positions once the economy recovers and

and components for the automotive, electrical, the good times return.

electronics and telecommunication industries He said the government’s decision on the

is seeking Japanese partners to further expand setting up of a technical committee to monitor

its business in the region and Middle East. the implementation of the RM60 billion mini-

Its assistant manager for Business Devel- budget announced by Deputy Prime Minister

opment Department, Mohd Fazeli Mohd Isa, Datuk Seri Najib Abdul Razak on Tuesday would

said the company is an original equipment provide positive vibes to the market.

manufacturer for the local car makers. Last week the market was lower on Tuesday

“There are several reasons for us to come as investors awaited the details of the second

over to Japan and participate in the Malaysian stimulus package. It continued to be lower the

Auto Exhibition,” he told Bernama.“We hope to next two days amid the lack of the immediate

market our products here and also to get infor- measures anticipated to lift the market up.

mation if any companies here are looking for However, the market rebounded on Friday,

agents to enter the South East Asia market.” driven by limited bargain hunting after four con-

Mohd Fazeli who speaks fluent Japanese secutive trading days of downtrend. – Bernama

said the company was also on the lookout On a Friday-to-Friday basis, the KLCI closed

for technical partners to further enhance the the week at 843.45, down 14.38 points from the

quality of its products. previous week’s closing of 858.22. - Bernama

You might also like

- Uber QuestionsDocument4 pagesUber Questionssyk666sykNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Arsenal FC - Financial AnalysisDocument14 pagesArsenal FC - Financial AnalysisDidiDieva0% (1)

- FRS 136 Impairment Testing TemplateDocument40 pagesFRS 136 Impairment Testing TemplatejaykhorNo ratings yet

- V2 Exam 3 Morning PDFDocument82 pagesV2 Exam 3 Morning PDFCatalinNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDocument1 pageThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDocument1 pageThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNo ratings yet

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2008-12-18 Page20 Msias rm2Document1 pageThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBDocument1 pageThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersDocument1 pageTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorNo ratings yet

- Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichDocument1 pageThesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichImpulsive collectorNo ratings yet

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDocument1 pageThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNo ratings yet

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekDocument1 pageTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierDocument1 pageThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorNo ratings yet

- Thesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidDocument1 pageThesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidImpulsive collectorNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- Thesun 2009-03-10 Page15 Bursa Likely To Open Flat This WeekDocument1 pageThesun 2009-03-10 Page15 Bursa Likely To Open Flat This WeekImpulsive collectorNo ratings yet

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverDocument1 pageTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorNo ratings yet

- Alfa Dyestuff Industries Ltd. 20-21Document14 pagesAlfa Dyestuff Industries Ltd. 20-21Naheyan Jahid PabonNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- Thesun 2009-05-18 Page13 Muslims Involvement in Halal Industry Still Low MusaDocument1 pageThesun 2009-05-18 Page13 Muslims Involvement in Halal Industry Still Low MusaImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- Mgomahinog-06-21-01 SF-4647Document1 pageMgomahinog-06-21-01 SF-4647LGU MAHINOG MTONo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDocument1 pageThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Ajinamoto Annual Report 2022Document4 pagesAjinamoto Annual Report 2022Thank YouNo ratings yet

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDocument1 pageTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNo ratings yet

- TheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileDocument1 pageTheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileImpulsive collectorNo ratings yet

- TheSun 2009-01-09 Page18 TNB Open To All Energy OptionsDocument1 pageTheSun 2009-01-09 Page18 TNB Open To All Energy OptionsImpulsive collectorNo ratings yet

- Unaudited Financial Results As On 30th June 2021Document4 pagesUnaudited Financial Results As On 30th June 2021pizza nmorevikNo ratings yet

- M& M PresentationDocument12 pagesM& M PresentationPratik AgarwalNo ratings yet

- M&M PresentationDocument12 pagesM&M PresentationPratik AgarwalNo ratings yet

- Top Stories:: TUE 22 SEP 2020Document5 pagesTop Stories:: TUE 22 SEP 2020Elcano MirandaNo ratings yet

- Thesun 2009-06-08 Page14 Investors Ask Us Court To Delay Chrysler SaleDocument1 pageThesun 2009-06-08 Page14 Investors Ask Us Court To Delay Chrysler SaleImpulsive collectorNo ratings yet

- "A Study On Mergers and Banks Performance in India": Key Words: Driven Merger, Forced MergerDocument7 pages"A Study On Mergers and Banks Performance in India": Key Words: Driven Merger, Forced MergerkumardattNo ratings yet

- Performance ReportDocument1 pagePerformance Reportkaushal talukderNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyDocument1 pageThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorNo ratings yet

- Directors' Report: Financial ResultsDocument63 pagesDirectors' Report: Financial Resultsmrindia2kNo ratings yet

- Other News:: THU 01 FEB 2018Document4 pagesOther News:: THU 01 FEB 2018JM CrNo ratings yet

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaNo ratings yet

- Top Story:: Ubp: Manageable Increase Npls in May Maintain HoldDocument7 pagesTop Story:: Ubp: Manageable Increase Npls in May Maintain HoldJajahinaNo ratings yet

- Brand Valuation MethodsDocument23 pagesBrand Valuation MethodsvroommNo ratings yet

- MAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Investor PresentationDocument36 pagesMAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Investor Presentationmukesh bhattNo ratings yet

- Cekd Ipo 20210914Document10 pagesCekd Ipo 20210914FazliJaafarNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Statistics For Business and Economics: Bab 17Document22 pagesStatistics For Business and Economics: Bab 17balo100% (1)

- Jia Yi Useful GodDocument3 pagesJia Yi Useful GodBazi100% (2)

- CroissantDocument5 pagesCroissantPapin Joseph MichaelNo ratings yet

- Cost Accounting 1 SW No. 4 With AnswersDocument1 pageCost Accounting 1 SW No. 4 With AnswersApril NudoNo ratings yet

- Chattel MortgageDocument3 pagesChattel MortgageEve SaltNo ratings yet

- Prateek Jain ResumeDocument3 pagesPrateek Jain ResumeShilpi KhetanNo ratings yet

- Qualcomm Stadium Overflow Parking: Friars RDDocument1 pageQualcomm Stadium Overflow Parking: Friars RDaliNo ratings yet

- Problem Set 3 New SolutionsDocument5 pagesProblem Set 3 New Solutionsapi-235832666No ratings yet

- Profit Planning and Activity Based BudgetingDocument50 pagesProfit Planning and Activity Based BudgetingcahyatiNo ratings yet

- JKR Presentation SSDocument32 pagesJKR Presentation SSChristopher RileyNo ratings yet

- Cultural Differences in Daily Business Life Between Germans and Japanese PeopleDocument13 pagesCultural Differences in Daily Business Life Between Germans and Japanese PeopleMarv Marvsen100% (1)

- Zero Based Budgeting in IndiaDocument13 pagesZero Based Budgeting in IndiaBandita RoutNo ratings yet

- Igalauk Minutes 5112011Document2 pagesIgalauk Minutes 5112011Igala UKNo ratings yet

- Turism Present Perfect Si PastDocument4 pagesTurism Present Perfect Si PastgratielageorgianastoicaNo ratings yet

- Change in Account Type - RequestDocument1 pageChange in Account Type - RequestsritraderNo ratings yet

- Product Redesign BookDocument10 pagesProduct Redesign Bookcdee1989No ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Econ 132 Midterm 2 Book StuffDocument3 pagesEcon 132 Midterm 2 Book StuffThomas NgoNo ratings yet

- A Comparative Mismatch Study of The 20 NM Gate-Last and 28 NM Bulk CmosDocument8 pagesA Comparative Mismatch Study of The 20 NM Gate-Last and 28 NM Bulk Cmoshpnx9420No ratings yet

- Accounting Transaction CodeDocument18 pagesAccounting Transaction CodedptsapNo ratings yet

- Industrial CombinationsDocument2 pagesIndustrial CombinationsTamanna JunejaNo ratings yet

- Performance of Banking Sector in India: A Comparative Study of Selected BankDocument3 pagesPerformance of Banking Sector in India: A Comparative Study of Selected Bankharshita khadayteNo ratings yet

- Econjn-0060-PremPPTCh 10 (23) Measuring A Nation S IncomeDocument42 pagesEconjn-0060-PremPPTCh 10 (23) Measuring A Nation S IncomeLauren SerafiniNo ratings yet

- Mapping of Construction Site in NCRDocument45 pagesMapping of Construction Site in NCRAdarsh JosephNo ratings yet

- Foreign Direct InvestmentDocument9 pagesForeign Direct InvestmentshalabhzxcvbnmNo ratings yet

- Informe 3 MANUFACTURADocument14 pagesInforme 3 MANUFACTURADanny Urtecho Ponte100% (1)