Professional Documents

Culture Documents

Allegro Unlocking Trader Productivity For Crude Oil and Refined Products PDF

Allegro Unlocking Trader Productivity For Crude Oil and Refined Products PDF

Uploaded by

sushilk28Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allegro Unlocking Trader Productivity For Crude Oil and Refined Products PDF

Allegro Unlocking Trader Productivity For Crude Oil and Refined Products PDF

Uploaded by

sushilk28Copyright:

Available Formats

www.allegrodev.

com

Unlocking Trader Productivity for Crude Oil & Refined Products

Most energy companies today still rely on spreadsheets or patchwork systems to run their trading & risk management business. This means that most trading organizations could be doing more to maximize the productivity and profitability of their trading team. This paper describes systems, processes, and metrics to help increase trader productivity in crude oil and refined products. Advanced trading and risk management software is available today and provides a significant competitive advantage to trading organizations.

An Allegro White Paper www.allegrodev.com

2011 Allegro Development. All rights reserved.

A traders time is precious and can have an immense impact on a companys profitability. Petroleum traders are required to match supply and demand across a wide variety of products at different locations and across different time horizons crude oil, fuels and refined products. They are responsible for buying and selling both the transportation and the product itself, and need to get the best price possible. Traders need to make sure theyre balanced in maintaining the right amount of inventory to meet physical requirements of their firm. Anything that can be done to automate the calculation of this work for a trader, means that the trader can spend more time finding the best price in the market and putting together superior trades. It almost goes without saying that the most successful traders focus on markets and information, rather than on clerical tasks. Almost. The reality is that many energy trading organizations could be doing more to maximize the productivity and profitability of their trading team. From the traders perspective, it means that they could be achieving superior performance and being appropriately compensated for it.

The Burden of Spreadsheets and Disparate Systems

Allegro recently completed a market research study regarding the preparedness of the energy sector. Over 250 survey responses were received from risk managers, traders, finance, logistics, and marketers in energy companies. Three quarters of them were in trading, risk, and finance departments. The fascinating result of the study is that the majority of energy companies today still rely on spreadsheets or in-house developed systems to run their trading and risk management business. Thats 2 out of 3! Only 1-in-3 make use of todays highly evolved commercial software for energy trading and risk management (ETRM). For organizations still relying on legacy systems, the impacts to productivity are serious. When traders input trades into spreadsheets or legacy systems, data entry can often be cumbersome. Such systems often dont provide much in the way of error checking. Templates for common trades may be unavailable. Templates for complex trades may be non-existent, or such trades may require inefficient outside the system workarounds to be accurately captured.

Spreadsheets An in-house developed system A commercial system

Error correction is also a concern. If a mistake is made during trade entry, all of the processes that follow are impacted. Then errors propagate so that valuation, scheduling, and accounting all experience the errors as well. This causes the need for error correction, exception reporting, rework, and re-checking. Another problem is that with multiple systems that dont talk to each other, traders are often required to enter the same trade into multiple systems. This inevitably yields differences in different systems, and creates the need for the different trades to be reconciled another process that takes time away from identifying trading opportunities and analyzing the market. The overall problem with these approaches is that organizations lose valuable trader productivity because they are spending time trying to get trades into inadequate systems. Simplifying processes and reducing errors with the right systems is positive for a trading shop both in terms of efficiency and profits.

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 2/7

Achieving Increased Trader Productivity

Todays commercial energy trading and risk management systems can make a real difference in the way that traders do their day-to-day work. Traders are concerned about knowing the current price, if they are long or short, seeing all of the trades that have been done today and in the past, if there are new inventory measurements or new transportation details. In other words, petroleum traders need perfectly up to date information. In leading ETRM systems like Allegro, accurate, timely positions are provided with grid architecture so that traders can see all of this information in real-time.

Accurate, timely positions with grid architecture

Traders also need to see exposure and P&L - both volumetrically and by values. This information must be broken out by type of crude or refined product, location, and time period. Product-level detail is very important -- jet fuel is very different from gasoline and effective ETRM systems offer rich drill-down capabilities for analysis at any level of aggregation. Next, lets turn to trade entry, another potential source of inefficiency for traders. Many trades are easy trades, and todays best ETRM systems offer ways to handle these trades very efficiently so that routine trades can be input quickly. For example, the US and Europe have very extensive pipeline networks and bulk trades on a pipeline are common, such as bulk trades at a storage location. For these simple transactions, leading systems like Allegro prompt traders to provide very little information, which enables rapid trade creation. This is possible through the use of trade templates and other features that streamline trade entry for simple trades. For more complex trades, Allegro helps improve trader productivity with the use of flexible, intuitive input. For example, in crude oil purchasing both the oil & gas producer and the crude oil first purchaser enter into a trade to purchase crude oil at the Quick, easy trade input for simple wellhead. Typically, this type of trade will have certain definitions on what wellhead means. In trades such as bulk trades at this example, there may actually be 20 different producing properties, each with a different start storage locations and stop date. These may each have a different price differential and price index. A very compli-

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 3/7

cated set of information must be specified to trade crude at the wellhead. This is only one of many real-world examples of complex trades in the petroleum business. The bottom line is that traders need a format that allows a complex trade to be entered without redundant entry and with the least effort possible. Allegros ETRM system is designed to address the complexities of petroleum trading for the straightforward handling of even complex trades.

Getting There: Key Performance Indicators

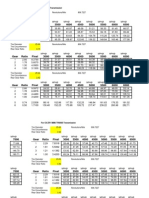

Effective energy trading and risk management solutions can help trading organizations understand their performance and drive improvements. The visibility into key performance indicators (KPIs) made possible by ETRM systems can help firms track efficiency gains and increased profitability for individual traders and for the team as a whole: Daily volume by trader. Managers want to see who is trading what volume, on what day. This enables organizations to measure efficiency gains and determine if they are getting what they need from each individual trader. Daily crude oil balance by trade book. When trading crude oil, visibility into inventory levels is very important for a trader- you dont want too much inventory and you dont want too little inventory. This KPI shows the positives (increases to inventory) and the negatives (refinery consumption) for the net balance change by day and net inventory levels being carried. This enables managers to determine if trading activity is netting the right inventory levels for crude oil at the refinery.

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 4/7

Daily refinery production balance by trade book. Producing refined products involves position production coming out of the refinery, and then reductions to that. This key performance indicator shows where inventory stands at any given point when production has increased, or when inventory has decreased through rack sales or sales to pipelines or barges. With this information, managers have the ability to ensure inventory levels stay within the right parameters. This information can also help to explain how trading activity has caused inventory to drop or climb. Net value of trader positions. This metric shows what position each trader is carrying, and their net quantity position and net value. It offers a rapid way to determine who is running a positive or negative book. Managers can then determine if traders are where they should be in their overall position. Mark to market comparison with value at risk. There are two important measurements to evaluate when it comes to decision making: Mark-toMarket (MtM) is what your products position is worth, while Value at Risk (VaR) is the amount you can possibly lose in a days turnover at this position. Traders want to determine whether or not the value they can make on the oil exceeds the risk theyd take to make it. When mark-to-market is lower than the VaR, you are risking more money to take that position than you can make in that position. This is very useful in examining traders productivity and overall performance.

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 5/7

Daily profit and loss by trader. With movements in the commodity markets, each traders overall book is either going to make money or lose money on a daily basis. Managers need to see how productive their traders are and who is making money. The organization needs to understand what the good traders are doing to get a better MtM and P&L, and what the poorer traders are doing that can be improved.

Profit and loss for each trader by delivery month. Managers need to understand and manage profit and loss for forward delivery months, a year or more into the future. Effective ETRM systems enable a view 12 or more months into the future, so that you can see profit and loss by the month of delivery or any other timeframe. In commodity trading there are two important dates the date of the trade and the delivery date. Successful trading organizations need to understand and report on both of these.

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 6/7

Total Business Benefits

Effective ETRM solutions provide traders with better real time information for better market decisions, while cutting administrative tasks to a minimum. This enables the entire trading organization to spend more time on the markets identifying and capturing the most profitable trading opportunities. An important overall metric is: The average market value that each trader is carrying in the book, times The number of traders, times The percentage increase in trade profits. The product of these three terms is the value of implementing a trader productivity solution. If you have an average market value of $2 million per trader and a staff of 10 traders, then even a conservative 1% increase in trade profitability results in an annual gain of $200,000 per year. In practice, the value of better market decisions can be much higher. The intangible benefit of identifying additional opportunities for better trading can be substantial. World class systems can also have a positive impact on recruiting and retention of top traders. If traders have a very efficient system to work with youll get better traders and theyll make more money. Advanced trading and risk management software is available today and provides a significant competitive advantage to trading organizations. We invite you to contact Allegro to learn more.

About Allegro

For more information go to www.allegrodev.com or call us at +1.888.239.6850 North America +1.214.237.8000 Europe +44(0)20.7382.4310 Asia Pacific +65.6236.5730

Allegro is a global leader in energy trading & risk management solutions for power and gas utilities, refiners, producers, traders, and commodity consumers. With more than 27 years of deep industry expertise, Allegros enterprise platform drives profitability and efficiency across front, middle, and back offices, while managing the complex logistics associated with physical commodities. Allegro provides customers with agile solutions to manage risk across gas, power, coal, crude, petroleum, emissions, and other commodity markets, allowing decision makers to hedge and execute with confidence. Headquartered in Dallas, Texas, Allegro has offices in Calgary, Houston, London, Singapore and Zurich, along with a global network of partners. For More Information Contact: Christie Lindstrom; Media & Analyst Relations Manager, Allegro Development at media@allegrodev.com or call +1.214.237.8117.

www.allegrodev.com

Unlocking Trader Productivity for Crude Oil & Refined Products

Page 7/7

You might also like

- Interview Prep For ETRM ProfileDocument2 pagesInterview Prep For ETRM ProfileVîshësh ÄñâñdNo ratings yet

- BM203 - Business Strategy: Group AssignmentDocument23 pagesBM203 - Business Strategy: Group AssignmentPoorni Perera100% (5)

- Setting Up New Business Associate in RightAngleDocument29 pagesSetting Up New Business Associate in RightAnglemike8895No ratings yet

- PNL ExplainDocument44 pagesPNL ExplainJeremy Allen100% (1)

- Demystifying ARC RRCsDocument6 pagesDemystifying ARC RRCsAskanaNo ratings yet

- Personal Savings Template v2.3.1Document87 pagesPersonal Savings Template v2.3.1Chandra SekharNo ratings yet

- Family MartDocument1 pageFamily MartPrevitha VithaNo ratings yet

- B. Com. Part-I Business Economics Marathi Version PDFDocument93 pagesB. Com. Part-I Business Economics Marathi Version PDFDilip Jadhav88% (34)

- How To Raise Money PDFDocument3 pagesHow To Raise Money PDFYash SNo ratings yet

- Gear Ratio Transmission MPH CalculatorDocument3 pagesGear Ratio Transmission MPH CalculatorGreg SuchomelNo ratings yet

- Ethane (R-170) : Physical & Chemical PropertiesDocument3 pagesEthane (R-170) : Physical & Chemical Propertiesfaiq_pp10No ratings yet

- Ethane c2h6 Safety Data Sheet Sds p4592Document9 pagesEthane c2h6 Safety Data Sheet Sds p4592Lucious LightNo ratings yet

- Accenture Futre Trading SystemDocument18 pagesAccenture Futre Trading SystemtanmartinNo ratings yet

- Study - of - Settling - Velocity - of - Sand - Particles - Locat PentingDocument6 pagesStudy - of - Settling - Velocity - of - Sand - Particles - Locat Pentinganik suciNo ratings yet

- Scada (Supervisory Control and Data Acquisition) : PgdiaeDocument49 pagesScada (Supervisory Control and Data Acquisition) : PgdiaeAdrian ReyesNo ratings yet

- JFD Excel RTD User-Guide ENDocument49 pagesJFD Excel RTD User-Guide ENANGKIONGBOHNo ratings yet

- 2012 Lexus ct200h 50Document82 pages2012 Lexus ct200h 50freezifateNo ratings yet

- The Basics of Cathodic ProtectionDocument2 pagesThe Basics of Cathodic ProtectionlsatchithananthanNo ratings yet

- How To Hack WiFi Password - Guide To Crack Wireless Network On Windows PCDocument14 pagesHow To Hack WiFi Password - Guide To Crack Wireless Network On Windows PCTamilselvan GNo ratings yet

- Oil&Gas Sector AnalysisDocument7 pagesOil&Gas Sector AnalysisAMEY PATALENo ratings yet

- Strategic Benefits of A Global Trade Management Software SystemDocument4 pagesStrategic Benefits of A Global Trade Management Software SystemSileaLaurentiuNo ratings yet

- Extraction of Ethane From Natural Gas at PDFDocument6 pagesExtraction of Ethane From Natural Gas at PDFanon_936836736No ratings yet

- Pricing and Meaning of Ethane PlusDocument3 pagesPricing and Meaning of Ethane PlusvenkateswarantNo ratings yet

- Merpro SPE March 2006Document42 pagesMerpro SPE March 2006dayrogNo ratings yet

- Commodities and ETRM PDFDocument4 pagesCommodities and ETRM PDFhquaoNo ratings yet

- 2022Q4 QuanticaQuarterlyInsightsDocument22 pages2022Q4 QuanticaQuarterlyInsightsRiccardo RoncoNo ratings yet

- Senior Natural Gas Trader in Houston TX Resume Guy DePaolisDocument2 pagesSenior Natural Gas Trader in Houston TX Resume Guy DePaolisGuyDePaolisNo ratings yet

- Managing Commodity Price Risk: A Supply Chain PerspectiveDocument9 pagesManaging Commodity Price Risk: A Supply Chain PerspectiveBusiness Expert Press50% (2)

- International Oil Trader Academy Winter School - Virtual DeliveryDocument6 pagesInternational Oil Trader Academy Winter School - Virtual DeliveryMuslim NasirNo ratings yet

- 22 G3512 C555Document4 pages22 G3512 C555texwan_No ratings yet

- Upstream Oil and Gas Application MapDocument1 pageUpstream Oil and Gas Application MapBunda SheziaNo ratings yet

- PDD - Questionnaire Rajendra - ShahaneDocument2 pagesPDD - Questionnaire Rajendra - ShahaneRRSNo ratings yet

- EF MT5 User Guide Android en Content TabletDocument47 pagesEF MT5 User Guide Android en Content TabletzooorNo ratings yet

- I DocsDocument22 pagesI DocssirajsamadNo ratings yet

- Investment Banking Landscape India V4Document32 pagesInvestment Banking Landscape India V4Keshav KhannaNo ratings yet

- eTRM User Guide: California Statewide Deemed MeasuresDocument16 pageseTRM User Guide: California Statewide Deemed MeasuresSusheel SriramNo ratings yet

- Risk Based PNLDocument27 pagesRisk Based PNLSherry YangNo ratings yet

- Understand MRPDocument14 pagesUnderstand MRPAziz Ahmed KhanNo ratings yet

- Institut Für Informatik: Technischer BerichtDocument51 pagesInstitut Für Informatik: Technischer BerichtSridhar MandadiNo ratings yet

- Day 1Document3 pagesDay 1Sudhanshu MalandkarNo ratings yet

- FIX ProtocolDocument3 pagesFIX Protocolksenthil77No ratings yet

- Detailed SAP Interface Design Fundamental DocumentDocument4 pagesDetailed SAP Interface Design Fundamental Documentamitava_bapiNo ratings yet

- Crude Oil 20 Point ManualDocument5 pagesCrude Oil 20 Point ManualmanjuypNo ratings yet

- Global Trade ManagementDocument11 pagesGlobal Trade ManagementFabricPainting KaraHoNo ratings yet

- Commodity Trading-Mutual FundsDocument17 pagesCommodity Trading-Mutual Fundsapi-3832523No ratings yet

- How To Replicate Condition Records For Pricing To External System From SAPDocument12 pagesHow To Replicate Condition Records For Pricing To External System From SAParunakumarbiswalNo ratings yet

- F1F9 Agile Financial Modelling EbookDocument21 pagesF1F9 Agile Financial Modelling EbookMatthieu Van Damme100% (1)

- Deloitte TradingDocument4 pagesDeloitte TradingspencedeanNo ratings yet

- Business Case GuidelinesDocument6 pagesBusiness Case GuidelinesLana sereneNo ratings yet

- Vix N NiftyDocument11 pagesVix N Niftyrahul.ztbNo ratings yet

- Crudeoil 6pm StrategyDocument2 pagesCrudeoil 6pm StrategymohanNo ratings yet

- Journal of Financial Economics: Amy Kwan, Ronald Masulis, Thomas H. McinishDocument19 pagesJournal of Financial Economics: Amy Kwan, Ronald Masulis, Thomas H. McinishJackCardosoNo ratings yet

- Carbon Dioxide SequestrationDocument10 pagesCarbon Dioxide SequestrationKevin Mandira LimantaNo ratings yet

- The Financial Information EXchangeDocument7 pagesThe Financial Information EXchangeIshwar DharmadhikariNo ratings yet

- Commodities TradingDocument2 pagesCommodities TradingAdityaKumarNo ratings yet

- 2012 Fin Tech 100Document25 pages2012 Fin Tech 100issglobalNo ratings yet

- Pairs Trading Cointegration ApproachDocument82 pagesPairs Trading Cointegration Approachalexa_sherpyNo ratings yet

- Financial Information EXchange - Wikipedia, The Free EncyclopediaDocument7 pagesFinancial Information EXchange - Wikipedia, The Free EncyclopediaAnkur ShahNo ratings yet

- Emerson Process Management-PrnDocument3 pagesEmerson Process Management-PrnGovind Kumar VermaNo ratings yet

- Installation GuideDocument16 pagesInstallation GuideRajNo ratings yet

- 1 Customs Management Generic Functions - Delta Part IDocument53 pages1 Customs Management Generic Functions - Delta Part Isnd31No ratings yet

- TCS FS AlgorithmictradingDocument14 pagesTCS FS AlgorithmictradingpercysearchNo ratings yet

- COMPDocument13 pagesCOMPVahidNo ratings yet

- OilAndGasFinancialJournalOctober2008 EnergyTradingRiskManagementDocument24 pagesOilAndGasFinancialJournalOctober2008 EnergyTradingRiskManagementjohnsm2010No ratings yet

- .. Devi Aparadha Kshamapana Stotra ..: D Ev Aprad "Mapn - ToDocument2 pages.. Devi Aparadha Kshamapana Stotra ..: D Ev Aprad "Mapn - Tosushilk28100% (1)

- Business Resilience Guide PDFDocument16 pagesBusiness Resilience Guide PDFsushilk28No ratings yet

- 04 - Contract Management - Areva PDFDocument27 pages04 - Contract Management - Areva PDFsushilk28No ratings yet

- JCT2005Document272 pagesJCT2005SFeganUK100% (2)

- Willis Energy Market Review 2013 PDFDocument92 pagesWillis Energy Market Review 2013 PDFsushilk28No ratings yet

- Causes of Contractor FailuresDocument3 pagesCauses of Contractor FailuresPradeep GsNo ratings yet

- Building Business Case For Procure To Pay WP v2 PDFDocument9 pagesBuilding Business Case For Procure To Pay WP v2 PDFsushilk28No ratings yet

- 250driving High Performance For Accenture Through Procurement Outsourcing PDFDocument12 pages250driving High Performance For Accenture Through Procurement Outsourcing PDFsushilk28No ratings yet

- WWW - Tantrik-Astrologer - In: DR - Rupnathji (DR - Rupak Nath)Document4 pagesWWW - Tantrik-Astrologer - In: DR - Rupnathji (DR - Rupak Nath)sushilk28No ratings yet

- Business Development ManagerDocument3 pagesBusiness Development Managermatteo2009No ratings yet

- Investment Performance of Al-Arafah Islami BankDocument64 pagesInvestment Performance of Al-Arafah Islami BankSharifMahmud100% (2)

- Sreekanth Resume (Recruiter)Document2 pagesSreekanth Resume (Recruiter)Raj KiranNo ratings yet

- Chapter 6 Set 1 Dividend Discount ModelsDocument14 pagesChapter 6 Set 1 Dividend Discount ModelsNick HaldenNo ratings yet

- Myvhi Policy Document 29976414Document3 pagesMyvhi Policy Document 29976414pat oneillNo ratings yet

- MBA Strategy Exam - Detailed Answer MarkingDocument21 pagesMBA Strategy Exam - Detailed Answer MarkingMuse ManiaNo ratings yet

- Technical Assistance Support For Provincial and Kabupaten Road Maintenance Management Plans Phase 2 Inception ReportDocument68 pagesTechnical Assistance Support For Provincial and Kabupaten Road Maintenance Management Plans Phase 2 Inception ReportLutfi TofiqNo ratings yet

- Coca Cola BCG MatrixDocument7 pagesCoca Cola BCG MatrixSinyan ChongNo ratings yet

- Unit 5 - Pricing DecisionsDocument10 pagesUnit 5 - Pricing DecisionsJhandy TaguibolosNo ratings yet

- OligopolyDocument12 pagesOligopolyAyush KapoorNo ratings yet

- Marketing: Fundamentals of Destination Management and Marketing (323TXT)Document22 pagesMarketing: Fundamentals of Destination Management and Marketing (323TXT)iecasiaNo ratings yet

- Municipal Social Welfare and Development Office Social Case StudyDocument2 pagesMunicipal Social Welfare and Development Office Social Case StudyHannah Naki MedinaNo ratings yet

- Case Social Science Question PaperDocument4 pagesCase Social Science Question Paperakilan0108No ratings yet

- Uas B.inggris LukmanferdiansyahDocument3 pagesUas B.inggris LukmanferdiansyahLukman FerdiansyahNo ratings yet

- Project Dse-3 6TH Semester (S04517com067)Document43 pagesProject Dse-3 6TH Semester (S04517com067)RajeshNo ratings yet

- JNUG Factsheet PDFDocument2 pagesJNUG Factsheet PDFCho CuteNo ratings yet

- Lecture 3 Tender DocumentDocument15 pagesLecture 3 Tender Documentnur sheNo ratings yet

- 1.2-Emodule TA RulesDocument76 pages1.2-Emodule TA RulesGK TiwariNo ratings yet

- Final Requirements: Logistics Management BA-519Document5 pagesFinal Requirements: Logistics Management BA-519GINANo ratings yet

- HRM Chapter 6 RecruitingDocument19 pagesHRM Chapter 6 RecruitingTonmoy Chowdhury TmzNo ratings yet

- Economics 2 1 1Document14 pagesEconomics 2 1 1DEMISSIE SIKUARIENo ratings yet

- M Minervini Twitter NoteDocument1 pageM Minervini Twitter NoteLNo ratings yet

- Compound InterestDocument2 pagesCompound InterestPalvi ChalanaNo ratings yet

- How COVID-19-is-changing-consumer-behaviornow-and-foreverDocument6 pagesHow COVID-19-is-changing-consumer-behaviornow-and-forevermesay83No ratings yet

- Risk Pooling Game 6Document3 pagesRisk Pooling Game 6Stephen HartantoNo ratings yet