Professional Documents

Culture Documents

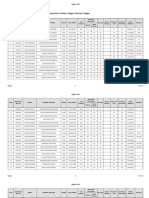

DIPOSITE

DIPOSITE

Uploaded by

Jigisha MugdalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DIPOSITE

DIPOSITE

Uploaded by

Jigisha MugdalCopyright:

Available Formats

Savings Bank Accounts Savings Bank Account Rules

Best suited for all classes of persons. Running account. Cheques, Drafts, Interest Warrants, Dividend warrants etc.., in Indian rupees and foreign currencies in the personal names of the depositors can be collected and credited to these accounts. Liberal withdrawal facilities. No Income Tax deduction at source on interest. Standing instructions for remittances of insurance premium, rent and similar payments carried out. Minors above 10 years can open and operate the account. Nomination facility is available Quarterly Average Minimum Balance to be maintained in SB accounts is Rs.1000/- with Cheque Book facility and Rs.500/- without Cheque Book facility Internet Banking/ATM/Mobile Banking Facilities are available

Current Accounts

Running account with unlimited operational facilities. Minimum balance to be maintained is Rs. 3000/- for rural branches and Rs.5000/- for others. Monthly statement of accounts made available. Standing instructions for remittances of insurance premium, rent and similar payments carried out. Internet Banking Facility is available

Term Deposit Accounts

Deposits for periods of 7 days to 120 months. *** Minimum deposit is Rs.1000/- and multiples Rs.100/-. Interest normally paid quarterly, half yearly, or yearly. Monthly payment can be had at discounted rates. Loans are available upto 90% of the deposit, with interest 1% above the deposit rate. Minors above the age of 10 can deposit upto Rs.200000/- in their names independently.

Premature withdrawal permitted with applicable penalty. Ideal investment for earning regular quarterly income without disturbing principal, and with maximum liquidity and safety. The deposit will be renewed on due date for the same period. TDS is applicable, 15H/15G to be submitted for exemption

SBT Reinvestment Plan(Special Term Deposits)

Term Deposit accounts with automatic reinvestment of the accrued interest at quarterly compounding till maturity of the principal. No interim withdrawal of interest and therefore investment multiplies. Loans upto 90%, with interest 1% above the deposit rates. Existing term deposit accounts can freely be converted to Special term deposit accounts and vice versa. Minors above the age of 10 can deposit upto Rs.2,00,000/- in their names independently. Ideal for maximum returns, long term investment with safety and liquidity. Premature withdrawal permitted with applicable penalty. TDS is applicable, 15H/15G to be submitted for exemption.

Unit Deposit Scheme

Amount deposited is held in units of Rs.1000/- each. Accounts can be opened with Rs.10,000/- and thereafter in multiples of Rs.1000/-. The salient feature of the scheme is that it allows the depositor to withdraw the deposit partially in multiplies of Rs.1000/- without breaking his entire deposit. It can be opened as either Term Deposit or Special Term deposit accounts and interest payments are as applicable to those schemes. Loans, Premature withdrawal and Nomination facilities are available.

Recurring Deposit Accounts

Recurring deposit for periods ranging from 12 to 120 months with fixed monthly remittances. No Income tax deducted at source. Premature withdrawal is permitted. Minors above 10 years can open accounts in their name independently subject to the maturity value not exceeding Rs.2,00,000/-. Ideal for persons who can set apart a portion of their monthly earnings especially regular monthly income earners; Traders, pensioners etc. An easy way to save money. Loans, Premature withdrawal and Nomination facilities are available. Penalty is applicable for delayed remittance.

Variable Deposit Scheme (Super Surplus)

Recurring deposit scheme for a period of 12 months to 120 months, offers flexibility in the amount of monthly remittance. Depositor can fix their core monthly installment from Rs.100 to Rs.10000/p.m. Depositor can vary the monthly installments and can deposit upto 10 times the agreed core amount subject to maximum of Rs.100000/ per month. One remittance per month. No insistence on regular monthly payment. Interest credited to the account half yearly. Minors over 10 years can open in their name singly provided the maturity value does not exceed Rs.2,00,000/-. No penalty for delayed remittance but if the number of remittance is less than 10 per year Rs.10/will be levied as penalty. Ideal for persons whose monthly savings vary from month to month and for those seeking flexibility in remittances. Loans, Premature withdrawal and Nomination facilities are available.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Salaam InsuranceDocument23 pagesSalaam InsuranceNur Alia100% (1)

- DNM Vendor BibleDocument93 pagesDNM Vendor BibleWane Stayblur100% (2)

- Case Analysis: Murphy Stores, Capital ProjectDocument2 pagesCase Analysis: Murphy Stores, Capital Projectariba farrukhNo ratings yet

- Payment of WagesDocument2 pagesPayment of WagesRoizki Edward Marquez100% (1)

- CXC History Past Paper QuestionsDocument5 pagesCXC History Past Paper QuestionsJM Mondesir100% (3)

- Bitfinex Preview BFX Conversion PitchDocument25 pagesBitfinex Preview BFX Conversion PitchAnonymous wRn8eDNo ratings yet

- Exit PolicyDocument2 pagesExit PolicyJigisha Mugdal100% (1)

- 1.5 Scope of Management AccountingDocument2 pages1.5 Scope of Management AccountingJigisha MugdalNo ratings yet

- There Is No Need For Other Adjectives.: This Is Just ELEGANTDocument2 pagesThere Is No Need For Other Adjectives.: This Is Just ELEGANTJigisha MugdalNo ratings yet

- There Is No Need For Other Adjectives.: This Is Just ELEGANTDocument2 pagesThere Is No Need For Other Adjectives.: This Is Just ELEGANTJigisha MugdalNo ratings yet

- ReportDocument19 pagesReportJigisha MugdalNo ratings yet

- The "New" Population PolicyDocument13 pagesThe "New" Population PolicyJigisha MugdalNo ratings yet

- The "New" Population PolicyDocument13 pagesThe "New" Population PolicyJigisha MugdalNo ratings yet

- Sardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentDocument7 pagesSardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentJigisha MugdalNo ratings yet

- Report 1Document52 pagesReport 1Jigisha MugdalNo ratings yet

- 26-DJR Nagpur - Co-Operative Officer Grade-1Document61 pages26-DJR Nagpur - Co-Operative Officer Grade-1Abdul Raheman ShaikhNo ratings yet

- Indikator SDG Malaysia 2021 Executive SummaryDocument152 pagesIndikator SDG Malaysia 2021 Executive SummaryJeffery Beti100% (1)

- Sakman Bawanawa by U Dhammajiva Maha TheroDocument57 pagesSakman Bawanawa by U Dhammajiva Maha TheroMalinda Ruwan100% (1)

- Nigerian Price Control Act 1977Document41 pagesNigerian Price Control Act 1977AhmadNo ratings yet

- Kelompok 10 PronounsDocument19 pagesKelompok 10 PronounssariNo ratings yet

- Marketing StrategyDocument3 pagesMarketing StrategyZeenat CouvelineNo ratings yet

- Internship Report On Performance Appraisal System of Janata Bank LimitedDocument47 pagesInternship Report On Performance Appraisal System of Janata Bank LimitedFahimNo ratings yet

- Exam NotesDocument104 pagesExam NotesJezMillerNo ratings yet

- Legal Guide TopicsDocument19 pagesLegal Guide TopicsAngela JohnNo ratings yet

- Business Secrets of The Trappist MonksDocument6 pagesBusiness Secrets of The Trappist MonksRaja Wajahat100% (2)

- Market Analysis Close UpDocument16 pagesMarket Analysis Close UpRishabh VijayNo ratings yet

- Set B: Part 1 A) Using Suitable Software, Prepare The Following Documentations For of SESB SDN BHDDocument12 pagesSet B: Part 1 A) Using Suitable Software, Prepare The Following Documentations For of SESB SDN BHDdini sofiaNo ratings yet

- Republic Act No 11573Document6 pagesRepublic Act No 11573Ced Jabez David Enoc100% (1)

- Lay Carmelite Community #578: Who Are The Third Order Lay Carmelites?Document2 pagesLay Carmelite Community #578: Who Are The Third Order Lay Carmelites?Gerille Mae LibaNo ratings yet

- Print Control PageDocument1 pagePrint Control PageLohith TendulkarNo ratings yet

- Scholaro GPA CalculatorDocument1 pageScholaro GPA CalculatorTanvirNo ratings yet

- Horn Complainant Position Paper 1Document5 pagesHorn Complainant Position Paper 1tonybhorn785688% (17)

- Epicurus' Letter To MenoeceusDocument3 pagesEpicurus' Letter To MenoeceusUnknownNo ratings yet

- Beauty IndustryDocument20 pagesBeauty Industryapi-593844395No ratings yet

- Loan SchemesDocument48 pagesLoan SchemesbalwinderNo ratings yet

- Introduction To Lean Project Delivery - MON1016 - MacNeelDocument68 pagesIntroduction To Lean Project Delivery - MON1016 - MacNeelMohammed NizamNo ratings yet

- Achieving Economy and Reliability in Piled Foundation Design For A Building ProjectDocument6 pagesAchieving Economy and Reliability in Piled Foundation Design For A Building ProjectRodrigo RiveraNo ratings yet

- Castillo v. CruzDocument2 pagesCastillo v. CruzLuna BaciNo ratings yet

- 01 20Document488 pages01 20Steve Barrow100% (1)