Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Uploaded by

Impulsive collectorThe document summarizes the performance of major stock market indices in Asia and Australia, and the performance of Bursa Malaysia on March 17, 2009. Selective buying of key heavyweights like Sime Darby, IOI Corp and Public Bank led the KLCI index to close slightly higher. Permodalan Nasional Bhd expressed confidence that subscribing to Maybank's upcoming rights shares will benefit the group long-term through securing long-term returns. Mintye Marketing is looking to further expand its export business to Japan.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Modenas Kris 110Document183 pagesModenas Kris 110manori92% (12)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- RCB 19 PDFDocument126 pagesRCB 19 PDFmohd firdaus bin ibrahim100% (1)

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDocument1 pageThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNo ratings yet

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDocument1 pageThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNo ratings yet

- Thesun 2008-12-18 Page20 Msias rm2Document1 pageThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDocument1 pageThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNo ratings yet

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDocument1 pageThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyDocument1 pageThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDocument1 pageThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDocument1 pageThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNo ratings yet

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocument1 pageThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDocument1 pageThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNo ratings yet

- Thesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBDocument1 pageThesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- Thesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesDocument1 pageThesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesImpulsive collectorNo ratings yet

- TheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaDocument1 pageTheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaImpulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierDocument1 pageThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- TheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityDocument1 pageTheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityImpulsive collectorNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDocument1 pageThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocument1 pageTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNo ratings yet

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocument1 pageThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNo ratings yet

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocument1 pageTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocument1 pageTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNo ratings yet

- Mpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksDocument3 pagesMpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksSanya HelinoNo ratings yet

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDocument1 pageTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNo ratings yet

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- Thesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMDocument1 pageThesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Confirmation of Purchase of TakafulDocument5 pagesConfirmation of Purchase of TakafulSuparno Sarjono Sukiman VNo ratings yet

- Projek Siap HRMDocument22 pagesProjek Siap HRMkala0222100% (1)

- 20 Mind Blowing Concept Motorcycle Designs - Technology PDFDocument27 pages20 Mind Blowing Concept Motorcycle Designs - Technology PDFgabriel_danutNo ratings yet

- RCB Product Catalogue 2021 - V1Document142 pagesRCB Product Catalogue 2021 - V1Daniel ZabalaNo ratings yet

- Sim Motors Electric Sdn. BHD.: Category Superbike Brand SuzukiDocument14 pagesSim Motors Electric Sdn. BHD.: Category Superbike Brand SuzukiSaryonoNo ratings yet

- Single Cylinder Four Stroke Diesel Engine Test RigDocument24 pagesSingle Cylinder Four Stroke Diesel Engine Test RigDigvijay Todkar100% (1)

- Online Public Auction Listing 20240417Document13 pagesOnline Public Auction Listing 20240417Che DeenNo ratings yet

- .My Plugins EventCalendar ReportToExcelPage 1366 Page 0Document16 pages.My Plugins EventCalendar ReportToExcelPage 1366 Page 0Aizat FaliqNo ratings yet

- Tekudugam PDFDocument5 pagesTekudugam PDFNews Channel FourNo ratings yet

- RCB Product Catalogue 2020 - Web PDFDocument132 pagesRCB Product Catalogue 2020 - Web PDFjacob caipangNo ratings yet

- Underbone: & Universal AccessoriesDocument169 pagesUnderbone: & Universal AccessoriesvietkhamNo ratings yet

- Draft Report Li - MH20012Document21 pagesDraft Report Li - MH20012Yunus 2001No ratings yet

- C7F9EC018367Document14 pagesC7F9EC018367Florensia VintaNo ratings yet

- Cover Note 829a751Document3 pagesCover Note 829a751Mohamad Hakimi Bin MakhtarNo ratings yet

- MotorcycleDocument42 pagesMotorcycleAiddie GhazlanNo ratings yet

- Forum Discussion - ODDocument5 pagesForum Discussion - ODHo Kok WengNo ratings yet

- J. Pra 8Document14 pagesJ. Pra 8putriarumNo ratings yet

- Bpme 6093 Modenas Combine LastDocument12 pagesBpme 6093 Modenas Combine LastjibamcomotNo ratings yet

- Modenas OverviewDocument7 pagesModenas OverviewMiak JaikNo ratings yet

- RCB 210216Document169 pagesRCB 210216bgmentNo ratings yet

- Modenas Kriss 2 - Motorcycles For Sale Kuala Lumpur - MudahDocument2 pagesModenas Kriss 2 - Motorcycles For Sale Kuala Lumpur - MudahSharvin RajNo ratings yet

Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Uploaded by

Impulsive collector0 ratings0% found this document useful (0 votes)

18 views1 pageThe document summarizes the performance of major stock market indices in Asia and Australia, and the performance of Bursa Malaysia on March 17, 2009. Selective buying of key heavyweights like Sime Darby, IOI Corp and Public Bank led the KLCI index to close slightly higher. Permodalan Nasional Bhd expressed confidence that subscribing to Maybank's upcoming rights shares will benefit the group long-term through securing long-term returns. Mintye Marketing is looking to further expand its export business to Japan.

Original Description:

Original Title

thesun 2009-03-18 page14 maybanks rights shares a good buy pnb

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the performance of major stock market indices in Asia and Australia, and the performance of Bursa Malaysia on March 17, 2009. Selective buying of key heavyweights like Sime Darby, IOI Corp and Public Bank led the KLCI index to close slightly higher. Permodalan Nasional Bhd expressed confidence that subscribing to Maybank's upcoming rights shares will benefit the group long-term through securing long-term returns. Mintye Marketing is looking to further expand its export business to Japan.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNB

Uploaded by

Impulsive collectorThe document summarizes the performance of major stock market indices in Asia and Australia, and the performance of Bursa Malaysia on March 17, 2009. Selective buying of key heavyweights like Sime Darby, IOI Corp and Public Bank led the KLCI index to close slightly higher. Permodalan Nasional Bhd expressed confidence that subscribing to Maybank's upcoming rights shares will benefit the group long-term through securing long-term returns. Mintye Marketing is looking to further expand its export business to Japan.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

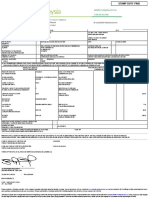

14 theSun | WEDNESDAY MARCH 18 2009

business

KLCI 841.87 0.99 Nikkei 7,949.13 244.98

STI 1,559.03 27.29 TSEC 5,041.39 70.07

market summary MARCH 17, 2009

Hang Seng 12,878.09 98.62 KOSPI 1,163.88 38.42

SCI 2,218.33 65.04 S&P/ASX200 3,451.90 103.50

Prices slightly higher INDICES CHANGE

on selective buying FBMEMAS

COMPOSITE

5,467.54

841.87

+17.03

+0.99

Maybank’s rights shares

SHARE prices on Bursa Malaysia INDUSTRIAL 2,052.74 +10.90

closed slightly higher yesterday on CONSUMER PROD 278.18 -0.96

INDUSTRIAL PROD 63.97 -0.01

selective buying of key heavyweights, CONSTRUCTION 161.84 +0.15

particularly Sime Darby, IOI Corp and TRADING SERVICES 112.33 +0.24

Public Bank, dealers said. FINANCE 6,168.50 +25.30

The benchmark KLCI ended the PROPERTIES 495.12 +0.21

day 0.99 points higher at 841.87 after PLANTATIONS 4,373.63 -1.79

a good buy: PNB

opening 1.75 points higher at 842.63. MINING 241.15 (UNCH

The KLCI moved between 840.38 and FBMSHA 5,868.12 +15.82

846.56 during the trading session FBM2BRD 3,843.00 +12.59

TECHNOLOGY 11.74 -0.52

yesterday.

According to the dealers, the TURNOVER VALUE

gains were partly due to some mild 333.006mil RM579.567mil

bargain-hunting and also profit-taking

KUALA LUMPUR: Permodalan Nasional Bhd A previous report said Maybank had fixed the

activities involving select plantation

(PNB) is confident that its subscription in Malayan price of its upcoming rights shares at RM2.74 a

stocks. 272.445 million shares worth

Banking Bhd‘s (Maybank) rights shares will benefit share, which is a 43.2% discount to the closing

“The market is expected to con- RM462.166 million.

the group in the long term, its president and chief price of RM4.82 on March 5, and secured an under-

As a tinue to languish in the absence of Among the actives, KNM rose

executive officer Tan Sri Hamad Kama Piah said taking where nearly 90% of the rights shares would

positive leads,” OSK said in research two sen to 34.5 sen, Resorts was

yesterday. be taken up by major institutional shareholders. long-term note. flat at RM1.92 and TMI fell 10 sen to

“In this type of market where most of the The price of the rights share is a 34.4% dis- player, we Gainers led losers by 241 to RM2.18.

stocks have gone down so much, we believe in count to the theoretical ex-rights price of RM4.17 want to 213 while 223 counters traded un- For the heavyweights, Sime Darby

their fundamentals and the price they are giving is a share.

a good buy for us,” he told reporters here. On talks of proposed merger between Island make sure changed, 566 were untraded and 31 closed 15 sen higher at RM5.55,

we get others suspended. Tenaga Nasional rose five sen to

“As a long-term player, we want to make sure & Peninsular, Pelangi and Petaling Garden in a

The day’s turnover increased to RM5.95, Maybank advanced four sen

we get long-term returns,” he said. bid to create a large property firm, Hamad Kama long-term 333.006 million shares valued at to RM4.02 and TM dropped two sen

Maybank had previously received undertakings Piah said any proposal to merge the entities under returns.” RM579.567 million from Monday’s to RM3.50. – Bernama

from PNB and certain unit trust funds managed PNB’s belt would have to ensure better returns

by Amanah Saham Nasional Bhd, a wholly owned for the group. – Tan Sri

subsidiary of PNB, to subscribe to about 55.7% of “I think the issue is that we are always looking at Hamad Kama

the proposed rights issue. each of our counters. We want to make sure we can Piah Mintye looks to further expand to Japan

Maybank said PNB has also agreed to apply be more efficient in terms of getting better results.

for the excess allocation of 20% of the proposed This is ongoing, and it is normal so that we can TOKYO: Mintye Marketing Sdn Bhd, Today, Mintye exports its products

rights issue. improve from time to time,” he said. – Bernama a subsidiary and marketing arm of to 60 countries worldwide including

Mintye Industries Bhd, is looking to Australia, England, Greece, Ireland,

Modenas banking on its early planning further expand its business to Japan, its

executive director Yeo Kim Soon said.

Japan, Taiwan and the Middle East.

Its products range from brake lin-

ALOR STAR: A planning which took a period of Modenas increase its market share of motorcycles Mintye Marketing is a local market ings (blocks), brake linings in rolls, disc

three years has become an important weapon sales in the country to 18% with the introduction leader in the trading of friction materi- brake pad, disc pad backing plates,

now for Motosikal dan Enjin Nasional (Modenas) of several new models this year. als, brake fluid and other automotive brake shoe cores and brake fluids.

in its fight against the ongoing world economic “During the three-year period (of planning), parts. The company started in the late “We went into full production from

crisis with so many other companies getting Modenas carried out strong research and develop- 70s, importing semi-finished materi- 1984 with emphasis on the local mar-

affected. ment (R&D) to come up with more sophisticated als for the production of automotive ket and within two years, managed to

According to its chief executive officer Abdul models to replace the old models,” he told Bernama and industrial friction products, from capture a sizeable portion of it,” Yeo

Harith Abdul Rahman the plan is expected to help here yesterday. Germany. told Bernama here.

MAHB hopes to recoup LCCT

investment in two years

SEPANG: Malaysia Airports Holdings Bhd departure hall in LCCT, yesterday.

(MAHB) hopes to recoup its investment on the “We are also bringing in more retail outlets

low-cost carrier terminal (LCCT) in two years, and restaurants here via the expansion pro-

supported by rising passenger traffic and de- gramme, and with more revenue collection from

mand for retail as well as food and beverage, airport charges and landing charges, it would

said its senior general manager Datuk Azmi help to recover our investments,” he said.

Murad yesterday. Azmi said MAHB expects the LCCT passen-

The company spent RM108 million to set ger traffic to grow by 30% this year while the

up a 35,290sq m LCCT in Sepang and allocated aircraft movement to reach 300 flights per day.

another RM124 million for the expansion of in- Last year, the airport operator handled

ternational departure and arrival halls, including around 10.139 million passengers, of which

public concourse, government offices, curbside 5.088 million passengers were from interna-

and parking area. tional flights.

Scheduled to be completed in April this year, Asked whether there was interest from

the expansion programme would enable the other low cost carriers to have an operation in

handling of 15 million passengers a year from LCCT, Azmi said the terminal was open to any

the current 10 million. no-frills airlines and MAHB was on the look out

“We believe the passenger traffic, especially for opportunities.

on the international flights will continue to grow Located 20km away from the KL International

as the low cost carrier operator continues to Airport Main Terminal Building, the LCCT was

mount for new destinations and increase flight opened for familiarisation on March 9, 2006 and

frequencies, and thus will encourage more retail was fully operational by March 23, 2006.

and food and beverage activities,” he told re- It is managed and operated by Malaysia

porters during a media tour of the international Airports (Sepang) Sdn Bhd. – Bernama

Astro posts pre-tax loss of RM372m

KUALA LUMPUR: Astro All Asia Networks proposed joint venture in Indonesia.

Plc posted a pre-tax loss of RM372.373 It said various legal actions have com-

million for the financial year ended Jan menced in respect of developments in Indo-

31, 2009 compared with a pre-tax profit of nesia and the group is required to account

RM136.631 million the previous year. for costs associated with these actions as

However, its revenue rose to RM2.971 they incur.

billion from RM2.602 billion previously due Chairman Datuk Badri Masri said Astro

to higher subscriber additions in Malaysia will be more cautious and manage the

pay-TV business, Astro said in a statement business with a high regard for conserving

to Bursa Malaysia yesterday. cash and minimising costs amid the current

“Gross subscriber additions in the year economic uncertainties.

were at a new high of 612,000 resulting in “We can continue to grow the Malaysian

374,000 net new customers,” it said adding pay-TV, radio and content businesses by

that “good progress was also made in the strengthening their value propositions to

pay-TV business in India”. achieve better market share and implement-

Meanwhile, Astro said it has accounted ing effective cost management measures to

for RM687 million of cost incurred in pro- sustain margins and profit growth,” he said.

viding services and support to a previously – Bernama

You might also like

- Modenas Kris 110Document183 pagesModenas Kris 110manori92% (12)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- RCB 19 PDFDocument126 pagesRCB 19 PDFmohd firdaus bin ibrahim100% (1)

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDocument1 pageThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNo ratings yet

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDocument1 pageThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNo ratings yet

- Thesun 2008-12-18 Page20 Msias rm2Document1 pageThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDocument1 pageThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNo ratings yet

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDocument1 pageThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyDocument1 pageThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDocument1 pageThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDocument1 pageThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNo ratings yet

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocument1 pageThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDocument1 pageThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNo ratings yet

- Thesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBDocument1 pageThesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- Thesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesDocument1 pageThesun 2009-04-02 Page13 Sarkozy Warns g20 Over False CompromisesImpulsive collectorNo ratings yet

- TheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaDocument1 pageTheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaImpulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierDocument1 pageThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- TheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityDocument1 pageTheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityImpulsive collectorNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDocument1 pageThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNo ratings yet

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocument1 pageTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNo ratings yet

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocument1 pageThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNo ratings yet

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocument1 pageTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocument1 pageTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNo ratings yet

- Mpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksDocument3 pagesMpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksSanya HelinoNo ratings yet

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDocument1 pageTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNo ratings yet

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- Thesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMDocument1 pageThesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Confirmation of Purchase of TakafulDocument5 pagesConfirmation of Purchase of TakafulSuparno Sarjono Sukiman VNo ratings yet

- Projek Siap HRMDocument22 pagesProjek Siap HRMkala0222100% (1)

- 20 Mind Blowing Concept Motorcycle Designs - Technology PDFDocument27 pages20 Mind Blowing Concept Motorcycle Designs - Technology PDFgabriel_danutNo ratings yet

- RCB Product Catalogue 2021 - V1Document142 pagesRCB Product Catalogue 2021 - V1Daniel ZabalaNo ratings yet

- Sim Motors Electric Sdn. BHD.: Category Superbike Brand SuzukiDocument14 pagesSim Motors Electric Sdn. BHD.: Category Superbike Brand SuzukiSaryonoNo ratings yet

- Single Cylinder Four Stroke Diesel Engine Test RigDocument24 pagesSingle Cylinder Four Stroke Diesel Engine Test RigDigvijay Todkar100% (1)

- Online Public Auction Listing 20240417Document13 pagesOnline Public Auction Listing 20240417Che DeenNo ratings yet

- .My Plugins EventCalendar ReportToExcelPage 1366 Page 0Document16 pages.My Plugins EventCalendar ReportToExcelPage 1366 Page 0Aizat FaliqNo ratings yet

- Tekudugam PDFDocument5 pagesTekudugam PDFNews Channel FourNo ratings yet

- RCB Product Catalogue 2020 - Web PDFDocument132 pagesRCB Product Catalogue 2020 - Web PDFjacob caipangNo ratings yet

- Underbone: & Universal AccessoriesDocument169 pagesUnderbone: & Universal AccessoriesvietkhamNo ratings yet

- Draft Report Li - MH20012Document21 pagesDraft Report Li - MH20012Yunus 2001No ratings yet

- C7F9EC018367Document14 pagesC7F9EC018367Florensia VintaNo ratings yet

- Cover Note 829a751Document3 pagesCover Note 829a751Mohamad Hakimi Bin MakhtarNo ratings yet

- MotorcycleDocument42 pagesMotorcycleAiddie GhazlanNo ratings yet

- Forum Discussion - ODDocument5 pagesForum Discussion - ODHo Kok WengNo ratings yet

- J. Pra 8Document14 pagesJ. Pra 8putriarumNo ratings yet

- Bpme 6093 Modenas Combine LastDocument12 pagesBpme 6093 Modenas Combine LastjibamcomotNo ratings yet

- Modenas OverviewDocument7 pagesModenas OverviewMiak JaikNo ratings yet

- RCB 210216Document169 pagesRCB 210216bgmentNo ratings yet

- Modenas Kriss 2 - Motorcycles For Sale Kuala Lumpur - MudahDocument2 pagesModenas Kriss 2 - Motorcycles For Sale Kuala Lumpur - MudahSharvin RajNo ratings yet