Professional Documents

Culture Documents

Z Score Template-MRS

Z Score Template-MRS

Uploaded by

Jack Francis FernandezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Z Score Template-MRS

Z Score Template-MRS

Uploaded by

Jack Francis FernandezCopyright:

Available Formats

Credit Analysis:Altman Z-Score Model

NAME OF COMPANY Eastern Housing Ltd.

FIRST CALENDAR YEAR OF DATA NUMBER OF YEARS OF DATA

2007 5

Please input your assigned firm's value in the following table. Results will be computed autom

Requirement: hardcopy of this template and photocopies of your assigned firm's in If anyboby collected the softcopy of annual reports, then inputs all the requirment Submission Date: 22-12-12. It will be a easier term paper... Best of luck

2007

140,179,500

Particulars Operating Income Net Income Current Assets Current Liabilities Net Working Capital Total Assets Total Liabilities Book Value of Equity Or Stockholders' Equity Retained Earnings

71481600 6593986300 5424966100 1169020200 6666245900 5873847200 792398700 171830700

Degree of Financial Leverage

% change in net income % change in operating income Degree of Financial Leverage Degree of Financial Leverage (Average) 1.51

Interpretation: For every 1 percent change in operating income , net income changes 1.51 percent dye to financi Financial leverage tends to increase the risk of ownership for sareholders. Altman Z score Formula

6.56 net working capital /total assets 3.26 Retained Earnings/Total Assets 1.05 Operating Income/Total assets

0.1754 0.0258 0.0210

6.72 Book Value of Equity/Total Liabilities

0.1349 2.1630 1.8306

Z Score Z Score (Average)

Interpretation: Where z< 1.23 indicates a bankruptcy prediction, 1.23 z 2.90 indicates a gray area, and z> 2.90 indicates As z = 1.83, it indicates a gray area. That's mean it can be concluded that firm's credit risk is undefined. Lender will be in co

Score Model

s will be computed automatically.Then just interpret the results.

your assigned firm's income statement and balance sheet during the period of 2007-2011. If puts all the requirments in CDs and submit it along with the hard copy of this template. ... Best of luck:)

2008

166,053,800

2009

155,944,800

2010

200,846,700

2011

195,781,700

69859300 6797846400 5559815600 1238030800 6876643800 6076442600 800201200 179633200

75443200 7366120800 6099179100 1266941700 7440874400 6627299400 813575000 193007000

112564700 9340540500 8078991900 1261548600 9422547800 8570876300 851671500 231103500

96137600 12698478100 11562822700 1135655400 12787055100 11959073700 827981400 207413400

-2.27% 18.46% -0.12

7.99% -6.09% -1.31

49.20% 28.79% 1.71

-14.59% -2.52% 5.79

ges 1.51 percent dye to financial leverage.

0.1800 0.0261 0.0241

0.1703 0.0259 0.0210

0.1339 0.0245 0.0213

0.0888 0.0162 0.0153

0.1317 2.1765

0.1228 2.0485

0.0994 1.6484

0.0692 1.1168

a gray area, and z> 2.90 indicates no bankruptcy. is undefined. Lender will be in confused position to predict it's credit risk.

riod of 2007-2011. If anyboby collected the softcopy of annual reports, then inputs all the r of this template.

s, then inputs all the requirments in CDs and submit it.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- What Is tZERO - DraftDocument26 pagesWhat Is tZERO - DraftJuan Pablo GómezNo ratings yet

- Accounting Cycle by BalladaDocument50 pagesAccounting Cycle by Balladakyleramos83% (6)

- HSBC Global Research GuideDocument28 pagesHSBC Global Research GuideSOVATANo ratings yet

- SAP - SD - Whitepaper-Down Payment Request With Billing PlanDocument3 pagesSAP - SD - Whitepaper-Down Payment Request With Billing Plansmiti84No ratings yet

- Differences Between Operating Lease and Finance LeaseDocument2 pagesDifferences Between Operating Lease and Finance Leasetanya1780No ratings yet

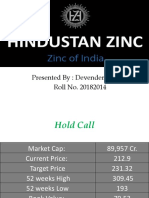

- Hindustan ZincDocument8 pagesHindustan ZincDevender SharmaNo ratings yet

- Marriott CorporationDocument7 pagesMarriott Corporationparth2kNo ratings yet

- Sujan ProposalDocument39 pagesSujan ProposalsujankarkieNo ratings yet

- The Inside Bar Trading Strategy Guide PDFDocument18 pagesThe Inside Bar Trading Strategy Guide PDFsnmathad233% (3)

- TradeInformation - 2011Document3,606 pagesTradeInformation - 2011sazzad_ßĨdNo ratings yet

- Caiib BFM 30 Day WorkplanDocument3 pagesCaiib BFM 30 Day WorkplanPrabhat KrNo ratings yet

- 2004-05 Report of All BanksDocument133 pages2004-05 Report of All BanksAjay KumarNo ratings yet

- TQ Kick Off PresentationDocument29 pagesTQ Kick Off PresentationSanaa2510No ratings yet

- Gabaritorendafixa1 PDFDocument7 pagesGabaritorendafixa1 PDFhmvungeNo ratings yet

- Salesoft, IncDocument5 pagesSalesoft, IncArpit Kasture0% (1)

- Flexible Exchange RatesDocument14 pagesFlexible Exchange Ratestapan mistryNo ratings yet

- Modern Portfolio Theory (MPT) and What Critics SayDocument6 pagesModern Portfolio Theory (MPT) and What Critics SayEvans MandinyanyaNo ratings yet

- Round PDFDocument2 pagesRound PDFmnrcavNo ratings yet

- Nifty 4Document4 pagesNifty 4Suhas SalehittalNo ratings yet

- Majesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Document2 pagesMajesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Shyam SunderNo ratings yet

- Theories of Exchange Rate DeterminationDocument6 pagesTheories of Exchange Rate DeterminationOmisha SinghNo ratings yet

- The Global Cost and Availability of CapitalDocument41 pagesThe Global Cost and Availability of CapitalayurishiNo ratings yet

- International Financial Management BIB 3064 (GROUP 3) Topic: Exchange Rate DeterminationDocument10 pagesInternational Financial Management BIB 3064 (GROUP 3) Topic: Exchange Rate DeterminationKëërtäñ SubramaniamNo ratings yet

- Xumit CapitalDocument30 pagesXumit CapitalSumit SinghNo ratings yet

- A48970353 - 23417 - 30 - 2019 - Worksheet - Profit LossDocument2 pagesA48970353 - 23417 - 30 - 2019 - Worksheet - Profit Lossadarsh rajNo ratings yet

- Week 8 - Lecture NotesDocument34 pagesWeek 8 - Lecture Notesbao.pham04No ratings yet

- Forward ContractDocument19 pagesForward Contractsuhaspujari93No ratings yet

- Functions and Roles of RbiDocument3 pagesFunctions and Roles of RbiMOHITNo ratings yet

- Hawkins Cookers Limited: Summary of Rated Instruments Instrument# Rated Amount (In Rs. Crore) Rating ActionDocument6 pagesHawkins Cookers Limited: Summary of Rated Instruments Instrument# Rated Amount (In Rs. Crore) Rating ActionViral VaishnavNo ratings yet

- BBA Financial Markets Primary MarketDocument29 pagesBBA Financial Markets Primary MarketAbhishekNo ratings yet