Professional Documents

Culture Documents

Net Banking

Net Banking

Uploaded by

Pardeep SainiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net Banking

Net Banking

Uploaded by

Pardeep SainiCopyright:

Available Formats

Net-Banking

What is internet banking?

Internet banking system is a that has developed in order to help client with the daily to daily transactions. Internet banking system means that client cans now dobanking at the leisure of their homes. Also known as online banking, the system allows both transaction and non transaction features. Online banking or internet banking allows customer to conduct financial transactions on a secure on secure website operated by the retail or virtual bank

History of internet banking

The term online banking was first started in 80s. The termonline became popular in the late '80s and referred to the use of aterminal, keyboard and TV (or monitor) to access the bankingsystem using a phone line. Home banking can also refer t o theuse of a numeric keypad to send tones down a phone line withinstructions to the bank. Online services started in New York in1981 when four of the citys major banks(Citibank ,Chase Manhattan,Chemical and Manufacturers Hanover)offered home banking services using the videotext system. Because of the commercial failure of videotex these banking services never became popular except in France where the use of videotext (Minitel) was subsidized by the telecom provider and the UK, where the Prestel system was usedThe UKs first home online banking services was set up by the Nottingham Building Society(NBS) in 1983 .The system

used was based on the UK's Prestel system and used a computer , such as the BBC Micro, or keyboard (Tandata Td1400) connected to thetelephone system and television set. The system (known as'Home link') allowed on-line viewing of statements, bank transfers and bill payments. In order to make bank transfers and bill payments, a written instruction giving details of the intended recipient had to be sent to the NBS who set the details up on theHome link system. Typical recipients were gas, electricity andtelephone companies and accounts with other banks. Details of payments to be made were input into the NBS systemby theaccount holder via Prestel. A cheque was then sent by NBS to the payee and an advice giving details of the payment was sent tothe account holder. BACS was later used to transfer the paymentdirectly.Stanford Federal Credit Union was the first financial institutionto offer online internet banking services to all of itsmembers inOct, 1994. Today, many banks are internet only banks. Unlike their predecessors, these internet only banks do not maintain brick and mortar bank branches. Instead, they typically differentiate themselves by offering better interest rates and online banking features.

working of internet banking in state bank of India

Where SBI was? In early 1990s more than 7000 branches were usingtraditional manual procedures. These manual procedures were inherited from the ImperialBank. Traditional procedures were evolved over decades Very few changes were brought in those procedures as per the need of time In the time , mainframe or mini computers were used for MIS, RECONCILLATION & FUND SETTLEMENT PROCESS, or we can say that for backhand operations purpose

Changes brought in information technology by SBI In the next decade internet facility was provide for individuals. All SBI branches were connected and ATMs were launch . 2001 KMPG appointed consultant for preparing IT plan for the bank . Later on core banking proposed by the IT consultancy company. 2002- all branches computerized but on decentralized system, there the initiative of core banking took place. 2008- More than 6500 branches (95%of business) on core banking solution (CBS).

Internet banking facility for corporate customers was also launched in early 2008. More Interfaces developed with e-Commerce & other sites through alternate channels like ATM & Online Banking. All Foreign Offices were brought on Centralized Solution. Large network is playing the role of backbone for connectivity across the country. Multiple Service Providers are providing the links BSNL, MTNL, Reliance, Tata & reliance which are making the system errorless and provide high speed. Multiple Technologies to support the networking infrastructure Leased lines, Dial-up, CDMA & VSAT.

Services provided by SBI internet banking

Online SBI (www.onlinesbhi.com) State Bank of India is Indias largest bank with a branch network of over 11000 branches and 6 associate banks located even in the remotest parts of India. State Bank of India (SBI) offers a wide range of banking products and services to corporate and retail customers. OnlineSBI is the Internet banking portal for State Bank of India. The portal provides anywhere, anytime, online access to accounts for State Banks Retail and Corporate customers. The application is developed using the latest cutting edge technology and tools. The infrastructure supports unified, secure access to banking services for accounts in over 11,000 branches across India.

RETAIL BANKING:The Retail banking application is an integration of severalfunctional areas, and enables customers to:

feature

for online tax payment

CORPORATE BANKING:The OnlineSBI corporate banking application provides features to administer and manage corporate accounts online. The corporate module provides roles such as Regulator, Admin, Uploaded, Transaction Maker, Authorizer, and Auditor. These roles have access to the following functions:

-onmechanism

collection authorities.

party payments, and draft issues

to the user ate account statement

Value added services:

-VFS- Electronic Vendor Finance Scheme) Facility

Products and services

E-ticketing SBI E-tax Bill payment RTGS/NEFT E-payment Fund transfer Third party transfer Demand draft Cheque book request Account opening request Account statement Transaction enquiry Demat account statement Donation

1) E-TICKETING :You can book your railway, air and bus tickets online through OnlineSBI. To book your train ticket, just log on to irctc.co.in and create an ID there at if you do not have one. Submit your travel plan and book the ticket(s)-either i-ticket (where the delivery of tickets will be made at your address) or E-tickets (wherein after successful payment transactions, an e-ticket is generated which can be printed any time .For an e-ticket, the details of photo identity card will required to be filled in)And select State Bank of India in the payment options. You will be redirected to Internet Banking site of SBI (www.onlinesbi.com).After submitting the respective ID and password, you can select your account. After a successful debit, Railways will generate the ticket. E-ticket can be printed by you whereas the i-ticketwillbe dispatched by IRCTC at the given address. Service charges @ Rs.10/- per transaction shall be levied in addition to the cost of the ticket. Cancellation of E-ticket can be done by logging on to IRCTC's site; refund amount will be credited to your account directly within 2-3 days. For cancellation of i-ticket, you shall be required to submit your ticket at a computerized counter of Railways and on cancellation; the amount shall be credited back to your account. You can also book your Air ticket through the e-ticketing feature. Logon to Indian Airlines website to make a payment for an e-ticket through State Bank of India, you need to select SBI as the payment option. The payment request will be redirected to Internet Banking site. The request may be processed based on values sent from the airlines website. Once a transaction is processed, an appropriate response will be sent to airlines site to update the status of the transaction. You can print the E-ticket immediately. To book bus tickets to destinations in Karnataka, log on to the KSRTC website. Provide details about the start and end points of your

journey, date of journey and number of tickets. Verifyavailability of seats on the selected date and confirm the transaction. Select OnlineSBI to make the payment. Provide your

credentials and select the SBI account that will be debited for the payment. You are provided a KSRTC reference number for your e-Ticket.

2) SBI E-TAX:You can pay your taxes online through SBI E-Tax. This facilityenables you to pay TDS, Income tax, Indirect tax, Corporation tax, Wealth tax, Estate Duty and Fringe Benefits tax. Click the e-Tax link in the home page. You are displayed a page with twolinks Direct Tax and Indirect Tax.Click the Direct Tax link. You will be redirected to the NSDLsite where you can select an online challan based on the tax youwish to pay. Provide the PAN, name and address, assessmentyear, nature of payment and bank name. On selecting the bank name as SBI and submitting the form, you will be redirected tothe Internet Banking site. After submitting the respective ID and password, you can select your account for making payment of taxes. After payment is successful you can print the E-Receipt for the payment. The Ereceipt can be printed at a later date alsoand the same can be retrieved from: Enquiries > Find Transactions > Status Enquiries > Click on the respective transaction to print the tax receipt.The Indirect Tax link is used to make Central Excise and Service Tax payments to Central Board of Excise and Customs. The online payment feature facilitates anytime, anywhere paymentand an instant E-Receipt is generated once the transaction is complete. The Indirect Tax payment facility is available to Registered Central Excise/Service Tax Assesse who possesses the 15 digit PAN based Assessee Code. You can make CBEC payments using the Indirect Taxes

link available in the Payments/Transfers tab. You need to provide your assesseecodeas registered with CBEC and select the minor heads towards which you intend to pay tax. Select the appropriate tax type and enter the tax amount. Select an account for debiting the total tax amount. You can use any of your transaction accounts to make the payment. If a payment is successful, CBEC provides a link to generate an E-Receipt for the payment. Internet banking customers can pay tax through site to site integration. For government agencies, which are not Internet-enabled, OnlineSBI offers the Government Tax Payment facility. This facility is available as a post login feature in the retail and corporate banking sites of the Online SBI portal. Please note that the cut-off time for OLTAS and CBEC payment is 8 P.M. IST. Any transactions created after the cut off time will be processed after 7 A.M. on the following day.

3) Bill Payment:A simple and convenient service for viewing and paying your bills online. No more late payments No more queues No more hassles of depositing chequesUsing the bill payment you can 'view and Pay various bills online, directly from your SBI account. You can pay telephone, electricity, insurance, credit cards and other bills from the comfort of your house or office, 24 hours a day, 365 days a year. Simply log on to http:/www.onlinesbi.com with your credentials and register the biller to which you want to pay, with all the bill detail. Once the bill is uploaded by the biller, you can make payment online.you can see how do it to learn the steps for using the facility ..

You can also setup Auto pay instruction with an upper limit to ensure that your bills are paid automatically wherever they are due. The upper limit ensure that only bills within the specified limit are paid automatically, there by providing you complete control over these payments.

The e-pay service is available in various cities across the country and you can now make payment to several billers in your region.

4 RTGS/NEFT

You can transfer money from your state bank account to account in other bank using the RTGS/NEFT service. The RTGS system facilitates transfer of funds from accounts in one bank to another on a "real time" and on "gross settlement" basis. This system is the fastest possible interbank money transfer facility available through secure banking channels in India. RTGS transaction requests will be sent to RBI immediately during working hours post working hours requests are registered and sent to RBI on next working day. You can also schedule a transaction for a future date. You can transfer an amount of Rs.1lac and above using RTGS system.

National Electronic Funds Transfer (NEFT) facilitates transfer of funds to the credit account with the other participating bank. RBI acts as the service provider and transfers the credit to the other bank's account.

NEFT transactions are settled in batches based on the following Timings

1. 6 settlements on weekdays - at 09:00, 11:00, 12:00, 13:00, 15:00 and 17:00 hrs. 2. 2.3 settlements on Saturdays - at 09:00, 11:00 and 12:00 hrs Please note that all the above timings are based on indian standard time (IST) only In order to transfer the fund to an account with other bank kindly ensure that the bank branch of the beneficiary is covered under the RGTS/NEFT payment system. It is recommended that you choose the bank/branch from the drop down option provided under the link add interbank beneficiary Please exercise care to provide the correct account number and name of the beneficiary.

5 E-payment:you can pay your insurance premium mobile phone bills and also you can purchase mutual fund units by coming from the billers website and selec ting state bank of india in the payment option. LIC PREMIUM: for paying premium of lic policy logon to

www.licindia.comand register your policy details. When the premium is due select State Bank of India in the make paymentoption. SBI Mutual FUND: You can invest in the SBI Mutual Fund schemes online. Logon to www.sbimf.comAnd select the scheme inwhich you want to make investment in the payment option selectState Bank of India.

CCA VENUES: Enjoy shopping at the CCAvenue Shopping Malland purchase from a wide variety of products and servicesthrough CCAvenue Certified Vendors. Make payments for your purchases using your Internet enabled SBI accounts.

6) Fund Transfer :The Funds Transfer facility enables you to transfer funds within your accounts in the same branch or other branches. You can transfer aggregating rs 1 lakh per day to own account in the same branch and other branches. To make a fund transfer, you should be an active internet banking user with transction rights, fund transfer to ppf account is restricted to the same branch. Just log on the retail section of the internet bnking site with your credentials and select the fund transfer link under payment/transfer tab. You can see all your online debit and credit accounts, select the debit account from which you wish to transfer fund and the credit account in to which the amount is to b credited. Enter the amount and remarks. The remarks will be displayed in your accounts statement for this transaction. You will be displayed the last five funds transfer operation on your account. On confirming the transaction, you will be display a confirmation page with the detail of the transaction and theoptin to submit or cncel the funds transfer request. A reference number will be generated for your record..

7 THIRD PARTY TRANSFER:You can transfer funds to your trusted third parties by addingthem as third party accounts. The beneficiary account should beany branch SBI. Transfer is instant. You can do any number of Transactions in a day for amount aggregating

Rs.1lakh.To transfer funds to third party having account in SBI, you needto add and approve a third party, you need to register your mobile number in personal details link under profile section. Youwill receive a One Time SMS password on your mobile phone toapprove a third party. If you do not have a mobile number, third party approval will be handled by your branch. Only after approval of third party, you will be able to transfer funds to thethird party. You can set limits for third party transactions madefrom your accounts or even set limits for individual third parties.

8) Demand Draft :The Internet Banking application enables you to register demanddrafts requests online. You can get a demand draft from any of your Accounts (Savings Bank, Current Account, Cash Credit or Overdraft). You can set limits for demand drafts issued from your accounts or use the bank specified limit for demand drafts. You can option to collect the draft in person at your branch, quoting a reference to the transaction. A printed at your branch, quoting a reference to the transaction. A printed advice can also be obtained from the site for your record. Alternatively, you may eaquest the branch to courier it to your registered address, and the courier change will be recovered from you. If you have any queries, kindly approach your branch, quoting the reference number generated for the request.

9 cheques book request :You can request for a cheque book online, cheque book can be requested for any of your saving, current, cash credit and over draft account. You can option for cheque book with 25,50 or 100 cheque leaves. You can either collect it form branch or request your branch to send it by post or courier. You can option to get the cheque book delivered at your registered address or youcan provide an alternate address. Cheque books will bedispatched within 3 working days from the date of request.Just log on to retail section of the Internet Banking site with your credentials and select the Cheque Book link under Requests tab.You can view all your transaction accounts. Select the accountfor which you require a cheque book; enter the number of cheque leaves required and the mode of delivery. Then, submitthe same.

10) Account Opening Request:OnlineSBI enables you to open a new account online. Youcan apply for a new account only in branches where youalready have accounts. You should have an INB-enabledaccount with transaction right in the branch. Funds in anexisting account are used to open the new account. You can open Savings, Current, Term Deposit and Recurring Deposit accounts of Residents, NRO and NRE types. Just log on to retail section of the Internet Banking site with your credentials and select the New Account link under Requests tab. You can see all types of accounts. Select the account and account type you wish to open and submit the same. Then, you need to select the branch and enter the initial amount to open the account. You can select any of your accounts for debiting the initial amount. Then, submit the transaction. Your new account opening request will be processed by the branch.

11) Account Statement:The Internet Banking application can generate an online,downloadable account statement for any of your accountsfor any date range and for any account mapped to your username. The statement includes the transaction details, opening, closing and accumulated balance in the account. You can generate the online account statement for any date range or for any month and year. The account statement can be viewed online, printed or downloaded as an Excelor PDF file. You also have the option to select the number of records displayed in each page of the statement. The options are 25, 50, 75, 100 and ALL.

12) Transaction Enquiry:OnlineSBI provides features to enquire status of onlinetransactions. You can view and verify transaction detailsand the current status of transactions. Your VISAtransactions can also be viewed separately. Just log on toretail section of the Internet Banking site with your credentials and select the Status Enquiry link under theEnquiries tab. You will be displayed all online transactionsyou have performed. To view details of individualtransactions, you need to click the Transaction Reference number link. You are displayed the debit and credit account details, transaction amount, narration and transaction status.

13) Demat Account Statement:OnlineSBI enables you to view Demat account statement andmaintain such accounts. The bank acts as your depository participant. In the third party site, you can mark a lien on your Demat accounts and use the funds to trade on stock using fundsin your SBI savings account.You can view Demat account details, and generate the followingstatements: statement of holding, statement of

transactions,statement of billing.

14) Donation:You can make donation to religious and charitable institution byusing Internet Banking of SBI. Simply log on to http://www.onlinesbi.com/with your credentials and go to Payment and transfer and click on make donation link. After selecting the debit account select the religious/charitable institution that you want to offer donation. After successful payment you can print an E-receipt for the donation made.

Conclusion:Studying the project we came to know that Internet banking isclearly the way forward for the State Bank of India. It providescomfort to customers at the same time it provides cost cutting toSBI by eliminating physical documentation. Internet bankingsaves time of bank as well as those of customers.Study states that internet banking provides greater reach tocustomers. Feedback can be obtained easily as internet is virtualin nature. Customer loyalty can be gain. Personal attention can be

given by bank to customer also quality service can be served.Bank should know that No system is perfect, however a systemof such a type will need to be very secure. This is a systemwhich holds account details and customers wealth. If such asystem was not trusted and not reliable, then SBI would faceserious laws and would lose business.After studying the SWOC analysis, we came to know variousstrengths of SBI such as quality customer service, greater reach,customer loyalty, easy access to information, 24 hours access, easy online applications etc. SBI should put efforts to multiplythe number of strengths. In terms of weakness I come to knowsome of the major weaknesses they are lack of awareness of internet banking among the customers, obsolesce of technologyrelated to security, complicated procedures of availing internet banking facilities, lack of knowledge among the employees of SBI. SBI should concentrate on the weaknesses and reduce themto zero.In the third segment of SWOC analysis of internet banking wedealt with opportunities like 95 % market of internet market isuntapped, SBIs path to become first virtual bank.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 09.Project-Hospital Management SystemDocument50 pages09.Project-Hospital Management SystemRajeev Ranjan89% (91)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Feasibility StudyDocument14 pagesFeasibility StudyPardeep SainiNo ratings yet

- UC Browser HD 2Document14 pagesUC Browser HD 2Pardeep SainiNo ratings yet

- Computer NetworkDocument19 pagesComputer NetworkPardeep SainiNo ratings yet

- 33Document12 pages33Pardeep SainiNo ratings yet

- AnonymousDocument27 pagesAnonymousPardeep SainiNo ratings yet

- Nav Jyoti Sen Sec School 4 ScienceDocument2 pagesNav Jyoti Sen Sec School 4 SciencePardeep SainiNo ratings yet

- SanjuDocument3 pagesSanjuPardeep SainiNo ratings yet

- Home Science 10+1Document2 pagesHome Science 10+1Pardeep SainiNo ratings yet

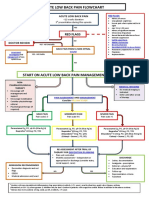

- Acute Low Back Pain Flowchart January 2017Document1 pageAcute Low Back Pain Flowchart January 20171234chocoNo ratings yet

- The Expanding Universe - Sir Arthur Stanley Eddington - Cambridge University Press - 1987Document153 pagesThe Expanding Universe - Sir Arthur Stanley Eddington - Cambridge University Press - 1987cramerps2084No ratings yet

- SUMAWAY - Nevada V CasugaDocument2 pagesSUMAWAY - Nevada V CasugaTintin SumawayNo ratings yet

- Laurie Baker: (The Brick Master of Kerala)Document8 pagesLaurie Baker: (The Brick Master of Kerala)Malik MussaNo ratings yet

- Haridwar Cancelled TCKTDocument2 pagesHaridwar Cancelled TCKTRavikumar AppaniNo ratings yet

- Full Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapternahoonabid100% (5)

- Dwivedietal 2023 Metaverse PMDocument28 pagesDwivedietal 2023 Metaverse PMAnissaNo ratings yet

- Shark ClassificationDocument44 pagesShark ClassificationSheeka TareyamaNo ratings yet

- 12-32 List of Events Shelter Bus - TTC Nov 1-12 - All Depts (2) - CensoredDocument26 pages12-32 List of Events Shelter Bus - TTC Nov 1-12 - All Depts (2) - CensoredThe Globe and MailNo ratings yet

- The Crest of The Tide of Renascence: Sankaradeva's Kirttan-GhosāDocument30 pagesThe Crest of The Tide of Renascence: Sankaradeva's Kirttan-GhosāBhargavNo ratings yet

- Project Management Process GroupsDocument10 pagesProject Management Process GroupsQueen Valle100% (1)

- MR Robert Sheaffer - Bad UFOs - Critical Thinking About UFO Claims-CreateSpace Independent Publishing Platform (2015)Document331 pagesMR Robert Sheaffer - Bad UFOs - Critical Thinking About UFO Claims-CreateSpace Independent Publishing Platform (2015)María Eugenia LivaNo ratings yet

- 哈佛商业评论 (Harvard Business Review)Document7 pages哈佛商业评论 (Harvard Business Review)h68f9trq100% (1)

- DeputationDocument8 pagesDeputationAnand MauryaNo ratings yet

- ABB Fittings PlugsDocument204 pagesABB Fittings PlugsjohnNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- 1.publications All BranchesDocument25 pages1.publications All BranchesNaresh GollapalliNo ratings yet

- 1.1 Mechatronics Technology PRESENTATIONDocument46 pages1.1 Mechatronics Technology PRESENTATIONInnocent katengulaNo ratings yet

- Indian RailwayDocument37 pagesIndian RailwayAnonymous 3BGW2XaXZeNo ratings yet

- Q4FY23 HMCL Transcript-230711-085731Document19 pagesQ4FY23 HMCL Transcript-230711-085731vishwesh gautamNo ratings yet

- 22 Nb-Iot: 22.1 GeneralDocument574 pages22 Nb-Iot: 22.1 GeneralganeshNo ratings yet

- Essay On Corruption in in IndiaDocument1 pageEssay On Corruption in in IndiaGaurav ThakurNo ratings yet

- ITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Document5 pagesITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Aws FaeqNo ratings yet

- Module 4Document18 pagesModule 4Christian Diki JooeNo ratings yet

- Handout - Education in EmergenciesDocument31 pagesHandout - Education in EmergenciesFortunatoNo ratings yet

- Bir Regulations MonitoringDocument87 pagesBir Regulations MonitoringErica NicolasuraNo ratings yet

- Rekayasa IdeDocument21 pagesRekayasa IdelilyNo ratings yet

- Kelas Toefl Jilc: Reading ComprehensionDocument11 pagesKelas Toefl Jilc: Reading ComprehensionRANINo ratings yet

- Yngwie J Malmsteen - Seventh Sign TabDocument18 pagesYngwie J Malmsteen - Seventh Sign TabwahonojepangNo ratings yet

- Topic 3 SequencesDocument4 pagesTopic 3 SequencesWan Aziah100% (1)