Professional Documents

Culture Documents

Perez, Carlota-Technological Revolution FC Contents

Perez, Carlota-Technological Revolution FC Contents

Uploaded by

MoritzkaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perez, Carlota-Technological Revolution FC Contents

Perez, Carlota-Technological Revolution FC Contents

Uploaded by

MoritzkaCopyright:

Available Formats

chapter title

iii

Technological Revolutions and Financial Capital

The Dynamics of Bubbles and Golden Ages

Carlota Perez

Honorary Research Fellow, SPRU Science and Technology Policy Research, University of Sussex, UK Adjunct Senior Research Fellow, INTECH, Maastricht, The Netherlands Visiting Scholar 2002, Cambridge University, UK International Consultant and Lecturer on change strategies and technology policy, Eureka A.C., Caracas, Venezuela

Edward Elgar

Cheltenham, UK Northampton, MA, USA.

chapter title

Contents

List of tables List of figures Preface Chris Freeman Acknowledgments Introduction: An Interpretation PART I TECHNOLOGICAL REVOLUTIONS AS SUCCESSIVE GREAT SURGES OF DEVELOPMENT 3 8 22 36 47 60 vii viii ix xiii xvii

1. 2. 3. 4. 5. 6.

The Turbulent Ending of the Twentieth Century Technological Revolutions and Techno-Economic Paradigms The Social Shaping of Technological Revolutions The Propagation of Paradigms: Times of Installation, Times of Deployment The Four Basic Phases of Each Surge of Development Uneven Development and Time-Lags in Diffusion TECHNOLOGICAL REVOLUTIONS AND THE CHANGING BEHAVIOR OF FINANCIAL CAPITAL

PART II

7. 8. 9. 10. 11. 12. 13.

Financial Capital and Production Capital Maturity: Financial Capital Planting the Seeds of Turbulence at the End of the Previous Surge Irruption: The Love Affair of Financial Capital with the Technological Revolution Frenzy: Self-Sufficient Financial Capital Governing the Casino The Turning Point: Rethinking, Regulation and Changeover Synergy: Supporting the Expansion of the Paradigm across the Productive Structure The Changing Nature of Financial and Institutional Innovations

71 81 90 99 114 127 138

vi

Technological Revolutions and Financial Capital Contents

PART III

THE RECURRING SEQUENCE, ITS CAUSES AND IMPLICATIONS 151 159 167 173 183

14. 15.

The Sequence and its Driving Forces The Implications for Theory and Policy

Epilogue: The World at the Turning Point Bibliography Index

chapter title

vii

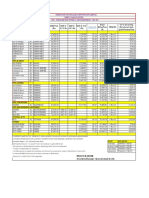

List of Tables

2.1 2.2 2.3 8.1 13.1 13.2 Five successive technological revolutions, 1770s to 2000s The industries and infrastructures of each technological revolution A different techno-economic paradigm for each technological revolution; 1770 to 2000s Fluctuations in UK foreign investment (at current prices) as percentage of total net capital formation, 18551914 A tentative typology of financial innovations The shifting behavior of financial capital from phase to phase of each surge 11 14 18 84 139 141

vii

viii

Technological Revolutions and Financial Capital

List of Figures

2.1 3.1 4.1 4.2 4.3 The double nature of technological revolutions The life cycle of a technological revolution Two different periods in each great surge Steel displacing iron as the main engineering material from the second to the third surge Decoupling of the system: the differing performance of the high-tech sector and the rest of the economy in the USA, 198996 Oil and automobile industries replacing steel as engines of growth from the third to the fourth surge Recurring phases of each great surge in the core countries Approximate dates of the installation and deployment periods of each great surge of development The geographic outspreading of technologies as they mature The recurring sequence in the relationship between financial capital (FK) and production capital (PK) Five successive surges, recurrent parallel periods and major financial crises The recurrence of loan fever and default: the Latin American case The diverging growth of the New York Stock Market and US GDP, 197199 The rise and fall of the NASDAQ bubble, 19712001 Development by surges: the elements of the model and their recurring changes The dynamics of the system: three spheres of change in constant reciprocal action Paradigm shift and political cleavage 9 30 37 38

40 45 48 57 64 74 78 87 112 119 152 156 164

4.4 5.1 5.2 6.1 7.1 7.2 8.1 10.1 11.1 14.1 14.2 15.1

viii

You might also like

- Technological Revolutions and Financial Capital (2002) PDFDocument219 pagesTechnological Revolutions and Financial Capital (2002) PDFBenny Apriariska Syahrani90% (10)

- Carl R. Rogers - Freedom To Learn (1969)Document3 pagesCarl R. Rogers - Freedom To Learn (1969)Moritzka86% (7)

- Yes To The Mess ContentDocument2 pagesYes To The Mess ContentMoritzkaNo ratings yet

- Acct Statement - XX0310 - 30012023Document13 pagesAcct Statement - XX0310 - 30012023IRSHAD SHAN KNo ratings yet

- TROMPENAARS-A New Framework For Managing Change Across Cultures - JofCMDocument15 pagesTROMPENAARS-A New Framework For Managing Change Across Cultures - JofCMMoritzkaNo ratings yet

- Inside The Black Box - Nathan Rosenberg PDFDocument316 pagesInside The Black Box - Nathan Rosenberg PDFDenise Gabriela Rodrigues100% (1)

- Allianz The Sixth Kondratieff enDocument28 pagesAllianz The Sixth Kondratieff enebavali100% (1)

- Mokyr - Institutional Origins of Industrial Revolution - 2007Document51 pagesMokyr - Institutional Origins of Industrial Revolution - 2007kkskNo ratings yet

- Mokyr - Institutional Origins of Industrial Revolution - 2007-1-26Document26 pagesMokyr - Institutional Origins of Industrial Revolution - 2007-1-26kkskNo ratings yet

- Cep - Globalization and Technological AdvancementsDocument41 pagesCep - Globalization and Technological AdvancementsJeman TamayoNo ratings yet

- Content ServerDocument46 pagesContent ServerImjusttryingtohelpNo ratings yet

- Janos KornaiDocument206 pagesJanos KornaiAlejandro GallianoNo ratings yet

- Tipos de Iinovaciones FreemanDocument4 pagesTipos de Iinovaciones FreemanMario Alberto Martínez BautistaNo ratings yet

- Software IndustriDocument26 pagesSoftware IndustriRifan Alif PrastowoNo ratings yet

- The Technology TrapDocument5 pagesThe Technology TrapXiangyi TianNo ratings yet

- Mark Setterfield - The Economics of Demand-Led Growth - Challenging The Supply-Side Vision of The Long Run PDFDocument306 pagesMark Setterfield - The Economics of Demand-Led Growth - Challenging The Supply-Side Vision of The Long Run PDFAlex Rilie100% (2)

- Colemanreviewof Mokyrand RosenbergDocument5 pagesColemanreviewof Mokyrand RosenbergDreem S. WangNo ratings yet

- Review Paper Journal - Mohammad Ezykel Pasha - 205040107111009Document2 pagesReview Paper Journal - Mohammad Ezykel Pasha - 205040107111009ezykelpashaaNo ratings yet

- IRENA Renewable SpringDocument26 pagesIRENA Renewable SpringIkhennaNo ratings yet

- CG 2Document65 pagesCG 2Muhammad RandyNo ratings yet

- Technology, Globalization, and International CompetitivenessDocument18 pagesTechnology, Globalization, and International CompetitivenessOscar Felipe Castaño MartínezNo ratings yet

- Dimensions of Innovation in A Technology-Intensive Economy: Policy Sci DOI 10.1007/s11077-011-9129-3Document8 pagesDimensions of Innovation in A Technology-Intensive Economy: Policy Sci DOI 10.1007/s11077-011-9129-3hermin endratnoNo ratings yet

- 3 The Modern Industrial Revolution, Exit, and The Failure of Internal Control SystemsDocument50 pages3 The Modern Industrial Revolution, Exit, and The Failure of Internal Control Systemsjunqin SunNo ratings yet

- An Economic History of EuropeDocument271 pagesAn Economic History of Europevictorginer850% (2)

- Colemanreviewof Mokyrand RosenbergDocument5 pagesColemanreviewof Mokyrand Rosenbergavataravatar75No ratings yet

- BELL - & - PAVITT - Technological Accumulation and Industrial GrowthDocument54 pagesBELL - & - PAVITT - Technological Accumulation and Industrial GrowthJasar GraçaNo ratings yet

- RR 89 001Document80 pagesRR 89 001Kunter ŞahinNo ratings yet

- Global Economic Meltdown: Long-Wave Economic Cycles: Myth or RealityFrom EverandGlobal Economic Meltdown: Long-Wave Economic Cycles: Myth or RealityNo ratings yet

- Economic History of EuropeDocument271 pagesEconomic History of EuropeIoproprioio100% (2)

- The Sixth Kondratieff - Long Waves of Prosperity: Analysis & TrendsDocument28 pagesThe Sixth Kondratieff - Long Waves of Prosperity: Analysis & TrendszingisajNo ratings yet

- Socio-Institutional Change - Technological ParadigmDocument26 pagesSocio-Institutional Change - Technological ParadigmaleckkennyNo ratings yet

- Rostow 1956Document25 pagesRostow 1956yaraNo ratings yet

- Technological Advancement and Long-Term Economic GDocument30 pagesTechnological Advancement and Long-Term Economic GArgie Villacote BarracaNo ratings yet

- Praes 42asut-Sem PerezDocument22 pagesPraes 42asut-Sem PerezMohanNarendranNo ratings yet

- New Technologies, BusinessDocument18 pagesNew Technologies, BusinessZoran KatanicNo ratings yet

- W 7375Document54 pagesW 7375Axel StraminskyNo ratings yet

- 5 Kondratieff Waves, Technological Modes, and The Theory of Production RevolutionsDocument50 pages5 Kondratieff Waves, Technological Modes, and The Theory of Production RevolutionsNelsonVictorLeCocqNo ratings yet

- Technology GovernanceDocument26 pagesTechnology GovernancerotilioaNo ratings yet

- The Technology of Transition: Science and Technology Policies for Transition CountriesFrom EverandThe Technology of Transition: Science and Technology Policies for Transition CountriesNo ratings yet

- Why The Industrial Revolution Was BritishDocument28 pagesWhy The Industrial Revolution Was BritishAndreiGeorgescuNo ratings yet

- Consumerism and The Industrial RevolutionNODocument31 pagesConsumerism and The Industrial RevolutionNOJuan José Cabrera LazariniNo ratings yet

- Lapavitsas (FInance and Globalization)Document27 pagesLapavitsas (FInance and Globalization)MarcoKreNo ratings yet

- The Socioeconomic Development of Russia: Some Historical AspectsDocument13 pagesThe Socioeconomic Development of Russia: Some Historical AspectsDer MeisterNo ratings yet

- D R U I DDocument80 pagesD R U I DJose Leonardo Simancas GarciaNo ratings yet

- Developmental Lessons of The Vietnamese Transitional EconomyDocument21 pagesDevelopmental Lessons of The Vietnamese Transitional EconomynghiencuulichsuNo ratings yet

- Kondratiev WaveDocument12 pagesKondratiev Wavejosh321No ratings yet

- Working Paper No. 69 China's Transition To A Market Economy: How Far Across The River?Document38 pagesWorking Paper No. 69 China's Transition To A Market Economy: How Far Across The River?chenyueying826No ratings yet

- The Social Shaping of Technological RevolutionsDocument14 pagesThe Social Shaping of Technological RevolutionsCarlos AñezNo ratings yet

- Science and Technology in The BritishDocument18 pagesScience and Technology in The BritishJubert MarquezNo ratings yet

- Entrepreneurship, Innovation and Industrial Development: Geography and The Creative Field RevisitedDocument24 pagesEntrepreneurship, Innovation and Industrial Development: Geography and The Creative Field RevisitedΛιγεία ΔάρμαNo ratings yet

- Banking On Change: Information Systems and Technologies in UK High Street Banking, 1919-1969Document24 pagesBanking On Change: Information Systems and Technologies in UK High Street Banking, 1919-1969herrflick82No ratings yet

- This Content Downloaded From 163.117.159.87 On Tue, 08 Feb 2022 09:32:12 UTCDocument17 pagesThis Content Downloaded From 163.117.159.87 On Tue, 08 Feb 2022 09:32:12 UTCavataravatar75No ratings yet

- Tech Push Pull JeeDocument17 pagesTech Push Pull JeeAzalea CanalesNo ratings yet

- CHAPTER.10 Growth, Immigration and MultinationalsDocument45 pagesCHAPTER.10 Growth, Immigration and MultinationalsAnjali sharmaNo ratings yet

- Ch03 FinalDocument29 pagesCh03 FinalSofia FerreiraNo ratings yet

- American Economic Association The American Economic ReviewDocument29 pagesAmerican Economic Association The American Economic ReviewCrystal CaiNo ratings yet

- Models of Growth and Distribution For BrazilDocument371 pagesModels of Growth and Distribution For BrazilMarcelo100% (1)

- Impact of Port Reform, Political and Economic Events On Maritime Traffic in Chinese PortsDocument15 pagesImpact of Port Reform, Political and Economic Events On Maritime Traffic in Chinese PortsSouravMalikNo ratings yet

- Bell and Pavitt 1993 Technological Accumulation and Industrial GrowthDocument54 pagesBell and Pavitt 1993 Technological Accumulation and Industrial GrowthAna Paula Azevedo100% (2)

- Rothwell Towards The Fifth GenerationDocument25 pagesRothwell Towards The Fifth GenerationLiga Valko100% (2)

- Ethial Leadership PDFDocument16 pagesEthial Leadership PDFMoritzkaNo ratings yet

- Leadershipcode Bahrein PDFDocument9 pagesLeadershipcode Bahrein PDFMoritzkaNo ratings yet

- The Knowing Doing GapDocument2 pagesThe Knowing Doing GapMoritzka100% (1)

- Drucker BucketDocument2 pagesDrucker BucketMoritzkaNo ratings yet

- Some Men See Things As They Are and Ask "Why." I Dream Things That Never Were and Ask "Why Not." - Design Thinking Has Ignited The Business WorldDocument4 pagesSome Men See Things As They Are and Ask "Why." I Dream Things That Never Were and Ask "Why Not." - Design Thinking Has Ignited The Business WorldMoritzkaNo ratings yet

- Vegetable Corp. V TrinidadDocument1 pageVegetable Corp. V TrinidadLouNo ratings yet

- The Foreign Exchange Management Act, 1999Document20 pagesThe Foreign Exchange Management Act, 1999rashpinder singhNo ratings yet

- Global Finance3Document11 pagesGlobal Finance3kbogdanoviccNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)GaganDasPapaiNo ratings yet

- Economic Analysis of The Zimbabwe EconomyDocument3 pagesEconomic Analysis of The Zimbabwe EconomyMardha Tilla SeptianiNo ratings yet

- Europe Euro Euro Euro: Different Countries Currencies Country by Continent Currency Name Currency CodeDocument5 pagesEurope Euro Euro Euro: Different Countries Currencies Country by Continent Currency Name Currency Codethejasdk100% (2)

- HPCL Price List Eff-01st March 2021Document1 pageHPCL Price List Eff-01st March 2021aee lwe0% (1)

- SPP R4 New An. Rahmadi - BanjarmasinDocument98 pagesSPP R4 New An. Rahmadi - BanjarmasinAlpiannoorNo ratings yet

- 2196 Usd To Inr Today Rate - Google SearchDocument1 page2196 Usd To Inr Today Rate - Google SearchLIQUID SUMIT CLASHERNo ratings yet

- Report On KnitwearDocument5 pagesReport On KnitwearHSNo ratings yet

- Inward Remittance Transaction Advice: To, FromDocument2 pagesInward Remittance Transaction Advice: To, FromCma Subhash AtipamulaNo ratings yet

- The Global Interstate SystemDocument14 pagesThe Global Interstate SystemKyan Dieve Cabuquid100% (2)

- Quiz Economics MeetDocument22 pagesQuiz Economics MeetMeet AhirNo ratings yet

- Chapter 5 (BOM)Document19 pagesChapter 5 (BOM)Ritika GosainNo ratings yet

- Textile IndustryDocument6 pagesTextile IndustryRenjitha rajuNo ratings yet

- Solved A Draw The Wage Schooling Locus For Someone For Whom TheDocument1 pageSolved A Draw The Wage Schooling Locus For Someone For Whom TheM Bilal SaleemNo ratings yet

- Assessment Task SOCSCI 1105 The Contemporary WorldDocument2 pagesAssessment Task SOCSCI 1105 The Contemporary WorldMardie Mae AriolaNo ratings yet

- GST Invoice: Shubham Engineering Works - (2019-20)Document3 pagesGST Invoice: Shubham Engineering Works - (2019-20)vinodNo ratings yet

- 3-Types of IndustriesDocument16 pages3-Types of Industriesbias si jakeNo ratings yet

- Saudi Arabia Vision 2030 Mepov26Document4 pagesSaudi Arabia Vision 2030 Mepov26Kamlesh Pillai100% (1)

- CG 1Document8 pagesCG 1NagarajuNo ratings yet

- DeclarationDocument2 pagesDeclarationprimefxNo ratings yet

- Robert Bryle C. Price BSHM Mh1-9 THC 102 MTH 2:30 - 4:00 P.MDocument2 pagesRobert Bryle C. Price BSHM Mh1-9 THC 102 MTH 2:30 - 4:00 P.Myannie isananNo ratings yet

- Global Economy: Ivy Charrize Caseres Angel Braceros Class 3ADocument21 pagesGlobal Economy: Ivy Charrize Caseres Angel Braceros Class 3ACrislyn DavidNo ratings yet

- e-StatementBRImo 453901021380539 May2023 20230619 112554Document7 pagese-StatementBRImo 453901021380539 May2023 20230619 112554Dwi AlmadaniNo ratings yet

- Answers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93Document4 pagesAnswers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93anaNo ratings yet

- South Korean CaseDocument6 pagesSouth Korean CaseIqbal JoyNo ratings yet

- Trade in PakistanDocument22 pagesTrade in PakistanANJUM KHANNo ratings yet

- #1 - Bilateral AidDocument5 pages#1 - Bilateral AidArif IstiaqueNo ratings yet