Professional Documents

Culture Documents

Aknight Quarter Report-Sept 2012

Aknight Quarter Report-Sept 2012

Uploaded by

James WarrenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aknight Quarter Report-Sept 2012

Aknight Quarter Report-Sept 2012

Uploaded by

James WarrenCopyright:

Available Formats

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

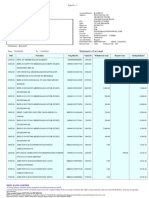

Interim Financial report on the consolidated results for the 3rd quarter of the financial period ended 30-9-2012 (The figures have not been audited.) CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE 9 MONTHS ENDED 30 SEPTEMBER 2012

INDIVIDUAL QUARTER CURRENT PRECEDING YEAR YEAR CORRESPONDING QUARTER QUARTER 30-9-2012 30-9-2011 RM'000 RM'000 Revenue Cost of sales Operating expenses Other Operating Income/(loss) Profit/(loss) from operations Finance Cost 1,862 (2,324) (877) 479 ---------(860) (104) ---------(964) 1,053 (2,224) (589) 153 ---------(1,607) (112) ---------(1,719)

CUMULATIVE QUARTER CURRENT PRECEDING YEAR YEAR CORRESPONDING TO-DATE PERIOD 30-9-2012 30-9-2011 RM'000 RM'000 4,453 (6,639) (2,204) 666 ---------(3,724) (376) ---------(4,100) 3,673 (6,225) (1,938) 187 ---------(4,303) (393) ---------(4,696) -

Profit/(loss) before Taxation Taxation

---------Profit/(loss) for the period (964) ====== 9)

---------(1,71 ======

---------(4,100) ======

---------(4,696) ======

Attributable to: Equity holders of the parent Non-Controlling interest

(971) 7 ----------(964) =======

(1,719) ---------(1,719) ======

(4,109) 9 ----------(4,100) =======

(4,696) ---------(4,696) ======

Earning/(loss) per share (sen) Basic Diluted

(2.2) (2.2)

(3.9) (3.9)

(9.3) (9.3)

(10.7) (10.7)

(The Condensed Consolidated Income Statement should be read in conjunction with the annual Financial Report for the year ended 31st December 2011)

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 SEPTEMBER 2012 As At End Of Current Quarter 30-9-2012 RM000 (Unaudited) ---------------As At Preceding Financial Year Ended 31-12-2011 RM000 (Audited) -------------------

ASSETS Non-current assets Property , plant and equipment Quoted Investment

49,578 5 -----------49,583 ------------

51,918 5 -----------51,923 ------------

Current assets Inventories Trade receivables Other receivables Tax recoverable Fixed deposits with licensed banks 1,329 2,669 791 13 4,802 -----------54,385 ======= 1,458 523 422 13 2,416 -----------54,339 =======

TOTAL ASSETS EQUITY AND LIABILITIES Equity attributable to equity holders of the parent Share capital Revaluation Surplus Capital reserve Reserve on consolidation Accumulated loss

Non-Controlling interest

44,083 30,835 38 (47,411) -------------27,545 86 -------------27,631

44,083 30,835 38 (43,310) -------------31,646 -------------31,646

Non-current liabilities Long term borrowings Deferred taxation Hire purchase liabilities 415 -----------415 -----------415 -----------415 ------------

Current liabilities Trade payables Other payables Short Term borrowings Bank Overdraft Provision for taxation Proposed dividend 2,224 17,236 6,366 513 26,339 26,754 -------------54,385 ======== 0.62 1,545 13,143 7,080 416 94 22,278 22,693 -------------54,339 ======== 0.72

Total Liabilities TOTAL EQUITY AND LIABILITIES Net assets per share attributable to ordinary equity holders of the parent

(The Condensed Consolidated Balance Sheet should be read in conjunction with the annual Financial Report for the year ended 31st December 2011)

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

CONDENSED CONSOLIDATED CASH FLOW STATEMENT FOR THE PERIOD ENDED 30-9-2012 30-9-2012 RM000 -------------(4,100) 30-9-2011 RM000 -------------(4,696)

CASH FLOWS FROM OPERATING ACTIVITIES Loss before taxation Adjustment for: Depreciation Interest expenses Dividend income Decrease in inventory Increase in trade and other receivables Increase in trade and other payables Cash generated from operations Interest paid Net cash from operating activities

2,363 376 ------------(1,361) 129 (2,515) 4,772 ------------1,025 (376) ------------649 -------------

2,318 393 1 ------------(1,984) 238 160 2,257 ------------671 (393) ------------278 -------------

CASH FLOWS FROM INVESTING ACTIVITIES Purchase of property, plant and equipment Proceeds from sales of unquoted investment Net cash used in investing activities

(23) 85 ------------62 ------------(225) (583) ------------(808) ------------(97) (416) ------------(513) -----------------------(513) ------------(513) -------------

(23) ------------(23) ------------500 (375) (173) ------------(48) ------------207 (698) ------------(491) ------------------------(491) ------------(491) -------------

CASH FLOWS FROM FINANCING ACTIVITES Term Loan raised Repayment of term loan Repayment of hire purchase liabilities Net proceeds from Bankers acceptance Net cash used in financing activities Net increase / (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period

CASH AND CASH EQUIVALENTS COMPRISE: Fixed deposit Less amount pledge as security

Bank overdraft Cash and bank balances

The condensed consolidated cash flow statement should be read in conjunction with the annual financial report for the year ended 31.12.2011

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

Condensed Consolidated Statement of changes in Equity for the period ended 30-9-2012 Attributable to Equity Holders of the Parent Share Capital Capital Reserve (Accumulated Losses) Reserves on Consolidation Revaluation Surplus Total

RM'000 -----------------Balance as at 01-01-2012 Revaluation surplus Transfer from deferred tax Loss for the period Balance as at 30-9-2012 44,083 ---------44,083 ----------

RM'000 -----------------38 ---------38 ----------

RM'000 -----------------(43,311) (4,100) ---------(47,411) ----------

RM'000 -------------------------------

RM000 --------------30,835 ------------30,835 -------------

RM000 -------------31,645 (4,100) ----------27,545 ----------

Non Distributable Share Capital Capital reserve (Accumulated Losses) Distributable Reserves on Consolidation Revaluation Surplus Total

RM'000 -----------------Balance as at 01-01-2011 Revaluation Surplus Transfer from deferred tax Loss for the period ---------Balance as at 30-9-2011 44,083 ---------44,083 -

RM'000 -----------------38 ---------38 ----------

RM'000 -----------------(36,522) (4,696) ---------(41,218) ----------

RM'000 ----------------------------------

RM'000 ------------21,038 ---------21,038 ----------

RM'000 ---------------28,637 (4,696) ---------23,941 ----------

( The Condensed Consolidated Statement of changes in Equity should be read in conjunction with the annual Financial Report for the year ended 31st December 2011 )

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

NOTES TO THE INTERIM FINANCIAL REPORT

Part A: Explanation notes as per FRS 134

A1. Accounting policies and methods of computation.

The unaudited interim financial statements have been prepared in accordance with FRS 134 Interim Financial Reporting and Chapter 9.22 of the Listing Requirements. The accounting policies and method of computation adopted for the interim financial Reports were consistent with those adopted for the audited financial statements for the year ended 31st December 2011. The unaudited interim financial statements include the adoption of new Financial Reporting Standard (FRS) applicable to the Group. FRS 8 FRS 101 FRS 117 FRS 139 Operating segments Presentation of Financial Statement Reclassification of leasehold land and building Financial instrument: Recognition and measurement

The adoption of the above FRS does not have any significant financial effect on the Group. A2. A3. A4. A5. A6. A7. A8. The audited annual financial statements for the preceding year ended 31 st December 2011 was not qualified. The business operations of the Group is not affected by any seasonal or cyclical factors except than the Group has commenced fashion ware division in the second quarter of the year. There were no items of unusual nature affecting the assets, liabilities, equity, net income or cash flows. There were no estimates of amounts reported in prior interim periods of the current financial year or in prior financial year. There were no issuances, cancellations, repurchases, resale and repayments of debt and equity securities, during the period ended 30-9-2012. Dividend paid during the period ended 30-9-2012 Segment information for the current financial year-to-date. Revenue Industry segment Manufacturing Hotel operation Trading RM000 1,066 1,981 1,406 ----------4,453 ----------Profit/(Loss) Before taxation RM000 (4,285) 165 20 ----------(4,100) ----------Assets Employed RM000 34,240 18,960 1,185 ----------54,385 ----------- Nil

Information on the Groups operation by geographical segments has not been presented as the Group operates principally in Malaysia. A9. A10. The valuations of properties, plant and equipment has been brought forward without any amendment from the previous annual financial statements. In the opinion of the Directors, no items, transactions or event of the material and/or unusual nature has arisen which would affect substantially the results of the Group and of the companys operation from 30-92012 to the date of this report except as mentioned in Note B8. There were no changes in the composition of the Group for the current quarter. Contingent Liabilities. The Directors are of the opinion that the Group has no contingent liabilities, which upon crystallization, would have any material effect on the financial and business position of the Group. A13. Recurrent Related Party Transaction Nil

A11. A12.

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

Part B: B1. Additional information required by Bursa Securities Listing Requirement for Quarterly report ended 30 September 2012

Review of performance The Group incurred loss before tax of RM0.964 million in the current quarter compared to the Group loss before tax of RM1.719 million in the preceding year corresponding quarter. The revenue of the Group for the current quarter is RM1.862 million against the revenue of RM1.053 million in preceding year corresponding quarter. The loss during the current quarter is due to the weak market demand for particleboard and high cost of raw materials.

B2.

Material Changes in the Quarter Results compared to the preceding Quarter During the current quarter, the Group generated revenue of RM1.862 million and incurred loss before tax of RM0.964 million compared to the revenue of RM1.677 million and loss before tax of RM1.367 million in the immediate preceding quarter. The loss before tax in the current quarter is due to the weak market demand for particleboard and high cost of raw materials.

B3.

Prospects of the Group. The prospect of the Group may improve with the contribution of shoe business from JC Concept International Sdn Bhd.

B4.

Variance of the actual profit from forecast profit. Not applicable.

B5.

Taxation Current quarter RM000 Year to date RM000 -

Provision for current year Over provision in prior year Transfer from / (to) deferred taxation

B6. . B7.

There were no sales of unquoted investments for the current quarter. (a) (b) There were no purchase and sales of quoted securities for the current quarter and financial year-todate. Investments in quoted Securities as at 30-9-2012 (i) (ii) at cost less allowance for diminution in value at market value RM000 5 5

B8.

The status of corporate proposals On the 9 November 2012, the Group announced to Bursa Malaysia on the following proposals: (a) (b) (c) (d) (e) Proposed Renounceable Rights Issue of Irredeemable Convertible Preference Shares with free Warrants. Proposed acquisition of the entire equity interest in Skykod Polyscience Sdn Bhd. Proposed Employees Share Option Scheme. Proposed increase in authorized share capital. Proposed amendments to the memorandum and / or articles of association.

The applications to the relevant authorities are expected to be submitted within 3 months from the date of announcement.

Asia Knight Berhad (formerly known as Pahanco Corporation Berhad) (71024 T)

B9. The group borrowings (a) (b) The borrowings are secured by legal charge over certain property of the Group and Corporate guarantee of the company. RM000 Short term borrowings (i) Short term trade finance 6,316 (ii) Term loan 50 ---------6,366 ---------Long term borrowings The borrowing is in Ringgit Malaysia. -

(c) (d) B10. B11. B12.

There were no financial instruments with off balance sheet risk being transacted or contracted to the date of this report. Material litigation to the date of this report. Nil Dividends The Board of Directors does not recommend the payment of dividend.

B13.

The basic loss per share is calculated by dividing the net loss of RM964,000 in the current quarter attributable to equity holders of the parent by the weighted average number of 44,083,200 ordinary shares in issue as at 30-9-2012. The diluted loss per share is the same as the basic loss per share as the effects of anti-dilutive potential ordinary shares are ignored in calculating diluted loss per share.

B14. of

Disclosure of realized and unrealized profits and losses As at end of As at end Current

preceding Quarter quarter 30.9.2012 2012 RM000 RM000 Total Accumulated losses of Asia Knight Group Realised (46,032) Unrealised (415) -------------------Total accumulated losses as per consolidated accounts (46,447) ====== ======= B15. Current Quarter date RM000 RM000 (a) 2,363 (b) 376 Interest expenses 104 Depreciation 788 Year to The following relevant amounts have been credited for charged in arriving at profit before tax: Additional Disclosures Current (47,411) (415) (46,996) 30-6-

BY ORDER OF THE BOARD SEE TECK WAH Chairman Date : 29.11.2012

You might also like

- Test Bank For Walston Dunham Introduction To Law 7thDocument10 pagesTest Bank For Walston Dunham Introduction To Law 7thamberleemakegnwjbd100% (13)

- All Religions Are Not The SameDocument3 pagesAll Religions Are Not The SameJames Warren100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- (Adam Schlecter) BookDocument55 pages(Adam Schlecter) BookJames Warren50% (2)

- FS5188-DurablePOA ForSecurtiesDocument3 pagesFS5188-DurablePOA ForSecurtiestafilli54100% (2)

- MA-2018Document261 pagesMA-2018Dr Luis e Valdez rico0% (1)

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 11 MalabonCity2018 - Part4 AnnexesDocument4 pages11 MalabonCity2018 - Part4 AnnexesJuan Uriel CruzNo ratings yet

- Opensys An20200518a2 1Document17 pagesOpensys An20200518a2 1Nor FarizalNo ratings yet

- YumBrandsInc 10Q Q2-2013Document58 pagesYumBrandsInc 10Q Q2-2013nitin2khNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Sirius XM Holdings Inc.: FORM 10-QDocument62 pagesSirius XM Holdings Inc.: FORM 10-QguneetsahniNo ratings yet

- Wema-Bank-Financial Statement-2020Document24 pagesWema-Bank-Financial Statement-2020john stonesNo ratings yet

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1No ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- Willowglen MSC Berhad: (Company No. 462648-V)Document10 pagesWillowglen MSC Berhad: (Company No. 462648-V)Shungchau WongNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- dASE Statment Sinke - CBEDocument50 pagesdASE Statment Sinke - CBEHashim TuneNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- Fidelity National Financial, Inc.: FORM 10-QDocument76 pagesFidelity National Financial, Inc.: FORM 10-Qrocky6182002No ratings yet

- MMH SGXnet 03 12 FinalDocument16 pagesMMH SGXnet 03 12 FinalJosephine ChewNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- MMC BerhadDocument27 pagesMMC Berhadpuravi91No ratings yet

- First Quarter Ended March 31 2012Document24 pagesFirst Quarter Ended March 31 2012Wai HOngNo ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- 8 MIS November 2012Document129 pages8 MIS November 2012kr__santoshNo ratings yet

- Maybank Group FS - September 2023 (Bursa)Document106 pagesMaybank Group FS - September 2023 (Bursa)GZHNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Consolicated PL AccountDocument1 pageConsolicated PL AccountDarshan KumarNo ratings yet

- UnAudited Half Yearly FMBL Account As On 30-06-16 (Print Version)Document9 pagesUnAudited Half Yearly FMBL Account As On 30-06-16 (Print Version)touseefNo ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- 2008 Consolidated Financial Statement CrisilDocument23 pages2008 Consolidated Financial Statement CrisilRamesh babuNo ratings yet

- MDRX10 Q 2Document63 pagesMDRX10 Q 2mrjohnseNo ratings yet

- Sibl-Fs 30 June 2018Document322 pagesSibl-Fs 30 June 2018Faizal KhanNo ratings yet

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Earnings Presentation (Company Update)Document29 pagesEarnings Presentation (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Profit Loss Account TemplateDocument4 pagesProfit Loss Account TemplatesnehaNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- RFL 3rd Quarter 2017 FinalDocument4 pagesRFL 3rd Quarter 2017 Finalanup dasNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document10 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Unaudited Financialresults 30092019Document12 pagesUnaudited Financialresults 30092019SuhasNo ratings yet

- Page 32 - P&L AnnexureDocument1 pagePage 32 - P&L AnnexureKelly GandhiNo ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- Financial Results Consolidated Q1fy23Document4 pagesFinancial Results Consolidated Q1fy23Raj veerNo ratings yet

- Balance Sheet RsDocument5 pagesBalance Sheet RsBinesh BashirNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Consolidated AccountDocument44 pagesConsolidated Accountnaveed153331No ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Padini Msia AR 2020 PDFDocument126 pagesPadini Msia AR 2020 PDFJames WarrenNo ratings yet

- Supermax 2021Document122 pagesSupermax 2021James WarrenNo ratings yet

- Prolexus PDFDocument146 pagesProlexus PDFJames WarrenNo ratings yet

- Data Visualisation For Reporting: Using Microsoft Excel DashboardDocument2 pagesData Visualisation For Reporting: Using Microsoft Excel DashboardJames WarrenNo ratings yet

- World Intelectual Property IndicatorsDocument2 pagesWorld Intelectual Property IndicatorsJames WarrenNo ratings yet

- Martin Armstrong ArticleDocument28 pagesMartin Armstrong ArticleJames WarrenNo ratings yet

- Chee Kok Wing - JudgementDocument7 pagesChee Kok Wing - JudgementJames WarrenNo ratings yet

- The Best Chess BooksDocument3 pagesThe Best Chess BooksJames Warren100% (1)

- JY The School of FormsDocument3 pagesJY The School of FormsJames Warren100% (2)

- 007.the Value of Not Being SureDocument2 pages007.the Value of Not Being SureJames WarrenNo ratings yet

- Hotel Budget 8mths Forecast 09Document1 pageHotel Budget 8mths Forecast 09James WarrenNo ratings yet

- Construction CompanyDocument111 pagesConstruction CompanyJames Warren0% (1)

- BCS English Preparation Fill in The Appropriate Preposition PDFDocument7 pagesBCS English Preparation Fill in The Appropriate Preposition PDFTabassum MeemNo ratings yet

- The Essential Guide For Malaysia My Second Home (Mm2h) VisaDocument14 pagesThe Essential Guide For Malaysia My Second Home (Mm2h) VisaRussell ChaiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMehndi HasanNo ratings yet

- Pavement Marking ManualDocument19 pagesPavement Marking ManualhighwayNo ratings yet

- Loan and AdvancesDocument72 pagesLoan and AdvancesAbdulqayum SattigeriNo ratings yet

- 1st Assignment of 3rd Year 6th Semester 2023 EEPMDocument2 pages1st Assignment of 3rd Year 6th Semester 2023 EEPMSUBRATA MODAKNo ratings yet

- Application Format For Advance Payment For ImportDocument2 pagesApplication Format For Advance Payment For Importsrinivasan ragothaman50% (2)

- Thomas BushellDocument1 pageThomas Bushellapi-361779682No ratings yet

- List of Important Articles of The Indian Constitution - Notes, Tips, Tricks and Shortcuts For All Competitive ExamsDocument2 pagesList of Important Articles of The Indian Constitution - Notes, Tips, Tricks and Shortcuts For All Competitive ExamsBhuvnesh KhandelwalNo ratings yet

- SFC FranchiseDocument10 pagesSFC FranchisecorinacretuNo ratings yet

- Omvic Automotive Certification Course Student Manual English 2024 Edition Georgian College Feb 06 24Document198 pagesOmvic Automotive Certification Course Student Manual English 2024 Edition Georgian College Feb 06 24viterittidevidNo ratings yet

- PD 1 of 2019Document11 pagesPD 1 of 2019terencebctanNo ratings yet

- Quanti Tray Sealer Plus ManualDocument52 pagesQuanti Tray Sealer Plus ManualHannah LeeNo ratings yet

- Payment Due Date Extension GuidelinesDocument1 pagePayment Due Date Extension Guidelinesapi-526528055No ratings yet

- MIBC - Methyl Isobutyl CarbinolDocument2 pagesMIBC - Methyl Isobutyl CarbinolMatias EnriqueNo ratings yet

- Position PaperDocument3 pagesPosition PaperDaria MargaritNo ratings yet

- C.4. G.R. No. 214044-2019-University - of - The - Philippines - v. - City Treasurer QCDocument16 pagesC.4. G.R. No. 214044-2019-University - of - The - Philippines - v. - City Treasurer QC0506sheltonNo ratings yet

- IPR International Conventions - Lectute 5Document20 pagesIPR International Conventions - Lectute 5Akhil AugustineNo ratings yet

- Macroeconomics Canadian 5th Edition Blanchard Test Bank Full Chapter PDFDocument37 pagesMacroeconomics Canadian 5th Edition Blanchard Test Bank Full Chapter PDFqueeningalgatestrq0100% (16)

- Unit IiDocument42 pagesUnit IiArnee Jezarie AvilaNo ratings yet

- 2014-07-21 Monthly Attendance Report Template Format OptionsDocument3 pages2014-07-21 Monthly Attendance Report Template Format OptionsAhmed El AmraniNo ratings yet

- Articles of The Confederation 1781 PDFDocument13 pagesArticles of The Confederation 1781 PDFRenn DallahNo ratings yet

- What Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionDocument3 pagesWhat Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionVirginia PalisukNo ratings yet

- Fieldmen's Insurance Co., Inc. vs. Vda. de SongcoDocument1 pageFieldmen's Insurance Co., Inc. vs. Vda. de Songcomack100% (1)

- In Re Delay in Release of Convicts After Grant of BailDocument5 pagesIn Re Delay in Release of Convicts After Grant of BailShubhankar SoniNo ratings yet

- EOI Empanelment Bhoramdeo Sugar Factory 1.0Document5 pagesEOI Empanelment Bhoramdeo Sugar Factory 1.0Paritosh BNo ratings yet

- Eschaton PDFDocument289 pagesEschaton PDFMarkNo ratings yet