Professional Documents

Culture Documents

Settlement

Settlement

Uploaded by

abhirocks_bigjCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Statement: Stefan Fegerl Stefan FegerlDocument2 pagesStatement: Stefan Fegerl Stefan Fegerlpaiment flechetteNo ratings yet

- India Fintech Report 2021Document29 pagesIndia Fintech Report 2021devang bohraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

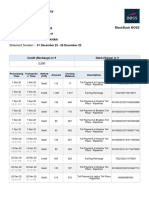

- 156114-124731 20190930 PDFDocument7 pages156114-124731 20190930 PDFAmru OmarNo ratings yet

- Singapore Financial SystemDocument21 pagesSingapore Financial SystemSaikat SahaNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureASHISH PANDEYNo ratings yet

- Soa 102021Document2 pagesSoa 102021Jethro VillahermosaNo ratings yet

- The Bank of The Future PDFDocument124 pagesThe Bank of The Future PDFsubas khanal100% (1)

- Report - 2023 11 16 - 23 56 11Document2 pagesReport - 2023 11 16 - 23 56 11jennyscol4realNo ratings yet

- The Impact of Blockchain Technology in Banking: Roshan KhadkaDocument37 pagesThe Impact of Blockchain Technology in Banking: Roshan KhadkamonuNo ratings yet

- DBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Document3 pagesDBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002sudheermca068345No ratings yet

- S2-The Ultimate Guide To Buying CryptocurrenciesDocument12 pagesS2-The Ultimate Guide To Buying CryptocurrenciesShoaib MohammadNo ratings yet

- R20AMR ReleaseHighlights ClientDocument176 pagesR20AMR ReleaseHighlights ClientZakaria AlmamariNo ratings yet

- Receipt 2Document2 pagesReceipt 2avsmaju management100% (1)

- NTVAXBPr 6 R 8 H FHU4Document9 pagesNTVAXBPr 6 R 8 H FHU4Ranjit BeheraNo ratings yet

- XboxDocument6 pagesXboxvenipaz63No ratings yet

- Debit CardDocument16 pagesDebit CardAvinash Sahu100% (2)

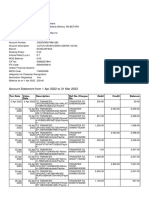

- Account Statement From 1 Apr 2022 To 13 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Apr 2022 To 13 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham TyagiNo ratings yet

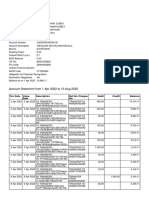

- 1.04.22 - 21.08.22 CanaraDocument7 pages1.04.22 - 21.08.22 CanaraMADHUBALA SAHAYNo ratings yet

- Moldcell PromoDocument4 pagesMoldcell PromounifunNo ratings yet

- Famous Debit and Credit Fraud CasesDocument7 pagesFamous Debit and Credit Fraud CasesAmy Jones100% (1)

- Cespt Tijuana Online Payment TranslationDocument2 pagesCespt Tijuana Online Payment TranslationJessica DonahueNo ratings yet

- Freelance Independent Contractor Invoice TemplateDocument2 pagesFreelance Independent Contractor Invoice TemplateBrendan DickinsonNo ratings yet

- Annoucement and Guideline - Eng VDocument1 pageAnnoucement and Guideline - Eng VMohammad Syafiq Mohd YalanNo ratings yet

- Chargeback Process FlowDocument11 pagesChargeback Process FlowguyNo ratings yet

- JNNJDocument48 pagesJNNJBirdmanZxNo ratings yet

- Product Overview IMPSDocument3 pagesProduct Overview IMPSKuriya HardikNo ratings yet

- New BankDocument13 pagesNew BankVelayudhan SunkaraNo ratings yet

- IDFC FASTag Summary1672234138849Document2 pagesIDFC FASTag Summary1672234138849MAHESH MOTORSNo ratings yet

- آليات رقمنة الخدمات المالية والمصرفية لإرساء الشمول المالي الرقمي - اعتماد ابتكارات التكنولوجيا المالية كسبيلDocument16 pagesآليات رقمنة الخدمات المالية والمصرفية لإرساء الشمول المالي الرقمي - اعتماد ابتكارات التكنولوجيا المالية كسبيلsofiane.meamicheNo ratings yet

- Buy Bitcoin Cash With A Credit Card Trust WalletDocument1 pageBuy Bitcoin Cash With A Credit Card Trust WalletMichelle GoorisNo ratings yet

Settlement

Settlement

Uploaded by

abhirocks_bigjOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Settlement

Settlement

Uploaded by

abhirocks_bigjCopyright:

Available Formats

INTERNATIONAL FINANCIAL MANAGEMENT

Assignment On Settlement Systems In The World

Submitted ByAbhishek Jhanwar Roll No.24 M.B.A. (Finance)

U.S. Settlement System

In the United States, payment and securities settlement systems consist of numerous financial intermediaries, financial services firms, and non-bank businesses that create, distribute, and process large-value payments. The bulk of the dollar value of these payments are processed electronically and are generally used to purchase, sell, or finance securities transactions; disburse or repay loans; settle real estate transactions; and make large-value, time-critical payments, such as payments for the settlement of interbank purchases and sales of federal funds, settlement of foreign exchange transactions, or other financial market transactions. There are two primary networks for interbank, or large-value, domestic, funds transfer payment orders. The first, Fedwire Funds Service, is operated by the Federal Reserve Banks, and is an important participant in providing interbank payment services as well as safekeeping and transfer services for U.S. government and agency securities, and mortgage-backed securities. Funds Service and the Federal Reserve's National Settlement Service (NSS) are critical components used in other payment systems' settlement processes. The Clearing House Interbank Payments Company L.L.C. (CHIP Co.) operates the second, the Clearing House In e e e Processing large-value funds transfers involves two key elements: clearing and settlement. Clearing is the transfer and confirmation of information between the payer (sending financial institution) and payee (receiving financial institution). Settlement is the actual transfer of funds between the payer's financial institution and the payee's financial institution. Settlement discharges the obligation of the payer financial institution to the payee financial institution with respect to the payment order. Final settlement is irrevocable and unconditional. The finality of the payment is determined by that system's rules and applicable law. In general, payment messages may be credit transfers or debit transfers. Most largevalue funds transfer systems are credit transfer systems in which both payment messages and funds move from the payer financial institution to the payee financial institution. An institution initiates a funds transfer by transmitting a payment order (a message that requests the transfer of funds to the payee). Payment order processing follows the predefined rules and operating procedures of the large-value payment system used. Typically, large-value payment system operating procedures include identification, reconciliation, and confirmation procedures necessary to process the payment orders. In some systems, financial institutions may contract with one or more third parties to help perform clearing and settlement activities on behalf of the institution. The legal framework governing payment activity and the regulatory structure for financial institutions that provide payment services is complex. There are rules for large-value payments that are distinct from retail payments. Large-value funds transfer systems differ from retail electronic funds transfer (EFT) systems, which generally handle a large volume of low value payments including automated clearinghouse (ACH) and debit and credit card transactions at the point of sale.

Fedwire Funds Service Fedwire Funds Service is a real-time gross settlement system (RTGS) enabling participants to transmit and receive payment orders between each other and on behalf of their customers. Real-time gross settlement means that the clearing and settlement of each transaction occurs continuously during the processing day. Payment to the receiving participant (payee) over Fedwire Funds Service is final and irrevocable when the Federal Reserve Bank either credits the amount of the payment order to the receiving participant's Federal Reserve Bank reserve account or sends notice to the receiving participant, whichever is earlier. Fedwire Funds Service participants must maintain an account with a Federal Reserve Bank. Because of this requirement, non-financial organizations are not permitted direct access to Fedwire Funds Service, although these entities may use these services indirectly as customers of deposit-taking financial institutions.Subject to the Federal Reserve Bank's and the Federal Reserve Board's risk reduction policies, where applicable, entities authorized by law, regulation, policy, or agreement to be participants include depository institutions, agencies and branches of foreign banks, member banks of the Federal Reserve System, the Treasury and any entity specifically authorized by federal statute to use the Reserve Banks as fiscal agents or depositories, entities designated by the Secretary of the Treasury, foreign central banks, foreign monetary authorities, foreign governments, and certain international organizations; and any other entities authorized by a Federal Reserve Bank to use Fedwire Funds or Security Services. See Appendix E for a discussion of the Federal Reserve Board's PSR Policy. Certain payment and securities settlement systems, such as CHIPS and CLS, also rely upon Fedwire Funds Service to allow participants or their correspondents to provide necessary funding.CHIPS and CLS also use Fedwire Funds Service for settlement services by establishing zero-balance settlement accounts to settle clearinghouse participant obligations. The Federal Reserve Bank requires participants in a net debit position to make a Fedwire Funds Service funds transfer payment to the settlement account. It then pays participants in a net credit position by means of a Fedwire Funds Service funds transfer from that settlement account. Once the Federal Reserve Bank processes these funds transfers, they are final and irrevocable. Financial institutions sending a Fedwire Funds Service payment order irrevocably authorize their Federal Reserve Bank to debit (charge) their Federal Reserve account for the transfer amount and to give credit in the same amount to the payee. Only the originating financial institution can have funds removed from its Federal Reserve account using the Fedwire Funds Service. Depository institutions that maintain a reserve or clearing account with a Federal Reserve Bank may use Fedwire Funds Service to send payments to, or receive payments from, other account holders directly. Once the Federal Reserve Bank credits the receiving institution's account, it will not reverse the transaction at the request of the originating institution. Financial institutions may access the Fedwire Funds Service via high-speed direct computer interface (CI), FedLine, or with off-line telephone connectivity with a

Federal Reserve Bank. Financial institutions may also access certain Fedwire Funds Service inquiry information via FedLine for the Web.By year-end 2004, customers should be able to initiate Fedwire Funds Service and Fedwire Securities Service transactions through the web via FedLine Advantage. On-line participants, using either a CI or FedLine PC connection to Fedwire Funds Service, require no manual processing by the Federal Reserve Banks. Off-line participants provide funds transfer instructions to one of two Federal Reserve Bank customer support sites by telephone, and after authenticating the participant, the Federal Reserve Bank enters the transfer instruction into the Fedwire Funds Service system for execution. The manual processing required for off-line requests makes them more costly and suitable only for institutions processing a small number of funds transfer payment orders. The Federal Reserve Bank's FedLine for the Web currently offers access to low-risk Federal Reserve Bank financial services. FedLine Advantage, which should begin a graduated rollout by year-end 2004, will allow depository institutions access to additional Federal Reserve financial services, including the Fedwire Funds Services and the Fedwire Securities Service, via a secure Internet Protocol (IP) gateway to Federal Reserve Bank financial services. Residing on a secure Web server, FedLine Advantage will be accessible to customer financial institutions with authenticated credentials using digital certificates. CHIPS CHIPS is a privately operated, real-time, multilateral, payments system typically used for large dollar payments. CHIPS is owned by financial institutions, and any banking organization with a regulated U.S. presence may become an owner and participate in the network. The payments transferred over CHIPS are often related to international interbank transactions, including the dollar payments resulting from foreign currency transactions (such as spot and currency swap contracts) and Euro placements and returns. Payment orders are also sent over CHIPS for the purpose of adjusting correspondent balances and making payments associated with commercial transactions, bank loans, and securities transactions. Since January 2001, CHIPS has been a real-time final settlement system that continuously matches, nets and settles payment orders. This system provides realtime finality for all payment orders released by CHIPS from the CHIPS queue. To achieve real-time finality, payment orders are settled on the books of CHIPS against participants' positive positions, simultaneously offset by incoming payment orders, or both. This process is dependent on up to two rounds of required prefunding. To facilitate this prefunding, CHIP Co. members jointly maintain a pre-funded balance account (CHIPS account) on the books of the Federal Reserve Bank of New York. Under the real-time finality arrangement, each CHIPS participant has a preestablished opening position (or initial prefunding) requirement, which, once funded via a Fedwire Funds Service funds transfer to the CHIPS account, is used to settle payment orders throughout the day.CHIP Co., using a formula based on the latest transaction history of each participant, establishes the amount of a

participant's opening position requirement. A participant cannot send or receive CHIPS payment orders until it transfers its opening position requirement to the CHIPS account. Opening position requirements can be transferred into the CHIPS account any time after the opening of CHIPS and Fedwire Funds Service at 9:00 p.m. Eastern Time. However, all participants must transfer their requirement no later than 9:00 a.m. Eastern Time. During the operating day, participants submit payment orders to a centralized queue maintained by CHIPS. Participants may remove payment orders from the queue at any time prior to the daily cutoff time for the system (5:00 p.m. Eastern Time). When an opportunity for settlement involving one, two or more payment orders is found, the system releases the relevant payment orders from the central queue and simultaneously marks the CHIPS records to reflect the associated debits and credits to the relevant participant's positions. Debits and credits to the current position are reflected only in CHIPS records and are not recorded on the books of the Federal Reserve Bank of New York. Under New York law and CHIPS Rules, payments orders are finally settled at the time of release from the central CHIPS queue. This process, however, typically will be unable to settle all queued messages. Soon after 5:00 p.m. Eastern Time, CHIPS tallies any unreleased payment orders remaining in the queue on a multilateral net basis. The resulting net position for each participant is provisionally combined with that participant's current position (which is always zero or positive) to calculate the participant's final net position; if that position is negative, it is the participant's "final position requirement." Each participant with a final position requirement must transfer, via Fedwire Funds Service, this second round of prefunding to the CHIPS account. These requirements, when delivered, are credited to participants' balances. Once all of the Fedwire Funds Service funds transfers have been received, CHIPS is able to release and settle all remaining payment orders. After completion of this process, CHIPS transfers to those participants who have any balances remaining the full amount of those positions, reducing the amount of funds in the CHIPS account to zero by the end of the day. In the event that less than all final position requirements are received, CHIPS settles as many payments as possible, subject to the positive balance requirement, and deletes any remaining messages from the queue. Participants with deleted messages are informed of which messages were not settled, and may choose, but are in no way required, to settle such messages over Fedwire Funds Service.

Settlement System In U.K. The Bank's role as settlement agent - providing the ultimate, risk-free means of discharging payment obligations between parties - emerged in the mid-19th century with the provision of settlement accounts for the banking sector. Since 1996, these accounts have been held within the Bank's Real-Time Gross Settlement (RTGS) system, which provides for real-time posting with finality and irrevocability of debit and credit entries to participants' accounts. The RTGS system settles for all the major sterling interbank payment systems or schemes. By values settled, the two most important are CHAPS and CREST payments. CHAPS is the same-day electronic funds transfer system, operated by the bankowned CHAPS Clearing Company, that is used for high-value/wholesale payments but also for other time-critical lower value payments (such as house purchase). CHAPS payment instructions are routed via the RTGS system and settled individually across the paying and receiving CHAPS banks' settlement accounts. The Bank supports the timely settlement of CHAPs payments through its provision of additional intraday liquidity to the settlement banks; this is provided via same-day repos of eligible securities between the CHAPS banks and the Bank. One particularly important category of CHAPS payments settled in RTGS are CLS (Continuous Linked Settlement) payments. CLS is the foreign exchange settlement system that was introduced in 2002 to eliminate foreign exchange settlement risk in participating currencies. CREST is the UK's securities settlement system, operated by Euroclear UK & Ireland, which since November 2001 has provided real-time Delivery versus Payment ultimately against central bank money for transactions in UK securities (gilts, equities and moneymarket instruments). The CREST system settles in a series of very high-frequency cycles through the day; after each cycle the RTGS system is advised of the debits and credits to be made to the CREST settlement banks' accounts as a result of the settlement activity performed by CREST in that cycle. The Bank supports the real-time settlement process in CREST through the provision of intraday liquidity to the CREST settlement banks; and again this is provided via a same-day repo (under a procedure known as auto-collateralisation). RTGS also settles, on a multilateral net basis, the interbank obligations arising in the following payment schemes: Bacs - The UK's automated clearing house, processing in particular Direct Debits and Direct Credits Faster Payments Service. The same-day settlement service for standing orders,

internet and telephone banking payments. The paper-based cheque and credit clearings. LINK, the UK's ATM network. Payments under the Note Circulation Scheme (NCS) are also settled in RTGS. NCS allows its members (commercial banks, cash-in-transit companies and the Post Office) to hold notes in custody for the Bank within their network of cash centres. As the final record of sterling interbank transfers, the resilience of the RTGS system is paramount. As such, it operates on fault-tolerant computer hardware, which is replicated on a second site; and with the business operation also conducted on a split site basis

Settlement System In France

A number of important reforms have been implemented in France over the past years in the field of payment systems and securities clearing and settlement systems (SCSSs). The main objectives of these reforms were to minimise the risks arising from interbank settlements, to improve efficiency and to ensure the openness of the French systems within the euro area. The French infrastructure for wholesale transactions is thus characterised by a common platform for settlement in central bank money, composed of three systems linked by real-time bridges: At the heart of this organisation is the French RTGS system operated by the Bank of France, TBF, which came into operation in October 1997 and is part of the TARGET system; In the field of SSSs, the high-speed Relit system, RGV, started up in February 1998. Thanks to its close link with the RTGS system and a sophisticated mechanism for self- collateralisation, RGV provides for continuous intraday final DVP in central bank money; and Launched in February 1997, the Paris Net Settlement (PNS) system, which can be described as a hybrid settlement system inasmuch as it offers netting mechanisms while settling in real time and in central bank money. In the field of retail means of payment and systems, substantial changes have been implemented in order to achieve the dematerialisation of interbank exchanges in 2002. Since February 2002, there has been only one retail payment system, the French automated clearing house (Systme Interbancaire de Tlcompensation SIT), through which all retail payments, now including cheques, are cleared. As for the oversight of these systems, L 141-4 of the Financial and Monetary Code (CoMF), which codifies Article 4 of the 1993 Bank of France Statute, gives a broad competence to the Bank of France to ensure the smooth operation and security of payment and securities systems. This article has been recently broadened in order to strengthen its statutory powers vis--vis the issuers of means of payment regarding security matters.

Settlement System In Germany

Payments between banks, enterprises, public institutions and private persons are mainly carried out in cashless form nowadays. It is much safer and more convenient to make payments via bank accounts rather than with cash for larger payments in particular. Disruptions to payments impair trade and industry and can undermine confidence in the currency. Payments are therefore one of the key tasks of the European System of Central Banks (ESCB) and by extension also of the Deutsche Bundesbank. The Bundesbank ensures the smooth functioning of domestic and foreign payments. For this purpose, it provides settlement and clearing services. Moreover, the Bundesbank, as part of the ESCB, is involved in creating a common standard for European payments. It is also responsible for monitoring payments; in doing so, it makes an important contribution to maintaining and strengthening the stability of the financial system. The structures of cashless payments vary from country to country, which often renders cross-border payments cumbersome and slow. In order to make cashless payments simpler, more efficient and more secure across Europe, the Single Euro Payments Area (SEPA) was created in 2008. SEPA offers uniform procedures and standards for transfers and direct debits. The electronic payment system TARGET2 forms the technical basis for the secure and rapid settlement of cashless payments within the European Union by enabling banks to transfer large amounts in a matter of seconds. Since November 2007, TARGET2 not only allows banks to make payments in real time; it also helps them save liquidity. Additionally, it promotes financial integration in Europe as the system settles not only interbank but also customer payments. TARGET2 is based on a single technical platform and offers all participants services at standardised prices for both domestic and cross-border payment transactions. payment transactions.

Settlement System In Switzerland

Swiss Interbank Clearing (SIC) is the central electronic Swiss payment system in which the participating financial institutions process their large-value payments as well as a part of their retail payments in Swiss francs. SIC is operated on behalf of the Swiss National Bank (SNB) by SIX Interbank Clearing Ltd (SIC Ltd), a subsidiary of SIX Group Ltd. At the end of 2008, around 350 Swiss and foreign financial institutions were participating in SIC. Over 2008 as a whole, the system handled a daily average of 1.5 million payments with the value of CHF 230 billion. On peak days, SIC processed over 4 million payments totalling up to CHF 343 billion. The majority of cashless payment transactions in Switzerland are thus settled through SIC. In addition, the e pl ce l ole i he i ple e io of he NB o e polic . SIC is therefore very important for the functioning of the Swiss financial centre and is a key element in the Swiss Value Chain. The Swiss Value Chain is the term used to describe the fully electro- nic integration of the trade, clearing and settlement of shares, bonds, derivatives and structured products in Switzerland.2 This article aims to familiarise a wider audience with the way SIC works. The first section is devoted to matters of governance as well as the legal provisions. The article then continues with a description of the main features of the SIC system. The third section explains the risks inherent in a payment system and how they may be reduced or eliminated in SIC. Governance and legal provisions SIC has been operated by SIC Ltd on behalf of the SNB since June 1987. The SNB is the system manager. In this function, it lays down the conditions for admission to and exclusion from the SIC system. It provides the liquidity necessary for settlement in SIC, sets times when operations begin and end, and maintains the accounts of the participating financial institutions. In addition, the SNB monitors daily operations and is responsible for crisis management in the event of disruptions or incidents. SIC Ltd operates and maintains the processing centres as well as the communications and security installations. It also develops and maintains the software and manages the data files as well as the organisational and administrative rules of conduct in SIC. SIC Ltd is 75% owned by SIX Group Ltd (Swiss Infrastructure and Exchange), while Post Finance holds a 25% stake. The shareholders in SIX Group are the Swiss big banks (30.12%), foreign banks in Switzer- land (22.68%), commercial and asset management banks (14.96%), cantonal banks (13.64%), private bankers (10.17%) and regional and Raiffeisen banks (4.09%). Other banks account for 1.23%. SIX Group and its companies hold the remaining 3.11%. The SNB considers the SIC payment system to be important for the stability of the Swiss financial system. It is therefore subject to SNB oversight.

Principal Features: This section provides a description of main features of the SIC system. They comprise real-time gross settlement, account management, the process sequence of a settlement day, the supply of liquidity to SIC participants and the links to other payment and securities settlement systems. Real-time gross settlement: SIC is a real-time gross settlement system (RTGS). In contrast to net payment systems, where incoming and outgoing payments are accumulated and the net amount settled irrevocably and with finality at a later, predetermined time, the process is continuous at SIC, with each payment being settled individually, irrevocably and with finality. RTGS systems have been introduced in many countries in the last few years. In most cases, they are used exclusively for the settlement of large-value payments. In addition to large-value payments, SIC also processes retail payments individually and is, in this regard, an exception. Account management: The deposits which SIC participants hold in their sight deposit accounts at the SNB serve as the means of payment. Payments are thus settled with central bank money. A sight deposit account consists of a master account and a SIC settlement account. The master account is used for cash withdrawals and direct transactions with the SNB which e ou ed h ough he NB ccou i g e . e c io in SIC are routed via the SIC settlement account. The reason for having a separate master account and settlement account is of a technical nature; from a legal point of view, both accounts are considered as one. An additional SIC sub-account is available to those SIC participants that are linked to the international foreign exchange settlement system, Continuous Linked Settlement (CLS). In this subaccount, banks can reserve liquidity to be used exclusively for time-critical payments to CLS Bank.4 Process sequence of a settlement day: Participants can enter their payment orders in SIC around the clock. Payments are processed for approximately 23 hours. The process sequence of a settlement day in SIC is described in more detail in the chart below. A settlement day starts at approximately 5.00 p.m. on the previous calendar day and ends on the value date at 4.15 p.m. All payments entered by 3.00 p.m. (clearing stop 1) are settled as of the same value date. Customer payments entered after clearing stop 1, however, will be settled as of the following value date. Cover payments, however, may also be submitted for same-day settlement between 3.00 p.m. and 4.00 p.m. (clearing stop 2).

Cover payments are bank-to-bank payments that are made in the name and on account of the bank is- suing the transfer order. The reason for such payments may, for instance, be money market transactions. Consequently, the interval between clearing stop 1 and clearing stop 2 allows those participants whose payments could not be fully processed, to procure the necessary liquidity on the money market. In addition, between 4.00 p.m. and 4.15 p.m. (clearing stop 3), counterparties may also obtain liquidity from the SNB under the liquidity-shortage financing facility via special-rate repo transactions. The SIC day closes with end-of-day processing of payments. The system cancels all payments still pending and transfers the balance from the SIC settlement account to the master account. The next value date begins at approximately 5.00 p.m., and the balances of the individual master accounts are transferred to the SIC settlement accounts. Payments are only settled in SIC if the remit- ting party has sufficient cover in its SIC settlement account. Any time the participant enters a new payment, it is first queued. If there is sufficient cover in the SIC settlement account, the payment order only remains in the queuing system for a few seconds and will then be settled immediately. If cover is insufficient, the payment remains in the queuing system until there are sufficient liquid funds. SIC participants can manage the settlement sequence of their payments by assigning payments to priority classes. The exact settlement sequence of the payments in the queuing system is then determined by an algorithm, the functioning of which is described in the box to the right. Payments in the queuing system can be revoked by the remitter at any time up to clearing stop 1 (3.00 p.m.) without the consent of the recipient.5 Payments remaining in the queuing system at the end of the settlement day on account of insufficient cover will be deleted and must be resubmitted. In such a case, the recipient of the payment that was not settled is entitled to charge the remitter default interest amounting to the prevailing money market rate plus half a percentage point. Risk Management The settlement of payments involves certain risks. The following is a description of the individual risks and the instruments and measures provided in SIC to reduce or eliminate them. Credit risk: Credit risk is the risk that a party will not be able to meet its financial obligations either when they fall due or at any time thereafter. In connection with payment systems, a distinction is made between two types of credit risk: Credit risk between direct participants: In the case of net payment systems, incoming and outgoing payments are accumulated, with the transfer taking place at a later, predetermined time. Up to the time of the final transfer, credit relationships can be established between participants, and this gives rise to a credit risk. In the case of SIC, no such credit relationships are established because, owing to the use of real-time gross settlement, all payments are settled individually, irrevocably and

with finality. - Settlement bank risk: Financial institutions that are not able or do not wish to participate in SIC directly, incur the risk that their settlement bank will default, causing them to lose their deposits. The SNB counters this risk by providing access to the payment system for as wide a range of participants as possible. Those financial institutions without access to SIC can minimise this risk by choosing an account-holding institution that is as solvent as possible. Liquidity risk: Liquidity risk is the risk that a system participant does not have enough liquidity to meet its financial obligations when they fall due (but can do so at a later date). Different measures help to keep the liquidity risk for participants and the danger of a system grid- lock as low as possible. First, participants can access different sources of liquidity, which allows them to react to fluctuating liquidity situations quickly and flexibly. The intraday and liquidity-shortage financing facilities, in particular, are worth mentioning in this regard (cf. chapter 2, section on liquidity supply). Second, SIC supports the efficient use and active management of the available liquidity. Participants are not only able to check their account balances and the pending incoming and outgoing payments in the queue at any time, they can also manage the queue by prioritising and cancelling payments, thus optimising the payment stream. The option of being able to enter payments in the system up to five days prior to their due date also facilitates liquidity planning. Finally, the following measures help to reduce system-wide liquidity requirements: In accordance with the agreement with SIC participants, payments in excess of CHF 100 million must be split up into smaller tranches, to prevent any gridlocks in the queuing system. In case of a system-wide gridlock, SIC automatically activates its optimisation routine to unblock it. The system searches for any pending cross-payments from sending and receiving banks. If this is the case, and if sufficient cover is available, the payments are offset simultaneously and on a bilateral basis. The remitter of a payment pays a dual-component fee. One component depends on the time of initiation of the payment, the other on the time of settlement. Both fees increase in the course of the day. This creates an incentive for the participants to transfer payment orders to the system early, while at the same time providing sufficient liquidity so that settlement can occur equally early. The aim is to prevent participants from delaying their payments and waiting for incoming payments to finance their own outgoing payments. Operational risk: Operational risk is the risk of losses or disturbances as a result of the inadequacy or

failure of internal procedures, employees and systems, or due to external events. Payment systems must satisfy high security standards with regard to availability, integrity, confidentiality and traceability throughout the entire processing of transactions. An operational disruption or indeed a temporary failure of the SIC system would greatly impair cashless payment transactions in Swiss francs. A whole range of organisational and technical measures help to reduce the likelihood of an operational disruption of the SIC system, and ensure that normal processing operations can be resumed quickly in the event of a disruption. Should the need arise, a semi-automatic back-up system (Mini-SIC) is available. In the event of technical disruptions affecting individual participants, the SNB can access the p icip e le e ccou di ec l d execu e p e o hei eh lf.

Settlement System In Japan

There are four major payment systems for clearing and settling interbank payments in Japan - three clearing systems in the private sector and a funds transfer system operated by the central bank. The three clearing systems are: the Zengin Data Telecommunication System (Zengin System), which clears retail credit transfers; the Foreign Exchange Yen Clearing System (FXYCS), which clears mainly yen legs of foreign exchange transactions; and bill and cheque clearing systems (BCCSs), which clear bills and cheques presented at regional clearing houses. The BOJ-NET Funds T fe e i he ce l fu d fe e d i u ed o e le interbank obligations including net obligations of participants in the private sector clearing systems. There have been several notable developments in the respective payment systems in this decade. Both the Zengin System and the FXYCS have introduced countermeasures against credit and liquidity risks involved in clearing and settlement procedures, and the Bank of Japan Financial Network System (BOJ-NET) introduced a new real-time gross settlement (RTGS) system in 2001. Concerning securities settlement systems, the Bank of Japan serves as the central securities depository (CSD) for Japanese government bonds (JGBs), and the Japan Securities Depository Centre (JASDEC) is the CSD for stocks. A number of registrars and the Japan Bond Settlement Network (JB Net) make up the settlement system for corporate and other bonds. Delivery versus payment (DVP) has been available for JGBs, corporate and other bonds, and exchange-traded stocks. In recent years, reform of the securities settlement systems has been proceeding and significant and wide-ranging progress has been made. In terms of the legal framework, a new law was enacted in 2002 enabling the dematerialisation of JGBs, corporate and other bonds, and commercial paper (CP) from 2003. JGBs and CP are scheduled to be settled through new book-entry systems that will operate under the new law from 2003. DVP will also be achieved for CP in the new book-entry system. A unified central counterparty (CCP) for exchange-traded stocks will start operation in 2003, and the introduction of a DVP mechanism for stocks traded outside the exchanges in 2004 has been agreed among the relevant parties. In addition, the use of trade or pre-settlement confirmation systems is expected to become available for broader types of securities. In retail payments, the predominance of cash for small-value payments and the almost complete absence of cheque use by individuals are the prominent features that distinguish payment practices in Japan. Electronic funds transfers, including services such as prearranged direct debits for the payment of utility bills and direct credits for the payment of payrolls, are widely used by both firms and individuals. Credit cards are commonly used while the use of electronic money and debit cards is very limited. Postal accounts and postal giro services provided by the government-run Post Office are also popular. With regard to access channels for various retail payment services, new channels such as the internet and mobile phones, as well as existing channels such as bank windows and automated teller machines (ATMs), are used. Convenience stores have also become popular locations for paying utility bills.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Statement: Stefan Fegerl Stefan FegerlDocument2 pagesStatement: Stefan Fegerl Stefan Fegerlpaiment flechetteNo ratings yet

- India Fintech Report 2021Document29 pagesIndia Fintech Report 2021devang bohraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 156114-124731 20190930 PDFDocument7 pages156114-124731 20190930 PDFAmru OmarNo ratings yet

- Singapore Financial SystemDocument21 pagesSingapore Financial SystemSaikat SahaNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureASHISH PANDEYNo ratings yet

- Soa 102021Document2 pagesSoa 102021Jethro VillahermosaNo ratings yet

- The Bank of The Future PDFDocument124 pagesThe Bank of The Future PDFsubas khanal100% (1)

- Report - 2023 11 16 - 23 56 11Document2 pagesReport - 2023 11 16 - 23 56 11jennyscol4realNo ratings yet

- The Impact of Blockchain Technology in Banking: Roshan KhadkaDocument37 pagesThe Impact of Blockchain Technology in Banking: Roshan KhadkamonuNo ratings yet

- DBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Document3 pagesDBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002sudheermca068345No ratings yet

- S2-The Ultimate Guide To Buying CryptocurrenciesDocument12 pagesS2-The Ultimate Guide To Buying CryptocurrenciesShoaib MohammadNo ratings yet

- R20AMR ReleaseHighlights ClientDocument176 pagesR20AMR ReleaseHighlights ClientZakaria AlmamariNo ratings yet

- Receipt 2Document2 pagesReceipt 2avsmaju management100% (1)

- NTVAXBPr 6 R 8 H FHU4Document9 pagesNTVAXBPr 6 R 8 H FHU4Ranjit BeheraNo ratings yet

- XboxDocument6 pagesXboxvenipaz63No ratings yet

- Debit CardDocument16 pagesDebit CardAvinash Sahu100% (2)

- Account Statement From 1 Apr 2022 To 13 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Apr 2022 To 13 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham TyagiNo ratings yet

- 1.04.22 - 21.08.22 CanaraDocument7 pages1.04.22 - 21.08.22 CanaraMADHUBALA SAHAYNo ratings yet

- Moldcell PromoDocument4 pagesMoldcell PromounifunNo ratings yet

- Famous Debit and Credit Fraud CasesDocument7 pagesFamous Debit and Credit Fraud CasesAmy Jones100% (1)

- Cespt Tijuana Online Payment TranslationDocument2 pagesCespt Tijuana Online Payment TranslationJessica DonahueNo ratings yet

- Freelance Independent Contractor Invoice TemplateDocument2 pagesFreelance Independent Contractor Invoice TemplateBrendan DickinsonNo ratings yet

- Annoucement and Guideline - Eng VDocument1 pageAnnoucement and Guideline - Eng VMohammad Syafiq Mohd YalanNo ratings yet

- Chargeback Process FlowDocument11 pagesChargeback Process FlowguyNo ratings yet

- JNNJDocument48 pagesJNNJBirdmanZxNo ratings yet

- Product Overview IMPSDocument3 pagesProduct Overview IMPSKuriya HardikNo ratings yet

- New BankDocument13 pagesNew BankVelayudhan SunkaraNo ratings yet

- IDFC FASTag Summary1672234138849Document2 pagesIDFC FASTag Summary1672234138849MAHESH MOTORSNo ratings yet

- آليات رقمنة الخدمات المالية والمصرفية لإرساء الشمول المالي الرقمي - اعتماد ابتكارات التكنولوجيا المالية كسبيلDocument16 pagesآليات رقمنة الخدمات المالية والمصرفية لإرساء الشمول المالي الرقمي - اعتماد ابتكارات التكنولوجيا المالية كسبيلsofiane.meamicheNo ratings yet

- Buy Bitcoin Cash With A Credit Card Trust WalletDocument1 pageBuy Bitcoin Cash With A Credit Card Trust WalletMichelle GoorisNo ratings yet