Professional Documents

Culture Documents

IMT-58 Asignment

IMT-58 Asignment

Uploaded by

jbhadanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMT-58 Asignment

IMT-58 Asignment

Uploaded by

jbhadanaCopyright:

Available Formats

Institute of Management Technology

Centre for Distance Learning

A16, Site 3, UPSIDC Industrial Area, Meerut Road, Ghaziabad - 201 003

Subject Code: IMT-58

Subject Name : MANAGEMENT ACCOUNTING

Objectives

This Course intends to:

1. Develop basic understanding of cost management,

2. Introduce budgetary control and standard costing techniques as control mechanism, and

3. Impart analytical technique of cost estimation, cost analysis and benchmarking.

Contents

1. Understanding Costs

2. Overhead Analysis

3. Job Cost Analysis

4. Process Cost Analysis

5. Marginal Costing and Break Even Analysis

6. Cost Volume Profit Analysis

7. Budgetary Control and Responsibility Accounting

8. Standard Costing and Variance Analysis

References

1. Management Accounting, Pankaj Gupta (Excel Books).

2. Introduction to Management Accounting, Horngren, Charles T., Gary L., Sundem and William O. Stratton,

Prentice Hall.

3. Management and Cost Accounting, Drury, C., International Thompson Business Press.

a. First Set of Assignments: Part-A : 5 Marks & Part-B : 5 Marks. Each question carries 1 marks.

b. Second Set of Assignments: Part-C : 5 Marks & Part-D : 5 Marks. Each question carries 1 marks.

c. Third Set of Assignments: 20 Short Answer Questions : 10 Marks. Each question carries ½ marks.

Confine your answers to 150 to 200 Words.

d. Forth Set of Assignments: Two Case Studies : 10 Marks. Each case study carries 5 marks.

Notes:

a. Write answers in your own words as far as possible and refrain from copying from the text books/handouts.

b. Answers of Ist Set (Part-A & Part-B), IInd Set (Part-C, Part-D), IIIrd Set (Short Answer Questions) and Case

Study must be sent together.

c. Mail the answer sheets alongwith the copy of assignments for evaluation & return.

d. Only hand written assignments shall be accepted.

Management Accounting ........................................ Page 1 of 6 ................................................................................IMT-58

ASSIGNMENTS

Subject Code : IMT-58

Subject Name: MANAGEMENT ACCOUNTING

PART– A

1. “A cost accounting system that simply records cost for the purpose of fixing sale price has accomplished

only a small part of its mission”. Comment.

2. Distinguish and define:

• Direct materials and indirect materials

• Direct wages and indirect wages

• Direct expenses and indirect expenses

• Factory overheads and office overheads

3. Define and discuss:

• Marginal cost.

• Direct cost.

• Absorption cost.

• Activity based costing.

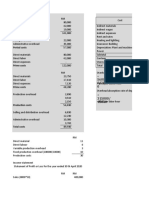

4. Calculate the Prime cost, Factory cost, Total cost of production and cost of sales from the following

particulars:

Particulars Amount Amount

(Rs.) (Rs.)

Raw material consumed 60,000

Wages paid to labourers 15,000

Directly chargeable expenses 3,000

Oil and waste 150

Wages of foreman 1500

Store keeper’s wages 750

Electric power 300

Lighting : Factory 750

: Office 300 1,050

Rent : Factory 3,000

: Office 1,500 4,500

Repair and Renewal :

Plant & Machinery 2,250

Office Premises 300 2,550

Depreciation :

Office Premises 750

Plant & Machinery 300 1,050

Consumable stores 1,500

Managers salary 3,000

Director’s fees 750

Office printing & stationery 300

Telephone charges 75

Postage 150

Salesman commission and salary 750

Travelling expenses 300

Advertisement 750

Warehouse charges 300

Carriage outward 225

Management Accounting ........................................ Page 2 of 6 ................................................................................IMT-58

5. Classify costs on the basis of elements, functions and variability.

PART– B

1. A firm has several items of inventory. The average number of each of these as well as their unit cost is

listed below:

Item Avg. No. of Avg. Cost per Item Avg. No. of Avg. Cost

No. units in unit No. units in per unit

inventory inventory

1 4000 1.96 11 1800 25.00

2 200 10.00 12 130 2.70

3 440 2.40 13 4400 9.50

4 2000 16.80 14 3200 2.60

5 20 165.00 15 1920 2.00

6 800 6.00 16 800 1.20

7 160 76.00 17 3400 2.20

8 3000 3.00 18 2400 10.00

9 1200 1.90 19 120 21.00

10 6000 0.50 20 320 4.00

The firm wishes to adopt ABC inventory system. How should the item be classified into A, B and C

categories?

2. What is the role of ordering cost and carrying cost in calculating the EOQ?

3. Write short notes on:

• Safety stock.

• Break-even analysis.

• P.V. ratio.

• Flexible budgeting.

• Capacity cost.

4. What is stores ledger account? How is it a useful method to control movement of stocks? Explain with

example.

5. What is prime cost? How is it different from conversion cost and manufacturing cost?

PART – C

1. What are overheads? Discuss in detail the principles of primary and secondary distribution.

2. What is job costing? How does it differ from contract costing?

3. In a contract estimates of following costs have been made:

Imported raw material US$ 5,000 (Rate 1$ = Rs. 47.00)

Local raw material Rs. 1,70,000/-

Wages Rs. 1,25,000/-

Production overheads Rs. 60,000 (1/4th of estimated production overhead charged to contract)

Administrative overheads Rs. 50,000/- (1/4th of estimated administrative overhead charged to contract)

Cost escalation clauses:

1. Actual materila cost ot be accepted.

2. Wages increase to be covered up to 4% of estimated.

3. Overhead increase to be restricted to 2% of estimated.

Management Accounting ........................................ Page 3 of 6 ................................................................................IMT-58

Actual Overheads:

Production overheads Rs. 2,80,000

Administrative overheads Rs. 2,10,000

Wages Rs. 1,28,750

Exchange rate on the date of purchase of raw material was Rs. 48 per US$.

Exchange rate on the date of payment was Rs. 48.20 per US $.

Custom duty is applicable @ 25% on imported price converted into Indian Rupees. Excise on local raw

material is @ 10%. Excise on Ex-factory price is @ 12.5% modvat credit is available. Profit margin is 10%

of cost including excise and customs. Prepare a contract cost schedule and show profit.

4. Define and differentiate between cost centres and cost drivers. Give examples.

5. What is margin of safety? How is it related with P.V. ratio?

PART– D

1. “Different methods of valuation of stock give the different value of stock”, discuss with examples.

2. From the following particulars calculate material cost variance; material usage and material price variance:

Quantity of material purchased 3,000 units

Value of material purchased Rs. 9,000/-

Std. Quantity of materials required

per tonne of finished product 25 units

Std. Rate of material Rs. 2/- per unit.

Opening stock of raw material NIL

Closing stock of raw material 500 units

Finished production during the period 80 tones

3. Following information is available from cost records of M/s ABC Ltd. manufacturing spare parts:

Particulars Unit X Unit Y

Direct material Rs. 80 per unit Rs. 60 per unit

Direct wages 24 hrs. @ Rs. 2.50 per hr. 16 hrs. @ Rs. 2.50 per hr.

Variable overheads 150% of direct wages 150% of direct wages

Fixed overheads Rs. 7,500 (common)

Selling price Rs. 250 per unit Rs. 200 per unit

The management wants to be acquainted with the desirability of accepting any one of the following

alternative sales mixes in the budget for next period.

• 250 units of X and 250 units of Y.

• 400 units of X only.

• 400 units of Y only.

• 400 units of X and 150 units of Y.

• 150 units of X and 350 units of Y.

State which of the alternative sales mix you would recommend to management.

4. Explain the significance and objectives of a break even chart and elucidate what factors would cause the

B.E.P. change?

5. The budgeted results of X Ltd. include the following:

Sales Amount (Rs.) in lacs Variable cost as a % of

sales value

A 5.00 60%

B 4.00 50%

C 8.00 65%

D 3.00 80%

E 6.00 75%

Total : 26.00

Management Accounting ........................................ Page 4 of 6 ................................................................................IMT-58

Fixed cost for the period is Rs. 9.00 lacs. You are required to:

(a) Produce a statement showing the amount of loss expected.

(b) Recommend a change in sales volume of each product which will eliminate the expected loss assuming

that sales of only one product can be increased at a time.

SHORT ANSWER QUESTIONS

1. “Though financial accounting helps the financial managers to take decision for internal use but the

information supplied is inadequate”. In the light of above statement, discuss the advantages of cost

accounting.

2. What is the difference between marginal cost and variable cost?

3. What is the difference between fixed cost and differential cost?

4. What is the difference between imputed cost and sunk cost?

5. What is the difference between overhead apportionment and overhead allocation?

6. What is difference between primary distribution and secondary distribution with reciprocity and without

reciprocity?

7. How do you differentiate between:

(a) Opportunity cost and capacity cost.

(b) Social cost and replacement cost.

8. “Contribution is the backbone of marginal cost analysis”. Discuss.

9. Discuss in detail:

(a) Make or buy decisions.

(b) Selling a product below sale price to a special customer.

(c) In the long run all fixed cost tend to become variable.

10. How does conversion cost differ from cost of goods sold?

11. What is process costing? How is the W.I.P. evaluated in process costing?

12. Describe the process of job costing.

13. What is difference between normal loss and abnormal loss? What is the accounting treatment for both

these losses?

14. What is the significance of transfer pricing? How does the final process may not be able to show any profit

in ‘cost plus’ transfer pricing?

15. What is the concept of ‘push back cost’? How does it work?

16. What is the difference between joint product and by product? What is the relevance of ‘split-off point’ cost in

joint product cost?

17. Discuss the reverse cost method used in by product costing.

18. Differentiate between margin of safety and B.E.P.?

19. Explain the concept of sensitivity analysis as used in marginal costing. Give examples.

20. Discuss:

(a) Concept of Kaizen budgeting.

(b) Zero based budgeting.

(c) Difference between standard cost and target cost

Management Accounting ........................................ Page 5 of 6 ................................................................................IMT-58

CASE STUDY-1

M /s M.I. Ltd. produces and markets industrial containers and packing cases. Due to stiff competition, the

company proposes to reduce its selling prices.

If the present level of profits is to be maintained indicate the number of units that must be sold if proposed

reduction in selling price is 5%, 10% and 15%. Following additional information is also available:

Present Sales Turnover (30000 units) Rs. 3,00,000

Variable cost (30000 units) Rs. 1,80,000

Fixed cost Rs. 70,000 Rs. 2,50,000

Net Profit Rs. 50,000

Question

1. How does marginal cost analysis help in taking key financial decisions?

CASE STUDY-2

T he cost of an article at capacity level of 5,000 units is given under. For a variation of 20% in capacity above

or below this level, the individual expenses vary as indicated below:

Material Cost Rs. 25,000 (100% variable)

Labour Cost Rs. 15,000 (100% variable)

Power Rs. 1,250 (80% variable)

Repair & Maintenance Rs. 2,000 (75% variable)

Stores Rs. 1,000 (100% variable)

Inspection Rs. 500 (20% variable)

Depreciation Rs. 10,000 (100% fixed)

Adm. overheads Rs. 5,000 (25% variable)

Selling overheads Rs. 3,000 (30% variable)

Total: Rs. 62,750

Per unit cost Rs. 12.55

Questions

1. Find the per unit cost at production level of 4,000 units and 6000 units.

2. How flexible budget is considered better than fixed budget.

Management Accounting ........................................ Page 6 of 6 ................................................................................IMT-58

You might also like

- Value Chain AnalysisDocument31 pagesValue Chain AnalysisArvind Renganathan100% (1)

- Cost and Management Accounting CIA 1.1Document5 pagesCost and Management Accounting CIA 1.1Kanika BothraNo ratings yet

- Chapter2A - Cost SheetDocument15 pagesChapter2A - Cost SheetDhwni A NanavatiNo ratings yet

- Cost Sheet & Single or Output Costing: Rs. RsDocument23 pagesCost Sheet & Single or Output Costing: Rs. RsKnshk SnghNo ratings yet

- Cost-V Sem BBMDocument10 pagesCost-V Sem BBMAR Ananth Rohith BhatNo ratings yet

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDocument11 pagesSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- Mumbai University - TYBCOM - Sem 5 - Cost AccountingDocument19 pagesMumbai University - TYBCOM - Sem 5 - Cost Accountingpritika mishraNo ratings yet

- Soalan2 Quiz Chapter 3Document8 pagesSoalan2 Quiz Chapter 3biarrahsiaNo ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Cost SheetDocument20 pagesCost SheetVannoj AbhinavNo ratings yet

- Eos Elements of Cost Accounting Acc203Document3 pagesEos Elements of Cost Accounting Acc203Emilia JacobNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Caunit 5costsheetqapdf 240331043600 73a67000Document32 pagesCaunit 5costsheetqapdf 240331043600 73a67000affinitienterprisesNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Unit 3 Part 1 - CostingDocument17 pagesUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNo ratings yet

- CA Work Sheet Unit 2Document23 pagesCA Work Sheet Unit 2Shalini SavioNo ratings yet

- Cost Sheet Practical Solevd QuestionsDocument6 pagesCost Sheet Practical Solevd QuestionsMansi VermaNo ratings yet

- Cost Sheet and Single and Output CostingDocument21 pagesCost Sheet and Single and Output CostingHard WorkoutNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- 8.0 Financial EstimatesDocument8 pages8.0 Financial Estimatesnur syafieraNo ratings yet

- Cost Sheet 1Document1 pageCost Sheet 1ARUNSANKAR NNo ratings yet

- Financial Plan 4.1 Project Cost The Total Project Cost of Printing Urbane Is P80,000. This Is Also Known As TotalDocument11 pagesFinancial Plan 4.1 Project Cost The Total Project Cost of Printing Urbane Is P80,000. This Is Also Known As TotalNormailah Sultan MacalaNo ratings yet

- Entrada Gericho TP-Costing-1Document3 pagesEntrada Gericho TP-Costing-1jessalyn carranzaNo ratings yet

- Activity Based CostingDocument7 pagesActivity Based CostingCzar Ysmael RabayaNo ratings yet

- Cost & Management Accounting MBADocument4 pagesCost & Management Accounting MBAashwinimore811No ratings yet

- Cost Sheet 19.08.2020Document6 pagesCost Sheet 19.08.2020VISHAGAN MNo ratings yet

- P6.36 Job Costing: Consulting FirmDocument11 pagesP6.36 Job Costing: Consulting FirmPat0% (1)

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- Tutorial 5Document7 pagesTutorial 5YANG YUN RUINo ratings yet

- Alpha LTD QuestionDocument2 pagesAlpha LTD Question2018314506No ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- Chapter 7 Annex A PDFDocument10 pagesChapter 7 Annex A PDFJingjing ZhuNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 15Document22 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 15Mr. JalilNo ratings yet

- Cost Sheet Illustration 1.4Document2 pagesCost Sheet Illustration 1.4Sunny PatelNo ratings yet

- Management Advisory Services: Number 1 (Costs and Cost Concepts)Document3 pagesManagement Advisory Services: Number 1 (Costs and Cost Concepts)Angel Keith MercadoNo ratings yet

- SM CSE ACT 301 Final AssessmentDocument4 pagesSM CSE ACT 301 Final AssessmentArifur Rahaman 182-15-2111No ratings yet

- Cost Management Accounting AM1 STDocument5 pagesCost Management Accounting AM1 STAash RedmiNo ratings yet

- OverheadApportionment 7Document5 pagesOverheadApportionment 7mitsob27No ratings yet

- MAF151 Tutorial 1Document3 pagesMAF151 Tutorial 1AaaAAAa aaANo ratings yet

- Module 2 - Problems On Cost Sheet New 2019 PDFDocument7 pagesModule 2 - Problems On Cost Sheet New 2019 PDFJibin JoseNo ratings yet

- FOH Allocation and ApportionmentDocument11 pagesFOH Allocation and ApportionmentAyan NoorNo ratings yet

- Completed (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkDocument4 pagesCompleted (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkYolo LeetNo ratings yet

- Tutorial 2 Traditional Overhead Q PDFDocument7 pagesTutorial 2 Traditional Overhead Q PDFNur SyafiqahNo ratings yet

- Tut 5 Overheads PDFDocument7 pagesTut 5 Overheads PDFYANG YUN RUINo ratings yet

- Topic 2: Cost Terms, Concepts and Classifications Exercise 1Document4 pagesTopic 2: Cost Terms, Concepts and Classifications Exercise 1j hNo ratings yet

- HW 1 MGT202Document4 pagesHW 1 MGT202Rajnish Pandey0% (1)

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- CMC-MT-PRMX-2-Q P !Document7 pagesCMC-MT-PRMX-2-Q P !ritesh choudhuryNo ratings yet

- 026 Exercise-Part-FourDocument7 pages026 Exercise-Part-FourMi TvNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Tuto 11Document3 pagesTuto 11WEI QUAN LEENo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- Contoh Soal Flexibel Budget PDFDocument3 pagesContoh Soal Flexibel Budget PDFJaihut NainggolanNo ratings yet

- Ent 600 FinanceDocument3 pagesEnt 600 FinanceDanial FahimNo ratings yet

- Cost Accounting 1Document4 pagesCost Accounting 1Rohan RalliNo ratings yet

- ACB 10203 Tutorial Cost Allocation With SolutionDocument5 pagesACB 10203 Tutorial Cost Allocation With SolutionainfarhanaNo ratings yet

- Alka 25-7-2015 OverheadDocument9 pagesAlka 25-7-2015 OverheadShubhamNo ratings yet

- Revision Note - Section 10Document9 pagesRevision Note - Section 10Sohid BacusNo ratings yet

- Expenses: Direct LaborDocument3 pagesExpenses: Direct LaborVictor LimNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced Levelayesha zafarNo ratings yet

- Fading Suns - Ruinous FollyDocument32 pagesFading Suns - Ruinous FollyPaolo Leccese0% (1)

- Option Trading StrategiesDocument5 pagesOption Trading StrategiesNeeraj SharmaNo ratings yet

- CH0002 Koopmans ProductionDocument36 pagesCH0002 Koopmans ProductionFadi HadiNo ratings yet

- July14.2012 - B Full Implementation of Food Fortification Law May Result in High Price of SugarDocument1 pageJuly14.2012 - B Full Implementation of Food Fortification Law May Result in High Price of Sugarpribhor2No ratings yet

- Cookery 10-Quarter 1 Product Plan: Quantity Unit Description Unit Cost TotalDocument3 pagesCookery 10-Quarter 1 Product Plan: Quantity Unit Description Unit Cost TotalJas InocandoNo ratings yet

- 2006 First Prelim (Questions Plus Solutions 2 March Version)Document8 pages2006 First Prelim (Questions Plus Solutions 2 March Version)Jhong Floreta MontefalconNo ratings yet

- MAS Annual Report 2011Document191 pagesMAS Annual Report 2011Aboi BoboiNo ratings yet

- BOP AdjustmentsDocument7 pagesBOP Adjustmentshimanshuagarwal3005No ratings yet

- Car Alamo DalDocument6 pagesCar Alamo Dalharsoft0% (1)

- Marketing Plan of Knorr PastaDocument27 pagesMarketing Plan of Knorr PastaIlyas Ahmad Farooqi75% (8)

- MorningStar StockInvestor Apr 09Document32 pagesMorningStar StockInvestor Apr 09Daniel MillerNo ratings yet

- Comp1821 NotesDocument2 pagesComp1821 NotesHari proNo ratings yet

- Public Goods - Economics - Tutor2u PDFDocument7 pagesPublic Goods - Economics - Tutor2u PDFFify AzizNo ratings yet

- Chữa đề NLKT thầy Cường và đề EBBADocument12 pagesChữa đề NLKT thầy Cường và đề EBBATiêu Vân GiangNo ratings yet

- Systematic RiskDocument3 pagesSystematic RiskWEI CHIN KHOONo ratings yet

- Case Study - GAPDocument3 pagesCase Study - GAPkierselennNo ratings yet

- Tax2 Premid PDFDocument18 pagesTax2 Premid PDFJoben CuencaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument12 pagesThis Paper Is Not To Be Removed From The Examination HallsSithmi HimashaNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- International Trade TheoriesDocument26 pagesInternational Trade TheoriesparadeeptownNo ratings yet

- Find Solutions For Your Homework: Textbook Solutions Expert Q&A Study Pack PracticeDocument5 pagesFind Solutions For Your Homework: Textbook Solutions Expert Q&A Study Pack PracticeQuratulain Shafique Qureshi100% (1)

- ECON302 Tutorial1 Answers PDFDocument5 pagesECON302 Tutorial1 Answers PDFAngel RicardoNo ratings yet

- Cost of CapitalDocument45 pagesCost of CapitalTaliya ShaikhNo ratings yet

- IFM Chapter 17 - Class PresentationDocument15 pagesIFM Chapter 17 - Class PresentationCecilia Ooi Shu QingNo ratings yet

- Da Matta Et Al. 2007 Crescimento Das Cidades Brasileiras JUEDocument21 pagesDa Matta Et Al. 2007 Crescimento Das Cidades Brasileiras JUEKarine Medeiros AnunciatoNo ratings yet

- 2013 Mazda MX5 Brochure Mx5Document5 pages2013 Mazda MX5 Brochure Mx5edeleon19100% (1)

- Test Bank Chapter1Document4 pagesTest Bank Chapter1shawktNo ratings yet

- Valuation of HDFCDocument21 pagesValuation of HDFCG Nagarajan0% (1)