Professional Documents

Culture Documents

The Day Ahead - April 12th 2013

The Day Ahead - April 12th 2013

Uploaded by

wallstreetfoolCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Day Ahead - April 12th 2013

The Day Ahead - April 12th 2013

Uploaded by

wallstreetfoolCopyright:

Available Formats

THE DAY AHEAD

REUTERS NEWS

KEY ECONOMICS EVENTS PPI mm for Mar PPI yy for Mar Retail sales mm for Mar Retail sales Ex-auto mm for Mar ExAuto/gas/bldg for Mar Reuters/UMich prelim for Apr Current conditions prelim for Apr Expectations prelim for Apr Business inventories for Feb ECRI weekly index for w/e 05/04

North American Edition

ET/GMT 0830/1230 0830/1230 0830/1230 0830/1230 0830/1230 0955/1355 0955/1355 0955/1355 1000/1400 1030/1430 REUTERS POLL -0.2 pct 1.4 pct 0.0 pct 0.0 pct 0.2 pct 78.5 89.5 70.0 0.4 pct -PRIOR 0.7 pct 1.7 pct 1.1 pct 1.0 pct 0.4 pct 78.6 90.7 70.8 1.0 pct 129.2 Commerce Department Census Bureau SOURCE Labor Department

For Friday, April 12, 2013

Reuters/University of Michigan

Economic Cycle Research Institute

MARKET RECAP

Stocks rose for a fourth straight day on Thursday, taking the Dow and S&P 500 to new all-time highs. Treasuries edged higher as a three-day rise in yields attracted investors. Gold fell as the dollar traded close to a four-year high against the yen. Oil fell as the IEA trimmed its energy demand forecast.

STOCKS DJIA Nasdaq S&P 500 Toronto Russell FTSE Eurofirst Nikkei Hang Seng Close 14864.98 3300.16 1593.30 12481.37 947.01 6416.14 1192.87 13549.16 22101.27 Yield 1.7930 0.2340 0.7275 2.9975 Change 62.74 2.90 5.57 -53.54 0.92 28.77 6.70 261.03 66.71 % Chng Yr-high 0.42 14887.51 0.09 0.35 -0.43 0.10 0.45 0.56 1.96 0.30 3299.16 1589.07 12904.71 954.00 6533.99 1209.05 13331.39 23944.74 Yr-low 12035.10 2726.68 1266.74 11209.55 729.75 5897.81 1132.73 10398.61 21612.05

COMING UP

JPMorgan Chase is expected to post higher quarterly results, but

the numbers may be overshadowed by lingering bad memories of the London Whale trading debacle. Earnings per share at the biggest U.S. bank are expected to be up nearly 9 percent from the same quarter a year earlier. But any apparent growth will be tarnished by the fact that the year-earlier profits were retroactively slashed by nearly 10 percent when the company had to restate results because its financial controls had failed to pick up the derivatives loss. In addition, the newest results are expected to be about flat with fourth-quarter results and show that the company is still falling short of what executives have said is its potential.

Wells Fargo, the No. 4 U.S. bank by assets, is expected to post

increased quarterly profit, and investors will be closely watching for an update on the mortgage business as a harbinger of what to expect in the rest of the industry.

Federal Reserve Chairman Ben Bernanke speaks in Washington

at the 2013 Federal Reserve System Community Development Research Conference on the topic of "Creating Resilient Communities" before the "Resilience and Rebuilding for Low-Income Communities" conference. Atlanta Fed President Dennis Lockhart speaks at the same event, and Federal Reserve Bank of Boston President Eric Rosengren gives remarks before the "Fulfilling the Full Employment Mandate: Monetary Policy and the Labor Market" conference hosted by the Federal Reserve Bank of Boston.

TREASURIES 10-year 2-year 5-year 30-year COMMODITIES May crude $ Spot gold (NY/oz) $

Price FOREX 4 /32 Euro/Dollar 0 /32 Dollar/Yen 1 /32 Sterling/Dollar 5 /32 Dollar/CAD Price 93.43 1561.26 3.4280 290.46 Price 2.12 0.87 1.40 20.88

Last % Chng 1.3099 99.85 1.5383 1.0106 0.24 0.08 0.35 -0.35

$ change -1.21 3.12 0.0140 -0.85 $ change 0.33 0.13 -0.14 -1.44

% change -1.28 0.20 0.41 -0.29 % change 18.44 17.57 -9.09 -6.45

Several data reports are expected to be released, including Retail

Sales, which likely stalled in March, a possible sign that a tax hike enacted earlier in the year has had a bigger impact on consumer spending than previous reports had indicated. The Commerce Department releases the data. The Labor Department releases the producer price index report for March, which is expected to show a drop in prices due to lower costs for gasoline.

Copper U.S. (front month/lb) $ Reuters/Jefferies CRB Index

BIG MOVERS

Rite Aid Suntech Power Primo Water Hewlett-Packard

AT&T is expected to begin sales of the first smartphones preloaded with Facebook's new family of "Home" applications.

For The Day Ahead - Canada, click here

THE DAY AHEAD

For April 12, 2013

MARKET MONITOR

Stocks rose for a fourth straight day on Thursday, sending the Dow and the S&P 500 to all-time highs as positive data on the labor market and an encouraging retail outlook assuaged recent concerns about economic growth. Nevertheless, technology stocks were the day's underperformers, with tech blue chips such as Microsoft and Hewlett-Packard sharply lower after an industry report that showed shipments of personal computers had fallen significantly in the first quarter. The Dow got its biggest boost from Pfizer, up 2.41 percent. Hewlett-Packard fell 6.45 percent and Microsoft shed 4.44 percent. Shares of Acadia Pharmaceuticals surged 64.37 percent. The Dow was up 0.42 percent, the S&P 500 Index was up 0.35 percent and Nasdaq was up 0.09 percent. Treasury prices rose as a three-day rise in yields lured investors to buy government debt both on the open market and at a $13 billion auction of 30-year bonds, the final part of this week's $66 billion in longer-dated supply. The 30-year bond sale fetched lukewarm demand, although indirect bidders that include foreign central banks accounted for 31.44 percent of the purchases, the lowest in six months. The overall bidding for the second reopening of the bond issue due in February 2043 came in at 2.49, up from 2.43 at the March auction but below its long-term average. Benchmark 10-year Treasury notes last traded 4/32 higher to yield 1.79 percent. The 30-year bond last traded 5/32 higher to yield 3.00 percent. The dollar hovered close to a four-year high against the yen, with a climb above the key 100 yen level highly expected given the massive amount of bonds the Bank of Japan plans to buy to buoy its economy. "I think there's trepidation going above 100 because we've gone so quickly ... in the wake of the BoJ decision," said Michael Woolfolk, senior currency strategist at BNY Mellon in New York. The dollar was last trading flat at 99.82 yen. The euro rose to its highest against the yen in more than three years, hitting 131.00 yen, and was last trading up 0.29 percent on the day at 130.79. Against the dollar, the euro rose 0.24 percent to $1.3100, after a session peak of $1.3138. Click on the chart for full-size image

Oil prices settled lower after the International Energy Agency trimmed its forecast for energy demand growth this year, the third of the world's top forecasters to do so at a time of growing supplies. "The IEA not only lowered their demand outlook, but they also speculated about the potential for a crude oil bear market this year. The agency's negative sentiment is weighing on prices," said John Kilduff, partner at Again Capital LLC in New York. May crude was down 1.26 percent at $93.45 a barrel, well below its 50-day moving average of $94.33. Gold rose as a drop in the dollar triggered bargain hunting after the previous session's sharp drop on news of possible gold sale by Cyprus and uncertainty over Fed's monetary stimulus. Spot gold rose 0.22 percent to $1,561.50 an ounce. U.S. gold for June delivery was at $1,560.20 an ounce, up 0.1 percent.

THE DAY AHEAD

For April 12, 2013

TOP NEWS

Jobless claims data calms jitters over U.S. labor market The number of Americans filing new claims for unemployment benefits fell more than expected last week, easing fears of a marked deterioration in labor market conditions after a surprise stumble in job growth in March. Initial claims for state unemployment benefits dropped 42,000 to a seasonally adjusted 346,000, the Labor Department said. Employers added only 88,000 workers to their payrolls in March after a solid 268,000 increase in February. Economists said the claims data suggested the slowdown in job creation reflected seasonal hiring being brought forward rather than underlying weakness in the labor market. A second report from the Labor Department showed little sign of inflation, which should allow the Fed to keep policy very accommodative. Import prices slipped 0.5 percent last month after rising 0.6 percent in February. U.S. retailers have ho-hum start to spring, see better April Cold weather and lingering concerns about the job market dampened U.S. shoppers' enthusiasm and hurt early spring selling at several retailers in March, but some executives and analysts said they expected business to improve slightly in April. Several top U.S. retailers, including Costco Wholesale and T.J. Maxx parent TJX Cos, reported weaker-than-expected March sales. Costco's sales at stores open at least a year were up 4 percent, less than the 5.2 percent jump analysts expected. TJX reported a 2 percent decline in March same-store sales, deeper than the 1 percent drop analysts were projecting. But the company said business improved as the weather warmed up, and CEO Carol Meyrowitz said April "was off to a good start." Burger King stock up on profit view, CEO going to Heinz Burger King Worldwide forecast a slightly higher quarterly profit than Wall Street expected, even though spending among fast-food diners remains weak. The hamburger chain also said Chief Executive Bernardo Hees will leave to take over at H.J. Heinz Co. Burger King expects first-quarter adjusted earnings of 17 cents per share - a penny higher than the average analyst estimates. The company expects sales at restaurants open at least 13 months to fall 1.5 percent globally and 3 percent in the United States and Canada in the first quarter, slightly more than Wall Street's average estimates. But it said sales were up in March after it found the right recipe for value food offers. Three more top executives leave J.C. Penney Three more top executives at J.C. Penney have left the ailing retailer, the New York Post reported, following the ouster of Chief Executive Ron Johnson. Chief Operating Officer Mike Kramer, Chief Talent Officer Daniel Walker and Chief Creative Officer Mike Fisher exited the retailer on Wednesday, it said. Citing a source close to the retailer, the newspaper said Kramer resigned but added it was not clear whether Walker and Fisher left voluntarily. Rite Aid posts quarterly and annual profits, shares up Rite Aid posted its second consecutive quarterly profit, topping Wall Street's expectations, as the drugstore chain filled more prescriptions and sold more generic drugs, which carry higher profit margins. Adjusted EBITDA rose to $340.3 million from $274.3 million a year earlier. On a net basis, Rite Aid earned $123.1 million, or 13 cents per share, for the fourth quarter, compared with a year-earlier loss of $161.3 million, or 18 cents a share. Fourth-quarter revenue fell to $6.46 billion from $7.15 billion a year earlier. Analysts, on average, had expected a loss of 2 cents per share and $6.43 billion in revenue. Click on the chart for full-size image

Rosneft, Exxon reveal plans for $15 bln Russia LNG project Rosneft and ExxonMobil unveiled details of a $15 billion liquefied natural gas project to supply Asia-Pacific markets that would challenge Gazprom's monopoly on Russian gas exports. The Russian and U.S. energy majors have agreed to study the possibility of building the plant to liquefy gas from their joint Sakhalin1 oil and gas project off Russia's Pacific coast. Production could start in 2018 - the same year that Gazprom plans to commission its own LNG plant near the Pacific port of Vladivostok - pitting the state energy giants against each other in a battle for market share in China, Japan and South Korea. China bird flu threatens KFC parent's winning streak Yum Brands, the biggest foreign fast-food chain operator in China, is in danger of breaking its 11-year streak of double-digit profit growth as it scrambles to deal with food scares and bird flu in its most lucrative market. The company said in a filing Wednesday that the latest deadly avian flu outbreak would have a "significant, negative impact" on sales at KFC stores in China in April. Analysts said the company's problems in China - which accounts for more than half its global sales - were deeply rooted, and that sales which started slowing before the chicken scare would need more than a flu-jab to revive. Google submits formal concessions to EU in antitrust case Google has formally submitted a package of concessions to European Union competition regulators, signalling that the company may be able to settle a two-year antitrust investigation without a fine. "In the last few weeks, the Commission completed its preliminary assessment formally setting out its concerns. On this basis, Google then made a formal submission of commitments to the Commission," said Antoine Colombani, the Commission's spokesman on competition policy. "We are now preparing the launch of a market test to seek feedback from market players, including complainants, on these commitment proposals," he said, declining to provide details.

THE DAY AHEAD

For April 12, 2013

TOP NEWS (continued)

Goldman explores sale of Metro metals warehouse business Goldman Sachs has explored a sale of its metals warehousing business Metro International, three sources with knowledge of the matter told Reuters, just three years after the investment bank bought the firm for $550 million. The sources say the bank has been happy with Metro's performance. It has proven to be a lucrative money-spinner as stockpiles of aluminum have mounted in its global warehouse network. Goldman may still decide to keep Metro, the sources said, but the bank has indicated it is ready to listen to any offers having already earned a sizeable return on its investment in the business. Acadia says data from Parkinson's trial enough to file for approval Acadia Pharmaceuticals said data from an initial late-stage trial would be sufficient to file for approval for its experimental antipsychotic drug for Parkinson's disease patients, and that it would not need to conduct an additional trial as planned earlier. The U.S. Food and Drug Administration agreed with the company that data from the late-stage trial 020, along with supporting data from other studies, was sufficient to support its marketing application for the drug pimavanserin to treat Parkinson's disease psychosis.

PIC OF THE DAY

Female North Korean soldiers patrol along the banks of Yalu River, near the North Korean town of Sinuiju, opposite the Chinese border city of Dandong.

ANALYSTS RECOMMENDATIONS

Company Name Adobe Systems Adtran Bed Bath & Beyond Microsoft Toll Brothers Action Evercore started coverage with overweight rating and set target price of $52, says well positioned to monetize the explosion in digital content and demand for digital marketing tools. UBS raised target price to $19 from $17 on expectations the company has booked some orders from a key customer, with revenue to ramp in the second-half of the year. Nomura raised target price to $72 from $65.50 citing stabilizing trends in the housing sector, says the company will benefit as the sector recovers more fully. Goldman Sachs cut rating to sell from neutral to reflect worsening PC trends and a lack of traction in tablets and smartphones. Susquehanna raised rating to neutral from negative and raised target price to $33 from $25 on valuations and accelerating land prices.

THE DAY AHEAD - CANADA

COMING UP

Dollar-store operator Dollarama is scheduled to report fourthquarter earnings. Analysts expect an earnings of C$1.02 per share, compared to a profit of 55 Canadian cents a share in the year-ago quarter.

For April 12, 2013

MARKET MONITOR

Canada's main stock index fell for the first time in four sessions on Thursday as energy and mining stocks were hurt by declining prices and weak investor sentiment, while BlackBerry plunged on doubts about the company's recovery plan. The Toronto Stock Exchange's S&P/TSX composite index was down 0.43 percent at 12,481.37. Suncor Energy was down 1.46 percent. Shares of BlackBerry fell 7.43 percent. The Canadian dollar was down 0.38 percent at $1.0102.

Cable company Shaw Communications will report secondquarter earnings. Analysts expect a profit of 36 Canadian cents per share, compared to a profit of 38 Canadian cents a share, a year earlier.

BIG MOVERS Centerra Gold Paladin Energy Aquila Resources Sandvine Price 5.39 0.95 0.14 2.15 C$ -0.26 -0.04 0.02 0.10 % Change -4.60 -4.04 12.50 4.88

TOP NEWS

Canada new housing prices up 0.2 percent on strength in Calgary New home prices in Canada rose by 0.2 percent in February, the 23rd consecutive month-on-month increase, pushed up by a buoyant market in the western city of Calgary, Statistics Canada said. The advance matched analysts' expectations. Calgary prices rose 1.0 percent from January - the largest month-overmonth increase since May 2007 - on higher material and labor costs. Results at Canada's Astral, Corus take divergent paths Two of Canada's biggest independent media companies handed in very different second-quarter earnings report cards, with profits plunging at Corus Entertainment while rival Astral Medias earnings jumped 9 percent. Astral Media reported a 9 percent rise in second-quarter profit on higher television revenue. Net earnings before acquisition and other costs, and Bell-Astral transaction costs rose 8 percent to C$41.2 million. Revenue rose 2 percent to C$237.1 million. For Corus, adjusted income, which does not include the cost of its debt refinancing, was C$24.4 million, or 29 cents a share. Analysts on average expected Corus to earn 36 cents a share on revenue of C$199.7 million. Hudson's Bay expects sales growth to slow in 2013 Canadian department store operator Hudson's Bay said sales in its first quarter have been below its expectations so far and added that growth would slow down for the full year as a late onset of spring hit sales at its Lord & Taylor's stores in the U.S. The company expects sales to rise 1.5 percent to 3.5 percent in 2013. Sales rose 5.9 percent to C$4.0 billion last year. In the fourth quarter, sales rose 6.7 percent to C$1.39 billion. Net income from continuing operations fell to C$93.6 million, or 81 Click on the chart for full-size image

Canadian cents per share, from C$99.2 million, or 95 Canadian cents, a year earlier. Same-store sales rose 6.1 percent at the company's namesake Canadian stores but fell 2.9 percent in the U.S. as superstorm Sandy hampered sales at Lord & Taylor stores. Rio Tinto adds $87 mln Ivanhoe Australia stake to auction block Global miner Rio Tinto's list of assets up for sale has lengthened, with its unit, Turquoise Hill Resources, looking to sell its A$83 million majority stake in Ivanhoe Australia. Ivanhoe said in a statement it was aware Turquoise Hill had begun a "review of its options in relation to its shareholding in Ivanhoe Australia", after Dow Jones reported Turquoise Hill had appointed Citi to advise on a sale of the stake.

THE DAY AHEAD

For April 12, 2013

ANALYSIS AND INSIGHT

DEALTALK Banks find new niche as activist campaigns grow By Jessica Toonkel U.S. investment banks, many of which have reduced headcount in the face of shrinking profits, have found new opportunities in an unusual place, the growth in shareholder activism. Goldman Sachs Group Inc has long been the go-to firm for companies defending against activists ever since the days when they were called corporate raiders. But over the past few years, big banks like Credit Suisse and Barclays Plc as well as investment bank Houlihan & Lokey, which focuses on the middle market, have formed practices offering the services. The banks help companies with everything from writing press releases to analyzing the costs of a breakup or countering activists' demands, bankers said. They are also aid companies in identifying where they could be vulnerable, even before activist investors show up on their doorsteps. "The level of receptivity from companies has definitely increased," said Daniel Kerstein, head of the strategic finance group at Barclays. "In some cases the proposed medicine may be worse than the problem, but you are still going to listen." Companies are increasingly coming under fire from activists. There were 241 activist campaigns in 2012 targeting a change in company strategy or board, up from 187 in 2009, according to FactSet SharkWatch. Over the past three years, activist hedge funds have outperformed more traditional hedge funds, according to Chicagobased Hedge Fund Research (HFR). Its activist index has returned 3.80 percent on an annualized basis, compared with its global hedge fund index, up only 0.25 percent. That has drawn the attention of investors. Assets under management in activist funds doubled to more than $65 billion in 2012 from $32 billion in 2008, according to HFR. Successful activist campaigns, and the pressure to outperform index funds in a low-return environment, have made pension and mutual funds more willing to join up with activist investors, giving them more allies in their campaigns. With the U.S. economy recovering, it is also easier to discern which companies are underperforming, making them more visible targets. "The numbers are not going to retreat," said Chris Young, head of contested situations at Credit Suisse. Once investors see that activist campaigns are successful, "then that tool is identified as one of the tools in their toolbox," he said. For the investment banks, offering defense advice can help solidify relationships at the most senior level, such as a board of directors or top management, bankers said. Barclays has grown its shareholder defense services over the past few years as an outgrowth of its equity restructuring business, which helps with non-distressed corporate breakups. The team sits within the bank's mergers and acquisitions practice, Kerstein said. Credit Suisse hired Young, the former director of M&A and proxy fight at influential proxy adviser Institutional Shareholder Services, to head its takeover defense practice in June 2010. "As a firm we've been devoting more resources and more headcount to this subject matter in an environment where banks in general have been decreasing headcount," Young said, declining to elaborate. Houlihan & Lokey, which focuses on mid-sized corporations, has expanded its business advising on activist defense over the past couple of years, said Gregg Feinstein, managing director and co -head of M&A. Unlike larger peers Goldman and Credit Suisse, Houlihan works with both activist funds as well as companies. Being proactive is key, said Bill Anderson, head of the defense practice at Goldman. For example, companies are increasingly assessing potential vulnerabilities, even before activists show up. Communicating with other shareholders - not just the activist investors - is also crucial, bankers said. "Companies need to make sure they are talking to all of their shareholders on a regular basis," Kerstein said. "You want your shareholders to be brutally honest with you." COLUMN Equities in a sweet rut By James Saft The record-breaking rise of the stock market is in part a function of the lousy jobs picture, which ensures an ongoing prescription refill of Federal Reserve medicine. The S&P 500 index hit a record high on Wednesday, rising more than 1 percent to as much as 1588. Since data showed on Friday that the economy added just 88,000 jobs in March, the S&P has added a cool 2.3 percent. And while the jobless rate fell to 7.6 percent this was largely thanks to almost 500,000 people falling out of the workforce, taking the labor force participation rate to its lowest since 1978. This state of play isnt indefinitely sustainable, but there is absolutely no contradiction between a spluttering economy and a levitating stock market. The Fed is boxed in unless they see signs of a rapid improvement in jobs, the debate theyve been having among themselves about tapering quantitative easing later this year is going to be nothing more than a historical curiosity. And why that rapid improvement should happen as the effects of sequestration are felt through the year, I could not tell you. It is likely that a strong jobs number would have actually undermined equities, raising the prospect that complaints about QE from those outside of Chairman Bernankes tightly knit consensus would get a better hearing. Minutes from the Federal Open Market Committees rate-setting meeting in March, released on Wednesday, bear this out. At the meeting, held before the jobs figures were compiled, there was notable debate, with a few participants wanting to bring the program to an end relatively soon and a few others seeing quickly increasing risks and wanting tapering before too long. Those views are probably more hawkish than the consensus among those members who actually get to vote this year, and also dont seem to reflect the consensus at the Bernanke-led core. What seemed to get no hearing at all by the Fed were alternatives to asset purchases which might work better. All of the focus is on the risks and the rewards of QE, with consensus coming down that the latter justify the former. The critics position is weakened by the fact that the un-enunciated alternative amounts to admitting the limits of Fed power and waiting to see what happens. ROSY OUTLOOK, WEATHER TO REMAIN DREARY That would be ugly if it happened, and precisely because of this it wont any time soon. The Fed will very likely continue QE for the rest of this year, at least, and will try to plug the dyke of doubt by making thoughtful and sober comments about how it is working through mitigating the risks. That leaves equities, if not job seekers, in a sweet spot. Not only will money flow to riskier assets via the Feds own QE program, the really quite large one recently announced by the Bank of Japan will also help. Japanese institutions and savers will doubtless flee the yen and the single-buyer Japanese government bond market, with some of the money flowing to the U.S., supporting asset prices here. In the meantime, corporate profitability is helped by the fact that

THE DAY AHEAD

For April 12, 2013

ANALYSIS AND INSIGHT (continued)

there is a large core of highly employable people who are seeing decent wage growth and whose assets, like houses and stocks, are going up in value. There are also signs of a nascent consumer credit loosening, verging on a bubble, which will also support stocks, though obviously not in a sustainable way. Reuters Carrick Mollenkamp had a great report last week detailing the surge in subprime auto loans, up 18 percent last year, and the Wall Street Journal this week detailed a trend towards longer-term auto loans, of as much as eight years. I could tell you about how its not a great idea to devote a huge chunk of your take-home pay to a high-rate auto loan, or for that matter of the questionable wisdom of financing a rapidly depreciating asset with long-term debt, but that is all beside the point. These loans are being made, officialdom seems unlikely to interfere, in fact QE is a prime support, and for a while at least, this will keep the merry-go-round spinning. The main risks to equities, other than a worsening in conditions in Asia or Europe, are all at what must seem a safe distance. The Fed wont pull back soon, and it will take a while for the impact of sequestration to be felt. This rally wont go on forever, but, like the last two stock market booms, will probably last longer and go further than it merits. (James Saft is a Reuters columnist. The opinions expressed are his own. At the time of publication, he did not own any direct investments in securities mentioned in this article. He may be an owner indirectly as an investor in a fund. ) PayPal hopes to break U.S. shoppers' swipe habit in stores By Alistair Barr PayPal will soon be ubiquitous in U.S. retail stores, but just being there may not be enough. The online payment service will take a giant step beyond its Internet roots on April 19, when a partnership with Discover Financial Services officially kicks in. The deal means that, by the end of this year, PayPal will be accepted as a payment option in roughly 2 million retail stores that already take Discover credit cards. For parent eBay Inc, PayPal's expansion is crucial. The 13-yearold payment service accounts for about 40 percent of eBay's revenue and its growth is slowing. A foothold in physical payments, a $10 trillion market roughly 10 times the size of online transactions, could power longer-term growth. But a nagging question hangs over PayPal's push to checkout counters: how can it convince consumers to try its new payment method when swiping a credit or debit card is so easy? "Consumers need to be convinced they need a single digital wallet or card that links to all their other cards," said Rick Oglesby, a payments industry analyst at Aite Group, which provides research to financial services clients. "That's a huge mindset shift and the average consumer wonders why they would need it." PayPal has been testing its physical payments service at Home Depot Inc stores since early 2012. At the checkout counter, shoppers can use PayPal by typing in a mobile phone number and a four-digit PIN that has to be set up online beforehand. They can also use a PayPal card that links to their account. PayPal's uphill battle becomes clear from interviews with employees at the Home Depot store in San Carlos, California, one of the first to test the new service. Cashiers there said very few customers chose to use PayPal - and some who did soon gave up because they found keying in a bunch of numbers was not as convenient as swiping a credit card. "I ask at my local Home Depot and I get the same response not many people have used it," said Brian Kilcourse of RSR Research, a consulting firm focused on retail technology. "Unless there are specific benefits that consumers can touch and feel, they're unlikely to adopt something new." Don Kingsborough, the PayPal executive overseeing the offline push, said the company will soon be releasing an updated smartphone app that makes it easier for consumers to enroll in the program. PayPal will also be sending out new PayPal cards to users who still prefer to swipe. Kingsborough said he expects the cards to be used a lot at first, but they will be slowly replaced by the app as more stores set up mobile payments and shoppers get comfortable using their smartphones to make purchases. "An average credit card user uses the card 18 to 20 times a week. For us to get to those kinds of levels will take time," he said in an interview. "But by Christmas PayPal will start to be a more prevalent way to pay." RIVALS PayPal's offline initiative is in part a response to stiffening competition in the payments market. Square, a mobile payments start-up headed by Twitter cofounder Jack Dorsey, is used by more than 300,000 merchants and has struck a partnership with Starbucks. Credit card giants Visa Inc and MasterCard Inc are working on their own digital wallets. These companies declined to comment on PayPal's expansion. When people pay with PayPal, the purchases are often funded by credit cards. That means PayPal pays huge amounts of fees to Visa and MasterCard, making it a valuable partner. However, as PayPal expands into physical stores it will be more of a rival because it can forge closer ties to consumers and distance them from the credit card networks and card issuers. Morgan Stanley analyst Scott Devitt told investors on Thursday that he was not increasing his PayPal estimates because of this new business. In his best-case scenario, Devitt estimates the initiative could boost the value of eBay by $5 a share, assuming about 5 percent of PayPal U.S. customers would complete about half of their offline transactions via the service. "The road to merchant ubiquity is clear; consumer adoption is less so," Devitt wrote in a research note. Ebay shares were trading at $57.94, up 64 cents or 1.12 percent. Devitt's price target for the shares remained $62. PayPal originally caught on online because it offered users an easy way to pay for goods without having to type in personal information, like credit card numbers and addresses. In the physical world, this advantage no longer applies. That forces PayPal to attract customers through a mix of financial incentives and small fixes for what it calls "consumer pain points," or irksome shopping experiences. For example, Home Depot and PayPal have run several promotions in recent months, offering $5, $10 or $25 rewards to users who spend a certain amount in-store with PayPal. One such promotion was expected to last two weeks but proved so popular that it lasted only 30 minutes before the budgeted reward money ran out, Kingsborough said. Home Depot is also working with PayPal to improve customer service. One possible solution would help contractors track the money they give plumbers and other specialists to buy equipment for a project. At Jamba Juice, customers can use PayPal smartphone apps to order and pay for smoothies, then pick them up from a dedicated line. PayPal ran a similar test with McDonald's in France last year. The new smartphone app will also let diners order and pay without waiters approaching their table. And another solution PayPal is testing allows users at stadium events to order and pay for food and drinks from their seats.

THE DAY AHEAD

For April 12, 2013

ANALYSIS AND INSIGHT (continued)

Retailers are interested in working with PayPal because it may give them leverage to negotiate better terms with the likes of Visa and MasterCard. PayPal is also offering to share more valuable customer data with merchants. Kingsborough said he hopes to turn PayPal into a kind of digital Swiss Army knife: "It solves so many of your problems that you're willing to carry it." JURY IS OUT It remains to be seen if these tactics will win over enough customers to give PayPal a significant physical footprint. Wall Street is largely optimistic - shares of eBay are up about 75 percent since mid-2011, when PayPal revealed its offline plans. Home Depot Treasurer Dwaine Kimmet said he had low expectations about the initial use of PayPal in its stores and the experience so far has confirmed such caution. But when PayPal is more widely available in other stores and enrollment gets easier, adoption should increase, he said. "The real killer app comes when PayPal rolls all the incremental functionality around the transaction and the shopping experience," Kimmet told Reuters. Guitar Center, the world's largest musical instruments retailer, began to accept PayPal at its stores on Oct. 15 last year and says the service still accounts for less than than 1 percent of instore payments. But that number is growing, said Wes Muddle, vice president of finance at Guitar Center. Although a February promotion was not successful in boosting PayPal usage, Guitar Center is not giving up because it believes the partnership would help the retailer know its customers and market better to them over the long term. "Would we have preferred the promotion move the needle more? Yes," he said. "There's no silver bullet for switching people from credit cards to PayPal. It will just take some time."

KEY RESULTS vs. THOMSON REUTERS I/B/E/S ESTIMATES

Company Name Quarter EPS Estimates Year Ago Rev Estimates (mln)

JPMorgan Chase

Q1

$1.39

$1.19

$25,861

** Includes companies on S&P 500 index. Estimates may be updated or revised.

The Day Ahead - North American Edition is compiled by Naveen Mutnal, Benny Thomas and Chandrashekhar Modi in Bangalore; Franklin Paul and Meredith Mazzilli in New York. THE DAY AHEAD - North American Edition is produced by Reuters News For questions or comments about this report, email us at: TheDay.Ahead@thomsonreuters.com Or call us at +91 80 4135 5929 Visit the Thomson Reuters Equities Community Site at: http://customers.reuters.com/community/equities/ For more information about our products: http://thomsonreuters.com/products_services Or send us a sales enquiry at: http://thomsonreuters.com/products_services/financial/contactus/ or call us on North America: +1 800 758 5555 2013 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Using Caterpillar's Fleet Production Cost Program FPCDocument46 pagesUsing Caterpillar's Fleet Production Cost Program FPCFRed Pacompia100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Credit Markets Update - April 10th 2013Document5 pagesCredit Markets Update - April 10th 2013wallstreetfoolNo ratings yet

- Credit Markets Update - March 28 2013Document5 pagesCredit Markets Update - March 28 2013wallstreetfoolNo ratings yet

- The Day Ahead - April 17th 2013Document7 pagesThe Day Ahead - April 17th 2013wallstreetfoolNo ratings yet

- Credit Markets Update - April 22nd 2013Document5 pagesCredit Markets Update - April 22nd 2013wallstreetfoolNo ratings yet

- The Day Ahead - April 22nd 2013Document9 pagesThe Day Ahead - April 22nd 2013wallstreetfoolNo ratings yet

- Credit Markets Update - April 5th 2013Document5 pagesCredit Markets Update - April 5th 2013wallstreetfoolNo ratings yet

- The Day Ahead - April 10th 2013Document8 pagesThe Day Ahead - April 10th 2013wallstreetfoolNo ratings yet

- CDP Joura EnglishDocument179 pagesCDP Joura EnglishCity Development Plan Madhya PradeshNo ratings yet

- Appendix I: Financial Statement of Nestle India - in Rs. Cr.Document3 pagesAppendix I: Financial Statement of Nestle India - in Rs. Cr.XZJFUHNo ratings yet

- Sr. No Branch Total BatchDocument16 pagesSr. No Branch Total BatchGL BAJAJNo ratings yet

- Question Bank MAN 22509 UT1Document17 pagesQuestion Bank MAN 22509 UT1Avinash GarjeNo ratings yet

- Baniqued VALUE ADDED TAXDocument5 pagesBaniqued VALUE ADDED TAXMRNo ratings yet

- Feasibility Report Business Plan On D Establish of A Nusery and Primary School in Ibadan Oyo State PDFDocument118 pagesFeasibility Report Business Plan On D Establish of A Nusery and Primary School in Ibadan Oyo State PDFHardeep Singh Khehra0% (2)

- The Cemex WayDocument9 pagesThe Cemex Wayhassan ijazNo ratings yet

- A UN Treaty Now Under Discussion Looks PromisingDocument3 pagesA UN Treaty Now Under Discussion Looks PromisingAsfawosen DingamaNo ratings yet

- Reasons For New Product DevelopmentDocument9 pagesReasons For New Product DevelopmentTalha SaeedNo ratings yet

- RatioDocument24 pagesRatioSadika KhanNo ratings yet

- Report Industrial Visit To Yakult Danone India Pvt. Ltd. 1Document2 pagesReport Industrial Visit To Yakult Danone India Pvt. Ltd. 1Abhishek SinghNo ratings yet

- DMC College FoundationDocument13 pagesDMC College FoundationEarl Russell S PaulicanNo ratings yet

- Marketing Project TopicDocument2 pagesMarketing Project TopicChristopher JosephNo ratings yet

- Benchmarking - Best Practices: An Integrated ApproachDocument23 pagesBenchmarking - Best Practices: An Integrated ApproachVivek MahajanNo ratings yet

- Preparation of Financial StatementsDocument5 pagesPreparation of Financial StatementsOji ArashibaNo ratings yet

- Accounts Receivable Control Account in The General Ledger of Montgomery CompanyDocument2 pagesAccounts Receivable Control Account in The General Ledger of Montgomery CompanyIshanNo ratings yet

- The Walt Disney CompanyDocument10 pagesThe Walt Disney CompanyYves GuerreroNo ratings yet

- Poster Iti4-223 - 1.22 - Eng - Edducait - Itil4fo - SWDocument4 pagesPoster Iti4-223 - 1.22 - Eng - Edducait - Itil4fo - SWAlejandro BoteroNo ratings yet

- m2h HandbookDocument33 pagesm2h HandbookJohann DreierNo ratings yet

- Unorganised Labour - Labour Law IIDocument23 pagesUnorganised Labour - Labour Law IIAman BeriwalNo ratings yet

- Conceptual and Regulatory Frameworks For Financial ReportingDocument20 pagesConceptual and Regulatory Frameworks For Financial ReportingDhanushika SamarawickramaNo ratings yet

- Nissan CaseDocument12 pagesNissan Casegiadcunha50% (4)

- Finance Lafargeholcim 2017 Annual Report enDocument256 pagesFinance Lafargeholcim 2017 Annual Report enAlezNgNo ratings yet

- Maturity Organization Level ISO 9004Document2 pagesMaturity Organization Level ISO 9004abimanyubawono100% (2)

- I. Industry Profile: Part-ADocument40 pagesI. Industry Profile: Part-Amalthu.malthesh6185100% (1)

- E Freight Handbook PDFDocument110 pagesE Freight Handbook PDFharikrishnanNo ratings yet

- Business PlanDocument10 pagesBusiness PlanSheryl BorromeoNo ratings yet

- 2-ZI-2211-0473-Pak Budi Yulianto-R1 Project Furniture Outdoor Rooftop OfficeDocument5 pages2-ZI-2211-0473-Pak Budi Yulianto-R1 Project Furniture Outdoor Rooftop OfficeRendy GunawanNo ratings yet

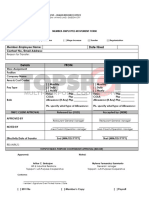

- TMPC Employee Movement FormDocument1 pageTMPC Employee Movement FormGabriel GarciaNo ratings yet