Professional Documents

Culture Documents

Commodities Weekly Outlook 15 04 13 To 19 04 13

Commodities Weekly Outlook 15 04 13 To 19 04 13

Uploaded by

hitesh315Copyright:

Available Formats

You might also like

- Fule Station 2 (Pas Ful)Document24 pagesFule Station 2 (Pas Ful)Heyder Abdusamad92% (53)

- Quick Facts About Tiger 21: Who We Are Experiencing Tiger 21Document2 pagesQuick Facts About Tiger 21: Who We Are Experiencing Tiger 21Harley soulNo ratings yet

- Interest Rate and Currency SwapsDocument143 pagesInterest Rate and Currency Swapscrinix7265100% (1)

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielNo ratings yet

- The Titmar Motor Company Is Considering The Production of ADocument1 pageThe Titmar Motor Company Is Considering The Production of ATaimour HassanNo ratings yet

- Microfin 4.12Document134 pagesMicrofin 4.12Neo_Mx_NeoNo ratings yet

- Handling Foreign Currency Transactions PDFDocument34 pagesHandling Foreign Currency Transactions PDFnigus82% (11)

- Commodities Weekly Outlook, 22.04.13 To 26.04.13Document5 pagesCommodities Weekly Outlook, 22.04.13 To 26.04.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 06 05 13 To 10 05 13Document6 pagesCommodities Weekly Outlook 06 05 13 To 10 05 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 25 02 13 To 01 03 13Document6 pagesCommodities Weekly Outlook, 25 02 13 To 01 03 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 25.03.13 To 30.03.13Document6 pagesCommodities Weekly Outlook, 25.03.13 To 30.03.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 24.06.13 To 28.06.13Document5 pagesCommodities Weekly Outlook, 24.06.13 To 28.06.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 10 05 13 To 14 05 13Document5 pagesCommodities Weekly Outlook 10 05 13 To 14 05 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 30.07.13 To 03.08.13Document5 pagesCommodities Weekly Outlook 30.07.13 To 03.08.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 15.07.13 To 19.07.13Document6 pagesCommodities Weekly Outlook 15.07.13 To 19.07.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 05 11 12 To 09 11 12Document5 pagesCommodities Weekly Outlook 05 11 12 To 09 11 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 12.08.13 To 16.08.13Document5 pagesCommodities Weekly Outlook, 12.08.13 To 16.08.13Angel BrokingNo ratings yet

- Content: Weekly Technical Levels Strategy/RecommendationsDocument5 pagesContent: Weekly Technical Levels Strategy/RecommendationsAngel BrokingNo ratings yet

- Commodities Weekly Outlook 09 09 13 To 13 09 13Document6 pagesCommodities Weekly Outlook 09 09 13 To 13 09 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16 12 13 To 20 12 13Document6 pagesCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315No ratings yet

- Commodities Weekly Outlook, 08.07.13 To 12.07.13Document6 pagesCommodities Weekly Outlook, 08.07.13 To 12.07.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 28th January 2013Document5 pagesCommodities Weekly Outlook, 28th January 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFDocument6 pagesCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315No ratings yet

- Commodities Weekly Outlook 20 08 12 To 24 08 12Document5 pagesCommodities Weekly Outlook 20 08 12 To 24 08 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 19 11 12 To 23 11 12Document5 pagesCommodities Weekly Outlook 19 11 12 To 23 11 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 17 09 12 To 21 09 12Document6 pagesCommodities Weekly Outlook 17 09 12 To 21 09 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 29.10.2012 To 03.11.2012Document5 pagesCommodities Weekly Outlook 29.10.2012 To 03.11.2012Angel BrokingNo ratings yet

- Commodities Weekly Outlook 26.11.2012 To 01.12.2012Document6 pagesCommodities Weekly Outlook 26.11.2012 To 01.12.2012Angel BrokingNo ratings yet

- Commodities Weekly Outlook 10.12.2012 To 14.12.2012Document5 pagesCommodities Weekly Outlook 10.12.2012 To 14.12.2012hitesh315No ratings yet

- Commodities Weekly Outlook 22 10 12 To 26 10 12Document5 pagesCommodities Weekly Outlook 22 10 12 To 26 10 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 17 12 12 To 21 12 12Document5 pagesCommodities Weekly Outlook 17 12 12 To 21 12 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 12.11.2012 To 17.11.2012Document6 pagesCommodities Weekly Outlook 12.11.2012 To 17.11.2012Angel BrokingNo ratings yet

- MCX Weekly Report8 AprilDocument10 pagesMCX Weekly Report8 AprilexcellentmoneyNo ratings yet

- Special Technical Report On MCX Nickel AugustDocument2 pagesSpecial Technical Report On MCX Nickel AugustAngel BrokingNo ratings yet

- Weekly Commodity Report 15 AprDocument11 pagesWeekly Commodity Report 15 AprNidhi JainNo ratings yet

- Daily Commodity Market Tips Via ExpertsDocument9 pagesDaily Commodity Market Tips Via ExpertsRahul SolankiNo ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument54 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument36 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Commodity MCX Gold and Silver Market TrendDocument9 pagesCommodity MCX Gold and Silver Market TrendRahul SolankiNo ratings yet

- July 032012 56030712morningDocument5 pagesJuly 032012 56030712morningPasam VenkateshNo ratings yet

- MCX Silver: 31 July, 2012Document2 pagesMCX Silver: 31 July, 2012arjbakNo ratings yet

- Index Watch:: EPIC Research ReportDocument8 pagesIndex Watch:: EPIC Research Reportapi-211507971No ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument55 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- MCX Silver Daily ChartDocument1 pageMCX Silver Daily Chartronak2484bhavsarNo ratings yet

- Daily Commodity Report22!04!2013Document10 pagesDaily Commodity Report22!04!2013Anupriya SaxenaNo ratings yet

- Free Commodity MCX Market Research ReportDocument9 pagesFree Commodity MCX Market Research ReportRahul SolankiNo ratings yet

- Daily Commodity Report: MCX Gold Oct (Document5 pagesDaily Commodity Report: MCX Gold Oct (Ravi Kant ThakurNo ratings yet

- Free Commodity Market TipsDocument9 pagesFree Commodity Market TipsRahul SolankiNo ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument55 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Special Technical Report On NCDEX ChanaDocument2 pagesSpecial Technical Report On NCDEX ChanaAngel BrokingNo ratings yet

- Special Technical Report On NCDEX TurmericDocument2 pagesSpecial Technical Report On NCDEX TurmericAngel BrokingNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Weekly Commodity by Epic Research - 16 July 2012Document6 pagesWeekly Commodity by Epic Research - 16 July 2012Brian PaceNo ratings yet

- Aug 2412 6240812Document5 pagesAug 2412 6240812k_kestutisNo ratings yet

- Commodity Market Updates 18 MayDocument9 pagesCommodity Market Updates 18 MayRahul SolankiNo ratings yet

- Daily Commodity Report 12-04-2013Document12 pagesDaily Commodity Report 12-04-2013EpicresearchNo ratings yet

- Weekly Trading Highlights & OutlookDocument5 pagesWeekly Trading Highlights & OutlookDevang VisariaNo ratings yet

- Daily Commodity Report 29-08-2013Document7 pagesDaily Commodity Report 29-08-2013Nidhi JainNo ratings yet

- Weekly Commodity Report 13-05-2013Document9 pagesWeekly Commodity Report 13-05-2013EpicresearchNo ratings yet

- Free Commodity Market ReportDocument9 pagesFree Commodity Market ReportRahul SolankiNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Indain Commodity Market TrendDocument9 pagesIndain Commodity Market TrendRahul SolankiNo ratings yet

- Weekly Commodity Report 4 MARCH 2013: WWW - Epicresearch.CoDocument9 pagesWeekly Commodity Report 4 MARCH 2013: WWW - Epicresearch.Coapi-196234891No ratings yet

- Metal and Energy Tech Report October 29Document2 pagesMetal and Energy Tech Report October 29Angel BrokingNo ratings yet

- Weekly-Commodity-Report 01 JULY 2013Document11 pagesWeekly-Commodity-Report 01 JULY 2013Nidhi JainNo ratings yet

- Commodity Market Updates and TipsDocument9 pagesCommodity Market Updates and TipsRahul SolankiNo ratings yet

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.From EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No ratings yet

- Nitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation CoatingDocument2 pagesNitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation Coatinghitesh315No ratings yet

- TDS Nitoproof Damp Protect India2Document2 pagesTDS Nitoproof Damp Protect India2hitesh315No ratings yet

- Don't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and InstrumentsDocument1 pageDon't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and Instrumentshitesh315No ratings yet

- Content: Market Highlights Day's Overview Outlook Important Events For TodayDocument3 pagesContent: Market Highlights Day's Overview Outlook Important Events For Todayhitesh315No ratings yet

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Document4 pagesThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021hitesh315No ratings yet

- Carcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, GotriDocument55 pagesCarcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, Gotrihitesh3150% (1)

- Commodity Market: 2018 BBU BBM BBL Weekly DailyDocument2 pagesCommodity Market: 2018 BBU BBM BBL Weekly Dailyhitesh315No ratings yet

- Venous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose VeinsDocument53 pagesVenous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose Veinshitesh315No ratings yet

- N SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K JDocument3 pagesN SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K Jhitesh315No ratings yet

- Dr. Chirag Pandya Year 2007Document76 pagesDr. Chirag Pandya Year 2007hitesh315No ratings yet

- Symbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790Document3 pagesSymbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790hitesh315No ratings yet

- RR 090620145Document5 pagesRR 090620145hitesh315No ratings yet

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFDocument6 pagesCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315No ratings yet

- Comparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal HerniaDocument7 pagesComparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal Herniahitesh315No ratings yet

- Positional Call Nirmal BangDocument1 pagePositional Call Nirmal Banghitesh315No ratings yet

- Gold Short Term Report: StrategyDocument3 pagesGold Short Term Report: Strategyhitesh315No ratings yet

- Original Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal HerniaDocument4 pagesOriginal Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal Herniahitesh315No ratings yet

- Commodities Weekly Outlook 16 12 13 To 20 12 13Document6 pagesCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315No ratings yet

- Copper Takes A Bullish Stance: Punter's CallDocument3 pagesCopper Takes A Bullish Stance: Punter's Callhitesh315100% (1)

- Commodities Weekly Tracker 10th June 2013Document27 pagesCommodities Weekly Tracker 10th June 2013hitesh315No ratings yet

- Commodities: I Vayda BazaarDocument7 pagesCommodities: I Vayda Bazaarhitesh315No ratings yet

- Gold Report: Analyst: Hareesh VDocument2 pagesGold Report: Analyst: Hareesh Vhitesh315No ratings yet

- Management Accounting: Level 3Document16 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- UIC ISO 55000 Guidelines - FinalDocument96 pagesUIC ISO 55000 Guidelines - FinalIrma Galego Paz100% (1)

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- Year Beginning Value Ending Value HPR HPYDocument3 pagesYear Beginning Value Ending Value HPR HPYmubarek oumerNo ratings yet

- Gerrard Construction Co Is An Excavation Contractor The Following SummarizedDocument3 pagesGerrard Construction Co Is An Excavation Contractor The Following SummarizedCharlotteNo ratings yet

- WF 8.1.13 PDFDocument11 pagesWF 8.1.13 PDFChad Thayer VNo ratings yet

- University Student Investment Banking Resume TemplateDocument1 pageUniversity Student Investment Banking Resume Templateiduncan91No ratings yet

- Lucky Cement Strategic OptionsDocument5 pagesLucky Cement Strategic OptionsFahim QaiserNo ratings yet

- Assignment HBDocument3 pagesAssignment HBJhay Sy LynNo ratings yet

- Tutorial 4 Consolidated FS I (CBS) (A)Document10 pagesTutorial 4 Consolidated FS I (CBS) (A)fooyy8No ratings yet

- How Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?Document20 pagesHow Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?aggarwal.aki123No ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- Ahmad AyubDocument16 pagesAhmad Ayubfresh juiceNo ratings yet

- Mar3023 Exam 1 Review-1Document31 pagesMar3023 Exam 1 Review-1Anish SubramanianNo ratings yet

- 1st Quarter EntrepreneurshipDocument28 pages1st Quarter EntrepreneurshipSamantha ValienteNo ratings yet

- Importance of Gold: in Indian EconomyDocument4 pagesImportance of Gold: in Indian EconomyTapan anandNo ratings yet

- Entrepreneurship ReviewerDocument5 pagesEntrepreneurship ReviewerThea Mae TudilloNo ratings yet

- Menna's ResumeDocument1 pageMenna's Resumemohamed mustafaNo ratings yet

- Strategic Cost Management QuizDocument9 pagesStrategic Cost Management Quizctarenas.studentNo ratings yet

- Escrow OfficerDocument4 pagesEscrow Officerapi-121435323No ratings yet

- MS Accountancy Set 5Document9 pagesMS Accountancy Set 5Tanisha TibrewalNo ratings yet

- Module 9 - Earnings and Market Approach ValuationDocument46 pagesModule 9 - Earnings and Market Approach Valuationnatalie clyde matesNo ratings yet

- Week 8: Financial Statement Analysis & PerformanceDocument41 pagesWeek 8: Financial Statement Analysis & Performanceyow jing peiNo ratings yet

Commodities Weekly Outlook 15 04 13 To 19 04 13

Commodities Weekly Outlook 15 04 13 To 19 04 13

Uploaded by

hitesh315Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodities Weekly Outlook 15 04 13 To 19 04 13

Commodities Weekly Outlook 15 04 13 To 19 04 13

Uploaded by

hitesh315Copyright:

Available Formats

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

Content

Weekly Technical Levels Strategy/Recommendations

Prepared by

Samson Pasam Sr. Technical Analyst Samsonp@angelbroking.com (040) 30932632

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

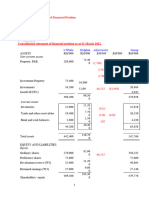

MCX GOLD JUNE (CMP 27,884 / $ 1480.30)

MCX Gold June as seen in the weekly chart above has opened at 29,701 levels, initially made a high of 29,751 and then fell sharply lower, breaking all the key supports towards 27,680 levels and finally closed sharply lower from the previous weeks closing levels. For the next week we expect gold prices to find very strong Support in the range of 27,140 27,040 levels. Multiple closing below 27,040 levels would open the door for an extended decline initially towards 26,450 levels, and then finally towards the major support at 25,950 levels. Resistance is now observed in the range of 28,440-28,500 levels. Trading consistently above 28,500 levels would lead towards the strong resistance at 29,190 levels, and then finally towards the Major resistance at 30,500 levels.

MCX / Spot Gold Trading levels for the week Trend: Down S1-27,140/ $ 1443 S2-26,450 / $ 1406 R1-28,440 / $ 1517 R2-29,190 / $ 1553

Recommendation: Sell MCX Gold June between 28,400-28,450, SL-29,025, Target -27,250.

www.angelcommodities.com

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

MCX SILVER MAY (CMP 48,845 / $ 25.85)

MCX Silver May as seen in the weekly chart above has opened at 51,520 levels initially moved sharply higher, but found good resistance at 52,447 levels. Later prices fell sharply breaking all the key supports towards 48,550 levels and finally closed sharply lower from the previous weeks closing levels. For the next week we expect Silver prices to find support in the range of 47,450-47,350 levels. Trading consistently below 47,300 levels would lead towards the strong support at 46,200 levels and then finally towards the major support at 45,560 levels. Resistance is now observed in the range of 49,900-49,970 levels. Trading consistently above 50,000 levels would lead towards the strong resistance at 51,330 levels, and then finally towards the major Resistance at 53,830 levels.

MCX / Spot Silver Trading levels for the week

Trend: Down S1-47,450 / $ 25.04 S2-46,200 / $ 24.25 R1-49,940 / $ 26.55 R2-51,330 / $ 27.36

Recommendation: Sell MCX Silver May Between 49,700-49,750, SL-50,501, Target -47,500/46,400 OR Buy MCX Silver May between 46,200-46,100, SL-45,400, Target -49,000

www.angelcommodities.com

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

MCX COPPER APRIL (CMP - 404/ $7428)

MCX Copper April as seen in the weekly chart above has opened at 408.25 levels initially moved sharply higher, but found good resistance at 415.50 levels. Later prices fell sharply towards 402 levels and finally closed sharply lower from the previous weeks closing levels. For the next week we expect Copper prices to find support in the range of 399-397 levels. Trading consistently below 396 levels would lead towards the strong support at 393 levels and then finally towards the major support at 387 levels. Resistance is now observed in the range of 412-413 levels. Trading consistently above 414 levels would lead towards the strong resistance at 420.50 levels and then finally towards the major resistance at 432 levels. MCX / LME Copper Trading levels for the week Trend: Down S1 399/ $7320 S2 393 / $7215 R1 412.30/$7591 R2 420.70/$7753

Recommendation: Sell MCX Copper April between 408-410, SL-416.20, Target -399 OR Buy MCX Copper April between 399-397, SL-392, Target -408

www.angelcommodities.com

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

MCX CRUDE APRIL (CMP 4973 / $ 90.66)

MCX Crude April as seen in the weekly chart above has opened at 5110 levels initially moved higher, but found very good resistance at 5149 levels. Later prices fell sharply towards 4941 levels and finally closed sharply lower from the previous weeks closing levels. For the next week we expect Crude prices to find support at 4895-4880 levels. Trading consistently below 4880 levels would lead towards the strong support at 4813 levels and then finally towards the major support at 4758 levels. Resistance is now observed in the range of 5020-5035 levels. Trading consistently above 5040 levels would lead towards the strong resistance at 5103 levels, and then finally towards the Major resistance at 5230 levels. MCX / NYMEX Crude Oil Trading levels for the week Trend: Down S1- 4893 / $ 89.10 S2-4813 / $ 87.35 R1-5103 / $ 91.95 R2-5230 / $ 93.60

Recommendation: Sell MCX Crude April between 5090-5100, SL-5161, Target -4895. OR Buy MCX Crude April between 4820-4810, SL-4750, Target -4980

www.angelcommodities.com

Commodities Weekly Technical Report

15.04.2013 to 19.04.2013

www.angelcommodities.com

You might also like

- Fule Station 2 (Pas Ful)Document24 pagesFule Station 2 (Pas Ful)Heyder Abdusamad92% (53)

- Quick Facts About Tiger 21: Who We Are Experiencing Tiger 21Document2 pagesQuick Facts About Tiger 21: Who We Are Experiencing Tiger 21Harley soulNo ratings yet

- Interest Rate and Currency SwapsDocument143 pagesInterest Rate and Currency Swapscrinix7265100% (1)

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielNo ratings yet

- The Titmar Motor Company Is Considering The Production of ADocument1 pageThe Titmar Motor Company Is Considering The Production of ATaimour HassanNo ratings yet

- Microfin 4.12Document134 pagesMicrofin 4.12Neo_Mx_NeoNo ratings yet

- Handling Foreign Currency Transactions PDFDocument34 pagesHandling Foreign Currency Transactions PDFnigus82% (11)

- Commodities Weekly Outlook, 22.04.13 To 26.04.13Document5 pagesCommodities Weekly Outlook, 22.04.13 To 26.04.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 06 05 13 To 10 05 13Document6 pagesCommodities Weekly Outlook 06 05 13 To 10 05 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 25 02 13 To 01 03 13Document6 pagesCommodities Weekly Outlook, 25 02 13 To 01 03 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 25.03.13 To 30.03.13Document6 pagesCommodities Weekly Outlook, 25.03.13 To 30.03.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 24.06.13 To 28.06.13Document5 pagesCommodities Weekly Outlook, 24.06.13 To 28.06.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 10 05 13 To 14 05 13Document5 pagesCommodities Weekly Outlook 10 05 13 To 14 05 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 30.07.13 To 03.08.13Document5 pagesCommodities Weekly Outlook 30.07.13 To 03.08.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 15.07.13 To 19.07.13Document6 pagesCommodities Weekly Outlook 15.07.13 To 19.07.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 05 11 12 To 09 11 12Document5 pagesCommodities Weekly Outlook 05 11 12 To 09 11 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 12.08.13 To 16.08.13Document5 pagesCommodities Weekly Outlook, 12.08.13 To 16.08.13Angel BrokingNo ratings yet

- Content: Weekly Technical Levels Strategy/RecommendationsDocument5 pagesContent: Weekly Technical Levels Strategy/RecommendationsAngel BrokingNo ratings yet

- Commodities Weekly Outlook 09 09 13 To 13 09 13Document6 pagesCommodities Weekly Outlook 09 09 13 To 13 09 13Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16 12 13 To 20 12 13Document6 pagesCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315No ratings yet

- Commodities Weekly Outlook, 08.07.13 To 12.07.13Document6 pagesCommodities Weekly Outlook, 08.07.13 To 12.07.13Angel BrokingNo ratings yet

- Commodities Weekly Outlook, 28th January 2013Document5 pagesCommodities Weekly Outlook, 28th January 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFDocument6 pagesCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315No ratings yet

- Commodities Weekly Outlook 20 08 12 To 24 08 12Document5 pagesCommodities Weekly Outlook 20 08 12 To 24 08 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 19 11 12 To 23 11 12Document5 pagesCommodities Weekly Outlook 19 11 12 To 23 11 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 17 09 12 To 21 09 12Document6 pagesCommodities Weekly Outlook 17 09 12 To 21 09 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 29.10.2012 To 03.11.2012Document5 pagesCommodities Weekly Outlook 29.10.2012 To 03.11.2012Angel BrokingNo ratings yet

- Commodities Weekly Outlook 26.11.2012 To 01.12.2012Document6 pagesCommodities Weekly Outlook 26.11.2012 To 01.12.2012Angel BrokingNo ratings yet

- Commodities Weekly Outlook 10.12.2012 To 14.12.2012Document5 pagesCommodities Weekly Outlook 10.12.2012 To 14.12.2012hitesh315No ratings yet

- Commodities Weekly Outlook 22 10 12 To 26 10 12Document5 pagesCommodities Weekly Outlook 22 10 12 To 26 10 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 17 12 12 To 21 12 12Document5 pagesCommodities Weekly Outlook 17 12 12 To 21 12 12Angel BrokingNo ratings yet

- Commodities Weekly Outlook 12.11.2012 To 17.11.2012Document6 pagesCommodities Weekly Outlook 12.11.2012 To 17.11.2012Angel BrokingNo ratings yet

- MCX Weekly Report8 AprilDocument10 pagesMCX Weekly Report8 AprilexcellentmoneyNo ratings yet

- Special Technical Report On MCX Nickel AugustDocument2 pagesSpecial Technical Report On MCX Nickel AugustAngel BrokingNo ratings yet

- Weekly Commodity Report 15 AprDocument11 pagesWeekly Commodity Report 15 AprNidhi JainNo ratings yet

- Daily Commodity Market Tips Via ExpertsDocument9 pagesDaily Commodity Market Tips Via ExpertsRahul SolankiNo ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument54 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument36 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Commodity MCX Gold and Silver Market TrendDocument9 pagesCommodity MCX Gold and Silver Market TrendRahul SolankiNo ratings yet

- July 032012 56030712morningDocument5 pagesJuly 032012 56030712morningPasam VenkateshNo ratings yet

- MCX Silver: 31 July, 2012Document2 pagesMCX Silver: 31 July, 2012arjbakNo ratings yet

- Index Watch:: EPIC Research ReportDocument8 pagesIndex Watch:: EPIC Research Reportapi-211507971No ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument55 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- MCX Silver Daily ChartDocument1 pageMCX Silver Daily Chartronak2484bhavsarNo ratings yet

- Daily Commodity Report22!04!2013Document10 pagesDaily Commodity Report22!04!2013Anupriya SaxenaNo ratings yet

- Free Commodity MCX Market Research ReportDocument9 pagesFree Commodity MCX Market Research ReportRahul SolankiNo ratings yet

- Daily Commodity Report: MCX Gold Oct (Document5 pagesDaily Commodity Report: MCX Gold Oct (Ravi Kant ThakurNo ratings yet

- Free Commodity Market TipsDocument9 pagesFree Commodity Market TipsRahul SolankiNo ratings yet

- Sairam Shares & Sairam Shares & Commodities Commodities: W KL CU $ODocument55 pagesSairam Shares & Sairam Shares & Commodities Commodities: W KL CU $Oapi-237713995No ratings yet

- Special Technical Report On NCDEX ChanaDocument2 pagesSpecial Technical Report On NCDEX ChanaAngel BrokingNo ratings yet

- Special Technical Report On NCDEX TurmericDocument2 pagesSpecial Technical Report On NCDEX TurmericAngel BrokingNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Weekly Commodity by Epic Research - 16 July 2012Document6 pagesWeekly Commodity by Epic Research - 16 July 2012Brian PaceNo ratings yet

- Aug 2412 6240812Document5 pagesAug 2412 6240812k_kestutisNo ratings yet

- Commodity Market Updates 18 MayDocument9 pagesCommodity Market Updates 18 MayRahul SolankiNo ratings yet

- Daily Commodity Report 12-04-2013Document12 pagesDaily Commodity Report 12-04-2013EpicresearchNo ratings yet

- Weekly Trading Highlights & OutlookDocument5 pagesWeekly Trading Highlights & OutlookDevang VisariaNo ratings yet

- Daily Commodity Report 29-08-2013Document7 pagesDaily Commodity Report 29-08-2013Nidhi JainNo ratings yet

- Weekly Commodity Report 13-05-2013Document9 pagesWeekly Commodity Report 13-05-2013EpicresearchNo ratings yet

- Free Commodity Market ReportDocument9 pagesFree Commodity Market ReportRahul SolankiNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Indain Commodity Market TrendDocument9 pagesIndain Commodity Market TrendRahul SolankiNo ratings yet

- Weekly Commodity Report 4 MARCH 2013: WWW - Epicresearch.CoDocument9 pagesWeekly Commodity Report 4 MARCH 2013: WWW - Epicresearch.Coapi-196234891No ratings yet

- Metal and Energy Tech Report October 29Document2 pagesMetal and Energy Tech Report October 29Angel BrokingNo ratings yet

- Weekly-Commodity-Report 01 JULY 2013Document11 pagesWeekly-Commodity-Report 01 JULY 2013Nidhi JainNo ratings yet

- Commodity Market Updates and TipsDocument9 pagesCommodity Market Updates and TipsRahul SolankiNo ratings yet

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.From EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No ratings yet

- Nitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation CoatingDocument2 pagesNitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation Coatinghitesh315No ratings yet

- TDS Nitoproof Damp Protect India2Document2 pagesTDS Nitoproof Damp Protect India2hitesh315No ratings yet

- Don't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and InstrumentsDocument1 pageDon't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and Instrumentshitesh315No ratings yet

- Content: Market Highlights Day's Overview Outlook Important Events For TodayDocument3 pagesContent: Market Highlights Day's Overview Outlook Important Events For Todayhitesh315No ratings yet

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Document4 pagesThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021hitesh315No ratings yet

- Carcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, GotriDocument55 pagesCarcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, Gotrihitesh3150% (1)

- Commodity Market: 2018 BBU BBM BBL Weekly DailyDocument2 pagesCommodity Market: 2018 BBU BBM BBL Weekly Dailyhitesh315No ratings yet

- Venous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose VeinsDocument53 pagesVenous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose Veinshitesh315No ratings yet

- N SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K JDocument3 pagesN SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K Jhitesh315No ratings yet

- Dr. Chirag Pandya Year 2007Document76 pagesDr. Chirag Pandya Year 2007hitesh315No ratings yet

- Symbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790Document3 pagesSymbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790hitesh315No ratings yet

- RR 090620145Document5 pagesRR 090620145hitesh315No ratings yet

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFDocument6 pagesCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315No ratings yet

- Comparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal HerniaDocument7 pagesComparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal Herniahitesh315No ratings yet

- Positional Call Nirmal BangDocument1 pagePositional Call Nirmal Banghitesh315No ratings yet

- Gold Short Term Report: StrategyDocument3 pagesGold Short Term Report: Strategyhitesh315No ratings yet

- Original Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal HerniaDocument4 pagesOriginal Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal Herniahitesh315No ratings yet

- Commodities Weekly Outlook 16 12 13 To 20 12 13Document6 pagesCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315No ratings yet

- Copper Takes A Bullish Stance: Punter's CallDocument3 pagesCopper Takes A Bullish Stance: Punter's Callhitesh315100% (1)

- Commodities Weekly Tracker 10th June 2013Document27 pagesCommodities Weekly Tracker 10th June 2013hitesh315No ratings yet

- Commodities: I Vayda BazaarDocument7 pagesCommodities: I Vayda Bazaarhitesh315No ratings yet

- Gold Report: Analyst: Hareesh VDocument2 pagesGold Report: Analyst: Hareesh Vhitesh315No ratings yet

- Management Accounting: Level 3Document16 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- UIC ISO 55000 Guidelines - FinalDocument96 pagesUIC ISO 55000 Guidelines - FinalIrma Galego Paz100% (1)

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- Year Beginning Value Ending Value HPR HPYDocument3 pagesYear Beginning Value Ending Value HPR HPYmubarek oumerNo ratings yet

- Gerrard Construction Co Is An Excavation Contractor The Following SummarizedDocument3 pagesGerrard Construction Co Is An Excavation Contractor The Following SummarizedCharlotteNo ratings yet

- WF 8.1.13 PDFDocument11 pagesWF 8.1.13 PDFChad Thayer VNo ratings yet

- University Student Investment Banking Resume TemplateDocument1 pageUniversity Student Investment Banking Resume Templateiduncan91No ratings yet

- Lucky Cement Strategic OptionsDocument5 pagesLucky Cement Strategic OptionsFahim QaiserNo ratings yet

- Assignment HBDocument3 pagesAssignment HBJhay Sy LynNo ratings yet

- Tutorial 4 Consolidated FS I (CBS) (A)Document10 pagesTutorial 4 Consolidated FS I (CBS) (A)fooyy8No ratings yet

- How Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?Document20 pagesHow Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?aggarwal.aki123No ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- Ahmad AyubDocument16 pagesAhmad Ayubfresh juiceNo ratings yet

- Mar3023 Exam 1 Review-1Document31 pagesMar3023 Exam 1 Review-1Anish SubramanianNo ratings yet

- 1st Quarter EntrepreneurshipDocument28 pages1st Quarter EntrepreneurshipSamantha ValienteNo ratings yet

- Importance of Gold: in Indian EconomyDocument4 pagesImportance of Gold: in Indian EconomyTapan anandNo ratings yet

- Entrepreneurship ReviewerDocument5 pagesEntrepreneurship ReviewerThea Mae TudilloNo ratings yet

- Menna's ResumeDocument1 pageMenna's Resumemohamed mustafaNo ratings yet

- Strategic Cost Management QuizDocument9 pagesStrategic Cost Management Quizctarenas.studentNo ratings yet

- Escrow OfficerDocument4 pagesEscrow Officerapi-121435323No ratings yet

- MS Accountancy Set 5Document9 pagesMS Accountancy Set 5Tanisha TibrewalNo ratings yet

- Module 9 - Earnings and Market Approach ValuationDocument46 pagesModule 9 - Earnings and Market Approach Valuationnatalie clyde matesNo ratings yet

- Week 8: Financial Statement Analysis & PerformanceDocument41 pagesWeek 8: Financial Statement Analysis & Performanceyow jing peiNo ratings yet